| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tympanostomy Products Market Size 2024 |

USD 112.79 Million |

| Tympanostomy Products Market, CAGR |

3.98% |

| Tympanostomy Products Market Size 2032 |

USD 153.59 Million |

Market Overview:

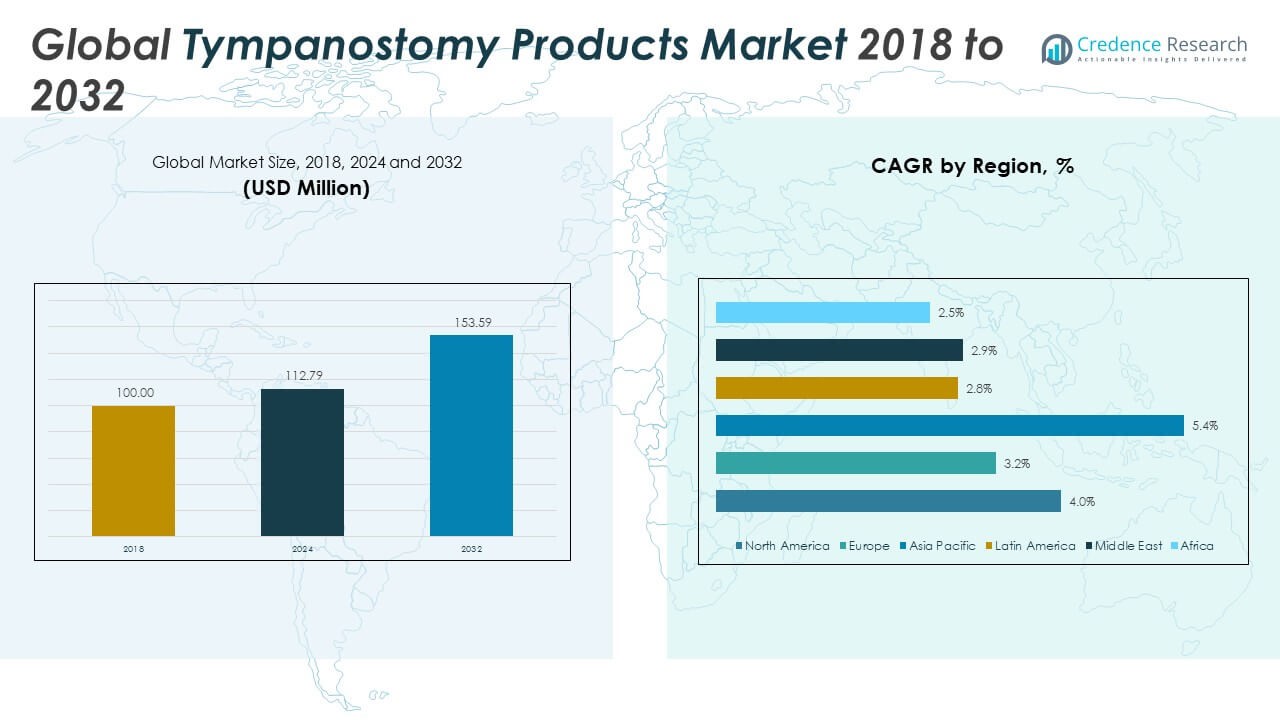

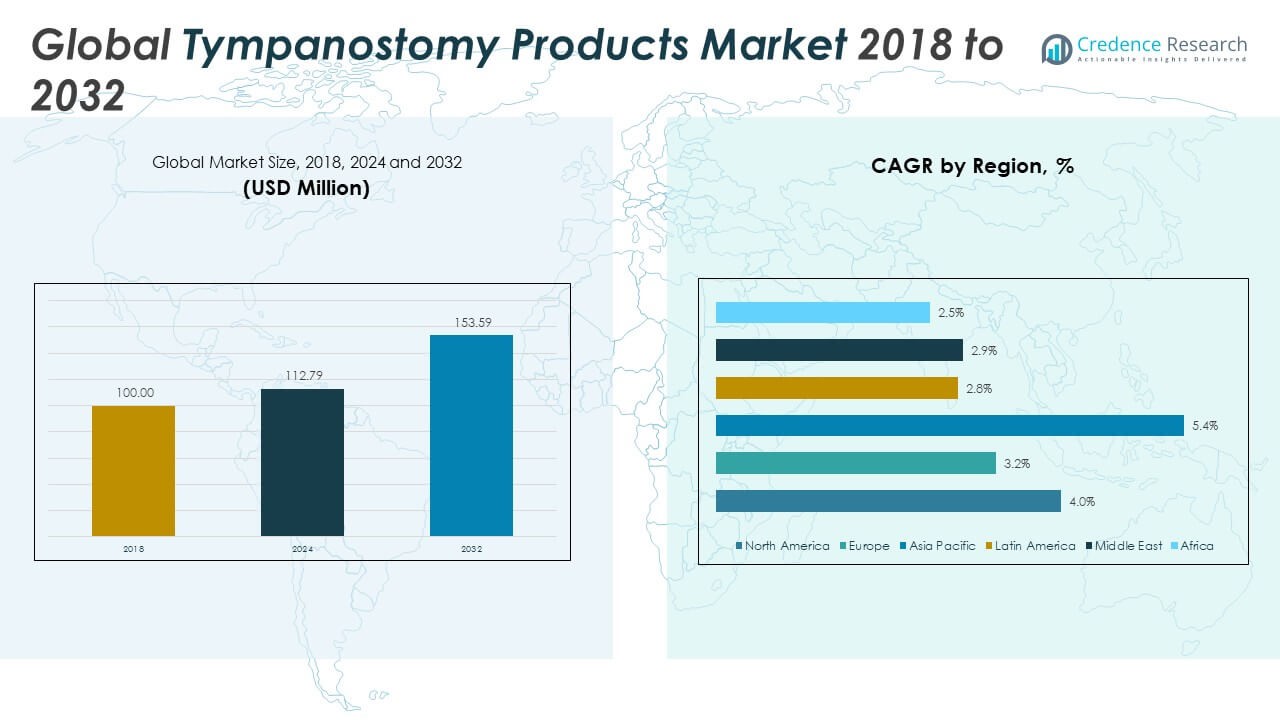

Tympanostomy Products Market size was valued at USD 100.00 million in 2018 to USD 112.79 million in 2024 and is anticipated to reach USD 153.59 million by 2032, at a CAGR of 3.98% .

Several key factors are driving this market. The global prevalence of middle-ear infections, especially among children, remains high, and repeated cases often require surgical intervention instead of prolonged antibiotic treatment. Tympanostomy tubes offer a reliable solution by enabling fluid drainage and ventilation in the middle ear, which helps prevent hearing loss and recurrent infections. Additionally, technological advancements in the design and delivery of tympanostomy products—such as the introduction of bioresorbable and drug-eluting tubes, as well as minimally invasive, office-based insertion systems—are transforming treatment protocols. These innovations improve patient outcomes, reduce the need for general anesthesia, and enhance procedural efficiency. Expanding healthcare access in developing countries is also contributing to market growth, as rising medical awareness, improving infrastructure, and increased investment in ENT care boost the number of procedures performed each year.

Regionally, North America continues to lead the global tympanostomy products market in terms of value, driven by high procedure volumes, strong reimbursement systems, and early adoption of advanced medical devices. The United States remains a major contributor, with widespread use of tympanostomy tubes in pediatric care and increasing availability of outpatient ENT procedures. Asia-Pacific represents the fastest-growing regional market, supported by growing healthcare investments, a large pediatric population, and the development of ENT surgical capabilities in countries like China and India. Europe maintains a stable position with strong public health systems and well-established clinical practices in otolaryngology. Meanwhile, Latin America, the Middle East, and Africa represent smaller but steadily expanding markets, as improvements in healthcare infrastructure and awareness of hearing disorders drive gradual growth. As regional health systems mature, these areas are expected to offer increasing opportunities for manufacturers and healthcare providers alike.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Tympanostomy Products Market grew from USD 100.00 million in 2018 to USD 112.79 million in 2024 and is expected to reach USD 153.59 million by 2032, indicating consistent and moderate expansion.

- High incidence of pediatric otitis media continues to drive demand, with tympanostomy tubes widely used to treat recurrent infections and prevent hearing-related complications in young children.

- Minimally invasive, office-based insertion devices are shifting procedures away from hospitals, lowering costs and improving access in outpatient and pediatric care settings.

- Technological advancements such as bioresorbable and drug-eluting tympanostomy tubes are improving clinical outcomes while reducing the need for follow-up surgical removal.

- Healthcare investments in emerging markets are expanding ENT infrastructure, increasing awareness, and boosting procedural capacity, especially in Asia-Pacific, Latin America, and parts of Africa.

- Lack of trained ENT professionals and limited surgical infrastructure in low-income and rural regions remains a key barrier to wider market penetration and patient access.

- North America maintains the largest market share due to established reimbursement systems and early technology adoption, while Asia-Pacific leads in growth rate driven by healthcare development and demographic factors.

Market Drivers:

High Prevalence of Pediatric Otitis Media is Driving Tympanostomy Tube Adoption:

The Global Tympanostomy Products Market is experiencing growth due to the widespread incidence of otitis media, particularly among children. A significant percentage of children suffer from at least one ear infection by the age of three, and a large proportion experience recurrent or chronic episodes. Physicians often prefer tympanostomy tubes when conservative treatments such as antibiotics fail or when infections recur frequently. These tubes provide a reliable and effective method to ventilate the middle ear and prevent fluid buildup. The medical community recognizes tympanostomy as a critical intervention to avoid hearing loss and developmental delays in young children. This high demand in pediatric care settings supports consistent procedural volumes and product utilization.

- For instance, the Tula® Tympanostomy System, developed by Tusker Medical (now part of Smith+Nephew), was evaluated in a prospective multicenter study (OTTER, NCT03323736) involving children aged 6 months to 12 years.

Advancements in Minimally Invasive Devices and Office-Based Procedures Are Expanding Market Reach:

Recent innovations in tympanostomy technology are contributing significantly to market expansion. Devices such as the Hummingbird Tympanostomy Tube System allow for in-office placement, eliminating the need for general anesthesia in many cases. These minimally invasive systems reduce procedural risks, shorten recovery time, and improve patient and caregiver convenience. Hospitals and outpatient clinics benefit from lower operational costs and increased procedural efficiency. The ability to perform tympanostomy in non-surgical settings is expanding access, particularly in regions with limited surgical infrastructure. It is encouraging clinicians to recommend tube placement more readily, further supporting growth in the Global Tympanostomy Products Market.

- For instance, the Hummingbird® Tympanostomy Tube System from Preceptis Medical received FDA 510(k) clearance for in-office use in children as young as six months. In a pivotal clinical study, over 200 children were treated, with a 99% success rate for bilateral tube placement and a median procedure time of five minutes.

Improved Materials and Functional Designs Are Enhancing Treatment Outcomes:

Material innovation plays a central role in improving the performance of tympanostomy tubes. Newer products incorporate bioresorbable materials that naturally degrade after their therapeutic window, eliminating the need for surgical removal. Drug-eluting tubes are also gaining traction for their ability to deliver localized medication, reducing the risk of infection and inflammation. These advancements not only improve clinical outcomes but also increase product value and justify premium pricing. It enables manufacturers to differentiate their offerings in a competitive market. Hospitals and ENT specialists are increasingly seeking advanced designs that support better healing and reduce follow-up interventions.

Growing Access to ENT Care in Emerging Markets Is Expanding Patient Base:

Rising healthcare investment in developing regions is broadening access to ENT services and tympanostomy procedures. Governments and private sectors are investing in new hospitals, training programs, and equipment procurement, improving procedural capacity. Public awareness of hearing loss and the long-term impact of untreated ear infections is increasing, encouraging earlier intervention. It is prompting caregivers to seek timely specialist consultations for children showing signs of chronic ear problems. As ENT infrastructure expands across Asia-Pacific, Latin America, and parts of Africa, the patient pool for tympanostomy procedures continues to grow. This trend strengthens the long-term outlook for product demand across diverse regions.

Market Trends:

Increased Preference for Bioresorbable Tubes Reflects a Shift Toward Non-Removal Solutions:

One of the key trends emerging in the Global Tympanostomy Products Market is the rising demand for bioresorbable tympanostomy tubes. These devices eliminate the need for a second procedure to remove the tube after treatment completion, offering a more streamlined patient experience. Physicians are increasingly favoring solutions that reduce procedural burden, especially in pediatric cases where follow-up interventions can cause stress for both children and caregivers. Bioresorbable materials, including polylactic acid and related polymers, degrade naturally over time while maintaining structural integrity during the therapeutic window. This trend reflects a broader shift toward minimizing post-procedure risks and improving long-term outcomes. It is expected to gain further traction as clinical data continues to support the safety and efficacy of these materials.

- For instance, the Tula® System clinical trial reported that the mean intubation period for tubes was 16.8 months, with 23% of tubes still in place at 24-month follow-up, consistent with traditional tube performance. The study also demonstrated high parent satisfaction, with 95% of surveyed parents expressing satisfaction with the in-office procedure.

Integration of Digital Otoscopy and Imaging Is Supporting Better Clinical Decision-Making:

The integration of digital otoscopy and high-resolution imaging into ENT practice is influencing how tympanostomy procedures are recommended and planned. Clinicians now rely on improved visualization technologies to assess eardrum status, detect fluid presence, and document middle ear pathology with greater accuracy. This shift toward evidence-backed diagnostics is supporting more precise and timely intervention. The Global Tympanostomy Products Market is benefiting from the adoption of these tools, which help reduce overuse or underuse of tube placement by ensuring appropriate patient selection. It aligns with value-based care models where treatment decisions are tied to clearly documented clinical indications. ENT specialists equipped with advanced diagnostic systems are better positioned to justify tympanostomy interventions to insurers and families alike.

- For instance, the Welch Allyn Digital MacroView Otoscope provides approximately twice the field of vision and 30% greater magnification compared to traditional otoscopes, allowing for more precise assessment of the tympanic membrane. These features enhance diagnostic confidence and support better clinical decision-making for tympanostomy interventions.

Single-Use Device Formats Are Gaining Ground in Infection Control Protocols:

The healthcare sector’s intensified focus on infection prevention is shaping purchasing decisions in favor of single-use tympanostomy products. Hospitals and ambulatory centers are shifting away from reusable insertion tools and accessories to minimize cross-contamination risks. Manufacturers are responding by offering pre-packaged, sterile, disposable systems that support efficient, hygienic workflows. This trend has accelerated post-pandemic, as institutions reevaluate sterilization protocols and procedural safety. In the Global Tympanostomy Products Market, it is driving interest in comprehensive kits that include tubes, insertion instruments, and related consumables. The convenience and safety advantages of single-use formats are likely to keep influencing product design and procurement policies.

Growth of ENT Specialty Clinics and Ambulatory Surgery Centers Is Redefining Care Settings:

The growing number of ENT specialty clinics and ambulatory surgery centers is changing where and how tympanostomy procedures are performed. These decentralized care models are increasing procedural volumes outside of traditional hospital environments. They offer faster scheduling, reduced overhead costs, and shorter patient wait times, which appeal to both physicians and families. It is reshaping the dynamics of the Global Tympanostomy Products Market by encouraging the development of compact, user-friendly devices suited for outpatient use. Vendors are aligning their portfolios with the needs of ambulatory practitioners who prioritize efficiency and minimal equipment complexity. The trend supports broader market penetration, especially in urban areas with high outpatient surgical demand.

Market Challenges Analysis:

Limited Access to ENT Specialists and Surgical Infrastructure in Low-Income Regions Restricts Market Potential:

One of the major challenges facing the Global Tympanostomy Products Market is the lack of access to qualified ENT specialists and surgical infrastructure in many low- and middle-income countries. Tympanostomy tube placement requires trained personnel and basic operative settings, which remain limited outside of major urban centers. Rural populations often rely on general practitioners who may not be equipped or authorized to perform such procedures. This creates a care gap, delaying intervention and allowing chronic ear infections to persist untreated. It restricts the total addressable market and slows product penetration in high-need but underserved regions. Expanding access will require coordinated efforts in workforce training, telemedicine integration, and equipment deployment.

Reimbursement Barriers and Cost Sensitivities Limit Procedure Uptake in Certain Health Systems:

Reimbursement policies and cost-control measures also pose significant hurdles for the Global Tympanostomy Products Market. In some healthcare systems, especially those driven by public insurance or tight hospital budgets, there is limited reimbursement for newer, premium-priced devices such as bioresorbable or drug-eluting tubes. Payers often require extensive clinical justification before approving tympanostomy procedures, particularly for borderline or recurrent cases. Physicians may delay or avoid tube placement due to administrative burdens or concerns over out-of-pocket costs for patients. It places pressure on manufacturers to balance product innovation with affordability. These financial constraints hinder broader adoption, even when clinical need is present.

Market Opportunities:

Expansion of Office-Based Tympanostomy Procedures Can Broaden Patient Access and Reduce Costs:

The shift toward office-based tympanostomy tube placement presents a major growth opportunity for the Global Tympanostomy Products Market. Devices that allow for quick, anesthesia-free procedures in outpatient settings reduce the burden on hospitals and improve patient convenience. Pediatric practices, ENT clinics, and ambulatory centers are adopting in-office systems that simplify workflow and increase throughput. It creates a scalable care model that suits both urban and semi-urban regions. Manufacturers can leverage this shift by designing compact, easy-to-use products tailored for clinic-based deployment. This trend supports higher procedure volumes and reduces barriers to treatment for patients previously deterred by hospital-based surgery.

Product Innovation Focused on Smart Tubes and Drug Delivery Enhances Long-Term Market Differentiation:

Next-generation tympanostomy products incorporating drug-eluting technology or diagnostic sensors offer promising avenues for differentiation. The Global Tympanostomy Products Market can benefit from increased investment in smart medical devices that combine therapeutic and monitoring functions. Drug-coated tubes can help prevent infection or inflammation, reducing the need for follow-up care. Embedded sensors may enable early detection of complications, supporting proactive clinical management. These innovations position tympanostomy devices within a broader framework of precision ENT care. It gives manufacturers a strategic edge in both premium markets and long-term care pathways.

Market Segmentation Analysis:

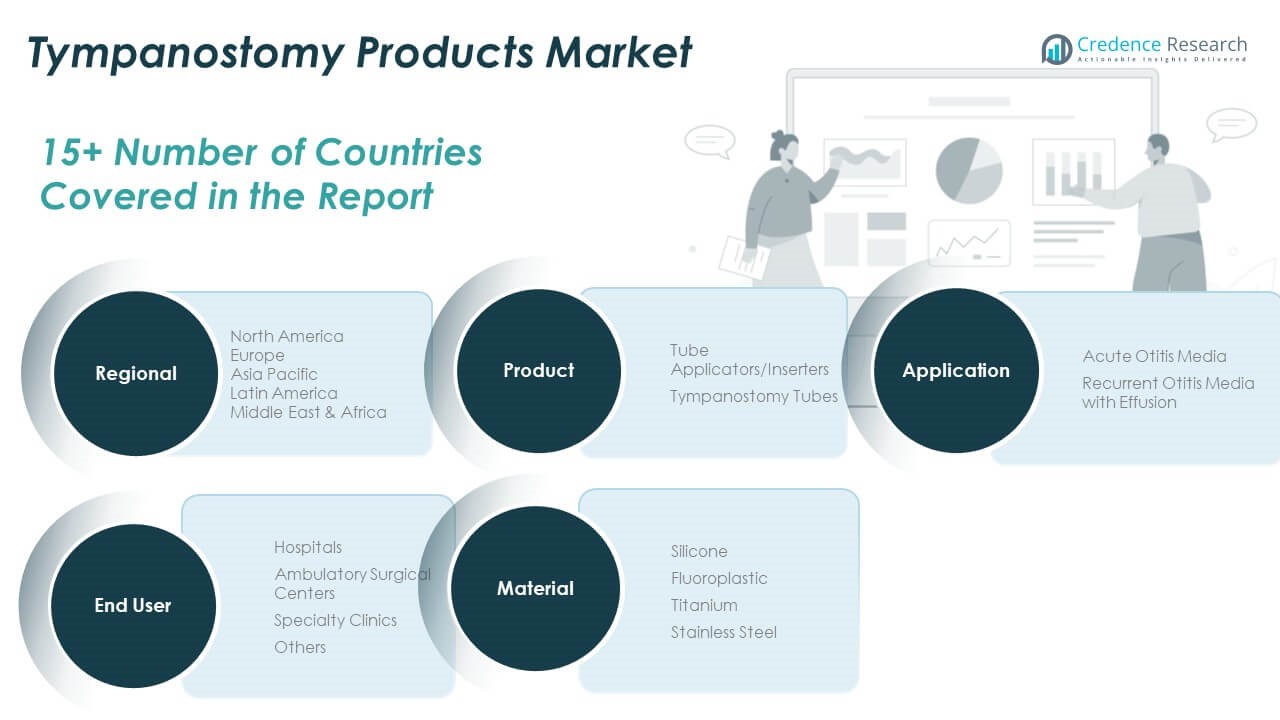

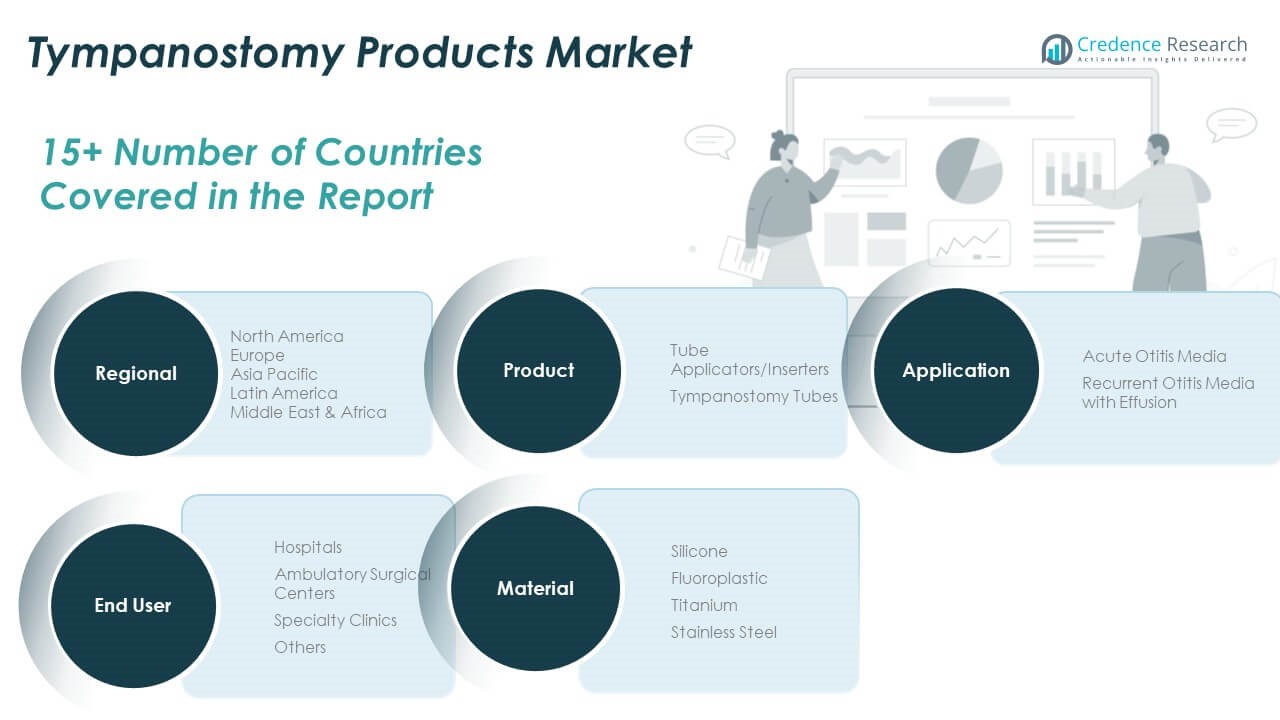

By Product

The Global Tympanostomy Products Market is primarily segmented into tympanostomy tubes and tube applicators/inserters. Tympanostomy tubes dominate the product segment, driven by their routine use in managing recurrent ear infections, particularly in pediatric populations. Tube applicators/inserters are growing steadily due to innovations that support quick, in-office procedures, reducing reliance on operating rooms and general anesthesia.

- For instance, the Tula® System’s tube delivery device is specifically designed for rapid, single-click insertion under local anesthesia, as demonstrated in multicenter clinical studies with procedural success rates exceeding 85% in pediatric populations.

By Application

Recurrent otitis media with effusion accounts for the larger share of the application segment. Its chronic nature and frequent occurrence in young children create sustained demand for tympanostomy intervention. Acute otitis media also holds a significant position, especially in cases requiring urgent drainage to alleviate pain and prevent complications. It continues to drive consistent procedure volumes across various care settings.

- For instance, long-term follow-up studies show that tympanostomy tube placement leads to symptom resolution and improved clinical outcomes in the majority of pediatric patients with recurrent or chronic otitis media.

By End-user

Hospitals remain the leading end-user due to their advanced ENT facilities and access to surgical staff. Ambulatory surgical centers are expanding their presence by offering cost-effective and efficient tympanostomy procedures. Specialty clinics serve as important access points, especially for pediatric ENT care. The “others” category includes public health institutions and academic centers that contribute to localized treatment delivery.

By Material

Silicone leads the material segment due to its flexibility, biocompatibility, and widespread clinical acceptance. Fluoroplastic follows closely, known for its inert properties and reduced tissue reactivity. Titanium and stainless-steel serve niche needs where long-term durability or rigid support is required. It reflects growing customization of tube materials to match clinical scenarios and patient profiles.

Segmentation:

By Product

- Tube Applicators/Inserters

- Tympanostomy Tubes

By Application

- Acute Otitis Media

- Recurrent Otitis Media with Effusion

By End-user

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Others

By Material

- Silicone

- Fluoroplastic

- Titanium

- Stainless Steel

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Regional Analysis:

North America

The North America Tympanostomy Products Market size was valued at USD 39.78 million in 2018, reached USD 44.37 million in 2024, and is anticipated to reach USD 60.35 million by 2032, at a CAGR of 4.0% during the forecast period. North America holds the largest share of the Global Tympanostomy Products Market, contributing over 39% of global revenue in 2024. The region benefits from widespread insurance coverage, advanced ENT infrastructure, and a high volume of pediatric tympanostomy procedures. The United States leads in both technology adoption and outpatient care expansion, while Canada and Mexico continue to grow steadily. Strong clinical guidelines and increasing preference for office-based procedures support ongoing market growth. It remains a priority market for manufacturers offering high-end and minimally invasive devices.

Europe

The Europe Tympanostomy Products Market size was valued at USD 25.46 million in 2018, reached USD 27.56 million in 2024, and is anticipated to reach USD 35.38 million by 2032, at a CAGR of 3.2% during the forecast period. Europe accounts for approximately 24% of the global market in 2024. The market is supported by public healthcare systems, high ENT specialization, and strong pediatric care standards. Germany, France, and the United Kingdom are leading contributors. Cost sensitivity in some markets drives demand for both premium and value-tier products. It benefits from regulatory consistency, mature procurement channels, and a stable procedural base.

Asia Pacific

The Asia Pacific Tympanostomy Products Market size was valued at USD 21.65 million in 2018, reached USD 25.64 million in 2024, and is anticipated to reach USD 38.98 million by 2032, at a CAGR of 5.4% during the forecast period. Asia Pacific is the fastest-growing region in the Global Tympanostomy Products Market, holding nearly 23% share in 2024. Rapid expansion of healthcare infrastructure, particularly in China and India, is driving surgical volumes. A large pediatric population, coupled with growing awareness of hearing health, is boosting demand. Developed markets such as Japan, South Korea, and Australia contribute through advanced device usage and early intervention protocols. It offers strong growth potential through public-private healthcare partnerships and improved ENT training programs.

Latin America

The Latin America Tympanostomy Products Market size was valued at USD 5.12 million in 2018, reached USD 5.71 million in 2024, and is anticipated to reach USD 7.08 million by 2032, at a CAGR of 2.8% during the forecast period. Latin America represents around 5% of the global market in 2024. Brazil is the leading contributor, supported by its large healthcare network and expanding private sector investment. Argentina, Chile, and Colombia are also witnessing slow but steady growth. Urban areas see higher procedural adoption, while rural regions face access challenges. It is gradually benefiting from public health campaigns and targeted pediatric programs aimed at early diagnosis.

Middle East

The Middle East Tympanostomy Products Market size was valued at USD 4.35 million in 2018, reached USD 4.63 million in 2024, and is anticipated to reach USD 5.78 million by 2032, at a CAGR of 2.9% during the forecast period. The region holds approximately 4% of the global market share in 2024. Healthcare investment in the UAE, Saudi Arabia, and Israel is improving ENT infrastructure and procedure availability. Growth is supported by rising demand for specialized pediatric care and expanding private hospital networks. Israel leads in device innovation, while Gulf countries focus on expanding outpatient capacity. It is building regional interest in minimally invasive tympanostomy solutions aligned with international care standards.

Africa

The Africa Tympanostomy Products Market size was valued at USD 3.64 million in 2018, reached USD 4.87 million in 2024, and is anticipated to reach USD 6.03 million by 2032, at a CAGR of 2.5% during the forecast period. Africa represents the smallest share of the Global Tympanostomy Products Market at under 5% in 2024. South Africa leads in ENT service delivery, followed by Egypt and Nigeria. Market growth is constrained by a lack of trained personnel and limited surgical infrastructure, especially in rural areas. International aid programs and public awareness efforts are gradually addressing these gaps. It presents long-term opportunities as regional health systems evolve and pediatric care becomes a greater focus.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Olympus America

- Medtronic

- Summit Medical

- GRACE MEDICAL

- Preceptis Medical

- Atos Medical

- Medasil Surgical Ltd

- Adept Medical Limited

- Smith and Nephew Plc

- Integra LifeSciences

Competitive Analysis:

The Global Tympanostomy Products Market is moderately consolidated, with a mix of established medical device companies and niche ENT-focused manufacturers. Olympus Corporation and Medtronic hold leading positions due to their broad ENT portfolios, global distribution networks, and strong brand recognition. Companies like Summit Medical, Grace Medical, and Preceptis Medical specialize in tympanostomy solutions and compete through innovation, particularly in bioresorbable tubes and in-office insertion systems. Atos Medical and Adept Medical are expanding their presence through regional partnerships and product diversification. The market emphasizes product safety, ease of use, and clinical effectiveness, pushing manufacturers to invest in research and development. It favors companies that can align with outpatient care trends, regulatory compliance, and surgeon preferences. Competitive advantage lies in offering differentiated materials, user-friendly applicators, and pediatric-focused designs. The landscape is dynamic, with strategic collaborations, product launches, and geographic expansion shaping future positioning.

Recent Developments:

- In May 2025, Olympus America announced FDA 510(k) clearance for its most advanced imaging endoscopes featuring Extended Depth of Field (EDOF™) technology. While primarily for GI endoscopy, this innovation enhances ENT procedures by providing sharper, continuously focused images, which may support more precise tympanostomy tube placement and diagnosis in otolaryngology settings.

- In April 2025, Atos Medical launched an updated healthcare professional website, enhancing access to product information, educational resources, and clinical support for ENT professionals. While the update focuses on laryngectomy and tracheostomy care, it reflects Atos Medical’s commitment to supporting clinicians with the latest resources and digital tools.

- In January 2025, Preceptis Medical secured a new CMS G code (effective January 1, 2025) for in-office pediatric tympanostomy tube procedures using its Hummingbird® Tympanostomy Tube System. This update enables standardized reimbursement for in-office ear tube placement, expanding access to minimally invasive tympanostomy for children and supporting broader adoption among healthcare providers.

Market Concentration & Characteristics:

The Global Tympanostomy Products Market exhibits moderate market concentration, with a few key players accounting for a significant share of total revenue. It features a balance of multinational device manufacturers and specialized ENT-focused companies. The market is characterized by high clinical specificity, low product substitution, and steady procedural demand, particularly in pediatric care. Entry barriers include regulatory compliance, clinical validation, and the need for strong physician relationships. Innovation centers on ease of insertion, bioresorbable materials, and compatibility with outpatient settings. Procurement decisions often depend on clinician preference, hospital protocols, and reimbursement dynamics. It supports stable growth with incremental product upgrades and regional customization.

Report Coverage:

The research report offers an in-depth analysis based on product, application, end-user, and material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing pediatric population will continue to drive consistent demand for tympanostomy procedures globally.

- Advances in bioresorbable and drug-eluting tubes will open new opportunities for premium product segments.

- Shift toward in-office, anesthesia-free procedures will expand adoption in outpatient and ambulatory settings.

- Emerging markets in Asia-Pacific and Africa will contribute to long-term volume growth through infrastructure expansion.

- Greater awareness of early childhood hearing health will lead to earlier diagnosis and intervention.

- Strong reimbursement support in North America and Europe will sustain high procedural volumes.

- Competition will intensify as niche players introduce innovative delivery systems tailored to pediatric use.

- Regulatory approvals for minimally invasive devices will accelerate product launches and market entry.

- Strategic partnerships and regional distribution agreements will shape expansion strategies.

- Digital diagnostics and integration of ENT care with telemedicine platforms may influence treatment models.