Market Overview

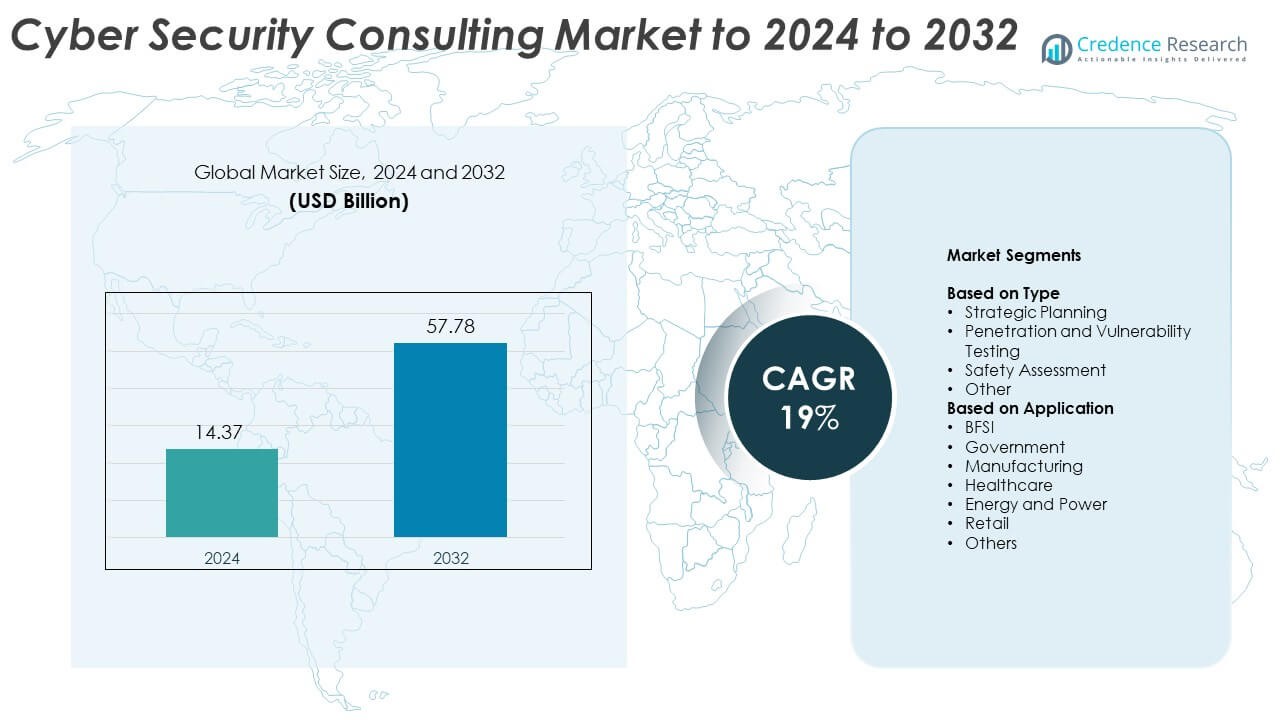

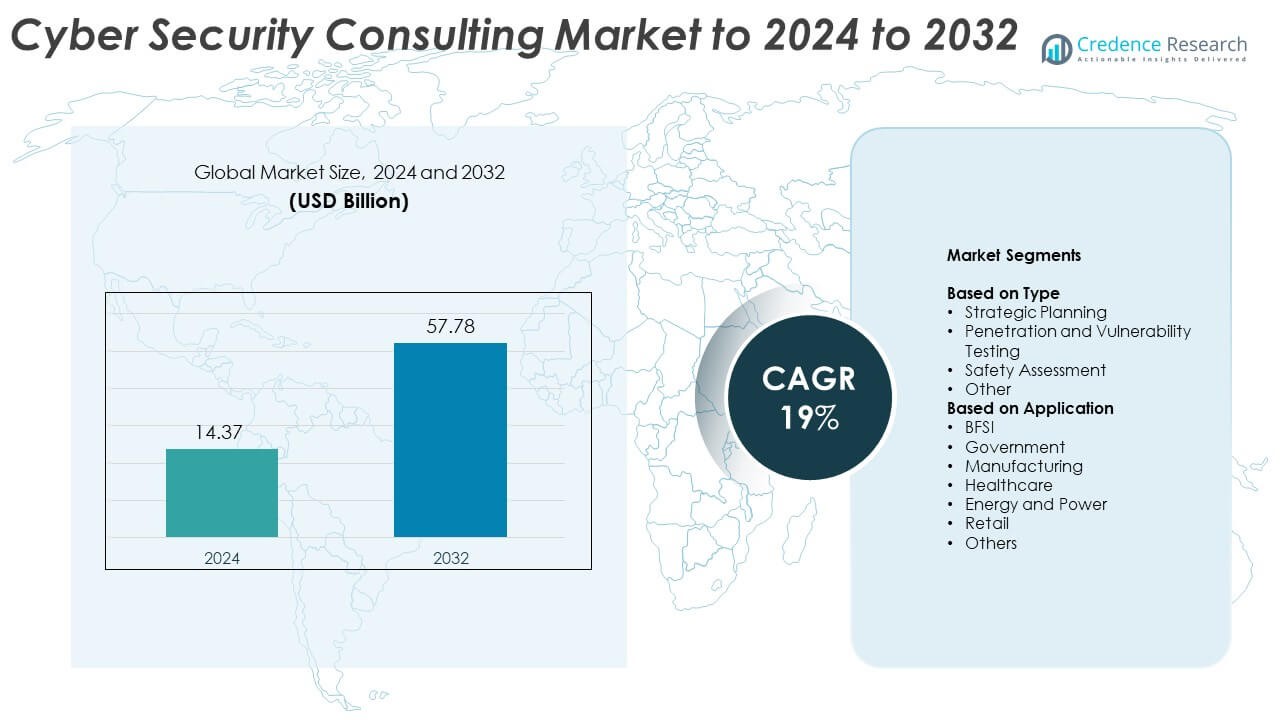

Cyber Security Consulting Market size was valued at USD 14.37 Billion in 2024 and is anticipated to reach USD 57.78 Billion by 2032, at a CAGR of 19% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cyber Security Consulting Market Size 2024 |

USD 14.37 Billion |

| Cyber Security Consulting Market, CAGR |

19% |

| Cyber Security Consulting Market Size 2032 |

USD 57.78 Billion |

The Cyber Security Consulting Market is driven by leading firms such as Accenture, Deloitte, IBM, Booz Allen Hamilton, Capgemini, PwC, Optiv, EY, DXC, and KPMG, which strengthen global adoption through advanced advisory capabilities and sector-focused security expertise. These companies expand their reach by integrating AI-enabled threat analysis, zero-trust implementation support, and multi-cloud risk-management services. North America leads the market with about 38% share in 2024 due to high cybersecurity spending, strict regulatory frameworks, and strong digital adoption. Europe follows with nearly 28% share, supported by stringent data-protection laws and rising enterprise modernization across major industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cyber Security Consulting Market was valued at USD 14.37 Billion in 2024 and is projected to reach USD 57.78 Billion by 2032, growing at a CAGR of 19% during the forecast period.

• Strong market growth is driven by rising cyberattacks, strict compliance mandates, and rapid digital adoption, with strategic planning holding the largest segment share at about 34% in 2024.

• Key trends include the shift toward zero-trust frameworks, multi-cloud defense strategies, and AI-enabled threat-monitoring services that improve detection accuracy and shorten response times.

• The competitive landscape remains active as global consulting firms expand advisory portfolios, strengthen incident-response units, and integrate automated security tools to enhance client resilience.

• North America leads with nearly 38% share in 2024 due to high cybersecurity spending and strict regulations, followed by Europe with about 28%, while Asia Pacific shows the fastest expansion supported by rapid digitization across BFSI, telecom, and manufacturing sectors.

Market Segmentation Analysis:

By Type

Strategic planning leads this segment with about 34% share in 2024 due to rising demand for long-term security roadmaps and risk-aligned frameworks that help enterprises handle complex threats. Companies adopt strategic services to strengthen governance models and prepare for evolving regulations across critical industries. Penetration and vulnerability testing expands as firms seek deeper insights into system weaknesses, while safety assessment and other advisory services grow steadily as businesses move toward continuous monitoring and zero-trust adoption.

- For instance, According to their 2024 Year in Review report, Cisco Talos analyzed over 886 billion security events daily, drawing telemetry from more than 46 million devices across 193 countries.

By Application

BFSI and government hold the dominant position with nearly 37% share in 2024 because these sectors manage high-value data and face strict compliance requirements. Rising cyberattacks on financial systems and public infrastructure push agencies to invest in advanced consulting solutions. Healthcare, manufacturing, energy, retail, and other industries show strong adoption as digital expansion increases exposure to ransomware, cloud risks, and supply-chain vulnerabilities, boosting the appeal of tailored cyber-risk consulting.

- For instance, as of 2023, JPMorgan Chase’s Global Technology division included approximately 900 data scientists, 600 machine learning engineers, and 1,000 individuals involved in data management.

Key Growth Drivers

Rising Attack Frequency and Advanced Threat Landscape

Cybersecurity consulting demand grows as threat actors target critical infrastructure, financial platforms, and cloud-native systems. Enterprises face complex ransomware, phishing, and zero-day attacks that overwhelm internal security teams. This rising threat pressure pushes organizations to adopt expert-led assessments, improved governance frameworks, and continuous monitoring support. The need for 24/7 risk visibility and stronger incident-readiness strategies strengthens the adoption of consulting services across large enterprises and regulated sectors.

- For instance, Google typically blocks approximately 15 billion unwanted emails, including spam, phishing, and malware, per day.

Expanding Digital Transformation Across Industries

Rapid adoption of cloud, IoT, AI-driven tools, and hybrid IT architectures increases exposure to multi-layered security risks. Businesses seek consulting partners to design secure migration plans, protect distributed workloads, and align digital initiatives with risk tolerance. Digital transformation also accelerates cybersecurity maturity programs and boosts investment in advisory services that help integrate compliance, identity protection, and system hardening. As modernization expands, demand for strategic consulting strengthens across both mid-sized and global enterprises.

- For instance, as of 2014, AWS had over 1.4 million servers, a figure reported by sources analyzing AWS’s scale at the time.

Strict Regulatory Compliance and Data Protection Standards

Growing enforcement of data privacy and cybersecurity regulations drives organizations to adopt high-level consulting support. Standards such as GDPR, HIPAA, PCI DSS, and national cybersecurity frameworks push companies to invest in gap assessments, compliance audits, and policy restructuring. Consulting firms guide enterprises in documentation, governance updates, and secure architecture development. Heightened penalties for non-compliance motivate continuous advisory engagement, making regulatory alignment a key driver of market expansion.

Key Trends & Opportunities

Adoption of Zero-Trust and Identity-Centric Security Models

Zero-trust frameworks gain traction as companies shift from perimeter defense to user-centric protection. Consulting teams help organizations build verification layers, apply least-privilege access, and secure identity paths across distributed environments. Growing hybrid workforces and cloud dependence accelerate adoption, opening opportunities for advisory firms specializing in identity governance, authentication redesign, and risk-based access strategies. This transition strengthens long-term consulting demand.

- For instance, as of the end of fiscal year 2024 (January 31, 2024), CrowdStrike reported having more than 29,000 subscription customers, as detailed in their fiscal year 2024 financial results released in March 2024.

Growth of AI-Enabled Cyber Defense and Automation

AI-driven analytics, automated threat detection, and predictive modeling reshape enterprise defense strategies. Companies seek consulting expertise to integrate machine learning tools, automate response processes, and improve security operations center efficiency. As organizations face alert overload and faster attack cycles, AI-based consulting services become attractive due to improved accuracy and reduced manual workloads. This trend opens new advisory opportunities in advanced detection, AI governance, and automated compliance management.

- For instance, Cisco’s AI Assistant for Security is trained on one of the largest data sets in the world, which analyzes more than 550 billion security events each day across web, email, endpoints, networks, and applications.

Key Challenges

Shortage of Skilled Cybersecurity Professionals

The global talent gap limits the speed at which organizations can adopt robust security strategies. Many enterprises lack experienced analysts, threat hunters, and compliance specialists, which increases dependence on external consultants. This shortage raises project timelines and inflates service costs, creating pressure on smaller firms with limited budgets. As threats evolve quickly, the inability to secure specialized skills remains a major challenge for market growth.

Rising Complexity of Multi-Cloud and Hybrid Environments

Enterprises struggle to secure distributed workloads across multiple cloud providers, on-prem systems, and edge devices. This complexity makes vulnerability tracking, policy management, and unified monitoring difficult. Consulting teams must handle diverse architectures, fragmented toolsets, and inconsistent security policies. As organizations scale operations, the challenge of maintaining visibility and consistent protection across hybrid environments becomes a significant barrier in cybersecurity consulting adoption.

Regional Analysis

North America

North America holds the largest share at about 38% in 2024, supported by strong cybersecurity spending across BFSI, government, and technology enterprises. The region benefits from strict data-protection mandates and rapid cloud adoption, which increases demand for advanced consulting services. High attack frequency and strong regulatory pressure push companies to invest in strategic planning, compliance audits, and zero-trust transformation programs. The presence of leading consulting providers and mature digital infrastructures keeps North America the dominant market with steady expansion across hybrid security, managed advisory, and incident-readiness services.

Europe

Europe accounts for nearly 28% share in 2024, driven by stringent frameworks such as GDPR, NIS2, and sector-specific cyber directives. Enterprises seek consulting support to manage complex compliance requirements and evolving digital-sovereignty standards. Growing cloud migration across manufacturing, energy, and healthcare sectors increases the need for security assessments and identity-management advisory. Rising cross-border data-flow restrictions further strengthen demand for advanced consulting capabilities. The region sees consistent growth due to expanding enterprise digitization and heightened focus on cyber-resilience and regulatory alignment.

Asia Pacific

Asia Pacific holds about 22% share in 2024 and shows the fastest growth due to rapid digitalization across banking, telecom, and e-commerce sectors. Expanding cloud ecosystems and rising cybercrime incidents push companies to adopt consulting services for vulnerability management and strategic defense planning. Governments also increase investments in national cybersecurity frameworks, improving adoption across public agencies and regulated industries. Growing SME focus on security modernization and rising critical-infrastructure protection needs boost consulting demand, positioning the region as a high-growth market through 2032.

Latin America

Latin America captures nearly 7% share in 2024, supported by growing digital transformation in financial services, manufacturing, and retail. Rising ransomware cases and expanding cloud usage encourage organizations to seek expert guidance for risk assessments and governance upgrades. Limited in-house cybersecurity capabilities increase reliance on external consulting partners for compliance, incident-response planning, and network hardening. As national cybersecurity laws advance, enterprises invest more in structured advisory programs, driving steady but moderate market expansion across the region.

Middle East & Africa

Middle East & Africa hold around 5% share in 2024, driven by increased digital investments in government, energy, and telecom sectors. Large enterprises adopt consulting services to address escalating threats targeting national infrastructure and critical assets. Rapid smart-city development and cloud adoption push companies to strengthen identity security, governance frameworks, and operational resilience. Growing regional regulations and rising awareness of data-protection requirements support further consulting uptake, although skill shortages and budget constraints slow adoption in smaller organizations.

Market Segmentations:

By Type

- Strategic Planning

- Penetration and Vulnerability Testing

- Safety Assessment

- Other

By Application

- BFSI

- Government

- Manufacturing

- Healthcare

- Energy and Power

- Retail

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cyber Security Consulting Market is shaped by major players such as Accenture (Ireland), Deloitte (U.K.), IBM (U.S.), Booz Allen Hamilton (U.S.), Capgemini (France), PwC (U.K.), Optiv (U.S.), EY (U.K.), DXC (U.S.), and KPMG (Netherlands). These firms compete by offering broad advisory portfolios that cover strategic planning, regulatory alignment, penetration testing, and zero-trust transformation. Providers strengthen their position by expanding global delivery centers, enhancing incident-response capabilities, and integrating AI-driven threat-analysis tools. Many firms also invest in sector-specific consulting models that support BFSI, government, and healthcare clients facing strict compliance demands. Partnerships with cloud vendors, cybersecurity software developers, and threat-intelligence platforms further improve competitive advantage. As cyber risks escalate and digital infrastructures grow more complex, consulting companies focus on building long-term client relationships, delivering continuous monitoring support, and guiding organizations through large-scale modernization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Deloitte announced strategic alliances with Thales, a global security provider, to deliver advanced cybersecurity solutions with a focus on cloud and data security.

- In 2025, EY expanded its cybersecurity practice by appointing three new partners—Rahul Patel, Alok Panda, and Gaurav Tandon—to meet rising demand and strengthen its capabilities in cybersecurity consulting, systems integration, and identity solutions.

- In 2025, IBM Consulting introduced IBM Security for AI Transformation Services, integrating IBM Guardium AI Security to help organizations secure and govern AI deployments from discovery through to secure design and regulatory compliance management

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as enterprises adopt advanced threat-prevention and detection models.

- Demand will rise for consulting services that support zero-trust and identity-centric frameworks.

- Companies will increase reliance on experts to manage hybrid and multi-cloud security challenges.

- AI-driven risk analytics and automated response systems will expand consulting opportunities.

- Regulatory pressure will push more organizations to invest in compliance and governance advisory.

- Critical-infrastructure operators will strengthen long-term consulting partnerships for resilience.

- Small and mid-size firms will seek affordable consulting support to manage rising cyber risks.

- Global talent shortages will increase outsourcing of high-skill cybersecurity functions.

- Incident-readiness and forensic consulting will gain priority as attack severity escalates.

- Cross-industry digital transformation will expand the addressable market for advisory solutions.