Market Overview

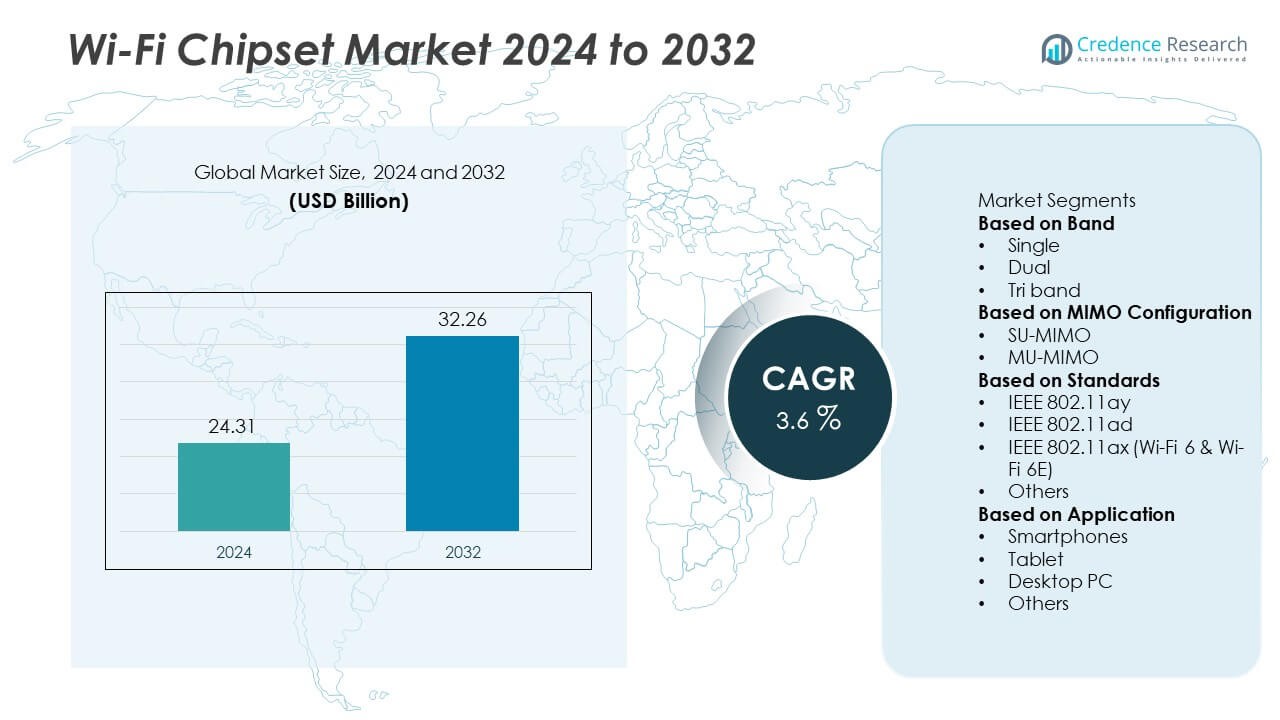

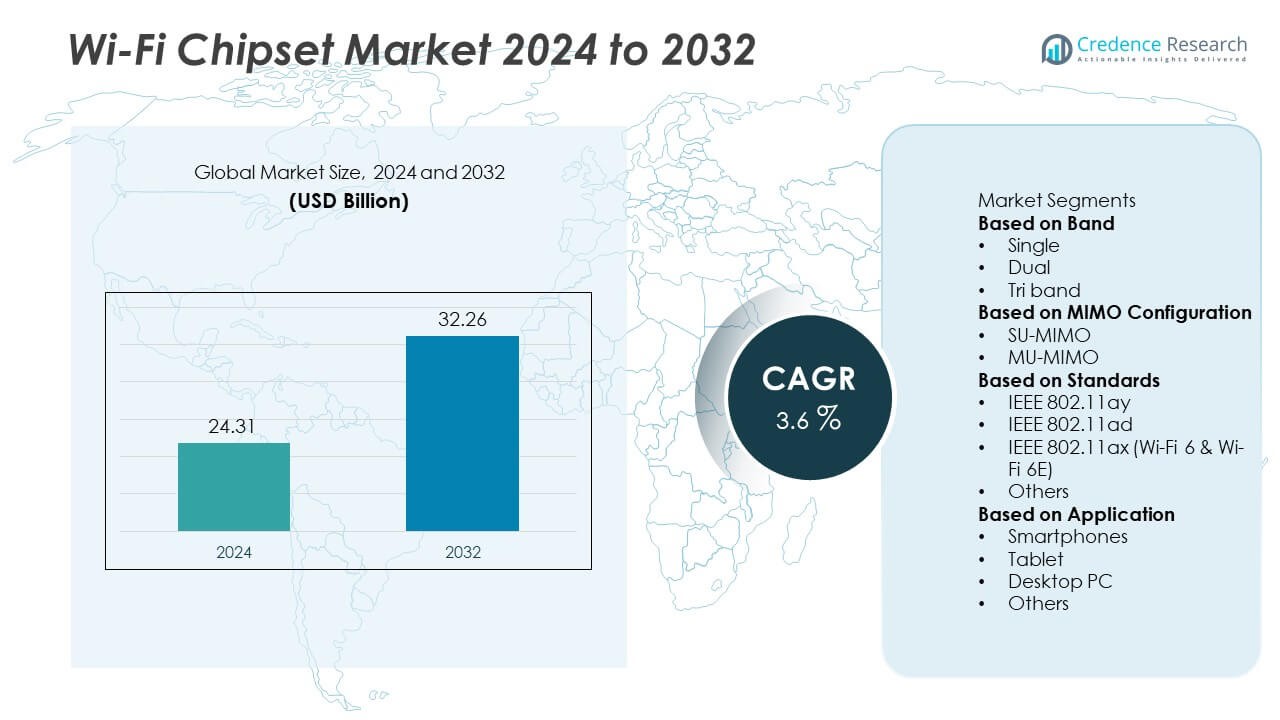

The Wi-Fi Chipset market reached USD 24.31 billion in 2024 and is projected to reach USD 32.26 billion by 2032, registering a CAGR of 3.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wi-Fi Chipset Market Size 2024 |

USD 24.31 Billion |

| Wi-Fi Chipset Market, CAGR |

3.6% |

| Wi-Fi Chipset Market Size 2032 |

USD 32.26 Billion |

Top players in the Wi-Fi Chipset market include Qualcomm Technologies, Broadcom Inc., Intel Corporation, MediaTek Inc., Texas Instruments, Marvell Technology, Samsung Electronics, Cypress Semiconductor, NXP Semiconductors, and Huawei Technologies. These companies strengthen market growth by developing advanced chipsets that support Wi-Fi 6, Wi-Fi 6E, and the upcoming Wi-Fi 7 standard. Their focus on higher data speeds, improved latency, and better power efficiency drives strong adoption across smartphones, laptops, routers, and IoT devices. North America leads the market with a 36% share, followed by Asia-Pacific at 29% due to strong electronics manufacturing, while Europe holds a 27% share, supported by growing digital infrastructure and enterprise connectivity needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Wi-Fi Chipset market was valued at USD 24.31 billion in 2024 and will reach USD 32.26 billion by 2032, expanding at a 3.6% CAGR due to rising global demand for high-speed wireless connectivity.

- Strong demand for advanced connectivity in consumer electronics drives growth, with dual-band chipsets holding a 57% segment share as manufacturers prioritize balanced performance and cost efficiency.

- Key trends include rapid adoption of Wi-Fi 6 and Wi-Fi 6E, increased deployment of MU-MIMO technology, and early development of Wi-Fi 7 to support low-latency applications such as AR/VR and cloud gaming.

- Competition intensifies as leading players enhance throughput, reduce power consumption, and integrate AI-based optimization to strengthen performance in dense device environments.

- Regionally, North America leads with a 36% share, Asia-Pacific follows with 29%, Europe holds 27%, while Latin America accounts for 5% and the Middle East & Africa for 3%, supported by expanding digital infrastructure.

Market Segmentation Analysis:

By Band

Dual-band chipsets lead this segment with a 57% market share, driven by strong adoption across smartphones, routers, laptops, and smart home devices. These chipsets support both 2.4 GHz and 5 GHz bands, enabling better coverage, faster speeds, and reduced interference in high-density environments. Manufacturers prefer dual-band technology because it balances performance and cost, making it suitable for mass-market electronics. Tri-band solutions gain traction in premium routers and gaming systems, while single-band remains limited to low-cost IoT devices. The rapid expansion of connected homes and enterprise Wi-Fi systems continues to strengthen dual-band dominance globally.

- For instance, Qualcomm’s FastConnect 7800 platform delivers 5.8 Gbps peak throughput with High-Band Simultaneous (HBS) Multi-Link, enabling dual-band and tri-band optimization in flagship phones.

By MIMO Configuration

MU-MIMO dominates this segment with a 62% market share, supported by rising demand for high-capacity and multi-user connectivity across residential, commercial, and industrial networks. This configuration allows simultaneous data transmission to multiple devices, improving network efficiency and reducing latency. As households and offices add more connected devices, MU-MIMO becomes essential for stable performance. SU-MIMO still appears in entry-level devices but struggles to meet modern bandwidth needs. Growth in smart TVs, VR headsets, and cloud-based applications continues to accelerate MU-MIMO chipset deployment across major device categories.

- For instance, Intel’s AX200 chipset supports 2×2 MU-MIMO with 2.4 Gbps maximum data rates in next-gen PCs.

By Standards

IEEE 802.11ax (Wi-Fi 6 & Wi-Fi 6E) leads this segment with a 53% market share, driven by strong global adoption across smartphones, routers, enterprise access points, and IoT systems. This standard improves speed, network capacity, and energy efficiency, making it suitable for high-density environments such as offices, airports, and smart homes. Wi-Fi 6E further expands capabilities with access to the 6 GHz band, supporting higher throughput and lower interference. Older standards like 802.11ad and 802.11ay hold niche roles in ultra-high-speed and short-range applications. The shift toward Wi-Fi 7 strengthens long-term demand for advanced 802.11ax-based chipsets.

Key Growth Drivers

Rising Demand for High-Speed Connectivity Across Consumer Electronics

The growing need for fast and reliable wireless connectivity in smartphones, laptops, smart TVs, and home networking devices drives strong demand for advanced Wi-Fi chipsets. Users expect seamless streaming, low-latency gaming, and stable performance in multi-device environments, pushing manufacturers to adopt higher-bandwidth solutions. The expansion of smart homes, supported by connected appliances and voice-controlled devices, further accelerates chipset integration. Continuous upgrades in Wi-Fi standards enhance user experience, strengthening long-term market growth across residential and commercial applications.

- For instance, Broadcom’s BCM67263 Wi-Fi 7 (802.11be) chipset delivers 11.5 Gbps speeds with 320 MHz channel support for premium routers.

Expansion of IoT, Industrial Automation, and Smart Infrastructure

The rapid growth of IoT devices across healthcare, manufacturing, logistics, and smart city projects boosts demand for energy-efficient and high-capacity Wi-Fi chipsets. Industrial automation systems rely on robust wireless connectivity to support sensors, robotics, and remote monitoring. Smart meters, surveillance systems, and building automation platforms increasingly adopt advanced MIMO configurations to manage high data loads. This trend supports strong deployment of Wi-Fi 6 and Wi-Fi 6E chipsets in both enterprise and public infrastructure environments.

- For instance, NXP’s IW612 tri-radio chipset supports Wi-Fi 6 at a peak throughput of 114.7 Mbps and enables concurrent operation of Wi-Fi, Bluetooth, and 802.15.4 for industrial IoT nodes.

Advancement of Wi-Fi Standards and Increased Adoption of Wi-Fi 6/6E

Technological progress in wireless standards significantly drives market expansion. Wi-Fi 6 and Wi-Fi 6E offer improved spectral efficiency, reduced latency, and higher network capacity, making them ideal for dense environments. Device manufacturers integrate these standards to future-proof hardware and meet rising performance expectations. Growing availability of 6 GHz spectrum further enhances throughput and reliability, encouraging adoption across flagship consumer devices and enterprise networks.

Key Trends & Opportunities

Emergence of Wi-Fi 7 and High-Bandwidth Applications

Development of Wi-Fi 7 opens new opportunities for ultra-fast connectivity, low latency, and enhanced multi-device handling. This standard supports high-resolution AR/VR, cloud gaming, and advanced industrial applications. Early adoption by premium device manufacturers accelerates innovation in chipset capabilities. Increasing demand for real-time applications encourages vendors to invest in next-generation architecture and multi-link operation technologies. This trend strengthens long-term growth across consumer, enterprise, and industrial sectors.

- For instance, MediaTek’s Filogic 880 platform integrates a 6 nm chip design and delivers 36 Gbps total throughput for premium gateways.

Growing Integration of AI and Power-Efficient Chipset Designs

AI-enabled chipset optimization creates new opportunities for intelligent bandwidth management, interference reduction, and adaptive power control. These advancements enhance performance in congested networks and extend battery life in portable devices. Chipset vendors focus on low-power designs to support wearable devices, IoT sensors, and compact consumer electronics. AI-driven connectivity management also helps improve user experience in smart homes and enterprise networks, boosting market adoption.

- For instance, Texas Instruments WL1837MOD uses integrated coexistence algorithms to improve efficiency in dense networks.

Key Challenges

Spectrum Limitations and Network Congestion Issues

High device density in homes, offices, and public areas creates congestion, straining network performance. Limited availability of clean spectrum reduces throughput and increases interference, challenging chipset efficiency. Despite advancements in Wi-Fi 6E and emerging Wi-Fi 7, not all regions support expanded spectrum policies. This slows global adoption and restricts availability of advanced features in some markets.

Security Vulnerabilities and Integration Complexities

Complex wireless environments increase exposure to security threats such as unauthorized access and data breaches. Chipset vendors must implement stronger encryption, secure firmware updates, and advanced authentication protocols. Integration with diverse devices, operating systems, and network configurations creates technical challenges for manufacturers. Ensuring compatibility across evolving standards adds cost and development complexity, slowing deployment in certain applications.

Regional Analysis

North America

North America leads the Wi-Fi Chipset market with a 36% market share, driven by strong adoption of advanced wireless standards across consumer electronics and enterprise infrastructure. The region benefits from early deployment of Wi-Fi 6 and Wi-Fi 6E in smartphones, laptops, routers, and smart home devices. Growth in cloud computing, remote work, and high-bandwidth applications strengthens demand for high-performance chipsets. Large investments in industrial IoT, smart manufacturing, and connected healthcare also support expansion. Major chipset manufacturers and technology providers contribute to continuous innovation, solidifying regional leadership.

Europe

Europe holds a 27% market share, supported by rising demand for high-speed connectivity across residential, commercial, and industrial sectors. Countries accelerate adoption of Wi-Fi 6 and Wi-Fi 6E to enhance digital infrastructure and meet data-intensive application needs. Smart home adoption grows steadily, increasing chipset integration across appliances and entertainment systems. Enterprise digital transformation and strong regulatory support for spectrum availability drive market expansion. Growth in connected vehicles, automation, and public Wi-Fi networks further strengthens chipset demand across the region.

Asia-Pacific

Asia-Pacific accounts for a 29% market share, fueled by large-scale consumer electronics production, strong smartphone penetration, and rapid digital adoption. The region leads manufacturing of Wi-Fi-enabled devices, driving high chipset demand from OEMs. Growing urbanization and rising disposable income boost adoption of smart TVs, laptops, and routers. Strong investments in industrial automation, smart cities, and 5G-Wi-Fi convergence accelerate chipset deployment. China, South Korea, Japan, and India remain major contributors due to expanding electronics ecosystems and continuous innovation in connectivity technologies.

Latin America

Latin America holds a 5% market share, with growth supported by increasing internet penetration and rising demand for affordable Wi-Fi devices. Countries expand broadband infrastructure and digital services, boosting adoption of Wi-Fi chipsets in homes and small businesses. Consumer electronics sales rise as more households adopt smart TVs, smartphones, and connected appliances. Despite economic limitations, demand grows steadily with support from telecom operators and public digital-inclusion programs. Brazil and Mexico lead regional adoption as they invest in upgraded Wi-Fi networks and enterprise connectivity solutions.

Middle East & Africa

The Middle East & Africa account for a 3% market share, driven by expanding telecom networks and rising demand for connected consumer devices. Smart city initiatives in the UAE, Saudi Arabia, and South Africa boost deployment of advanced Wi-Fi technologies. Adoption of Wi-Fi 6 gradually increases in commercial buildings, hospitality, and education sectors. Growth in e-learning, digital payments, and IoT applications supports steady market expansion. However, limited affordability and uneven infrastructure slow broader adoption, keeping the region in an early growth stage.

Market Segmentations:

By Band

By MIMO Configuration

By Standards

- IEEE 802.11ay

- IEEE 802.11ad

- IEEE 802.11ax (Wi-Fi 6 & Wi-Fi 6E)

- Others

By Application

- Smartphones

- Tablet

- Desktop PC

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape in the Wi-Fi Chipset market includes major players such as Qualcomm Technologies, Broadcom Inc., Intel Corporation, MediaTek Inc., Texas Instruments, Marvell Technology, Samsung Electronics, Cypress Semiconductor, NXP Semiconductors, and Huawei Technologies. These companies compete by developing high-performance chipsets that support Wi-Fi 6, Wi-Fi 6E, and emerging Wi-Fi 7 standards. Vendors focus on enhancing data throughput, reducing latency, and improving power efficiency to support modern applications in smartphones, laptops, routers, and IoT devices. Strategic partnerships with OEMs and device manufacturers strengthen product integration across consumer electronics and enterprise networks. Companies invest heavily in R&D to advance MU-MIMO, beamforming, and multi-band technologies, improving reliability in dense environments. Growing demand for industrial IoT, smart home devices, and advanced connectivity solutions continues to intensify competition as firms expand product portfolios and optimize chipset designs for diverse use cases.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Qualcomm Technologies

- Broadcom Inc.

- Intel Corporation

- MediaTek Inc.

- Texas Instruments

- Marvell Technology

- Samsung Electronics

- Cypress Semiconductor

- NXP Semiconductors

- Huawei Technologies

Recent Developments

- In October 2025, Broadcom Inc. launched the industry’s first Wi-Fi 8 silicon ecosystem, targeting smartphones, PCs, automotive and IoT edge devices.

- In September 2024, Samsung Electronics’s System LSI business announced a Wi-Fi 7 client-chipset collaboration with NETGEAR to ensure interoperable Wi-Fi 7 connectivity.

- In November 2023, MediaTek Inc. expanded its Wi-Fi 7 portfolio with the “Filogic 860” and “Filogic 360” chipsets aimed at access points and client devices.

Report Coverage

The research report offers an in-depth analysis based on Band, MIMO Configuration, Standards, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Wi-Fi 7 adoption will rise as demand grows for ultra-low latency and higher throughput.

- Dual-band and tri-band chipsets will gain traction with increasing smart home device usage.

- MU-MIMO and advanced beamforming will support stronger network performance in dense environments.

- Chipset designs will become more power-efficient to meet IoT and wearable device needs.

- AI-enabled optimization will improve connectivity, interference management, and network stability.

- Integration of Wi-Fi with 5G will expand hybrid connectivity solutions across industries.

- Enterprise demand will increase as workplaces upgrade to high-capacity Wi-Fi networks.

- Smart city deployments will boost adoption of high-performance Wi-Fi chipsets.

- Security-focused features will strengthen as cyber risks escalate for connected devices.

- R&D investment will rise as manufacturers shift toward next-generation multi-band wireless technologies.