Table of Content

CHAPTER NO. 1 : INTRODUCTION 14

1.1.1. Report Description 14

Purpose of the Report 14

USP & Key Offerings 14

1.1.2. Key Benefits for Stakeholders 14

1.1.3. Target Audience 15

1.1.4. Report Scope 15

CHAPTER NO. 2 : EXECUTIVE SUMMARY 16

2.1. 503b Compounding Pharmacies Market Snapshot 16

2.1.1. U.S. 503b Compounding Pharmacies Market, 2018 – 2032 (USD Million) 17

CHAPTER NO. 3 : GEOPOLITICAL CRISIS IMPACT ANALYSIS 18

3.1. Russia-Ukraine and Israel-Palestine War Impacts 18

CHAPTER NO. 4 : 503B COMPOUNDING PHARMACIES MARKET – INDUSTRY ANALYSIS 19

4.1. Introduction 19

4.2. Market Drivers 20

4.2.1. Driving Factor 1 Analysis 20

4.2.2. Driving Factor 2 Analysis 21

4.3. Market Restraints 22

4.3.1. Restraining Factor Analysis 22

4.4. Market Opportunities 23

4.4.1. Market Opportunity Analysis 23

4.5. Porter’s Five Forces Analysis 24

4.6. Value Chain Analysis 25

4.7. Buying Criteria 26

CHAPTER NO. 5 : MANUFACTURING COST ANALYSIS 27

5.1. Manufacturing Cost Analysis 27

5.2. Manufacturing Process 27

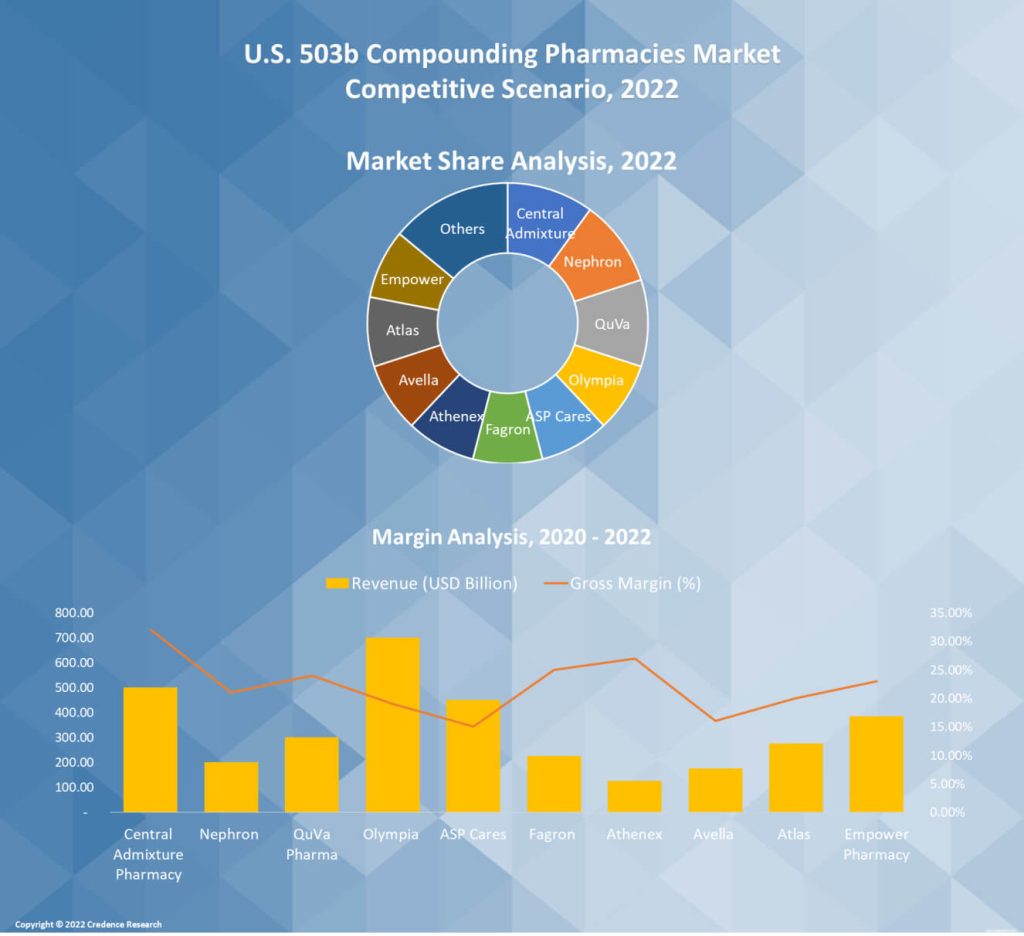

CHAPTER NO. 6 : ANALYSIS COMPETITIVE LANDSCAPE 28

6.1. Company Market Share Analysis – 2023 28

6.1.1. U.S. 503b Compounding Pharmacies Market: Company Market Share, by Volume, 2023 28

6.1.2. U.S. 503b Compounding Pharmacies Market: Company Market Share, by Revenue, 2023 29

6.1.3. U.S. 503b Compounding Pharmacies Market: Top 6 Company Market Share, by Revenue, 2023 29

6.1.4. U.S. 503b Compounding Pharmacies Market: Top 3 Company Market Share, by Revenue, 2023 30

6.2. U.S. 503b Compounding Pharmacies Market Company Volume Market Share, 2023 31

6.3. U.S. 503b Compounding Pharmacies Market Company Revenue Market Share, 2023 32

6.4. Company Assessment Metrics, 2023 33

6.4.1. Stars 33

6.4.2. Emerging Leaders 33

6.4.3. Pervasive Players 33

6.4.4. Participants 33

6.5. Start-ups /SMEs Assessment Metrics, 2023 33

6.5.1. Progressive Companies 33

6.5.2. Responsive Companies 33

6.5.3. Dynamic Companies 33

6.5.4. Starting Blocks 33

6.6. Strategic Developments 34

6.6.1. Acquisitions & Mergers 34

New Product Launch 34

Regional Expansion 34

6.7. Key Players Product Matrix 35

CHAPTER NO. 7 : PESTEL & ADJACENT MARKET ANALYSIS 36

7.1. PESTEL 36

7.1.1. Political Factors 36

7.1.2. Economic Factors 36

7.1.3. Social Factors 36

7.1.4. Technological Factors 36

7.1.5. Environmental Factors 36

7.1.6. Legal Factors 36

7.2. Adjacent Market Analysis 36

CHAPTER NO. 8 : 503B COMPOUNDING PHARMACIES MARKET – BY MOLECULE SEGMENT ANALYSIS 37

8.1. 503b Compounding Pharmacies Market Overview, by Molecule Segment 37

8.1.1. 503b Compounding Pharmacies Market Revenue Share, By Molecule, 2023 & 2032 38

8.1.2. 503b Compounding Pharmacies Market Attractiveness Analysis, By Molecule 39

8.1.3. Incremental Revenue Growth Opportunity, by Molecule, 2024 – 2032 39

8.1.4. 503b Compounding Pharmacies Market Revenue, By Molecule, 2018, 2023, 2027 & 2032 40

8.2. Acetaminophen 41

8.3. Phenylephrine 42

8.4. Midazolam 43

8.5. Esmolol 44

8.6. Vancomycin 45

8.7. Epinephrine 46

8.8. Adenocaine 46

8.9. Fentanyl/ Bupivacaine 46

8.10. Morphine 46

8.11. Amiodarone 46

8.12. Heparin 46

8.13. Ketamine 46

8.14. Dextrose 46

8.15. Hydromorphone 46

8.16. Bupivacaine 46

8.17. Lidocaine 46

8.18. BKK (Bupivacaine, ketorolac, Ketamine) 46

8.19. RCK (Ropivacaine, Clonidine, Ketorolac) 46

8.20. RKK (Ropivacaine, Ketorolac, Ketamine) 46

8.21. Others 46

CHAPTER NO. 9 : 503B COMPOUNDING PHARMACIES MARKET – BY PACKAGING SEGMENT ANALYSIS 47

9.1. 503b Compounding Pharmacies Market Overview, by Packaging Segment 47

9.1.1. 503b Compounding Pharmacies Market Revenue Share, By Packaging, 2023 & 2032 48

9.1.2. 503b Compounding Pharmacies Market Attractiveness Analysis, By Packaging 49

9.1.3. Incremental Revenue Growth Opportunity, by Packaging, 2024 – 2032 49

9.1.4. 503b Compounding Pharmacies Market Revenue, By Packaging, 2018, 2023, 2027 & 2032 50

9.2. Vials 51

9.3. Prefilled Syringes 52

9.4. Ampoules 53

9.5. Syringes 54

9.6. Others 55

CHAPTER NO. 10 : 503B COMPOUNDING PHARMACIES MARKET – U.S. ANALYSIS 56

10.1. Molecule 56

10.1.1. U.S. 503b Compounding Pharmacies Market Revenue, By Molecule, 2018 – 2023 (USD Million) 56

10.2. U.S. 503b Compounding Pharmacies Market Revenue, By Molecule, 2024 – 2032 (USD Million) 56

10.3. Packaging 57

10.3.1. U.S. 503b Compounding Pharmacies Market Revenue, By Packaging, 2018 – 2023 (USD Million) 57

10.3.2. U.S. 503b Compounding Pharmacies Market Revenue, By Packaging, 2024 – 2032 (USD Million) 57

CHAPTER NO. 11 : COMPANY PROFILES 58

11.1. Central Admixture Pharmacy Services, Inc. 58

11.1.1. Company Overview 58

11.1.2. Product Portfolio 58

11.1.3. Swot Analysis 58

11.1.4. Business Strategy 59

11.1.5. Financial Overview 59

11.2. Nephron Pharmaceuticals Corporation 60

11.3. QuVa Pharma 60

11.4. Olympia Pharmacy 60

11.5. ASP Cares 60

11.6. Fagron Compounding Pharmacies 60

11.7. Athenex, Inc. 60

11.8. Optum 60

11.9. Atlas Pharmaceuticals 60

11.10. Empower Pharmacy 60

11.11. Carie Boyd’S Prescription Shop 60

11.12. Edge Pharma 60

11.13. IntegraDose Compounding services 60

11.14. Wells Pharma 60

11.15. SCA Pharma 60

11.16. Imprimis NJOF 60

11.17. Others 60

CHAPTER NO. 12 : RESEARCH METHODOLOGY 61

12.1. Research Methodology 61

12.1.1. Phase I – Secondary Research 62

12.1.2. Phase II – Data Modeling 62

Company Share Analysis Model 63

Revenue Based Modeling 63

12.1.3. Phase III – Primary Research 64

12.1.4. Research Limitations 65

Assumptions 65

List of Figures

FIG NO. 1. U.S. 503b Compounding Pharmacies Market Revenue, 2018 – 2032 (USD Million) 18

FIG NO. 2. Porter’s Five Forces Analysis for U.S. 503b Compounding Pharmacies Market 25

FIG NO. 3. Value Chain Analysis for U.S. 503b Compounding Pharmacies Market 26

FIG NO. 4. Manufacturing Cost Analysis 28

FIG NO. 5. Manufacturing Process 28

FIG NO. 6. Company Share Analysis, 2023 29

FIG NO. 7. Company Share Analysis, 2023 30

FIG NO. 8. Company Share Analysis, 2023 30

FIG NO. 9. Company Share Analysis, 2023 31

FIG NO. 10. 503b Compounding Pharmacies Market – Company Volume Market Share, 2023 32

FIG NO. 11. 503b Compounding Pharmacies Market – Company Revenue Market Share, 2023 33

FIG NO. 12. 503b Compounding Pharmacies Market Revenue Share, By Molecule, 2023 & 2032 39

FIG NO. 13. Market Attractiveness Analysis, By Molecule 40

FIG NO. 14. Incremental Revenue Growth Opportunity by Molecule, 2024 – 2032 40

FIG NO. 15. 503b Compounding Pharmacies Market Revenue, By Molecule, 2018, 2023, 2027 & 2032 41

FIG NO. 16. U.S. 503b Compounding Pharmacies Market for Acetaminophen, Revenue (USD Million) 2018 – 2032 42

FIG NO. 17. U.S. 503b Compounding Pharmacies Market for Phenylephrine, Revenue (USD Million) 2018 – 2032 43

FIG NO. 18. U.S. 503b Compounding Pharmacies Market for Midazolam, Revenue (USD Million) 2018 – 2032 44

FIG NO. 19. U.S. 503b Compounding Pharmacies Market for Esmolol, Revenue (USD Million) 2018 – 2032 45

FIG NO. 20. U.S. 503b Compounding Pharmacies Market for Vancomycin, Revenue (USD Million) 2018 – 2032 46

FIG NO. 21. 503b Compounding Pharmacies Market Revenue Share, By Packaging, 2023 & 2032 49

FIG NO. 22. Market Attractiveness Analysis, By Packaging 50

FIG NO. 23. Incremental Revenue Growth Opportunity by Packaging, 2024 – 2032 50

FIG NO. 24. 503b Compounding Pharmacies Market Revenue, By Packaging, 2018, 2023, 2027 & 2032 51

FIG NO. 25. U.S. 503b Compounding Pharmacies Market for Vials, Revenue (USD Million) 2018 – 2032 52

FIG NO. 26. U.S. 503b Compounding Pharmacies Market for Prefilled Syringes, Revenue (USD Million) 2018 – 2032 53

FIG NO. 27. U.S. 503b Compounding Pharmacies Market for Ampoules, Revenue (USD Million) 2018 – 2032 54

FIG NO. 28. U.S. 503b Compounding Pharmacies Market for Syringes, Revenue (USD Million) 2018 – 2032 55

FIG NO. 29. U.S. 503b Compounding Pharmacies Market for Others, Revenue (USD Million) 2018 – 2032 56

FIG NO. 30. Research Methodology – Detailed View 62

FIG NO. 31. Research Methodology 63

List of Tables

TABLE NO. 1. : U.S. 503b Compounding Pharmacies Market: Snapshot 16

TABLE NO. 2. : Drivers for the 503b Compounding Pharmacies Market: Impact Analysis 20

TABLE NO. 3. : Restraints for the 503b Compounding Pharmacies Market: Impact Analysis 22

TABLE NO. 4. : U.S. 503b Compounding Pharmacies Market Revenue, By Molecule, 2018 – 2023 (USD Million) 56

TABLE NO. 5. : U.S. 503b Compounding Pharmacies Market Revenue, By Molecule, 2024 – 2032 (USD Million) 56

TABLE NO. 6. : U.S. 503b Compounding Pharmacies Market Revenue, By Packaging, 2018 – 2023 (USD Million) 57

TABLE NO. 7. : U.S. 503b Compounding Pharmacies Market Revenue, By Packaging, 2024 – 2032 (USD Million) 57