Market Overview:

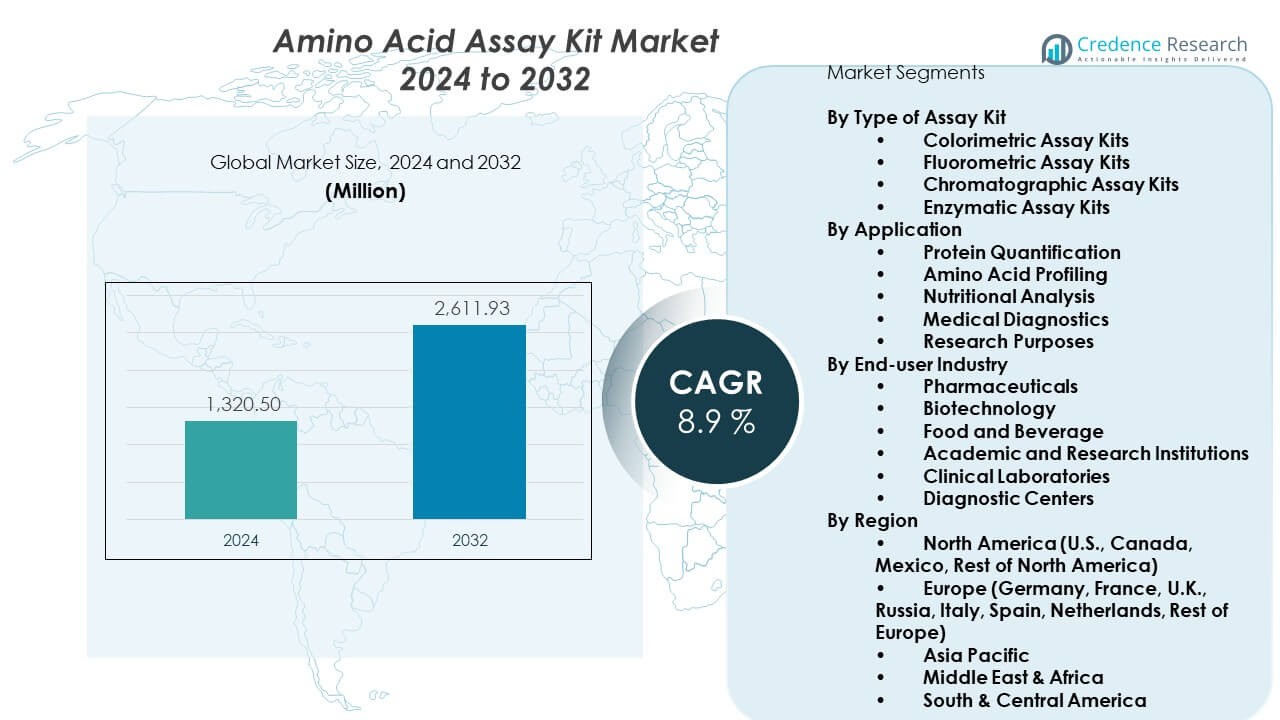

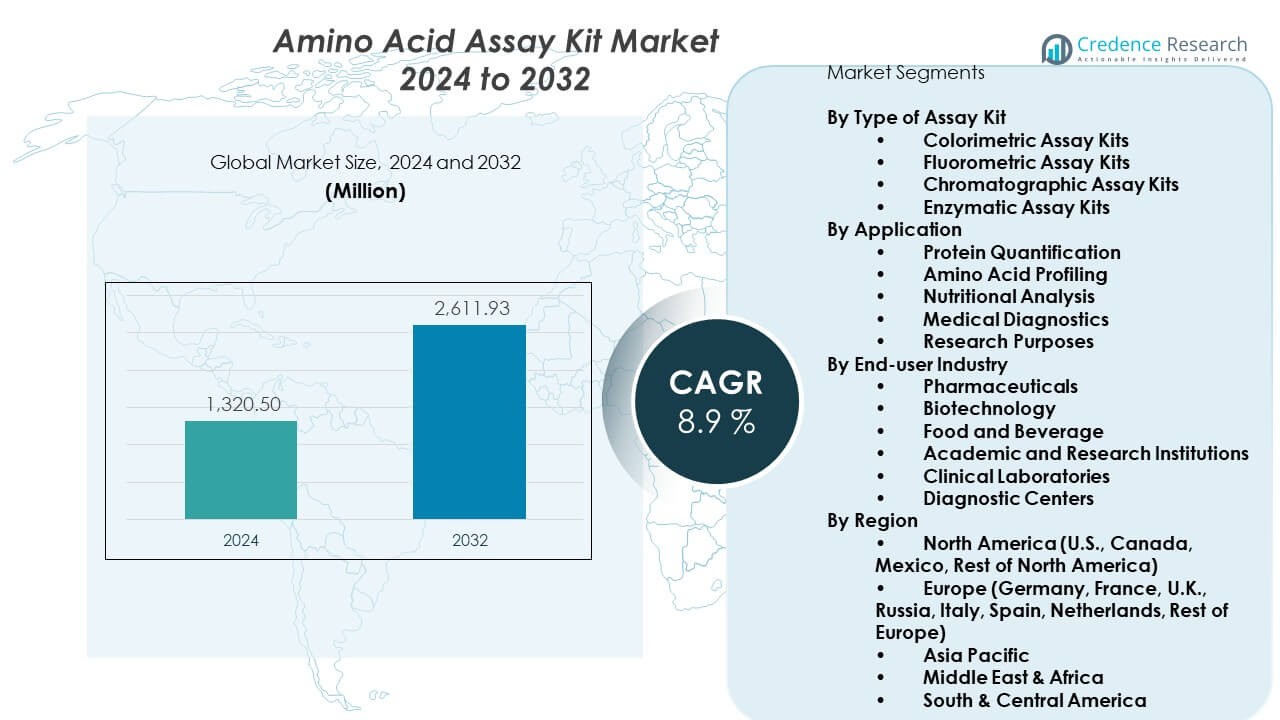

The Amino Acid Assay Kit Market is projected to grow from USD 1320.5 million in 2024 to an estimated USD 2611.93 million by 2032, with a compound annual growth rate (CAGR) of 8.9% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Amino Acid Assay Kit Market Size 2024 |

USD 1320.5 Million |

| Amino Acid Assay Kit Market, CAGR |

8.9% |

| Amino Acid Assay Kit Market Size 2032 |

USD 2611.93 Million |

Growing demand from biopharmaceutical developers strengthens interest in advanced assay tools. Research teams use these kits to support protein analysis, metabolic studies, and cell health testing. Diagnostic labs adopt fast-response formats to improve workflow outcomes. Rising investments in precision medicine boost the use of quantification methods. Food and nutrition companies depend on amino acid profiling for quality control. Academic institutes expand research around metabolic disorders. Automation improves turnaround time across laboratories and drives wider acceptance. These combined forces accelerate adoption across major scientific hubs.

North America leads due to strong biotech activities and wide diagnostic usage. Europe follows with a mature network of research centers and strict quality standards. Asia Pacific emerges as the fastest-growing region driven by expanding pharmaceutical manufacturing and rising clinical research capacity. China, India, and South Korea strengthen their lab infrastructure to support protein and metabolite studies. Latin America increases uptake as local testing capabilities improve. The Middle East and Africa show gradual progress through expanding academic and hospital labs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Amino acid assay kit market stands at USD 1320.5 million in 2024 and is projected to reach USD 2611.93 million by 2032, growing at a CAGR of 8.9% driven by rising biopharma research and diagnostic expansion.

- North America holds ~38%, Europe ~30%, and Asia Pacific ~22% of the global share, supported by advanced R&D infrastructure, strong diagnostic capacity, and high adoption of analytical technologies.

- Asia Pacific remains the fastest-growing region with ~22% share, driven by expanding pharmaceutical manufacturing, rising clinical testing demand, and rapid investment in academic research capabilities.

- Colorimetric assay kits account for ~35% of total demand, supported by ease of use, fast workflows, and strong integration into routine laboratory testing.

- Pharmaceutical and biotechnology end users together hold ~45% of the market, driven by extensive usage in protein analysis, metabolic studies, and biologics development programs.

Market Drivers:

Growing Application in Biopharmaceutical Research

The Amino acid assay kit market gains strong momentum from rising biopharmaceutical research. Drug developers depend on accurate amino acid measurement to support protein engineering tasks. Labs adopt advanced kits to improve analysis efficiency. Demand rises as biologics pipelines expand across global facilities. High-throughput platforms help teams manage large testing volumes. Researchers rely on consistent output to validate metabolic functions. Diagnostic groups use these tools to enhance precision in clinical workflows. Wider adoption continues across major research hubs.

- For instance, Thermo Fisher Scientific’s Pico•Tag amino acid analysis system supports high-accuracy profiling and is documented to deliver retention time reproducibility below 1% RSD, which enables consistent protein characterization in biologics development.

Rising Focus on Nutritional Quality Assessment

Food and nutrition companies adopt amino acid assays to improve quality testing. Producers need reliable profiling methods to validate ingredient composition. Sports nutrition brands depend on precise analysis to support product claims. Kit manufacturers design specialized formats for routine testing needs. Regulatory checks push firms to maintain strong nutrient transparency. The workflow helps teams optimize formulation accuracy. It also supports rapid authentication of raw materials. Demand grows across global nutrition supply chains.

- For instance, Shimadzu’s LC-2030 amino acid analysis platform is widely used in food laboratories and has documented analysis cycle times under 10 minutes per sample, enabling rapid verification of nutritional amino acid profiles in processed foods.

Expanding Use in Academic and Clinical Research

Universities integrate advanced kits into metabolic and cellular studies. Research teams measure amino acid patterns to understand disease pathways. The workflow supports early-stage studies across multiple disciplines. Clinicians use results to support diagnostic insights for metabolic disorders. Labs adopt faster protocols to reduce turnaround time. Funding growth strengthens equipment purchases across institutions. Automation tools help teams scale test volumes. Adoption expands with rising interest in precision medicine.

Increasing Preference for High-Throughput and Automated Tools

Automation improves consistency across testing workflows. Labs shift toward platforms that support multiplex analysis. High-throughput tools help teams complete projects faster. Consistent output supports quality goals across regulated sectors. The method reduces manual workload for research groups. It ensures stronger reproducibility during repeated testing cycles. Growing demand for workflow optimization strengthens adoption. Users prefer simplified kits that reduce handling errors.

Market Trends:

Shift Toward Advanced Chromatography and Mass-Based Detection

The Amino acid assay kit market sees strong interest in chromatography-linked assays. Labs adopt LC and mass-based enhancements to improve sensitivity. Detection limits improve through advanced reagent designs. Teams choose hybrid formats to support complex profiling needs. The trend improves identification accuracy across dense protein samples. Users prefer modular kits that match instrument upgrades. Innovation pushes suppliers to expand analytical compatibility. The shift aligns with rising expectations for precise biomolecule analysis.

- For instance, Agilent Technologies’ 6475 Triple Quad LC/MS system supports amino acid quantification with documented detection limits in the low femtomole range, verified through application notes used in metabolomics and biomarker research.

Growing Demand for Ready-to-Use and Pre-Optimized Kits

Pre-optimized kits reduce preparation time for research teams. Users prefer formats that improve workflow reliability. Ready-to-use designs help labs maintain strong output quality. Newer products include stable reagents for longer storage. The method supports routine testing in multi-user environments. Researchers choose simplified layouts to reduce handling mistakes. Kit makers expand offerings that support fast adoption. The trend accelerates with rising interest in efficient lab operations.

- For instance, Merck KGaA’s EZ:faast amino acid analysis kit is documented to reduce sample preparation time to under 7 minutes, a major improvement compared to traditional hydrolysis workflows spanning several hours.

Rising Integration of Digital Data Management

Labs integrate software tools to manage result tracking. Digital platforms help teams centralize amino acid profiles. Users adopt automated data capture for streamlined reporting. Cloud-based storage supports collaborative work across research centers. Teams improve traceability with structured data flows. Suppliers add digital features to strengthen user experience. Integration supports regulatory documentation for clinical labs. Adoption grows across global research networks.

Growing Use in Personalized Nutrition and Wellness Platforms

Consumer-focused labs deploy amino acid analysis for tailored nutrition programs. Test providers improve wellness profiling with advanced kits. The method supports personalized diet design. Rising interest in biochemical markers drives higher testing demand. Startups integrate amino acid data into digital health tools. Clinics use insights to guide metabolic assessments. The segment gains support from expanding wellness segments. Growth continues as personalized care becomes mainstream.

Market Challenges Analysis:

Variability in Testing Standards Across Research Environments

The Amino acid assay kit market faces challenges linked to inconsistent testing protocols. Labs rely on differing methods that create output variations. Inconsistent reagent quality affects reproducibility across facilities. Users require trained personnel to manage complex workflows. Limited standardization complicates cross-lab data comparison. Some older instruments struggle with new kit formats. Teams face delays during method validation. Suppliers work to improve stability across product categories.

High Cost of Advanced Assays and Limited Access in Developing Regions

Advanced kits require costly reagents that raise operational expenses. Labs in developing regions struggle with procurement delays. Import barriers hinder consistent supply for research centers. Limited funding restricts access to advanced automation platforms. Users depend on basic testing tools that reduce accuracy. Service gaps affect skill growth among early-stage lab teams. The challenge slows expansion across emerging markets. Industry players explore scalable models to improve accessibility.

Market Opportunities:

Expansion of Precision Medicine and Metabolic Disorder Research

The Amino acid assay kit market gains strong opportunities from precision medicine growth. Labs expand testing to support metabolic disorder studies. Biomarker programs require accurate amino acid profiling. Hospitals integrate advanced assays for patient evaluations. Developers design targeted therapies that rely on metabolic insights. The workflow aligns with global focus on personalized treatment. Wider adoption supports new research collaborations. Growth prospects strengthen across clinical networks.

Rising Adoption in Food, Agriculture, and Alternative Protein Development

Food producers increase testing to validate nutritional content. Agriculture labs explore amino acid patterns to improve crop output. Alternative protein developers use assays to assess formulation quality. Startups adopt profiling to optimize fermentation processes. The opportunity grows with rising demand for nutrient-rich foods. Testing helps teams maintain transparency for clean-label products. Researchers explore new applications for amino acid mapping. Adoption expands across global food innovation hubs.

Market Segmentation Analysis:

By Type of Assay Kit

The Amino acid assay kit market covers four core assay formats that support varied analytical needs. Colorimetric kits lead routine laboratory workflows due to their simple protocols and fast readouts. Fluorometric kits attract users who need higher sensitivity for low-concentration samples. Chromatographic kits support complex studies that require precise separation and detailed profiling. Enzymatic kits help teams achieve stronger specificity during biochemical testing. Each format supports unique research and industrial applications. Demand continues to shift toward high-performance platforms that improve workflow reliability.

- For instance, Bio-Rad Laboratories’ Amino Acid Standard H supports chromatographic workflows with certified concentration accuracy better than ±2%, ensuring precise calibration for research and industrial users.

By Application

Protein quantification remains a key application category that drives steady adoption across research and production groups. Amino acid profiling supports deeper metabolic studies and strengthens advanced R&D programs. Nutritional analysis gains traction in food testing environments that require strict composition checks. Medical diagnostics uses targeted assays for metabolic disorder evaluation. Research purposes remain broad, covering cellular studies, protein engineering tasks, and biomarker discovery. Each application contributes to the overall expansion of analytical demand.

- For instance, PerkinElmer’s QSight LC/MS platform is used in clinical metabolic labs and supports amino acid diagnostic panels with documented CV values typically below 10%, enabling reliable detection of inborn errors of metabolism.

By End-user Industry

Pharmaceutical companies rely on amino acid assays to support drug development and biologics manufacturing. Biotechnology firms adopt high-precision platforms for molecular research and strain optimization workflows. Food and beverage producers use kits to validate nutritional content and maintain quality standards. Academic and research institutions integrate these tools into teaching, experimentation, and long-term scientific projects. Clinical laboratories and diagnostic centers deploy assays for patient evaluations and specialized metabolic screenings. End users seek accuracy, ease of use, and strong reproducibility across testing cycles.

Segmentation:

By Type of Assay Kit

- Colorimetric Assay Kits

- Fluorometric Assay Kits

- Chromatographic Assay Kits

- Enzymatic Assay Kits

By Application

- Protein Quantification

- Amino Acid Profiling

- Nutritional Analysis

- Medical Diagnostics

- Research Purposes

By End-user Industry

- Pharmaceuticals

- Biotechnology

- Food and Beverage

- Academic and Research Institutions

- Clinical Laboratories

- Diagnostic Centers

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The Amino acid assay kit market holds its largest share in North America due to strong biopharmaceutical R&D activity. The region benefits from mature laboratory infrastructure and high adoption of advanced analytical technologies. U.S. research institutions drive heavy usage through ongoing protein and metabolic studies. Clinical laboratories expand testing volumes to support precision-based diagnostics. Canada strengthens demand through biotechnology growth and academic research initiatives. Mexico contributes a smaller but rising portion of regional uptake. The region maintains its lead through continuous investment in scientific innovation.

Europe

Europe accounts for a significant share of global demand, supported by strong regulatory standards and extensive research networks. Labs in Germany, the U.K., and France adopt high-performance kits for pharmaceutical and academic applications. Research teams rely on advanced profiling tools to support molecular biology programs. Clinical centers integrate amino acid testing to strengthen diagnostic workflows. Italy, Spain, and the Netherlands contribute steady consumption across food and medical sectors. The region maintains a balanced share through sustained investment in analytical technologies. It continues to expand adoption in both public and private laboratories.

Asia Pacific, Middle East & Africa, and South & Central America

Asia Pacific holds a fast-growing share driven by rapid expansion of pharmaceutical manufacturing and research institutions. China and India lead usage through large academic ecosystems and rising diagnostic demand. South Korea and Japan support strong adoption through advanced technology platforms. Middle East & Africa maintain a smaller share but show steady growth through investments in healthcare and laboratory infrastructure. South & Central America continue to hold a developing share with rising uptake across clinical and food testing facilities. Each region expands adoption through improved research capabilities and growing interest in biochemical analysis.

Key Player Analysis:

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Abcam plc

- BioVision Inc.

- Bio-Rad Laboratories Inc.

- Lonza Group AG

- GE Healthcare

- Danaher Corporation

- Wako Pure Chemical Industries Ltd.

- Promega Corporation

- Roche Diagnostics International Ltd.

- Sigma-Aldrich Corporation (Merck)

- Shimadzu Corporation

- PerkinElmer Inc.

- Agilent Technologies Inc.

Competitive Analysis:

The Amino acid assay kit market features strong competition led by global analytical and life-science companies. Vendors focus on higher sensitivity, simplified workflows, and stronger assay reproducibility. Major brands enhance product portfolios through chromatography-linked, enzymatic, and fluorometric platforms. New entrants target niche applications such as nutritional profiling and precision diagnostics. Established suppliers strengthen reach through digital integration and instrument-compatible kits. Companies offer differentiated reagent stability to support high-volume laboratories. It remains competitive due to continuous product innovation and performance benchmarking. Partnerships with research institutes support wider adoption across key scientific hubs.

Recent Developments:

- In October 2025, Thermo Fisher Scientific Inc. announced the acquisition of Clario Holdings, Inc., a clinical trial data company, for $8.9 billion in cash to enhance its pharma and biotech customer offerings and accelerate innovation in clinical trials. This acquisition aims to deepen Thermo Fisher’s clinical trial capabilities supporting drug development and biopharma research.

- In October 2025, Merck KGaA announced the definitive agreement to acquire the chromatography business of JSR Life Sciences. This acquisition will enhance Merck’s downstream process offerings, especially with advanced Protein A chromatography technology, boosting biopharmaceutical therapy production efficiency. The transaction is expected to close by mid-2026.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on By Type of Assay Kit and By Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for high-throughput amino acid profiling will rise across major laboratories.

- Automation tools will support faster adoption in clinical and biopharmaceutical workflows.

- Chromatography-ready kits will gain traction due to higher accuracy needs.

- Nutritional testing and food science applications will expand rapidly.

- Advanced reagent stability will shape purchasing decisions across high-volume labs.

- Digital data integration will strengthen quality control requirements.

- Personalized medicine programs will increase clinical testing volumes.

- Academic institutions will boost adoption through expanded metabolic research.

- Diagnostic centers will deploy more sensitive kits for disorder screening.

- Global manufacturers will compete through innovation and regional expansion strategies.