Market Overview

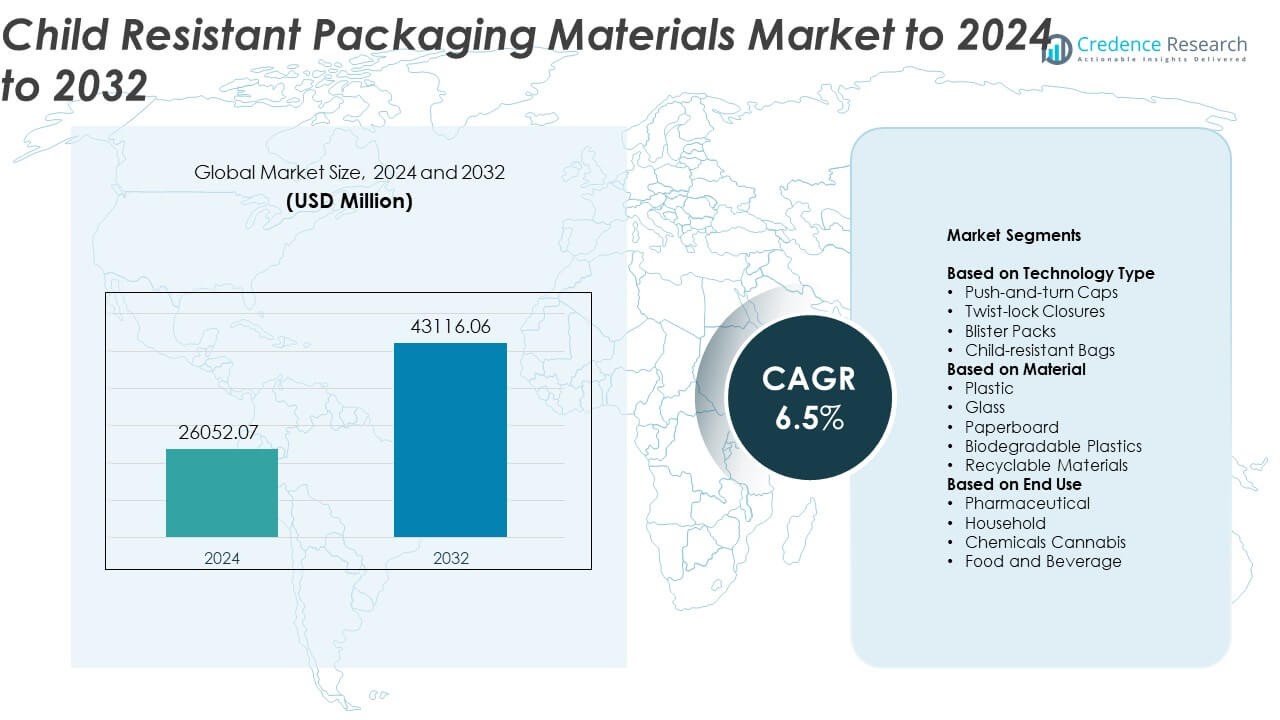

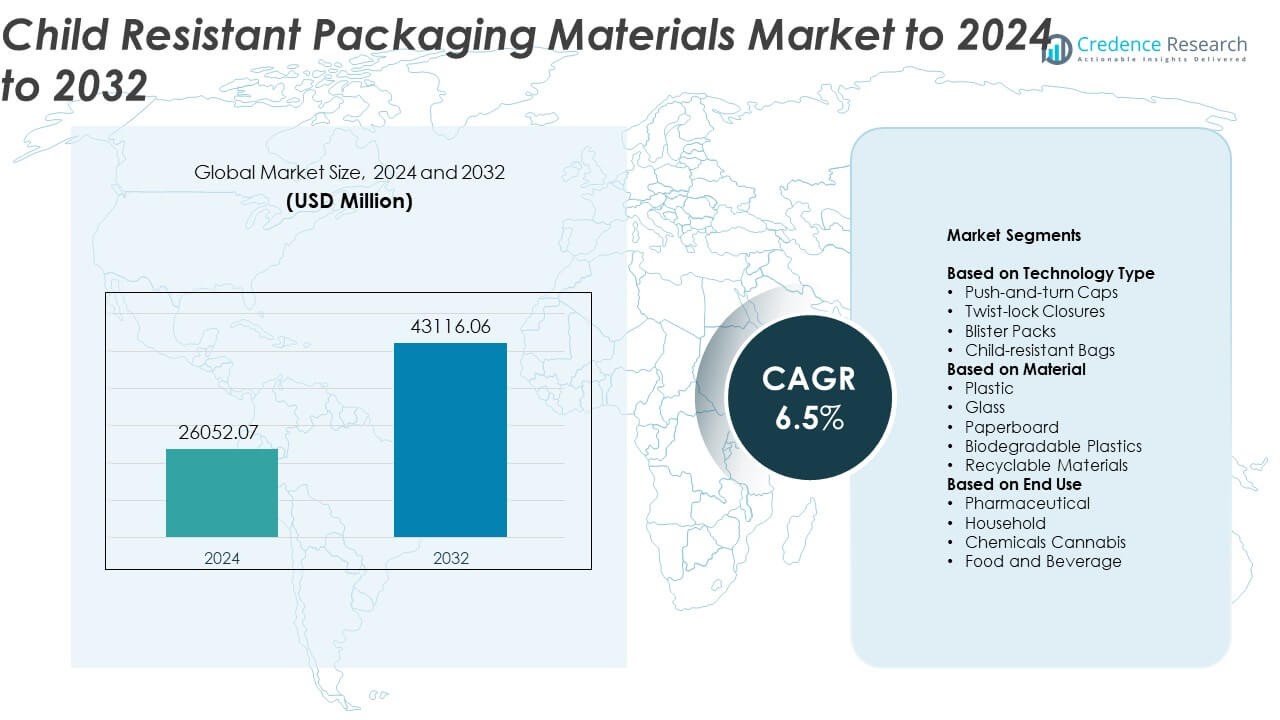

Child Resistant Packaging Materials Market size was valued at USD 26052.07 Million in 2024 and is anticipated to reach USD 43116.06 Million by 2032, at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Child Resistant Packaging Materials Market Size 2024 |

USD 26052.07 Million |

| Child Resistant Packaging Materials Market, CAGR |

6.5% |

| Child Resistant Packaging Materials Market Size 2032 |

USD 43116.06 Million |

The child resistant packaging materials market is led by major players such as Amcor plc, Berry Global Inc., Gerresheimer AG, WestRock Company, AptarGroup, Inc., and Mondi Group, alongside emerging competitors like Stora Enso Oyj and Klockner Pentaplast. These companies focus on developing innovative, compliant, and sustainable packaging materials that meet global safety regulations. North America leads the market with approximately 37% share in 2024, driven by stringent safety standards and high pharmaceutical consumption. Europe follows with around 28% share, supported by strong regulatory frameworks and sustainability initiatives, while Asia Pacific rapidly expands with nearly 23% share due to rising healthcare and industrial packaging demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The child resistant packaging materials market was valued at USD 26052.07 Million in 2024 and is projected to reach USD 43116.06 Million by 2032, growing at a CAGR of 6.5%.

- Increasing regulatory requirements for child safety in pharmaceuticals and household chemicals are key drivers enhancing adoption across industries.

- Rising sustainability trends are pushing manufacturers toward biodegradable plastics and recyclable materials, improving product appeal and compliance.

- The market is highly competitive, with major players investing in smart closure technologies, eco-friendly materials, and global expansion to maintain leadership.

- North America holds 37% share due to strict safety regulations, followed by Europe with 28%, while Asia Pacific grows fastest at 23%, supported by expanding pharmaceutical and packaging manufacturing bases.

Market Segmentation Analysis:

By Technology Type

The push-and-turn caps segment dominates the child resistant packaging materials market, accounting for nearly 41% share in 2024. Their widespread use in pharmaceutical and household chemical packaging is driven by reliability and cost efficiency. These closures provide an effective balance between child safety and user convenience. Increasing regulatory focus on child safety standards and the high adaptability of push-and-turn designs across container types support market growth. Blister packs and child-resistant bags are gaining traction due to expanding applications in over-the-counter medicines and cannabis products.

- For instance, Gwalia Healthcare lists over 7 push-and-turn CRC sizes (20–45 mm) certified to BS EN ISO 8317:2015, offering a full range of closures within this standard.

By Material

Plastic leads the market with around 52% share in 2024, driven by its durability, flexibility, and lightweight properties. It enables complex designs for closures and blister packs that meet strict safety standards. Rising use of polypropylene and polyethylene in packaging pharmaceuticals and household products enhances market expansion. However, growing environmental concerns are pushing manufacturers toward recyclable and biodegradable plastics. Glass and paperboard are also gaining moderate growth due to their sustainability appeal and compliance with eco-friendly packaging trends.

- For instance, Gerresheimer offers Duma® Twist-Off in 18 sizes from 15–600 ml, with optional child-resistant closures.

By End Use

The pharmaceutical segment holds the largest share of approximately 48% in 2024. Strict global regulations for child-resistant packaging in prescription and over-the-counter medicines drive its dominance. Increasing medication use and safety awareness among parents further boost adoption. Household and chemical applications follow, supported by demand for safe packaging for cleaning agents and pesticides. Meanwhile, the food and beverage and cannabis industries are rapidly adopting child-resistant materials to comply with safety laws and enhance product credibility.

Key Growth Drivers

Stringent Regulatory Mandates

Stringent global regulations mandating child-resistant packaging for pharmaceuticals, chemicals, and cannabis products remain a primary growth driver. Authorities such as the U.S. Consumer Product Safety Commission and the European Medicines Agency enforce strict safety standards to reduce accidental poisoning incidents. Manufacturers are investing in compliant packaging designs that balance safety with user convenience. The growing enforcement of these standards across developing economies further strengthens market expansion and pushes companies to innovate in materials and closure mechanisms.

- For instance, Berry Global’s PET bottle with PP28 Medi-Loc® cap is certified to ISO 8317 and 16 CFR 1700.20, covering five bottle sizes and four liner types.

Rising Pharmaceutical Consumption

The surge in prescription and over-the-counter drug use globally is fueling demand for child-resistant packaging materials. The rise in chronic diseases, coupled with expanding geriatric and pediatric populations, increases the need for safe and accessible medication containers. Pharmaceutical firms prefer push-and-turn caps and blister packs to meet regulatory and safety requirements. Continuous innovations in packaging formats that enhance both safety and usability are boosting adoption across pharmaceutical supply chains and distribution networks.

- For instance, WestRock reports Shellpak® users were 11–23% more likely to achieve PDC ≥ 80% versus vials.

Sustainability-Focused Packaging Innovations

Growing environmental awareness is driving the shift toward recyclable and biodegradable child-resistant materials. Manufacturers are increasingly adopting eco-friendly plastics, paperboard, and bio-based polymers to meet sustainability goals without compromising safety performance. The use of recycled content in closures and containers is expanding, supported by green manufacturing incentives. This move toward sustainable packaging solutions attracts environmentally conscious consumers and aligns with corporate social responsibility initiatives, creating new market opportunities.

Key Trends & Opportunities

Integration of Smart Packaging Solutions

Smart child-resistant packaging is emerging as a key trend, integrating digital authentication and tracking features. Technologies such as NFC tags and QR codes enhance product safety, traceability, and consumer engagement. These solutions are gaining popularity in pharmaceuticals and cannabis packaging, where counterfeiting and compliance are critical. Companies are leveraging connected packaging to monitor usage and improve supply chain transparency, driving innovation in both materials and functionality.

- For instance, Avery Dennison (atma.io) manages item-level digital IDs for over 30 billion products.

Expansion of Cannabis Packaging Regulations

Legalization of medical and recreational cannabis in several regions has created new opportunities for child-resistant packaging materials. Regulations require tamper-evident, odor-proof, and secure packaging for cannabis products to ensure child safety and product integrity. This has led to growing demand for specialized child-resistant pouches and closures tailored for the cannabis industry. The segment’s rapid growth is encouraging manufacturers to design cost-effective and sustainable packaging compliant with evolving standards.

- For instance, KushCo Holdings has sold over 1 billion packaging units, including child-resistant formats, across the Americas and Europe.

Key Challenges

High Manufacturing and Compliance Costs

Developing child-resistant packaging that meets safety and environmental standards involves high production costs. Testing, certification, and design validation add further expenses, making it challenging for smaller manufacturers to compete. Balancing functionality, sustainability, and affordability remains complex, particularly as material costs rise. Companies face pressure to deliver innovative yet cost-efficient packaging without compromising regulatory compliance or safety performance.

Balancing Ease of Use with Child Safety

Achieving the right balance between child resistance and user accessibility is a key design challenge. Packaging must prevent accidental access by children while remaining easy for adults and elderly users to open. Overly complex mechanisms can lead to usability issues and consumer dissatisfaction. Manufacturers continue to refine closure technologies and ergonomic designs to maintain safety compliance while improving user experience.

Regional Analysis

North America

North America dominates the child resistant packaging materials market with around 37% share in 2024. The region’s leadership is driven by stringent regulatory requirements set by agencies such as the U.S. Consumer Product Safety Commission and Health Canada. High pharmaceutical consumption, strong demand for household chemical safety packaging, and growth in the legalized cannabis market further support expansion. The United States leads regional demand, while Canada is witnessing steady growth due to sustainability-focused packaging initiatives and increasing adoption of eco-friendly child-resistant materials.

Europe

Europe holds approximately 28% share of the global market in 2024, supported by strict packaging safety standards under EU regulations. Rising consumption of prescription drugs and the growing emphasis on recyclable and biodegradable materials are key growth factors. Germany, France, and the United Kingdom are major contributors, with strong pharmaceutical manufacturing bases. The adoption of sustainable plastic alternatives and innovative closure systems is accelerating across European countries, driven by environmental goals and compliance with the Packaging and Packaging Waste Directive.

Asia Pacific

Asia Pacific accounts for about 23% share in 2024 and is the fastest-growing regional market. Expanding pharmaceutical production in China, India, and Japan is a key driver, alongside rising health awareness and regulatory enforcement for child safety. Rapid industrialization, urbanization, and growing disposable incomes contribute to increasing demand for safe packaging in household and chemical products. The regional shift toward biodegradable plastics and localized manufacturing investments further enhances market penetration across emerging economies.

Latin America

Latin America represents around 7% share of the child resistant packaging materials market in 2024. Growth is supported by expanding pharmaceutical and chemical industries, particularly in Brazil and Mexico. Increasing government focus on child safety and regulatory adoption similar to North American standards drive gradual market advancement. The region also shows rising interest in recyclable and cost-effective packaging solutions. Local manufacturers are strengthening capabilities through partnerships with global packaging companies to improve compliance and technology integration.

Middle East & Africa

The Middle East & Africa holds a smaller but growing share of nearly 5% in 2024. Demand is driven by the expanding pharmaceutical and healthcare sectors, along with growing awareness of child safety standards. Countries such as South Africa, Saudi Arabia, and the UAE are leading adopters of advanced packaging materials. The gradual shift toward sustainable materials and regional investments in packaging infrastructure are boosting market development. Increasing import of child-resistant containers and closures from global suppliers supports steady growth in the region.

Market Segmentations:

By Technology Type

- Push-and-turn Caps

- Twist-lock Closures

- Blister Packs

- Child-resistant Bags

By Material

- Plastic

- Glass

- Paperboard

- Biodegradable Plastics

- Recyclable Materials

By End Use

- Pharmaceutical

- Household

- Chemicals Cannabis

- Food and Beverage

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Amcor plc, Berry Global Inc., Gerresheimer AG, WestRock Company, AptarGroup, Inc., Stora Enso Oyj, Klockner Pentaplast, Mondi Group, SGD Pharma, Comar, LLC, Bilcare Limited, Reynolds Group Holdings, Global Closures Systems, Origin Pharma Packaging, and Pretium Packaging are key players shaping the competitive landscape of the child resistant packaging materials market. The market is characterized by strong competition, driven by regulatory compliance, sustainability initiatives, and innovation in design. Leading companies focus on advanced material development, smart closure technologies, and eco-friendly solutions to meet global safety standards. Strategic mergers, acquisitions, and partnerships strengthen their global presence and production capacity. Manufacturers are expanding portfolios with recyclable and biodegradable materials to align with environmental policies. Growing investment in R&D, automation, and digital printing technologies enhances efficiency and product differentiation. The competition remains intense, as companies continuously innovate to balance child safety, usability, and environmental responsibility across diverse end-use sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Amcor plc

- Berry Global Inc.

- Gerresheimer AG

- WestRock Company

- AptarGroup, Inc.

- Stora Enso Oyj

- Klockner Pentaplast

- Mondi Group

- SGD Pharma

- Comar, LLC

- Bilcare Limited

- Reynolds Group Holdings

- Global Closures Systems

- Origin Pharma Packaging

- Pretium Packaging

Recent Developments

- In 2025, Amcor launched the Hector Child Resistant Closure (CRC), a lightweight polypropylene closure designed for household products with enhanced sustainability and user-friendly squeeze-and-turn safety features.

- In 2025, Aptar Beauty launched the TSP (Trigger Spray Pump), an all-plastic and highly recyclable trigger spray pump for the home care industry, which includes an optional child-resistant (CRC) feature for added product security.

- In 2023, Berry Global Group introduced a new line of child-resistant packaging solutions, including ASTM-certified closures and PCR (Post-Consumer Recycled) CRP containers to support circular packaging in healthcare and chemical sectors.

Report Coverage

The research report offers an in-depth analysis based on Technology Type, Material, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising demand for eco-friendly and recyclable child-resistant materials will shape product development.

- Integration of smart packaging technologies will enhance safety, traceability, and consumer engagement.

- Expanding pharmaceutical and healthcare sectors will continue driving large-scale adoption.

- Legalization of cannabis in new markets will create fresh opportunities for compliant packaging.

- Manufacturers will invest more in biodegradable plastics to align with sustainability goals.

- Increasing regulatory harmonization across regions will standardize safety and labeling requirements.

- Automation and digital printing advancements will improve packaging precision and efficiency.

- Partnerships between material suppliers and packaging firms will foster innovation and cost optimization.

- Growing consumer preference for user-friendly yet secure packaging will guide design strategies.

- Emerging markets in Asia and Latin America will experience accelerated adoption through regulatory reforms.