Market Overview

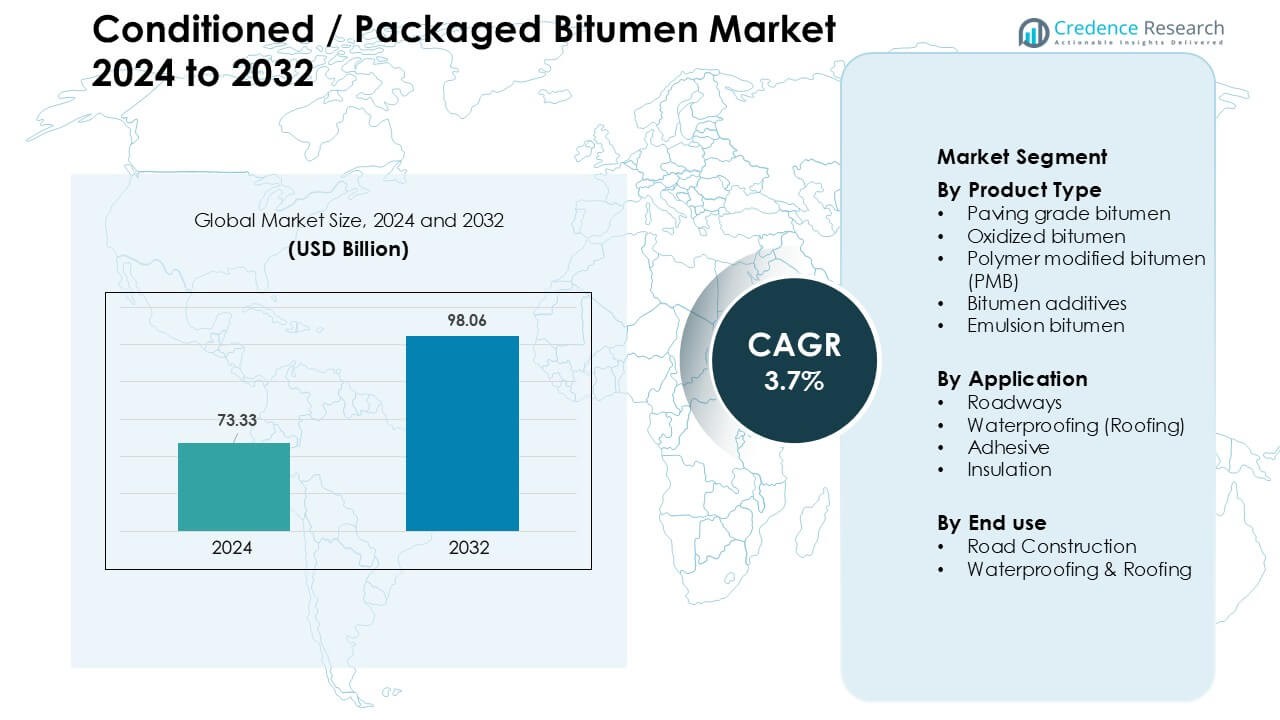

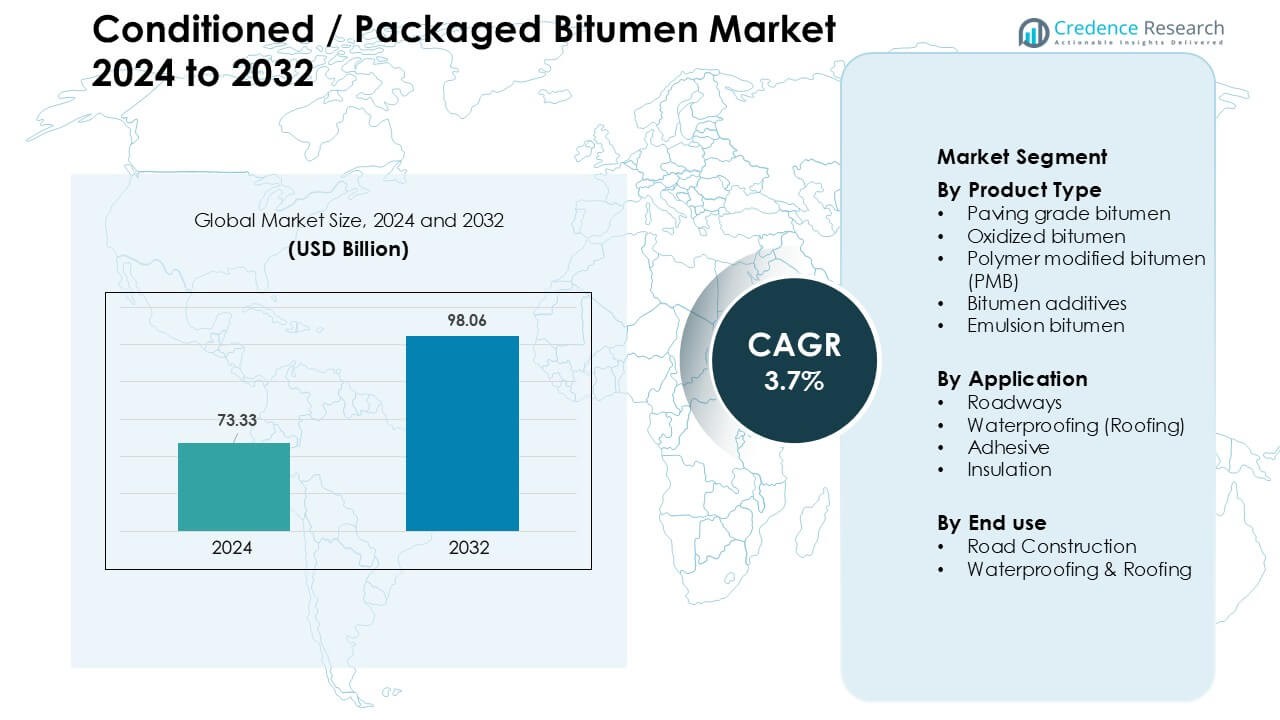

Conditioned / Packaged Bitumen Market was valued at USD 73.33 billion in 2024 and is anticipated to reach USD 98.06 billion by 2032, growing at a CAGR of 3.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Conditioned / Packaged Bitumen Market Size 2024 |

USD 73.33 Billion |

| Conditioned / Packaged Bitumen Market, CAGR |

3.7% |

| Conditioned / Packaged Bitumen Market Size 2032 |

USD 98.06 Billion |

The conditioned/packaged bitumen market is led by major players such as Mackay Consolidated, GAF, Nynas, Bauder, BASF, Carlisle Companies, Kibok, Sika, and Icopal, each offering strong portfolios across paving grades, PMB, emulsions, and waterproofing materials. These companies expanded production capacity, improved packaging formats, and strengthened supply networks to support rising demand from road construction and building projects. Asia Pacific emerged as the leading region in 2024 with 34% share, driven by large-scale highway development, rapid urbanization, and strong growth in commercial and residential infrastructure that increased the need for reliable, easy-to-handle bitumen solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The conditioned/packaged bitumen market reached USD 73.33 billion in 2024 and is projected to grow at a CAGR of 3.7% through 2032.

- Strong infrastructure spending and rising highway rehabilitation needs drive demand, with paving-grade bitumen holding the largest share at 58% due to widespread road construction activity.

- Polymer-modified binders, emulsions, and advanced packaging formats shape key trends as contractors shift toward safer handling, cleaner application, and longer-lasting pavement performance.

- Competition intensifies as players such as Mackay Consolidated, GAF, Nynas, Bauder, BASF, Carlisle Companies, Kibok, Sika, and Icopal expand portfolios and regional supply chains to meet infrastructure growth.

- Asia Pacific leads the global market with 34% share, followed by North America at 31%, supported by strong road development pipelines, while road construction remains the dominant end-use segment with 67% share in 2024.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

Paving grade bitumen dominated the product type segment in 2024 with about 58% share, driven by large-scale highway expansion, urban road upgrades, and rising government investment in resilient pavement surfaces. Contractors preferred paving grades because the material offers stable viscosity, strong binding strength, and reliable performance in hot and moderate climates. Polymer modified bitumen advanced due to demand for rut-resistant roads, while oxidized bitumen and emulsions expanded in industrial coatings and cold-mix applications that support safer handling and faster on-site use.

- For instance, ExxonMobil has a refinery in Singapore that, after restarting its bitumen production plant, reached a production capacity of 100,000–120,000 tons per month for its paving-grade and modified binders.

By Application

Roadways led the application segment in 2024 with nearly 64% share as countries expanded national highway programs, smart mobility corridors, and rural connectivity networks. Construction agencies selected conditioned bitumen because packaged formats ensure consistent quality, easier transport, and reduced contamination risk. Waterproofing gained traction across commercial buildings due to higher adoption of bitumen membranes, while adhesives and insulation grew in manufacturing zones seeking durable bonding solutions for structural protection and thermal performance.

- For instance, Sika is a specialty chemicals company with a global presence, producing products in over 400 factories worldwide. The SikaShield® range is manufactured and distributed internationally.

By End Use

Road construction dominated the end-use segment in 2024 with about 67% share, supported by major public infrastructure budgets focused on expressways, bridges, and urban transit lanes. The segment expanded as packaged bitumen reduced on-site heating needs and improved project efficiency through controlled packaging and uniform grade supply. Waterproofing and roofing followed steady demand from residential and industrial projects that used bitumen sheets and coatings for moisture resistance, energy efficiency upgrades, and long-life building envelopes.

Key Growth Drivers

Growing Road Infrastructure Spending

Rising investment in national and regional road infrastructure remained a major growth driver for the conditioned/packaged bitumen market. Governments expanded highway networks, smart mobility corridors, and rural road connectivity, which increased bitumen usage across both new construction and resurfacing cycles. Packaged formats gained preference due to easy handling, reduced heating requirements, and stable performance during long-distance transport. Public–private partnerships accelerated expressway development, while maintenance programs focused on upgrading aged pavements with high-quality paving grades and polymer-modified variants. Rapid urbanization pushed municipalities to enhance road durability and safety, further increasing the demand for consistent bitumen supply. The growth of cold-mix technologies also raised adoption for remote regions, where packaged bitumen ensured reliability in varying climatic conditions. Together, these factors strengthened long-term consumption in the transportation sector.

- For instance, Tiki Tar & Shell India a joint venture between Shell plc and Tiki Tar Industries operates multiple bitumen manufacturing plants across India (including in Mumbai, Vadodara, Panvel, Visakhapatnam, Mangalore, Pithampur, and Palwal), enabling it to supply packaged and polymer‑modified bitumen reliably across national highways and expressways.

Rising Adoption of Safer and Cleaner Bitumen Handling

A shift toward safer, cleaner, and more efficient handling processes drove strong adoption of conditioned and packaged bitumen. Traditional bulk heating and transfer methods posed safety risks, contamination issues, and energy inefficiencies, prompting contractors to switch to packaged blocks and drums. These solutions minimized workplace hazards, reduced emissions, and lowered fuel consumption during heating. Packaged formats enhanced supply chain efficiency by allowing easier loading, storage, and transport, especially for remote or small-scale projects. Rising sustainability mandates encouraged the use of low-VOC additives and ready-to-use emulsions that align with green construction standards. Construction firms embraced packaged bitumen because the material offered consistent quality and reduced waste, improving operational reliability. This transition supported broader ESG goals in the infrastructure ecosystem and created significant demand across developing economies.

- For instance, TotalEnergies developed a packaged bitumen solution named AZALT INBLOCK, which reduces waste by eliminating discarded drums this helps to minimize environmental and health impact during transport.

Expansion of Waterproofing and Roofing Applications

Growing construction activity in residential, commercial, and industrial buildings boosted demand for packaged bitumen products in waterproofing and roofing. Builders preferred bitumen membranes, oxidized grades, and emulsions because these materials deliver strong moisture resistance, UV stability, and cost-effective performance in varied climates. Packaged formats ensured cleaner application, uniform consistency, and better site management across high-rise and industrial structures. The global shift toward energy-efficient buildings also increased the use of bitumen-based insulation systems, which enhance thermal performance and extend building life cycles. Rising urban redevelopment projects strengthened the demand for modern roofing solutions, while industrial warehouses used bitumen coatings for corrosion protection. The growth of modular construction further expanded the use of easy-to-transport prefabricated bitumen sheets, supporting sustained opportunity in the building materials segment.

Key Trends & Opportunities

Growth of Polymer-Modified and High-Performance Bitumen

The market observed strong traction for polymer-modified bitumen (PMB) as governments and contractors demanded higher-performance road surfaces. PMB offered superior rut resistance, elasticity, and fatigue durability, making it ideal for expressways and heavy-traffic zones. Manufacturers expanded PMB production with SBS and EVA polymers to meet climate-specific requirements. Increased investment in long-life pavement design and smart-road programs supported the demand for high-performance bitumen variants. This trend opened opportunities for advanced additive formulations that enhance temperature stability and extend lifecycle costs for road agencies.

- For instance, experiments documented by the NZ Transport Agency show that PMB with ~ 3.5 wt% SBS polymer exhibits rutting reduction and fatigue resistance improvements these modified binders outperform conventional bitumen under repeated loading, leading to longer pavement life in highways.

Rising Demand for Ready-to-Use Bitumen Emulsions

Bitumen emulsions gained prominence as countries pushed for sustainable, low-energy construction methods. Emulsions required no high-temperature heating, reducing carbon emissions and workplace hazards. Road maintenance agencies adopted cold-mix and micro-surfacing technologies that rely heavily on emulsions, especially in regions with strict environmental regulations. Growing global focus on climate-resilient roads created opportunities for specialty emulsions that perform in high-moisture or freeze-thaw cycles. Manufacturers benefited from increased demand for quick-setting and slow-setting grades suited for varied construction workflows.

- For instance, Strabag, a major European construction firm, opened a new bitumen‑emulsion plant in Criseni, Romania, with a production capacity of 15 tonnes per hour, greatly boosting its ability to supply micro‑surfacing and surface treatment emulsions.

Key Challenge

Volatility in Crude Oil and Bitumen Prices

Fluctuations in crude oil prices posed a major challenge for market stability. Bitumen, being a petroleum derivative, experienced frequent cost swings that disrupted budgeting for infrastructure projects. Contractors faced difficulties in long-term planning as raw material expenses shifted unpredictably. Price instability also affected packaged bitumen suppliers, who struggled to maintain consistent margins due to higher packaging and logistics costs. These fluctuations placed pressure on public agencies and private developers, especially in emerging markets with tight project budgets. Managing cost uncertainty remained a critical issue for the industry.

Environmental Regulations and Sustainability Pressures

Strict environmental norms on emissions, VOC content, and construction waste created compliance challenges for bitumen producers and contractors. Countries introduced tighter rules on hot-mix plants, storage practices, and transportation emissions, increasing the operational cost for bitumen processing. Packaged formats helped reduce some environmental risks, yet manufacturers still faced pressure to adopt greener additives, cleaner production technologies, and recyclable packaging materials. Meeting these sustainability demands required significant investment in R&D and energy-efficient processes. These regulatory hurdles slowed adoption in price-sensitive regions and compelled industry players to redesign formulations for lower environmental impact.

Regional Analysis

North America

North America held about 31% share of the conditioned/packaged bitumen market in 2024, driven by strong investment in highway rehabilitation, airport runway upgrades, and city road maintenance programs. The U.S. dominated regional demand as federally funded infrastructure modernization prioritized durable paving materials and safer handling practices. Packaged formats grew due to strict worksite safety rules and the need for consistent bitumen grades across long-distance transport. Canada contributed steady consumption through expansion of industrial roofing, commercial waterproofing systems, and urban redevelopment projects. Rising adoption of polymer-modified grades and emulsions further supported market expansion.

Europe

Europe accounted for nearly 27% share in 2024, supported by the region’s advanced road networks, high construction standards, and strong focus on sustainable building materials. Countries such as Germany, France, and the U.K. increased packaged bitumen use due to strict emission norms and demand for cleaner, controlled-application materials. The region saw wider adoption of PMB for heavy-traffic corridors and climate-resilient pavements. Growth in waterproofing applications strengthened demand across commercial roofing and industrial insulation. Ongoing refurbishment of transport infrastructure and energy-efficient buildings continued to sustain steady market performance.

Asia Pacific

Asia Pacific dominated the global market with about 34% share in 2024, driven by massive road development programs, logistics corridor expansion, and significant growth in residential and commercial construction. China and India remained major contributors as packaged bitumen improved project efficiency across large-scale expressways and rural road connectivity schemes. Southeast Asia saw rising demand for emulsions suited for tropical climates and wet-season maintenance. Rapid industrialization heightened the use of bitumen membranes for roofing, insulation, and waterproofing. High urbanization rates and government-funded infrastructure pipelines kept regional consumption on a strong upward trajectory.

Latin America

Latin America captured around 5% share in 2024, supported by ongoing road rehabilitation and moderate construction activity across Brazil, Mexico, and Chile. Packaged bitumen gained traction in regions with limited bulk-heating infrastructure, offering safe handling and longer shelf stability. Road resurfacing programs and rural connectivity investments increased adoption of paving grades and emulsions. The commercial building sector used oxidized bitumen and membranes for roof protection and waterproofing. Despite budget constraints in several economies, sustainable pavements and urban infrastructure upgrades continued to support steady market growth.

Middle East & Africa

The Middle East & Africa held nearly 3% share in 2024, driven by infrastructure modernization, industrial expansion, and large-scale urban development projects. Gulf countries adopted packaged bitumen for controlled handling in high-temperature environments and for long-haul transport to remote project sites. Africa recorded rising demand through road connectivity programs funded by government and development agencies. Waterproofing applications grew across commercial and industrial buildings, supported by expanding real estate investment. While market growth varied across countries, rising construction spending and improved supply chains gradually strengthened regional adoption of packaged bitumen solutions.

Market Segmentations:

By Product Type

- Paving grade bitumen

- Oxidized bitumen

- Polymer modified bitumen (PMB)

- Bitumen additives

- Emulsion bitumen

By Application

- Roadways

- Waterproofing (Roofing)

- Adhesive

- Insulation

By End use

- Road Construction

- Waterproofing & Roofing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the conditioned/packaged bitumen market features strong participation from leading players such as Mackay Consolidated, GAF, Nynas, Bauder, BASF, Carlisle Companies, Kibok, Sika, and Icopal, each expanding product portfolios across paving grades, polymer-modified formulations, emulsions, and waterproofing solutions. These companies strengthened distribution networks to support large infrastructure projects and building applications, while also investing in advanced packaging technologies that improve safety, reduce handling risks, and ensure material consistency. Many players focused on sustainable production by introducing low-VOC additives, recyclable packaging, and energy-efficient processing systems. Strategic collaborations with construction contractors and public agencies helped manufacturers secure long-term supply contracts in road construction and roofing markets. Continuous R&D efforts targeted performance enhancements, including higher temperature stability, better crack resistance, and improved adhesion for membranes. Rising competition encouraged companies to expand regional manufacturing bases and develop climate-adaptive bitumen grades tailored to diverse project environments.

Key Player Analysis

- Mackay Consolidated

- GAF

- Nynas

- Bauder

- BASF

- Carlisle Companies

- Kibok

- Sika

- Icopal

Recent Developments

- In October 2025, A recent industry article notes the bitumen/asphalt sector is undergoing transformation using polymers, bio-binders, recycled materials and “smart-tech” to deliver longer-lasting, lower-carbon asphalt pavements.

- In September 2025, Demand in Asia-Pacific remains robust, driven by infrastructure growth in India and China. The same report notes growing interest in bio-based bitumen and advanced asphalt additives to meet environmental requirements.

- In August 2025, A trade-report highlighted that global bitumen demand faces a “complex picture” demand diverges across regions, trade flows shift, and bitumen prices & supply chains are under pressure due to geopolitical uncertainties.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as countries expand highway networks and upgrade aging pavements.

- Packaged bitumen adoption will grow due to safer handling and lower on-site risks.

- Polymer-modified grades will gain traction for high-performance and long-life road projects.

- Emulsion-based products will expand as cold-mix and low-emission road solutions increase.

- Waterproofing applications will strengthen with higher construction of commercial and industrial buildings.

- Manufacturers will invest in recyclable packaging and cleaner production technologies.

- Supply chains will improve as companies expand regional storage and distribution hubs.

- Climate-adaptive bitumen grades will see higher demand in regions with extreme temperatures.

- Digital quality control and automated packaging systems will enhance product consistency.

- Public–private partnerships in infrastructure will create stable long-term demand.

Market Segmentation Analysis:

Market Segmentation Analysis: