Market Overview

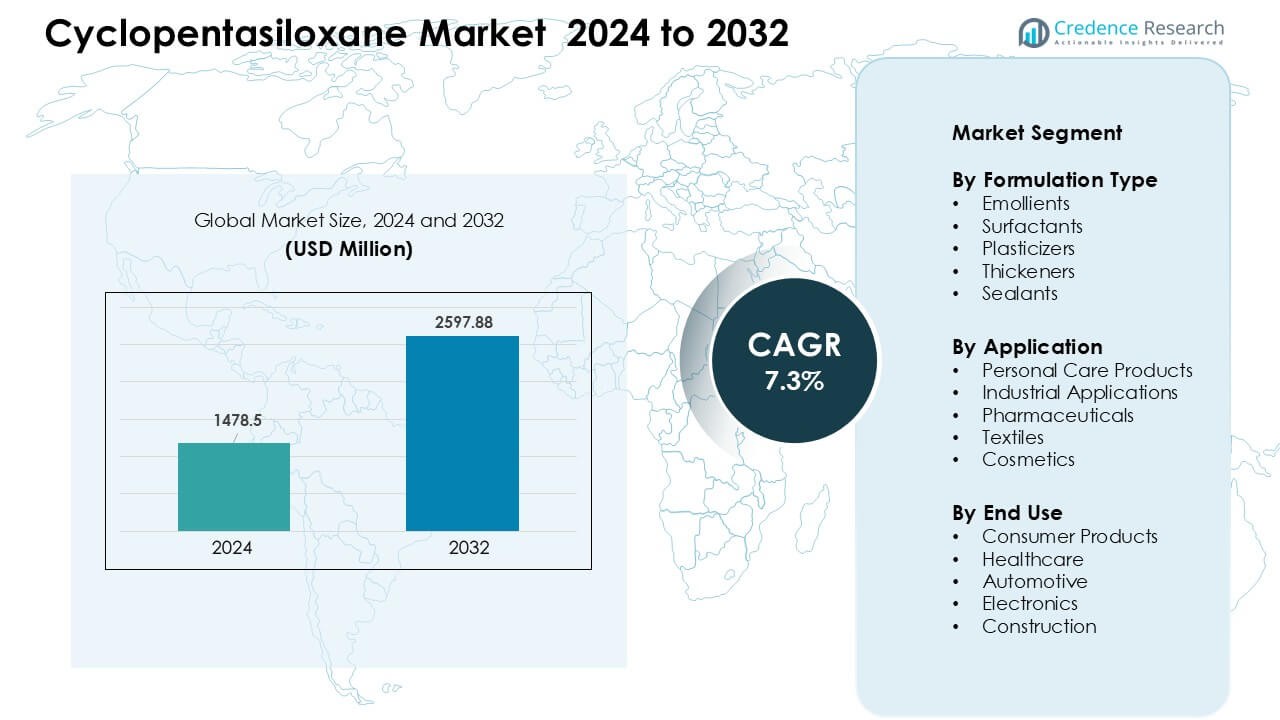

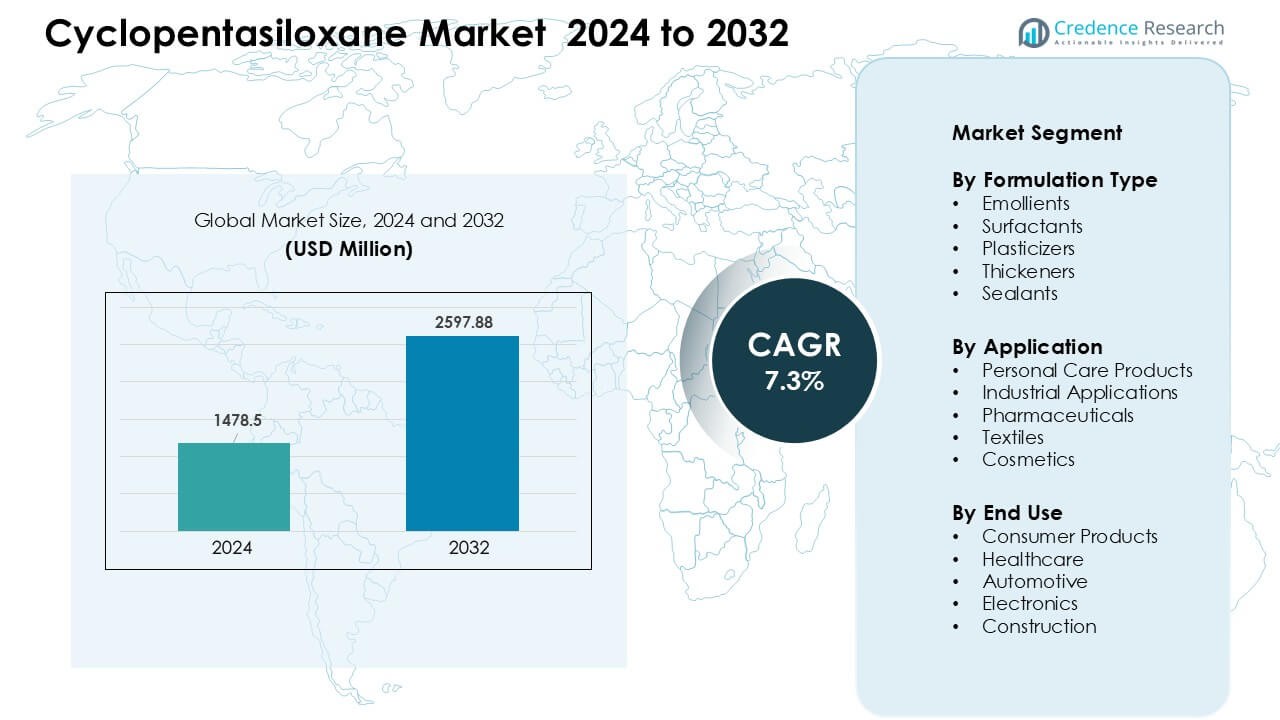

Cyclopentasiloxane Market was valued at USD 1478.5 million in 2024 and is anticipated to reach USD 2597.88 million by 2032, growing at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cyclopentasiloxane Market Size 2024 |

USD 1478.5 Million |

| Cyclopentasiloxane Market, CAGR |

7.3% |

| Cyclopentasiloxane Market Size 2032 |

USD 2597.88 Million |

The Cyclopentasiloxane Market is shaped by major players such as BASF SE, Shin-Etsu Silicones, Celanese Corporation, Evonik Industries, Momentive Performance Materials Inc., Wacker Chemie AG, Air Products and Chemicals, Inc., KCC Beauty, and Dow Chemical Company. These companies compete through high-purity silicone production, expanded distribution networks, and strong technical support for personal care and industrial formulators. Asia-Pacific emerged as the leading region with about 38% share in 2024, driven by large-scale cosmetic manufacturing, rapid urbanization, and strong demand for lightweight skincare and haircare formulations across China, India, South Korea, and Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cyclopentasiloxane Market was valued at USD5 million in 2024 and is projected to reach USD2597.88 million by 2032, growing at a CAGR of 7.3% during the forecast period.

- Strong demand from personal care and cosmetics remained the key driver, with emollient-grade cyclopentasiloxane holding about 41% share in formulations due to its smooth, fast-evaporating texture.

- Trends centered on rising use in premium skincare, long-wear makeup, and silicone-enhanced hair treatments, along with expanding opportunities in pharmaceuticals and specialty industrial applications.

- Competition intensified as major companies improved high-purity silicone grades and expanded supply networks, while regulatory pressure on volatile silicones acted as a restraint and encouraged broader innovation in compliant formulations.

- Asia-Pacific led the global market with about 38% share in 2024, while North America held 31% and Europe 27%, supported by strong beauty consumption and expanding industrial use across these regions.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Formulation Type

Emollients held the dominant share in the Cyclopentasiloxane Market in 2024 with about 41%. Demand stayed strong because personal care brands used emollient-grade cyclopentasiloxane to improve spreadability and achieve a smooth, non-greasy feel. Surfactants and plasticizers expanded as manufacturers adopted silicone-based blends for stable formulations. Thickeners and sealants grew at a slower pace but found steady use in hair care, skincare, and specialized industrial mixtures that required lightweight texture and quick evaporation.

- For instance, major cosmetic-ingredient suppliers report that cyclopentasiloxane (chemical formula C₁₀H₃₀O₅Si₅) when used at typical formulation levels provides a colourless, odorless, water-thin liquid base that evaporates quickly after application, delivering a silky, non-greasy texture suitable for lotions, serums, and leave-on products.

By Application

Personal care products led the Cyclopentasiloxane Market in 2024 with nearly 48% share. Growth came from wide use in lotions, serums, deodorants, and color cosmetics where fast-spreading and volatile silicone fluids enhanced user experience. Pharmaceuticals and textiles recorded moderate gains due to rising interest in silicone-coated medical materials and soft-finish fabrics. Industrial applications expanded as manufacturers used cyclopentasiloxane for lubrication and surface treatment, while cosmetics continued steady adoption across global beauty brands.

- For instance, many hair-care products (shampoos, conditioners, leave-in serums) rely on cyclopentasiloxane to provide a smooth, slip-ease during combing, reduce frizz, and improve hair manageability thanks to its lubricating and conditioning properties.

By End Use

Consumer products dominated the Cyclopentasiloxane Market in 2024 with about 53% share. Strong demand from skincare, hair care, and makeup lines supported this lead, as brands relied on cyclopentasiloxane for smooth application and quick drying. Healthcare applications grew due to higher production of silicone-based medical coatings and topical formulations. Automotive and electronics showed measured adoption in detailing sprays and thermal interface materials, while construction used silicone fluids for sealants and surface enhancers in niche applications.

Key Growth Drivers

Growing Use of Cyclopentasiloxane in Personal Care Formulations

Personal care manufacturers continued to drive strong demand for cyclopentasiloxane as brands focused on lightweight, fast-drying, and smooth-finish products. This silicone fluid helped improve spreadability and sensory experience in skin creams, hair serums, color cosmetics, and deodorants, which increased its adoption across mass and premium ranges. Rising consumer preference for non-greasy textures supported wider use in daily-use skincare, while global beauty companies expanded silicone-based formulations in developing markets. Growth in hair care treatments and leave-on conditioners added further momentum as cyclopentasiloxane enhanced shine and reduced friction. Continuous launches of advanced beauty solutions strengthened reliance on volatile silicones, keeping this segment a major growth engine.

- For instance, major cosmetic formulations use cyclopentasiloxane with volatility such that it typically evaporates within 4-12 hours after application, enabling a non-greasy, dry-touch finish in leave-on moisturizers and serums.

Rising Industrial and Pharmaceutical Utilization

Industrial and pharmaceutical sectors accelerated cyclopentasiloxane use due to its favorable volatility, safety profile, and compatibility with sensitive materials. Manufacturers adopted this silicone in lubricants, surface treatment agents, and polymer processing additives to meet performance needs in electronics, automotive, and specialty coatings. Pharmaceutical players used cyclopentasiloxane in topical formulations and dermal delivery systems requiring smooth application and fast evaporation. Demand grew further as medical material producers integrated silicone coatings for improved biocompatibility and product durability. Expansion of specialty chemicals production in Asia and stronger investments in medical-grade silicones supported steady growth. Increased emphasis on high-purity formulations strengthened adoption across regulated applications.

- For instance, regulatory-grade cyclopentasiloxane used in topical pharmaceutical formulations is supplied at > 99% purity, as documented in submissions reviewed by safety bodies ensuring minimal contamination (e.g., trace of less-desirable cyclic siloxanes) and suitability for sensitive dermal products.

Expansion of Beauty, Cosmetics, and Premium Skincare Markets

The global beauty and premium skincare industry played a major role in boosting cyclopentasiloxane consumption due to rising consumer spending and product diversification. Brands developed advanced serums, primers, foundations, and sunscreens using volatile silicones to deliver smoother texture and faster absorption. Premium cosmetic lines leveraged cyclopentasiloxane for soft-focus effects, even application, and enhanced wearability. Growth of e-commerce beauty platforms increased product reach, especially in Asia and Latin America. Natural-beauty brands that still required lightweight silicone alternatives for performance also relied on cyclopentasiloxane in hybrid formulations. The surge in multifunctional and long-wear cosmetics ensured continuous demand for sensory-enhancing silicones.

Key Trends & Opportunities

Growing Shift Toward High-Performance Cosmetic Ingredients

A key trend emerged as manufacturers pursued high-performance ingredients that improved feel, finish, and durability in beauty and personal care items. Cyclopentasiloxane gained attention for enabling silky textures and quick evaporation, qualities valued in premium skincare and color cosmetics. Companies invested in advanced silicone blends tailored for long-wear makeup, lightweight sunscreens, and smooth hair treatments. Rising demand for enhanced sensorial profiles pushed brands to integrate volatile silicones into new product lines, strengthening market opportunities across global beauty hubs.

- For instance, many formulations employ Cyclopentasiloxane (D5) as a key volatile silicone D5 is described as a “water-thin” cyclic silicone that evaporates rather than stays on skin, which helps create a silky, smooth feel for users.

Expansion of Silicone Alternatives and Sustainable Formulation Opportunities

Another trend appeared with growing interest in sustainable and hybrid formulations that balanced performance with environmental expectations. While cyclopentasiloxane remained widely used, brands explored modified silicone systems, biodegradable blends, and cleaner-label solutions. This shift opened opportunities for innovation within the silicone value chain. Manufacturers began developing lower-emission processes, improved purity grades, and more transparent supply practices to maintain acceptance among eco-conscious customers. The move toward responsible beauty standards encouraged R&D investment, opening new possibilities for specialty-grade cyclopentasiloxane.

- For instance, ingredient-specialty players such as Inolex have developed silicone-free, plant-based alternatives that replicate the sensorial benefits (smoothness, spreadability, non-greasiness) typically offered by silicones enabling brands to deliver comparable texture while avoiding use of cyclic silicones.

Increasing Adoption in industrial and textile applications

Industrial and textile sectors recognized broader opportunities for cyclopentasiloxane due to its application flexibility. Textile finishers adopted the material for soft-hand effects and improved glide, while manufacturers in the electronic and automotive industries used it for lubrication, coating, and surface-modification needs. These emerging uses created new demand zones beyond personal care. Growth in high-performance fabrics and precision manufacturing supported this trend, encouraging producers to expand product portfolios for technical applications.

Key Challenges

Environmental and Regulatory Pressures on Silicone Materials

The market faced challenges from tightening environmental and chemical-safety regulations, particularly in regions assessing volatile silicone persistence. Some regulatory bodies reviewed restrictions or usage limitations, prompting brands to reassess formulation strategies. Increased scrutiny raised compliance costs and encouraged greater documentation of product safety. These pressures compelled manufacturers to invest in transparent supply chains, testing, and reformulation readiness to maintain market presence. Regulatory uncertainty also influenced procurement decisions across industries.

Rising Shift Toward Silicone-Free and Green Formulations

Growing consumer awareness of ingredient sustainability and clean-label trends created notable challenges for cyclopentasiloxane use. Some brands shifted toward silicone-free claims to align with natural-product positioning, which affected demand in certain beauty segments. Competition from bio-based emollients and plant-derived alternatives increased, forcing manufacturers to justify silicone performance advantages. Market players needed to invest in communication, safety data, and hybrid formulations to address perception challenges. This shift required strategic adjustment while preserving product performance across key applications.

Regional Analysis

North America

North America held about 31% share of the Cyclopentasiloxane Market in 2024. Strong demand from skincare, hair care, and color cosmetic brands supported steady growth across the United States and Canada. Major manufacturers expanded silicone-based formulations in premium beauty lines, which increased consumption in both mass and specialty categories. Industrial use also grew as electronics, automotive, and pharmaceutical companies relied on volatile silicones for surface treatment and topical applications. Rising adoption of high-performance cosmetic ingredients and the presence of established personal care brands kept the region a key contributor to global demand.

Europe

Europe accounted for nearly 27% share of the Cyclopentasiloxane Market in 2024. Strong regulatory frameworks shaped formulation choices, but demand stayed solid due to high consumption of skincare, haircare, and cosmetic products across Germany, France, Italy, and the United Kingdom. Beauty companies focused on sensorial enhancement, which supported continued use of volatile silicones. Industrial and textile applications added incremental growth, particularly in advanced coatings and soft-finish treatments. Increasing adoption of premium personal care items and well-established chemical manufacturing capabilities helped maintain Europe’s steady position in the market.

Asia-Pacific

Asia-Pacific led the Cyclopentasiloxane Market in 2024 with about 38% share. Expanding beauty and personal care consumption in China, India, South Korea, and Japan drove strong demand for silicone-based formulations. Rapid growth in e-commerce beauty platforms boosted product penetration across mid-range and premium categories. Industrial and pharmaceutical sectors also used cyclopentasiloxane in coatings, topical formulations, and manufacturing processes. Strong regional production capacities, competitive pricing, and rising disposable incomes further supported market expansion. The presence of major cosmetic manufacturing hubs strengthened Asia-Pacific’s dominant position.

Latin America

Latin America captured roughly 3% share of the Cyclopentasiloxane Market in 2024. Brazil and Mexico led demand due to their expanding beauty and personal care sectors, with strong interest in hair treatments, skincare, and color cosmetics. Local and international brands used cyclopentasiloxane to improve product feel and application. Industrial use remained modest but grew in niche coatings and lubrication applications. Gradual economic recovery and rising consumer spending supported market stability. Although smaller in scale, the region showed steady adoption driven by increasing awareness of silicone-enhanced formulations.

Middle East & Africa

Middle East & Africa held about 1% share of the Cyclopentasiloxane Market in 2024. Growing urbanization and rising demand for beauty and grooming products in Gulf countries supported moderate market growth. The region adopted cyclopentasiloxane primarily in skincare, hair care, and personal hygiene items. Industrial applications expanded slowly as manufacturers integrated silicone fluids into specialty coatings and surface treatments. Limited local production kept dependence on imports high, but rising retail beauty investments and broader product availability contributed to gradual market development.

Market Segmentations:

By Formulation Type

- Emollients

- Surfactants

- Plasticizers

- Thickeners

- Sealants

By Application

- Personal Care Products

- Industrial Applications

- Pharmaceuticals

- Textiles

- Cosmetics

By End Use

- Consumer Products

- Healthcare

- Automotive

- Electronics

- Construction

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Cyclopentasiloxane Market featured key companies such as BASF SE, Shin-Etsu Silicones, Celanese Corporation, Evonik Industries, Momentive Performance Materials Inc., Wacker Chemie AG, Air Products and Chemicals, Inc., KCC Beauty, and Dow Chemical Company. These manufacturers focused on expanding high-purity silicone production, improving volatile silicone grades, and strengthening supply reliability across personal care and industrial applications. Competitive activity increased as beauty brands demanded smoother textures and fast-evaporating formulations, pushing suppliers to invest in R&D for enhanced sensory profiles and better formulation stability. Several players expanded technical support services to help global cosmetic producers meet performance and regulatory requirements. Strategic moves such as capacity upgrades, distribution partnerships, and region-specific product customization supported stronger regional penetration. Growing attention to sustainable formulation practices also encouraged companies to refine manufacturing processes and enhance transparency. This mix of innovation, compliance focus, and global network strength shaped competition across the market.

Key Player Analysis

- BASF SE

- Shin-Etsu Silicones

- Celanese Corporation

- Evonik Industries

- Momentive Performance Materials Inc.

- Wacker Chemie AG

- Air Products and Chemicals, Inc.

- KCC Beauty

- Dow Chemical Company

- Momentive Performance Materials Inc.

Recent Developments

- In February 2025, Momentive signed a definitive agreement with a Chinese silicone-materials firm, Jiangxi Hungpai Material Co., Ltd., to form a joint venture targeting silane production, promotion, and sale across Asia. This indicates expansion and regional diversification of its silicone-derivative business.

- In October 2024, Momentive opened a European application-development centre for beauty and personal care in Abingdon, UK. The facility includes a Haircare Centre of Excellence to support development of new silicone raw materials.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Formulation Type, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as beauty brands expand lightweight skincare and haircare lines.

- Premium cosmetic formulations will strengthen the use of volatile silicone fluids.

- Pharmaceutical applications will grow due to higher adoption in topical systems.

- Industrial and textile use will increase with advanced coating needs.

- Regulatory reviews will encourage cleaner and more transparent silicone production.

- Innovation will focus on improved purity grades and safer formulation frameworks.

- Hybrid silicone–natural ingredient blends will gain wider acceptance.

- Asia-Pacific will maintain its lead with strong cosmetic manufacturing growth.

- Companies will expand capacity to support global supply reliability.

- Sustainable processing and reduced-emission technologies will influence product development.

Market Segmentation Analysis:

Market Segmentation Analysis: