| REPORT ATTRIBUTE |

DETAILS |

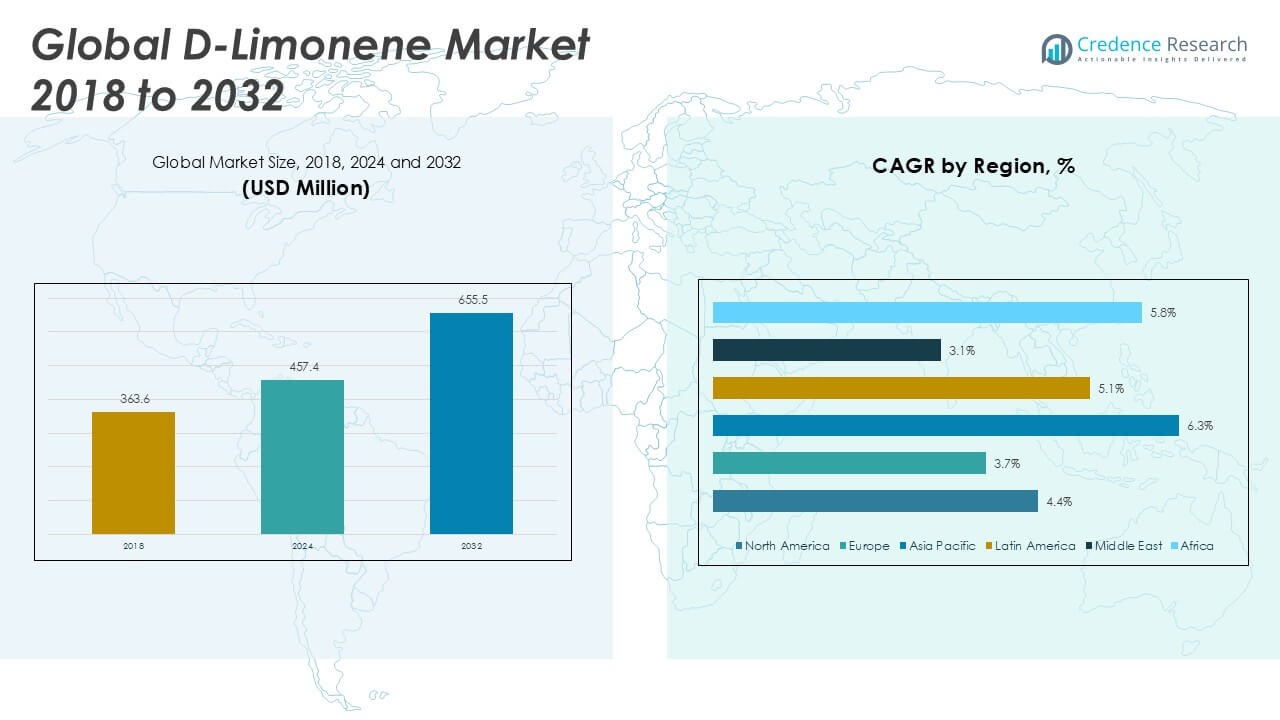

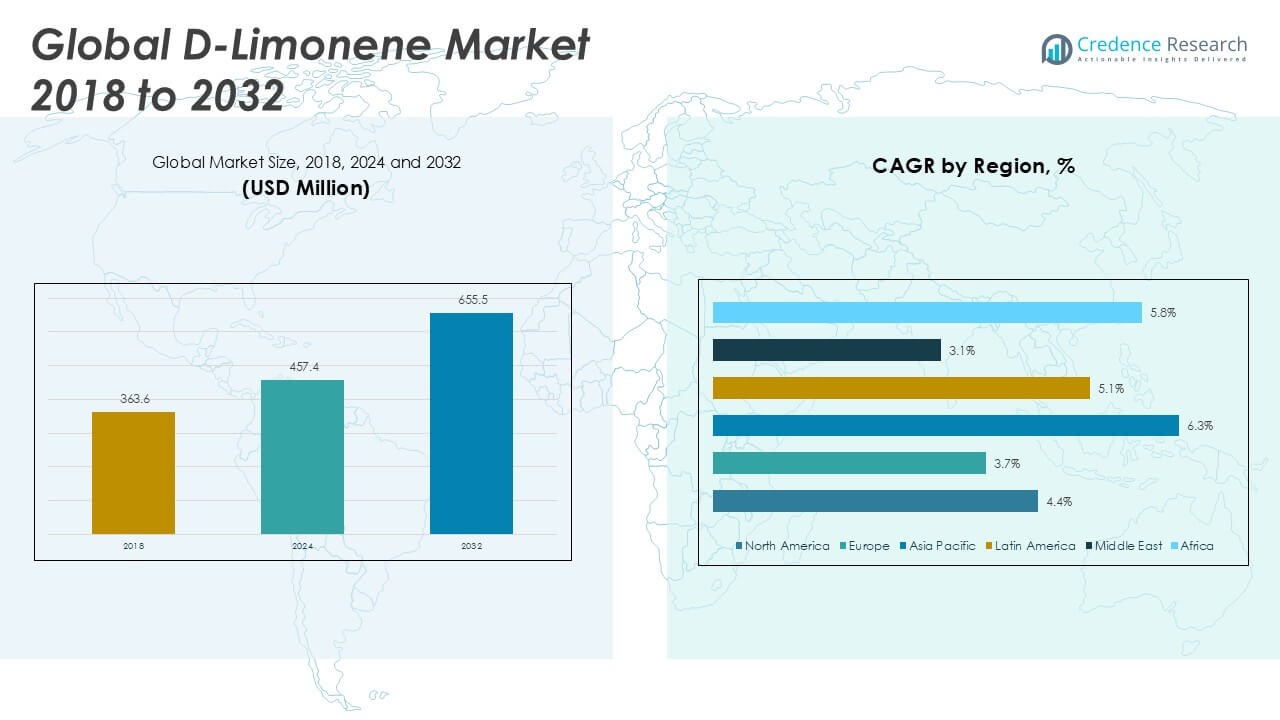

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| D-Limonene Market Size 2024 |

USD 457.4 Million |

| D-Limonene Market, CAGR |

4.60% |

| D-Limonene Market Size 2032 |

USD 655.5 Million |

Market Overview

The Global D-Limonene Market is projected to grow from USD 457.4 million in 2024 to an estimated USD 655.5 million by 2032, reflecting a compound annual growth rate (CAGR) of 4.60% from 2025 to 2032.

Growing environmental regulations that restrict petrochemical solvents drive demand for D-limonene as an eco-friendly alternative. Manufacturers capitalize on its low toxicity and high solvency, broadening adoption in degreasing formulations and specialty cleaning products. Concurrently, trends toward clean-label ingredients stimulate use in nutraceuticals and dietary supplements. Producers innovate extraction and purification techniques to enhance yield and purity, strengthening supply reliability and cost competitiveness.

Asia Pacific leads regional growth, driven by rapid industrialization in China and India and expanding food processing sectors. North America retains the largest market share, supported by established chemical and personal care industries in the United States. Europe follows with steady demand from fragrance and pharmaceutical applications. Key players shaping the competitive landscape include Citrus & Allied Products Ltd, Symrise AG, FMC Corporation, Frutarom Industries (a part of IFF), and Lanxess AG.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global D-Limonene Market grows steadily from USD 457.4 million in 2024 to USD 655.5 million by 2032, driven by expanding industrial and consumer applications.

- Demand for eco-friendly solvents pushes D-limonene adoption in degreasing and specialty cleaning, replacing petrochemical alternatives.

- Consumer preference for clean-label ingredients fuels its use in flavor, fragrance, and personal care formulations.

- Volatile citrus peel feedstock supplies create supply-chain variability and pressure on production schedules.

- Competitive pricing from synthetic solvents limits margin expansion and extends sales cycles in price-sensitive segments.

- North America commands over 35% share with robust cleaning and personal care sectors, while Asia Pacific posts the highest CAGR at 6.3%.

- Europe maintains roughly 27% share, driven by stringent environmental regulations and strong fragrance and pharmaceutical demand.

Market Drivers

Stringent Environmental Regulations Fuel Widespread Adoption

Global D-Limonene Market benefits from regulators enforcing stricter limits on petrochemical solvents and volatile organic compounds. It offers rapid biodegradability and low toxicity. Manufacturers adopt it to meet compliance and reduce environmental impact. Demand for natural solvents climbs in industrial cleaning applications. Producers secure certifications to validate green credentials. End users shift to plant-derived formulations to minimize health hazards. Strong regulatory support underpins market expansion.

- For instance, U.S. production of D-limonene in 2019 ranged from 10,000,000 to less than 50,000,000 pounds, reflecting the significant industrial shift toward natural solvents in response to environmental regulations

Personal Care and Fragrance Industries Embrace Natural Citrus Ingredients

Global D-Limonene Market finds strong traction in personal care and fragrance sectors. It delivers vibrant citrus aroma while meeting consumer demand for clean-label products. Brand managers incorporate it into shampoos, lotions, soaps and perfumes. High solubility and skin-friendly profile drive formulation flexibility. Marketing campaigns highlight plant-based origins and eco-friendly credentials. Sales teams report higher margins on nature-derived fragrances. Consumer preference for transparency further supports its uptake.

- For instance, D-limonene is included as a fragrance ingredient in approximately 1,542 consumer products across categories such as personal care, home maintenance, and auto products, according to product formulation databases

Food and Beverage Sector Leverages Flavoring Potential

Global D-Limonene Market sustains growth through expanding use in food and beverage flavoring. It adds fresh citrus notes to beverages, confectioneries and dairy products. Manufacturers value it for consistent taste and natural labeling benefits. It replaces synthetic alternatives to appeal to health-conscious consumers. Supply chain partners invest in quality assurance to meet food safety standards. Product developers experiment with microencapsulation to improve stability. Flavor-driven applications boost overall market demand.

Technological Advances Drive Extraction Efficiency and Yield

Global D-Limonene Market benefits from innovations in extraction and purification technology. It achieves higher yield and lower production cost. Extraction facilities integrate continuous processes for improved throughput. Research teams optimize solvent recovery to minimize waste. Equipment suppliers design scalable distillation units to enhance purity levels. Producers leverage process intensification to boost operational efficiency. Continuous improvement reduces supply constraints and supports long-term growth.

Market Trends

Growing Demand for Eco-friendly Solvent Alternatives

The Global D-Limonene Market reflects a shift toward sustainable cleaning solutions. It replaces petroleum-based solvents across commercial and industrial sectors. Regulatory bodies support renewable ingredients for environmental protection. Companies promote plant-based options to strengthen green credentials. Formulators value low toxicity and rapid biodegradability. Consumer awareness of ecological impact encourages its selection.

- For instance, a 2023 European manufacturer survey found that 68% of industrial clients prioritized bio-based solvents, with one major Scandinavian cleaning brand replacing synthetic solvents in 90% of its dishwasher detergent line with D-limonene-based solutions, reducing the use of hazardous chemicals in over 1 million product units annually

Increasing Preference for Clean-label Personal Care Formulas

The Global D-Limonene Market experiences uptake in clean-label personal care. It delivers natural citrus scent while ensuring product transparency. Brands highlight plant-origin content to win consumer trust. This trend drives formulators to remove synthetic additives. Scent designers rely on its purity and consistency. Marketing teams showcase real ingredient lists to boost engagement.

- For instance, in a 2024 consumer survey, a leading personal care brand found that 3 out of 5 new product launches featuring D-limonene as a key ingredient saw a 40% increase in repeat purchases among eco-conscious shoppers, with over 750,000 units sold in the first year of launch.

Integration into Next-generation Cleaning and Degreasing Technologies

The Global D-Limonene Market supports advanced cleaning equipment in manufacturing plants. It serves as a key component in automated degreasing systems. Engineers optimize process parameters to maximize solvency and reduce waste. Maintenance teams appreciate its low hazard classification and simple handling. Business leaders adopt it to lower operational risk and improve sustainability. It contributes to safer workplace practices and regulatory compliance.

Expansion of Flavor and Fragrance Applications through Innovative Delivery

The Global D-Limonene Market underpins new flavor encapsulation and controlled-release formats. It enhances shelf stability and maintains sensory integrity. Food scientists apply it in microencapsulation to mask volatility issues. Fragrance houses explore novel emulsion platforms to extend aroma life. This trend spurs development of blended terpene profiles for unique scents. It fuels collaboration between ingredient suppliers and application developers.

Market Challenges

Fluctuating Citrus Peel Feedstock Supplies Impact Production Stability

The Global D-Limonene Market relies heavily on citrus peel sourcing from agricultural producers. It faces seasonal yield variations that disrupt processing schedules. Suppliers endure weather events and crop diseases that reduce raw material volumes. Manufacturers adjust extraction protocols to maintain quality standards. Logistics teams manage transport delays that can degrade feedstock freshness. Procurement departments negotiate long-term contracts to buffer supply shocks. Quality control units implement testing regimes to ensure purity and consistency.

- For instance, Brazil, which supplies nearly 70% of global citrus products, experienced a 24% drop in orange yield in 2024 due to extreme weather and citrus greening disease, while Florida’s production fell to 17 million boxes from 242 million boxes two decades ago, causing notable reductions in D-limonene output and increased market volatility

Price Competition from Synthetic Solvent Alternatives Pressures Profit Margins

Producers contend with lower-cost petrochemical solvents that undercut natural extract prices. The Global D-Limonene Market must maintain competitive pricing without sacrificing eco-friendly credentials. Sales directors report lengthening sales cycles in price-sensitive segments. Operational managers seek process efficiencies to trim production expenses. Finance teams track margin erosion and explore cost-sharing models with suppliers. Marketing specialists differentiate products through performance claims and sustainability certifications. Research divisions evaluate process innovations that reduce input requirements.

Market Opportunities

Emerging Biotechnology and Pharmaceutical Integration Drive Novel Applications

The Global D-Limonene Market offers significant potential through collaborations with biotechnology and pharmaceutical manufacturers. It functions as a green solvent in active ingredient extraction and formulation. Researchers test its efficacy in targeted drug delivery and anti-cancer compounds. Equipment manufacturers refine extraction methods to yield pharmaceutical-grade purity. Regulatory bodies often favor plant-derived excipients that reduce synthetic chemical load. Marketing teams highlight proven performance in formulation stability. Supply chain managers secure partnerships to ensure consistent feedstock quality.

Growing Demand in Agrochemical and Food Preservation Sectors Presents Growth Avenues

The Global D-Limonene Market gains momentum from demand for natural agrochemical solutions and food preservation agents. It exhibits insecticidal properties that drive interest in eco-friendly pesticides. Food processing companies apply it to extend shelf life without synthetic preservatives. Packaging developers explore controlled-release coatings that leverage its aroma and antimicrobial traits. Investors fund pilot projects to integrate it into seed treatment and crop protection. Technical teams design scalable blending techniques for large-scale agricultural use. Sales departments report expanding inquiries from organic farming cooperatives.

Market Segmentation Analysis

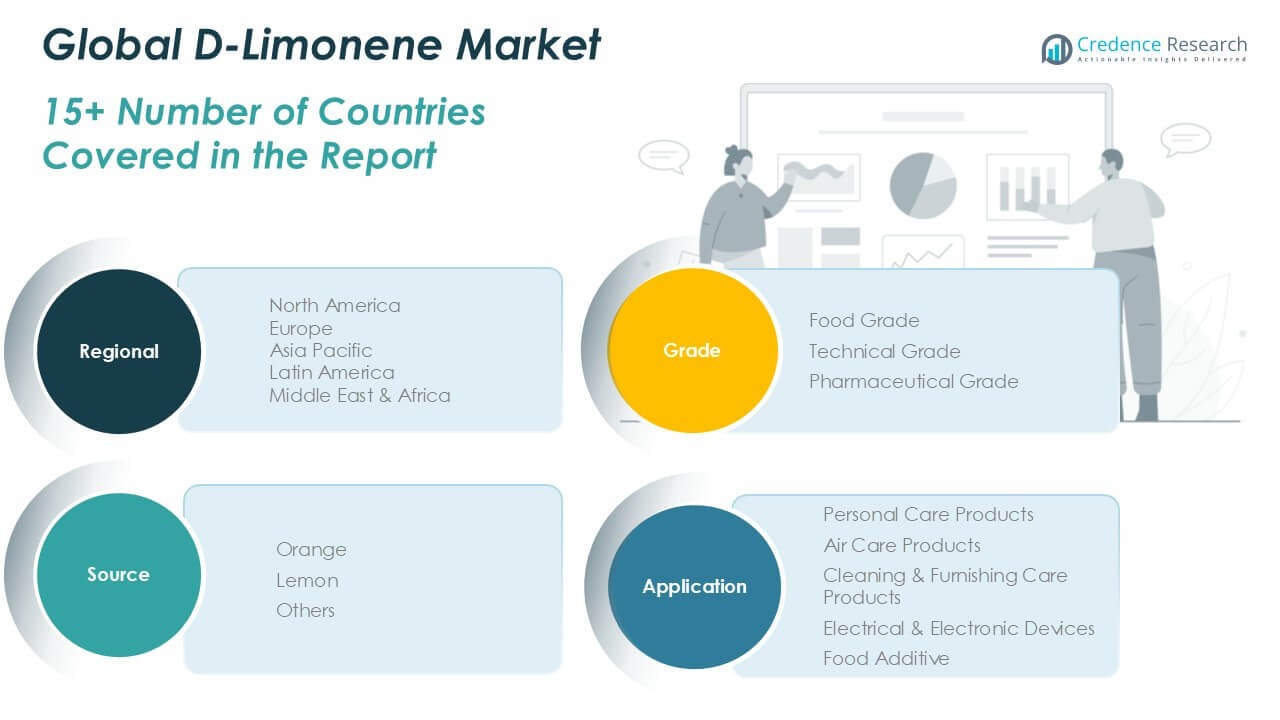

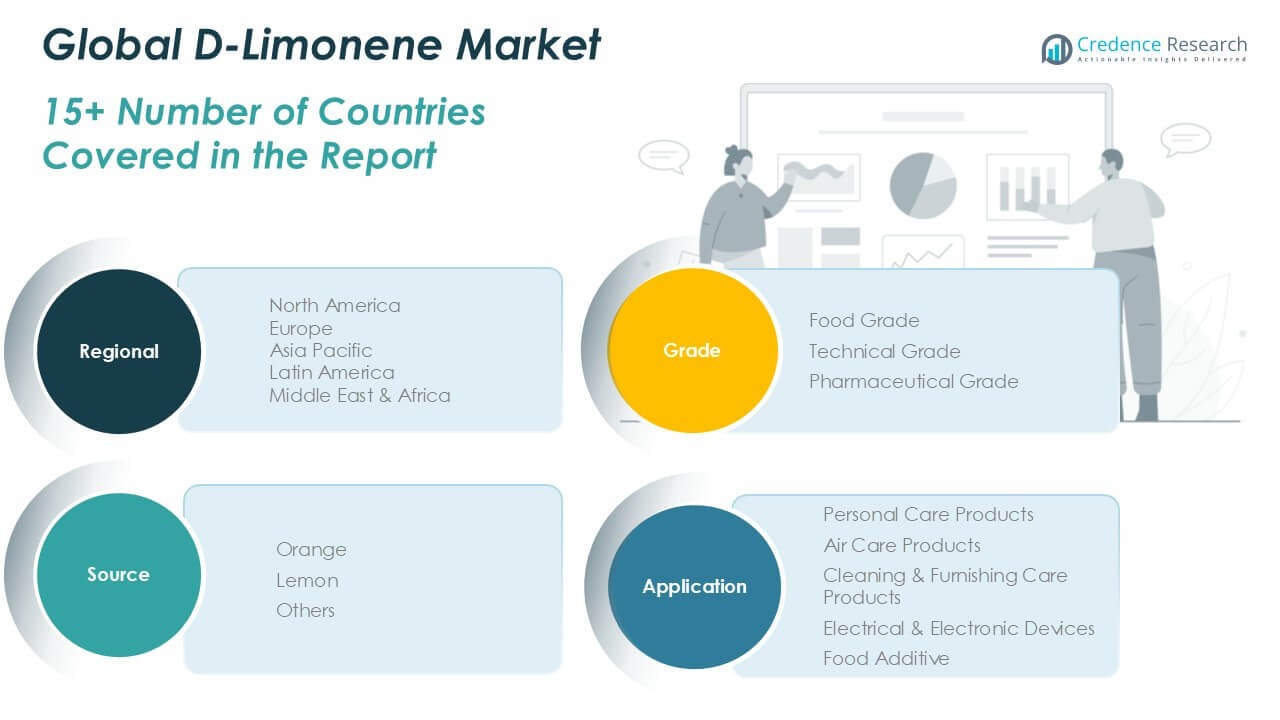

By Source

The Global D-Limonene Market divides by source into orange, lemon, and others. It captures most volume share from orange peel extraction due to high limonene content and established supply chains. Lemon peel contributes significant revenue share, driven by premium fragrance and flavor applications. The “others” category, including grapefruit and mandarin sources, gains traction in niche markets seeking unique citrus profiles. Producers optimize harvesting schedules and streamline peel processing to maintain consistent output.

- For instance, according to the U.S. Department of Agriculture (USDA), more than 5,000,000 tons of orange peels were processed for essential oil extraction in the United States in 2024, with a substantial portion used for D-limonene production.

By Grade

Grade segmentation covers food grade, technical grade, and pharmaceutical grade. It holds the largest volume share in technical grade for industrial cleaners and solvents. Food grade secures growing revenue share, supported by clean-label demands in beverages and confectioneries. Pharmaceutical grade occupies a smaller share but shows highest growth potential through use in green extraction of active compounds. Quality control labs enforce stringent purity tests to meet diverse regulatory requirements across each grade.

- For instance, a 2023 industry survey by the European Chemicals Agency (ECHA) found that over 900,000 tons of technical grade D-limonene were utilized in industrial cleaning products across Europe.

By Application

Application analysis includes personal care products, air care products, cleaning & furnishing care products, electrical & electronic devices, and food additive. It leads volume share in cleaning & furnishing care due to potent solvency and low toxicity. Personal care and air care segments follow, benefiting from natural fragrance and safety credentials. Electrical & electronic devices segment exploits limonene’s dielectric properties in circuit board cleaning. Food additive applications expand with demand for natural flavors and preservative functions.

Segments

Based on Source

Based on Grade

- Food Grade

- Technical Grade

- Pharmaceutical Grade

Based on Application

- Personal Care Products

- Air Care Products

- Cleaning & Furnishing Care Products

- Electrical & Electronic Devices

- Food Additive

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America D-Limonene Market

North America D-Limonene Market hit USD 161.0 million in 2024. It will reach USD 216.3 million by 2032 (CAGR 4.4%). It holds about 35.2% of global share. United States drives demand in cleaning applications. Canada supports flavor and fragrance segments. Producers expand local extraction facilities.

Europe D-Limonene Market

Europe D-Limonene Market rose from USD 124.4 million in 2024. It will reach USD 163.9 million by 2032 (CAGR 3.7%). It holds roughly 27.2% of global market. Germany and United Kingdom drive demand in personal care. It benefits from stringent EU environmental regulations. Spain and Italy host key processing facilities.

Asia Pacific D-Limonene Market

Asia Pacific D-Limonene Market stood at USD 101.1 million in 2024. It will reach USD 163.9 million by 2032 (CAGR 6.3%). It accounts for about 22.1% of global share. China and India lead consumption in flavor applications. Governments promote plant-derived solvents for sustainability. Producers plan capacity expansion across the region.

Latin America D-Limonene Market

Latin America D-Limonene Market measured USD 23.8 million in 2024. It will hit USD 39.3 million by 2032 (CAGR 5.1%). It holds about 5.2% of the global market. Brazil and Mexico lead in citrus-based production. It fuels demand in cleaning and agrochemical sectors. Local producers strengthen supply chain partnerships.

Middle East D-Limonene Market

Middle East D-Limonene Market reached USD 30.6 million in 2024. It will rise to USD 45.9 million by 2032 (CAGR 3.1%). It accounts for about 6.7% of global market share. United Arab Emirates and Saudi Arabia drive solvent uptake. It finds use in oilfield cleaning and personal care. Companies expand distribution hubs to improve supply.

Africa D-Limonene Market

Africa D-Limonene Market stood at USD 16.5 million in 2024. It will reach USD 26.2 million by 2032 (CAGR 5.8%). It holds about 3.6% of global market share. South Africa and Egypt drive consumption in flavor uses. It supports cleaning and personal care applications. Investment flows toward expanding extraction plants.

Key players

- Florida Chemical

- Firmenich

- Sucorrico

- LemonConcentrate

- Citrus Oleo International

- Ernesto Ventós, S.A.

- Citrosuco

- Arora Aromatics Pvt Ltd

- Tessenderlo Group

- FMC Corporation

- Takasago International Corporation

- Symrise AG

- Dabur India Ltd

- Givaudan

Competitive Analysis

The D-Limonene Market is moderately consolidated, with established players holding substantial market share through integrated supply chains and diversified portfolios. Florida Chemical and Citrosuco lead in raw material sourcing and bulk distribution. Symrise AG, Firmenich, and Givaudan maintain strong positions in flavors and fragrances. FMC Corporation and Takasago focus on advanced formulation solutions and global outreach. Companies such as Arora Aromatics and LemonConcentrate serve regional demand with competitive pricing. It sees strategic expansions, product innovation, and sustainability certification as primary growth tactics. Firms invest in citrus sourcing partnerships and green extraction technologies to strengthen their market presence.

Recent Developments

- In February 2024, DSM-Firmenich reported full-year 2023 results, highlighting the successful creation of the company with integration ahead of plan and significant cost and sales synergies.

- From 2023 to 2025, LemonConcentrate continued its D-limonene production, utilizing various Spanish citrus varieties. They emphasized the fresh, flavorful characteristics derived from Mediterranean-grown fruits.

Market Concentration and Characteristics

The D-Limonene Market exhibits moderate concentration, with the top five suppliers controlling over half of global production through integrated citrus processing and extraction facilities. It features a mix of large multinationals and specialized regional players that compete on purity, sustainability certification, and supply reliability. Manufacturers differentiate through advanced purification methods and green credentials. Buyers benefit from competitive pricing and diversified sourcing options. Stringent quality standards and regulatory compliance drive consistent supply chain transparency. Market entry barriers include capital-intensive extraction infrastructure and long-term citrus peel agreements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Source, Grade, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The D-Limonene Market will benefit from intensified investment in advanced extraction technologies to enhance yield and molecular purity. These improvements will reduce operating costs and support novel application development across pharmaceuticals, agrochemicals, and consumer goods.

- Producers will adopt continuous-flow processing and membrane separation methods to optimize throughput and minimize solvent waste. This operational shift will strengthen supply chain resilience and reinforce commitments to sustainable manufacturing practices.

- Research teams will investigate biocatalytic conversion pathways to diversify terpene derivatives and unlock high-value specialty chemicals. Successful development of these pathways will expand product portfolios and drive higher-margin revenue streams.

- Ingredient formulators will integrate microencapsulation and controlled-release platforms to stabilize limonene in complex matrices. These delivery systems will extend shelf life in food products and enhance sensory performance in fragrance applications.

- Regulatory bodies will tighten purity and residue standards, prompting producers to adopt rigorous analytics and quality management frameworks. Compliance with enhanced specifications will elevate market trust and facilitate entry into regulated pharmaceutical markets.

- Strategic partnerships between citrus growers and extraction companies will secure year-round feedstock availability and hedge price volatility. These alliances will underpin reliable raw material sourcing and foster long-term supply agreements.

- Market players will pursue vertical integration to control peel processing and downstream purification, capturing greater value across the value chain. This consolidation strategy will improve margin stability and enable rapid scale-up of production capabilities.

- Emerging economies will drive demand growth through expanding personal care, cleaning, and flavor sectors, leveraging limonene’s eco-friendly profile. Local manufacturers will invest in on-site distillation units to meet regional consumption dynamics and reduce import dependence.

- Innovation in agrochemical formulations will leverage limonene’s bio-insecticidal and antimicrobial properties to develop greener crop protection solutions. Adoption of these bio-based pesticides will address regulatory pressure to phase out synthetic agrochemicals and support organic farming initiatives.

- Corporate sustainability programs will emphasize third-party certifications and life-cycle assessments to validate environmental benefits. Transparent reporting of carbon footprints and biodegradability metrics will strengthen brand positioning and attract eco-conscious customers.