| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diatom Mud Market Size 2024 |

USD 1,250.0 million |

| Diatom Mud Market, CAGR |

7.50% |

| Diatom Mud Market Size 2032 |

USD 2,229.3 million |

Market overview

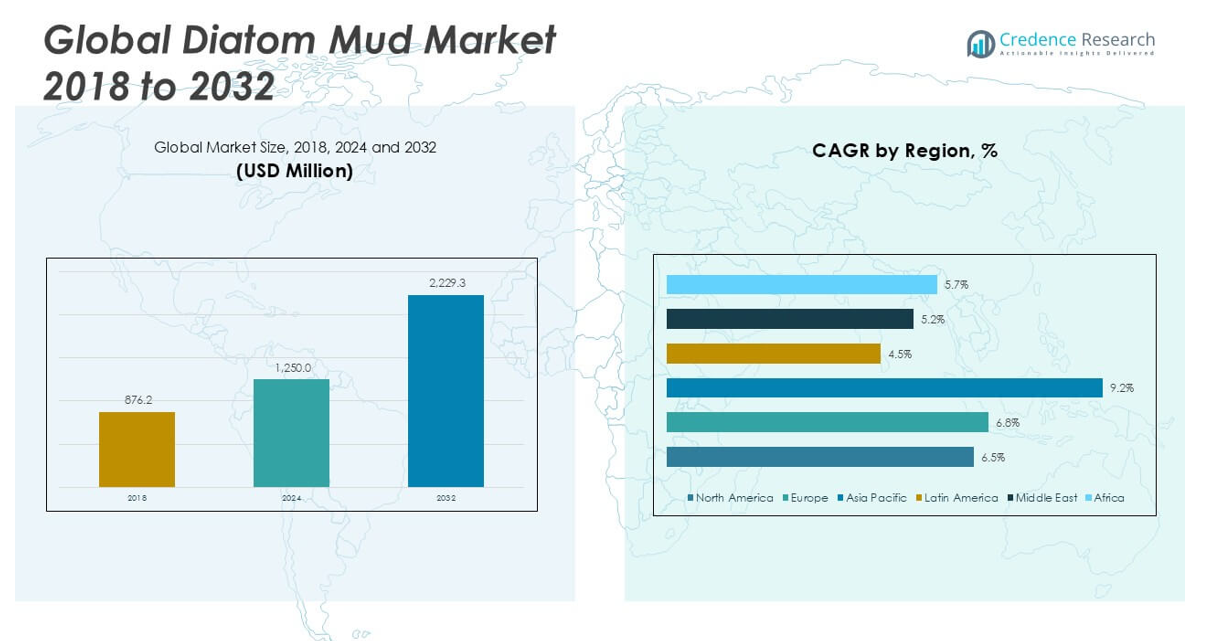

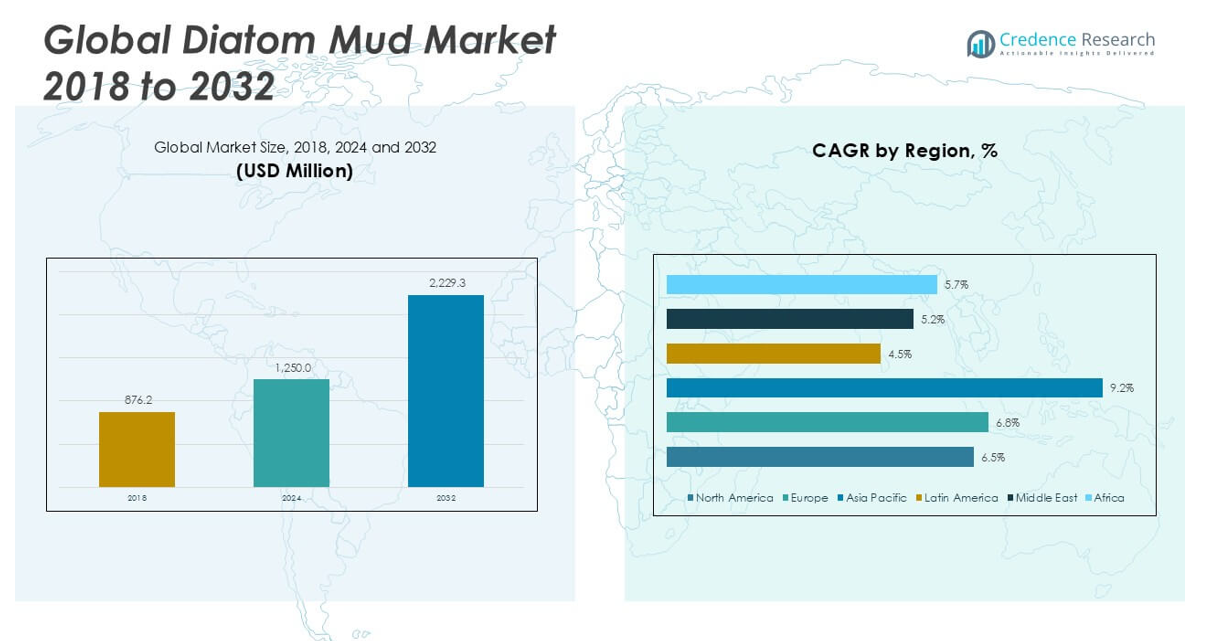

The Diatom Mud market size was valued at USD 876.2 million in 2018, increased to USD 1,250.0 million in 2024, and is anticipated to reach USD 2,229.3 million by 2032, growing at a CAGR of 7.50% during the forecast period.

In the Diatom Mud market, leading players such as Nippon Paint, SKK (Japan), Daitong Environmental Protection Material Co., Ltd., Zhisheng Environmental Protection Materials, and Sankyo Co., Ltd. hold significant competitive positions due to their extensive product offerings, technological advancements, and strong distribution networks. These companies continuously focus on developing eco-friendly, high-performance diatom mud products to meet growing consumer demand. Asia Pacific dominates the global market with a commanding market share of approximately 44% in 2024, driven by rapid urbanization, increasing residential construction, and strong consumer awareness of sustainable building materials, particularly in China, Japan, and India.

Market Insights

- The Diatom Mud market was valued at USD 876.2 million in 2018, reached USD 1,250.0 million in 2024, and is projected to reach USD 2,229.3 million by 2032, growing at a CAGR of 7.5% during the forecast period.

- Growing consumer preference for eco-friendly and non-toxic building materials is a key market driver, boosting demand across residential and commercial sectors.

- Rising trends such as the adoption of customized, aesthetic interior solutions and the expansion of online distribution channels are creating new growth opportunities.

- The market is moderately competitive, with leading players including Nippon Paint, SKK (Japan), Daitong Environmental Protection Material Co., Ltd., and Zhisheng Environmental Protection Materials focusing on product innovation and regional expansion.

- Asia Pacific leads the global market with a 44% share in 2024, followed by Europe at 22% and North America at 18%; by product, the Wall Coatings segment holds around 55-60% of the market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

In the Diatom Mud market, the Wall Coatings segment holds the dominant share, accounting for approximately 55-60% of the market. The superior moisture absorption, air purification properties, and eco-friendly composition of diatom mud wall coatings have driven their widespread adoption in modern construction and interior design. Consumers increasingly prefer these coatings due to their ability to reduce indoor humidity and prevent mold formation, enhancing indoor air quality. Additionally, the growing demand for sustainable and non-toxic building materials further supports the strong market position of the wall coatings sub-segment.

- For instance, Nippon Paint has developed advanced diatom mud wall coatings capable of absorbing up to 400 milliliters of moisture per square meter, significantly improving indoor air environments.

By Application

The Residential segment dominates the Diatom Mud market, capturing around 65-70% of the market share. The rising awareness regarding healthier indoor environments and the increasing trend of home renovations have significantly contributed to the segment’s growth. Homeowners prefer diatom mud products for their excellent breathability, odor absorption, and natural aesthetic appeal. Additionally, the ability of diatom mud to regulate indoor humidity levels makes it particularly attractive for residential settings, driving continuous demand in this segment. Expanding urban housing projects further boost the market growth for residential applications.

- For instance, SKK (Japan) has successfully installed its diatom mud coatings in over 12,000 residential units across urban centers in Japan, providing long-term mold resistance and air purification benefits.

By Distribution Channel

Specialty Stores represent the leading distribution channel in the Diatom Mud market, holding approximately 50-55% of the market share. Consumers often rely on specialty stores for expert advice, quality assurance, and a wider range of product customization options. These stores provide detailed information on product application and maintenance, which enhances customer trust and product adoption. The growing demand for personalized interior solutions and the emphasis on eco-friendly, high-performance materials have further strengthened specialty stores’ position as the preferred distribution channel for diatom mud products.

Market Overview

Rising Demand for Eco-Friendly Building Materials

The increasing consumer preference for sustainable and eco-friendly building materials is a significant growth driver for the Diatom Mud market. Diatom mud, known for its non-toxic, odor-absorbing, and moisture-regulating properties, aligns with the growing global emphasis on green construction. With governments and regulatory bodies promoting environmentally friendly practices, builders and homeowners are rapidly adopting diatom mud products to meet these standards. The material’s natural composition and health benefits, such as improving indoor air quality, further enhance its appeal, fueling steady market growth across both residential and commercial sectors.

- For instance, Daitong Environmental Protection Material Co., Ltd. has introduced wall panels with formaldehyde absorption rates exceeding 90 mg/m², directly addressing indoor air quality improvement.

Expanding Residential Construction and Renovation Activities

The surge in residential construction and home renovation projects, particularly in urban areas, is propelling the demand for diatom mud. Consumers are increasingly seeking interior solutions that combine aesthetic appeal with functional benefits like humidity control and air purification. Diatom mud’s ability to meet these requirements makes it a preferred material in modern home designs. Additionally, the rise in disposable incomes and growing awareness of healthy living environments encourage homeowners to invest in premium wall coatings and decorative panels, significantly driving market expansion in the residential segment.

- For instance, Zhisheng Environmental Protection Materials has completed over 500,000 square meters of residential projects using diatom mud coatings in major Chinese cities over the past three years.

Increasing Consumer Awareness of Indoor Air Quality

Heightened awareness regarding the importance of indoor air quality is boosting the adoption of diatom mud products. Diatom mud’s natural porosity helps absorb harmful substances, control humidity, and eliminate odors, making it a highly sought-after material in both homes and commercial spaces. As consumers prioritize health and wellness, the demand for materials that actively contribute to cleaner indoor environments continues to grow. This shift is especially prominent in regions with high urban density, where air quality concerns are more pronounced, thereby driving the sustained growth of the Diatom Mud market.

Key Trends & Opportunities

Growing Adoption of Customized and Aesthetic Interior Solutions

There is a rising trend toward using diatom mud in customized, visually appealing interior designs. Consumers are not only focusing on functionality but also on enhancing the visual appeal of living and commercial spaces. Diatom mud products, particularly decorative panels, offer a variety of textures and colors that can be tailored to meet specific design preferences. This demand for bespoke and sustainable interiors presents significant growth opportunities for manufacturers to develop innovative and aesthetically versatile diatom mud solutions that cater to diverse consumer tastes.

- For instance, Sankyo Co., Ltd. offers over 300 texture and color variations in its diatom mud decorative panels, which are widely used in custom home and office projects in Japan.

Expansion of Online Retail Channels

The increasing penetration of e-commerce platforms is opening new growth avenues for the Diatom Mud market. Consumers are becoming more comfortable purchasing building materials online due to the convenience, wider product selection, and easy access to product specifications and reviews. Online stores are particularly beneficial for reaching a broader customer base, including those in remote or under-served areas. This shift toward digital buying behavior creates opportunities for manufacturers and retailers to strengthen their online presence, invest in virtual consultation services, and offer direct-to-consumer sales strategies.

- For instance, Guangzhou Zhuodian Environmental Technology reported a 35% year-on-year increase in its online diatom mud product sales through platforms such as Tmall and JD.com in 2023, reflecting strong consumer acceptance of online purchasing channels.

Key Challenges

Limited Consumer Awareness in Emerging Markets

One of the primary challenges in the Diatom Mud market is the low consumer awareness in emerging regions. Despite the material’s advantages, many potential customers in developing countries remain unaware of its benefits and applications. This lack of awareness restricts market penetration and limits the growth potential in these high-opportunity regions. To overcome this challenge, companies must invest in educational marketing campaigns and engage local distributors to increase product visibility and consumer understanding in untapped markets.

High Product and Installation Costs

The relatively high cost of diatom mud products and their specialized installation processes pose a significant barrier to widespread adoption. Compared to conventional wall coatings, diatom mud requires skilled labor and precise application techniques, which increases overall project costs. These additional expenses may deter price-sensitive consumers, especially in budget-constrained residential and commercial projects. Cost reduction strategies and the development of easy-to-apply products could help mitigate this challenge and broaden the material’s appeal to a wider audience.

Competition from Alternative Wall Coatings

The Diatom Mud market faces strong competition from more established and cost-effective wall coatings such as traditional paints and wallpapers. These alternatives offer quicker application and a broad range of designs at lower prices, making them more accessible to the mass market. As a result, diatom mud struggles to compete in segments where cost and convenience are prioritized over environmental benefits. Continuous innovation, performance differentiation, and stronger consumer education about the long-term advantages of diatom mud are essential to address this competitive pressure.

Regional Analysis

North America

North America accounted for approximately 18% of the Diatom Mud market in 2024, with a market size of USD 225.0 million, up from USD 188.4 million in 2018. The market is projected to reach USD 338.9 million by 2032, growing at a CAGR of 6.5% during the forecast period. The region’s growth is driven by increasing consumer awareness of indoor air quality and the rising adoption of eco-friendly construction materials. The demand for premium wall coatings in residential and commercial spaces further supports market expansion, particularly in the United States and Canada.

Europe

Europe held around 22% of the Diatom Mud market in 2024, reaching a size of USD 275.0 million from USD 210.3 million in 2018. The market is anticipated to grow to USD 423.6 million by 2032 at a CAGR of 6.8%. The region benefits from stringent environmental regulations and a strong consumer shift towards sustainable building materials. Additionally, the popularity of modern, breathable wall coatings in residential renovations and commercial infrastructure drives steady growth. Countries such as Germany, France, and the UK are key contributors to the region’s expanding market share.

Asia Pacific

Asia Pacific dominates the Diatom Mud market with an estimated 44% market share in 2024, reaching USD 550.0 million, significantly up from USD 352.2 million in 2018. The market is expected to surge to USD 1,148.1 million by 2032, registering the highest CAGR of 9.2% among all regions. Rapid urbanization, expanding construction activities, and growing consumer preference for healthier indoor environments are major growth drivers. China, Japan, and India lead the regional market, driven by increasing disposable incomes and a rising focus on sustainable, high-performance interior solutions.

Latin America

Latin America accounted for around 5% of the Diatom Mud market in 2024, with a market size of USD 65.0 million, rising from USD 37.7 million in 2018. The market is projected to grow to USD 129.3 million by 2032, at a CAGR of 4.5%. Growth in this region is supported by gradual urban development and rising awareness of the benefits of eco-friendly wall coatings. Brazil and Mexico are key markets, where the demand is growing steadily, particularly in the residential sector. However, limited consumer awareness continues to moderate growth potential.

Middle East

The Middle East captured approximately 6% of the Diatom Mud market in 2024, with the market expanding from USD 56.1 million in 2018 to USD 83.8 million. It is forecasted to reach USD 153.8 million by 2032, growing at a CAGR of 5.2%. The region’s market growth is primarily driven by the rising trend of sustainable construction in urban centers like the UAE and Saudi Arabia. Increasing investments in premium commercial and residential projects are also enhancing the demand for eco-friendly, moisture-absorbing wall coatings like diatom mud.

Africa

Africa represented about 4% of the Diatom Mud market in 2024, with the market size growing from USD 31.5 million in 2018 to USD 51.2 million. However, the market is expected to experience relatively slower growth, reaching USD 35.7 million by 2032, despite a projected CAGR of 5.7%. The region’s growth is constrained by limited product awareness and lower purchasing power. However, increasing urbanization and gradual adoption of sustainable building practices, especially in South Africa and parts of North Africa, present modest growth opportunities for the Diatom Mud market in the coming years.

Market Segmentations:

By Product Type

- Wall Coatings

- Decorative Panels

- Others

By Application

- Residential

- Commercial

- Others

By Distribution Channel

- Online Stores

- Specialty Stores

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Diatom Mud market is characterized by the presence of both global and regional players, leading to moderate fragmentation and competitive intensity. Key companies such as Nippon Paint, SKK (Japan), and Daitong Environmental Protection Material Co., Ltd. dominate the landscape with strong brand recognition, extensive product portfolios, and a wide distribution network. These companies focus on continuous product innovation, sustainable material development, and strategic partnerships to strengthen their market position. Additionally, regional manufacturers like Zhisheng Environmental Protection Materials and Guangzhou Zhuodian Environmental Technology are gaining traction by offering cost-effective and eco-friendly solutions tailored to local preferences. Companies are actively investing in research and development to enhance the performance, aesthetic appeal, and application efficiency of diatom mud products. The growing importance of online retail and increasing demand for customized interior solutions are driving companies to expand their digital presence and improve customer engagement. Overall, competition is fueled by product differentiation, pricing strategies, and environmental sustainability initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nippon Paint

- SKK (Japan)

- Daitong Environmental Protection Material Co., Ltd.

- Zhisheng Environmental Protection Materials

- Sankyo Co., Ltd.

- Coloray Decoration

- Guangzhou Zhuodian Environmental Technology

- Beijing Moomoo New Material

- Xiangshan Bangde Environmental Protection Materials

- Shenzhen Aiyang Eco Materials Co., Ltd.

- Shanghai Yunyan Building Materials Co., Ltd.

- Fuzhou Huir Biological Technology Co., Ltd.

- Tianjin Shihuan New Materials

- Suzhou Green Building Materials Co., Ltd.

Recent Developments

- In March 2025, Nippon Paint Automotive Coatings Co., Ltd. announced the joint development of Japan’s first in-mold coating (IMC) technology for large thermoplastic automotive exterior applications. This innovation integrates resin molding and surface coating into a single process, significantly reducing CO₂ emissions and achieving zero VOC emissions. While this development is primarily for automotive coatings, it aligns with the company’s broader focus on sustainable and eco-friendly materials, which is a key trend in the diatom mud sector.

Market Concentration & Characteristics

The Diatom Mud Market demonstrates a moderately concentrated structure with the presence of several key global and regional players competing on product quality, innovation, and pricing. It exhibits strong product differentiation driven by unique characteristics such as moisture absorption, air purification, and eco-friendly composition. Leading companies focus on expanding product portfolios and enhancing performance to capture specific consumer preferences across residential and commercial sectors. The market shows steady consumer demand for sustainable wall coatings, particularly in urban areas where indoor air quality has become a priority. Companies invest in research and development to improve application methods and aesthetic flexibility, supporting wider adoption. The market benefits from growing regulatory support for non-toxic building materials, especially in regions with strict environmental guidelines. Competitive dynamics are shaped by regional players who offer cost-effective solutions tailored to local needs, creating pricing pressure for established brands. It relies heavily on distribution channels like specialty stores and online platforms to reach both premium and budget-conscious consumers.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Diatom Mud Market is expected to experience steady growth driven by rising demand for eco-friendly building materials.

- Increasing consumer awareness of indoor air quality will continue to support the adoption of diatom mud products.

- Wall coatings will likely remain the dominant product segment due to their functional and aesthetic advantages.

- Residential applications are expected to lead the market, supported by growing home renovation activities.

- Asia Pacific will retain its position as the largest regional market due to rapid urbanization and rising consumer preference for sustainable solutions.

- Europe and North America will see stable demand growth supported by stringent environmental regulations and higher adoption of green materials.

- Specialty stores and online retail channels will play an increasingly important role in market expansion.

- Key players are expected to focus on product innovation and regional market penetration to strengthen their positions.

- Competition from alternative, lower-cost wall coatings may challenge growth in price-sensitive markets.

- Expansion into emerging economies presents significant opportunities for market participants seeking new consumer bases.