Market Overview

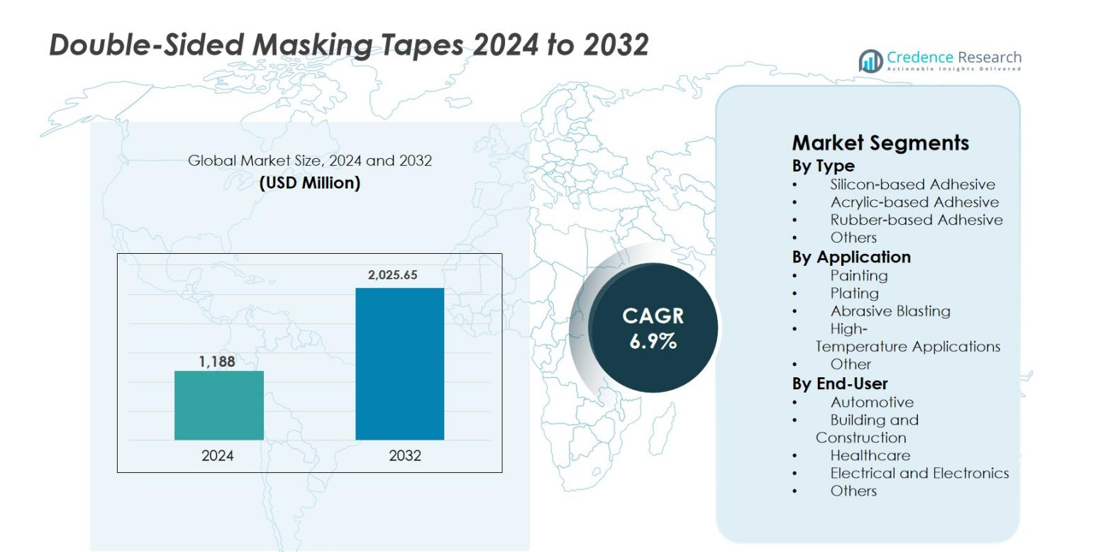

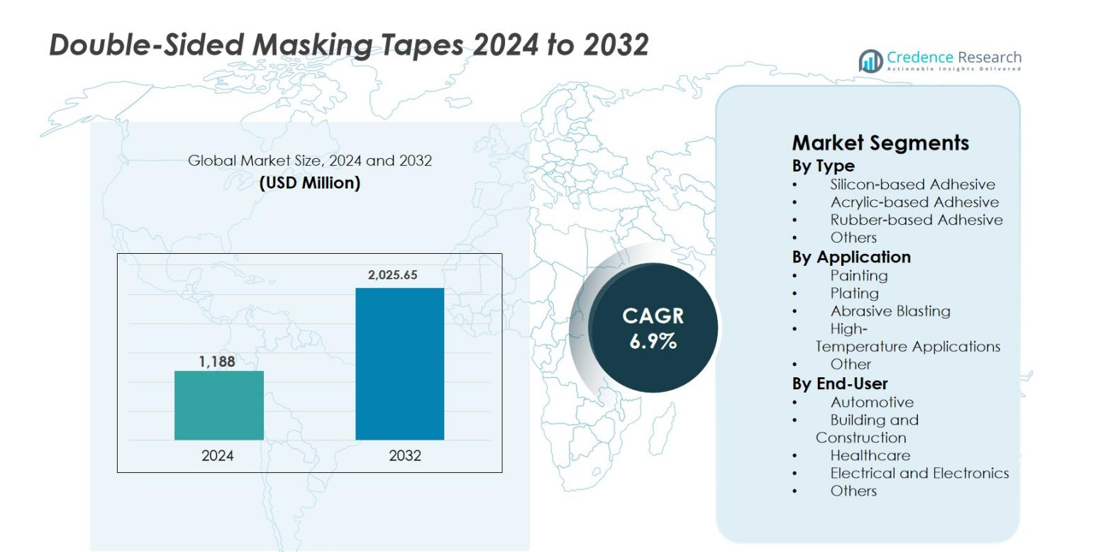

The Double-Sided Masking Tapes market size was valued at USD 1,188 million in 2024 and is anticipated to reach USD 2,025.65 million by 2032, growing at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Double-Sided Masking Tapes Market Size 2024 |

USD 1,188 million |

| Double-Sided Masking Tapes Market, CAGR |

6.9% |

| Double-Sided Masking Tapes Market Size 2032 |

USD 2,025.65 million |

The Double-Sided Masking Tapes market is driven by established global manufacturers and regional specialists that compete through product performance, innovation, and application-specific solutions. Key players including 3M, Nitto Denko Corporation, Saint-Gobain, Intertape Polymer Group, TesaTapes (India) Private Limited, Shurtape Technologies, Ahlstrom-Munksjö Oyj, Berry Global Inc., EMCOR Group, and Cintas Corporation focus on high-performance acrylic and silicone-based adhesives for automotive, construction, electronics, and healthcare applications. Asia-Pacific leads the market with an exact share of 41.8%, supported by strong manufacturing activity and infrastructure development. North America follows with 27.6% share, driven by automotive refinishing, healthcare, and renovation demand, while Europe holds 21.3%, supported by automotive production and sustainability-focused industrial applications.

Market Insights

- The Double-Sided Masking Tapes market was valued at USD 1,188 million in 2024 and is projected to reach USD 2,025.65 million by 2032, growing at a CAGR of 6.9% during the forecast period.

- Market growth is driven by rising demand from automotive painting, construction finishing, and electronics manufacturing, with acrylic-based adhesive tapes leading the segment at 41.6% share due to durability and clean removability.

- Increasing adoption of high-performance and high-temperature masking solutions represents a key trend, supported by expanding use in powder coating, electronics assembly, and precision industrial applications.

- Price volatility of raw materials and performance limitations across varied surfaces act as restraints, intensifying competition among manufacturers focused on product innovation and application-specific solutions.

- Asia-Pacific dominates with 41.8% market share, followed by North America at 27.6% and Europe at 21.3%, while painting applications hold the largest segment share at 38.9% driven by refurbishment and manufacturing activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

By type, the Double-Sided Masking Tapes market is led by the acrylic-based adhesive segment, which accounted for 41.6% market share in 2024. Acrylic-based tapes dominate due to their strong adhesion, UV resistance, aging stability, and consistent performance across a wide temperature range. These properties make them suitable for automotive refinishing, electronics assembly, and industrial masking. Silicone-based adhesives follow, driven by high-temperature resistance and clean removability in specialized applications. Rubber-based adhesives maintain steady demand in cost-sensitive uses where quick tack and short-term bonding are required.

- For instance, 3M’s 467MP/468MP (High Performance Acrylic Adhesive 200MP) is specified for strong bonding to metals and high-surface-energy plastics and is rated up to 400°F/204°C for short-term heat exposure—useful where parts see hot/cold cycling and humidity.

By Application

By application, painting emerged as the dominant segment, holding around 38.9% of the Double-Sided Masking Tapes market share in 2024. Extensive use in automotive painting, architectural coatings, and industrial surface finishing drives this dominance. The segment benefits from growing refurbishment activities, rising vehicle production, and demand for precision masking to achieve clean paint edges. High-temperature applications are gaining traction due to increased use in powder coating and electronics manufacturing. Abrasive blasting and plating applications also contribute steadily, supported by infrastructure maintenance and metal finishing activities.

- For instance, Avery Dennison Performance Tapes FT 1140 series is documented for paint masking and temporary bonding, using an acrylic adhesive system designed to withstand paint bake cycles while maintaining clean removal.

By End-User

By end-user, the automotive segment accounted for the largest share of about 34.7% in 2024, driven by widespread use of double-sided masking tapes in painting, surface protection, wire harnessing, and component assembly. Growth in vehicle production, increasing adoption of lightweight materials, and stringent quality standards support sustained demand. Building and construction follows closely, supported by renovation and interior finishing activities. Electrical and electronics applications are expanding rapidly due to demand for precision masking in circuit assembly, while healthcare adoption grows steadily for clean-room and device manufacturing needs.

Key Growth Drivers

Rising Demand from Automotive and Transportation Manufacturing

The Double-Sided Masking Tapes market is strongly driven by growing demand from automotive and transportation manufacturing. These tapes are widely used in vehicle painting, surface protection, trim fixing, wire harnessing, and interior assembly processes. Increasing global vehicle production, coupled with rising adoption of lightweight materials and complex component designs, requires reliable masking solutions that offer clean removal and strong adhesion. Electric vehicle production further accelerates demand, as battery assembly and thermal management processes require precision masking. Stringent quality standards in automotive finishing, along with growing focus on productivity and reduced rework, continue to support sustained adoption of double-sided masking tapes across OEMs and aftermarket applications.

- For instance, tesa SE documents the use of its acrylic-based double-sided tapes in automotive wire harnessing and interior assembly, citing high shear strength and resistance to plasticizers commonly found in vehicle interiors.

Expansion of Construction, Renovation, and Infrastructure Activities

Growth in building construction, renovation, and infrastructure development significantly supports the Double-Sided Masking Tapes market. These tapes are extensively used in painting, surface protection, glazing, insulation installation, and interior finishing applications. Rising urbanization, commercial construction projects, and home improvement activities increase demand for efficient and clean masking solutions. Double-sided masking tapes enable faster application, reduced labor time, and improved finish quality, making them preferred in both residential and commercial projects. Increasing investments in infrastructure modernization and refurbishment, particularly in emerging economies, further strengthen market growth by expanding usage across diverse construction and maintenance environments.

- For instance, Coroplast Fritz Müller documents the use of its double-sided technical tapes in construction masking and surface protection, supporting clean paint lines and temporary fixation on walls, metals, and composite panels.

Growing Adoption in Electrical, Electronics, and Healthcare Applications

The expanding electrical, electronics, and healthcare sectors act as a key growth driver for the Double-Sided Masking Tapes market. In electronics manufacturing, these tapes support precision masking during PCB assembly, soldering, and component protection. Miniaturization of electronic devices and rising production of consumer electronics increase demand for high-performance, residue-free tapes. In healthcare, double-sided masking tapes are used in medical device manufacturing, clean-room environments, and equipment assembly, where contamination control and reliable adhesion are critical. Increasing healthcare investments and technological advancements continue to broaden application scope, reinforcing long-term market expansion.

Key Trends & Opportunities

Shift Toward High-Performance and Specialty Adhesive Formulations

A major trend in the Double-Sided Masking Tapes market is the shift toward high-performance and specialty adhesive formulations. Manufacturers increasingly focus on acrylic and silicone-based adhesives that offer superior temperature resistance, chemical stability, and clean removability. Demand for tapes that perform reliably under extreme conditions, such as high-temperature coating and electronics manufacturing, creates opportunities for product differentiation. Development of low-residue, UV-resistant, and long-duration masking solutions enables suppliers to target premium industrial applications. This trend opens growth opportunities for innovation-driven companies offering customized solutions tailored to specific industry requirements.

- For instance, Lohmann GmbH highlights its DuploCOLL® acrylic and silicone adhesive systems developed for high-temperature masking and electronics assembly, offering chemical stability and residue-free removal after thermal exposure.

Rising Demand for Sustainable and Eco-Friendly Tape Solutions

Sustainability is emerging as a significant opportunity in the Double-Sided Masking Tapes market. Growing environmental regulations and customer preference for eco-friendly products encourage manufacturers to develop solvent-free adhesives, recyclable backings, and bio-based materials. Adoption of sustainable production practices and reduced VOC emissions enhances brand positioning and regulatory compliance. End-users in construction, automotive, and electronics increasingly favor environmentally responsible solutions without compromising performance. This shift creates opportunities for tape manufacturers to expand their portfolios with green alternatives and capture demand from sustainability-focused industries.

- For instance, Scapa Industrial has documented the expansion of solvent-free and low-VOC pressure-sensitive adhesive technologies within its industrial tape portfolio, supporting cleaner production and safer use in construction and electronics applications.Key Challenges

Fluctuating Raw Material Prices and Supply Chain Volatility

The Double-Sided Masking Tapes market faces challenges from fluctuating raw material prices, particularly for adhesives, polymers, and specialty backings. Volatility in petrochemical feedstock prices directly impacts production costs and profit margins. Supply chain disruptions, including transportation delays and sourcing constraints, further increase operational uncertainty. Manufacturers often face difficulties in maintaining stable pricing while meeting quality and performance requirements. Smaller players are particularly vulnerable to cost pressures, which may limit their ability to compete effectively in price-sensitive markets and impact overall market stability.

Performance Limitations Across Diverse Application Environments

Ensuring consistent performance across diverse application environments remains a key challenge in the Double-Sided Masking Tapes market. Variations in surface types, temperatures, humidity levels, and chemical exposure can affect adhesion strength and removability. End-users demand tapes that deliver reliable performance without residue or surface damage, even under challenging conditions. Meeting these expectations requires continuous product development and testing, increasing R&D costs. Failure to address application-specific requirements may lead to performance issues, reduced customer satisfaction, and limited adoption in high-precision industrial and specialty applications.

Regional Analysis

Asia-Pacific

Asia-Pacific dominated the Double-Sided Masking Tapes market with 41.8% market share in 2024, driven by strong manufacturing activity across automotive, electronics, and construction sectors. Rapid industrialization, expanding infrastructure projects, and rising vehicle production in China, India, Japan, and Southeast Asia significantly support demand. The region benefits from a large base of electronics manufacturing, where precision masking solutions are essential. Growth in residential and commercial construction, along with increasing refurbishment activities, further accelerates tape consumption. Cost-efficient production capabilities and expanding domestic demand position Asia-Pacific as the primary growth engine.

North America

North America accounted for 27.6% of the Double-Sided Masking Tapes market in 2024, supported by steady demand from automotive, aerospace, healthcare, and construction industries. The region emphasizes high-performance and specialty adhesive solutions, particularly for automotive refinishing, electronics assembly, and medical device manufacturing. Strong renovation and home improvement activities contribute to sustained usage in painting and surface protection applications. Technological advancements, strict quality standards, and growing adoption of premium masking solutions strengthen market presence. Demand for sustainable and low-VOC products also influences purchasing decisions across industrial and commercial end users.

Europe

Europe captured 21.3% market share in the Double-Sided Masking Tapes market in 2024, driven by automotive manufacturing, industrial coating, and construction activities. Countries such as Germany, France, and the UK support demand through strong automotive OEM presence and refurbishment projects. Stringent environmental regulations encourage adoption of eco-friendly and solvent-free adhesive tapes. The region shows rising demand for high-temperature and specialty masking solutions used in powder coating and electronics production. Focus on quality, sustainability, and advanced manufacturing processes sustains steady growth across both industrial and commercial applications.

Latin America

Latin America represented 5.6% of the Double-Sided Masking Tapes market in 2024, supported by gradual expansion in construction, automotive assembly, and industrial maintenance activities. Growing urbanization and infrastructure investments in Brazil, Mexico, and Argentina drive demand for masking solutions in painting and surface finishing. Automotive aftermarket services and refurbishment projects contribute steadily to tape consumption. While price sensitivity remains high, increasing awareness of quality masking products supports gradual adoption. Improving industrial capabilities and rising foreign investments are expected to strengthen regional demand over the forecast period.

Middle East & Africa

The Middle East & Africa accounted for 3.7% of the Double-Sided Masking Tapes market in 2024, driven primarily by construction, infrastructure development, and industrial maintenance projects. Large-scale commercial construction and renovation activities in Gulf countries support demand for masking tapes in painting and surface protection. Growth in oil and gas facility maintenance and industrial coatings also contributes to usage. While market penetration remains relatively low, increasing industrial diversification and infrastructure investments gradually expand application scope, supporting moderate long-term growth across the region.

Market Segmentations

By Type

- Silicon-based Adhesive

- Acrylic-based Adhesive

- Rubber-based Adhesive

- Others

By Application

- Painting

- Plating

- Abrasive Blasting

- High-Temperature Applications

- Other

By End-User

- Automotive

- Building and Construction

- Healthcare

- Electrical and Electronics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Double-Sided Masking Tapes market features a moderately consolidated competitive landscape characterized by the presence of global adhesive manufacturers and specialized tape producers competing on product performance, application specificity, and innovation. Leading players such as 3M, Nitto Denko Corporation, Saint-Gobain, Intertape Polymer Group, TesaTapes (India) Private Limited, Shurtape Technologies, Ahlstrom-Munksjö Oyj, Berry Global Inc., EMCOR Group, and Cintas Corporation focus on expanding high-performance adhesive portfolios to address automotive, construction, electronics, and healthcare applications. Companies emphasize product differentiation through acrylic and silicone-based formulations, clean removability, and high-temperature resistance. Strategic priorities include capacity expansions, new product launches, sustainability-focused materials, and customized solutions for industrial end users. Strong distribution networks, technical support capabilities, and long-term partnerships with OEMs and contractors further strengthen market positioning and competitive presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Berry Global Inc. (US)

- Nitto Denko Corporation (Japan)

- Cintas Corporation (US)

- Ahlstrom-Munksjö Oyj (Finland)

- 3M (US)

- Saint-Gobain (France)

- Intertapes Polymer Group (Canada)

- TesaTapes (India) Private Limited (India)

- EMCOR Group Inc. (US)

- Shurtape Technologies, LLC (US)

Recent Developments

- In October 2025, 3M Company launched the 3M™ VHB™ Tape Max Series, an advanced line of double-sided VHB tapes designed for enhanced bonding performance in demanding structural and industrial applications.

- In September 2025, Avery Dennison expanded its strategic partnership with Wiliot to meet surging global demand for ambient IoT-based supply chain intelligence, enhancing connectivity across product labeling and adhesive solutions.

- In April 2025, H.B. Fuller introduced its Close Sesame™ double-sided tape designed for secure, high-speed e-commerce packaging applications to meet rising global packaging demands.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Double-Sided Masking Tapes market will continue to benefit from steady growth in automotive manufacturing and refinishing activities worldwide.

- Rising infrastructure development and renovation projects will support sustained demand from construction and interior finishing applications.

- Increased adoption of electric vehicles will create new opportunities for precision masking in battery assembly and thermal management processes.

- Manufacturers will focus on developing high-temperature and residue-free masking solutions to meet advanced industrial requirements.

- Growing electronics miniaturization will drive demand for tapes offering precise adhesion and clean removability.

- Sustainability initiatives will accelerate the shift toward solvent-free adhesives and recyclable backing materials.

- Expansion of healthcare and medical device manufacturing will strengthen demand for clean-room compatible masking tapes.

- Product customization and application-specific solutions will become key competitive differentiators.

- Advancements in adhesive formulations will improve durability across diverse surfaces and environmental conditions.

- Emerging economies will play a growing role in market expansion due to industrialization and increasing manufacturing capacity.