Market Overview:

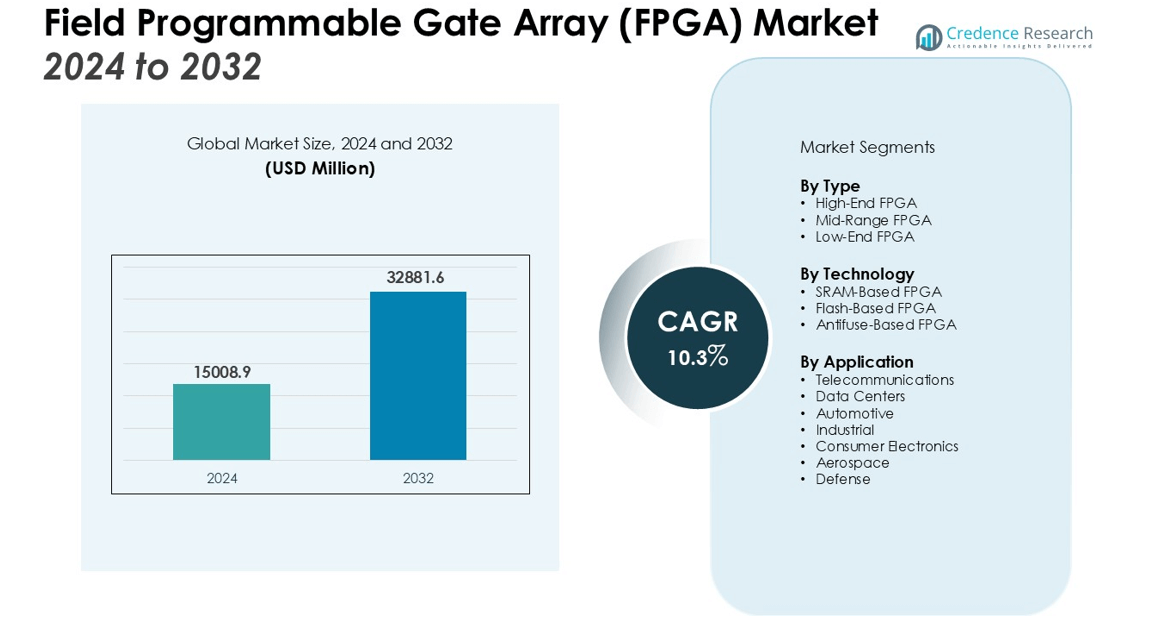

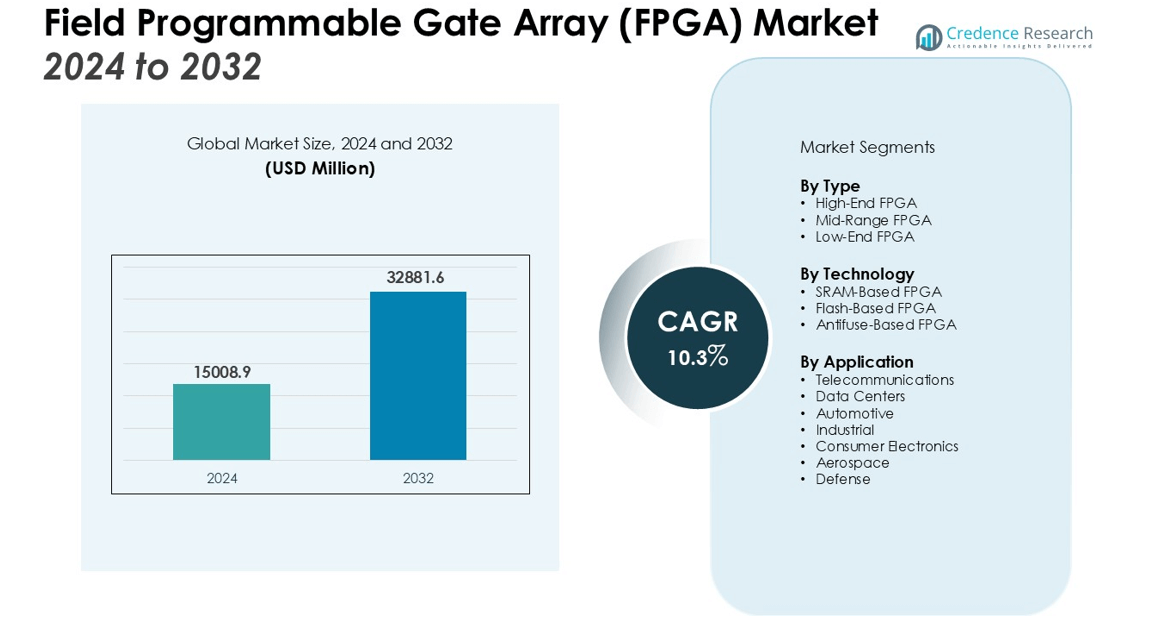

The Field Programmable Gate Array (FPGA) Market size was valued at USD 15008.9 million in 2024 and is anticipated to reach USD 32881.6 million by 2032, at a CAGR of 10.3% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Field Programmable Gate Array (FPGA) Market Size 2024 |

USD 15008.9 million |

| Field Programmable Gate Array (FPGA) Market, CAGR |

10.3% |

| Field Programmable Gate Array (FPGA) Market Size 2032 |

USD 32881.6 million |

Market expansion is driven by the rising use of FPGAs in telecommunications, data centers, automotive, aerospace, and defense sectors. The deployment of 5G networks, particularly open radio access networks (ORAN), is fueling demand for reprogrammable solutions. The growing need for edge-AI inference, rapid prototyping in chip design, and efficient hardware acceleration for AI and machine learning workloads is further boosting adoption. FPGAs’ capacity to handle complex processing tasks in real time is also propelling their use in autonomous driving, industrial automation, and high-speed networking.

Asia-Pacific holds the largest share of the market, accounting for roughly 39–46% of global revenue, and is expected to grow at up to 17.1% CAGR through 2030 due to strong semiconductor manufacturing capabilities and high adoption in electric vehicles and industrial automation. North America maintains strong growth momentum, supported by substantial investments in data center infrastructure and aerospace applications.

Market Insights:

- The Field Programmable Gate Array (FPGA) Market is valued at USD 15008.9 million and projected to reach USD 32881.6 million by 2032, registering a CAGR of 10.3% during the forecast period.

- Increasing deployment in telecommunications, data centers, automotive, aerospace, and defense sectors is driving strong adoption, with 5G network expansion and ORAN implementation fueling demand.

- Rising demand for AI acceleration and high-performance computing strengthens FPGA adoption, offering low-latency, reconfigurable solutions for autonomous vehicles, robotics, and analytics.

- Data center integration is expanding, with FPGAs enhancing encryption, compression, and network throughput while enabling rapid adaptation to emerging protocols.

- High development costs, complex design requirements, and power consumption challenges continue to limit adoption in cost-sensitive and energy-restricted applications.

- Asia-Pacific leads with 46% of global revenue, followed by North America at 31% and Europe at 18%, reflecting strong manufacturing capacity, R&D capabilities, and industrial adoption.

- Growth opportunities are emerging in AI-driven edge computing, 5G infrastructure, and advanced automotive systems, supported by rising investments in high-performance and adaptive hardware solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for High-Performance Computing and AI Acceleration

The Field Programmable Gate Array (FPGA) Market benefits from the increasing requirement for high-speed data processing in AI, machine learning, and deep learning applications. It delivers hardware-level parallelism and low-latency computation, which are critical for workloads in autonomous vehicles, robotics, and advanced analytics. The ability to reconfigure hardware for specific algorithms without redesigning the chip provides flexibility unmatched by fixed-function processors. Its integration into edge and cloud infrastructure enhances real-time processing capabilities for diverse industries.

- For instance, Intel’s Stratix 10 FPGAs deliver the necessary hardware acceleration for these intensive tasks, achieving up to 10 TFLOPS of single-precision floating-point performance.

Expansion of 5G Infrastructure and Advanced Telecommunications

The transition to 5G networks drives significant adoption of FPGA solutions in telecom infrastructure. It supports high-bandwidth, low-latency communication essential for network base stations, core networks, and emerging open radio access networks (ORAN). Its reconfigurable architecture allows telecom operators to adapt to evolving standards without costly hardware replacement. The rising global investments in telecom modernization further amplify the need for scalable and adaptable FPGA platforms.

Growth in Data Center Deployments and Network Optimization

Data centers increasingly integrate FPGAs to accelerate workloads such as encryption, compression, and search functions. It enhances network throughput and reduces latency for hyperscale cloud providers handling massive concurrent processes. The adaptability of its architecture enables quick updates for emerging protocols and application requirements. This capability is vital for maintaining performance efficiency in high-demand computing environments.

- For instance, in a pilot for its Project Catapult, Microsoft showed that running Bing’s decision-tree algorithms on FPGAs was 40 times faster than using CPUs alone.

Adoption in Automotive, Aerospace, and Defense Applications

The automotive industry employs FPGA technology for driver assistance systems, in-vehicle networking, and autonomous navigation. It delivers deterministic performance crucial for safety-critical applications. Aerospace and defense sectors leverage it for radar processing, signal intelligence, and secure communications due to its reliability and reconfigurability. The increasing complexity of mission-critical operations reinforces its role as a strategic enabler in these industries.

Market Trends:

Integration of FPGAs in AI-Driven and Edge Computing Applications

The Field Programmable Gate Array (FPGA) Market is witnessing increased adoption in AI-driven systems and edge computing environments. It delivers hardware acceleration for neural network inference, enabling faster decision-making in time-sensitive applications such as autonomous vehicles, predictive maintenance, and smart surveillance. The shift toward localized processing to reduce cloud dependency is increasing its deployment in edge devices. Its reconfigurable logic structure supports rapid adaptation to evolving AI models without requiring new hardware. Industries are leveraging this flexibility to optimize performance and energy efficiency in constrained environments. The combination of real-time analytics capability and reduced latency strengthens its role in next-generation computing infrastructure.

- For instance, in a collaboration with Airbus, a neural network inference implementation on a Xilinx Versal FPGA achieved a speedup factor of approximately 21 compared to a traditional CPU-based method for the same operation.

Advancements in 5G, High-Bandwidth Networking, and Heterogeneous Computing

The expansion of 5G networks and high-bandwidth data services is accelerating the integration of FPGAs into telecom and networking systems. It supports dynamic protocol updates, high-throughput data handling, and ultra-low-latency communication required for next-generation network services. The trend toward heterogeneous computing, where FPGAs work alongside CPUs and GPUs, is enhancing performance efficiency across workloads. Its adaptability makes it ideal for applications ranging from virtualized network functions to complex simulation environments. The demand for flexible hardware in cloud, enterprise, and IoT ecosystems is reinforcing its adoption in both centralized and distributed architectures. Ongoing developments in chiplet-based FPGA designs are also improving scalability and cost-effectiveness for diverse industry requirements.

- For instance, Affirmed Networks utilized Intel’s FPGA technology to develop a 5G core network solution, achieving a throughput of 200 Gbps per server.

Market Challenges Analysis:

High Development Costs and Complex Design Requirements

The Field Programmable Gate Array (FPGA) Market faces challenges related to high initial costs and intricate design processes. It demands specialized engineering expertise, which increases development time and resource requirements. The complexity of programming and optimizing FPGA architectures can limit adoption among smaller enterprises with limited technical capabilities. Integration with existing systems often requires custom development, further increasing costs. The need for advanced design tools and skilled personnel creates barriers for widespread implementation in cost-sensitive industries. These factors can slow market penetration despite the technology’s performance advantages.

Power Consumption and Competitive Pressure from Alternative Technologies

Power efficiency remains a critical concern, especially in applications requiring continuous operation under constrained thermal conditions. It often consumes more power compared to ASICs for specific workloads, affecting suitability in certain embedded systems. Competition from GPUs and ASICs, which can deliver similar performance for targeted applications at lower costs, exerts pressure on adoption rates. Rapid technological advances in alternative accelerators may divert potential demand from FPGA-based solutions. The challenge lies in balancing flexibility and performance with efficiency and affordability. Addressing these issues is essential for sustaining long-term market competitiveness.

Market Opportunities:

Expansion in AI, Machine Learning, and Edge Applications

The Field Programmable Gate Array (FPGA) Market holds significant growth potential in AI, machine learning, and edge computing domains. It offers reconfigurable hardware acceleration that can adapt to evolving algorithms without redesigning the chip. This capability positions it as a critical enabler for autonomous vehicles, industrial automation, and smart city infrastructure. Edge deployment of FPGAs reduces latency and improves real-time decision-making, which is vital for mission-critical applications. The rising demand for energy-efficient yet high-performance processing in distributed networks further strengthens its adoption. These factors create a substantial opportunity for technology providers to expand market reach.

Emerging Role in 5G, Data Centers, and Security Solutions

Global 5G rollout and increasing data center workloads are opening new avenues for FPGA integration. It can support high-throughput data processing, protocol adaptability, and secure network operations. The technology is well-suited for encryption, deep packet inspection, and cybersecurity functions, which are gaining importance in both commercial and defense sectors. Growth in virtualized network functions and software-defined infrastructures enhances the need for flexible, reprogrammable solutions. Its application in next-generation security appliances and network optimization platforms is expected to accelerate adoption. These emerging roles provide a strong foundation for sustained market expansion.

Market Segmentation Analysis:

By Type

The Field Programmable Gate Array (FPGA) Market is segmented into high-end, mid-range, and low-end devices. High-end FPGAs hold a dominant share due to their deployment in data centers, aerospace, and advanced telecommunications where performance and reconfigurability are critical. Mid-range devices are expanding in automotive electronics and industrial automation, offering a balance of cost and functionality. Low-end FPGAs serve embedded systems and consumer electronics, where compact design and lower power usage are priorities.

- For instance, Intel’s Cyclone 10 GX FPGAs are optimized for high-bandwidth applications by supporting a 72-bit wide DDR3 SDRAM interface that operates at a data rate of up to 1,866 Mbps.

By Technology

The market includes SRAM-based, flash-based, and antifuse-based architectures. SRAM-based FPGAs lead the segment with extensive use in reconfigurable computing and high-speed networking. It supports repeated programming, making it well-suited for prototyping and applications requiring frequent updates. Flash-based devices provide non-volatile storage, ensuring suitability for secure and low-power environments. Antifuse-based FPGAs, valued for their high reliability, are preferred in aerospace and defense for mission-critical operations.

- For instance, Microchip’s IGLOO family of flash FPGAs includes a Flash*Freeze technology that facilitates an ultra-low power mode, where the devices consume as little as 5µW while retaining SRAM and register data.

By Application

The market spans telecommunications, data centers, automotive, industrial, consumer electronics, aerospace, and defense. Telecommunications remain a key revenue generator, driven by 5G deployment and network virtualization. Data centers increasingly integrate FPGAs to accelerate AI, encryption, and analytics workloads. The automotive sector uses them for driver assistance, infotainment, and autonomous navigation. Industrial and consumer electronics applications focus on control systems and embedded solutions, while aerospace and defense rely on high-performance, secure, and reconfigurable computing for complex mission requirements.

Segmentations:

By Type

- High-End FPGA

- Mid-Range FPGA

- Low-End FPGA

By Technology

- SRAM-Based FPGA

- Flash-Based FPGA

- Antifuse-Based FPGA

By Application

- Telecommunications

- Data Centers

- Automotive

- Industrial

- Consumer Electronics

- Aerospace

- Defense

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia-Pacific Leading the Global Market with Strong Growth Potential

Asia-Pacific accounts for 46% of the global Field Programmable Gate Array (FPGA) Market revenue and is projected to retain its dominance through the forecast period. It benefits from a strong semiconductor manufacturing base in China, Taiwan, South Korea, and Japan. Expanding applications in automotive electronics, industrial automation, telecommunications, and consumer electronics fuel demand. Government initiatives promoting 5G deployment and advanced manufacturing strengthen regional adoption. Rapid growth in electric vehicle production and aerospace programs further increases FPGA demand. The region is expected to sustain double-digit growth rates, supported by investments in high-performance computing and AI-enabled systems.

North America Maintaining Technological and Infrastructure Leadership

North America captures 31% of global revenue in the Field Programmable Gate Array (FPGA) Market, driven by advanced R&D capabilities and the presence of leading semiconductor companies. It records high adoption in data centers, aerospace, defense, and next-generation communication networks. The region’s mature cloud infrastructure and demand for AI acceleration create favorable conditions for FPGA integration. Strategic investments in 5G infrastructure and defense modernization further enhance growth. It remains a hub for innovation, supported by collaboration between chip manufacturers, software developers, and research institutions.

Europe Advancing Through Industrial and Automotive Applications

Europe holds 18% of the global Field Programmable Gate Array (FPGA) Market revenue, with strong adoption in industrial automation, robotics, and automotive safety systems. It benefits from regulatory support for electric mobility and energy-efficient manufacturing solutions. Leading automotive producers in Germany, France, and Italy increasingly integrate FPGAs for advanced driver assistance systems and infotainment platforms. Growth in renewable energy projects drives FPGA demand for grid management and control applications. It continues to leverage engineering expertise and strategic partnerships to expand its application scope across multiple industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Xilinx, Inc.

- Intel Corporation

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- AMD, Inc.

- Broadcom

- Achronix Semiconductor Corporation

- Quicklogic Corporation

- Lattice Semiconductor Corporation

- Microchip Technology Inc.

Competitive Analysis:

The Field Programmable Gate Array (FPGA) Market is characterized by strong competition among global semiconductor leaders and specialized FPGA manufacturers. Key players focus on innovation, advanced process nodes, and integration of AI acceleration capabilities to enhance performance and efficiency. It witnesses strategic mergers, acquisitions, and partnerships to expand product portfolios and address diverse end-user requirements. Companies invest in developing FPGA solutions optimized for 5G networks, edge computing, automotive electronics, and data center acceleration. Competitive differentiation is driven by low-latency performance, power efficiency, reconfigurability, and support for heterogeneous computing environments. The market’s competitive landscape remains dynamic, with continuous advancements in design tools, packaging technologies, and software ecosystems strengthening vendor positions.

Recent Developments:

- In April 2025, Intel entered into a strategic agreement with the private equity firm Silver Lake, which will invest in Intel’s Altera business.

- In June 2025, Qualcomm announced its agreement to acquire Alphawave Semi for about $2.4 billion, a move intended to bolster its AI and data center offerings.

- In June 2025, Siemens and NVIDIA announced an expansion of their partnership to accelerate the integration of AI in industrial and manufacturing settings.

Market Concentration & Characteristics:

The Field Programmable Gate Array (FPGA) Market demonstrates moderate to high concentration, with a few multinational companies holding a significant share of global revenue. It is defined by high entry barriers due to complex design requirements, advanced manufacturing processes, and substantial R&D investments. Leading vendors maintain competitive advantage through proprietary architectures, strong software ecosystems, and long-term partnerships with key industries such as telecommunications, automotive, aerospace, and data centers. The market is technology-intensive, with rapid innovation cycles and a focus on integrating AI, high-speed connectivity, and low-power capabilities. Its growth characteristics include strong demand from emerging applications, regional manufacturing hubs driving supply, and a consistent push toward scalability and customization in FPGA solutions.

Report Coverage:

The research report offers an in-depth analysis based on Type, Technology, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Adoption in AI, machine learning, and edge computing will expand, driven by demand for real-time data processing and adaptable hardware acceleration.

- Integration with 5G infrastructure will intensify, supporting high-bandwidth, low-latency communication in telecom and enterprise networks.

- Use in automotive electronics will grow, enabling advanced driver assistance systems, autonomous navigation, and in-vehicle networking.

- Deployment in data centers will increase, enhancing workloads such as encryption, analytics, and network optimization.

- Advancements in heterogeneous computing will strengthen FPGA roles alongside CPUs and GPUs in high-performance environments.

- Development of low-power, high-efficiency architectures will improve suitability for embedded and portable applications.

- Expansion in aerospace and defense applications will continue, focusing on secure communications, radar processing, and mission-critical systems.

- Demand in industrial automation will rise, driven by smart manufacturing and robotics adoption.

- Broader use in consumer electronics will emerge, supporting high-speed interfaces and multimedia processing.

- Ongoing innovation in design tools and packaging technologies will enhance scalability, customization, and time-to-market efficiency.