Market Overview:

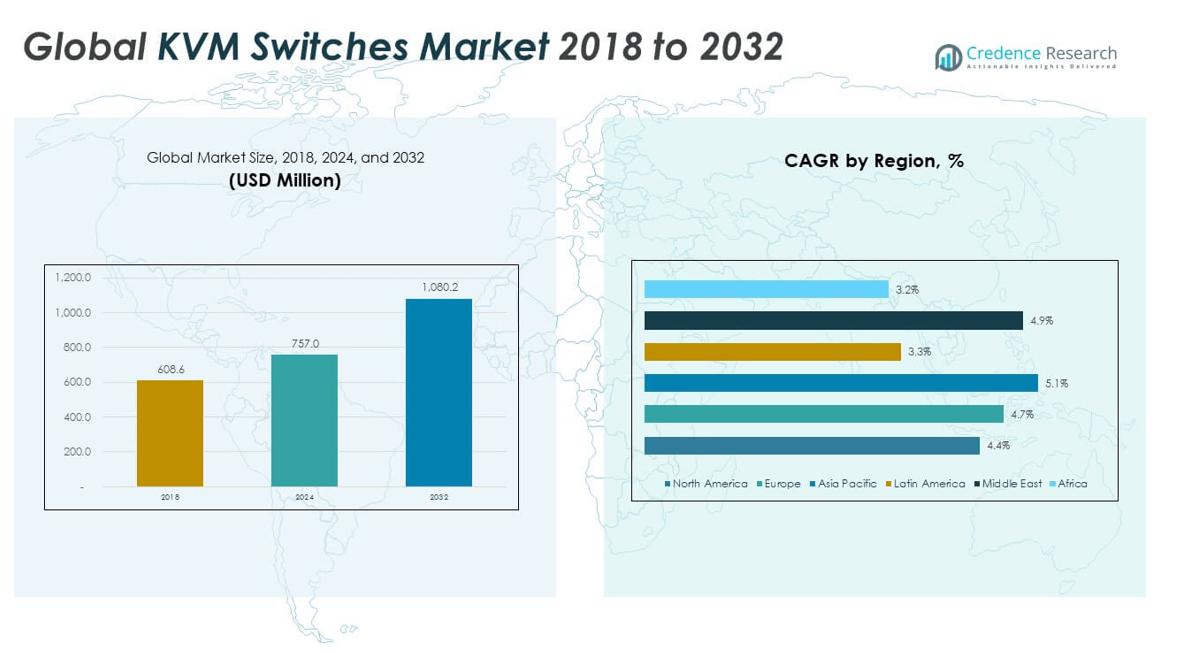

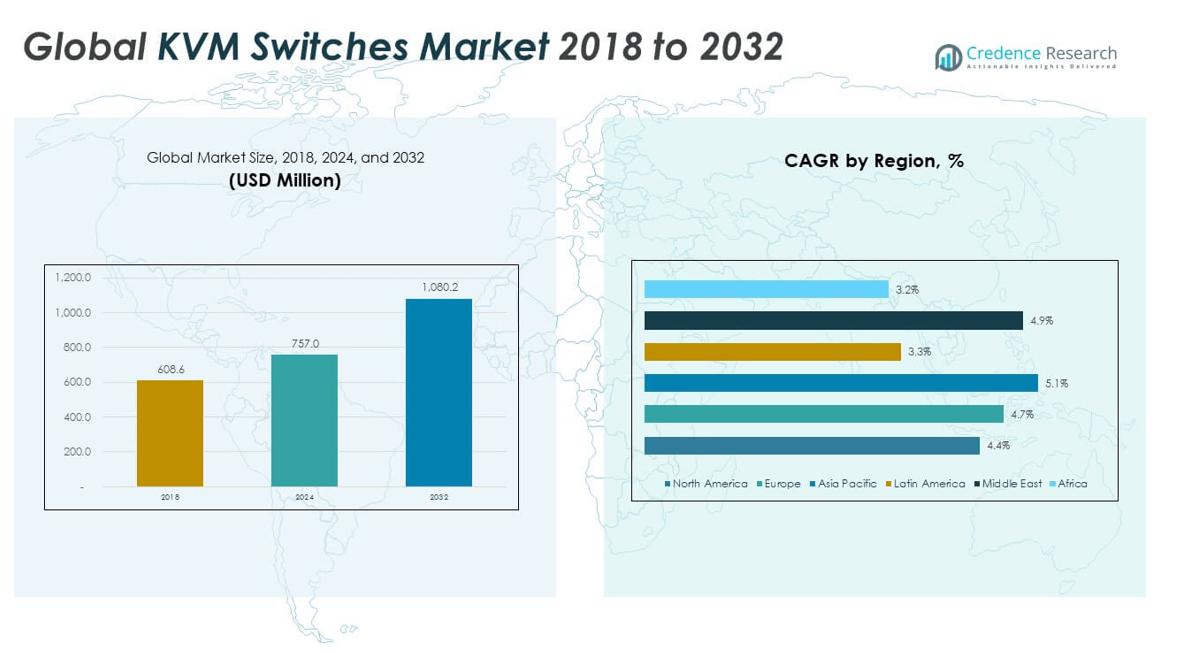

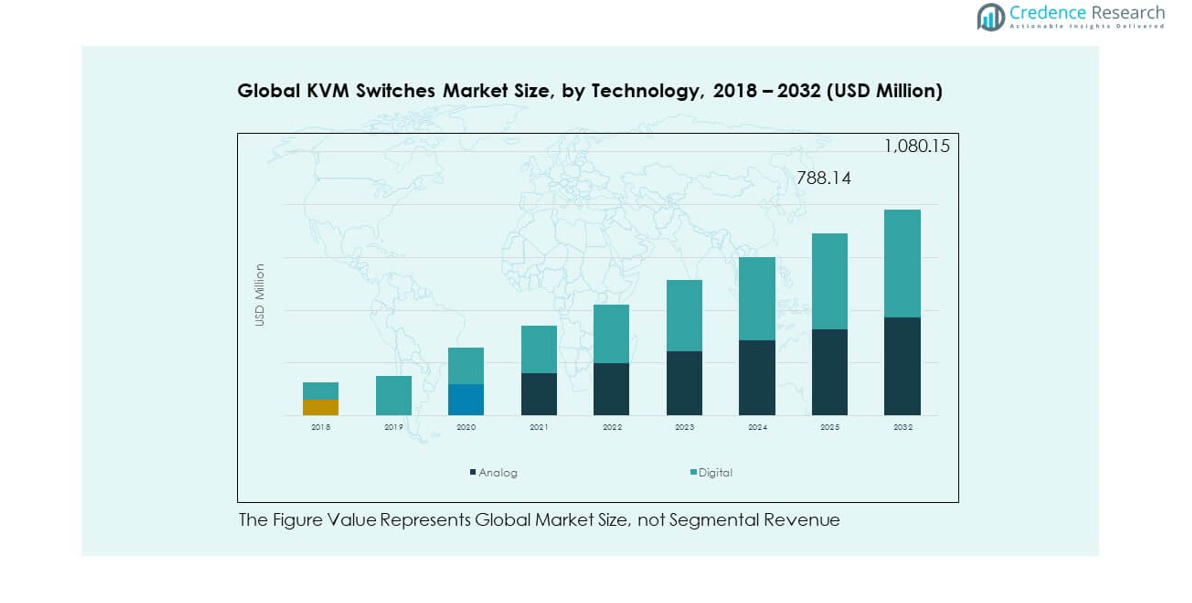

The KVM Switches Market size was valued at USD 608.6 million in 2018 to USD 757.0 million in 2024 and is anticipated to reach USD 1,080.2 million by 2032, at a CAGR of 4.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| KVM Switches Market Size 2024 |

USD 757.0 million |

| KVM Switches Market, CAGR |

4.61% |

| KVM Switches Market Size 2032 |

USD 1,080.2 million |

The growth of the KVM switches market is primarily driven by the increasing need for centralized control of multiple computers and servers, especially in data centers and enterprise IT environments. As organizations adopt virtualization, cloud computing, and remote monitoring systems, KVM switches help streamline operations by reducing the need for multiple peripherals. Additionally, the rising demand for secure, scalable, and space-efficient infrastructure in industrial automation, broadcasting, and defense sectors continues to fuel the adoption of advanced KVM solutions with higher bandwidth and remote access capabilities.

North America leads the KVM switches market, driven by a robust data center network, advanced IT infrastructure, and strong demand across enterprise and government sectors. Europe follows closely, benefitting from rising automation and data security requirements. Meanwhile, Asia-Pacific is emerging as a high-growth region due to rapid digitization, increasing investments in data centers, and the expansion of SMEs and cloud service providers in countries like China, India, and Southeast Asian nations. The Middle East and Latin America are also seeing gradual adoption, supported by infrastructure development and growing awareness of centralized IT management.

Market Insights:

- The KVM Switches Market was valued at USD 757.0 million in 2024 and is projected to reach USD 1,080.2 million by 2032, growing at a CAGR of 4.61%.

- Rising demand for centralized server control in data centers is a key driver accelerating adoption of KVM switches globally.

- The market gains momentum from increased deployment of KVM-over-IP systems supporting remote access and hybrid IT operations.

- High upfront costs and complex integration challenges limit adoption among small and mid-sized enterprises.

- North America remains a mature market with strong demand from IT, telecom, and defense sectors.

- Asia Pacific leads the global market due to rapid digital infrastructure expansion in China, India, and Southeast Asia.

- Europe shows steady growth supported by increasing automation and stringent cybersecurity requirements across industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Data Center Expansion and Infrastructure Consolidation Fuels Market Demand

The global rise in data centers continues to create strong demand for devices that simplify server management. KVM switches offer a cost-effective solution for managing multiple systems through a single console. Enterprises prefer KVM switches to optimize physical space, reduce hardware redundancy, and improve IT efficiency. The rapid increase in data traffic pushes companies to deploy scalable server infrastructure, increasing the need for centralized access tools. KVM switches provide real-time access to remote systems without compromising speed or security. It supports the seamless operation of virtualized environments. The KVM Switches Market benefits from large-scale digitization in enterprise networks and hyperscale data center setups. Government initiatives encouraging smart infrastructure projects also contribute to market momentum.

Growth in Industrial Automation Spurs Need for Centralized Control Systems

Automation across manufacturing, energy, and transportation sectors requires centralized monitoring of control systems and machinery. KVM switches provide a reliable interface to access multiple computers in automated setups. This capability improves operational safety, control accuracy, and response time. Industries rely on KVM systems to minimize equipment downtime and ensure remote troubleshooting. The integration of control rooms and automation panels with KVM devices enhances visibility and command over field operations. It helps engineers maintain control over critical equipment from a single interface. The KVM Switches Market sees adoption in harsh environments where reliability and system access are vital. Industries deploy ruggedized KVM switches with extended environmental tolerance to meet operational demands.

Cybersecurity and Compliance Requirements Drive Adoption in Sensitive Environments

Secure access to critical systems plays a significant role in data-intensive sectors such as healthcare, banking, and government. KVM switches allow physical and logical separation of secure networks, reducing the risk of unauthorized access. Industries implement secure KVMs to comply with standards like NIAP and Common Criteria. It becomes essential in multi-classification environments where data separation and secure switching are required. The KVM Switches Market gains traction in sectors with stringent data handling and compliance requirements. Defense and intelligence agencies prefer secure KVM switches to manage classified systems. Growing awareness of endpoint security risks also supports the use of hardware-based access control. Enterprises recognize the role of KVM solutions in safeguarding critical IT environments.

- Vertiv Cybex secure desktop KVMs, for example, comply fully with NIAP Common Criteria Protection Profile v3.0, ensuring unidirectional data flows and locked firmware to prevent tampering

Remote Management and Edge Computing Expand Application Scope of KVM Devices

Edge computing places computing resources closer to data sources, increasing the need for remote management tools. KVM switches enable IT teams to control distributed systems without physical presence. This becomes essential for managing edge sites in telecom, oil & gas, and retail sectors. It also reduces operational costs by eliminating the need for on-site personnel. The KVM Switches Market expands through its ability to manage remote and distributed IT assets securely. Cloud infrastructure also benefits from KVM systems that bridge physical and virtual resources. Enterprises deploy KVM-over-IP solutions for seamless, low-latency access across global operations. Adoption increases in branch offices, unmanned facilities, and mobile command centers where space and security are critical.

- For instance, in global enterprises adopting KVM-over-IP technology, IT administrators now control servers remotely across multiple continents from a single dashboard, eliminating the need for on-site personnel and dramatically accelerating troubleshooting and maintenance.

Market Trends:

Adoption of KVM-over-IP Solutions Gains Momentum in Hybrid IT Environments

Organizations increasingly prefer KVM-over-IP solutions for flexibility in managing servers and devices across distributed sites. These systems support high-resolution video, BIOS-level access, and multiple user sessions. It allows IT teams to manage infrastructure from any location with secure connectivity. The KVM Switches Market adapts to evolving enterprise demands by integrating IP-based control with traditional KVM hardware. It also aligns with hybrid cloud strategies where centralized and remote resources need unified management. Businesses adopt these switches to support 24/7 operations without the risk of network downtime. IP-based KVM switches help reduce response time for troubleshooting critical systems. Their role in managing disaster recovery sites also becomes more prominent.

- For instance, Dell’s Digital Remote KVM DMPU4032 enables management of up to 1,024 servers from a single interface with support for 4 remote and one local user, offering 1,600×1,200 remote video resolution and BIOS-level access for troubleshooting.

Integration with AV Systems and Multimedia Workflows Broadens Market Applications

Beyond traditional IT use, KVM switches find applications in broadcasting, post-production, and live event management. These sectors require seamless control of high-resolution video and multiple workstations. KVM systems offer low-latency switching and high-fidelity transmission across varied display outputs. It supports the coordination of AV assets in real time, improving workflow efficiency. The KVM Switches Market evolves with integration into AV-over-IP systems and professional studio setups. Organizations also use them to manage content servers, switching consoles, and monitoring tools. The entertainment industry adopts these systems for flexibility and secure access during production. KVM solutions help reduce physical clutter and streamline multi-device environments.

Miniaturization and Modular KVM Designs Meet Space-Constrained Environments

Modern IT deployments often operate in space-limited environments such as mobile units, control rooms, or compact server racks. Manufacturers develop modular and compact KVM switches to meet this challenge. These designs allow easy customization and scalability without compromising performance. It caters to verticals where real estate is premium and access precision is critical. The KVM Switches Market shifts towards portable and space-efficient solutions for aerospace, marine, and mobile command applications. Technicians benefit from flexible cable routing and modular console integration. These innovations also enhance maintenance access and reduce cabling complexity. Design flexibility becomes a key differentiator in competitive procurement scenarios.

- For instance, Raritan’s Dominion LX II modular KVM switch integrates a KVM switch with a 1U rack-mounted LCD console drawer, allowing direct and IP-based management of up to 16 servers within server racks, optimizing valuable data center real estate.

Demand for Multi-Display Support and High-Performance Video Switching Rises

Enterprises managing visual data streams need high-speed switching and multi-display control. KVM switches with support for 4K resolution and multi-monitor setups meet such requirements. These features become important in sectors like finance, defense, healthcare, and design. It provides uninterrupted video transmission without signal degradation. The KVM Switches Market responds to this demand by launching switches that handle video-intensive workloads. Organizations rely on these systems to manage command centers, diagnostic imaging, and surveillance platforms. The emphasis on visual clarity and frame rate stability continues to rise. Innovation focuses on integrating DisplayPort, HDMI, and DVI compatibility within a unified switch.

Market Challenges Analysis:

High Initial Cost and Complexity Limit Adoption Among Small and Mid-Sized Enterprises

While KVM switches enhance operational efficiency, their upfront cost often deters smaller organizations. Complex deployments involving multiple servers and IP-based systems require investment in both hardware and skilled personnel. The KVM Switches Market faces slow adoption in budget-conscious environments where alternatives like software-based remote desktops seem more attractive. Integration with legacy infrastructure also increases implementation time. It becomes challenging for SMEs to justify the cost without immediate productivity gains. In niche segments, limited awareness of KVM’s full capabilities creates further hesitation. Vendors need to simplify product offerings and deliver clear ROI messaging. Pricing strategies and bundled service models could reduce this barrier.

Security and Compatibility Issues Create Hurdles in High-Security Environments

KVM switches in sensitive sectors must meet strict cybersecurity standards, which not all devices can deliver. Lack of proper validation and certification restricts their use in government or defense networks. The KVM Switches Market must address these issues to gain trust in security-conscious environments. Compatibility with varied operating systems, firmware updates, and proprietary interfaces also poses risks. Users face system freezes or interface limitations during cross-platform integration. It becomes necessary to standardize support across environments without compromising control. Manufacturers need to enhance security firmware and improve interoperability features. Regulatory scrutiny further increases product development costs and approval time.

Market Opportunities:

Growing Edge and IoT Deployments Create New Demand for Remote Access Solutions

Edge computing and IoT growth expands the potential application base for remote management tools. KVM switches offer real-time access to edge servers, gateways, and remote devices. It improves control efficiency in logistics, agriculture, and industrial monitoring. The KVM Switches Market benefits from the expanding edge ecosystem, where system stability and remote uptime are critical. Vendors can target edge locations with compact, rugged KVM solutions tailored to field use. Enterprises operating distributed assets across multiple locations seek secure and unified control interfaces. Remote diagnostics and maintenance reduce travel costs and improve operational uptime. The need for scalable access solutions continues to grow with the proliferation of smart devices.

Rising Defense Modernization and Command Infrastructure Upgrade Programs

Defense modernization creates opportunities for secure and certified KVM deployments in control rooms and mobile units. Governments seek advanced monitoring solutions that ensure centralized access with strict data isolation. The KVM Switches Market aligns with these priorities by offering NIAP-certified switches and ruggedized units. It also opens up growth in homeland security, emergency response, and tactical communication environments. Defense IT infrastructure demands low-latency switching and robust failover capabilities to maintain mission-critical operations. KVM switches support seamless coordination between field units and central command. Procurement programs favor solutions with proven reliability in high-risk conditions. The growing focus on secure remote management in military environments strengthens demand.

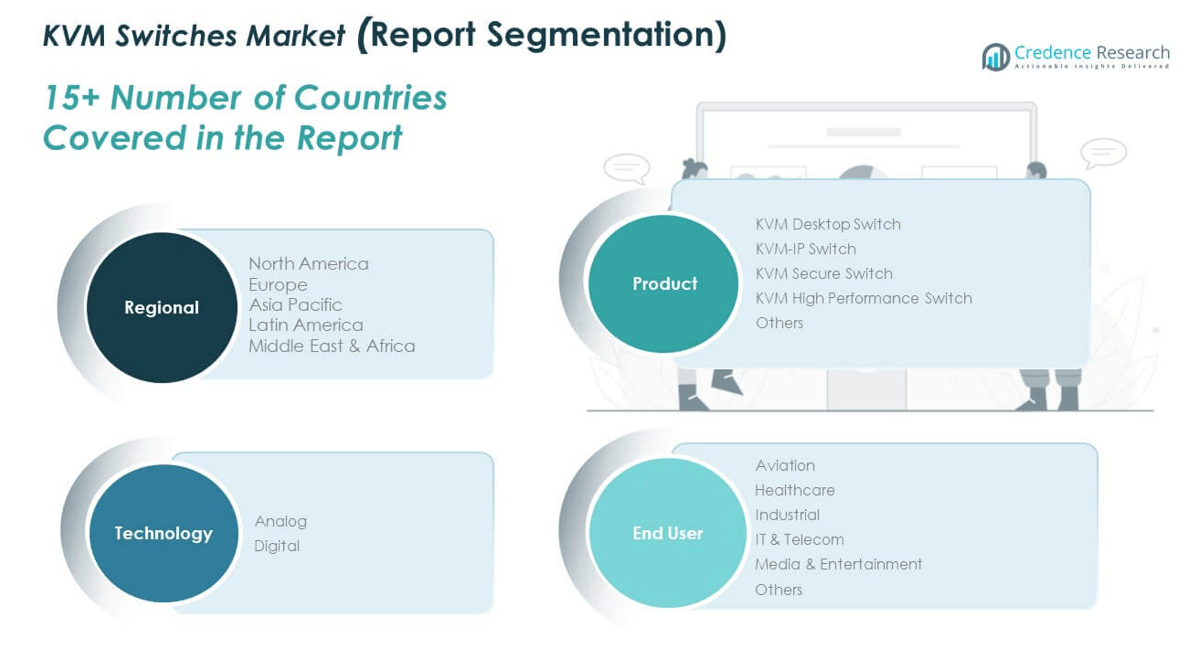

Market Segmentation Analysis:

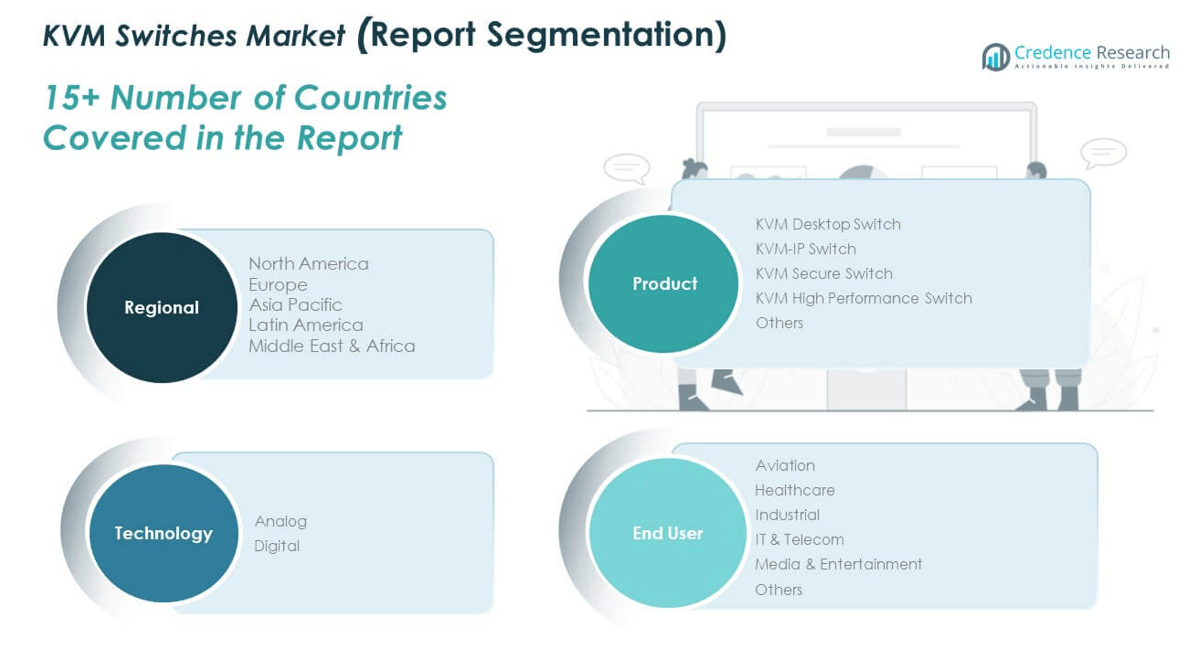

By product, the KVM Switches Market comprises a diverse product range addressing specific operational needs. The KVM Desktop Switch segment serves small-scale setups requiring localized access control, while the KVM-IP Switch segment leads with growing demand for remote infrastructure management. KVM Secure Switches gain traction in defense, healthcare, and financial institutions where data isolation is critical. The KVM High Performance Switch segment supports high-resolution, low-latency workflows in media and command center applications. The Others category includes niche and hybrid models designed for customized environments.

- For instance, the Avocent SV200 desktop KVM switch is widely used in small offices to connect up to four computers to a single keyboard, monitor, and mouse, offering support for high-resolution UHD 4K video without the need for remote access—ideal for small-scale, localized control.

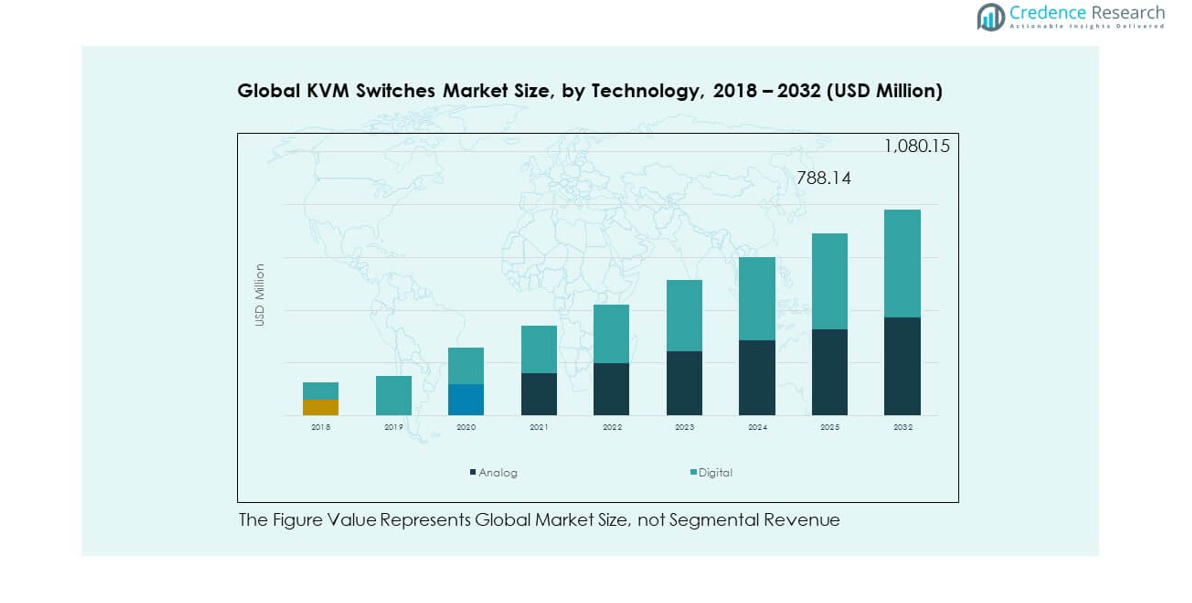

By technology, the market splits into Analog and Digital segments. Analog KVMs remain relevant for legacy systems and cost-sensitive applications, while Digital KVMs dominate in enterprises requiring advanced functionality, encryption, and multi-user access. It sees rapid preference shift toward digital solutions across large IT infrastructures.

- For instance, the APC Coaxial Analog KVM Switch (AP5201) allows control of up to eight servers using direct VGA and PS/2 connections and can be expanded to manage up to 512 servers through daisy-chaining, supporting legacy environments where cost and simplicity are prioritized.

By end users, the IT & Telecom sector represents the largest demand due to the scale of server infrastructure. The Industrial and Aviation segments use KVM switches for real-time equipment control and system redundancy. Healthcare organizations deploy secure and remote-capable KVMs for clinical data access. The Media & Entertainment segment prioritizes high-performance video routing, while Others cover education, government, and energy sectors requiring centralized control.

Segmentation:

By Product Segment

- KVM Desktop Switch

- KVM-IP Switch

- KVM Secure Switch

- KVM High Performance Switch

- Others

By Technology Segment

By End User Segment

- Aviation

- Healthcare

- Industrial

- IT & Telecom

- Media & Entertainment

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America KVM Switches Market size was valued at USD 167.74 million in 2018 to USD 205.94 million in 2024 and is anticipated to reach USD 288.73 million by 2032, at a CAGR of 4.4% during the forecast period. North America holds a market share of 27.22% in 2024. Strong demand from data centers, enterprise IT, and defense sectors supports regional growth. The U.S. continues to lead due to large-scale digital infrastructure investments and early adoption of advanced KVM-over-IP technologies. It benefits from the presence of key industry players and high awareness of secure remote access systems. Enterprises use KVM switches to manage centralized control rooms, virtualized environments, and edge computing nodes. Financial services, media, and healthcare sectors also contribute to the growing need for secure access solutions. Regulatory compliance further encourages secure KVM deployment in sensitive networks. Canada and Mexico offer stable demand with rising interest in cloud-based IT solutions and automation.

Europe

The Europe KVM Switches Market size was valued at USD 144.06 million in 2018 to USD 179.93 million in 2024 and is anticipated to reach USD 258.16 million by 2032, at a CAGR of 4.7% during the forecast period. Europe accounts for 23.76% of the market share in 2024. Enterprises across Germany, the UK, and France are adopting KVM technologies to support smart manufacturing and enterprise IT automation. It sees steady uptake in industrial control, broadcasting, and public sector applications. EU cybersecurity directives push organizations toward secure KVM deployment in critical infrastructure. KVM-over-IP solutions help organizations streamline operations across distributed sites. Digital transformation across European enterprises increases reliance on centralized management tools. The region also benefits from strong R&D initiatives by domestic technology providers. Eastern Europe shows emerging interest driven by data center expansion and rising IT service demand.

Asia Pacific

The Asia Pacific KVM Switches Market size was valued at USD 191.41 million in 2018 to USD 245.57 million in 2024 and is anticipated to reach USD 364.66 million by 2032, at a CAGR of 5.1% during the forecast period. Asia Pacific holds the largest market share at 32.44% in 2024. China, Japan, and India lead regional growth due to heavy investment in cloud infrastructure, automation, and remote monitoring systems. The demand for centralized IT control rises across telecom, manufacturing, and e-commerce sectors. It witnesses rapid growth in KVM-over-IP adoption to manage dense server deployments and edge systems. Data center boom across Southeast Asia accelerates hardware upgrade cycles. Domestic manufacturers expand KVM offerings to meet diverse market needs. The market gains further traction through smart city and digital governance projects. Regional diversity in tech maturity drives demand for both basic and advanced KVM solutions.

Latin America

The Latin America KVM Switches Market size was valued at USD 62.14 million in 2018 to USD 72.29 million in 2024 and is anticipated to reach USD 93.65 million by 2032, at a CAGR of 3.3% during the forecast period. Latin America holds a 9.55% market share in 2024. Brazil and Mexico dominate due to ongoing digitalization across government and financial institutions. It experiences gradual adoption of KVM switches to support data center consolidation and secure IT operations. Limited awareness and budget constraints in some countries slow growth compared to other regions. Demand rises in logistics, retail, and industrial automation sectors where remote access is critical. Enterprises explore KVM technologies for managing IT infrastructure in multi-branch operations. Regional growth is supported by increasing availability of cloud services and local data hosting. Vendors find opportunities through targeted channel partnerships and training programs.

Middle East

The Middle East KVM Switches Market size was valued at USD 29.09 million in 2018 to USD 36.90 million in 2024 and is anticipated to reach USD 54.01 million by 2032, at a CAGR of 4.9% during the forecast period. The region contributes 4.88% to the global market share in 2024. The UAE and Saudi Arabia lead adoption due to strong investment in IT modernization and smart infrastructure. Governments promote cybersecurity and centralized control across defense, oil & gas, and transport sectors. It leverages KVM switches to improve operational efficiency in control rooms and industrial sites. KVM-over-IP solutions support monitoring of remote facilities and edge data centers. Rising demand from fintech, healthcare, and telecom firms drives commercial sector growth. The market also benefits from increased local manufacturing and technology partnerships. Small and mid-size enterprises begin recognizing the value of secure access tools.

Africa

The Africa KVM Switches Market size was valued at USD 14.18 million in 2018 to USD 16.37 million in 2024 and is anticipated to reach USD 20.95 million by 2032, at a CAGR of 3.2% during the forecast period. Africa represents 2.16% of the global market share in 2024. The region shows modest but steady demand, with South Africa and Nigeria leading in digital infrastructure adoption. It faces limitations due to budget constraints, lack of awareness, and insufficient IT support in rural areas. Governments and private institutions are investing in data centers and digital governance platforms. Demand for KVM switches increases in urban centers with rising cloud adoption. Multinational firms deploy KVM systems to manage branch networks and data hubs securely. Education and healthcare sectors also show interest in remote access technologies. Market penetration improves with increased vendor presence and training initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Avocent

- ATEN International

- Black Box Corporation

- Vertiv Group Corp.

- Belkin International

- Rose Electronics

- Guntermann & Drunck

- Adder

- Lenovo

- Sichuan HongTong

- Smart Avi

- Beijing Lanbao

- Reton

- Tripp Lite

- Other Key Players

Competitive Analysis:

The KVM Switches Market features a competitive landscape with a mix of global players and specialized vendors competing across varied application segments. Leading companies such as Vertiv, Aten International, Dell Technologies, Belkin, and Raritan focus on product innovation, IP-based solutions, and secure switching technologies. It sees strong differentiation through performance, port capacity, remote access features, and certifications for sensitive environments. Companies invest in expanding their product portfolios to serve growing demand from data centers, industrial automation, and defense sectors. Strategic partnerships with OEMs and system integrators help strengthen global distribution networks. Players also focus on customization and form factor flexibility to meet client-specific infrastructure needs. Mergers, acquisitions, and R&D initiatives continue to shape the competitive dynamics and enhance technological capabilities.

Recent Developments:

- In Jan 2025, ATEN International formed a technical partnership with Absen, a global leader in LED display solutions. The collaboration, announced on February 25, 2025, aims to revolutionize visual experiences by integrating ATEN’s award-winning video wall processor and KVM over IP solutions with Absen’s advanced LED displays.

- In May 2024, Black Box Corporation announced a strategic partnership with Extreme Networks. The collaboration, publicized on May 6, enables Black Box to deliver advanced networking and KVM technologies across the Asia-Pacific region. It combines Black Box’s integration and project management capabilities with Extreme Networks’ expertise in Wi-Fi 6, 5G, and cloud-managed networking solutions.

Market Concentration & Characteristics:

The KVM Switches Market is moderately concentrated, with a few major players accounting for a significant share of global revenue. It features a strong presence of hardware-focused vendors offering solutions for enterprise, industrial, and government use. The market is characterized by high reliability requirements, security certifications, and demand for scalable architectures. Product lifecycles are long due to the durable nature of KVM hardware. Buyers prioritize functionality, security, and compatibility with existing IT infrastructure. Emerging players compete by offering cost-effective or niche solutions tailored to specific verticals. Technological evolution remains gradual, with key innovations centered on IP-based access, 4K video support, and multi-user control.

Report Coverage:

The research report offers an in-depth analysis based on Product Segment, Technology Segment and End User Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for IP-based KVM switches will grow due to increasing reliance on remote infrastructure management.

- Edge computing deployments will drive adoption of compact and rugged KVM solutions in distributed environments.

- Data center modernization across emerging markets will create sustained opportunities for hardware-based access systems.

- Secure KVM switches will gain traction in defense, healthcare, and government networks requiring strict data isolation.

- Integration with AV systems and high-resolution video workflows will expand use in media and control rooms.

- Hybrid and multi-cloud strategies will push enterprises toward centralized console management tools.

- Manufacturers will prioritize development of energy-efficient and space-saving KVM architectures.

- Regional expansion by leading vendors will intensify competition and support localized solutions.

- Demand for multi-user and multi-display support will shape product innovation and interface design.

- Increasing focus on cybersecurity and regulatory compliance will influence feature development and procurement decisions.