| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lambda Cyhalothrin Market Size 2024 |

USD 1,654.0 Million |

| Lambda Cyhalothrin Market , CAGR |

5.40% |

| Lambda Cyhalothrin Market Size 2032 |

USD 2,519.2 Million |

Market Overview:

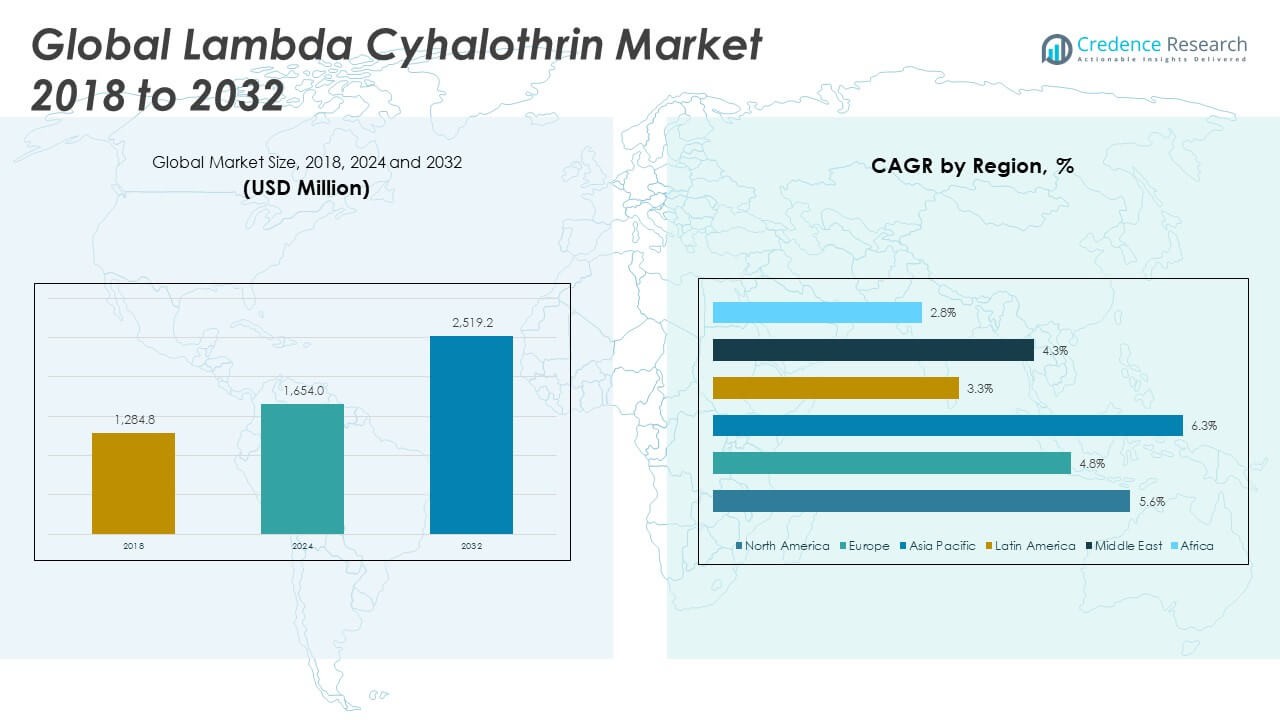

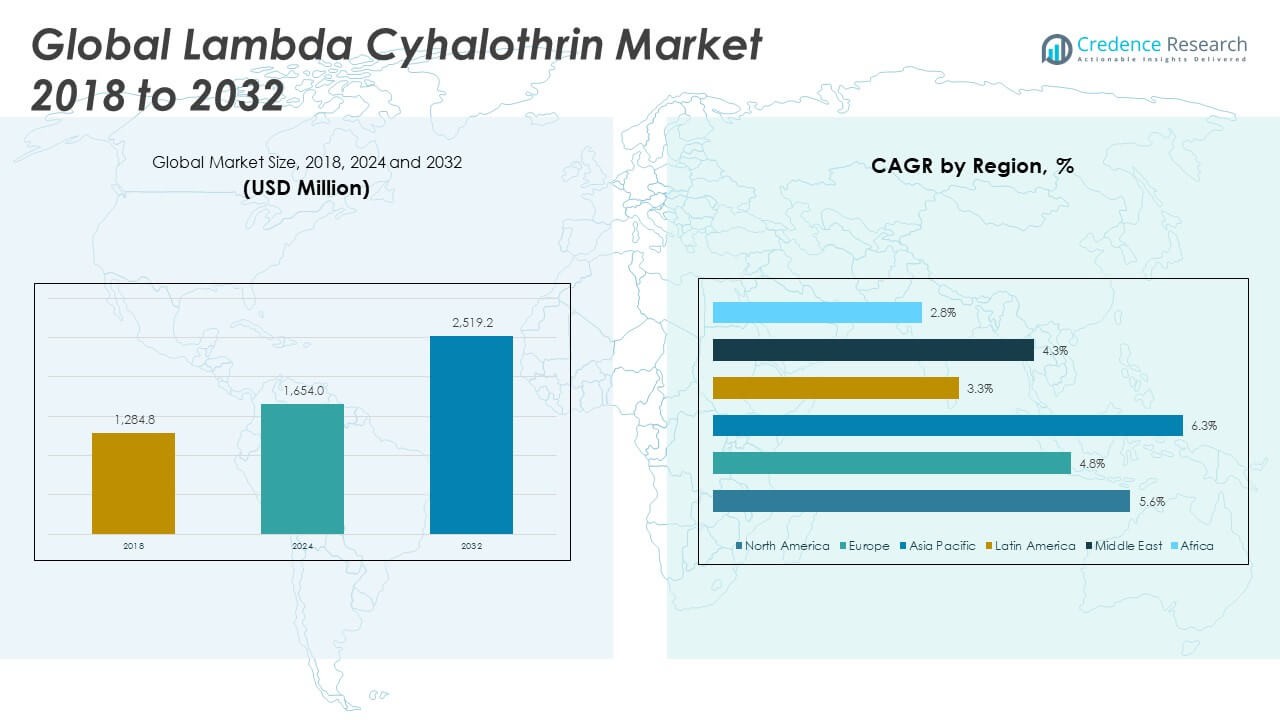

The Lambda Cyhalothrin Market size was valued at USD 1,284.8 million in 2018 to USD 1,654.0 million in 2024 and is anticipated to reach USD 2,519.2 million by 2032, at a CAGR of 5.40% during the forecast period.

The Lambda Cyhalothrin market is primarily driven by the increasing need for enhanced agricultural productivity in the face of growing global food demand. As pest-related crop losses pose a major challenge to food security, farmers are increasingly adopting effective insecticides like Lambda Cyhalothrin, known for its broad-spectrum control and long residual action. Its usage spans key crops such as cotton, soybeans, vegetables, and fruits. In addition to agriculture, its application in public health is rising due to the growing incidence of vector-borne diseases such as malaria, dengue, and Zika. Governments and health organizations are investing in mosquito control programs that include the use of Lambda Cyhalothrin in indoor residual spraying and insecticide-treated nets. Moreover, continued innovation in formulation technologies—such as microencapsulation and slow-release variants enhances safety and environmental compatibility, aligning with increasingly stringent regulatory frameworks and sustainability trends.

Regionally, North America holds a significant share of the Lambda Cyhalothrin market, supported by advanced agricultural infrastructure and strong public health initiatives. The United States leads the region in terms of usage, with consistent demand from large-scale farming operations and urban mosquito control programs. Europe also represents a mature market, where regulatory focus on low-toxicity and environmentally responsible pesticides has driven manufacturers to invest in safer formulations. In contrast, the Asia-Pacific region is witnessing the fastest growth, fueled by expanding agricultural activity in countries like China, India, and Vietnam, along with increased government spending on crop protection and disease prevention. Latin America and the Middle East & Africa are emerging as high-potential markets, with increasing adoption driven by both agricultural modernization and rising concerns about vector-borne diseases in tropical and subtropical climates.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Lambda Cyhalothrin Market was valued at USD 1,654.0 million in 2024 and is projected to reach USD 2,519.2 million by 2032, growing at a CAGR of 5.40%.

- Increasing global food demand and crop loss prevention are major drivers, with strong adoption across cotton, soybean, vegetable, and fruit farming.

- Public health applications are expanding due to rising cases of vector-borne diseases; the compound is used in indoor sprays and insecticide-treated nets.

- Advancements in formulation technologies like microencapsulation and slow-release variants are improving product safety and environmental compatibility.

- Regulatory pressure remains high, with market players investing in compliant, eco-friendly solutions to retain market access across key regions.

- Resistance development and competition from biopesticides challenge market growth, pushing producers to innovate and promote rotational use.

- Asia Pacific is the fastest-growing regional market, while North America and Europe maintain steady demand through advanced farming and public health infrastructure.

Market Drivers:

Rising Demand for Enhanced Agricultural Output Across Diverse Crop Types

Global agricultural producers face pressure to maximize yields due to population growth, shrinking arable land, and increasing food security concerns. The Lambda Cyhalothrin Market benefits directly from this pressure, as farmers seek effective pest control solutions to protect high-value crops such as cotton, corn, soybeans, fruits, and vegetables. It provides strong knockdown and residual effects against a wide range of pests, making it a reliable tool in integrated pest management strategies. The need to reduce crop losses caused by insects has made this compound essential in commercial farming. Farmers adopt it for its affordability, fast action, and compatibility with other agrochemical treatments. The compound’s effectiveness in both foliar and soil applications further strengthens its agricultural appeal.

Growing Public Health Concerns Related to Vector-Borne Diseases

Urban expansion, changing weather patterns, and poor sanitation contribute to the spread of vector-borne diseases such as malaria, dengue, and chikungunya. The Lambda Cyhalothrin Market gains traction from public health authorities aiming to reduce disease transmission through mosquito control programs. It is widely used in indoor residual spraying campaigns and insecticide-treated nets. Health organizations favor this compound due to its low toxicity to humans and high efficiency against mosquitoes. Governments in tropical and subtropical regions allocate budgets to large-scale vector control programs that rely on its effectiveness. The role of Lambda Cyhalothrin in disease prevention reinforces its value in both rural and urban settings.

Regulatory Approvals and Formulation Advancements Supporting Market Growth

Strict global pesticide regulations demand products that combine performance with environmental safety. The Lambda Cyhalothrin Market benefits from consistent approvals by major regulatory bodies such as the EPA and WHO, enabling its continued use in both agricultural and public health sectors. Manufacturers respond to compliance needs by investing in improved formulations such as microencapsulated and suspension concentrate types. These advancements reduce environmental runoff, improve user safety, and extend product longevity. The ability to meet evolving regulatory standards ensures stable demand for this compound in key global markets. It maintains relevance through innovation aligned with policy expectations.

- For instance, the U.S. EPA approved lambda-cyhalothrin in capsule suspension and suspension concentrate forms with labeled crop applications such as cucurbits and barley.

Increased Adoption of Precision Agriculture and Integrated Pest Management

Technological shifts in agriculture encourage precise and minimal use of pesticides to lower costs and reduce resistance. The Lambda Cyhalothrin Market aligns with this trend by offering compatibility with drone spraying, GPS-guided application, and remote-sensing systems. It fits well within integrated pest management frameworks, allowing farmers to optimize treatment intervals and application doses. These approaches reduce the risk of pest resistance while maintaining crop health. The growing awareness of sustainable farming practices increases reliance on targeted, efficient insecticides. It remains a preferred option due to its adaptability in both conventional and technology-driven farming environments.

- For instance, a trial at Rahuri, Maharashtra, compared drone and knapsack applications of lambda‑cyhalothrin and found similar effectiveness against pink bollworm.

Market Trends:

Expansion of Sustainable and Low-Toxicity Crop Protection Solutions

Consumer demand for chemical residue-free produce and environmentally responsible farming is growing rapidly. The Lambda Cyhalothrin Market is witnessing a shift toward formulations that reduce environmental impact while maintaining pest control efficacy. Manufacturers are focusing on encapsulated and water-based delivery systems to limit runoff and non-target effects. It aligns with regulatory pressure in key markets to lower pesticide residues in food supply chains. The trend also reflects increased awareness among farmers about the ecological consequences of conventional agrochemicals. Sustainable formulation strategies are gaining momentum, creating opportunities for market players to innovate and differentiate.

- For instance, Syngenta’s Karate Zeon is a microencapsulated formulation of lambda-cyhalothrin developed using Zeon Technology, which encapsulates the active ingredient within polymer-based microcapsules approximately 2–3 microns in diameter. Zeon formulation can reduce operator exposure by over 90%, enhancing both user safety and environmental protection. The encapsulation also contributes to improved rainfastness and residual control in field applications.

Rising Integration of Digital Farming and Smart Application Technologies

Precision agriculture tools are transforming how farmers manage crop protection. The Lambda Cyhalothrin Market benefits from the integration of drone-based spraying, variable rate application, and real-time field monitoring. These tools allow more efficient use of insecticides, minimizing waste and maximizing coverage. It supports data-driven decision-making, where applications are optimized for timing, dosage, and target pests. The compatibility of Lambda Cyhalothrin with smart delivery systems enhances its appeal in modern farming systems. Farmers adopting digital platforms find this compound reliable for managing pest cycles with accuracy and consistency.

- For instance, ADAMA launched its “ADAMA Fly High Drone” spraying service in Andhra Pradesh and Telangana, India, using drones for uniform, targeted applications. According to ADAMA, this technology helps farmers save time, reduce chemical exposure, and optimize pesticide use in the field.

Increased Focus on Resistance Management and Rotational Use

Pest resistance to pyrethroids presents a growing challenge in global agriculture. The Lambda Cyhalothrin Market is responding to this trend by promoting rotational use and integrating it with other insecticide classes. It plays a critical role in delaying resistance buildup when used within structured resistance management programs. Regulatory bodies and agronomists advocate for alternating active ingredients to preserve efficacy. Manufacturers are developing combination products that incorporate Lambda Cyhalothrin with complementary modes of action. This approach helps maintain the long-term effectiveness of pest control regimes in large-scale farming operations.

Steady Demand from Public Health Sector for Vector Control Programs

Government-led health campaigns continue to prioritize chemical interventions for disease vector control. The Lambda Cyhalothrin Market remains central to these efforts due to its proven performance against mosquitoes and other public health pests. It is included in national malaria control strategies across Asia, Africa, and Latin America. Public procurement programs support consistent demand, especially for indoor residual sprays and treated bed nets. Suppliers are focusing on quality assurance and supply chain readiness to meet government standards. The trend indicates sustained market participation from public health agencies and international development bodies.

Market Challenges Analysis:

Stringent Regulatory Landscape and Environmental Compliance Pressure

Evolving global pesticide regulations continue to challenge market participants in terms of compliance, formulation approval, and residue restrictions. The Lambda Cyhalothrin Market faces increasing scrutiny from agencies such as the European Chemicals Agency (ECHA) and the U.S. Environmental Protection Agency (EPA). Governments demand comprehensive toxicity studies, environmental risk assessments, and proof of minimal impact on non-target species. It must consistently meet safety thresholds while maintaining performance in field applications. Regulatory delays or bans in certain countries can restrict market access and disrupt supply chains. Companies must invest in reformulation and documentation to align with stricter environmental expectations, often increasing operational costs.

Rising Pest Resistance and Competition from Biopesticides

Widespread and repeated use of synthetic pyrethroids has led to rising resistance among key pest species. The Lambda Cyhalothrin Market encounters operational challenges as farmers report reduced efficacy in high-resistance zones. It requires integration into rotation programs and careful management to avoid further resistance buildup. At the same time, biopesticides and alternative pest control solutions are gaining market share due to their perceived safety and sustainability. Regulatory incentives and consumer demand are supporting this shift. The growing availability of microbial and botanical insecticides adds competitive pressure, requiring Lambda Cyhalothrin producers to adapt and innovate to maintain relevance.

Market Opportunities:

Emerging Demand from Developing Agricultural Economies

Rapid agricultural expansion in emerging economies offers new growth avenues for insecticide producers. The Lambda Cyhalothrin Market stands to benefit from rising crop protection needs in countries across Asia, Africa, and Latin America. Governments in these regions are investing in improving farm productivity and reducing post-harvest losses. It addresses pest-related challenges in staple and cash crops where alternative solutions are limited. Farmers in these markets seek affordable and fast-acting products, creating strong demand potential. Expanding rural distribution networks and extension services can further enhance market penetration.

Product Innovation and Compatibility with Precision Agriculture

Advancements in pesticide delivery and formulation science create opportunities to enhance product efficiency and safety. The Lambda Cyhalothrin Market can capitalize on innovations such as controlled-release technologies and tank-mix compatibility. It supports precision agriculture practices, allowing targeted applications with minimal environmental impact. Integration with drone and sensor-based systems aligns the product with modern farming trends. Manufacturers that align their offerings with digital farming tools gain a competitive advantage. Customizing products for specific crops and pest pressures also strengthens customer loyalty and market reach.

Market Segmentation Analysis:

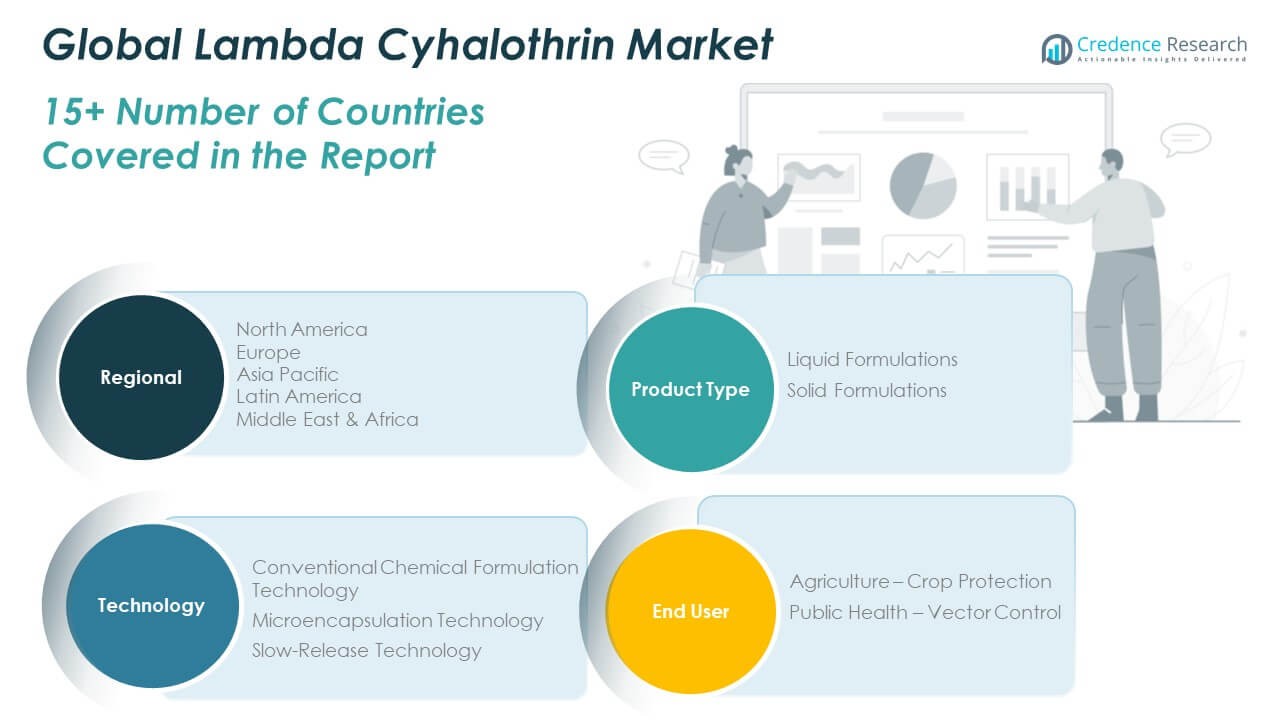

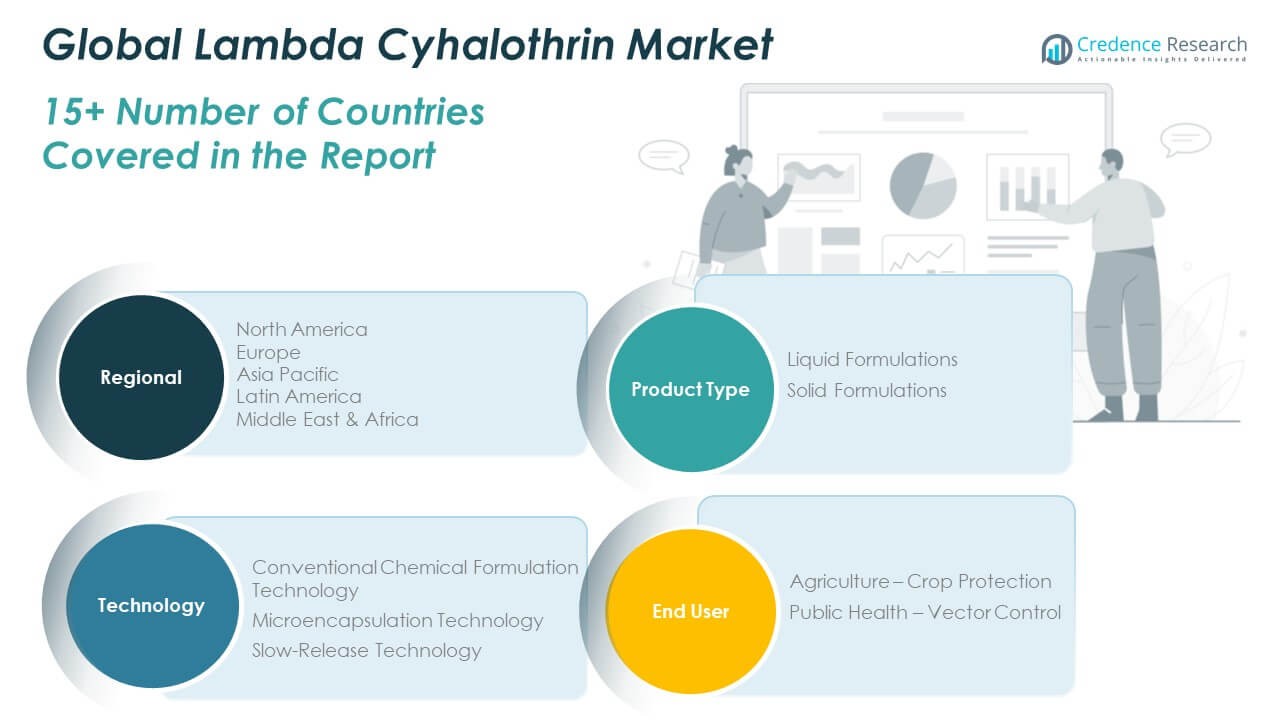

The Lambda Cyhalothrin Market is segmented by product type, technology, and end-user, reflecting its wide-ranging application in agriculture and public health.

By product type, liquid formulations dominate due to their ease of application, faster absorption, and widespread compatibility with modern spraying equipment. Solid formulations, such as granules and powders, are preferred in certain niche agricultural and vector control settings where moisture stability or controlled release is necessary.

- For instance, Syngenta’s Matador® 120EC and FMC’s Hero® are both popular liquid formulations used extensively in row crops and horticulture, allowing for uniform coverage and rapid pest knockdown.

By technology, the market includes conventional chemical formulation, microencapsulation, and slow-release technologies. Conventional formulations remain widely used for their cost-effectiveness and broad acceptance. However, microencapsulation technology is gaining market share due to its ability to reduce volatility, improve safety, and enhance environmental stability. It helps prolong the residual effect and reduce operator exposure. Slow-release technology, though still evolving, finds increasing relevance where long-term pest control and reduced application frequency are priorities.

By end-user, the Lambda Cyhalothrin Market serves agriculture and public health. Agriculture holds a larger share, with the compound being essential for protecting crops such as cotton, soybeans, vegetables, and fruits. Public health applications are expanding, especially in tropical regions, where governments and health agencies use Lambda Cyhalothrin in indoor residual spraying and insecticide-treated nets to combat vector-borne diseases. Each segment plays a key role in driving sustained demand across both developed and developing markets.

- For instance, Bayer’s Decis® and Syngenta’s Karate® are widely adopted by farmers globally to combat pests like bollworms and aphids. Public health applications are expanding, especially in tropical regions.

Segmentation:

By Product Type

- Liquid Formulations

- Solid Formulations

By Technology

- Conventional Chemical Formulation Technology

- Microencapsulation Technology

- Slow-Release Technology

By End-user

- Agriculture – Crop Protection

- Public Health – Vector Control

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

The North America Lambda Cyhalothrin Market size was valued at USD 367.4 million in 2018 to USD 435.0 million in 2024 and is anticipated to reach USD 602.1 million by 2032, at a CAGR of 5.6% during the forecast period. North America accounts for nearly 17% of the global Lambda Cyhalothrin Market share, supported by advanced agricultural practices and strong pest control regulations. It sees consistent demand from large-scale row crop production, particularly in the U.S. Midwest. Lambda Cyhalothrin plays a critical role in integrated pest management systems due to its effectiveness and ease of application. The region’s public health programs targeting mosquito-borne diseases further drive consumption. Regulatory compliance and product stewardship remain key focus areas for manufacturers. It continues to gain ground in digital agriculture platforms that enhance efficiency and precision.

Europe

The Europe Lambda Cyhalothrin Market size was valued at USD 301.9 million in 2018 to USD 350.6 million in 2024 and is anticipated to reach USD 481.2 million by 2032, at a CAGR of 4.8% during the forecast period. Europe holds nearly 14% of the global market, with demand led by countries such as France, Germany, and Spain. The market is shaped by strict environmental policies and a strong push toward sustainable farming. It remains in use for key cereals, oilseeds, and fruit crops, where regulatory-approved insecticides are limited. Formulations that meet residue limits and eco-toxicity benchmarks help sustain market presence. Public resistance to chemical pesticides drives manufacturers to invest in safer delivery systems. It remains relevant due to its cost-efficiency and broad pest spectrum coverage.

Asia Pacific

The Asia Pacific Lambda Cyhalothrin Market size was valued at USD 403.4 million in 2018 to USD 608.7 million in 2024 and is anticipated to reach USD 1,045.5 million by 2032, at a CAGR of 6.3% during the forecast period. Asia Pacific commands over 40% of the global Lambda Cyhalothrin Market share, led by high agricultural output and rising food demand. China and India are major consumers, supported by large-scale cultivation of rice, vegetables, cotton, and pulses. It is widely used in small and medium farms due to affordability and versatility. Public health programs targeting dengue and malaria also contribute to uptake. Product demand remains strong despite regulatory shifts in some countries. It continues to expand through government-backed crop protection schemes and rural distribution channels.

Latin America

The Latin America Lambda Cyhalothrin Market size was valued at USD 59.1 million in 2018 to USD 74.4 million in 2024 and is anticipated to reach USD 128.5 million by 2032, at a CAGR of 3.3% during the forecast period. Latin America holds about 5% of the global Lambda Cyhalothrin Market, supported by agricultural exports and large commercial farms. Brazil and Argentina drive most of the demand, especially in soybean and sugarcane cultivation. It is favored for its fast action against pests that threaten high-value crops. Expansion of agribusiness and pesticide-intensive farming strengthens regional growth. Challenges related to regulatory enforcement remain, but informal market channels sustain product circulation. It continues to serve as a staple input across various farming zones.

Middle East

The Middle East Lambda Cyhalothrin Market size was valued at USD 92.5 million in 2018 to USD 124.1 million in 2024 and is anticipated to reach USD 199.0 million by 2032, at a CAGR of 4.3% during the forecast period. The Middle East contributes nearly 6% to the global market, with demand centered around horticulture and public health applications. It is commonly used in greenhouse farming, date palm cultivation, and vector control programs. Countries such as Saudi Arabia and the UAE invest in agricultural productivity despite harsh climates. Urban vector management drives use in residential zones and municipal programs. Regulatory frameworks in the region remain stable, supporting product continuity. It holds potential for growth through import expansion and controlled-environment farming.

Africa

The Africa Lambda Cyhalothrin Market size was valued at USD 60.4 million in 2018 to USD 61.2 million in 2024 and is anticipated to reach USD 63.0 million by 2032, at a CAGR of 2.8% during the forecast period. Africa represents under 3% of the global Lambda Cyhalothrin Market, but plays a critical role in food security and public health initiatives. It is widely used in vector control programs combating malaria and other diseases across Sub-Saharan regions. Agricultural usage remains moderate due to limited access and purchasing power among smallholders. NGO and government procurement support steady demand for health-sector applications. Local registration and counterfeit pesticide concerns continue to pose barriers. It maintains a foothold in both agriculture and health due to its dual functionality and low-cost profile.

Key Player Analysis:

- BASF SE

- Bayer AG

- FMC Corporation

- Syngenta AG

- ADAMA Ltd.

- Nufarm Limited

- Sumitomo Chemical Co., Ltd.

- Tagros Chemicals India Pvt. Ltd.

- Rallis India Limited

- Jiangsu Yangnong Chemical Co., Ltd.

- HPM Chemicals & Fertilizers Ltd.

- Zhejiang Xinnong Chemical Co., Ltd.

- Meghmani Organics Ltd.

- Shandong Weifang Rainbow Chemical Co., Ltd.

Competitive Analysis:

The Lambda Cyhalothrin Market is moderately consolidated, with key players competing on formulation quality, pricing, distribution reach, and regulatory compliance. Leading companies include Syngenta AG, BASF SE, Bayer AG, FMC Corporation, ADAMA Agricultural Solutions, and UPL Limited. These firms maintain strong market positions through extensive product portfolios, crop-specific solutions, and global distribution networks. It witnesses continuous product development, with manufacturers focusing on low-toxicity, high-efficiency formulations that meet regional regulatory standards. Strategic collaborations with local distributors and government agencies enhance market penetration, especially in emerging economies. Companies invest in digital agriculture platforms and resistance management programs to sustain customer loyalty and performance consistency. Competitive intensity remains high as regional manufacturers offer cost-effective alternatives, increasing price pressure in price-sensitive markets.

Recent Developments:

- In July 2024, Syngenta launched INZAK® ZEON in Brazil using its ZEON® microencapsulation technology. This dual-action product combines acetamiprid and lambda-cyhalothrin, achieving continuous release of active ingredients. Syngenta highlighted its “rapid effect and long-lasting efficacy” against sucking pests—specifically targeting soybean, corn, and cotton—with improved environmental compatibility compared to non-encapsulated formulations.

Market Concentration & Characteristics:

The Lambda Cyhalothrin Market exhibits moderate market concentration, with a handful of global agrochemical companies dominating production and distribution. It features strong vertical integration, where leading players manage synthesis, formulation, packaging, and supply chain operations. The market is characterized by high regulatory oversight, seasonal demand patterns, and strong dependence on agricultural cycles and public health programs. It relies heavily on product performance, cost-efficiency, and compliance with evolving safety standards. Entry barriers remain significant due to complex registration processes, technical know-how, and capital-intensive production. Competitive dynamics are influenced by generic product availability, regional pricing, and government procurement contracts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on product type, technology, and end-user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising global food demand will sustain the need for effective pest control solutions.

- Technological integration such as drone-based spraying will expand precision usage.

- Product reformulations will focus on improving safety and environmental compliance.

- Growing vector-borne disease outbreaks will boost demand in public health sectors.

- Regulatory alignment across regions will influence market entry and expansion strategies.

- Asia Pacific will remain the fastest-growing regional market due to intensive farming.

- Resistance management programs will encourage rotational use and long-term product relevance.

- Digital agriculture adoption will drive demand for compatible and data-driven insecticides.

- Competitive pricing and local manufacturing in emerging markets will reshape supply dynamics.

- Increased investment in sustainable crop protection will guide product innovation.