| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Moulded Fibre Pulp Packaging Market Size 2024 |

USD 6,576.1 million |

| Moulded Fibre Pulp Packaging Market, CAGR |

5.83% |

| Moulded Fibre Pulp Packaging Market Size 2032 |

USD 10,325.5 million |

Market Overview:

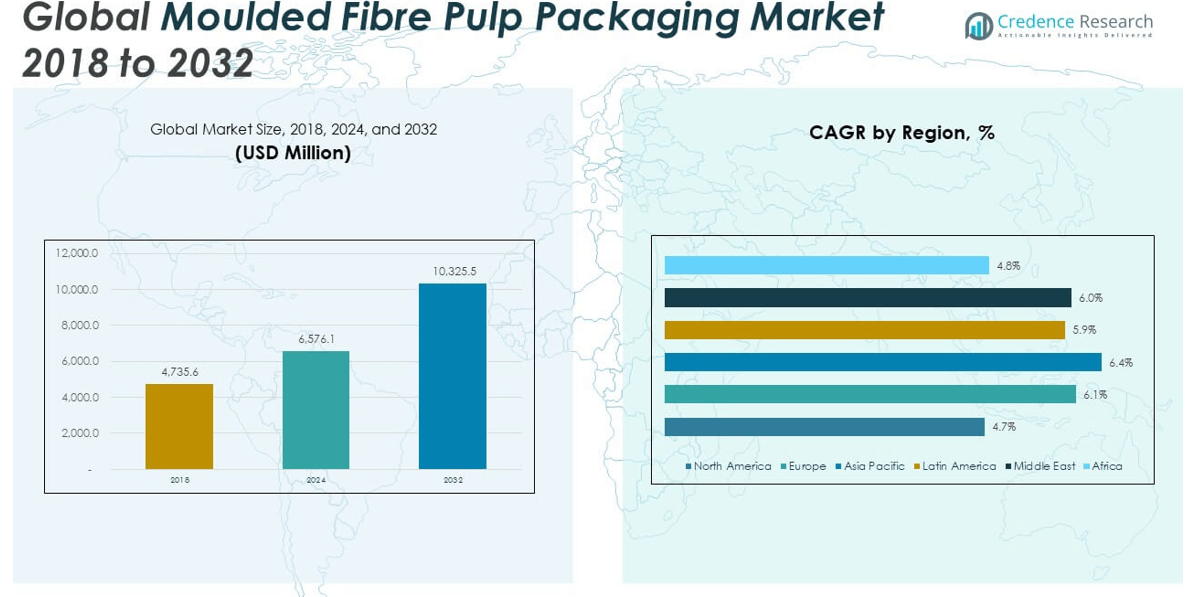

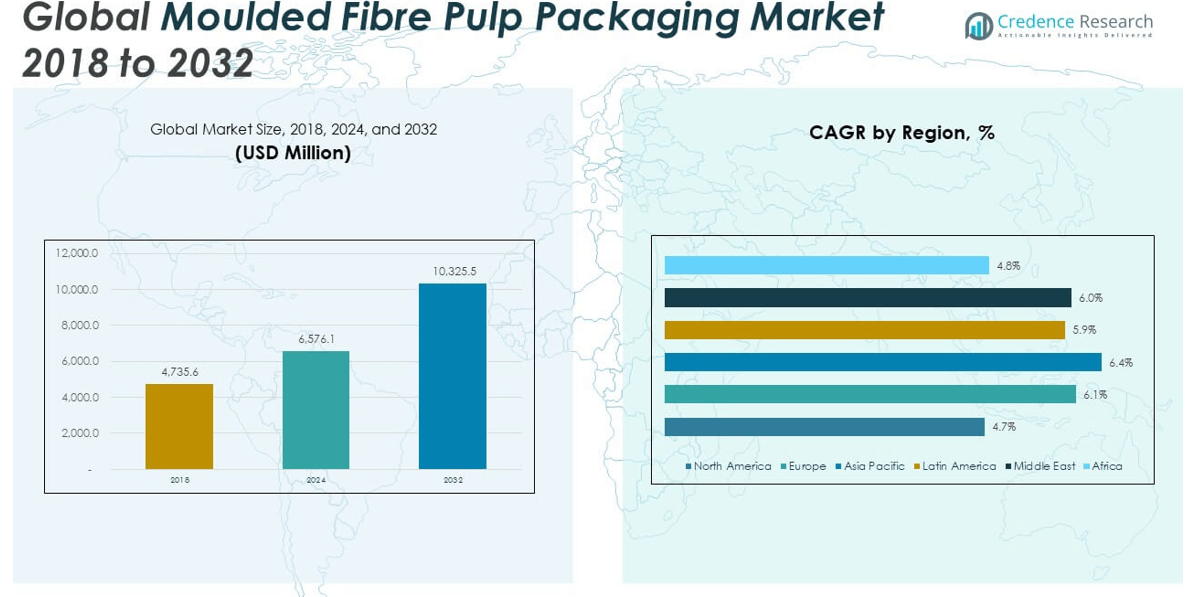

The Global Moulded Fibre Pulp Packaging Market size was valued at USD 4,735.6 million in 2018 to USD 6,576.1 million in 2024 and is anticipated to reach USD 10,325.5 million by 2032, at a CAGR of 5.83% during the forecast period.

Several key factors are driving the expansion of the moulded fibre pulp packaging market. First, increasing environmental awareness among consumers and regulatory bans on single-use plastics are prompting manufacturers to adopt biodegradable and compostable alternatives. Moulded fibre pulp packaging—made from recycled paper and natural fibers—meets these sustainability requirements effectively. Second, demand is rising from end-use industries such as food and beverage, electronics, healthcare, and e-commerce. These sectors value the shock-absorbent, lightweight, and cost-effective properties of fibre pulp packaging, particularly for trays, clamshells, and protective inserts. Third, advancements in manufacturing technologies such as 3D moulding, rapid drying, and enhanced coatings have improved product quality and broadened the use cases for moulded pulp. The availability of low-cost raw materials, especially recycled paper, also supports market scalability, although fluctuating pulp prices pose a challenge.

Regionally, Asia Pacific dominates the global market. China and India are the primary growth engines, driven by expanding food processing industries, rising e-commerce logistics, and government-led sustainability initiatives. North America follows closely, with the U.S. leading adoption in fast food, healthcare, and consumer goods sectors due to strong environmental policies and corporate sustainability commitments. Europe maintains steady growth, particularly in Western countries like Germany, France, and the UK, where strict recycling regulations and eco-conscious consumer behavior fuel demand. Meanwhile, Latin America, the Middle East, and Africa represent emerging markets where improving infrastructure and growing awareness of sustainable packaging solutions are expected to support moderate growth in the coming years. Collectively, these regional dynamics indicate a global shift toward environmentally responsible packaging, positioning moulded fibre pulp as a critical material in the future of sustainable packaging systems.

Market Insights:

- The Global Moulded Fibre Pulp Packaging Market was valued at USD 4,735.6 million in 2018 and is projected to reach USD 10,325.5 million by 2032, growing at a CAGR of 5.83% during the forecast period.

- Regulatory bans on single-use plastics and growing global awareness of environmental sustainability are accelerating the adoption of moulded fibre pulp packaging across industries.

- Strong demand from food, beverage, and foodservice sectors is driving market growth due to the material’s hygiene compliance, structural reliability, and compostability.

- E-commerce expansion is boosting the use of moulded pulp for transit packaging, offering form-fitting, lightweight, and protective alternatives to plastic fillers.

- Low-cost, recycled raw materials such as newspapers and cardboard support cost efficiency, but inconsistent quality and supply volatility challenge production stability.

- Technological advancements like 3D moulding and improved coatings are expanding application potential, though barrier limitations still restrict use in high-moisture or industrial contexts.

- Asia Pacific leads the market due to rapid industrialization in China and India, while North America and Europe maintain strong positions through regulatory support and /sustainable procurement practices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Regulatory Pressure and Global Push for Sustainable Packaging Solutions:

Governments across the globe are enforcing strict regulations against single-use plastics and non-recyclable materials. These mandates are compelling industries to transition toward biodegradable and compostable packaging options. The Global Moulded Fibre Pulp Packaging Market is directly benefiting from this policy shift due to its alignment with environmental goals. Manufacturers are integrating fibre pulp materials to comply with bans and extended producer responsibility (EPR) requirements. Regulatory support for recycled packaging solutions is increasing across regions such as the European Union, North America, and parts of Asia. This changing regulatory landscape has made moulded fibre pulp packaging not just a viable alternative but a preferred choice.

- For instance, Huhtamaki, a leading packaging company headquartered in Finland, produced nearly 20 billion moulded fibre product units in 2024, including trays and containers for food and retail applications, meeting EPR and plastic ban requirements in both the EU and North America. The company’s compliance efforts directly supported customer brands in passing regulatory audits on sustainable packaging use.

Growing Demand from Food, Beverage, and Foodservice Industries:

The expanding food and beverage sector is driving strong demand for eco-friendly, cost-efficient, and food-safe packaging materials. Single-use plastic trays and containers are being replaced by moulded pulp equivalents across quick-service restaurants, delivery platforms, and fresh produce retailing. The Global Moulded Fibre Pulp Packaging Market is witnessing rising volume uptake for egg trays, fruit packs, cup carriers, and takeout containers. Its ability to meet hygiene standards, maintain structural integrity, and biodegrade efficiently supports its increasing adoption. Fast food chains and food delivery apps are integrating pulp-based packaging into their supply chains. These efforts align with broader corporate sustainability goals and evolving consumer preferences.

- For instance, CKF Inc. delivered moulded fibre egg cartons and food trays in 2024 to supermarkets and foodservice providers in North America, directly supporting the phase-out of polystyrene containers at major retail chains.

Expansion of E-Commerce and Need for Protective Transit Packaging:

E-commerce growth has intensified the demand for shock-absorbent, lightweight, and durable packaging solutions. Moulded fibre pulp packaging provides excellent cushioning for electronics, cosmetics, and fragile consumer goods. The Global Moulded Fibre Pulp Packaging Market is seeing increased traction among logistics providers seeking to reduce plastic void fillers and foam inserts. E-retailers are also switching to pulp-based alternatives to meet internal ESG targets and reduce carbon emissions. Moulded pulp’s form-fitting nature allows companies to cut down on secondary packaging and optimize box sizing. These benefits support operational efficiency while reinforcing sustainability credentials.

Cost-Effectiveness and Circular Economy Compatibility:

The market is gaining momentum due to the cost-efficiency of using recycled pulp as a primary input. Recycled newspapers, cardboard, and agricultural waste offer a readily available and inexpensive material base. The Global Moulded Fibre Pulp Packaging Market leverages this resource advantage to offer affordable yet environmentally sound solutions. It fits seamlessly into circular economy models by enabling closed-loop recovery and reuse systems. Companies are investing in in-house pulp-forming capabilities to reduce packaging procurement costs. Cost efficiency, coupled with recyclability, strengthens its appeal across diverse industrial applications.

Market Trends:

Premiumization of Sustainable Packaging for Luxury and High-Value Products:

Brands in luxury, cosmetics, and electronics are elevating the aesthetic and functional appeal of sustainable packaging. Pulp-based packaging is no longer limited to trays and carriers but is entering upscale categories. The Global Moulded Fibre Pulp Packaging Market is expanding into high-end retail packaging, with customized embossing, color, and texture options. Companies are launching minimalist, brand-aligned pulp packaging to replace rigid boxes and foam inserts. This trend reflects a growing preference for premium packaging that signals environmental responsibility. It also creates opportunities for value-added differentiation in crowded retail segments.

- For instance, packaging also demonstrated superior strength with a compressive load capacity exceeding 20 kilograms, validated by third-party lab testing, ensuring premium protection while reinforcing environmental messaging.

Integration of Advanced Moulding Techniques for Complex Shapes and Functions:

Technological improvements are allowing more complex and functional moulded pulp structures. Manufacturers are deploying precision tooling, 3D mold design, and dry-press technologies to create intricate shapes. The Global Moulded Fibre Pulp Packaging Market is responding to demand for enhanced design flexibility, especially in consumer electronics and industrial equipment. Advanced moulding processes allow for closures, hinges, and multi-compartment formats that mimic plastic. This trend is making pulp packaging viable for categories where performance and form factor were once barriers. It also supports brand-specific structural packaging needs without compromising on sustainability.

Water and Oil Resistance Enhancements Through Coating Innovations:

New bio-based and compostable coatings are overcoming traditional limitations of pulp packaging. Companies are developing surface treatments that resist moisture, grease, and heat. The Global Moulded Fibre Pulp Packaging Market is adopting these innovations in applications such as frozen foods, ready-to-eat meals, and cosmetics. These coatings extend shelf life and improve product protection, without relying on plastic films. It supports the full compostability of packaging, which strengthens its use case in regulated markets. Packaging that balances performance and biodegradability is gaining favor among manufacturers and end users.

Local Sourcing and Decentralized Production to Reduce Supply Chain Risks:

Global brands are reshaping packaging procurement by moving toward regionalized and localized supply networks. Rising freight costs and geopolitical uncertainty have prompted companies to decentralize production. The Global Moulded Fibre Pulp Packaging Market is benefiting from investments in local pulp-processing and moulding facilities. Onsite or near-site production models support just-in-time logistics and reduce emissions. This trend aligns with circular economy principles by using locally sourced recycled materials. Regional customization and shorter lead times are becoming critical to market responsiveness.

Market Challenges Analysis:

Inconsistent Quality of Raw Materials and High Dependence on Recycled Inputs:

The Global Moulded Fibre Pulp Packaging Market relies heavily on recycled paper, agricultural residue, and post-consumer waste as primary raw materials. These inputs often vary in quality, fiber length, and moisture content, which can impact the consistency and durability of the final product. It faces production challenges when raw material supply becomes contaminated or insufficient, particularly during fluctuations in wastepaper availability. Small and medium-sized manufacturers lack the technical infrastructure to manage these inconsistencies effectively. Quality assurance becomes difficult when operating at scale with diverse feedstock sources. This constraint limits adoption in industries that require strict compliance with hygiene or safety standards, such as pharmaceuticals and high-end electronics.

Limited Barrier Properties and Structural Constraints in Certain Applications:

Moulded fibre packaging struggles to match the moisture, gas, and oil barrier performance of plastic or metal alternatives. The Global Moulded Fibre Pulp Packaging Market finds it difficult to expand into sectors like frozen foods, beverages, and some industrial uses where extended shelf life or airtight containment is critical. While coating technologies are evolving, they add costs and may compromise biodegradability if not carefully designed. The material also poses limitations in achieving ultra-thin walls or transparent surfaces, restricting its use for display packaging. Structural rigidity can be insufficient for heavy-load packaging without reinforcement, which limits its suitability in bulk logistics. These functional constraints remain a barrier to complete substitution of conventional packaging formats.

Market Opportunities:

Expansion into High-Barrier and Specialized Packaging Segments

The Global Moulded Fibre Pulp Packaging Market has significant opportunity to expand into high-barrier applications by integrating advanced coating technologies. Sectors such as frozen foods, cosmetics, and pharmaceuticals require packaging that resists moisture, oil, and microbial intrusion. Innovations in compostable coatings and hybrid fibre composites can help bridge the current performance gap. It can unlock new demand in markets that traditionally relied on plastics or foils for protection. Investment in R&D and material science will be key to meeting these technical requirements without compromising sustainability. Companies that develop scalable and compliant solutions will gain early mover advantage.

Localized Manufacturing and Customization to Meet Regional Needs

Growing interest in localized packaging production offers strategic opportunities for market penetration and cost control. The Global Moulded Fibre Pulp Packaging Market can benefit from setting up region-specific manufacturing hubs that use locally sourced raw materials. This approach reduces logistics costs and aligns with circular economy models favored by governments and consumers. It enables producers to tailor packaging formats for cultural, regulatory, or product-specific demands. Emerging markets in Latin America, Southeast Asia, and Africa are ideal for this decentralized model. It also allows for greater agility in responding to supply chain disruptions or changing consumer trends.

Market Segmentation Analysis:

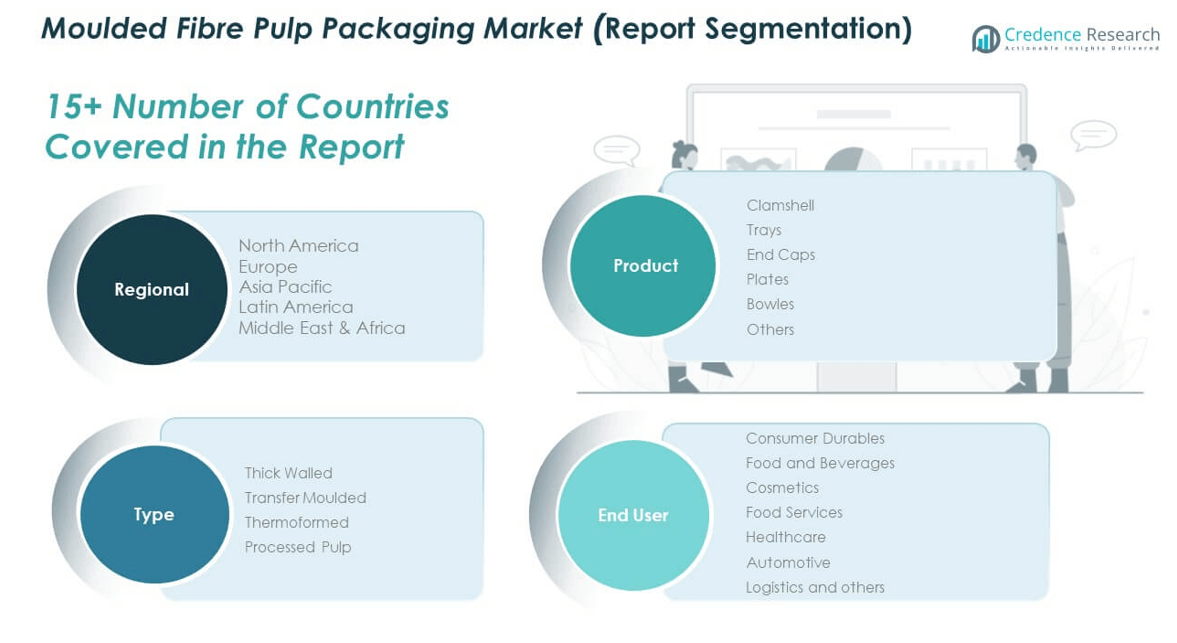

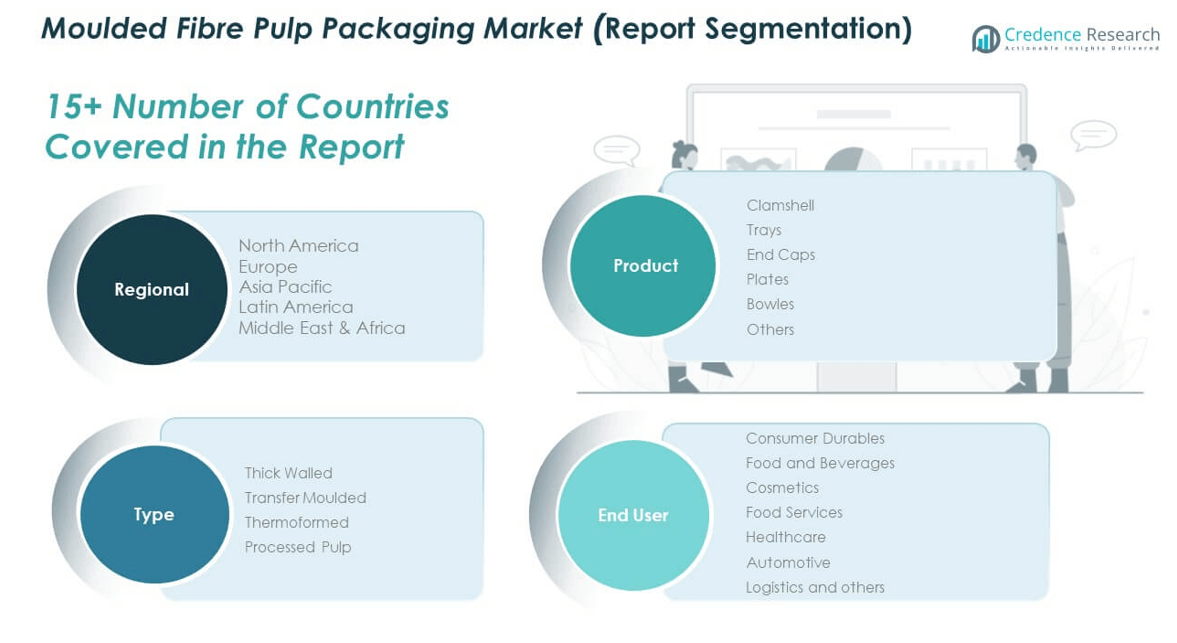

By Product Segment

The Global Moulded Fibre Pulp Packaging Market includes clamshells, trays, end caps, plates, bowls, and others. Clamshells and trays hold a major share due to their extensive use in food packaging and retail displays. End caps are essential for protective packaging in electronics and appliances. Plates and bowls cater to the rising demand for compostable, single-use food containers. The “others” segment includes customized and application-specific designs, especially in industrial packaging.

- For instance, Hartmann Group manufactured in excess of 13 billion moulded fibre trays and packaging units globally in 2024, with specific moisture barrier coatings maintaining product integrity for 48 hours at 85% relative humidity.

By Type Segment

The market segments by type into thick walled, transfer moulded, thermoformed, and processed pulp. Thick-walled variants offer durability for heavy or fragile items. Transfer moulded pulp provides smoother finishes, preferred in packaging for consumer goods. Thermoformed types support precision and detailing, making them suitable for cosmetics and electronics. Processed pulp enables coatings and surface treatments, helping address applications in healthcare and frozen food packaging.

- For instance, Huhtamaki transfer-molded Forest range officer premium smoothness and surface quality to meet cosmetic, healthcare, and electronics packaging needs. Micrometer (Ra), meeting stringent cosmetic and electronics packaging requirements.

By End User Segment

Key end user segments include food and beverages, food services, consumer durables, cosmetics, healthcare, automotive, and logistics and others. Food and beverage applications dominate due to global trends toward eco-friendly packaging. Food service providers are adopting fibre pulp containers across dine-in and takeaway formats. Consumer durables and cosmetics use it for protective and aesthetic packaging. It is also gaining importance in healthcare, automotive, and logistics sectors where sustainability, compliance, and material efficiency are critical.

Segmentation:

By Product Segment

- Clamshell

- Trays

- End Caps

- Plates

- Bowls

- Others

By Type Segment

- Thick Walled

- Transfer Moulded

- Thermoformed

- Processed Pulp

By End User Segment

- Consumer Durables

- Food and Beverages

- Cosmetics

- Food Services

- Healthcare

- Automotive

- Logistics and Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Moulded Fibre Pulp Packaging Market size was valued at USD 1,094.40 million in 2018 to USD 1,432.08 million in 2024 and is anticipated to reach USD 2,065.09 million by 2032, at a CAGR of 4.7% during the forecast period. North America holds around 21.8% share of the Global Moulded Fibre Pulp Packaging Market, driven by robust demand in foodservice, healthcare, and consumer electronics. It benefits from strong regulatory support for biodegradable materials and widespread consumer preference for sustainable packaging. The United States leads the region due to high per capita consumption of packaged goods and aggressive sustainability mandates by major corporations. Retailers and quick-service restaurants continue shifting from plastic to fibre-based formats. It also supports domestic recycling loops, making moulded pulp packaging a practical and scalable solution.

Europe

The Europe Moulded Fibre Pulp Packaging Market size was valued at USD 1,246.41 million in 2018 to USD 1,753.37 million in 2024 and is anticipated to reach USD 2,800.26 million by 2032, at a CAGR of 6.1% during the forecast period. Europe contributes approximately 26.6% of the Global Moulded Fibre Pulp Packaging Market and maintains steady growth due to strict environmental regulations and advanced recycling infrastructure. Countries like Germany, France, and the UK lead adoption across both food and non-food sectors. Demand is strong for premium and customized pulp packaging in cosmetics and electronics. EU directives on extended producer responsibility are influencing manufacturers to adopt circular packaging systems. It supports innovation in coating technologies to meet performance standards without compromising biodegradability.

Asia Pacific

The Asia Pacific Moulded Fibre Pulp Packaging Market size was valued at USD 1,441.99 million in 2018 to USD 2,074.28 million in 2024 and is anticipated to reach USD 3,407.40 million by 2032, at a CAGR of 6.4% during the forecast period. Asia Pacific dominates the Global Moulded Fibre Pulp Packaging Market with a share of about 32.2%, led by China, India, and Southeast Asian nations. Growth is fueled by the region’s expanding food processing industries, e-commerce logistics, and government sustainability initiatives. Manufacturers are investing in domestic capacity to meet surging local demand. Urbanization and rising disposable incomes are increasing packaged food consumption, which strengthens market growth. It also benefits from abundant availability of low-cost recycled raw materials.

Latin America

The Latin America Moulded Fibre Pulp Packaging Market size was valued at USD 532.76 million in 2018 to USD 742.35 million in 2024 and is anticipated to reach USD 1,170.91 million by 2032, at a CAGR of 5.9% during the forecast period. Latin America accounts for around 11.3% of the Global Moulded Fibre Pulp Packaging Market. Countries like Brazil, Mexico, and Argentina are leading market development, supported by rising demand for sustainable food and beverage packaging. Regional governments are introducing plastic regulations, encouraging industry shifts toward fibre-based alternatives. Local manufacturers are adopting low-tech yet scalable moulding solutions suited to regional infrastructure. It faces challenges in supply chain logistics but gains ground through low-cost production and export potential.

Middle East

The Middle East Moulded Fibre Pulp Packaging Market size was valued at USD 255.72 million in 2018 to USD 358.21 million in 2024 and is anticipated to reach USD 568.93 million by 2032, at a CAGR of 6.0% during the forecast period. The region holds approximately 5.5% of the Global Moulded Fibre Pulp Packaging Market and is showing growing interest in sustainable packaging alternatives. Foodservice, agriculture, and FMCG sectors are early adopters due to increasing eco-consciousness and urban consumption trends. Governments are launching green packaging regulations, especially in the UAE and Saudi Arabia. Import dependence for plastic alternatives is steering buyers toward domestic fibre packaging solutions. It offers opportunity for capacity expansion and local sourcing partnerships.

Africa

The Africa Moulded Fibre Pulp Packaging Market size was valued at USD 164.33 million in 2018 to USD 215.79 million in 2024 and is anticipated to reach USD 312.86 million by 2032, at a CAGR of 4.8% during the forecast period. Africa represents about 3.0% of the Global Moulded Fibre Pulp Packaging Market and is still in an early development phase. South Africa, Kenya, and Nigeria are emerging as key markets, where urbanization and plastic bans are influencing packaging choices. Limited access to advanced moulding technology and supply chain gaps remain barriers. It sees potential through international investment and NGO-led sustainability initiatives. Domestic paper recycling programs are gradually enabling raw material availability for pulp packaging production.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- FiberCel Packaging LLC

- Huhtamaki Oyj

- Pactiv LLC

- Henry Molded Products, Inc

- EnviroPAK Corporation

- KEYES Packaging Group

- Robert Cullen Ltd.

- Hawk Group

- Keiding, Inc.

- Brodrene Hartmann A/S

- Other Key Players

Competitive Analysis:

The Global Moulded Fibre Pulp Packaging Market features a competitive landscape with a mix of established manufacturers and emerging players. Key companies include Huhtamaki Oyj, Pactiv LLC, FiberCel Packaging LLC, Henry Molded Products, and Brodrene Hartmann A/S. It is driven by product innovation, regional expansion, and strategic partnerships. Players focus on developing advanced moulding technologies and bio-based coatings to enhance performance and meet regulatory demands. Market participants are investing in automation and localized production to reduce costs and improve supply chain efficiency. Competitive intensity remains high due to growing demand across foodservice, consumer goods, and healthcare sectors. Firms that offer scalable, customizable, and sustainable packaging solutions gain a strong advantage in securing long-term contracts with global brands. It is also seeing consolidation through mergers and acquisitions aimed at expanding capacity and geographic reach.

Recent Developments:

- In July 2025, Huhtamaki Oyj launched a new range of home and industrial compostable ice cream cups, further diversifying its sustainable packaging portfolio. These innovative cups, made from responsibly sourced and bio-based paperboard with a plastic content of less than 10%, are both recyclable and compostable, designed to help customers reduce their environmental footprint while maintaining performance standards. Earlier in February 2025, Huhtamaki also introduced recyclable single-coated ProDairy paper cups for yogurt and dairy, achieving less than 10% plastic content across the product line.

- In March 2025, Pactiv Evergreen Inc., the parent company of Pactiv LLC, announced receipt of all required regulatory approvals for its acquisition by Novolex. This transaction, expected to close in April 2025, will result in Pactiv Evergreen becoming a privately held entity and part of Novolex, with plans to strengthen its presence in food, beverage, and sustainable packaging markets.

- In early 2025, EnviroPAK Corporation highlighted increased demand for its zero-waste, compostable molded fibre packaging, aligning with the industry’s shift away from plastics. EnviroPAK continued its push to supply U.S.-sourced, sustainable packaging materials to consumer brands striving to meet new regulatory requirements and rising consumer expectations around environmental impact.

Market Concentration & Characteristics:

The Global Moulded Fibre Pulp Packaging Market exhibits moderate market concentration with a mix of multinational corporations and regional manufacturers. It is characterized by strong competition, low entry barriers, and a high degree of product customization. Leading players maintain a competitive edge through technological innovation, sustainable material sourcing, and established distribution networks. The market favors companies that can scale operations while maintaining compliance with environmental standards. It shows a strong orientation toward eco-friendly practices, circular economy integration, and cost-effective manufacturing. Demand is largely driven by end-user adaptability, regulatory alignment, and the global shift away from plastic packaging.

Report Coverage:

The research report offers an in-depth analysis based on product, type, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising bans on single-use plastics will continue to accelerate global demand for fibre pulp-based alternatives.

- Advanced moulding technologies will enable broader applications across high-performance packaging sectors.

- Foodservice and QSR industries will expand their adoption of biodegradable trays, clamshells, and plates.

- E-commerce packaging will drive innovation in protective moulded fibre solutions for consumer electronics.

- Growth in premium cosmetic and healthcare packaging will support demand for thermoformed pulp formats.

- Regional manufacturing hubs will emerge to reduce logistics costs and support local sourcing strategies.

- Investments in compostable barrier coatings will unlock new opportunities in moisture-sensitive applications.

- Asia Pacific will retain market leadership, supported by industrial expansion in China and India.

- Companies will pursue M&A strategies to gain access to new technologies and market segments.

- Sustainability mandates and circular economy models will shape product development and long-term competitiveness.