Market Overview:

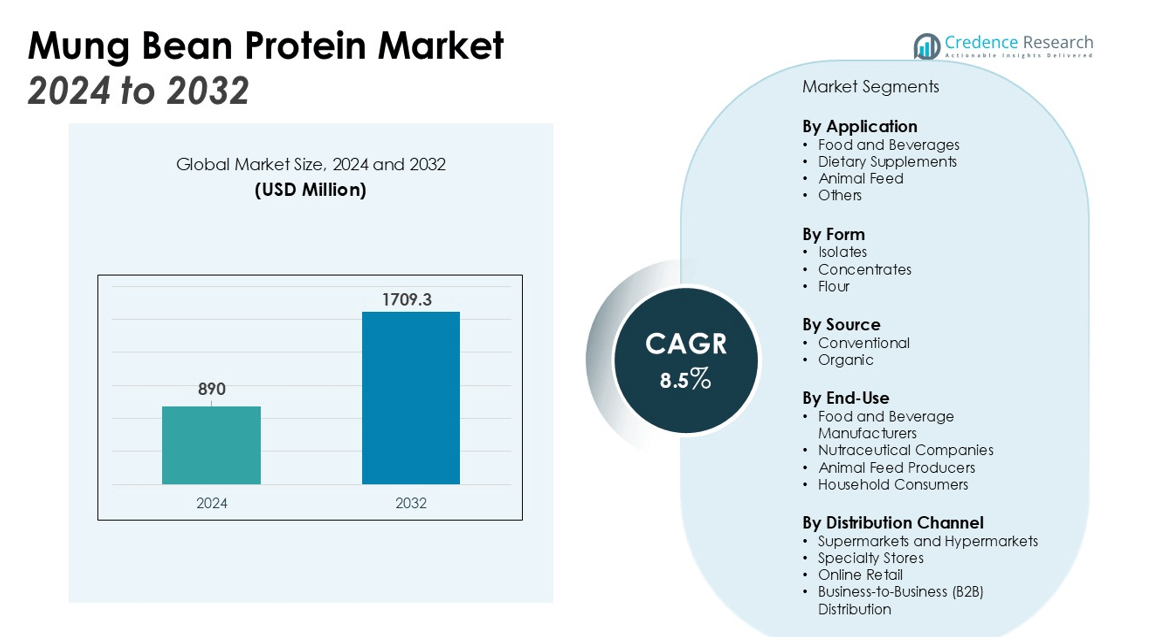

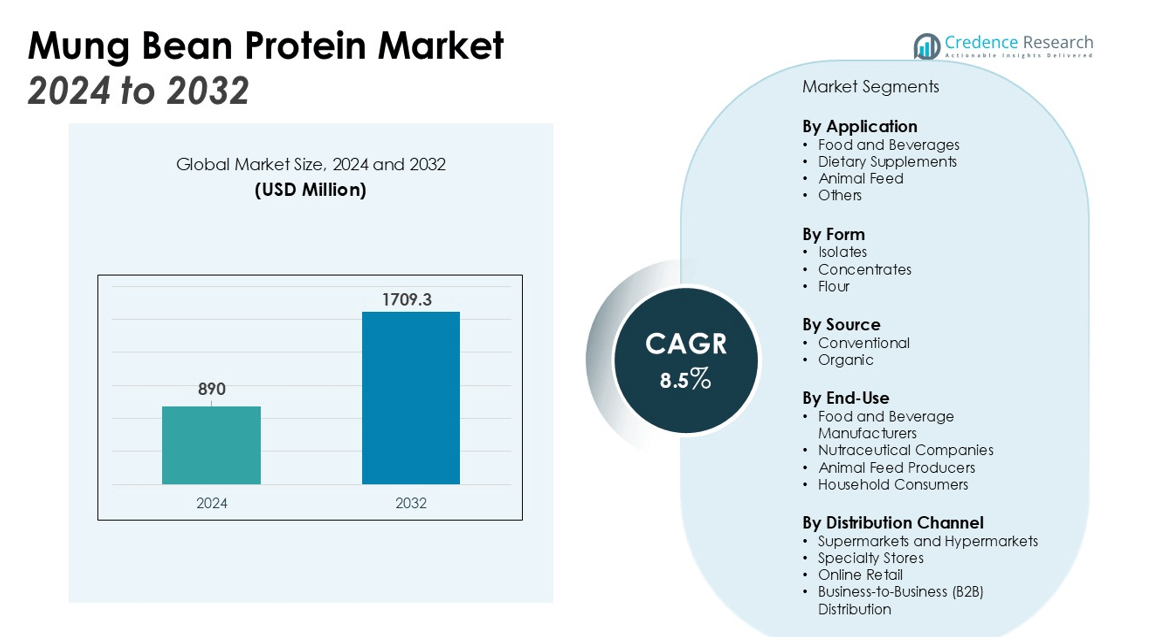

The Mung Bean Protein Market size was valued at USD 890 million in 2024 and is anticipated to reach USD 1709.3 million by 2032, at a CAGR of 8.5% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mung Bean Protein Market Size 2024 |

USD 890 million |

| Mung Bean Protein Market, CAGR |

8.5% |

| Mung Bean Protein Market Size 2032 |

USD 1709.3 million |

Rising consumer preference for plant-based diets, health-focused lifestyles, and allergy-free alternatives remain the primary growth drivers. Demand is further strengthened by advances in food-processing technologies that improve extraction efficiency, flavor, and application diversity. Changing lifestyles toward vegan, vegetarian, and flexitarian diets also drive wider adoption, particularly in sports nutrition, functional foods, and dietary supplements. Together, these dynamics are reshaping protein consumption patterns worldwide.

Asia-Pacific dominates the market, supported by traditional consumption, extensive mung bean cultivation, and favorable agricultural initiatives. North America and Europe follow as key regions, driven by the growing popularity of plant-based and functional foods. Expanding adoption in South and East Asia, fueled by rising health awareness, also contributes significantly to the overall market expansion, reinforcing the product’s global growth potential. Rising investments in plant-based protein innovation and sustainable sourcing practices are further expected to accelerate market growth over the coming years.

Market Insights:

- The Mung Bean Protein Market was valued at USD 890 million and is forecast to reach USD 1709.3 million by 2032, growing at a CAGR of 8.5%.

- Rising consumer preference for plant-based diets, health-focused lifestyles, and allergy-free alternatives continues to drive strong demand.

- Advances in food-processing technologies enhance extraction efficiency, purity, and flavor, broadening applications in beverages, snacks, and functional foods.

- Increasing adoption of vegan, vegetarian, and flexitarian diets supports demand in sports nutrition, fortified foods, and supplements.

- Asia-Pacific holds 52% of global revenue, supported by large-scale cultivation, traditional consumption, and strong agricultural policies.

- North America accounts for 23% share, driven by innovation in dairy substitutes, meat analogues, and protein-enriched products.

- Europe represents 18% share, supported by sustainability priorities, rising awareness of nutrition, and expanding vegan and flexitarian lifestyles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Consumer Shift Toward Plant-Based and Allergy-Free Protein Sources

The Mung Bean Protein Market is expanding due to rising global demand for plant-based diets. Consumers seek protein options that are free from common allergens such as soy and dairy. This shift is strongly linked to greater awareness of health, sustainability, and ethical food choices. Mung bean protein offers a clean-label, non-GMO profile that supports this consumer preference, making it a preferred ingredient in multiple applications.

- For instance, food technology company Eat Just has sold the plant-based equivalent of over 500 million eggs using its mung bean-based products, demonstrating significant consumer adoption of innovative plant-based alternatives.

Advancements in Food Processing and Extraction Technologies

Technological progress is a critical driver for the Mung Bean Protein Market. Enhanced extraction techniques improve yield, purity, and flavor while lowering production costs. These advances expand the usability of mung bean protein in diverse categories, including beverages, snacks, and functional foods. It allows manufacturers to maintain product quality while meeting the growing consumer demand for natural and sustainable protein sources.

Lifestyle Shifts Supporting Vegan, Vegetarian, and Flexitarian Diets

Changing food habits are accelerating adoption of mung bean protein in mainstream diets. The Mung Bean Protein Market benefits from rising numbers of consumers adopting vegan, vegetarian, and flexitarian lifestyles. It is increasingly used in sports nutrition, dietary supplements, and fortified food products. These shifts in consumption patterns are reshaping the competitive landscape and creating new growth opportunities for global suppliers.

- For instance, Calysta operates a commercial-scale fermentation facility in Chongqing, China, with an annual production capacity of 20,000 tonnes of its sustainable microbial protein, developed without arable land or animal inputs, supporting scalable protein supply.

Regional Strength in Asia-Pacific and Expanding Global Adoption

Strong regional foundations play a major role in the Mung Bean Protein Market. Asia-Pacific dominates, supported by traditional use, large-scale cultivation, and government-backed agricultural initiatives. North America and Europe are recording higher growth, driven by strong demand for functional and plant-based foods. Expanding adoption across South and East Asia, combined with rising investments in sustainable protein innovation, reinforces the long-term market potential.

Market Trends:

Rising Demand for Clean-Label, Functional, and Sustainable Protein Ingredients

The Mung Bean Protein Market is witnessing strong growth driven by consumer interest in clean-label and functional products. Demand for protein ingredients that are transparent, minimally processed, and free from synthetic additives is increasing across global food categories. It supports functional health trends by offering benefits such as easy digestibility, amino acid balance, and suitability for specialized diets. Brands are incorporating mung bean protein into beverages, plant-based dairy alternatives, and ready-to-eat snacks to address wellness-focused demand. Sustainability is also a significant factor, as consumers favor crops with lower environmental footprints compared to animal-based protein sources. This shift is positioning mung bean protein as a reliable alternative in the broader plant-based protein portfolio.

- For instance, JUST Egg produces plant-based egg alternatives using mung bean protein with a verified protein content of 5 grams per serving, replicating the protein amount found in a chicken egg while remaining cholesterol-free.

Innovation Across Applications and Expanding Role in Global Food Systems

Innovation remains a defining trend in the Mung Bean Protein Market, with manufacturers investing in research to improve versatility. Product development is expanding beyond traditional supplements into bakery, confectionery, meat alternatives, and fortified foods. It allows brands to differentiate in highly competitive plant-based segments by emphasizing texture, flavor, and nutritional advantages. Food companies are collaborating with ingredient suppliers to integrate mung bean protein into formulations that meet evolving consumer expectations. Growth in sports nutrition and functional beverages also demonstrates its relevance in premium and performance-focused categories. Increasing global investments in sustainable agriculture and protein diversification reinforce its role in shaping future food systems.

- For instance, research by the World Vegetable Center has contributed to economic gains of 1.4 billion USD for 637,000 smallholder mung bean farmers in Myanmar from 1980 to 2016, highlighting mung bean’s critical role in sustainable livelihoods and agriculture.

Market Challenges Analysis:

High Production Costs and Limited Processing Infrastructure

The Mung Bean Protein Market faces cost-related challenges that limit broader adoption. Extraction and isolation of mung bean protein remain more expensive compared to soy or pea protein. It requires specialized processing technologies, which are not widely available in all regions. Limited infrastructure increases reliance on a few producers, leading to supply chain bottlenecks and pricing pressures. Smaller food manufacturers often struggle to absorb these costs, reducing their ability to integrate mung bean protein into mainstream products. High costs remain a barrier to achieving large-scale competitiveness in the global protein market.

Supply Constraints and Consumer Awareness Gaps

The Mung Bean Protein Market also contends with raw material supply limitations and inconsistent global availability. Crop yields can fluctuate due to climate conditions, directly affecting protein output and pricing stability. It faces competition from more established plant proteins, which already have stronger consumer awareness and wider acceptance. Limited marketing efforts and lack of familiarity in Western markets restrict faster penetration into new categories. Food companies must invest in consumer education to highlight nutritional and sustainability benefits. Without stronger awareness and reliable sourcing strategies, growth potential may remain constrained in several regions.

Market Opportunities:

Expansion into High-Growth Food and Beverage Categories

The Mung Bean Protein Market presents strong opportunities across fast-growing food and beverage applications. Demand for plant-based meat alternatives, dairy substitutes, and functional beverages is creating new revenue streams. It offers a clean-label and allergen-free profile that appeals to health-conscious consumers seeking transparency and natural ingredients. Manufacturers can expand portfolios by integrating mung bean protein into bakery, snack, and ready-to-drink products. The ingredient’s versatility in flavor, texture, and nutrition provides a competitive edge for innovation. Expanding use in convenience-driven food categories positions mung bean protein as a valuable solution for evolving consumer preferences.

Rising Investments in Sustainable Protein Innovation and Global Nutrition Needs

Sustainability and nutrition priorities create long-term opportunities for the Mung Bean Protein Market. It aligns with global efforts to diversify protein sources and reduce dependence on resource-intensive animal proteins. Governments and investors are supporting research to enhance crop yields and processing efficiency. Growing demand in emerging economies, where affordable and sustainable protein is a priority, provides further expansion prospects. Rising interest in sports nutrition, fortified foods, and performance-based diets also supports future growth. These factors strengthen the market outlook and open avenues for large-scale adoption across diverse industries.

Market Segmentation Analysis:

By Application

The Mung Bean Protein Market is segmented by application into food and beverages, dietary supplements, animal feed, and others. Food and beverages dominate due to rising demand for plant-based dairy substitutes, bakery items, and ready-to-drink nutrition products. It is increasingly used in sports nutrition and fortified foods, supported by growing health awareness. Dietary supplements form a strong growth area, with consumers preferring clean-label protein alternatives. Animal feed applications remain niche but reflect the protein’s nutritional value and digestibility.

By Form

Segmentation by form includes isolates, concentrates, and flour. Isolates hold the largest share, supported by high purity and functional benefits in beverages and sports nutrition. It delivers superior solubility and amino acid balance, making it popular in premium formulations. Concentrates are gaining traction in bakery, snacks, and processed foods where cost efficiency matters. Flour maintains demand in traditional food preparation and regional diets, particularly in Asia-Pacific. This form also serves as a base for expanding applications in clean-label categories.

- For instance, Arla Foods’ Lacprodan SP-7017 whey protein concentrate contains 76 units of protein content, formulated for versatile use in food products including baked goods and beverages.

By Source

The market by source is categorized into conventional and organic. Conventional production dominates due to higher availability, large-scale cultivation, and cost benefits. It ensures consistent supply for food manufacturers operating across global markets. Organic is emerging rapidly, driven by consumer demand for chemical-free, sustainable, and ethically sourced proteins. It aligns strongly with clean-label and premium product positioning. Growing awareness of sustainability and healthy lifestyles is expected to accelerate organic adoption.

- For instance, Cargill expanded its partnership with ENOUGH in 2024 to support production of over 1 million tons of ABUNDA® mycoprotein by 2033, leveraging fermentation technology for sustainable protein supply.

Segmentations:

By Application

- Food and Beverages

- Dietary Supplements

- Animal Feed

- Others

By Form

- Isolates

- Concentrates

- Flour

By Source

By End-User

- Food and Beverage Manufacturers

- Nutraceutical Companies

- Animal Feed Producers

- Household Consumers

By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Retail

- Business-to-Business (B2B) Distribution

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia-Pacific Leading with Strong Cultivation and Traditional Consumption Base

Asia-Pacific holds 52% of the global Mung Bean Protein Market, making it the largest regional contributor. Strong agricultural production in China, India, and Southeast Asia ensures a consistent raw material base for processing. The region benefits from long-standing cultural reliance on mung beans as staple food, creating stable domestic demand. It is further supported by government initiatives promoting pulse cultivation and food innovation. Rising urbanization and income growth accelerate processed food adoption with mung bean protein. Strong supply chains reinforce Asia-Pacific’s leading role in global revenues.

North America Driven by Rising Plant-Based and Functional Food Demand

North America accounts for 23% of the global Mung Bean Protein Market, driven by rising consumer demand for plant-based diets. Health awareness and preference for allergen-free protein alternatives support expansion across food and beverage segments. It is widely used in sports nutrition, dairy substitutes, and meat analogues that align with evolving dietary habits. The region benefits from advanced food-processing capabilities and strong investment in product development. Retail distribution networks ensure wide availability of protein-enriched products. Increasing adoption underscores North America’s significance as a growth hub.

Europe Supported by Health Awareness and Sustainability Priorities

Europe represents 18% of the global Mung Bean Protein Market, supported by strong focus on sustainability and nutrition. Consumers are steadily shifting toward vegan, vegetarian, and flexitarian diets that favor plant-based proteins. It aligns with regional policies promoting reduced animal protein consumption and environmental responsibility. Food producers are incorporating mung bean protein into bakery products, meat alternatives, and fortified foods. Growing awareness of health benefits strengthens acceptance across multiple consumer groups. Collaboration between suppliers and food manufacturers is expected to expand its footprint further.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Mung Bean Protein Market features a mix of global ingredient suppliers, regional producers, and specialized firms focused on plant-based protein innovation. Competition centers on product purity, functional properties, and cost efficiency, with companies investing in advanced extraction methods to improve yield and flavor. It is shaped by rising consumer demand for clean-label proteins, driving firms to expand their presence in food, beverages, and dietary supplements. Strategic partnerships between food manufacturers and ingredient suppliers are common, allowing faster integration of mung bean protein into mainstream categories. Leading players are diversifying portfolios with organic and allergen-free options to strengthen their positioning. It faces competitive pressure from established plant proteins such as soy and pea, which already have wider consumer awareness. However, increasing investments in sustainable sourcing and innovation highlight the market’s potential to carve a strong niche within the global plant protein industry.

Recent Developments:

- In December 2024, Prinova announced the acquisition of Brazilian specialty food and supplement ingredient distributor Aplinova to increase its footprint in Latin America.

Report Coverage:

The research report offers an in-depth analysis based on Application, Form, Source, End-User, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for mung bean protein will expand as consumers increasingly adopt plant-based diets worldwide.

- It will gain traction in food and beverage categories such as dairy alternatives, bakery, and functional snacks.

- Rising use in sports nutrition and dietary supplements will create new opportunities for health-focused products.

- Organic and clean-label variants will strengthen their appeal among premium and sustainability-driven consumers.

- Advancements in extraction and processing technologies will enhance purity, flavor, and application versatility.

- Food manufacturers will explore collaborations with ingredient suppliers to integrate mung bean protein into mainstream offerings.

- Asia-Pacific will continue leading growth due to strong cultivation, cultural reliance, and supportive agricultural practices.

- North America and Europe will strengthen adoption through innovation in meat analogues and fortified foods.

- Expansion in emerging economies will be supported by rising health awareness and growing middle-class populations.

- Sustainability initiatives and investment in alternative proteins will position mung bean protein as a vital contributor to global nutrition security.