| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Netherlands Disposable Medical Supplies Market Size 2023 |

USD 2,289.33 Million |

| Netherlands Disposable Medical Supplies Market, CAGR |

4.13% |

| Netherlands Disposable Medical Supplies Market Size 2032 |

USD 3,295.76 Million |

Market Overview

Netherlands Disposable Medical Supplies Market size was valued at USD 2,289.33 million in 2023 and is anticipated to reach USD 3,295.76 million by 2032, at a CAGR of 4.13% during the forecast period (2023-2032).

The Netherlands disposable medical supplies market is experiencing steady growth, driven by an aging population, increasing prevalence of chronic diseases, and rising demand for infection control measures. The healthcare sector’s emphasis on hygiene and patient safety has led to greater adoption of single-use products, such as gloves, gowns, syringes, and drapes, particularly in hospitals and outpatient settings. Additionally, advancements in material technologies and product innovation are enhancing the quality and functionality of disposable supplies, further supporting market expansion. The growing shift toward home healthcare and ambulatory care services is also contributing to increased consumption of convenient, cost-effective disposable solutions. Furthermore, government initiatives promoting healthcare infrastructure development and regulatory support for infection prevention practices continue to bolster market demand. As environmental sustainability gains traction, manufacturers are increasingly focusing on developing eco-friendly and biodegradable disposable products, shaping future trends and encouraging responsible consumption across the Dutch healthcare system.

The Netherlands disposable medical supplies market is strategically positioned in a well-developed healthcare ecosystem, with key players spread across various regions. The Western Netherlands leads in market activities, driven by major cities like Amsterdam and Rotterdam, which host numerous healthcare institutions and medical manufacturers. Southern Netherlands, with its industrial focus and proximity to Belgium and Germany, contributes significantly to the sector. Northern and Eastern Netherlands also play key roles, especially in specialized care and home healthcare services. Major players such as Smith+Nephew, Medtronic, and Molnlycke Health Care are prominent in the market, offering a wide range of disposable products like wound care, drug delivery, and diagnostic disposables. These companies, alongside local players like Mellon Medical B.V. and Van Straten Medical, drive innovation and production in the disposable medical supplies industry, supporting the region’s growing demand for high-quality, hygienic, and cost-effective healthcare solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Netherlands disposable medical supplies market was valued at USD 2,289.33 million in 2023 and is expected to reach USD 3,295.76 million by 2032, growing at a CAGR of 4.13% during the forecast period (2023-2032).

- The global Disposable Medical Supplies market was valued at USD 2,45,000 million in 2023 and is expected to reach USD 3,93,306.92 million by 2032, growing at a CAGR of 5.40% during the forecast period.

- Key drivers include an aging population, rising chronic disease prevalence, and increased focus on infection control.

- The adoption of home healthcare services and telemedicine is boosting demand for disposable products like wound care, diagnostic tools, and drug delivery systems.

- Manufacturers are focusing on sustainable solutions, with eco-friendly and biodegradable products becoming increasingly popular.

- The market faces challenges such as the environmental impact of medical waste and disruptions in global supply chains.

- Major competitors include Smith+Nephew, Medtronic, and Molnlycke Health Care, with regional players like Mellon Medical B.V. and Van Straten Medical gaining traction.

- The Western Netherlands holds the largest market share, followed by Southern, Northern, and Eastern regions.

Report Scope

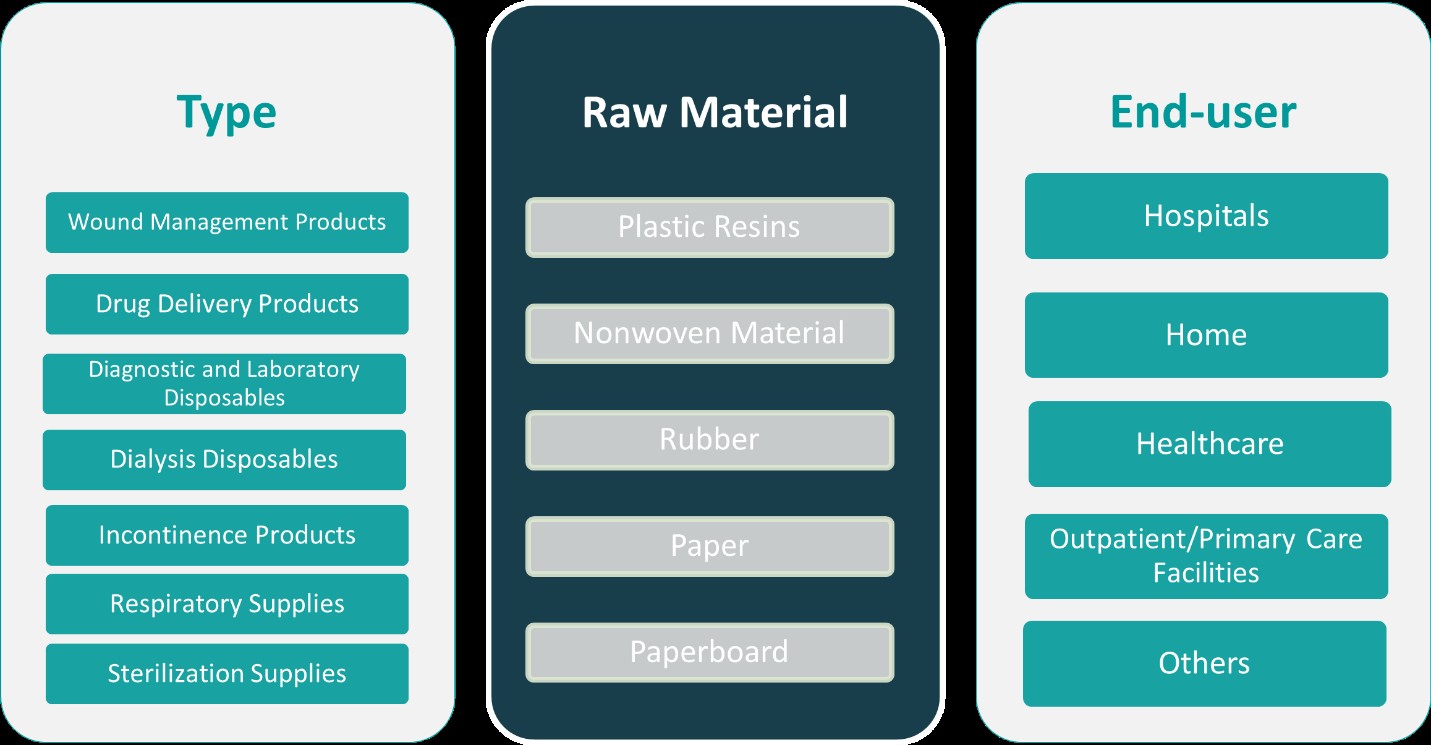

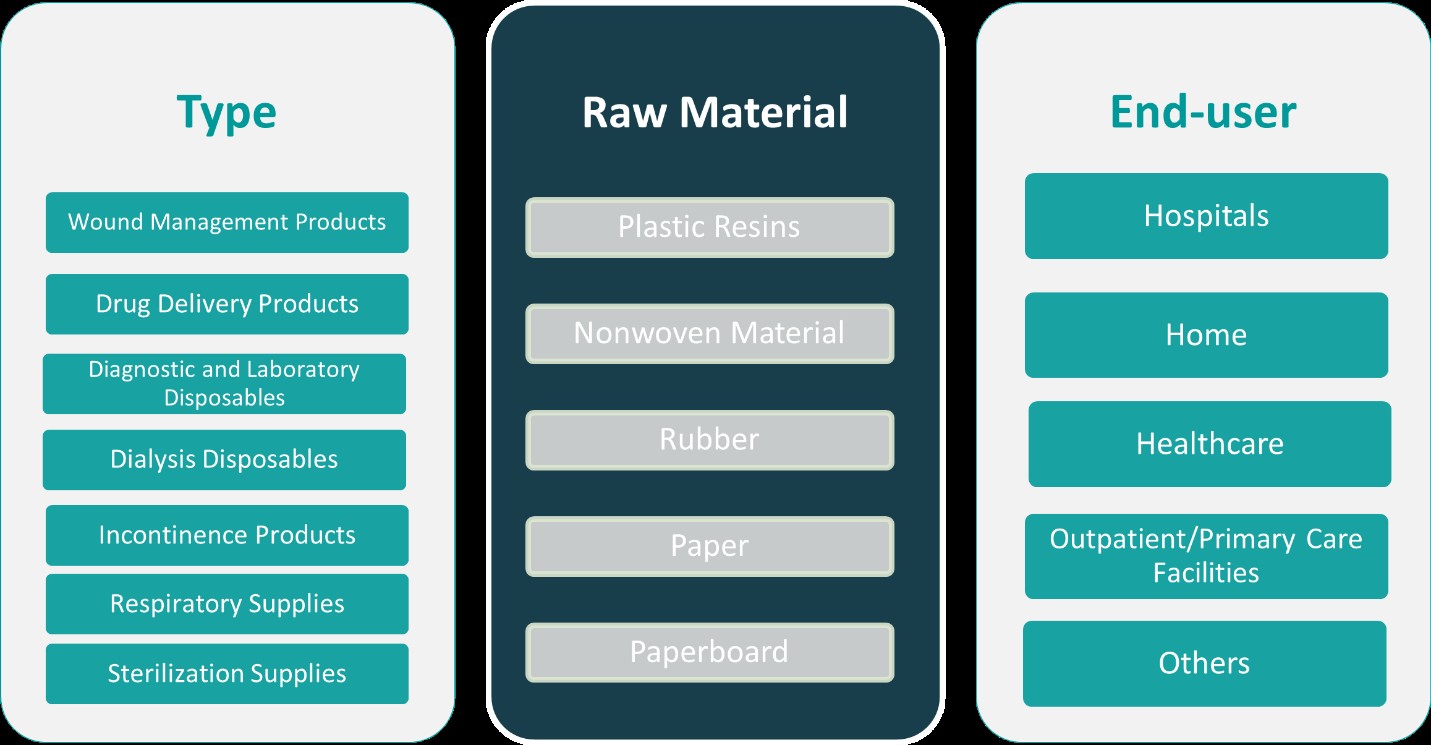

This report segments the Netherlands Disposable Medical Supplies Market as follows:

Market Drivers

Aging Population and Rising Chronic Disease Prevalence

The aging population in the Netherlands plays a pivotal role in driving the demand for disposable medical supplies. For instance, the Dutch National Institute for Public Health and the Environment (RIVM) reports that over 20% of the population is aged 65 and above, with a significant prevalence of chronic conditions like diabetes and cardiovascular diseases. As life expectancy increases and a larger proportion of the population enters retirement age, the healthcare system faces greater pressure to manage age-related conditions. Older adults typically require more frequent medical attention and procedures, leading to increased usage of disposable products such as catheters, wound care items, and incontinence supplies. Additionally, the rising prevalence of chronic diseases like diabetes, cardiovascular ailments, and respiratory conditions necessitates ongoing medical intervention and monitoring, further elevating the demand for sterile, single-use medical products that support infection control and patient care.

Emphasis on Infection Control and Patient Safety

Post-pandemic, healthcare facilities across the Netherlands have heightened their focus on infection prevention and control, significantly contributing to the growing market for disposable medical supplies. For instance, the Dutch Healthcare Inspectorate (IGZ) has implemented stricter hygiene protocols that mandate the use of single-use items like gloves, masks, and gowns to minimize cross-contamination risks. These practices are critical not only for patient safety but also for safeguarding healthcare workers. The regulatory environment has become more supportive of such measures, with authorities encouraging the use of disposables as part of standard operating procedures. This trend reflects a broader shift toward enhancing quality of care and operational efficiency in healthcare delivery.

Expansion of Home Healthcare and Ambulatory Services

The Netherlands is witnessing a significant rise in home healthcare and ambulatory care services, influenced by technological advancements and patient preference for home-based treatment options. This shift has created new opportunities for disposable medical supplies manufacturers, as patients and caregivers require easy-to-use, safe, and hygienic medical products for at-home treatment and recovery. Products such as wound dressings, insulin syringes, and disposable diagnostic tools have seen increased adoption in non-hospital settings. Moreover, the national healthcare policy increasingly supports decentralization of care to reduce the burden on hospitals, further reinforcing the role of disposable supplies in enabling efficient and accessible patient care beyond traditional clinical environments.

Technological Innovation and Sustainability Initiatives

Continuous innovation in material science and manufacturing processes is enhancing the quality, functionality, and safety of disposable medical supplies. Dutch manufacturers are investing in research and development to create products that are not only more effective but also environmentally sustainable. The growing awareness around medical waste and its environmental impact has led to a shift toward biodegradable and recyclable materials. Hospitals and healthcare providers are gradually incorporating sustainability criteria into their procurement policies, encouraging suppliers to offer eco-friendly solutions. These innovations are not only meeting market demands for better performance but also aligning with the Netherlands’ broader goals of reducing carbon footprints and promoting circular economy practices within the healthcare sector.

Market Trends

Surge in Home Healthcare Services

The Netherlands is witnessing a significant shift toward home healthcare, driven by an aging population and a preference for at-home treatment options. For instance, the Dutch Ministry of Health, Welfare and Sport has reported an increase in the adoption of home healthcare services, supported by policies that encourage decentralization of care. This trend is increasing the demand for disposable medical supplies such as wound care products, diagnostic tools, and infusion devices. The convenience, cost-effectiveness, and safety of single-use items make them ideal for home-based care, aligning with national healthcare policies that encourage decentralization of services. As more patients opt for home healthcare, manufacturers are focusing on developing user-friendly, sterile, and easy-to-use disposable products tailored for non-clinical settings.

Integration of Digital Health Technologies

Advancements in digital health technologies are transforming the disposable medical supplies market in the Netherlands. For instance, the Health Council of the Netherlands has emphasized the role of remote patient monitoring devices and telemedicine platforms in enhancing healthcare delivery. These technologies often rely on disposable components such as sensors, test strips, and electrodes. The adoption of digital health solutions is streamlining healthcare delivery, improving patient outcomes, and driving the demand for disposable medical supplies that support these innovations.

Regulatory Support and Healthcare Infrastructure Investments

The Dutch government’s commitment to improving healthcare infrastructure and patient safety is reinforcing the demand for disposable medical supplies. Policies that emphasize infection control, hygiene standards, and the prevention of healthcare-associated infections are encouraging healthcare facilities to adopt single-use products. Additionally, investments in healthcare infrastructure are expanding the reach of medical services, further increasing the need for disposable supplies. Regulatory frameworks that support quality standards and patient safety are creating a conducive environment for the growth of the disposable medical supplies market.

Focus on Sustainability and Eco-Friendly Products

Environmental sustainability is becoming a significant consideration in the disposable medical supplies market in the Netherlands. Growing awareness of the environmental impact of medical waste is prompting healthcare providers and manufacturers to seek eco-friendly alternatives. The development of biodegradable materials, recyclable packaging, and the reduction of plastic usage are key trends shaping the market. Healthcare institutions are increasingly prioritizing sustainable practices, aligning with broader environmental goals and driving the demand for eco-friendly disposable medical supplies.

Market Challenges Analysis

Rising Environmental Concerns and Waste Management Issues

One of the primary challenges facing the Netherlands disposable medical supplies market is the growing environmental impact of medical waste. For instance, the Health Council of the Netherlands has highlighted that the healthcare sector is responsible for a significant portion of national CO2 emissions and waste generation, particularly from single-use medical products. With the increasing adoption of single-use products, the volume of waste generated by healthcare facilities is rising significantly. Medical waste, particularly plastic-based disposables, poses a challenge in terms of disposal and recycling. The need for proper waste management systems and environmentally sustainable alternatives is becoming more pressing. While there is a growing demand for eco-friendly products, the transition to biodegradable or recyclable materials often involves higher production costs, which can be a barrier for manufacturers. Additionally, healthcare facilities are under pressure to balance infection control needs with the environmental impact of medical waste, creating a complex challenge for the industry.

Supply Chain Disruptions and Cost Pressures

Another challenge impacting the disposable medical supplies market in the Netherlands is the vulnerability of global supply chains. Recent disruptions, such as those caused by the COVID-19 pandemic, have highlighted the dependency on international suppliers for critical raw materials and finished products. Fluctuations in the availability of essential components, such as plastics and chemicals, can lead to supply shortages and price hikes, affecting both manufacturers and healthcare providers. Additionally, the rising cost of raw materials, labor, and transportation further compounds the financial pressures on companies in the medical supply sector. As cost-efficiency remains a priority, manufacturers are under constant pressure to innovate while maintaining competitive pricing, a challenge that is exacerbated by external economic factors.

Market Opportunities

The Netherlands disposable medical supplies market presents several key opportunities driven by demographic, technological, and regulatory factors. As the aging population continues to grow, the demand for healthcare services increases, driving the need for medical supplies in hospitals, outpatient facilities, and home care settings. The growing prevalence of chronic diseases, such as diabetes and cardiovascular conditions, is further contributing to this demand. This demographic shift opens opportunities for manufacturers to develop specialized disposable products tailored to the needs of older patients, including incontinence supplies, wound care items, and insulin syringes. Additionally, the government’s ongoing efforts to improve healthcare infrastructure and patient safety are likely to support continued growth in the sector, especially in areas focused on infection control and hygiene standards.

Another significant opportunity lies in the increasing adoption of digital health solutions and telemedicine, which is shaping the future of healthcare delivery in the Netherlands. The integration of remote patient monitoring and home healthcare services creates new avenues for disposable medical supplies that complement these technologies, such as sensors, diagnostic kits, and portable testing devices. Furthermore, the growing focus on sustainability in healthcare offers manufacturers the chance to innovate with eco-friendly materials and solutions. Developing biodegradable or recyclable disposable products that meet both environmental and regulatory standards presents a unique opportunity to gain market share in a more environmentally conscious healthcare landscape. As healthcare providers increasingly prioritize cost-effective, safe, and sustainable solutions, the market for disposable medical supplies will continue to expand, creating favorable conditions for innovation and growth.

Market Segmentation Analysis:

By Type:

The Netherlands disposable medical supplies market can be segmented based on product type, with each segment addressing distinct healthcare needs. Wound management products, including dressings, bandages, and surgical drapes, hold a significant share in the market due to the increasing number of surgeries and the growing demand for advanced wound care solutions. These products are essential in minimizing infection risks and promoting faster healing, making them highly critical in both hospital and home care settings. Drug delivery products, such as insulin syringes, inhalers, and auto-injectors, are also experiencing growth driven by the rising prevalence of chronic conditions like diabetes and asthma, which require regular medication administration. Diagnostic and laboratory disposables, including test kits, syringes, and sample collection tools, are in high demand due to the expansion of diagnostic testing and laboratory-based healthcare services. The dialysis disposables segment, consisting of dialysis machines, filters, and tubing, benefits from the increasing number of renal disease patients. Incontinence products, such as adult diapers and urinary catheters, are experiencing a surge due to the aging population, creating a significant demand in both institutional and home care environments.

By Raw Material:

The raw material segment plays a crucial role in determining the quality, cost, and functionality of disposable medical supplies in the Netherlands. Plastic resins dominate the market as the primary material used in manufacturing a wide range of disposable medical products, including syringes, gloves, and packaging materials. Plastic offers durability, versatility, and cost-effectiveness, making it a preferred choice across various medical applications. Nonwoven materials are also a key component, particularly in products such as surgical drapes, gowns, and wound care dressings, due to their absorbent and breathable nature. These materials are essential for maintaining patient comfort and hygiene during medical procedures. Rubber is commonly used in gloves, catheters, and seals due to its flexibility, elasticity, and resistance to various chemicals. Paper and paperboard are increasingly used in medical packaging and disposable sterilization wraps, where biodegradability and environmental considerations play an important role. The market is gradually shifting towards more sustainable materials, and as demand for eco-friendly solutions grows, manufacturers are exploring alternatives that combine both performance and environmental responsibility.

Segments:

Based on Type:

- Wound Management Products

- Drug Delivery Products

- Diagnostic and Laboratory Disposables

- Dialysis Disposables

- Incontinence Products

Based on Raw Material:

- Plastic Resins

- Nonwoven Material

- Rubber

- Paper

- Paperboard

Based on End- User:

- Hospitals

- Home

- Healthcare

- Outpatient/Primary Care Facilities

- Others

Based on the Geography:

- Western Netherlands

- Southern Netherlands

- Northern Netherlands

- Eastern Netherlands

Regional Analysis

Western Netherlands

The Western Netherlands region holds the largest market share in the disposable medical supplies sector, accounting for approximately 40% of the total market. This region includes key metropolitan areas such as Amsterdam, Rotterdam, and The Hague, which are hubs for healthcare institutions, research centers, and pharmaceutical companies. The dense population and the presence of leading hospitals and healthcare facilities in this region contribute to the high demand for disposable medical products. Moreover, Western Netherlands benefits from its advanced healthcare infrastructure, strong government support for healthcare innovation, and proximity to international trade routes, which facilitates the import and export of medical supplies. The region’s demand is driven by critical sectors such as wound management, drug delivery products, and diagnostic disposables, which continue to grow due to increasing healthcare needs in urban centers.

Southern Netherlands

Southern Netherlands, which includes cities such as Eindhoven, Maastricht, and Tilburg, holds a market share of around 25% in the disposable medical supplies market. This region is known for its strong industrial base, particularly in the healthcare and medical technology sectors. The presence of medical device manufacturers and research institutions stimulates demand for disposable medical supplies, especially in specialized areas like dialysis disposables and incontinence products. Southern Netherlands benefits from proximity to Belgium and Germany, enhancing its position as a gateway for international trade. The growing elderly population in the region, combined with a focus on chronic disease management, drives the demand for incontinence products, wound care, and diagnostic tools, further contributing to market growth.

Northern Netherlands

The Northern Netherlands region, including cities like Groningen and Leeuwarden, accounts for approximately 15% of the disposable medical supplies market share. While this region is less densely populated compared to other areas, it still plays a significant role due to its well-established healthcare infrastructure and specialized medical institutions. The demand for disposable medical supplies in this region is influenced by the aging population and the increasing need for home healthcare services. As a result, there is a growing consumption of products such as wound management supplies and drug delivery devices. The Northern Netherlands has also seen an increase in regional healthcare investments, fostering a supportive environment for the expansion of disposable medical products in both hospitals and home care settings.

Eastern Netherlands

Eastern Netherlands, with cities like Arnhem and Enschede, holds around 20% of the market share in disposable medical supplies. This region has a strong healthcare network and is increasingly focusing on medical research and innovation. The demand for disposable medical supplies is rising in areas such as diagnostic disposables and drug delivery products, driven by an increase in both outpatient care and chronic disease management. Additionally, Eastern Netherlands benefits from its strategic location close to Germany, enhancing the distribution of medical products. The region’s robust healthcare facilities and regional policies that support sustainable healthcare practices create a conducive environment for growth in disposable medical supplies. Although it holds a smaller share than the Western and Southern regions, the Eastern Netherlands continues to show promising growth due to the increasing adoption of advanced medical technologies.

Key Player Analysis

- Smith+Nephew

- Shanghai Neo-Medical Co., Ltd

- Procter & Gamble

- Principle Business Enterprises, Inc

- Ontex

- Medtronic

- Nu-Life Medical & Surgical Supplies Inc

- Narang Medical Limited

- Molnlycke Health Care

- Mellon Medical B.V.

- MedGyn Products, Inc

- MED-CON Inc.

- Van Straten Medical

Competitive Analysis

The Netherlands disposable medical supplies market is highly competitive, with leading global and regional players continually innovating to meet the growing demand for high-quality medical products. Key players include Smith+Nephew, Medtronic, Molnlycke Health Care, Procter & Gamble, Ontex, Shanghai Neo-Medical Co., Ltd, Principle Business Enterprises, Inc., Nu-Life Medical & Surgical Supplies Inc., Narang Medical Limited, Mellon Medical B.V., MedGyn Products, Inc., MED-CON Inc., and Van Straten Medical. These companies dominate the market by offering a wide range of disposable products, such as wound care, drug delivery devices, incontinence products, and diagnostic disposables. They focus on offering a diverse range of disposable medical products such as wound care solutions, drug delivery devices, diagnostic disposables, and incontinence products, catering to the rising demand from healthcare facilities and home care settings. Competitive strategies in this market include continuous product innovation to enhance safety, performance, and ease of use, addressing the increasing complexity of medical procedures. Manufacturers are also investing in sustainability, with many shifting toward eco-friendly and biodegradable materials to meet growing environmental concerns and regulatory pressures. Companies are increasingly forming strategic partnerships with healthcare providers to strengthen their market presence and expand their reach. Additionally, the development of cost-effective solutions is crucial as healthcare costs rise, driving competition in terms of both price and product value. As healthcare infrastructure improves across the Netherlands, competition among medical supply companies is expected to intensify, pushing further advancements in product quality and service delivery.

Recent Developments

- In March 2025, At the AAOS Annual Meeting, Smith+Nephew introduced the TESSA Spatial Surgery System, a 510(k)-pending technology combining augmented reality and advanced imaging for arthroscopic surgeries.

- In March 2025, Ontex inaugurated a new R&D center in Segovia, Spain, focusing on sustainable feminine care innovations and eco-friendly production processes.

- In May 2024, PBE invested in expanding production capacity for plus-size incontinence products, launching new 3XL disposable pull-on underwear with breathable materials to enhance comfort and skin health.

- In 2024, Medtronic initiated the limited release of its Evolut FX+ Transcatheter Aortic Valve Replacement device for minimally invasive heart surgeries.

- In May 2023, P&G acquired an established antiseptic brand to strengthen its hygiene portfolio, reflecting a strategic expansion into the personal hygiene market.

Market Concentration & Characteristics

The Netherlands disposable medical supplies market exhibits a moderate level of market concentration, with a mix of global giants and local players. While multinational companies dominate the market, local suppliers also hold significant positions by offering specialized products tailored to regional healthcare needs. The market is characterized by a high degree of innovation, with continuous advancements in product design and material technologies aimed at improving safety, efficacy, and patient comfort. Manufacturers are focusing on enhancing the functionality of their disposable medical products while responding to the growing demand for sustainable solutions, such as biodegradable and recyclable options. The competitive landscape is influenced by factors such as technological advancements, pricing strategies, and the ability to adapt to changing regulations and environmental considerations. The market is also marked by strategic collaborations, with companies partnering with healthcare providers to expand their reach and meet the increasing demand for quality, cost-effective, and environmentally friendly disposable medical supplies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Raw Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Netherlands disposable medical supplies market is projected to grow steadily, driven by increasing healthcare demands and an aging population.

- Technological advancements, including AI integration and smart monitoring systems, are enhancing product functionality and patient care.

- The shift towards eco-friendly and biodegradable materials is gaining momentum, aligning with sustainability goals in healthcare.

- The expansion of home healthcare services is boosting the demand for portable and user-friendly disposable medical products.

- Infection control remains a priority, leading to a sustained need for single-use sterile items in clinical settings.

- Regulatory pressures are encouraging manufacturers to adopt greener practices and reduce environmental impact.

- Strategic collaborations and acquisitions are expected to intensify as companies seek to strengthen market positions and expand product offerings.

- Rising awareness of hygiene and safety standards is influencing purchasing decisions in healthcare facilities.

- Supply chain optimization and digital transformation are improving efficiency and reducing operational costs.

- The market’s future growth is contingent upon balancing innovation, sustainability, and cost-effectiveness to meet evolving healthcare needs.