Market Overview:

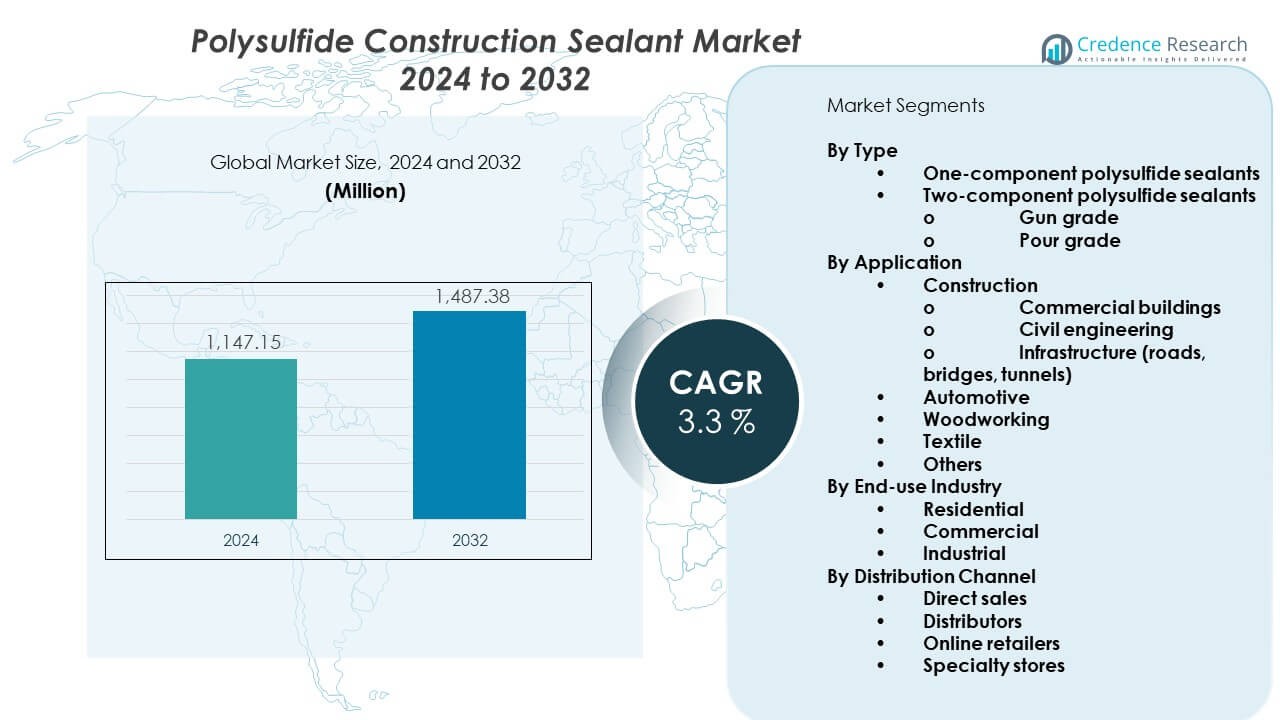

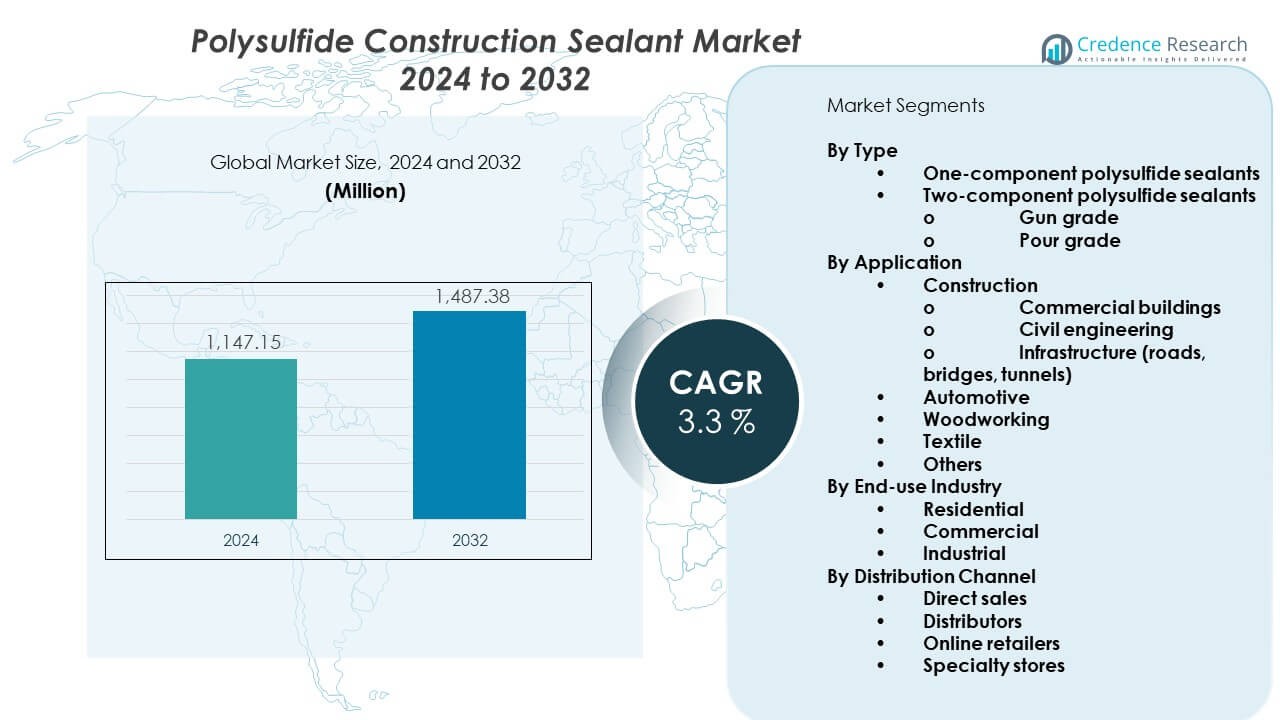

The Polysulfide Construction Sealant Market is projected to grow from USD 1,147.15 million in 2024 to an estimated USD 1,487.38 million by 2032, with a CAGR of 3.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polysulfide Construction Sealant Market Size 2024 |

USD 1,147.15 Million |

| Polysulfide Construction Sealant Market, CAGR |

3.3% |

| Polysulfide Construction Sealant Market Size 2032 |

USD 1,487.38 Million |

Demand grows as builders need durable sealing solutions for joints exposed to movement, chemicals, and weather stress. Adoption rises in large infrastructure upgrades where long-term elasticity supports safer structures. Manufacturers promote high-performance grades used in façades, runways, and water-retaining systems. Strict construction standards increase the shift toward materials that resist cracking and moisture. Repair teams also prefer these sealants due to strong bonding and long service life in harsh zones.

North America leads due to widespread commercial renovation and strong compliance with sealing standards. Europe follows based on strict building codes and ongoing infrastructure renewal. Asia Pacific emerges as a fast-growing region supported by urban expansion across India, China, and Southeast Asia. The Middle East shows rising adoption driven by large construction projects in high-temperature climates. Latin America develops steadily with increasing investment in transport and residential upgrades.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market overview shows the Polysulfide construction sealant market valued at USD 1,147.15 million in 2024, projected to reach USD 1,487.38 million by 2032, and growing at a CAGR of 3.3%.

- North America leads with approximately ~38% share due to extensive infrastructure and high sealing standards; Europe follows with ~28% driven by stringent regulations and renovation of older buildings; Asia-Pacific holds about ~22% aided by rapid urbanisation and industrial expansion.

- Asia-Pacific is the fastest-growing region, with a ~22% share driven by large-scale infrastructure projects, rising residential construction, and increasing industrial applications.

- By type, one-component sealants command around ~55% of the market thanks to ease of use, while two-component (gun-grade and pour-grade combined) hold about ~45% because of superior performance in demanding joints.

- In application, the construction segment (commercial buildings, civil engineering, infrastructure) comprises roughly ~65% of demand due to large joint sealing requirements, while automotive, woodworking, textile and other uses represent about ~35%.

Market Drivers:

Strong Demand for Long-Life Joint Protection in Infrastructure and Commercial Buildings

The Polysulfide construction sealant market advances due to rising demand for durable joint sealing across heavy structures. Builders specify these sealants for bridges, runways, façades, and tanks that require long-term elasticity. Engineers prefer formulations that maintain bond strength under heat, moisture, and chemical exposure. Demand expands with renovation cycles in commercial towers and transport hubs. It supports safer designs that reduce structural stress around movement-prone joints. Construction teams apply these sealants to protect expansion zones across large surfaces. Buyers choose high-performance grades that handle pressure changes in extreme climates. Strong lifespan advantages reinforce interest across public and private projects.

- For instance, Sika joint sealing systems for highways and runways are widely used on concrete pavements and plaza decks and meet ASTM C920 and ASTM D5893 requirements, with approvals from many U.S. Departments of Transportation.

Growing Need for High Chemical Resistance in Industrial and Utility Projects

Industrial operators adopt polysulfide sealants to secure storage zones, wastewater systems, and processing areas. The material offers stable performance when exposed to fuels, solvents, and aggressive compounds. Demand rises in chemical plants where joint failure creates safety risks. It supports regulated facilities that enforce strict sealing standards for containment. Utility agencies rely on these compounds to protect pipelines and reservoirs. Manufacturing sites choose them to maintain operational continuity in corrosive work zones. Strong adhesion helps reduce maintenance downtime across large layouts. Rising compliance pressure strengthens material preference across multiple industries.

- For instance, Fosroc reports that its joint sealant solutions have been used for over 60 years on iconic buildings such as the Royal Grandstand at Ascot Racecourse and the Holy Mosque in Madinah, while its water-industry systems protect reservoirs and treatment works from chemical attack, joint leaks, cracks, and corrosion.

Expansion of Modern Construction Practices Requiring Elastic and Movement-Tolerant Materials

Modern architecture favors flexible materials that adapt to thermal shifts and structural motion. Polysulfide sealants meet these requirements through consistent elasticity. Engineers specify them for curtain walls, modular units, and composite panels. It supports design approaches that integrate high glass content and lightweight framing. Demand rises as builders target leak-free joints in challenging geometric layouts. Contractors value easy tooling and predictable curing in large builds. Adoption grows with the shift toward precision sealing in prefabricated systems. Their mechanical stability boosts confidence across advanced construction workflows.

Rising Focus on Water-Retaining and Weather-Exposed Structures Needing Strong Moisture Barriers

Water-retaining structures depend on reliable sealing to prevent leakage and material fatigue. Polysulfide sealants maintain stability in submerged or damp conditions. Municipal agencies use them for dams, reservoirs, and treatment plants. It supports long-term moisture control in outdoor infrastructure. Builders apply these compounds to façades that encounter heavy wind load and rainfall. Strong UV and ozone tolerance preserve performance in open environments. Operators prefer them for reducing repair cycles in weather-exposed assets. Growing climate variability encourages broader use across sensitive construction categories.

Market Trends:

Shift Toward Advanced Formulations with Improved Environmental and Worker Safety Profiles

Producers introduce low-VOC formulations that meet updated emission norms. The Polysulfide construction sealant market adapts to stricter safety criteria across major regions. Manufacturers redesign blends to reduce odors and improve application comfort. It supports contractors who work in sealed or sensitive environments. Buyers prefer options that simplify compliance during large building upgrades. R&D teams develop cleaner chemistries without compromising durability. Adoption grows across sectors focused on green-building certification. The trend aligns with rising demand for sustainable construction materials.

- For instance, SikaSeal-106 Construction carries GEV-Emicode EC1PLUS, LEED v4 EQc2 low-emitting materials, and RTS M1 classifications, while Sikaflex Construction Sealant reports a VOC content of 37 g/L, supporting low-emission building and indoor air quality goals documented in Sika’s guidance on low-VOC adhesives and sealants.

Integration of Automated and Precision-Controlled Application Methods Across Worksites

Construction teams shift to automated dispensing systems that improve sealing accuracy. Advanced equipment applies uniform beads across large joint distances. The Polysulfide construction sealant market benefits from faster installation cycles supported by machine-assisted workflows. It supports reduced waste and more consistent adhesion. Robotics improve performance in difficult-to-reach joints. Skilled labor shortages accelerate interest in semi-automated tools. Adoption grows in high-volume commercial and industrial settings. Precise output enhances long-term structural reliability.

- For instance, a bus manufacturer partnering with Pioneer Industrial Systems deployed a robotic urethane dispensing cell that improved quality and consistency, increased throughput, and helped relieve labor shortages, showing how automated sealant application boosts productivity in high-volume settings.

Growing Use of Sealants in Smart Infrastructure and High-Performance Building Designs

Modern projects feature embedded sensors and technical components requiring controlled sealing zones. Builders incorporate polysulfide compounds into smart façades and utility hubs. The Polysulfide construction sealant market aligns with trends in connected and energy-efficient infrastructure. It supports airtight envelopes that reduce losses in climate-controlled spaces. Architects choose flexible sealants to accommodate dynamic building systems. Interest rises in mixed-use skyscrapers with complex joint structures. Designers value high bonding stability across varied materials. This trend expands use across premium construction segments.

Rising Adoption in Marine, Aviation, and Specialty Engineering Projects

Specialty sectors use polysulfide sealants for demanding environments involving vibration, salt exposure, and heavy load. Marine teams rely on them for hull joints and storage zones. Aviation crews apply them to fuel systems and pressure-sensitive areas. The Polysulfide construction sealant market gains traction in technical upgrades across transport sectors. It supports safety-critical repairs where bond failure carries high risk. Demand rises with fleet renewal projects in ports and airports. Specialty contractors value consistent adhesion in multi-material assemblies. Growth continues across industries with extreme exposure demands.

Market Challenges Analysis:

Stringent Regulatory Scrutiny and Rising Compliance Costs Across Manufacturing and Application Stages

Producers face complex regulatory requirements governing VOC emissions, worker safety, and chemical management. Compliance raises operational costs across production lines. The Polysulfide construction sealant market must adjust to frequent updates in material standards. It manages certification needs for infrastructure and industrial approvals. Buyers evaluate documentation more carefully before product selection. Regional variations in rules complicate international supply planning. Contractors require training to maintain safe application practices. These factors create pressure on companies operating in cost-sensitive project ecosystems.

Growing Competition from Alternative Sealant Technologies Offering Faster Cures and Easier Handling

Alternative chemistries such as silicone, polyurethane, and hybrid sealants gain traction in several projects. These options offer faster cure rates and simpler application steps. It challenges polysulfide manufacturers to maintain competitiveness in mainstream construction. Buyers often compare maintenance profiles and labor requirements before choosing a material. Some alternatives provide stronger aesthetic finishes for visible joints. Market penetration increases in segments where extreme chemical resistance is not required. Distributors introduce wider product lines that shift preference patterns. Competitive pressure pushes producers to enhance performance features.

Market Opportunities:

Expansion Potential in Harsh-Environment Structures Requiring Extreme Chemical, Water, and Weather Resistance

Builders of reservoirs, chemical zones, and coastal assets seek high-grade sealing solutions. The Polysulfide construction sealant market can expand through specialized grades designed for severe exposure. It supports uptime gains across industrial and utility networks. Demand increases in regions investing in water security and resilient infrastructure. Contractors adopt advanced sealants to reduce repair frequency in climate-heavy zones. Strong moisture control creates opportunities in both public and private construction. Buyers look for materials that deliver predictable long-term stability. Growth strengthens across sectors where safety margins remain critical.

Rising Scope in Modular, Prefabricated, and High-Precision Construction Models

Modern building methods rely on clean, consistent, and movement-tolerant sealing. The Polysulfide construction sealant market aligns with precision requirements in modular units. It supports rapid installation workflows across large housing and commercial programs. Prefabrication increases demand for uniform bonding solutions across varied surfaces. Design firms integrate flexible sealants to address expansion gaps in hybrid structures. Adoption rises as developers scale factory-built construction lines. Global prefabrication growth creates new opportunities for adaptable sealing products. This trend widens long-term demand across diverse applications.

Market Segmentation Analysis:

By Type

One-component and two-component polysulfide sealants drive usage across varied project needs. The Polysulfide construction sealant market gains strength from two-component grades that support heavy structural joints in civil and industrial settings. Gun grade formats suit precision work, while pour grade products handle large expansion joints. It supports diverse installation conditions across commercial and infrastructure projects.

- For instance, Fosroc supplies a wide range of two-component sealant systems for engineering projects and highlights long-term performance in major civil construction, while Sika’s pour-grade polysulphide products are specified for expansion joints where large movement is anticipated in concrete construction and between diverse materials.

By Application

Construction dominates due to extensive use in commercial buildings, civil structures, and transport infrastructure. Contractors depend on these sealants to protect road and bridge joints from moisture and chemical attack. Automotive applications grow with the need for fuel-resistant bonding. Woodworking, textile, and other sectors adopt these materials for stability and long-term elasticity. It maintains performance across demanding operational environments.

- For instance, Sika reports that its joint sealing systems for roads and highways are widely used in formed and saw-cut joints on concrete highways, runways, plaza decks, and driveways, meeting highway regulations and providing UV- and weather-resistant performance, while Fosroc solutions protect water-industry reservoirs and channels from chemical attack and joint leaks.

By End-use Industry

Commercial and industrial sectors lead adoption due to high structural load and safety requirements. Residential demand grows with rising renovation and waterproofing activities. Industrial facilities use these sealants to secure tanks, pipelines, and containment areas. It delivers consistent sealing performance across variable temperature and pressure conditions.

By Distribution Channel

Direct sales dominate large-scale procurement for infrastructure and commercial projects. Distributors support widespread availability for mid-sized contractors. Online retailers expand reach among small buyers needing fast access to specialized grades. Specialty stores maintain demand from technical users who prefer expert-guided product selection. It supports flexible sourcing across diverse customer segments.

Segmentation:

By Type

- One-component polysulfide sealants

- Two-component polysulfide sealants

By Application

- Construction

- Commercial buildings

- Civil engineering

- Infrastructure (roads, bridges, tunnels)

- Automotive

- Woodworking

- Textile

- Others

By End-use Industry

- Residential

- Commercial

- Industrial

By Distribution Channel

- Direct sales

- Distributors

- Online retailers

- Specialty stores

By Region / Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds a leading share of the Polysulfide construction sealant market, supported by strong infrastructure renewal programs. The region maintains high adoption across commercial buildings and transport networks with strict sealing standards. It benefits from advanced construction practices that require long-life joint protection. Demand increases in airports, bridges, and public facilities due to heavy structural stress. Suppliers operate well-established distribution networks across the United States and Canada. Market growth remains stable due to frequent maintenance cycles and rising waterproofing needs.

Europe

Europe secures a significant market share driven by strict regulatory norms and widespread use of high-performance sealing materials. The region invests heavily in heritage restoration, commercial renovation, and industrial upgrades. The Polysulfide construction sealant market supports projects targeting thermal movement control and moisture protection. Contractors prefer long-lasting formulations for façades, tunnels, and water-retaining structures. Demand expands with rising emphasis on energy-efficient buildings across Germany, the UK, and France. Strong compliance requirements sustain long-term consumption across public and private construction zones.

Asia-Pacific, Latin America, and Middle East & Africa

Asia-Pacific represents the fastest-growing share due to rapid urbanization, large-scale infrastructure programs, and industrial expansion. Demand rises across China, India, and Southeast Asia where high humidity and temperature shifts require elastic sealing materials. The Polysulfide construction sealant market gains traction through increasing construction of bridges, highways, and commercial complexes. Latin America holds a developing share supported by growing investment in residential and light commercial projects. The Middle East & Africa expand steadily with demand from industrial hubs and climate-exposed structures. Rising mega-projects in Gulf countries strengthen long-term adoption.

Key Player Analysis:

- Pecora Corporation

- Euclid Chemical

- Coastal Construction Products

- NEDEX GROUP

- AkzoNobel

- Fosroc Inc.

- Sika AG

- Henkel AG & Co. KGaA

- B. Fuller

- Trelleborg AB

Competitive Analysis:

The Polysulfide construction sealant market shows strong competition driven by performance upgrades, wider distribution reach, and targeted expansion across infrastructure and industrial segments. Leading companies focus on durable formulations that support long-life sealing in demanding environments. It benefits from suppliers that invest in high-adhesion compounds for bridges, tunnels, and commercial façades. Major brands strengthen market presence through supply chain alignment and contractor-focused product support. New entrants face pressure from established companies with long-standing regulatory compliance and technical certifications. Strategic pricing, product reliability, and wide application coverage influence competitive positioning. Vendors continue to expand across North America, Europe, and Asia-Pacific through technical partnerships and distribution agreements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on By Type, By Application, By End-use Industry, and By Distribution Channel segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise for high-flexibility sealants used in bridges, runways, and civil structures.

- Adoption will strengthen across commercial façades due to higher movement-tolerance needs.

- Industrial operators will expand use in chemical and water-retaining facilities requiring strong resistance.

- Product innovation will focus on low-VOC and safer formulations aligned with compliance norms.

- Distribution networks will widen through hybrid models combining direct sales and digital channels.

- Contractors will prefer formulations that deliver predictable curing and long-term durability.

- Infrastructure upgrades in Asia-Pacific will reinforce regional growth momentum.

- Repair and maintenance cycles will support steady consumption across aging structures.

- Marine and specialty projects will adopt more high-adhesion polysulfide solutions.

- R&D teams will invest in advanced bonding chemistries to support next-generation construction methods.