Market Overview:

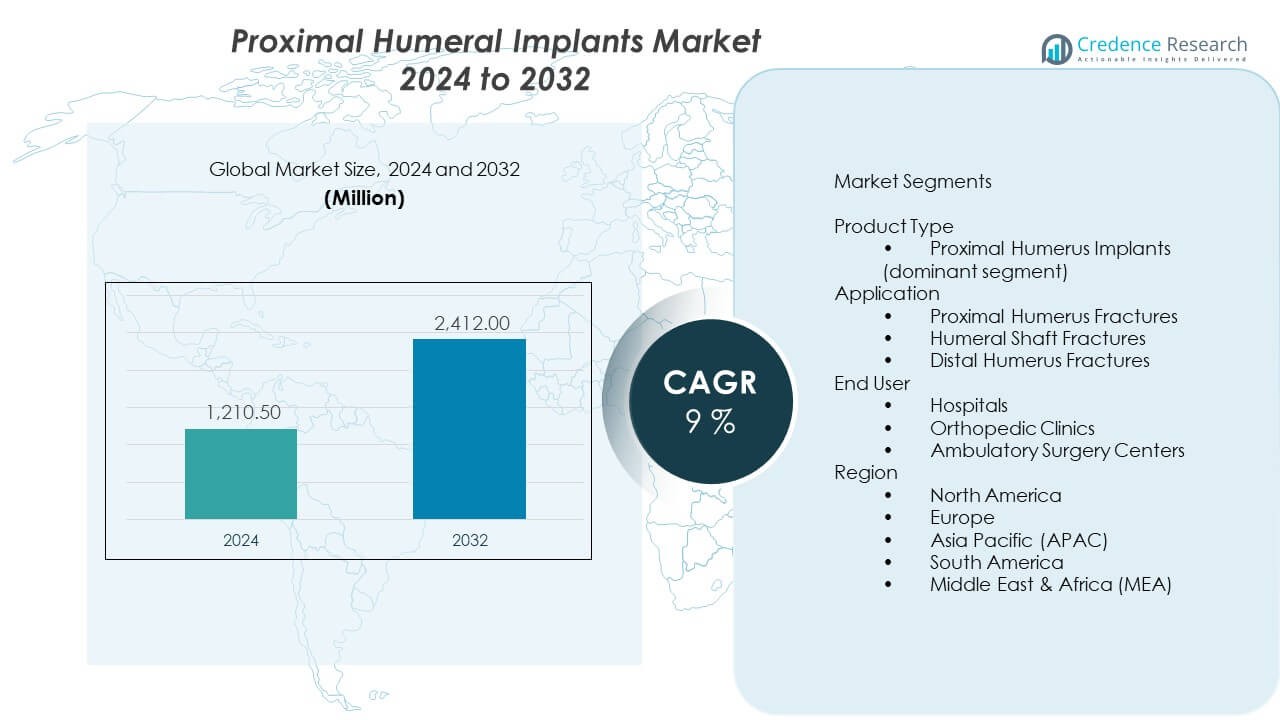

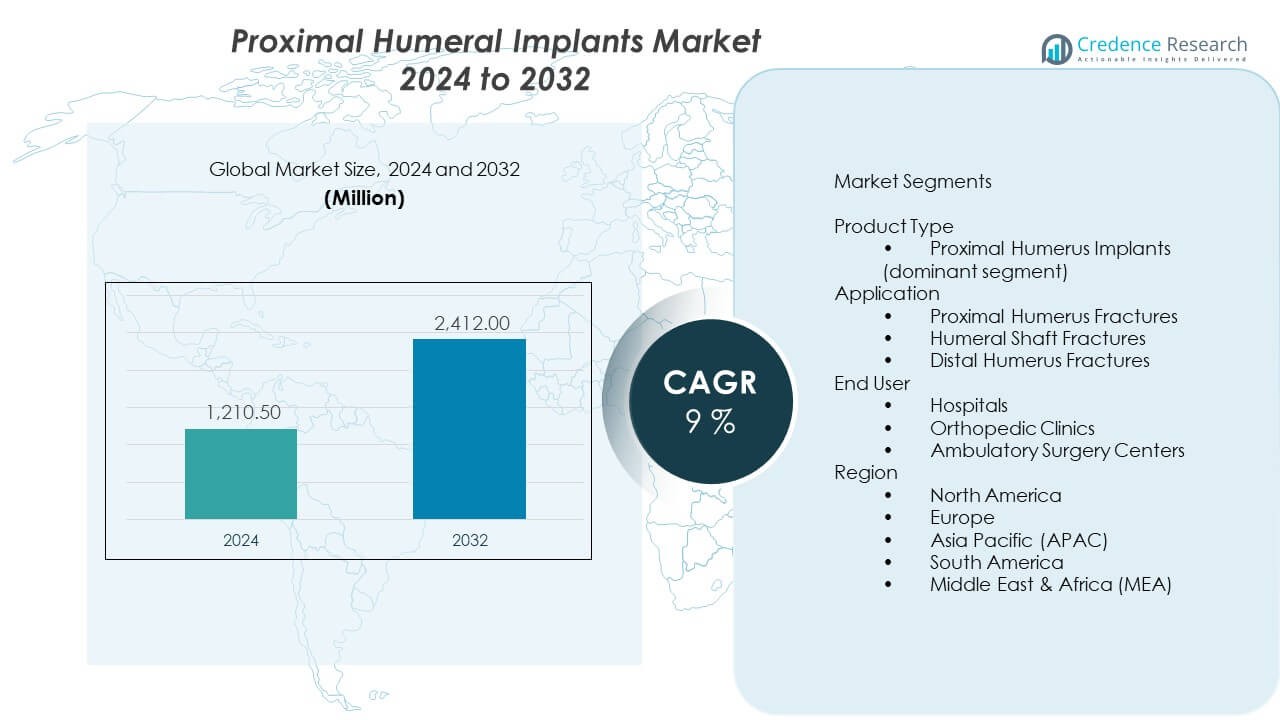

The Proximal Humeral Implants Market is projected to grow from USD 1,210.5 million in 2024 to an estimated USD 2,412 million by 2032, with a compound annual growth rate (CAGR) of 9% from 2024 to 2032. Rising demand for shoulder reconstruction procedures supports steady growth across hospitals and orthopedic centers.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Proximal Humeral Implants Market Size 2024 |

USD 1,210.5 Million |

| Proximal Humeral Implants Market, CAGR |

9% |

| Proximal Humeral Implants Market Size 2032 |

USD 2,412 Million |

Strong demand for trauma care drives wider adoption of proximal humeral implants. Surgeons prefer advanced fixation and replacement systems that support stable healing after fractures. The growth of outpatient orthopedic surgeries increases the use of modular and anatomically contoured implants. Aging populations raise the number of fracture cases linked to osteoporosis, which boosts procedural volume. Manufacturers enhance implant coatings and designs to reduce complications and improve postoperative recovery across diverse patient groups.

North America leads due to strong surgical infrastructure, high procedure rates, and early uptake of next-generation implant technologies. Europe follows with broad adoption supported by established orthopedic care networks and higher clinical awareness. Asia Pacific emerges as the fastest-growing region due to rising healthcare expansion, improving trauma care, and a sharp increase in fracture incidence across aging populations. Latin America and the Middle East show growing demand as access to specialized orthopedic services improves across major urban centers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Proximal humeral implants market is valued at USD 1,210.5 million in 2024 and is projected to reach USD 2,412 million by 2032, growing at a 9% CAGR during the forecast period.

- North America (38%), Europe (30%), and APAC (22%) hold the largest shares due to strong trauma care systems, advanced orthopedic networks, and rising fracture management capacity.

- APAC, holding 22%, is the fastest-growing region, driven by expanding trauma infrastructure, higher fracture incidence, and growing surgical adoption.

- Proximal humerus implants account for an estimated 62% of product-type share, supported by high usage in fracture reconstruction.

- Hospitals contribute around 58% of end-user share due to higher procedure volume and access to advanced implant systems.

Market Drivers:

Rising Surgical Volumes in Orthopedic Trauma Care

Rising fracture cases push hospitals to expand shoulder reconstruction capacity. Surgeons handle more proximal humerus trauma linked to aging populations. Demand for stable fixation grows across emergency departments. The Proximal humeral implants market gains traction through rising case complexity. It supports broader adoption of plates, nails, and stem systems. Better perioperative care encourages faster return-to-function goals. Hospitals invest in implants that reduce revision rates. Trauma centers adopt systems that streamline surgical workflows.

- For instance, a study of Zimmer Biomet’s A.L.P.S. proximal humerus locking plate in 15 patients reported 100% union with a mean union time of 15.1 weeks and no avascular necrosis, highlighting reliable fixation in demanding trauma cases.

Growing Adoption of Anatomically Designed Implant Systems

Surgeons choose implants that match patient anatomy with higher precision. Anatomical shaping helps achieve stable alignment in complex fractures. Demand rises for devices with smoother motion profiles after healing. The Proximal humeral implants market benefits from stronger clinical outcomes. It encourages hospitals to shift toward advanced designs. Better matching supports joint preservation and faster rehabilitation. Doctors value instruments that reduce soft-tissue disruption. Use expands in facilities with skilled orthopedic teams.

- For instance, a district general hospital series using DePuy Synthes’ PHILOS plate in 41 proximal humerus fractures achieved radiological union within eight weeks in 40 cases, with only four complications, demonstrating strong stability in multi-part fractures.

Advances in Biomaterials and Implant Surface Technologies

Manufacturers introduce surface treatments that support better bone integration. Coatings promote improved healing responses during early recovery. Hospitals prefer materials with strong corrosion resistance. The Proximal humeral implants market grows through rising technology upgrades. It gains support from improved biocompatibility features. Surgeons depend on coatings that reduce infection risk. New alloys support long-term endurance under active lifestyles. Implant stability improves across diverse patient age groups.

Shift Toward Outpatient and Minimally Invasive Shoulder Procedures

Ambulatory centers perform more shoulder surgeries each year. Smaller incisions reduce recovery timelines and improve patient comfort. Surgeons adopt implants suited for shorter operative cycles. The Proximal humeral implants market gains momentum from procedural efficiency. It fits modern care models that focus on faster discharge. Patients return sooner to routine activities through improved care pathways. Clinics prefer systems that simplify instrumentation. Demand grows across high-volume outpatient networks.

Market Trends:

Growth of Patient-Specific and Preoperative Planning Technologies

Software platforms guide surgeons in planning complex fracture repairs. Three-dimensional models support accurate implant positioning. Demand rises for procedures built around custom digital workflows. The Proximal humeral implants market evolves with broader adoption of planning tools. It benefits from improved visual guidance during surgery. Hospitals adopt systems that reduce alignment errors. Custom insights support better fixation outcomes. Clinics optimize surgical steps through digital integration.

- For instance, analysis shoulder arthroplasties performed with the ExactechGPS computer-assisted navigation and planning system showed that cases were completed as planned, with navigation-related complications in only 0.05% of patients, underlining high accuracy and safety.

Rising Integration of Robotic and Navigation-Assisted Systems

Navigation tools guide surgeons through detailed anatomical pathways. Robotic support improves accuracy in implant placement. Demand for automated alignment grows in complex trauma cases. The Proximal humeral implants market advances through higher precision needs. It gains momentum from hospitals adopting smart platforms. Controlled cutting and targeting reduce surgical variability. Teams value systems that support repeatable outcomes. Robotics strengthens confidence during demanding procedures.

- For instance, recent augmented reality–assisted navigation studies in reverse shoulder arthroplasty reported significantly reduced absolute error between planned and achieved glenoid inclination and version, confirming higher placement precision compared with conventional methods and supporting more reliable shoulder reconstruction.

Shift Toward Lightweight, High-Strength Implant Materials

Manufacturers explore new alloys that reduce implant weight. Stronger materials support reliable fixation under active use. Surgeons choose systems with higher fatigue resistance. The Proximal humeral implants market follows material innovation trends. It supports designs that maintain strength under repetitive motion. Engineers refine structures for optimal load transfer. Hospitals adopt lighter constructs that improve patient comfort. Growth aligns with rising preference for advanced material science.

Expansion of Reverse Shoulder Reconstruction in Complex Cases

Reverse techniques gain traction for complicated fracture patterns. Surgeons adopt designs that offer stronger deltoid-driven movement. Demand grows for implants supporting severe bone loss. The Proximal humeral implants market aligns with this shift in clinical practice. It supports broader use across elderly care settings. Better functional recovery encourages wider use. Doctors trust reverse systems for high-stability performance. Adoption expands across trauma and degenerative indications.

Market Challenges Analysis:

High Revision Rates and Clinical Complication Risks

Complications challenge long-term fixation stability across diverse patient groups. Surgeons face risks linked to non-union, implant loosening, and infection. Complex fractures raise chances of biomechanical failure. The Proximal humeral implants market must overcome variable bone quality. It sees slower adoption in regions with limited surgical expertise. Hospitals manage postoperative instability concerns in older patients. Device selection becomes difficult in osteoporotic conditions. Training gaps influence procedure consistency across institutions.

Cost Pressures and Limited Access in Resource-Constrained Regions

High implant prices restrict adoption in lower-income markets. Insurance coverage varies across healthcare systems. Limited trauma infrastructure slows advanced implant uptake. The Proximal humeral implants market faces challenges tied to affordability levels. It must address supply inconsistencies in remote areas. Hospitals depend on budget approvals for major orthopedic purchases. Economic strain delays upgrade cycles. Uneven access affects patient outcomes across global regions.

Market Opportunities:

Rising Demand for Advanced Shoulder Reconstruction Solutions Across Emerging Regions

Healthcare expansion supports greater access to orthopedic trauma care. Surgeons in emerging markets adopt modern fixation technologies. The Proximal humeral implants market gains opportunities through rising surgical capacity. It benefits from investments in trauma centers and improved imaging systems. Growth aligns with rising fracture incidence across aging populations. Hospitals seek implants that reduce long-term disability. Better training programs improve procedural confidence. Demand rises across both public and private facilities.

Growing Interest in Smart Implants and Real-Time Monitoring Technologies

Engineers explore implants with embedded sensors for performance tracking. Data-driven insights improve postoperative decision-making. The Proximal humeral implants market sees potential in connected device innovations. It supports hospitals focusing on predictive recovery models. Surgeons gain value from remote monitoring capabilities. Smart platforms enable early detection of complications. Adoption grows across research-driven orthopedic networks. Integration strengthens long-term patient management.

Market Segmentation Analysis:

Product Type

Proximal humerus implants dominate the product landscape due to strong use in fracture stabilization and joint reconstruction. Surgeons prefer these systems for reliable fixation, alignment control, and stable postoperative recovery. The Proximal humeral implants market gains traction through wider adoption of anatomically shaped plates, intramedullary nails, and stem-based devices that support varied clinical needs. It benefits from rising interest in advanced biomaterials and improved surgical instrumentation that strengthens procedural outcomes across trauma centers.

- For instance, a Taiwanese comparison of Zimmer Biomet’s A.L.P.S. and DePuy Synthes’ PHILOS plates in 66 patients reported an overall union rate of 98.5% and a significantly lower complication rate in the A.L.P.S. group, highlighting the performance of refined anatomic locking designs.

Application

Proximal humerus fractures lead demand due to high incidence among elderly patients with osteoporosis. Surgeons handle greater procedural volume in this group, which drives preference for locking plates and hybrid fixation systems. Humeral shaft fractures create steady demand for nails and plates that support controlled rotational stability. Distal humerus fractures require more complex fixation patterns, which guides uptake of specialized implants designed for joint preservation. Each application segment supports focused advancements in implant geometry and surface coatings.

- For instance, treatment of 28 proximal and combined proximal–shaft humeral fractures with Stryker’s T2 proximal humeral nail achieved healing in a mean 2.7 months, with only one delayed union and one asymptomatic humeral head necrosis, underscoring strong performance in both proximal and diaphyseal patterns.

End User

Hospitals remain the primary end users due to strong surgical capacity, trauma infrastructure, and access to advanced imaging support. Orthopedic clinics expand their role through rising elective and trauma-focused shoulder procedures. Ambulatory surgery centers gain momentum by adopting minimally invasive approaches that reduce patient stay and improve recovery timelines. Each end-user segment shapes purchasing patterns based on surgeon preference, case complexity, and procedural workflow requirements.

Segmentation:

Product Type

- Proximal Humerus Implants (dominant segment)

Application

- Proximal Humerus Fractures

- Humeral Shaft Fractures

- Distal Humerus Fractures

End User

- Hospitals

- Orthopedic Clinics

- Ambulatory Surgery Centers

Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the leading share of the global landscape, accounting for 38% of the Proximal humeral implants market. Strong trauma care systems support wider adoption of advanced fixation and reconstruction implants. Hospitals across the United States invest in updated plating and nailing systems to improve functional recovery after shoulder fractures. Surgeons rely on specialized instrumentation that enables precise alignment in complex trauma cases. The region benefits from early access to technological upgrades and faster regulatory approvals. It maintains high procedure volume due to active elderly populations and greater awareness of surgical treatment pathways.

Europe

Europe captures 30% of the market share and shows stable adoption across advanced orthopedic centers. Countries with strong trauma networks use structured clinical protocols that encourage widespread implant utilization. The Proximal humeral implants market gains steady traction through improved fixation techniques supported by regional training programs. It benefits from greater focus on anatomical implants that maintain joint mobility after fracture repair. Demand grows in Germany, France, and the United Kingdom due to rising osteoporosis-linked fracture rates. Hospitals and clinics adopt devices that reduce complication risk and support predictable rehabilitation outcomes.

Asia Pacific (APAC)

Asia Pacific secures 22% of the market and stands as the fastest-growing region due to expanding trauma infrastructure. Hospitals in China and India upgrade orthopedic departments to handle rising fracture incidence across both urban and rural populations. Surgeons adopt modern plating and nailing systems that support faster recovery under higher patient load. The Proximal humeral implants market advances through stronger investment in training programs and improved access to imaging technologies. It shows rapid expansion as private hospitals increase shoulder reconstruction volumes. Growth accelerates further through wider insurance coverage and rising awareness of surgical treatment options across emerging economies.

Key Player Analysis:

- Zimmer Biomet Holdings

- DePuy Synthes (Johnson & Johnson)

- Stryker Corporation

- Smith & Nephew plc

- Exactech, Inc.

- Arthrex, Inc.

- Medartis

- Wright Medical Group N.V

- Braun

- Medacta International

Competitive Analysis:

Leading manufacturers focus on expanding advanced fixation and reconstruction portfolios. The Proximal humeral implants market features strong competition among global orthopedic companies that invest in design upgrades, biomaterial improvements, and surgical instrumentation. It benefits from continuous product refinement that improves fixation strength and operative efficiency. Firms enhance coating technologies to support better bone integration. Strategic expansions increase surgeon access to optimized plating and nailing systems. Companies strengthen training programs that improve procedural consistency. Market competition intensifies as hospitals demand systems that reduce revision rates and improve functional outcomes.

Recent Developments:

- In March 2025, Zimmer Biomet also showcased a broad portfolio of orthopedic and musculoskeletal innovations at the AAOS annual meeting, including technologies for shoulder reconstruction that complement their proximal humeral implants, further reinforcing their leadership in upper extremity reconstruction.

- Zimmer Biomet’s OsseoFit® Stemless Shoulder System, cleared by the FDA in late 2024, continues to be adopted in clinical settings, offering a bone-preserving stemless shoulder implant designed for stable biological fixation by matching the natural asymmetric humeral anatomy.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on product, application, end user, and regional segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising need for advanced plating systems will support broader clinical adoption.

- Demand for anatomically shaped implants will increase across trauma centers.

- Growing interest in predictive digital planning will influence surgical workflows.

- Hospitals will invest more in systems that reduce revision risk.

- Surgeons will adopt stronger biomaterial-based implants for complex fractures.

- Reverse reconstruction procedures will gain traction for severe damage cases.

- Outpatient centers will expand usage through minimally invasive techniques.

- APAC markets will accelerate adoption with expanding trauma care networks.

- Smart implants will gain attention for improved postoperative monitoring.

- Training programs will strengthen regional expertise in shoulder trauma repair.