Market Overview

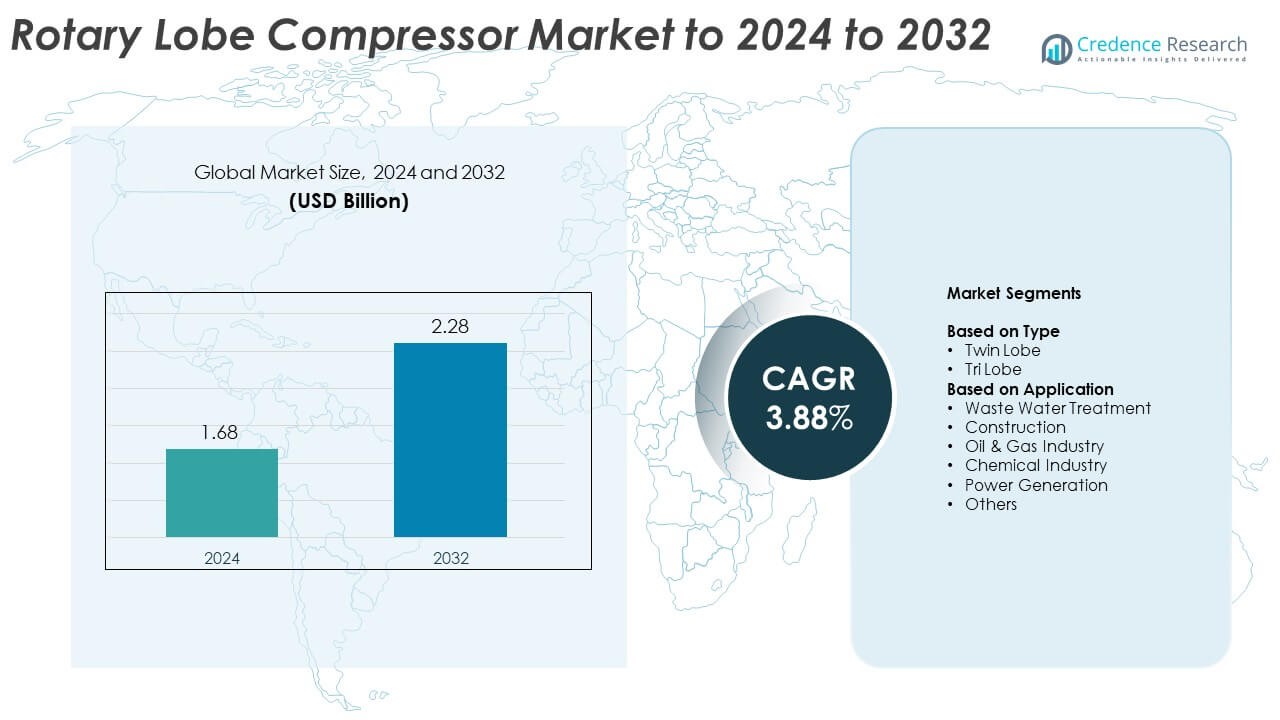

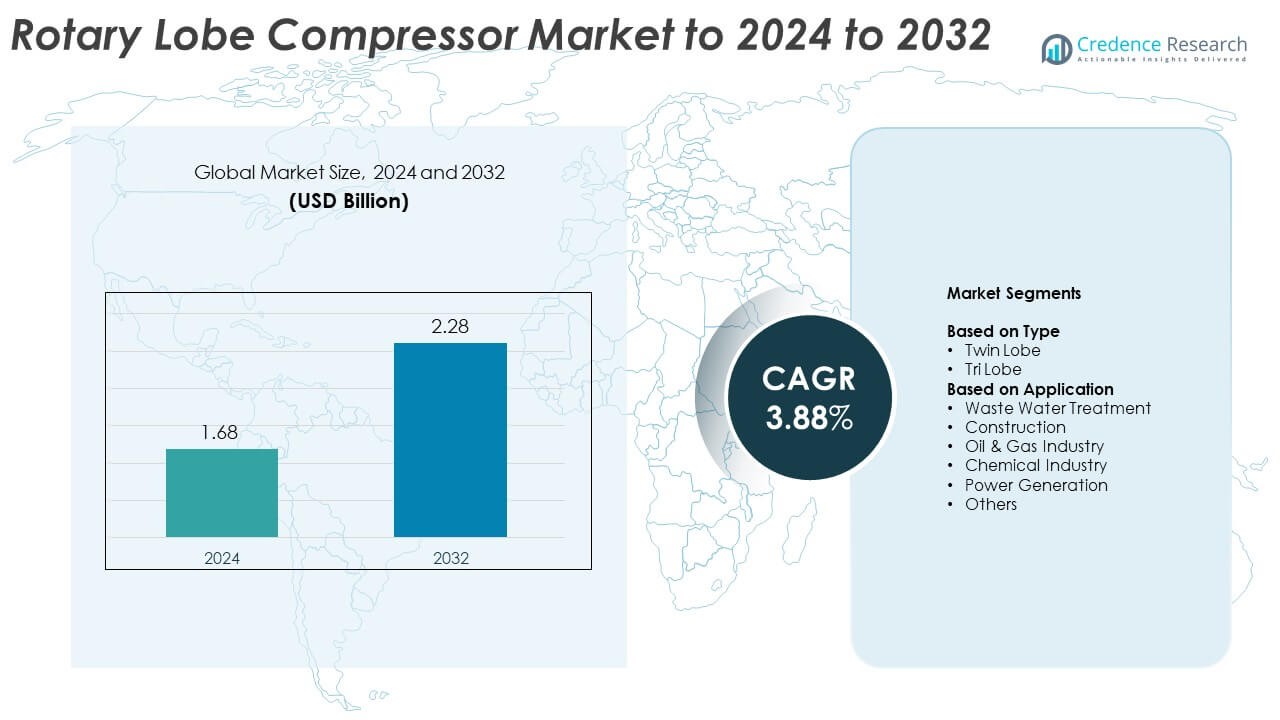

Rotary Lobe Compressor Market size was valued USD 1.68 Billion in 2024 and is anticipated to reach USD 2.28 Billion by 2032, at a CAGR of 3.88% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rotary Lobe Compressor Market Size 2024 |

USD 1.68 Billion |

| Rotary Lobe Compressor Market, CAGR |

3.88% |

| Rotary Lobe Compressor Market Size 2032 |

USD 2.28 Billion |

The rotary lobe compressor market is led by major players such as Atlas Copco AB, Kaeser Kompressoren SE, Gardner Denver Holdings Inc., Pfeiffer Vacuum Technology AG, Aerzen, Ebara Corporation, Busch Vacuum Solutions, Elmo Rietschle – Gardner Denver, Tuthill Corporation, and Anest Iwata Corporation. These companies dominate through advanced product portfolios, strong distribution networks, and focus on energy-efficient technologies. They invest heavily in R&D to enhance compressor performance and sustainability. Regionally, Asia-Pacific leads the market with a 30.9% share in 2024, driven by rapid industrialization and wastewater treatment expansion, followed by North America with 33.6% and Europe with 27.4%, supported by technological innovation and strict environmental regulations.

Market Insights

- The rotary lobe compressor market was valued at USD 1.68 billion in 2024 and is projected to reach USD 2.28 billion by 2032, expanding at a CAGR of 3.88%.

- Growing demand from wastewater treatment, chemical, and power generation sectors is driving market growth due to rising focus on efficient air systems.

- Trends such as IoT integration, predictive maintenance, and energy-efficient designs are reshaping compressor technology for industrial applications.

- The market is moderately competitive, with key players focusing on product innovation, low-maintenance systems, and expanding service networks to strengthen global presence.

- North America leads with 33.6% share, followed by Europe at 27.4% and Asia-Pacific at 30.9%, while the twin lobe segment dominates with 61.5% share driven by widespread industrial adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The twin lobe segment dominated the rotary lobe compressor market in 2024 with a 61.5% share. Its dominance stems from wide usage in low-pressure applications such as wastewater aeration and pneumatic conveying. Twin lobe compressors are preferred for their simple design, lower maintenance cost, and consistent air delivery. Their high reliability and suitability for continuous operation make them ideal in industries requiring non-contact air compression. The tri lobe segment is growing steadily due to better efficiency and reduced pulsation, supporting adoption in energy and process-intensive sectors.

- For instance, Howden offers a range of ROOTS rotary blowers. The small rotary performance blowers list flow rates up to 10,710 m³/h (6,300 cfm) and pressures to 15 psig.

By Application

The wastewater treatment segment held the largest market share of 34.2% in 2024. The segment’s growth is driven by rising investment in municipal and industrial water treatment infrastructure worldwide. Rotary lobe compressors are widely used for aeration and sludge drying due to their energy efficiency and low noise levels. The oil and gas and chemical industries also present strong demand for tri-lobe variants to ensure precise gas handling under variable pressure. Expanding environmental regulations and the need for efficient air systems continue to fuel adoption across wastewater facilities.

- For instance, Atlas Copco notes aeration blowers can consume at least 60% of a wastewater plant’s total energy, highlighting efficiency gains from modern units.

Key Growth Drivers

Rising Demand from Wastewater Treatment Plants

Expanding wastewater treatment infrastructure is a major driver of the rotary lobe compressor market. These compressors play a crucial role in aeration, sludge drying, and conveying systems. Growing urbanization and stricter water quality standards have increased the need for efficient aeration equipment. Governments and industries are investing in energy-efficient treatment systems, further supporting compressor adoption. Rotary lobe models are favored for continuous, low-maintenance operation and stable airflow, making them ideal for municipal and industrial treatment facilities.

- For instance, Inovair’s case study reports the Pickerington, Ohio WWTP aeration system used ~50% of the plant’s electricity before upgrades, guiding blower selection.

Growing Industrial Automation and Process Optimization

Industries such as chemical, oil and gas, and power generation are rapidly adopting automation technologies to enhance operational efficiency. Rotary lobe compressors support automation by providing precise, oil-free compressed air essential for sensitive processes. Manufacturers are integrating smart sensors and monitoring systems for predictive maintenance, reducing downtime. This shift toward automated operations across processing facilities significantly boosts compressor demand. The push for high reliability and efficiency in continuous production processes continues to strengthen market growth.

- For instance, Hitachi’s cloud service connected over 5,000 compressors by October 2019, enabling 24/7 condition monitoring and faster maintenance.

Increasing Focus on Energy Efficiency and Sustainability

Energy efficiency and sustainability are central to industrial air system design. Rotary lobe compressors consume less energy due to improved rotor profiles and optimized air delivery. Many industries are replacing older models with high-efficiency designs to reduce operational costs and carbon emissions. The market is gaining momentum as global initiatives promote cleaner and more sustainable technologies. Manufacturers are investing in eco-friendly compressor solutions that comply with energy management standards, strengthening adoption across power and manufacturing sectors.

Key Trends & Opportunities

Integration of IoT and Smart Monitoring Technologies

The integration of IoT in rotary lobe compressors is transforming maintenance and performance monitoring. Advanced sensors allow real-time tracking of pressure, vibration, and temperature, ensuring predictive maintenance. This digital shift minimizes unplanned downtime and enhances energy efficiency. Smart compressor systems are gaining traction in industries seeking data-driven insights for optimizing operations. The combination of connectivity and automation creates new opportunities for service-based compressor management models.

- For instance, KAESER’s SIGMA AIR MANAGER 4.0 centrally controls up to 16 compressors, coordinating real-time data and optimization.

Adoption in Renewable and Green Energy Projects

The global rise of renewable energy and green industrial projects is opening new opportunities for rotary lobe compressors. These compressors are increasingly used in biogas upgrading, hydrogen handling, and waste-to-energy plants due to their oil-free operation and reliable air output. As governments promote sustainable energy systems, the demand for low-emission and durable compressors continues to increase. This trend aligns with the shift toward cleaner production technologies and circular economy initiatives.

- For instance, Robuschi’s CRBIO/GRBIO lobe blower skids for biogas handling deliver capacities up to 2,850 m³/h with pressures to 400 mbar(g).

Key Challenges

High Initial Investment and Maintenance Costs

Despite their efficiency and durability, rotary lobe compressors involve high initial setup costs. Small and medium-scale enterprises often face financial constraints when upgrading to advanced compressor systems. Periodic maintenance, rotor replacement, and specialized repair services further add to operational expenses. These factors limit adoption in cost-sensitive industries. Manufacturers are focusing on offering modular and cost-effective models to overcome these barriers and enhance accessibility in emerging markets.

Competition from Alternative Compressor Technologies

The growing adoption of screw and centrifugal compressors presents a significant challenge for rotary lobe units. These alternatives often offer higher efficiency and quieter operation in certain pressure ranges. Rapid innovation in other compressor types makes it harder for rotary lobe systems to maintain competitiveness. However, their simplicity, oil-free operation, and steady flow rate remain strong advantages in niche applications such as wastewater treatment and pneumatic conveying.

Regional Analysis

North America

North America held a 33.6% share of the rotary lobe compressor market in 2024. The region benefits from strong industrial infrastructure and early adoption of advanced air systems. High demand across wastewater treatment, oil and gas, and power generation industries drives steady growth. The United States dominates due to expanding municipal treatment facilities and investments in energy-efficient technologies. Canada also contributes with increasing adoption in chemical and food processing sectors. Ongoing modernization of industrial air systems and sustainability initiatives continue to boost compressor deployment across the region.

Europe

Europe accounted for 27.4% of the global market share in 2024. The region’s growth is supported by stringent environmental regulations promoting energy-efficient air compression systems. Germany, the UK, and France lead in wastewater treatment and chemical processing applications. Manufacturers are integrating rotary lobe compressors into biogas and renewable energy projects, aligning with the EU’s decarbonization goals. The demand for oil-free and low-noise compressors remains high, particularly in industrial automation and wastewater management. Ongoing innovation and industrial retrofitting continue to drive stable market expansion across major European economies.

Asia-Pacific

Asia-Pacific dominated the rotary lobe compressor market with a 30.9% share in 2024. Rapid industrialization, urban development, and water treatment infrastructure investments drive regional demand. China, India, and Japan are key markets, fueled by expanding wastewater treatment projects and chemical production. Government policies supporting clean energy and air quality improvements are accelerating adoption. Growing manufacturing capacity and automation trends further enhance regional competitiveness. The shift toward high-efficiency and durable compressor systems continues to strengthen Asia-Pacific’s leading position in the global market.

Latin America

Latin America captured a 5.1% share of the rotary lobe compressor market in 2024. Industrial growth in Brazil, Mexico, and Argentina is fostering demand for air systems across wastewater treatment and construction sectors. The region’s increasing investment in renewable energy and infrastructure projects supports compressor adoption. Local industries are adopting energy-efficient equipment to meet emission and operational standards. However, limited industrial automation and slower technology integration slightly constrain market penetration. Ongoing economic development and modernization efforts are expected to strengthen regional demand in the coming years.

Middle East & Africa

The Middle East and Africa accounted for 3.0% of the global market share in 2024. The region’s growth is driven by expanding oil and gas operations and water treatment facilities. Gulf countries are investing in advanced industrial air systems to improve process reliability and energy efficiency. South Africa and the UAE show growing adoption across manufacturing and power sectors. Infrastructure modernization and water conservation initiatives support additional market expansion. Despite limited local manufacturing capacity, ongoing industrial diversification continues to create new opportunities for compressor suppliers.

Market Segmentations:

By Type

By Application

- Waste Water Treatment

- Construction

- Oil & Gas Industry

- Chemical Industry

- Power Generation

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The rotary lobe compressor market is characterized by the presence of leading global manufacturers such as Atlas Copco AB, Kaeser Kompressoren SE, Gardner Denver Holdings Inc., Pfeiffer Vacuum Technology AG, Aerzen, Ebara Corporation, Busch Vacuum Solutions, Elmo Rietschle – Gardner Denver, Tuthill Corporation, and Anest Iwata Corporation. The competitive landscape is driven by continuous innovation in energy-efficient technologies and product reliability. Companies are focusing on developing oil-free and low-maintenance compressor systems to meet rising environmental and operational standards. Strategic partnerships, product customization, and expansion into emerging markets are key priorities to strengthen global footprints. Advancements in smart monitoring, rotor design, and compact structures are enhancing performance efficiency. Manufacturers are also investing in aftersales services, digital diagnostics, and modular compressor systems to boost customer retention. The competition remains moderate to high, with increasing emphasis on sustainability and technological differentiation across industrial applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Atlas Copco AB

- Kaeser Kompressoren SE

- Gardner Denver Holdings Inc.

- Pfeiffer Vacuum Technology AG

- Aerzen

- Ebara Corporation

- Busch Vacuum Solutions

- Elmo Rietschle – Gardner Denver

- Tuthill Corporation

- Anest Iwata Corporation

Recent Developments

- In 2024, Aerzen announced updates to its Delta Hybrid (screw blower) series and other products at events like Hannover Messe and IFAT.

- In 2024, Gardner Denver, which is a brand within Ingersoll Rand, launched a new line of energy-efficient compressors called the “Green Series, designed to reduce carbon emissions.

- In June 2023, Atlas Copco launched a new range of its G-series 2-30 kW oil-injected screw compressors.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by rising industrial automation.

- Demand from wastewater treatment applications will continue to dominate globally.

- Energy-efficient and low-noise compressor designs will gain wider adoption.

- Asia-Pacific will remain the fastest-growing region due to rapid industrialization.

- Integration of IoT-based monitoring systems will improve operational reliability.

- Manufacturers will focus on developing oil-free and eco-friendly compressor models.

- Replacement of aging industrial air systems will create strong aftermarket opportunities.

- Partnerships between compressor manufacturers and energy service providers will expand.

- Growing adoption in biogas and renewable energy sectors will support market expansion.

- Continuous R&D in rotor design and materials will enhance performance and durability.