Market Overview

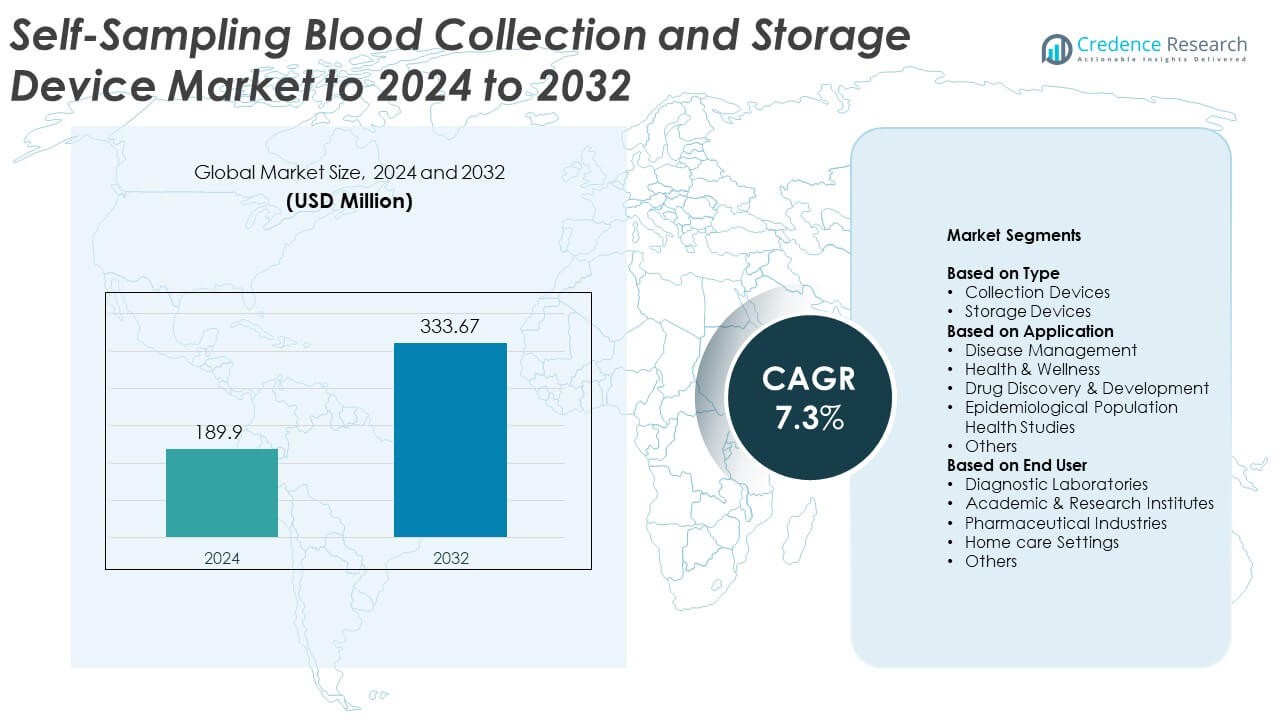

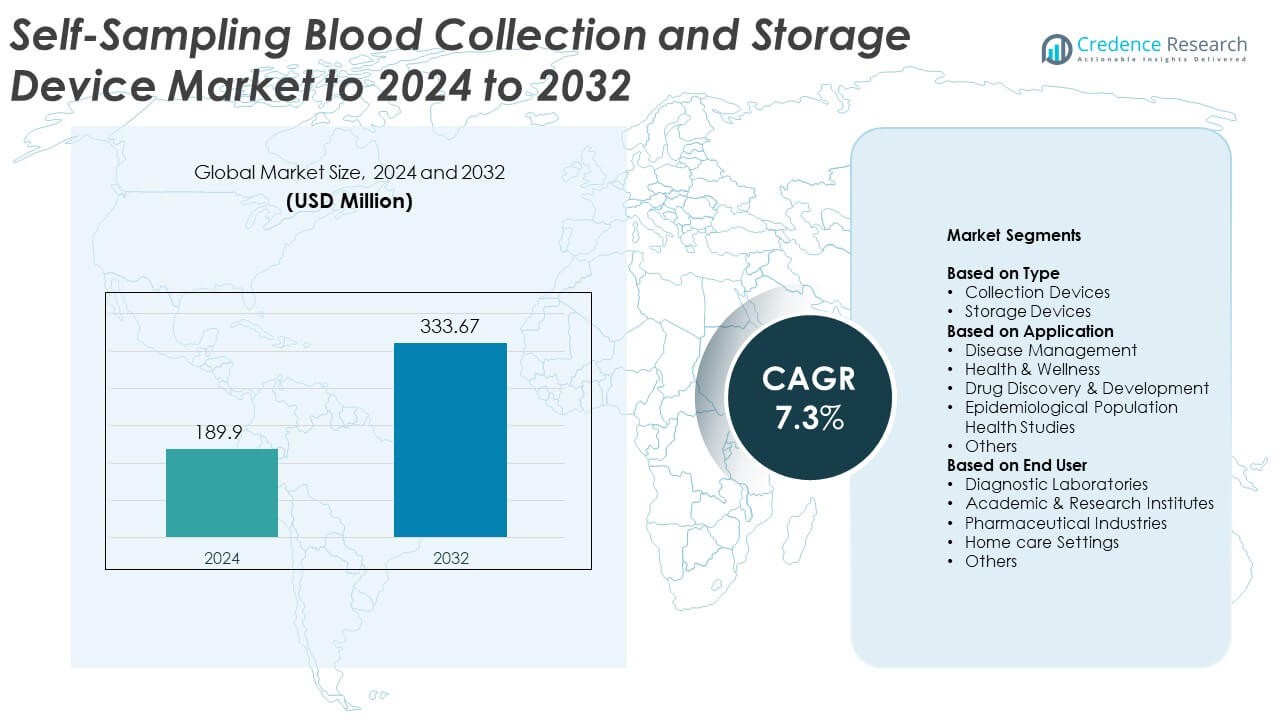

Self-Sampling Blood Collection and Storage Device Market size was valued USD 189.9 Million in 2024 and is anticipated to reach USD 333.67 Million by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Self-Sampling Blood Collection and Storage Device Market Size 2024 |

USD 189.9 Million |

| Self-Sampling Blood Collection and Storage Device Market , CAGR |

7.3% |

| Self-Sampling Blood Collection and Storage Device Market Size 2032 |

USD 333.67 Million |

The Self Sampling Blood Collection and Storage Device Market is shaped by leading innovators such as Drawbridge Health, Capitainer, Tasso, Inc, Trajan Scientific and Medical, Seventh Sense Biosystems, Spot On Sciences, LAMEDITECH, Neoteryx, LLC, PanoHealth, and DBS System SA. These companies advance microcollection technology, improve sample stability, and support remote diagnostics through user-friendly designs. North America leads the market with about 38% share in 2024 due to strong telehealth adoption, high testing volume, and widespread use of decentralized diagnostics. Europe follows with nearly 29% share, supported by robust clinical research networks and expanding preventive health programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Self Sampling Blood Collection and Storage Device Market was valued at USD 189.9 Million in 2024 and is projected to reach USD 333.67 Million by 2032 at a CAGR of 7.3%.

- Rising demand for decentralized testing and at-home sample collection drives strong adoption, with collection devices leading the type segment at about 64% share in 2024.

- Advancements in microcollection formats, improved stabilizing chemistries, and integration with digital health platforms shape major trends across diagnostic and wellness applications.

- Competition intensifies as key manufacturers enhance device usability, scale production, and expand partnerships with diagnostic laboratories, which hold nearly 52% share of end-user demand.

- North America leads with about 38% share, followed by Europe at 29% and Asia Pacific at 23%, while Latin America and Middle East & Africa hold 6% and 4% respectively.

Market Segmentation Analysis:

By Type

Collection devices lead this segment with about 64% share in 2024 due to rising adoption of minimally invasive sampling kits for at-home and remote testing. Demand stays strong because these devices reduce clinic visits and support high-compliance workflows for chronic disease monitoring. Storage devices grow at a steady pace as biobanks, research groups, and diagnostic labs expand sample preservation needs for long-term studies and stability testing. Growth across both categories is supported by broader use of decentralized diagnostics, improved microtube designs, and wider acceptance of self-collection in regulated settings.

- For instance, Becton Dickinson (BD) produces in excess of 3.5 billion blood collection tubes annually and is recognized as the world’s largest manufacturer of evacuated blood collection tubes.

By Application

Disease management dominates the segment with nearly 46% share in 2024 as self-sampling tools support regular monitoring for diabetes, cardiovascular risk, infectious diseases, and women’s health. Health and wellness follows, fueled by rising demand for preventive testing and personalized health tracking. Drug discovery and development benefit from growing decentralized clinical trials, while epidemiological studies use self-sampling kits to reach large, diverse populations. Expansion across all applications is driven by convenience, reduced collection costs, and higher participant compliance in both clinical and public health programs.

- For instance, Thermo Fisher Scientific confirmed that its larger CryoPlus storage systems can hold up to 38,500 2.0 mL vials per unit in their published technical specifications, though exact capacity varies by the specific model and rack configuration used.

By End User

Diagnostic laboratories hold the largest share at about 52% in 2024 due to heavy use of self-collected samples for high-throughput testing, PCR workflows, and biomarker analysis. Academic and research institutes show steady uptake for biobanking and longitudinal study designs. Pharmaceutical industries use these devices in remote clinical trials to improve participant retention. Home care settings also expand as consumers adopt self-testing for convenience and regular health tracking. Growth across end users is supported by increased acceptance of decentralized testing and advancements in stabilization chemistry that preserve sample integrity.

Key Growth Drivers

Rising Adoption of Decentralized and At-Home Testing

Decentralized testing continues to grow as patients and providers shift toward remote diagnostics, reducing pressure on clinical facilities. Self-sampling devices support rapid collection, easy logistics, and strong user compliance, making them ideal for chronic disease monitoring and infectious disease testing. Growth accelerates as healthcare systems integrate at-home blood sampling into digital care pathways, enabling faster decision-making and improved patient outcomes. This shift strengthens demand across diagnostic labs, telehealth platforms, and preventive health programs.

- For instance, 23andMe reported collecting over 14 million genetic samples from customers for health and wellness insights as of 2024.

Expansion of Clinical Trials Using Remote Sampling Models

Pharmaceutical companies and contract research organizations increasingly use self-sampling blood devices to streamline decentralized and hybrid clinical trials. Remote collection reduces site visits, lowers operational costs, and improves volunteer retention, especially in long-duration studies. These devices help capture high-quality samples for pharmacokinetic and biomarker testing while easing geographic limitations. As more studies adopt flexible participation models, self-sampling tools become essential infrastructure, supporting faster recruitment and broader patient diversity across global research programs.

- For instance, IQVIA documented conducting over 500 decentralized clinical trials globally. While earlier company reports from 2022 cited figures of more than 90 DCTs, the figure of over 500 has been used in various company materials as of late 2024 and mid-2025, demonstrating an acceleration in the adoption of these trial designs.

Growing Focus on Personalized and Preventive Healthcare

Self-sampling devices support the rising demand for personalized insights linked to nutrition, hormonal balance, cardiovascular markers, and lifestyle-driven health risks. Consumers prefer convenient sampling methods that reduce clinic dependency and allow continuous tracking of key biomarkers. Health companies expand subscription-based wellness programs using remote blood testing, which drives recurring demand. This growth aligns with rising awareness of preventive screening and digital health adoption, boosting the market across wellness brands, diagnostic companies, and population health programs.

Key Trends and Opportunities

Advancements in Sample Stabilization and Microcollection Technologies

Innovations in dried blood spot formats, microtainer designs, and improved stabilizing chemistries enhance sample integrity during transport and long-term storage. These technologies enable reliable analysis of complex biomarkers without cold-chain logistics, lowering operational costs for labs and research groups. Companies explore advanced materials and automated processing solutions to expand test menus compatible with self-collected samples. This trend opens opportunities for broader diagnostic coverage and strengthens adoption in epidemiological studies and decentralized biobanking.

- For instance, Revvity (PerkinElmer) validated that its DBS cards preserve biomarker stability for up to 28 days at ambient temperature, according to its technical validation documentation.

Integration of Self-Sampling With Digital Health Ecosystems

The growing use of app-linked sampling kits and connected diagnostic platforms creates new opportunities in remote care delivery. Digital integration supports guided collection, real-time tracking, and quick result access, improving user experience and adherence. Telehealth providers adopt these systems to expand virtual care models, while health insurers study them for preventive health programs. This trend accelerates the shift toward tech-enabled patient monitoring and supports long-term growth across disease management and wellness applications.

- For instance, Dexcom transmitted over 400 million glucose data points per day through its real-time connected ecosystem during 2023

Expansion of Population-Scale Health Studies

Large public health programs rely on self-sampling kits to reach diverse populations across rural and urban regions. These devices enable scalable sampling without intensive staffing or clinic support, making them suitable for national screening campaigns and longitudinal cohort studies. Growing interest in genomics, metabolic profiling, and infectious disease surveillance boosts demand. This creates strong opportunities for research institutions and government bodies to deploy high-volume, cost-efficient sampling tools across large demographic groups.

Key Challenges

Concerns About Sample Quality and User Collection Errors

Self-sampling depends heavily on user technique, which can lead to variability in sample volume, contamination, or improper storage. Laboratories must manage these inconsistencies, which may affect test accuracy or require repeat collection. Although improved device design and clearer instructions help reduce errors, quality assurance remains a major concern. Ensuring reliable results that match clinic-collected samples is essential for wider acceptance across regulated diagnostic workflows and clinical research settings.

Regulatory Complexity and Validation Requirements

Self-sampling devices must meet strict regulatory standards for safety, stability, and analytical performance, which increases development time and compliance costs. Expanding use in clinical trials and diagnostics requires extensive validation to ensure compatibility with various testing platforms. Market entry becomes challenging for smaller innovators due to lengthy approval cycles and evolving global regulations. Addressing these hurdles is crucial to support broader commercialization and ensure consistent clinical reliability across diverse healthcare environments.

Regional Analysis

North America

North America holds the largest share at about 38% in 2024, driven by strong adoption of at-home diagnostics, advanced clinical research infrastructure, and widespread use of decentralized testing programs. Diagnostic laboratories and telehealth platforms use self-sampling devices to support chronic disease monitoring and remote patient management. High awareness of preventive healthcare and strong insurance support also boost utilization. The United States leads regional demand due to active clinical trial activity and rapid integration of digital health tools. Canada follows with steady growth as population health programs expand remote sampling initiatives.

Europe

Europe accounts for nearly 29% share in 2024, supported by active government-backed screening programs, strong clinical research networks, and rising use of remote blood sampling in chronic disease management. Countries such as Germany, the United Kingdom, and the Nordics show high adoption due to strong digital health uptake and well-established biobanking practices. The region benefits from increasing use of self-sampling kits in epidemiological studies and decentralized clinical trials. Regulatory support for telemedicine and home-based testing continues to strengthen market penetration across leading healthcare systems.

Asia Pacific

Asia Pacific holds around 23% share in 2024 and represents the fastest-growing region due to expanding healthcare access, increasing chronic disease burden, and rising interest in digital health solutions. Countries such as China, India, Japan, and South Korea witness growing adoption of self-sampling devices for preventive care and remote diagnostics. Urbanization and rising consumer awareness enhance demand for home-based testing, while research institutes use these tools in population-scale studies. Government-backed health programs and broader telehealth acceptance further support rapid expansion across the region.

Latin America

Latin America captures roughly 6% share in 2024, with growth driven by expanding diagnostic networks and increasing focus on affordable remote testing solutions. Brazil and Mexico lead regional adoption as healthcare providers integrate self-sampling kits into chronic disease monitoring and wellness programs. Awareness of preventive screening rises across major cities, while research groups explore self-sampling for large-scale epidemiological projects. Though infrastructure gaps persist, improving digital connectivity and broader involvement of private laboratories support steady market penetration across the region.

Middle East and Africa

Middle East and Africa hold about 4% share in 2024, supported by improving healthcare infrastructure, rising demand for convenient testing solutions, and expanding private diagnostic services. Gulf countries show higher adoption, driven by strong investment in digital health and preventive care initiatives. African nations progressively use self-sampling devices for infectious disease surveillance and community health programs. Despite challenges in logistics and limited awareness in rural areas, growing urban populations and expanding telehealth ecosystems create opportunities for wider market growth across the region.

Market Segmentations:

By Type

- Collection Devices

- Storage Devices

By Application

- Disease Management

- Health & Wellness

- Drug Discovery & Development

- Epidemiological Population Health Studies

- Others

By End User

- Diagnostic Laboratories

- Academic & Research Institutes

- Pharmaceutical Industries

- Home care Settings

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Self Sampling Blood Collection and Storage Device Market features active competition among Drawbridge Health, Capitainer, Tasso, Inc, Trajan Scientific and Medical, Seventh Sense Biosystems, Spot On Sciences, LAMEDITECH, Neoteryx, LLC, PanoHealth, and DBS System SA. Companies focus on improving micro-collection efficiency, enhancing sample stability, and reducing user error through intuitive device designs. Many manufacturers invest in automation-ready consumables that support high-throughput laboratory workflows and faster processing. Partnerships with diagnostic laboratories, telehealth platforms, and clinical research organizations strengthen market presence and expand global distribution. Firms also advance dried blood technologies and integrate digital tracking features to improve compliance in remote testing programs. Continuous innovation in capillary blood extraction, transport safety, and long-term storage drives differentiation. Growing demand for decentralized testing further encourages companies to scale manufacturing capabilities and strengthen regulatory approvals across multiple regions, supporting wider adoption in diagnostic, wellness, and clinical research applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Drawbridge Health

- Capitainer

- Tasso, Inc

- Trajan Scientific and Medical

- Seventh Sense Biosystems

- Spot On Sciences

- LAMEDITECH

- Neoteryx, LLC

- PanoHealth

- DBS System SA

Recent Developments

- In 2025, ARUP Laboratories and Tasso announced a collaboration to expand at-home blood testing programs in the U.S., using Tasso’s upper-arm self-collection devices to enable remote sample collection for a broad test menu.

- In 2025, Tasso partnered with SheMed to power at‑home blood testing in the UK using Tasso+ for GLP‑1 patient screening and ongoing monitoring.

- In 2023, Neoteryx highlighted new data showing its Mitra® volumetric absorptive microsampling (VAMS) devices can be used for self-collected dried blood samples to monitor PFAS (“forever chemicals”), supporting remote exposure studies and home sampling.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as decentralized and home-based testing becomes mainstream in healthcare.

- Remote clinical trials will adopt self-sampling devices more widely to improve patient reach.

- Integration with digital health platforms will enhance user guidance, tracking, and result access.

- Advancements in sample stabilization will support more complex biomarker testing.

- Adoption will rise in chronic disease management due to higher monitoring frequency.

- Wellness and preventive health programs will drive recurring demand for subscription-based testing.

- Population-scale studies will increasingly use self-sampling to improve data diversity.

- Device miniaturization and improved usability will increase compliance across age groups.

- Regulatory frameworks will evolve to support broader diagnostic and clinical use.

- Emerging markets will see rapid uptake as telehealth and diagnostics infrastructure grow.