Market Overview

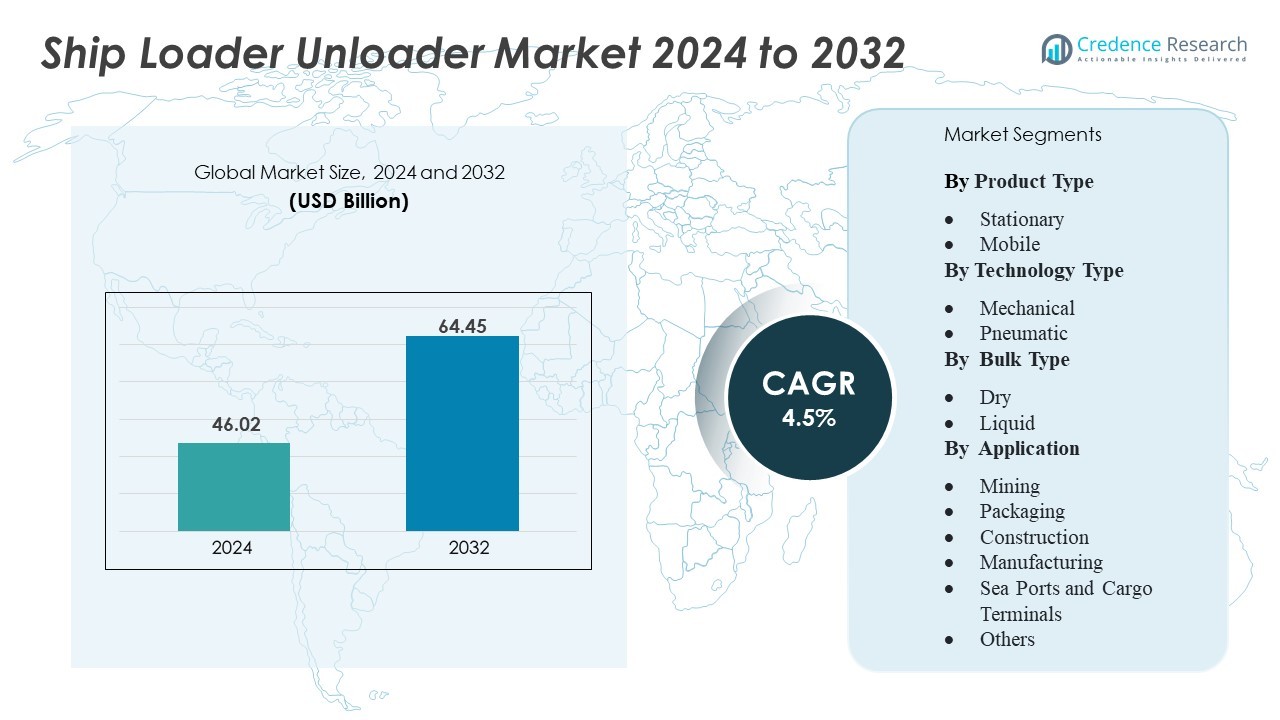

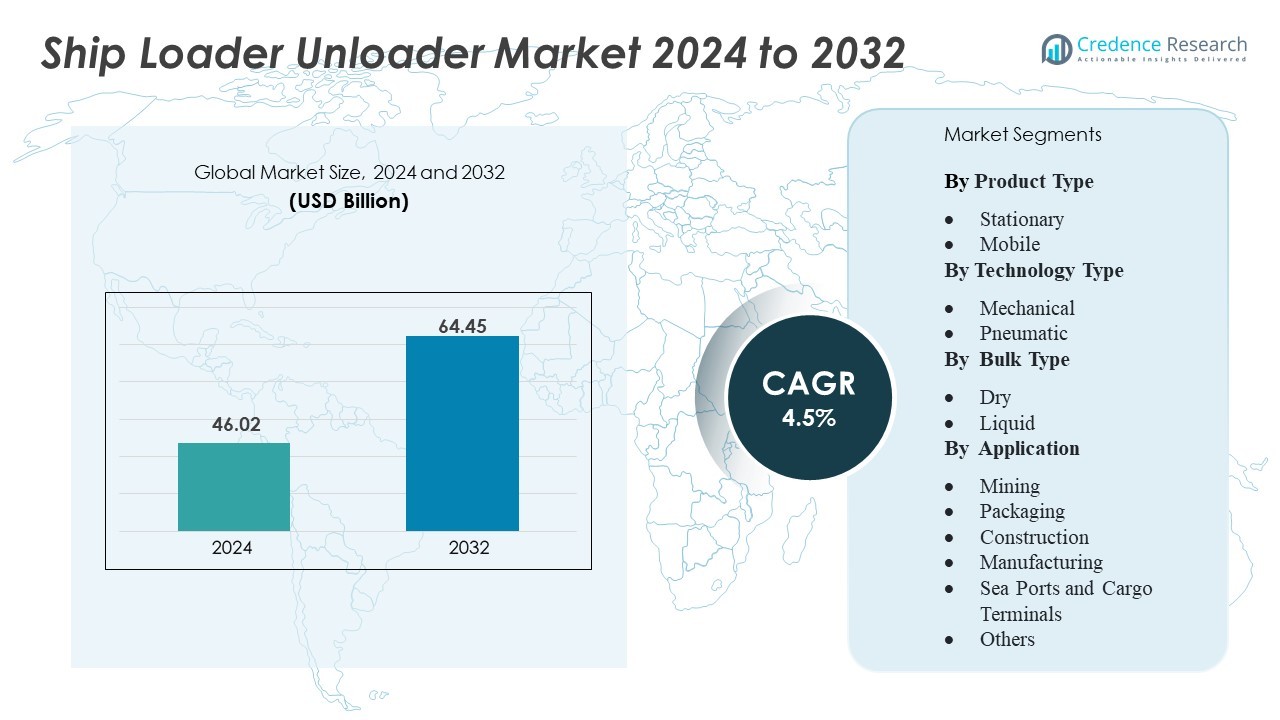

The Ship Loader Unloader Market size was valued at USD 46.02 billion in 2024 and is anticipated to reach USD 65.45 billion by 2032, at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ship Loader Unloader Market Size 2024 |

USD 46.02 Million |

| Ship Loader Unloader Market, CAGR |

4.5% |

| Ship Loader Unloader Market Size 2032 |

USD 65.45 Million |

The Ship Loader Unloader market is driven by leading companies such as Siwertell, Thyssenkrupp AG, Liebherr Group, MacGregor, Sandvik, and FLSmidth. These players lead through innovation in high-capacity loading systems, advanced automation, and environmentally efficient designs. Their strong global distribution networks and service capabilities enable them to cater to both developed and emerging port markets. Asia Pacific dominates the market with a 36% share, supported by rapid port infrastructure expansion and high export volumes. North America follows with 21%, driven by technology upgrades and regulatory compliance, while Europe holds 19%, emphasizing sustainable and energy-efficient handling solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Ship Loader Unloader market was valued at USD 46.02 billion in 2024 and is projected to reach USD 65.45 billion by 2032, growing at a CAGR of 4.5% during the forecast period.

- Rising bulk trade volumes and port modernization projects are driving market expansion, supported by increasing investments in high-capacity and automated handling systems.

- Automation, energy-efficient designs, and modular equipment are key trends, enabling operators to improve efficiency, reduce emissions, and align with sustainability goals.

- The market is competitive, with major players such as Siwertell, Thyssenkrupp AG, Liebherr Group, MacGregor, Sandvik, and FLSmidth focusing on innovation and global expansion. High capital costs remain a key restraint, particularly for small and mid-sized terminals.

- Asia Pacific leads with a 36% share, followed by North America at 21% and Europe at 19%. Mobile ship loaders hold the dominant product segment share due to flexibility and lower infrastructure requirements.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

Mobile ship loaders dominate the market with the highest share. Their flexible movement and lower infrastructure cost make them a preferred choice for ports handling varying cargo volumes. Fixed ship loaders hold a steady position in high-capacity terminals where space and handling efficiency are critical. Mobile units support faster setup, require minimal civil work, and allow efficient repositioning. These benefits reduce downtime and operational costs, making them ideal for bulk handling in emerging port facilities. Rising trade volumes and port modernization initiatives further support the strong demand for mobile loaders.

- For instance, Telestack commissioned one of its high-capacity radial telescopic ship loaders, such as the TS 2058 or TS 3042, with a peak loading capacity of up to 2,000 tons per hour or more, enabling rapid vessel turnaround and reduced dust emissions in bulk terminals.

By Technology Type

Conventional mechanical technology holds the largest share in this segment due to its proven reliability and cost efficiency. Mechanical systems are favored in bulk terminals requiring continuous high-capacity operations. Pneumatic technology is gaining traction in specialized cargo segments like grain and cement, where dust control and product quality are key. Mechanical systems offer lower maintenance complexity and higher throughput rates, making them suitable for large-scale export terminals. Global investments in infrastructure and trade expansion continue to drive their adoption across developed and developing ports.

- For instance, Muuga Port features several high-capacity material handling systems for bulk transfer operations, which enable efficient loading of various commodities, including coal.

By Bulk Type

Dry bulk dominates the segment with the largest market share. Ports handling commodities such as coal, grain, cement, and iron ore heavily rely on ship loaders and unloaders designed for dry bulk efficiency. Liquid bulk equipment holds a smaller but steady share, focused on specialized chemical and oil terminals. Dry bulk operations benefit from faster loading cycles, simpler handling systems, and lower environmental risks. Increased mining exports, agricultural trade, and construction activities strengthen demand for dry bulk solutions, particularly in regions with expanding commodity trade flows.

Key Growth Drivers

Expanding Global Bulk Trade Volumes

Rising global trade volumes drive the adoption of advanced ship loaders and unloaders. Growing demand for commodities such as coal, cement, grain, and ores strengthens the need for efficient port handling systems. Ports and terminals increasingly invest in automated and high-capacity equipment to manage higher throughput. Rapid industrialization in Asia Pacific and Latin America fuels bulk commodity exports, further increasing port traffic. Efficient ship loaders and unloaders reduce vessel turnaround times and operational costs, supporting global supply chain competitiveness. Governments are modernizing port infrastructure to meet international trade standards. This infrastructure expansion directly boosts market demand for reliable and high-performance loading and unloading systems.

- For instance, Bühler Group does produce ship loaders and unloaders with a handling rate of up to 1,200 tons per hour (and higher, up to 3,000 t/h for loaders and 1,300 t/h for unloaders).

Port Modernization and Infrastructure Development

Large-scale investments in port modernization are a major market growth driver. Many countries are expanding their port capacity to handle larger vessels and bulk carriers. Modernization projects integrate advanced mechanical and pneumatic ship loading technologies to increase handling speed and reduce cargo losses. Automation, digital monitoring systems, and environmentally friendly handling solutions are becoming standard in port upgrades. These initiatives enable ports to improve efficiency, safety, and regulatory compliance. Expanding export terminals and the construction of new deep-water ports strengthen long-term demand. Governments and private operators are focusing on reducing logistics bottlenecks, further accelerating equipment procurement.

- For instance, Siwertell AB delivered a rail-mounted ship unloader with a rated capacity of 1,500 tons per hour for cement handling at the Port of Houston, integrating dust-free conveying systems to enhance environmental performance and operational reliability.

Rising Demand for Efficient Material Handling Systems

Port operators prioritize operational efficiency and cost optimization, driving demand for advanced material handling systems. Ship loaders and unloaders designed with higher loading rates, flexible mobility, and low maintenance help reduce port congestion. These systems improve bulk transfer accuracy, reduce spillage, and ensure compliance with emission regulations. The adoption of modular designs enables faster installation and better adaptability to port layouts. With global shipping operations scaling rapidly, the need for equipment that supports faster vessel turnaround times is increasing. Industries handling grain, cement, fertilizers, and minerals rely on these systems to sustain throughput targets and control costs effectively.

Key Trends & Opportunities

Growing Focus on Sustainable Port Operations

Sustainability is becoming a strategic priority for port authorities and operators. Many new ship loader and unloader systems are designed with energy-efficient drives, enclosed conveyors, and dust suppression features to reduce environmental impact. Ports are integrating eco-friendly technologies to comply with emission standards and protect surrounding communities. Manufacturers focus on low-emission motors and modular designs that reduce energy use during operations. Green financing and policy incentives further accelerate sustainable equipment adoption. This shift not only enhances environmental performance but also helps ports align with international carbon reduction targets, making sustainability a key market opportunity.

- For instance, Konecranes implemented its Ecolifting™ program, which includes various solutions like Power Drive, Flow Drive, and Hybrid Drive technologies for new and existing equipment. These solutions help customers achieve significant fuel savings, with specific options offering reductions of up to 15% (Power Drive), up to 25-40% (Flow Drive depending on tests/conditions), or up to 40% (Hybrid Drive), and up to 30% with a Fuel Saver Retrofit.

Integration of Automation and Digital Technologies

Automation is a defining trend shaping the future of ship loader and unloader systems. Ports increasingly deploy automated handling equipment equipped with real-time monitoring, sensor integration, and AI-driven controls. These technologies enhance operational accuracy and minimize human error. Digital solutions also optimize equipment scheduling, maintenance, and energy usage, improving overall efficiency. Predictive maintenance through IoT systems reduces downtime and extends equipment life cycles. Automation allows operators to handle larger cargo volumes with fewer workforce requirements, improving cost efficiency. This trend aligns with global smart port development strategies and supports long-term modernization goals.

Key Challenges

High Initial Capital Investment

High upfront investment costs remain a key challenge for market expansion. Ship loaders and unloaders require significant financial resources for procurement, installation, and infrastructure preparation. Small and medium-sized ports often face budget constraints, limiting their ability to adopt advanced systems. Maintenance, training, and technology integration further add to operational expenses. While these systems offer long-term efficiency gains, the initial financial barrier slows adoption in developing markets. Limited access to financing and delayed return on investment make it difficult for smaller operators to compete with modernized ports. This cost challenge continues to restrain market growth in several regions.

Regulatory and Operational Constraints

Strict environmental and safety regulations pose operational challenges for port operators and equipment manufacturers. Ports must comply with air quality, dust control, and emission standards during loading and unloading operations. Non-compliance can lead to heavy penalties and operational delays. Integrating advanced environmental controls into existing infrastructure requires additional investment and technical expertise. Furthermore, operational constraints such as labor shortages, vessel scheduling complexities, and space limitations create bottlenecks. These challenges make it difficult for ports to achieve consistent high-volume throughput. Regulatory pressures, combined with operational inefficiencies, slow down the pace of equipment upgrades in certain markets.

Regional Analysis

North America

North America holds a 21% share of the Ship Loader Unloader market, driven by high automation adoption and robust trade volumes. Major port infrastructure in the United States and Canada supports large-scale bulk handling for grain, coal, and industrial minerals. Modernization initiatives in Gulf Coast and Great Lakes ports enhance operational efficiency. Advanced mechanical and pneumatic systems dominate deployments due to high throughput demands. Strong regulatory compliance and sustainability goals accelerate investment in energy-efficient systems. Continuous upgrades in terminal capacity and digitization of port operations strengthen North America’s competitive position in the global market.

Europe

Europe accounts for 19% of the global market, supported by well-established port infrastructure and strict environmental regulations. Leading economies such as Germany, the Netherlands, and the United Kingdom invest in modern, low-emission ship loading and unloading systems. European ports prioritize sustainable handling technologies to meet EU decarbonization targets. Grain, fertilizers, and construction materials drive high bulk throughput. Automation and predictive maintenance tools improve equipment reliability and reduce labor dependency. Strong trade connectivity and government incentives encourage ports to adopt efficient and eco-friendly handling solutions, solidifying Europe’s position as a mature and technologically advanced regional market.

Asia Pacific

Asia Pacific dominates the global market with a 36% share, fueled by rising commodity exports, expanding industrial activity, and rapid port infrastructure development. China, India, Japan, and South Korea lead regional investments in advanced handling equipment. Massive trade flows in coal, iron ore, cement, and agricultural products drive continuous capacity expansion. Governments in emerging economies are prioritizing smart port projects to boost logistics competitiveness. Mobile and high-capacity systems are preferred for their flexibility and cost efficiency. With strong export-led growth and sustained modernization programs, Asia Pacific remains the most dynamic and fastest-growing regional market.

Middle East & Africa

The Middle East & Africa hold a 12% market share, supported by rising energy and mineral exports. Gulf countries invest heavily in deep-water ports and bulk terminals to diversify trade activities. Countries like the UAE and Saudi Arabia focus on integrating automated and energy-efficient systems to improve port handling capacity. Africa is witnessing growing demand from mining hubs and agricultural exporters. Limited infrastructure remains a challenge in several regions, but public-private partnerships are helping accelerate modernization. Strategic port expansions and new logistics corridors position this region as a developing yet promising market.

Latin America

Latin America represents 12% of the Ship Loader Unloader market, driven by strong growth in agricultural and mining exports. Brazil, Argentina, and Chile lead investments in modern bulk handling infrastructure. Mobile ship loaders are favored for their flexibility and lower capital requirements in medium-sized terminals. Trade in iron ore, fertilizers, and grains boosts demand for high-capacity handling systems. Regional governments are promoting port upgrades to reduce vessel congestion and increase export competitiveness. Although infrastructure development is uneven across the region, increasing private investments are supporting steady market growth and modernization.

Market Segmentations:

By Product Type

By Technology Type

By Bulk Type

By Application

- Mining

- Packaging

- Construction

- Manufacturing

- Sea Ports and Cargo Terminals

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Ship Loader Unloader market features strong competition among global leaders such as Siwertell, Thyssenkrupp AG, Liebherr Group, MacGregor, Sandvik, and FLSmidth. These companies focus on expanding their product portfolios through advanced automation, higher loading rates, and improved environmental performance. Strategic investments in mobile and high-capacity systems enable them to address growing port modernization needs worldwide. Leading players emphasize modular designs, low maintenance requirements, and energy-efficient technologies to enhance operational efficiency. Partnerships with port authorities and logistics operators strengthen their global presence. Continuous R&D investments and service-based offerings further increase competitiveness. Many companies are also prioritizing sustainability initiatives to align with tightening environmental regulations, positioning themselves to meet future demand in both developed and emerging markets.

Key Player Analysis

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments

- In 2023, SAMSON installed a mobile ship loader for handling cement clinker. The system is designed to receive bulk materials. The fully mobile chassis of the SAMSON Mobile ship loader allows it to be operated anywhere in the port.

- In November 2023, FAM, a member of the BEUMER Group, announced that the company’s closed-loop ship loading system is being used by Anglo American plc, a mining company, at the Quellaveco mine in Peru.

- In May 2023, Zhenhua Heavy Industries Co., Ltd. (ZPMC) developed new high-efficiency and environment-friendly screw ship unloaders. The equipment is designed to unload bulk coal cargo with a weight of 100,000t, a rated capacity of 1,500t/h and a maximum capacity of 1,800t/h. The newly developed screw ship unloader adopts a new combination scheme of horizontal screw conveyor and belt conveyor.

- In March 2022, FLSmidth has been awarded the contract to build Gladstone Ports Corporation’s (GPC) new ship loader 1 on site in Queensland, Australia. As part of the contract, FLSmidth will build the new ship loader within Gladstone Ports Corporation’s Port Central Precinct, where it will then be transferred via a heavy lift ship a short distance to its new home for operation.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology Type, Bulk Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see strong growth driven by rising global bulk trade volumes.

- Port modernization initiatives will increase demand for advanced handling systems.

- Automation and digital control integration will become standard across major ports.

- Energy-efficient and low-emission technologies will gain wider adoption.

- Mobile ship loaders will continue to dominate due to flexibility and cost benefits.

- Asia Pacific will maintain its leading position with expanding export capacity.

- Manufacturers will focus on modular designs to reduce installation time and costs.

- Strategic partnerships and service-based models will enhance competitive strength.

- Regulatory compliance will push innovation in environmental control systems.

- Emerging economies will offer significant opportunities through new port development projects.

Market Segmentation Analysis:

Market Segmentation Analysis: