Market Overview

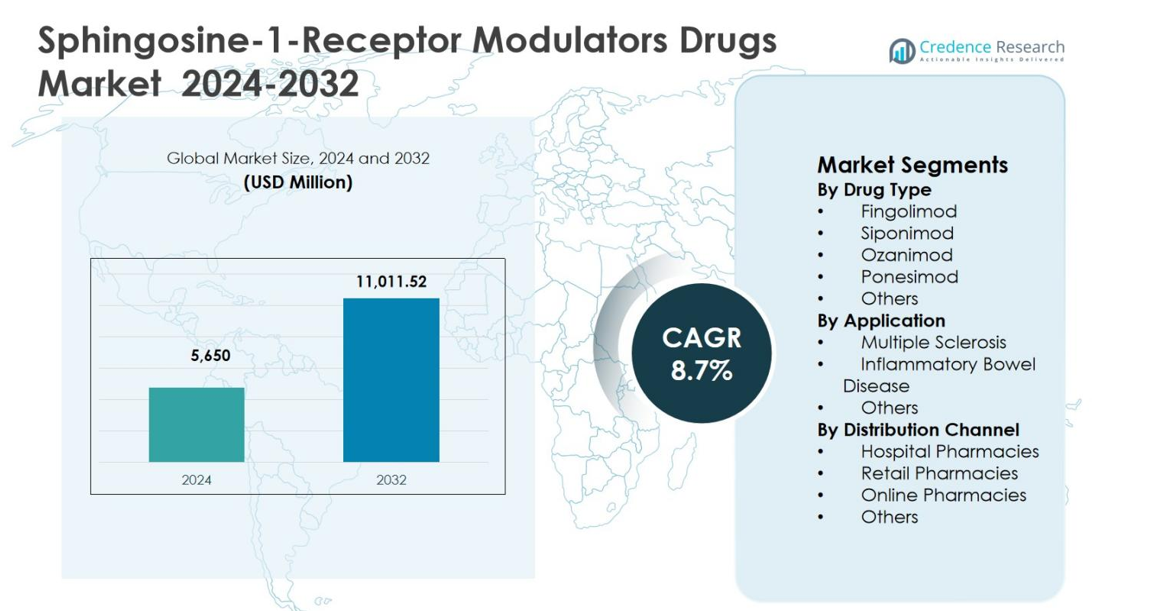

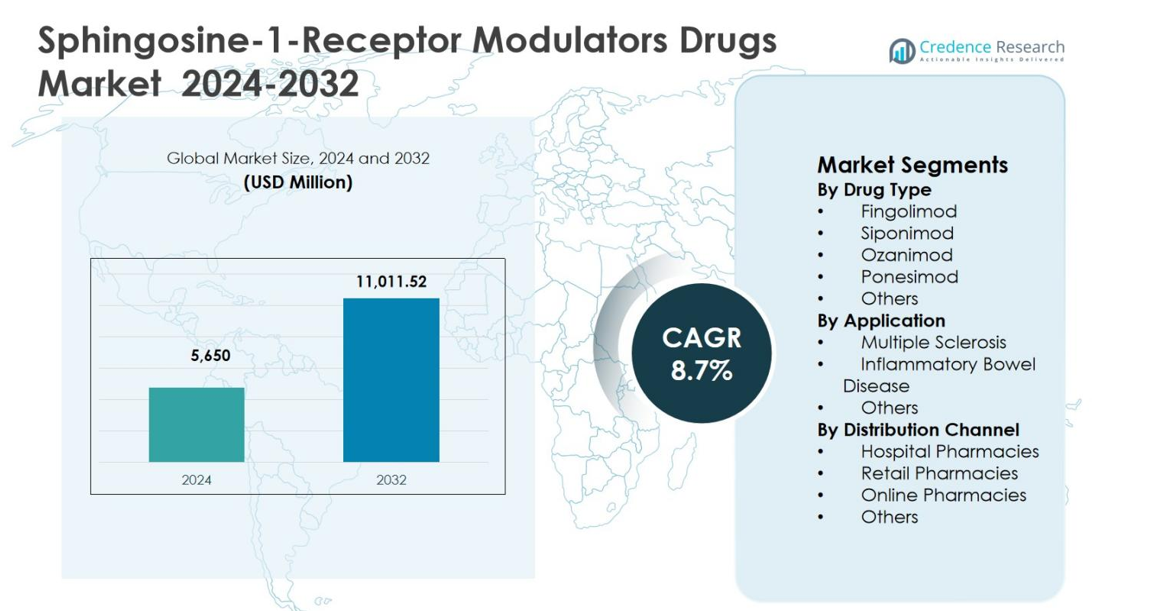

Sphingosine-1-Receptor Modulators Drugs Market size was valued at USD 5,650 million in 2024 and is anticipated to reach USD 11,011.52 million by 2032, growing at a CAGR of 8.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sphingosine-1-Receptor Modulators Drugs Market Size 2024 |

USD 5,650 million |

| Sphingosine-1-Receptor Modulators Drugs Market, CAGR |

8.7% |

| Sphingosine-1-Receptor Modulators Drugs Market Size 2032 |

USD 11,011.52 million |

Sphingosine-1-Receptor Modulators Drugs Market is driven by strong participation from leading pharmaceutical companies such as Novartis AG, Bristol-Myers Squibb Company, Merck & Co., Inc., Sanofi S.A., Pfizer Inc., Biogen Inc., Roche Holding AG, Eli Lilly and Company, and Teva Pharmaceutical Industries Ltd., which focus on product innovation, lifecycle management, and expanding therapeutic indications. These players invest heavily in research to enhance receptor selectivity and safety profiles while strengthening global distribution networks. Regionally, North America leads the Sphingosine-1-Receptor Modulators Drugs Market with a 41.8% market share, supported by high multiple sclerosis prevalence, advanced neurological care, and favorable reimbursement frameworks, followed by Europe with a 29.6% share, driven by structured healthcare systems and strong adoption of oral immunomodulatory therapies.

Market Insights

- Sphingosine-1-Receptor Modulators Drugs Market was valued at USD 5,650 million in 2024 and is projected to reach USD 11,011.52 million by 2032, growing at a CAGR of 8.7% during the forecast period, supported by rising adoption of oral immunomodulatory therapies.

- Market growth is driven by increasing prevalence of multiple sclerosis and other autoimmune disorders, with the Multiple Sclerosis segment holding a dominant 72.4% share in 2024 due to strong clinical efficacy and long-term disease management benefits.

- Product innovation and lifecycle strategies shape market dynamics, where Fingolimod leads the drug type segment with a 41.6% share in 2024, supported by early market entry, broad approvals, and established physician familiarity.

- Market expansion faces restraints from high treatment costs, safety monitoring requirements, and access limitations in price-sensitive regions, influencing reimbursement decisions and therapy initiation rates.

- Regionally, North America led with a 41.8% share in 2024, followed by Europe at 29.6%, Asia Pacific at 17.2%, Latin America at 6.3%, and Middle East & Africa at 5.1%, reflecting disparities in healthcare access and adoption levels.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Drug Type:

The Sphingosine-1-Receptor Modulators Drugs Market, by drug type, is led by Fingolimod, which accounted for 41.6% market share in 2024 due to its early market entry, strong clinical efficacy, and broad regulatory approvals for relapsing forms of multiple sclerosis. Fingolimod benefits from extensive physician familiarity and long-term safety data, supporting sustained prescriptions despite newer entrants. Siponimod and Ozanimod are gaining traction driven by improved receptor selectivity and favorable safety profiles, while Ponesimod adoption is supported by once-daily dosing. Ongoing lifecycle management and expanded indications continue to reinforce segment growth.

- For instance, Novartis’ Gilenya (fingolimod) received FDA approval in 2018 for children and adolescents aged 10-17 with relapsing MS, showing an 82% reduction in annualized relapse rate versus interferon beta-1a over up to two years in the Phase III PARADIGMS trial.

By Application:

By application, Multiple Sclerosis dominated the Sphingosine-1-Receptor Modulators Drugs Market with a 72.4% share in 2024, driven by the high prevalence of relapsing-remitting multiple sclerosis and the established role of S1P receptor modulators in disease modification. Strong clinical evidence demonstrating relapse reduction and delayed disability progression supports widespread clinical adoption. Inflammatory Bowel Disease represents an emerging growth area, supported by ongoing clinical trials and regulatory progress for selective S1P modulators. The expanding therapeutic pipeline and rising diagnosis rates continue to strengthen application-level demand.

- For instance, Bristol Myers Squibb’s ozanimod (Zeposia), approved for ulcerative colitis, demonstrated efficacy in phase III True North trials by reducing inflammatory markers like faecal calprotectin during induction and maintenance.

By Distribution Channel:

Based on distribution channel, Hospital Pharmacies held the dominant position with a 46.9% market share in 2024, supported by specialist-led prescribing, controlled initiation protocols, and monitoring requirements associated with S1P receptor modulators. Hospitals remain central to treatment initiation for multiple sclerosis patients, particularly during therapy switching and dose titration. Retail Pharmacies benefit from stable refill demand for chronic therapy, while Online Pharmacies are expanding due to improved patient access and digital prescription platforms. Reimbursement integration and specialty drug handling capabilities continue to favor hospital-led distribution.

Key Growth Driver

Rising Prevalence of Autoimmune Disorders

The Sphingosine-1-Receptor Modulators Drugs Market is significantly driven by the increasing global prevalence of autoimmune disorders, particularly multiple sclerosis. Growing diagnostic rates, improved disease awareness, and earlier treatment initiation are expanding the eligible patient pool. S1P receptor modulators offer targeted immune modulation, reduced relapse rates, and convenient oral administration, making them preferred options over injectable therapies. The chronic nature of autoimmune diseases ensures long-term therapy demand, while expanding indications beyond multiple sclerosis further strengthen sustained market growth across developed and emerging healthcare systems.

- For instance, Ozanimod from Bristol Myers Squibb sustained relapse-free rates of 69% at 60 months in the DAYBREAK extension study for relapsing multiple sclerosis. Continuous treatment from parent trials showed the lowest annualized relapse rates among participant groups.

Advancements in Drug Selectivity and Safety Profiles

Continuous advancements in receptor selectivity are accelerating adoption in the Sphingosine-1-Receptor Modulators Drugs Market. New-generation molecules such as siponimod and ozanimod demonstrate improved safety, reduced cardiovascular risks, and better tolerability compared to first-generation therapies. These enhancements expand physician confidence and patient adherence, supporting higher prescription volumes. Improved benefit-risk profiles also facilitate broader regulatory approvals and label expansions. Ongoing research efforts focused on minimizing adverse effects while maintaining efficacy continue to reinforce long-term market expansion.

- For instance, Siponimod selectively binds S1P1 and S1P5 receptors with low affinity for S1P3, mitigating cardiovascular effects observed in less selective modulators. Dose titration eliminates short-term vagomimetic cardiac impacts, with 12-month follow-up showing stabilized baroreflex sensitivity and normal autonomic responses in secondary progressive MS patients.

Expanding Regulatory Approvals and Reimbursement Coverage

Favorable regulatory approvals and expanding reimbursement frameworks are strengthening growth in the Sphingosine-1-Receptor Modulators Drugs Market. Regulatory agencies increasingly support innovative oral immunomodulators with proven clinical benefits. Inclusion of S1P receptor modulators in national treatment guidelines and insurance formularies improves patient access. Reimbursement support reduces treatment cost burdens, encouraging therapy initiation and continuation. These factors collectively accelerate market penetration, particularly in regions with structured healthcare systems and strong payer coverage.

Key Trend & Opportunity

Pipeline Expansion into New Therapeutic Indications

The Sphingosine-1-Receptor Modulators Drugs Market is witnessing strong opportunities from pipeline expansion into additional autoimmune and inflammatory conditions. Clinical development targeting inflammatory bowel disease, lupus, and dermatological disorders is broadening the therapeutic scope of S1P modulators. Positive trial outcomes create opportunities for label expansion and portfolio diversification. This trend enables manufacturers to maximize asset value while addressing unmet clinical needs. Expansion beyond multiple sclerosis positions the market for sustained revenue growth over the forecast period.

- For instance, Idorsia’s cenerimod, a selective S1P1 receptor modulator, showed in a phase 2 CARE trial a statistically significant reduction in modified SLEDAI-2K scores at month 6 versus placebo (LS mean difference -1.19), alongside reduced circulating antibody-secreting cells.

Shift Toward Personalized and Oral Therapies

A growing preference for personalized and oral therapies is shaping opportunities in the Sphingosine-1-Receptor Modulators Drugs Market. Oral administration improves patient compliance and quality of life compared to injectable biologics. Advances in biomarker-driven treatment selection support tailored therapy choices, improving outcomes. Healthcare providers increasingly favor convenient dosing regimens combined with strong efficacy. This trend enhances patient retention and supports broader adoption across both established and emerging healthcare markets.

- For instance, Bristol Myers Squibb’s Zeposia (ozanimod) reduces plasma neurofilament light chain (pNfL) levels by 20-27% at 12-24 months in relapsing MS trials, outperforming interferon beta-1a at 13-16%. This biomarker decline correlates with fewer lesions and better cognitive scores on tests like SDMT.

Key Challenge

Safety Concerns and Long-Term Risk Management

Safety concerns remain a key challenge in the Sphingosine-1-Receptor Modulators Drugs Market, particularly related to cardiovascular effects, infection risk, and long-term immune modulation. Mandatory monitoring requirements during treatment initiation increase clinical complexity and limit use in certain patient populations. Adverse event management influences prescribing decisions and may delay therapy adoption. Addressing long-term safety through post-marketing surveillance and real-world evidence remains critical for sustained market confidence.

High Treatment Costs and Access Limitations

High therapy costs present a significant challenge in the Sphingosine-1-Receptor Modulators Drugs Market, especially in price-sensitive regions. Patent protection and specialty drug pricing restrict affordability and limit widespread access. Inadequate reimbursement coverage in developing markets further constrains adoption. Cost pressures from healthcare payers also intensify price negotiations and formulary restrictions. Overcoming these barriers will require pricing strategies, patient assistance programs, and broader healthcare policy support to ensure equitable access.

Regional Analysis

North America

The Sphingosine-1-Receptor Modulators Drugs Market in North America accounted for 41.8% market share in 2024, driven by high multiple sclerosis prevalence, advanced diagnostic infrastructure, and early adoption of novel immunomodulatory therapies. Strong presence of leading pharmaceutical manufacturers and robust clinical research activity support sustained innovation. Favorable reimbursement frameworks and inclusion of S1P receptor modulators in treatment guidelines improve patient access. High physician awareness, strong patient adherence to oral therapies, and ongoing label expansions continue to reinforce market dominance across the United States and Canada.

Europe

Europe held a 29.6% market share in 2024 in the Sphingosine-1-Receptor Modulators Drugs Market, supported by rising autoimmune disease incidence and well-established public healthcare systems. Regulatory approvals from the European Medicines Agency and strong adoption of second-generation S1P modulators drive regional growth. Countries such as Germany, France, and the United Kingdom lead demand due to specialist availability and structured reimbursement mechanisms. Increasing focus on cost-effective oral therapies and growing clinical trial activity across Western Europe further strengthen regional market performance.

Asia Pacific

The Asia Pacific region captured a 17.2% market share in 2024 in the Sphingosine-1-Receptor Modulators Drugs Market, supported by improving healthcare access and rising awareness of multiple sclerosis. Expanding diagnostic capabilities and increasing investments in specialty pharmaceuticals contribute to adoption growth. Japan and Australia show strong uptake due to advanced neurological care, while China and India present long-term growth opportunities driven by expanding patient populations. Government initiatives to improve access to innovative therapies and growing private healthcare expenditure support sustained regional expansion.

Latin America

Latin America accounted for a 6.3% market share in 2024 in the Sphingosine-1-Receptor Modulators Drugs Market, driven by gradual improvements in neurological care infrastructure. Brazil and Mexico dominate regional demand due to higher diagnosis rates and better access to specialty medications. Expanding private healthcare facilities and improving reimbursement coverage support market penetration. However, access limitations and cost sensitivity continue to influence prescribing patterns. Increasing awareness programs and regulatory alignment with global standards are expected to enhance regional growth prospects.

Middle East & Africa

The Middle East & Africa region represented a 5.1% market share in 2024 in the Sphingosine-1-Receptor Modulators Drugs Market, supported by growing investments in advanced healthcare services. Gulf Cooperation Council countries lead adoption due to higher healthcare spending and improved access to specialty drugs. Increasing physician training and expansion of tertiary care hospitals contribute to demand growth. In Africa, limited access and diagnostic gaps restrict uptake, although gradual healthcare infrastructure development and international partnerships support long-term market potential.

Market Segmentations:

By Drug Type

- Fingolimod

- Siponimod

- Ozanimod

- Ponesimod

- Others

By Application

- Multiple Sclerosis

- Inflammatory Bowel Disease

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the Sphingosine-1-Receptor Modulators Drugs Market is characterized by the presence of key players including Novartis AG, Bristol-Myers Squibb Company, Merck & Co., Inc., Sanofi S.A., Pfizer Inc., Biogen Inc., Roche Holding AG, Eli Lilly and Company, and Teva Pharmaceutical Industries Ltd. The market is shaped by strong product portfolios, ongoing lifecycle management strategies, and continuous investment in research and development to enhance receptor selectivity and safety profiles. Leading companies focus on expanding approved indications, strengthening clinical evidence, and optimizing dosing regimens to sustain market positioning. Strategic collaborations, licensing agreements, and late-stage pipeline development support portfolio diversification and long-term revenue stability. Patent protection remains a key competitive factor, while emerging generic competition influences pricing strategies. Companies also emphasize geographic expansion, physician engagement, and real-world evidence generation to reinforce clinical adoption and maintain leadership across major healthcare markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, Nxera Pharma assigned the Japan and APAC (ex-China) rights to the investigational S1P₁ receptor modulator cenerimod to Viatris, giving Viatris exclusive global rights to develop and commercialize cenerimod, an oral S1P modulator being investigated for autoimmune diseases.

- In March 2024, Pfizer received approval from the UK Medicines and Healthcare products Regulatory Agency (MHRA) for Velsipity (etrasimod) in ulcerative colitis, expanding its regulatory footprint for this S1P receptor modulator in Europe.

- In December 2023, Vanda Pharmaceuticals announced that it acquired the U.S. and Canadian rights to PONVORY (ponesimod), a selective S1P1 receptor modulator for relapsing forms of multiple sclerosis, from Actelion Pharmaceuticals Ltd., a Johnson & Johnson company, in a transaction valued at 100 million dollars.

Report Coverage

The research report offers an in-depth analysis based on Drug Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Sphingosine-1-Receptor Modulators Drugs Market will continue expanding due to sustained demand for oral immunomodulatory therapies in autoimmune diseases.

- Advancements in receptor selectivity will improve safety profiles and support broader clinical adoption.

- Label expansions into additional inflammatory and neurological indications will strengthen long-term market growth.

- Increased real-world evidence generation will enhance physician confidence and prescribing consistency.

- Growing preference for oral therapies will improve patient adherence and treatment outcomes.

- Pipeline diversification will reduce reliance on single-indication revenue streams for manufacturers.

- Strategic collaborations will accelerate innovation and optimize late-stage drug development.

- Emerging markets will witness gradual adoption supported by improving diagnostic infrastructure.

- Pricing pressure from payers will drive value-based contracting and access-focused strategies.

- Ongoing post-marketing surveillance will play a critical role in sustaining long-term market trust.