Market Overview

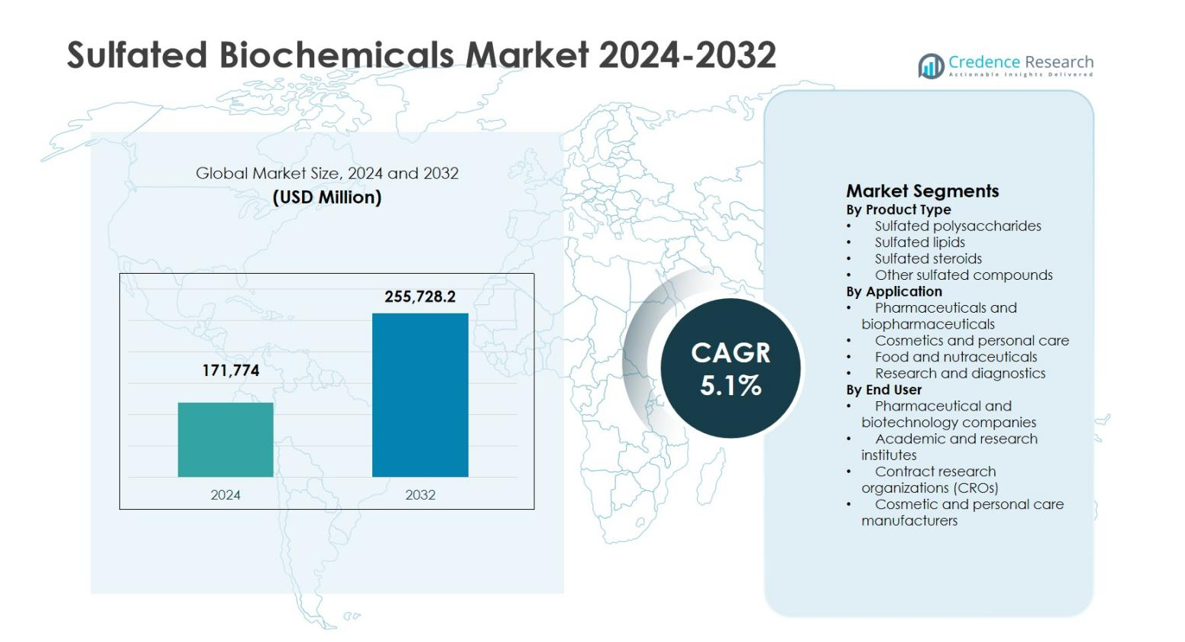

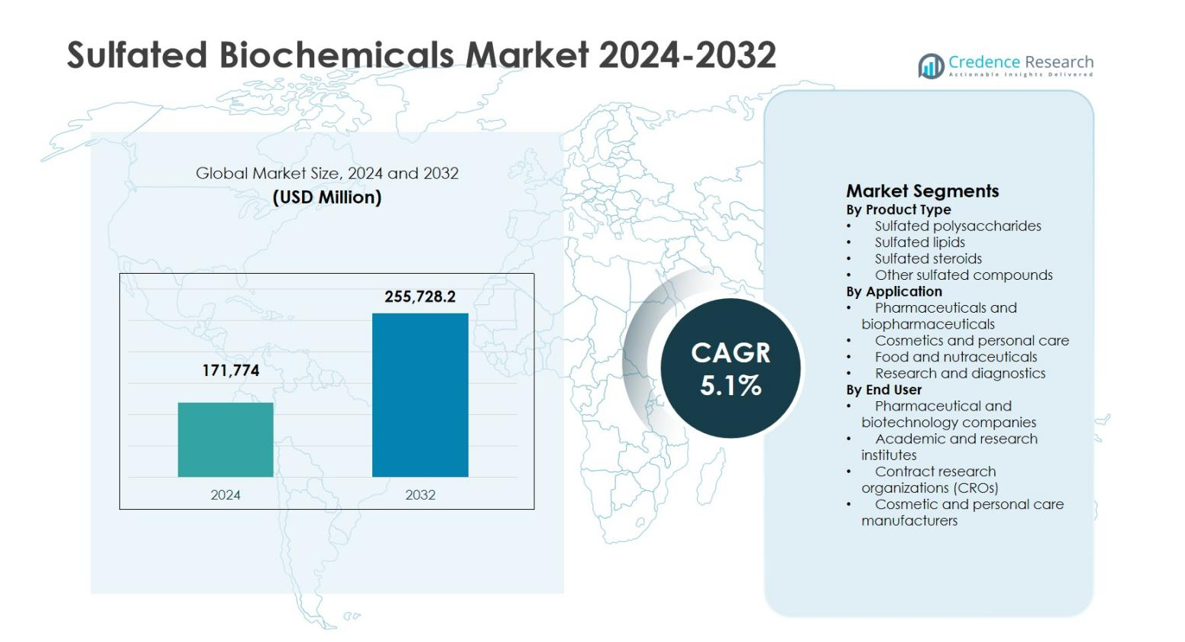

Sulfated Biochemicals Market size was valued at USD 171,774 Million in 2024 and is anticipated to reach USD 255,728.2 Million by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sulfated Biochemicals Market Size 2024 |

USD 171,774 Million |

| Sulfated Biochemicals Market, CAGR |

5.1% |

| Sulfated Biochemicals Market Size 2032 |

USD 255,728.2 Million |

Sulfated Biochemicals Market is characterized by the strong presence of established life science and specialty chemical companies that focus on high-purity and application-specific biochemical solutions. Key players such as Merck KGaA, Thermo Fisher Scientific Inc., Sigma-Aldrich Co. LLC, Lonza Group Ltd., FUJIFILM Wako Pure Chemical Corporation, Tokyo Chemical Industry Co., Ltd. (TCI), Cayman Chemical Company, Biosynth Ltd., Santa Cruz Biotechnology, Inc., and Carbosynth emphasize advanced synthesis, purification, and regulatory-compliant production to support pharmaceutical, biopharmaceutical, and research applications. Regionally, North America led the Sulfated Biochemicals Market with a 38.4% share in 2024, driven by strong pharmaceutical R&D infrastructure and high research spending, followed by Europe with 27.1% and Asia-Pacific with 24.6%, supported by expanding drug manufacturing and biomedical research activities.

Market Insights

- Sulfated Biochemicals Market size reached USD 171,774 Million in 2024 and is projected to reach USD 255,728.2 Million by 2032, expanding at a CAGR of 5.1% driven by steady demand across pharma and research sectors.

- Market growth is supported by rising pharmaceutical and biopharmaceutical R&D, where pharmaceutical and biopharmaceutical applications held 51.6% share in 2024, supported by drug discovery, biologics, and anticoagulant development.

- Product innovation and portfolio expansion remain central, with sulfated polysaccharides leading product type at 46.8% share in 2024, while pharmaceutical and biotechnology companies dominated end users with a 9% share.

- High production complexity, purification costs, and regulatory compliance requirements act as restraints, increasing operational burden and limiting rapid entry for smaller manufacturers despite strong downstream demand.

- Regionally, North America led with 38.4% share in 2024, followed by Europe at 27.1%, Asia-Pacific at 24.6%, Latin America at 5.6%, and Middle East & Africa at 4.3%, reflecting varied research and manufacturing maturity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type:

The Sulfated Biochemicals Market by product type is led by sulfated polysaccharides, which accounted for 46.8% of the market share in 2024, driven by their extensive use in anticoagulant therapies, anti-inflammatory drugs, and cell signaling research. These compounds demonstrate strong biological activity and high compatibility in pharmaceutical formulations. Sulfated lipids followed due to their role in membrane biology and metabolic studies, while sulfated steroids gained traction in endocrinology research. Demand growth is supported by rising biomedical research spending and increasing clinical adoption of biologically active sulfated compounds.

- For instance, LKT Labs supplies chondroitin sulfate from bovine trachea, a sulfated glycosaminoglycan used in research for its anticoagulant properties alongside joint health applications.

By Application:

By application, pharmaceuticals and biopharmaceuticals dominated the Sulfated Biochemicals Market with a 51.6% share in 2024, supported by increasing drug discovery activities and expanding biologics pipelines. Sulfated biochemicals play a critical role in anticoagulants, antivirals, and enzyme inhibitors, strengthening their demand in therapeutic development. Cosmetics and personal care followed due to growing use of sulfated compounds as stabilizers and active ingredients. Growth drivers include rising chronic disease prevalence, expanding biologics manufacturing, and continuous investment in advanced biochemical research and formulation technologies.

- For instance, Kiehl’s Amino Acid Shampoo incorporates Sodium Coco-Sulfate as a key surfactant, blended with wheat amino acids and hydrolyzed wheat protein to minimize scalp irritation while providing effective cleansing.

By End User:

Among end users, pharmaceutical and biotechnology companies held the largest share at 48.9% in 2024, driven by their high consumption of sulfated biochemicals for drug development, quality testing, and biologics manufacturing. These companies benefit from established R&D infrastructure and consistent demand for high-purity biochemical inputs. Academic and research institutes followed, supported by government-funded life science research, while CROs gained momentum due to outsourced clinical and preclinical studies. Market growth is driven by increasing R&D intensity, outsourcing trends, and global expansion of pharmaceutical production facilities.

Key Growth Driver

Expanding Pharmaceutical and Biopharmaceutical R&D

The Sulfated Biochemicals Market is strongly driven by rising pharmaceutical and biopharmaceutical research and development activities worldwide. Sulfated biochemicals play a critical role in anticoagulant therapies, antivirals, enzyme inhibitors, and cell signaling studies, making them essential inputs in modern drug discovery pipelines. Increasing prevalence of chronic and infectious diseases continues to push investments into biologics and advanced therapeutics. In addition, pharmaceutical companies are expanding their in-house capabilities and partnerships to accelerate molecule screening and validation, directly supporting sustained demand for high-purity sulfated biochemical compounds.

- For instance, TdB Labs produces pharma-grade dextran sulfate (e.g., 10 kDa low sulfate variant) as an anticoagulant analog and cell media supplement to enhance CHO cell growth in biopharmaceutical production.

Growth in Life Science and Biomedical Research

Rapid expansion of life science and biomedical research significantly supports the Sulfated Biochemicals Market. Academic institutions, biotechnology firms, and research laboratories increasingly rely on sulfated compounds for molecular biology, proteomics, and glycomics studies. Government funding programs and private investments aimed at advancing biomedical innovation have strengthened laboratory infrastructure across developed and emerging economies. The growing focus on understanding disease mechanisms at the cellular level further increases the adoption of sulfated polysaccharides and related compounds, reinforcing long-term market growth and research-driven consumption.

- For instance, ZBiotech’s Heparan Sulfate Glycan Array profiles interactions with 24 defined HS structures varying in sulfation, used by biotech firms for glycan-binding studies.

Rising Demand from Cosmetics and Personal Care Industry

The cosmetics and personal care industry represents a strong growth driver for the Sulfated Biochemicals Market due to increasing use of sulfated compounds as functional ingredients. These biochemicals improve product stability, texture, and bioactivity in skincare, haircare, and personal hygiene formulations. Growing consumer preference for scientifically validated and high-performance cosmetic products has encouraged manufacturers to integrate advanced biochemical ingredients. Additionally, expanding premium and dermatologically tested cosmetic lines across Asia-Pacific and Europe continue to accelerate demand for sulfated biochemicals in formulation development.

Key Trend & Opportunity

Advancements in Glycobiology and Cell Signaling Research

Advancements in glycobiology and cell signaling research present significant opportunities in the Sulfated Biochemicals Market. Researchers increasingly explore sulfated polysaccharides for their role in immune response modulation, tissue regeneration, and cellular communication. These developments are opening new application areas in regenerative medicine and targeted therapeutics. As analytical techniques and molecular characterization methods improve, demand for specialized and application-specific sulfated biochemicals continues to rise, offering manufacturers opportunities to expand customized product portfolios and strengthen research collaborations.

- For instance, Guangzhou Zuo Ke Biotechnology supplies chondroitin sulfate A (molecular weight 18 kDa, purity 98%) used in high-concentration collagen scaffolds that enhance tensile strength and promote endothelial cell proliferation for wound healing in porcine models.

Increasing Outsourcing to Contract Research Organizations

Growing reliance on contract research organizations creates a notable opportunity in the Sulfated Biochemicals Market. Pharmaceutical and biotechnology companies increasingly outsource preclinical and clinical research to optimize costs and accelerate development timelines. This trend drives consistent demand for sulfated biochemicals used in assays, formulation testing, and biological evaluations. CRO expansion in emerging markets further strengthens consumption, while long-term research contracts provide suppliers with stable revenue streams and opportunities to develop tailored biochemical solutions for outsourced research programs.

- For instance, Biocolor’s Blyscan sulfated glycosaminoglycan assay kit is used to quantify sGAGs and sulfated proteoglycans in in vitro and in vivo samples, and is distributed in North America by Ilex Life Sciences to support outsourced extracellular matrix and cartilage studies performed by contract research labs.

Key Challenge

High Cost of Production and Purification

High production and purification costs pose a major challenge in the Sulfated Biochemicals Market. Manufacturing these compounds requires complex synthesis processes, stringent quality control, and advanced purification techniques to meet pharmaceutical-grade standards. The need for specialized equipment and skilled labor increases operational expenses, which can limit adoption among cost-sensitive end users. Smaller manufacturers face barriers to scaling production, while price pressure from large buyers further constrains profit margins across the value chain.

Regulatory Compliance and Quality Standardization

Strict regulatory requirements and quality standardization challenges impact the Sulfated Biochemicals Market. Pharmaceutical and biopharmaceutical applications demand compliance with rigorous regulatory frameworks, including documentation, traceability, and batch consistency. Variability in international regulations adds complexity for manufacturers operating across multiple regions. Meeting evolving quality standards requires continuous investment in testing, validation, and certification processes. These regulatory pressures can delay product commercialization and increase compliance costs, particularly for new entrants and smaller suppliers.

Regional Analysis

North America

North America led the Sulfated Biochemicals Market with a 38.4% market share in 2024, supported by a strong pharmaceutical and biotechnology ecosystem and high research spending. The region benefits from the presence of major drug manufacturers, advanced research institutes, and well-established contract research organizations. Continuous investment in biologics, anticoagulant drugs, and cell-based therapies has accelerated the adoption of sulfated biochemicals. In addition, favorable regulatory frameworks, strong intellectual property protection, and high demand for high-purity biochemical inputs continue to reinforce North America’s dominant position in global consumption and innovation.

Europe

Europe accounted for a 27.1% share of the Sulfated Biochemicals Market in 2024, driven by robust pharmaceutical manufacturing and extensive academic research activity. Countries such as Germany, France, and the United Kingdom support strong demand through government-funded life science programs and expanding biopharmaceutical pipelines. The region also demonstrates growing use of sulfated biochemicals in cosmetics and personal care formulations, particularly in premium and dermatologically tested products. Strict quality standards and regulatory compliance requirements further promote demand for high-grade sulfated compounds, supporting stable growth across pharmaceutical, research, and industrial applications.

Asia-Pacific

Asia-Pacific captured a 24.6% market share in 2024, supported by rapid expansion of pharmaceutical production and increasing biomedical research investments. China, India, Japan, and South Korea are key contributors, benefiting from growing drug manufacturing capacity and rising outsourcing of research activities. The region also shows strong growth in cosmetics and nutraceuticals, where sulfated biochemicals are increasingly used as functional ingredients. Cost-effective manufacturing, improving laboratory infrastructure, and rising government support for life science research continue to strengthen Asia-Pacific’s position as a high-growth and strategically important regional market.

Latin America

Latin America held a 5.6% share of the Sulfated Biochemicals Market in 2024, driven by gradual expansion of pharmaceutical manufacturing and academic research capabilities. Countries such as Brazil and Mexico are increasing investments in healthcare infrastructure and local drug production, supporting demand for biochemical inputs. Growth is also supported by rising adoption of sulfated compounds in research laboratories and cosmetics manufacturing. Although the market remains smaller compared to developed regions, improving regulatory frameworks and increasing collaborations with global pharmaceutical companies continue to enhance regional demand and long-term growth prospects.

Middle East & Africa

The Middle East & Africa accounted for a 4.3% market share in 2024, supported by growing healthcare investments and gradual development of pharmaceutical and research infrastructure. Countries in the Gulf region are expanding biologics manufacturing and research initiatives as part of healthcare diversification strategies. In Africa, rising academic research activity and international collaborations are contributing to market demand. Although adoption remains limited compared to other regions, increasing government focus on healthcare modernization and research capacity building continues to create steady opportunities for sulfated biochemicals across the region.

Market Segmentations:

By Product Type

- Sulfated polysaccharides

- Sulfated lipids

- Sulfated steroids

- Other sulfated compounds

By Application

- Pharmaceuticals and biopharmaceuticals

- Cosmetics and personal care

- Food and nutraceuticals

- Research and diagnostics

By End User

- Pharmaceutical and biotechnology companies

- Academic and research institutes

- Contract research organizations (CROs)

- Cosmetic and personal care manufacturers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Merck KGaA, Thermo Fisher Scientific Inc., Sigma-Aldrich Co. LLC, Lonza Group Ltd., FUJIFILM Wako Pure Chemical Corporation, Tokyo Chemical Industry Co., Ltd. (TCI), Cayman Chemical Company, Biosynth Ltd., Santa Cruz Biotechnology, Inc., and Carbosynth dominate the Sulfated Biochemicals Market. The market structure reflects strong emphasis on product purity, regulatory compliance, and application-specific customization. Leading players focus on expanding high-purity sulfated polysaccharides, lipids, and steroids portfolios to support pharmaceutical and biopharmaceutical research. Strategic investments in advanced synthesis, purification technologies, and quality assurance systems strengthen supplier credibility. Companies also pursue geographic expansion through regional distribution networks and partnerships with research institutes and CROs. Continuous innovation, reliable supply chains, and strong technical support remain critical competitive factors, enabling established players to maintain long-term customer relationships and sustain their market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Merck KGaA

- Thermo Fisher Scientific Inc.

- Sigma-Aldrich Co. LLC

- Lonza Group Ltd.

- FUJIFILM Wako Pure Chemical Corporation

- Tokyo Chemical Industry Co., Ltd. (TCI)

- Cayman Chemical Company

- Biosynth Ltd.

- Santa Cruz Biotechnology, Inc.

- Carbosynth (a VWR / Avantor company)

Recent Developments

- In October 2025, Merck KGaA partnered with Promega Corporation to co-develop novel technologies that advance 3-D cell drug discovery, strengthening research capabilities.

- In September 2025, Thermo Fisher Scientific completed the acquisition of Solventum’s purification and filtration business, enhancing its bioprocessing and biochemical support offerings.

- In August 2025, Shimadzu launched its LC/MS/MS Method Package for Glycosaminoglycans for the LCMS-8065XE system, providing a ready-to-use workflow to analyze glycosaminoglycans and reduce method development time for sulfated GAG analysis.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Sulfated Biochemicals Market will witness steady growth driven by expanding pharmaceutical and biopharmaceutical research activities.

- Increasing development of biologics and advanced therapeutics will continue to strengthen demand for high-purity sulfated compounds.

- Rising investment in life science and biomedical research will support sustained consumption across academic and commercial laboratories.

- Expanding use of sulfated biochemicals in cosmetics and personal care formulations will create new application opportunities.

- Growth in contract research and outsourced drug development will drive consistent demand from CROs worldwide.

- Advancements in glycobiology and cell signaling studies will expand the scope of sulfated polysaccharide applications.

- Manufacturers will focus on product customization and application-specific solutions to enhance market competitiveness.

- Regulatory compliance and quality standardization will remain key focus areas for market participants.

- Asia-Pacific will emerge as a high-growth region supported by expanding pharmaceutical manufacturing capacity.

- Strategic partnerships and investments in advanced purification technologies will shape long-term market development.