| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sulfolane (Tetramethylene Sulfone) Market Size 2024 |

USD 138.4 million |

| Sulfolane (Tetramethylene Sulfone) Market, CAGR |

3.90% |

| Sulfolane (Tetramethylene Sulfone) Market Size 2032 |

USD 188.0 million |

Market overview

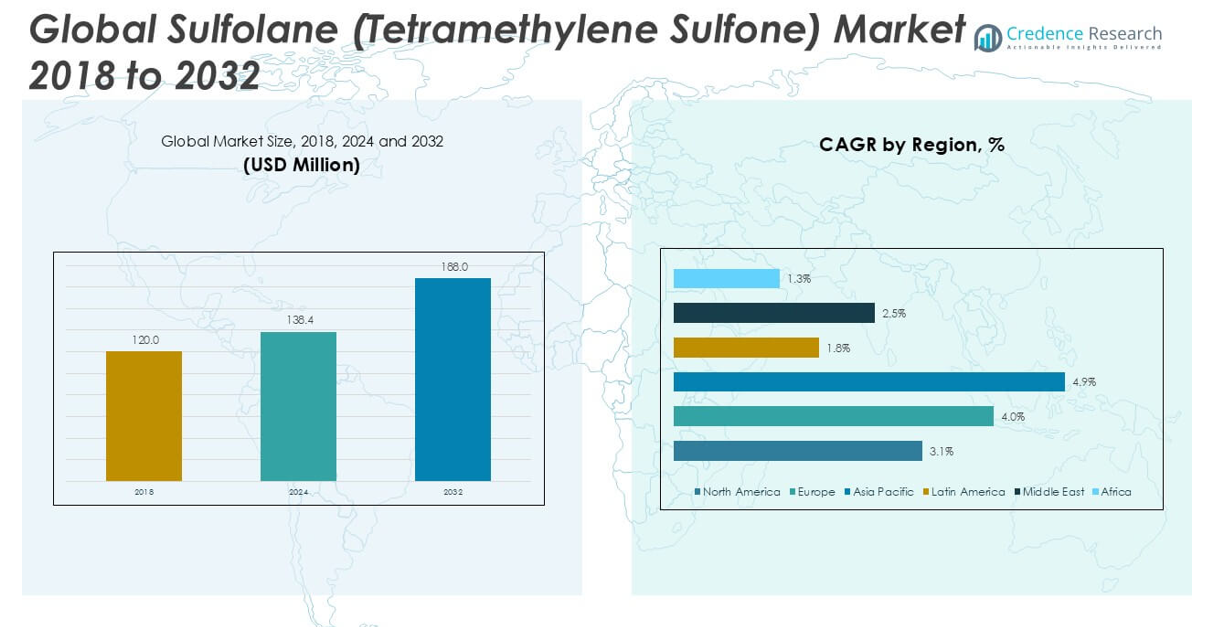

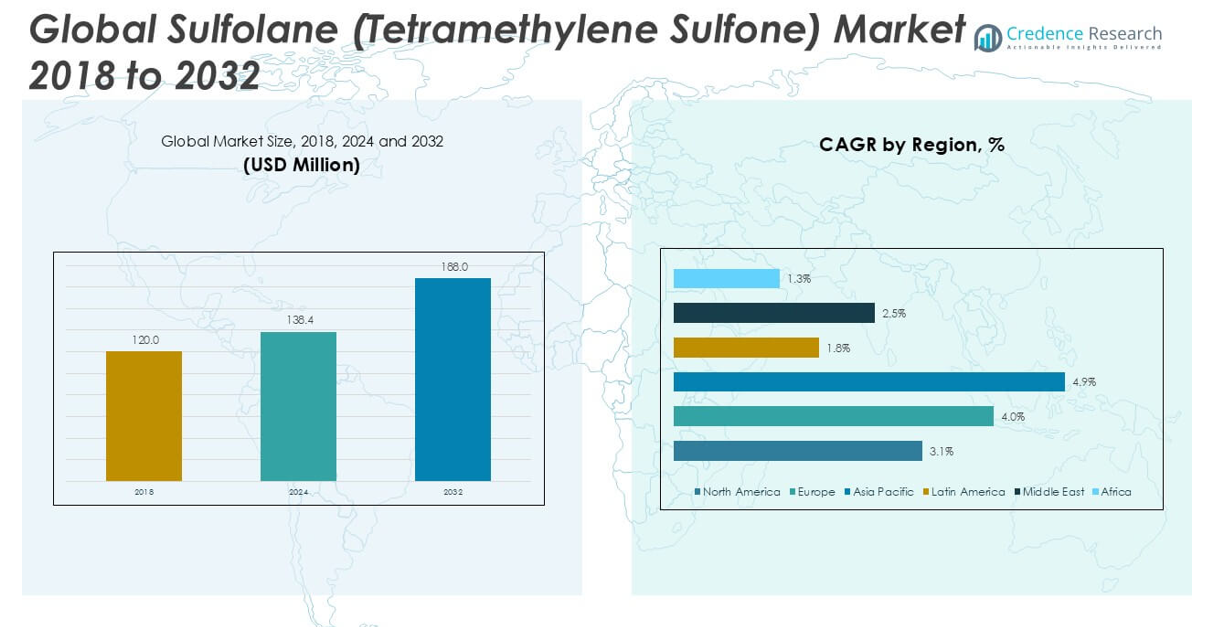

The Sulfolane (Tetramethylene Sulfone) market size was valued at USD 120.0 million in 2018, grew to USD 138.4 million in 2024, and is anticipated to reach USD 188.0 million by 2032, at a CAGR of 3.90% during the forecast period.

The Sulfolane (Tetramethylene Sulfone) market features prominent players such as Chevron Phillips Chemical Company, Arkema Group, Liaoyang Jinlan Chemical Co., Ltd., New Japan Chemical Co., Ltd., and INEOS Group, which actively drive market growth through product innovation, capacity expansion, and strategic collaborations. These companies focus on enhancing process efficiency and meeting strict environmental standards to maintain their competitive edge. Asia Pacific leads the global Sulfolane market with a commanding 48.1% market share in 2024, driven by rapid industrialization, expanding refinery capacities, and increasing energy demand in countries like China and India.

Market Insights

- The Sulfolane (Tetramethylene Sulfone) market was valued at USD 138.4 million in 2024 and is expected to reach USD 188.0 million by 2032, growing at a CAGR of 3.9% during the forecast period.

- Market growth is driven by increasing demand for cleaner fuels, expanding refining capacities, and rising adoption of Sulfolane in gas sweetening and aromatics extraction processes.

- The market is witnessing trends such as a growing focus on process efficiency, increasing demand in Asia Pacific, and emerging applications in fine chemical manufacturing.

- The market is moderately competitive with key players investing in research, product innovation, and regional capacity expansion to maintain market share, while alternative solvents and regulatory pressures intensify competition.

- Asia Pacific holds the largest regional share at 48.1% in 2024, followed by North America and Europe, while Anhydrous Sulfolane remains the dominant product type, leading the type segment due to its superior performance in critical applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

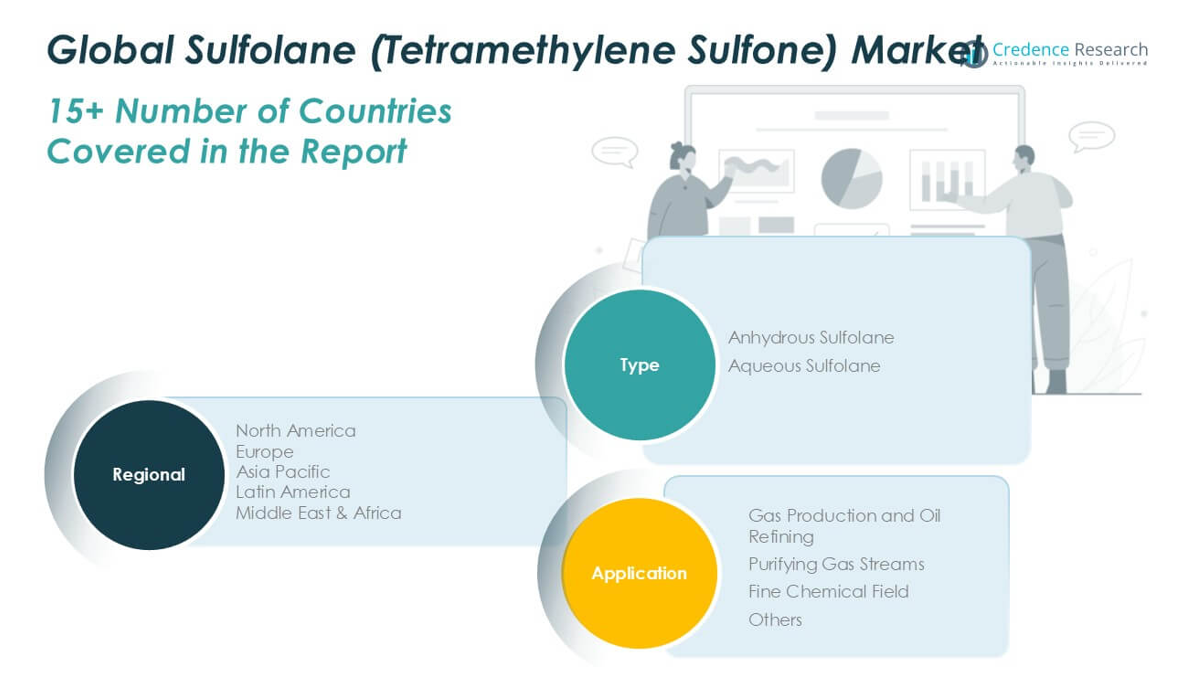

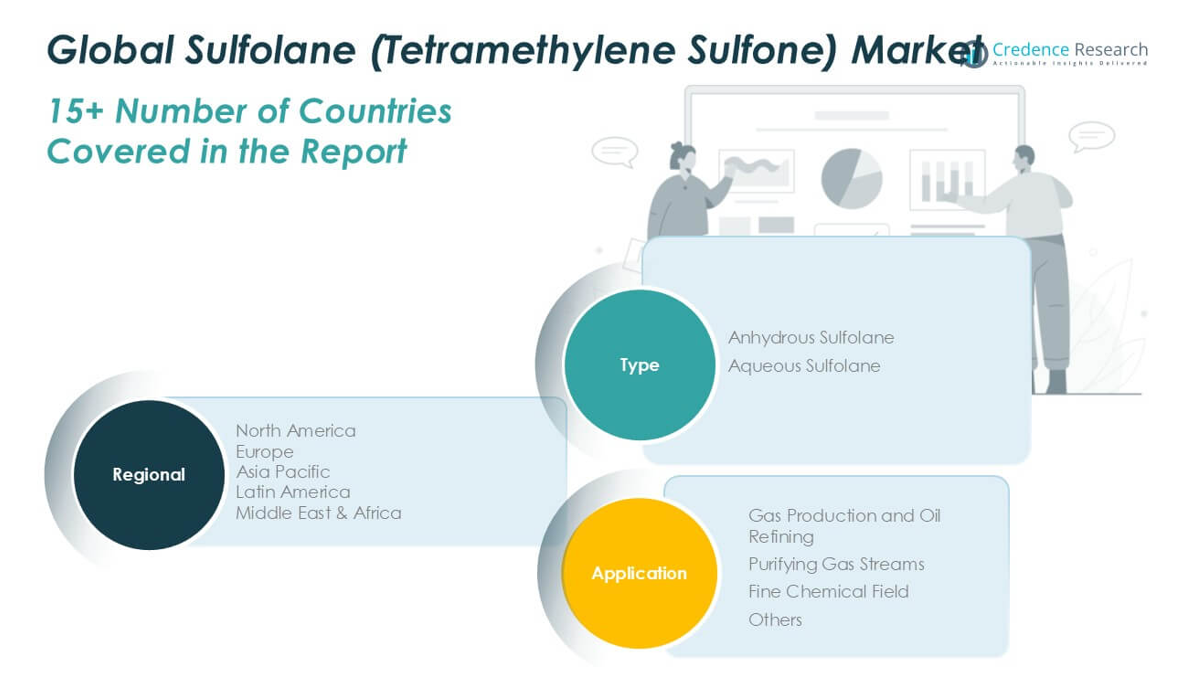

By Type

In the Sulfolane (Tetramethylene Sulfone) market, Anhydrous Sulfolane is the dominant type, holding the largest market share due to its superior solvency, high thermal stability, and excellent performance in demanding industrial processes. It is extensively used in gas production and oil refining, where its ability to operate effectively under high temperatures and pressures is critical. The increasing global demand for cleaner fuels and the continuous expansion of refining capacities are key drivers fueling the growth of this segment. In contrast, Aqueous Sulfolane holds a smaller share, primarily used in less intensive applications due to its lower solvency.

- For instance, Chevron Phillips Chemical operates Sulfolane units that process over 250,000 barrels per day in multiple refinery applications, emphasizing the large-scale reliance on Anhydrous Sulfolane.

By Application

Gas Production and Oil Refining is the leading application segment in the Sulfolane market, accounting for the majority of market demand. Sulfolane plays a vital role in gas sweetening and aromatics extraction processes, which are essential for producing low-sulfur fuels and meeting strict environmental standards. This segment’s growth is driven by the rising global energy demand, increasing investments in refinery modernization, and the push for high-purity fuel production. Other key applications include Purifying Gas Streams, the Fine Chemical Field, and Other specialized industrial processes, though they collectively hold a smaller market share compared to refining operations.

- For instance, Sinopec’s aromatics units in China utilize Sulfolane in processes that produce over 1.2 million metric tons of benzene annually, demonstrating the solvent’s critical application in large-scale refining.

Market Overview

Growing Demand for Cleaner Fuels

The increasing global focus on reducing environmental pollution and meeting stringent emission standards significantly drives the demand for Sulfolane in gas sweetening and aromatics extraction processes. As refineries worldwide adopt ultra-low sulfur fuel production to comply with environmental regulations, the need for high-performance solvents like Sulfolane becomes critical. This driver is further supported by the rapid industrialization and rising energy consumption across emerging economies, which fuels the continuous expansion and modernization of refining capacities.

- For instance, Indian Oil Corporation’s Panipat refinery uses Sulfolane in its gas sweetening units processing over 15 million metric tons of crude oil per year to produce ultra-low sulfur diesel.

Expansion of Refining and Gas Processing Facilities

Global investments in upgrading and expanding oil refining and natural gas processing infrastructure strongly support Sulfolane market growth. Sulfolane is widely used in processes such as the removal of impurities and aromatics extraction, making it indispensable in these facilities. Increasing refinery throughput and the development of advanced gas treatment units create sustained demand for Sulfolane. Additionally, the growing number of integrated petrochemical complexes in Asia-Pacific and the Middle East amplifies this trend, offering long-term growth opportunities for the market.

- For instance, the Ras Tanura Refinery in Saudi Arabia expanded its aromatics extraction capacity by 100,000 barrels per day using Sulfolane-based technologies to improve feedstock processing efficiency.

Superior Solvent Performance and Industrial Preference

Sulfolane’s superior solvency, high chemical stability, and ability to operate efficiently under high temperatures and pressures make it the preferred choice in multiple industrial applications. Its exceptional performance in gas sweetening and hydrocarbon processing ensures high selectivity and operational efficiency, which is critical for large-scale refining operations. The consistent industrial preference for Sulfolane over alternative solvents, due to its proven reliability and economic processing benefits, continues to support its strong position in the market.

Key Trends & Opportunities

Increasing Focus on Process Efficiency

The refining and gas processing industries are increasingly adopting process optimizations and advanced technologies to enhance operational efficiency. Sulfolane’s high selectivity and ability to facilitate cleaner separation processes align with these goals, making it a preferred solvent. As companies prioritize energy efficiency and lower processing costs, Sulfolane’s compatibility with modern extraction and purification units positions it as a key solution for future plant upgrades, creating significant market opportunities.

- For instance, Huntsman Corporation has implemented Sulfolane-based separation units with a processing capacity of over 180,000 barrels per day in its optimized aromatic extraction plants, significantly improving process yield and efficiency.

Rising Demand in Asia-Pacific

The Asia-Pacific region is emerging as a major growth hub for the Sulfolane market due to rapid industrialization, expanding refinery capacities, and increasing energy consumption in countries like China and India. Growing investments in large-scale petrochemical projects and stricter fuel quality regulations in the region present lucrative opportunities for Sulfolane suppliers. Additionally, the shift of global refining activities towards Asia-Pacific supports long-term market growth, positioning the region as a focal point for demand expansion.

- For instance, Reliance Industries’ Jamnagar refinery, the world’s largest single-site refinery, has an integrated aromatics extraction facility using Sulfolane to process more than 1.4 million barrels of crude oil per day, underscoring Asia-Pacific’s dominant refining position.

Emerging Applications in Fine Chemicals

The use of Sulfolane in fine chemical synthesis, including pharmaceuticals and specialty chemicals, is gradually increasing as industries seek high-purity solvents with excellent thermal stability. Although this is currently a niche segment, growing interest in precision chemical manufacturing and the development of novel synthetic pathways present new opportunities for Sulfolane. The solvent’s compatibility with complex chemical reactions and its effective recovery potential make it attractive for fine chemical manufacturers exploring efficient solvent options.

Key Challenges

Environmental and Health Concerns

One of the major challenges facing the Sulfolane market is increasing scrutiny regarding its potential environmental and health impacts. Sulfolane has been identified as a contaminant in some groundwater cases, raising regulatory concerns about its safe use, disposal, and potential long-term effects. As environmental agencies tighten safety standards, manufacturers may face higher compliance costs and additional treatment requirements, potentially limiting Sulfolane’s adoption in certain regions.

Availability of Alternative Solvents

The growing development of alternative solvent technologies poses a competitive challenge to the Sulfolane market. Companies are exploring solvents that offer lower toxicity, improved biodegradability, and reduced environmental impact, which could potentially replace Sulfolane in some applications. The rising demand for green and sustainable solvents, especially in regions with strict environmental regulations, may hinder Sulfolane’s growth prospects if these alternatives prove to be more economically viable and environmentally friendly.

Volatility in Raw Material Prices

Fluctuations in the prices of raw materials used in Sulfolane production can significantly impact the overall cost structure and profit margins of manufacturers. Volatile crude oil prices, supply chain disruptions, and changes in petrochemical feedstock availability contribute to pricing instability. These uncertainties may create challenges in maintaining competitive pricing, especially in highly cost-sensitive markets, and could potentially affect long-term investment decisions within the Sulfolane industry.

Regional Analysis

North America

In 2018, North America held a Sulfolane market size of USD 31.3 million, accounting for approximately 26.3% of the global market share. By 2024, the market grew to USD 33.6 million and is projected to reach USD 41.0 million by 2032, registering a CAGR of 3.1% during the forecast period. The region’s growth is driven by stable demand from advanced oil refining and gas processing facilities, supported by stringent environmental regulations promoting cleaner fuel production. North America’s strong technological base and focus on operational efficiency sustain its steady market contribution.

Europe

Europe captured 19.6% of the global Sulfolane market share in 2018, with a market size of USD 23.3 million. The market expanded to USD 25.1 million in 2024 and is anticipated to reach USD 30.4 million by 2032, growing at a CAGR of 4.0%. The region’s growth is supported by strict emission standards and the increasing adoption of Sulfolane in gas sweetening and refining operations. Continuous investments in energy transition, coupled with the region’s emphasis on process efficiency and environmental compliance, further drive Sulfolane demand across Europe.

Asia Pacific

Asia Pacific dominated the global Sulfolane market with a 38.8% market share in 2018, valued at USD 46.2 million. The market surged to USD 59.1 million in 2024 and is forecast to reach USD 88.5 million by 2032, exhibiting the highest CAGR of 4.9%. Rapid industrialization, expanding refinery capacities, and rising energy consumption in countries like China and India are key growth drivers. The increasing shift of global refining activities towards Asia Pacific and substantial investments in petrochemical complexes firmly position this region as the fastest-growing and most influential market for Sulfolane.

Latin America

Latin America accounted for 4.6% of the global Sulfolane market share in 2018, with a market value of USD 5.5 million. The region’s market grew to USD 7.2 million in 2024 and is projected to reach USD 11.1 million by 2032, reflecting a CAGR of 1.8%. Growth in this region is primarily supported by gradual refinery upgrades and increasing natural gas production. However, the market expansion is somewhat limited by slower industrial development compared to other regions. Demand remains concentrated in a few key countries with emerging oil and gas infrastructure investments.

Middle East

The Middle East held 6.2% of the global Sulfolane market share in 2018, with a market size of USD 7.4 million. The market expanded to USD 8.7 million in 2024 and is expected to reach USD 12.2 million by 2032, growing at a CAGR of 2.5%. The region’s growth is fueled by its strong oil and gas base, continuous refinery investments, and increasing demand for Sulfolane in gas sweetening applications. Ongoing energy sector developments and the strategic importance of hydrocarbon processing in the Middle East support steady market growth.

Africa

Africa represented 5.2% of the global Sulfolane market share in 2018, valued at USD 6.2 million. By 2024, the market declined to USD 4.7 million and is expected to remain at the same level through 2032, indicating a stagnant outlook with a low CAGR of 1.3%. Limited industrial growth, infrastructure challenges, and reduced refining activity constrain the region’s market potential. Despite small-scale refinery projects in selected countries, Africa’s overall Sulfolane demand remains modest. Long-term opportunities may emerge if energy sector investments and industrialization efforts accelerate across the region.

Market Segmentations:

By Type:

- Anhydrous Sulfolane

- Aqueous Sulfolane

By Application:

- Gas Production and Oil Refining

- Purifying Gas Streams

- Fine Chemical Field

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

he Sulfolane (Tetramethylene Sulfone) market is moderately competitive, with several key players actively focusing on expanding their market presence through product innovation, capacity expansions, and strategic partnerships. Major companies such as Chevron Phillips Chemical Company, Arkema Group, and Liaoyang Jinlan Chemical Co., Ltd. hold significant market shares, leveraging their extensive product portfolios and global distribution networks. These players are consistently investing in research and development to improve Sulfolane processing efficiency and environmental safety. The market is also witnessing capacity expansions and regional diversification, particularly in fast-growing areas such as Asia-Pacific, to address rising local demand and reduce supply chain complexities. Additionally, the increasing pressure to develop safer and more sustainable chemical solutions is prompting innovation across the industry. Competitive intensity is further influenced by the emergence of alternative solvents and fluctuating raw material prices, encouraging companies to optimize operational costs and enhance product differentiation to maintain market relevance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Chevron Phillips Chemical Company

- Arkema Group

- Liaoyang Jinlan Chemical Co., Ltd.

- New Japan Chemical Co., Ltd.

- Zhejiang Gaoma Industrial Co., Ltd.

- Zhejiang Taizhou Petrochemical Co., Ltd.

- Merck KGaA (Sigma-Aldrich)

- Thermo Fisher Scientific Inc.

- Huntsman Corporation

- TCI Chemicals (Tokyo Chemical Industry Co., Ltd.)

- Wako Pure Chemical Industries, Ltd. (Fujifilm)

- Jiangsu Fubang Chemical Co., Ltd.

- Henan Energy and Chemical Industry Group

- INEOS Group

Market Concentration & Characteristics

The Sulfolane (Tetramethylene Sulfone) Market demonstrates a moderately concentrated structure, with a few established players holding significant market shares. It shows characteristics of steady demand driven by specialized applications in gas sweetening and aromatics extraction. The market is technology-intensive, where solvent purity, process efficiency, and environmental compliance remain key factors influencing competitiveness. Companies actively invest in product improvement and regional capacity expansion to strengthen their positions. The market favors suppliers capable of ensuring high-quality, large-volume production with consistent supply reliability. It relies heavily on long-term contracts with oil refineries and gas processing plants, which creates stable demand cycles. Asia Pacific holds the largest share, supported by refinery expansion and increasing energy requirements, followed by North America and Europe. Pricing stability faces occasional disruption from raw material cost fluctuations and regulatory changes impacting solvent handling and disposal. It shows limited threat from new entrants due to high entry barriers, specialized processing requirements, and customer preference for proven suppliers.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Sulfolane (Tetramethylene Sulfone) Market will experience steady growth driven by rising demand for cleaner fuels.

- Refinery expansions and gas processing developments will continue to support long-term market demand.

- Asia Pacific will remain the leading region due to rapid industrialization and growing energy consumption.

- North America and Europe will maintain stable demand supported by technological advancements and regulatory compliance.

- Anhydrous Sulfolane will continue to dominate the product type segment due to its superior performance.

- Companies will focus on process efficiency and high-purity solvent production to meet evolving industry standards.

- Environmental regulations will influence product development and handling practices across key regions.

- New applications in fine chemicals and specialty processing will gradually create additional growth opportunities.

- Competition will intensify with the development of alternative solvents offering lower environmental impact.

- Market players will prioritize strategic partnerships and regional expansions to secure long-term supply agreements.