Market Overview

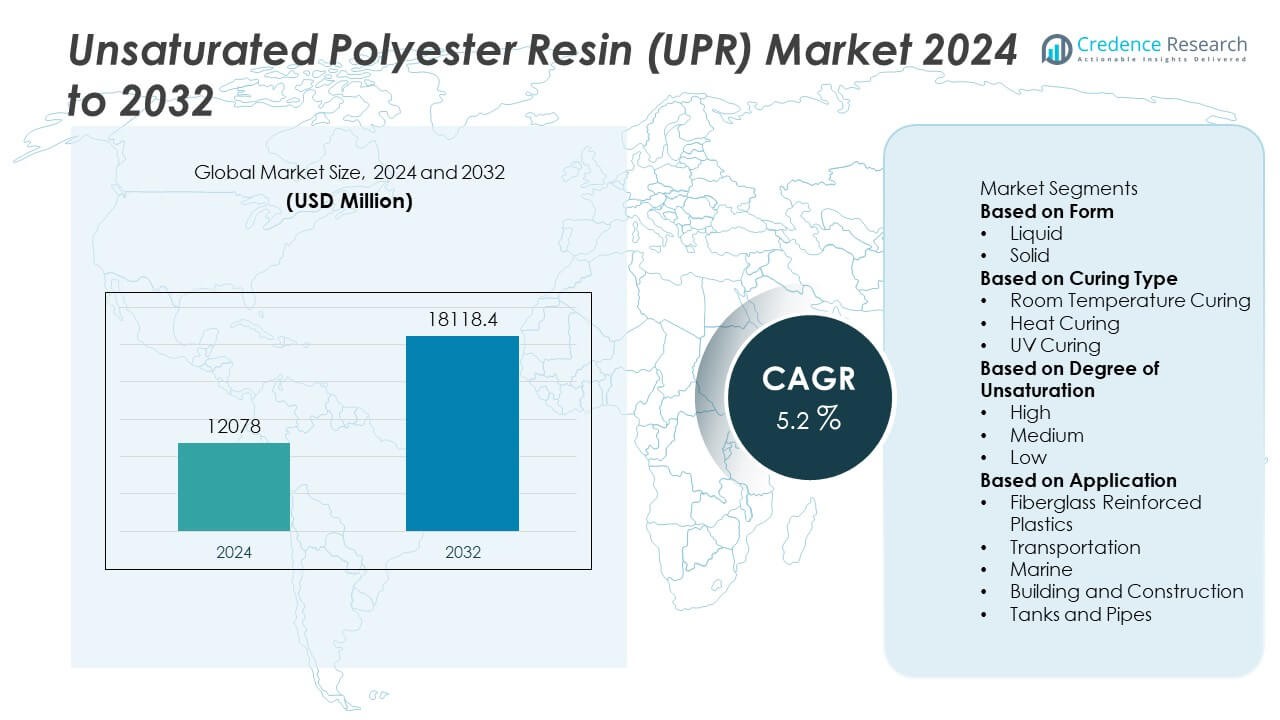

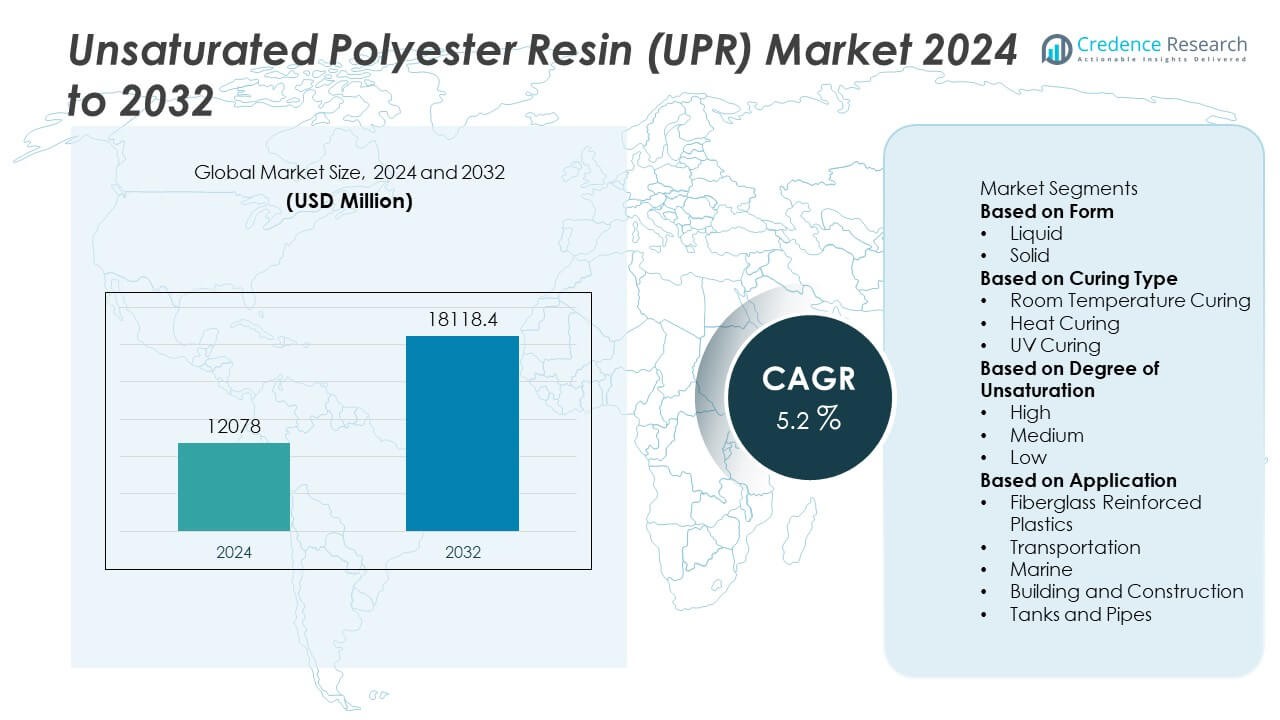

The Unsaturated Polyester Resin (UPR) Market was valued at USD 12,078 million in 2024 and is projected to reach USD 18,118.4 million by 2032, expanding at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Unsaturated Polyester Resin (UPR) Market Size 2024 |

USD 12,078 Million |

| Unsaturated Polyester Resin (UPR) Market, CAGR |

5.2% |

| Unsaturated Polyester Resin (UPR) Market Size 2032 |

USD 18,118.4 Million |

The Unsaturated Polyester Resin (UPR) Market grows on the strength of rising demand from construction, automotive, marine, and renewable energy sectors. UPR is widely used in pipes, tanks, building panels, wind turbine blades, and automotive components due to its durability, cost-effectiveness, and versatility.

The Unsaturated Polyester Resin (UPR) Market demonstrates strong growth across regions, supported by rising infrastructure projects, industrial expansion, and renewable energy developments. Asia-Pacific leads demand with rapid urbanization, large-scale construction, and growing automotive production, while Europe emphasizes sustainability and renewable integration through offshore wind and marine applications. North America shows steady growth with UPR used in pipelines, automotive composites, and housing projects, while Latin America and the Middle East & Africa advance with expanding construction and industrial initiatives. Key players shaping the market include Ashland, Arkema, and BASF, which focus on high-performance resins and advanced formulations. Evonik and Huntsman strengthen their portfolios with innovative composite solutions and strategic partnerships, while Polynt and AOC expand their presence through tailored products for infrastructure and automotive applications. Together, these companies drive innovation and competitiveness, ensuring UPR remains a versatile and indispensable material for diverse global industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Insights

- The Unsaturated Polyester Resin (UPR) Market was valued at USD 12,078 million in 2024 and is projected to reach USD 18,118.4 million by 2032, expanding at a CAGR of 5.2% during the forecast period.

- Rising demand from construction, automotive, marine, and renewable energy sectors drives the adoption of UPR for pipes, tanks, building panels, automotive parts, and wind turbine blades.

- A key trend shaping the market is the development of eco-friendly and bio-based UPR formulations, along with low-styrene emission variants to meet sustainability and regulatory requirements.

- The competitive landscape features major players such as Ashland, Arkema, BASF, Evonik, Huntsman, and Polynt, along with AOC and Reichhold, all investing in R&D, product diversification, and strategic expansions.

- Market restraints include volatility in raw material prices, particularly styrene and maleic anhydride, along with strict environmental regulations that increase compliance costs for producers.

- Regionally, Asia-Pacific leads growth due to large-scale industrialization, urban expansion, and infrastructure investments, while Europe focuses on renewable energy and bio-based composites, and North America shows strong usage in automotive and construction applications.

- The market outlook remains positive as industries continue to prioritize lightweight, durable, and cost-effective composite materials, ensuring UPR’s critical role in supporting global infrastructure and sustainable industrial growth.

Market Drivers

Rising Demand from Construction and Infrastructure

The Unsaturated Polyester Resin (UPR) Market benefits significantly from rapid growth in global construction and infrastructure projects. UPR is widely used in reinforced composites, roofing, cladding, and sanitary ware due to its strength and durability. It helps reduce material costs while maintaining high performance, making it a preferred choice for large-scale applications. Expanding urbanization in emerging economies fuels demand for lightweight and resilient building materials. Governments invest heavily in housing, transportation, and energy infrastructure, driving consistent use of UPR. It positions UPR as a critical material for supporting long-term infrastructure development.

- For instance, China’s Unsaturated Polyester Resin (UPR) consumption exceeded 1.2 million metric tons, primarily due to robust infrastructure expansion and high demand from the expanding electric vehicle (EV) industry.

Expanding Applications in Automotive and Transportation

The automotive sector plays a vital role in driving UPR demand due to its requirement for lightweight, fuel-efficient materials. The Unsaturated Polyester Resin (UPR) Market finds strong adoption in automotive parts, including body panels, bumpers, and interior components. It improves vehicle efficiency by reducing overall weight while maintaining strength and design flexibility. Electric vehicle manufacturing also increases UPR use in battery enclosures and lightweight structural parts. Automotive OEMs invest in composite materials that enhance performance and sustainability. It accelerates UPR adoption across both conventional and electric mobility platforms.

- For instance, the automotive and transport sector consumed approximately 1.04 million metric tonnes of UPR in 2023, indicating significant use in vehicle composite applications.

Growth in Marine and Wind Energy Sectors

Marine and renewable energy industries create major opportunities for UPR consumption. The Unsaturated Polyester Resin (UPR) Market supports marine applications such as boat hulls, decks, and interior components due to its water resistance and cost-effectiveness. It also plays a key role in manufacturing wind turbine blades, which demand strong and lightweight materials. Rising investments in offshore wind projects across Europe and Asia further elevate demand. Manufacturers adopt UPR formulations designed for high fatigue resistance and long service life. It reinforces the role of UPR as an enabler of sustainable energy transitions.

Rising Focus on Cost-Effectiveness and Versatility

The cost-effectiveness and versatility of UPR drive its adoption across multiple industries. The Unsaturated Polyester Resin (UPR) Market grows with its ability to be tailored for diverse applications, from electrical components to consumer goods. It offers superior moldability, making it suitable for complex designs in industrial products. Lower production costs compared to alternative resins strengthen its competitiveness in price-sensitive markets. Manufacturers emphasize UPR due to its balance of performance, flexibility, and affordability. It secures UPR’s role as a versatile solution for industries seeking efficient material alternatives.

Market Trends

Shift Toward Sustainable and Eco-Friendly Resins

The Unsaturated Polyester Resin (UPR) Market shows a clear trend toward sustainability as industries adopt eco-friendly materials. Manufacturers develop bio-based and low-styrene emission UPR to reduce environmental impact and meet regulatory requirements. It supports global efforts to cut carbon emissions and improve workplace safety. Consumer preference for greener products drives industries to switch to sustainable composites. Companies invest in R&D to create resins from renewable feedstocks, aligning with circular economy goals. It positions sustainable UPR as a growing segment within the overall market.

- For instance, Evonik introduced DYNACOLL® eCO polyester resins in March 2023, offering partially bio‑based polyols containing 500 grams of renewable content per kilogram of product for use in adhesives and composite formulations.

Rising Use in Lightweight Composites

The demand for lightweight yet durable materials drives innovation in UPR-based composites. The Unsaturated Polyester Resin (UPR) Market benefits from rising adoption in sectors such as automotive, aerospace, and construction. It enables weight reduction without compromising mechanical strength or performance. Industries increasingly replace traditional metals with UPR composites for efficiency gains. Advanced resin formulations deliver high fatigue resistance and longer service life in demanding applications. It reflects the growing role of UPR in supporting material innovation across multiple industries.

- For instance, Huntsman’s VITROX® and RIMLINE® polyurethane composite systems delivered cycle times under 10 minutes and incorporated mass‑balanced bio‑content in formulations used for automotive structural parts.

Increasing Penetration in Renewable Energy Applications

Renewable energy projects contribute significantly to UPR demand, particularly in wind energy and solar panel components. The Unsaturated Polyester Resin (UPR) Market expands as countries invest in clean energy infrastructure. It plays an essential role in producing large wind turbine blades that require lightweight and durable composites. Manufacturers design UPR solutions with enhanced fatigue resistance to withstand extreme operational environments. Offshore wind projects in Europe and Asia create substantial opportunities for UPR suppliers. It strengthens the position of UPR as a key material in the renewable energy sector.

Growing Adoption of Advanced Manufacturing Processes

Technological advancements in manufacturing influence UPR applications across industries. The Unsaturated Polyester Resin (UPR) Market benefits from automated molding, resin transfer molding (RTM), and additive manufacturing techniques. It allows higher precision, reduced waste, and faster production cycles. Integration of digital design tools with composite manufacturing enhances efficiency and quality. Companies leverage automation to meet rising demand for cost-effective, high-volume production. It highlights how process innovation continues to shape UPR adoption in global markets.

Market Challenges Analysis

Volatility in Raw Material Prices

The Unsaturated Polyester Resin (UPR) Market faces significant challenges due to fluctuating raw material costs. Key inputs such as styrene, maleic anhydride, and glycol are derived from petrochemicals, which are highly sensitive to global crude oil price variations. It creates uncertainty in production planning and affects profit margins for manufacturers. Frequent price shifts hinder long-term contracts with buyers and force companies to adjust pricing strategies. Small and mid-sized producers face higher risks in sustaining competitive positions under volatile conditions. It compels manufacturers to explore alternative sourcing and develop bio-based substitutes to reduce dependency.

Environmental and Regulatory Constraints

Stringent environmental regulations present another obstacle to market growth. The Unsaturated Polyester Resin (UPR) Market encounters restrictions on styrene emissions due to their impact on air quality and worker safety. It requires companies to invest in advanced production technologies and comply with strict emission standards, raising operational costs. Regulatory variations across regions make global expansion complex for producers. Growing environmental awareness pressures manufacturers to reduce volatile organic compound (VOC) levels in UPR products. It limits flexibility in traditional formulations and drives demand for costly sustainable alternatives.

Market Opportunities

Expansion in Renewable Energy and Infrastructure Projects

The Unsaturated Polyester Resin (UPR) Market holds strong opportunities in renewable energy and infrastructure development. Demand for wind turbine blades, solar panel components, and hydropower equipment drives new applications for UPR-based composites. It offers durability, lightweight properties, and cost efficiency, making it suitable for large-scale clean energy projects. Governments worldwide invest heavily in renewable capacity, boosting requirements for advanced resin solutions. Infrastructure projects, including bridges, pipelines, and construction reinforcements, also create consistent demand. It strengthens UPR’s role as a strategic material in supporting sustainable development and modern infrastructure.

Growth in Automotive, Marine, and Consumer Applications

Expanding use of composites in automotive, marine, and consumer goods industries opens fresh prospects for UPR producers. The Unsaturated Polyester Resin (UPR) Market benefits from automakers seeking lightweight solutions to improve fuel efficiency and meet emission targets. It supports marine applications such as boat hulls and decks due to its water resistance and long service life. Consumer goods including bathroom fittings, furniture, and household equipment also rely on UPR for cost-effective production. Emerging economies with rising middle-class populations drive demand for affordable, durable, and versatile products. It positions UPR as a material of choice across both industrial and consumer markets.

Market Segmentation Analysis:

By Form

The Unsaturated Polyester Resin (UPR) Market segments by form into liquid and powder types, with liquid resins holding a dominant position. Liquid UPR offers excellent processing flexibility, making it suitable for applications such as coatings, laminates, and fiber-reinforced plastics. It provides uniform curing and adaptability across diverse industries, from construction to automotive. Powder forms, while less prevalent, gain attention in specialized applications requiring enhanced handling safety and reduced emissions. It offers advantages in terms of storage stability and controlled processing. Growing demand for lightweight composites across industries ensures strong adoption of liquid forms, while technological advancements expand the scope for powder-based UPR.

- For instance, Nantong Fangxin Chemical Co. operates a facility in China with a powder-form UPR production capacity of 180,000 metric tonnes per year, serving markets that prioritize safer, low-emission handling.

By Curing Type

Curing type segmentation includes heat-cured and room-temperature-cured UPR. The Unsaturated Polyester Resin (UPR) Market sees high demand for room-temperature curing, especially in construction and consumer products, due to its ease of application and reduced processing costs. It enables efficient fabrication in small- and medium-scale production environments. Heat-cured UPR dominates in industrial applications that demand higher strength, thermal resistance, and durability, such as automotive and marine sectors. Controlled heat curing enhances mechanical performance and extends product lifespan. It ensures that both curing types continue to play critical roles depending on application requirements and performance expectations.

- For instance, BASF operates global UPR production capacity exceeding 800,000 metric tonnes per annum, including a newly commissioned heat‑cured bio‑UPR line of 100,000 metric tonnes capacity dedicated to specialized composite applications.

By Degree of Unsaturation

The degree of unsaturation defines resin performance characteristics, with orthophthalic, isophthalic, and dicyclopentadiene (DCPD)-based resins forming key categories. The Unsaturated Polyester Resin (UPR) Market widely adopts orthophthalic resins due to their cost-effectiveness and versatility in producing pipes, tanks, and panels. It maintains strong demand in general-purpose applications where moderate strength and chemical resistance are sufficient. Isophthalic resins offer superior mechanical strength and corrosion resistance, making them preferred in marine, chemical, and infrastructure applications. DCPD-based UPR provides low viscosity and excellent electrical insulation, supporting applications in electronics and automotive components. It reflects how degree of unsaturation determines resin suitability across diverse industries, driving tailored product development for end users.

Segments:

Based on Form

Based on Curing Type

- Room Temperature Curing

- Heat Curing

- UV Curing

Based on Degree of Unsaturation

Based on Application

- Fiberglass Reinforced Plastics

- Transportation

- Marine

- Building and Construction

- Tanks and Pipes

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

Asia-Pacific

Asia-Pacific dominates the Unsaturated Polyester Resin (UPR) Market with 41% share, driven by rapid industrialization, infrastructure expansion, and strong growth in automotive and construction sectors. China leads the region with large-scale demand for UPR in building materials, marine products, and wind energy components. It also benefits from India’s fast-growing construction and renewable energy projects, where UPR is widely adopted for pipes, tanks, and composite panels. Japan and South Korea focus on high-performance UPR applications in automotive and electronics, reflecting the region’s advanced manufacturing capabilities. Rising urbanization and increasing demand for affordable housing boost consumption across emerging economies in Southeast Asia. It positions Asia-Pacific as the fastest-growing and most dynamic market for UPR globally.

Europe

Europe accounts for 25% of the Unsaturated Polyester Resin (UPR) Market, supported by strong regulations that emphasize sustainable materials and high-performance composites. Germany, France, and the UK lead adoption, with UPR widely used in construction, automotive, and wind turbine manufacturing. It gains traction in marine applications, where European manufacturers focus on lightweight and corrosion-resistant resins. Investments in offshore wind projects across the North Sea significantly increase demand for UPR-based composites. European firms also emphasize bio-based UPR to align with the EU’s environmental targets. It highlights Europe’s role as a hub for innovation and renewable-driven UPR applications.

North America

North America holds 20% of the Unsaturated Polyester Resin (UPR) Market, driven by demand from construction, automotive, and marine industries. The United States remains the largest consumer, leveraging UPR in infrastructure upgrades, pipelines, and automotive composites. It supports the wind energy sector, where UPR is critical for manufacturing large turbine blades. Canada and Mexico contribute steadily, with increasing adoption in housing and industrial projects. The region’s emphasis on lightweight automotive materials strengthens UPR consumption in OEM production. It reflects a market where innovation, renewable integration, and infrastructure development sustain long-term growth.

Latin America

Latin America represents 8% of the Unsaturated Polyester Resin (UPR) Market, with Brazil and Mexico leading demand. Construction and transportation sectors remain primary consumers, supported by growing urban populations. It finds applications in water storage tanks, pipelines, and building materials across the region. Marine and automotive industries also adopt UPR due to its cost efficiency and versatility. Government-backed infrastructure development and renewable energy projects create further opportunities. It underscores the region’s steady growth despite economic challenges in some markets.

Middle East & Africa

The Middle East & Africa account for 6% of the Unsaturated Polyester Resin (UPR) Market, supported by infrastructure expansion and industrial growth. The UAE and Saudi Arabia lead in construction demand, with UPR used in panels, claddings, and piping systems. It gains relevance in marine and oil & gas applications, where corrosion resistance is critical. South Africa shows rising adoption in housing and industrial products, expanding overall regional demand. Renewable energy projects, particularly solar and wind, add momentum to UPR usage. It reflects a growing market with significant potential for long-term expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Huntsman

- AOC

- Arkema

- Polynt

- Ashland

- Reichhold

- Evonik

- BASF

- Sartomer

- SigmaAldrich

Competitive Analysis

The competitive landscape of the Unsaturated Polyester Resin (UPR) Market is shaped by global leaders such as Ashland, Arkema, Evonik, Huntsman, Sartomer, BASF, SigmaAldrich, Polynt, AOC, and Reichhold, all of which actively drive innovation and market expansion. Ashland and Arkema focus on developing advanced resin formulations with improved mechanical performance and lower emissions, aligning with sustainability targets. BASF and Evonik strengthen their positions through diversified product portfolios and strong R&D capabilities, catering to construction, automotive, and marine applications. Huntsman and Sartomer emphasize specialty UPR solutions tailored for high-performance composites, while Polynt and AOC expand their global presence through acquisitions and capacity enhancements to meet rising infrastructure and industrial demand. Reichhold maintains a strong role in supplying resins for marine and wind energy applications, supported by its legacy in composite materials. SigmaAldrich contributes with research-grade resins and specialty chemicals, supporting innovation across multiple industries. Intense competition encourages these players to invest in bio-based alternatives, enhance supply chain networks, and collaborate with end-use industries to meet the growing need for lightweight, durable, and cost-efficient UPR solutions worldwide.

Recent Developments

- In July 2025, Polynt partnered with LyondellBasell to develop marine-grade UPR utilizing LYB’s Styrene +LC (low‑carbon) solution. This approach uses the ISCC PLUS mass-balance method and incorporates bio-based feedstocks.

- In January 2025, AOC, together with Polynt and other members of the Cefic UP/VE Sector Group, contributed to a newly published Life Cycle Assessment (LCA) dataset for UPR and vinyl ester resins. The dataset enhances transparency around global warming impact and eco-footprint using recycled PET (rPET) inputs.

- In February 2024, Evonik launched a novel photopolymer resin with both flame-retardant properties and mechanical durability when cured, designed to meet high-performance application requirements. This resin delivers enhanced safety and robustness for components subjected to demanding operational conditions.

Market Concentration & Characteristics

The Unsaturated Polyester Resin (UPR) Market demonstrates a moderately consolidated structure, with a mix of multinational corporations and regional players competing on product quality, cost efficiency, and technological advancement. Large companies such as Ashland, Arkema, BASF, Huntsman, and Polynt dominate with broad product portfolios, advanced R&D, and global distribution networks, while regional producers like AOC and Reichhold strengthen competition by focusing on niche applications and cost-effective solutions. It is defined by high entry barriers due to capital-intensive production, dependence on petrochemical-derived raw materials, and strict environmental regulations around styrene emissions. Strong demand from construction, automotive, marine, and renewable energy sectors keeps competition intense, with companies investing in sustainable and bio-based UPR formulations to address tightening regulations and shifting customer preferences. It reflects a market where innovation, supply chain resilience, and regulatory compliance remain key competitive differentiators that shape long-term growth and global positioning.

Report Coverage

The research report offers an in-depth analysis based on Type, Curing Type, Degree of Unsaturation, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Unsaturated Polyester Resin (UPR) Market will expand steadily with growing demand across construction, automotive, marine, and renewable sectors.

- Infrastructure development in emerging economies will continue to drive large-scale adoption of UPR composites.

- Renewable energy projects, especially wind and solar, will create strong opportunities for UPR applications in turbine blades and panel components.

- Automotive manufacturers will increase use of UPR to achieve lightweight, fuel-efficient, and durable vehicle parts.

- Advances in bio-based and low-styrene emission formulations will support regulatory compliance and sustainability goals.

- Marine industries will adopt UPR for corrosion-resistant hulls, decks, and structural parts in both small and large vessels.

- Digital design integration and automated molding technologies will improve efficiency and expand industrial-scale use of UPR.

- Regional demand will grow strongest in Asia-Pacific, while Europe and North America focus on high-performance and eco-friendly resin solutions.

- Strategic partnerships and acquisitions will shape competition among leading players aiming to secure market leadership.

- Continuous innovation in resin formulations will enhance durability, thermal resistance, and adaptability for diversified applications.