Market Overview

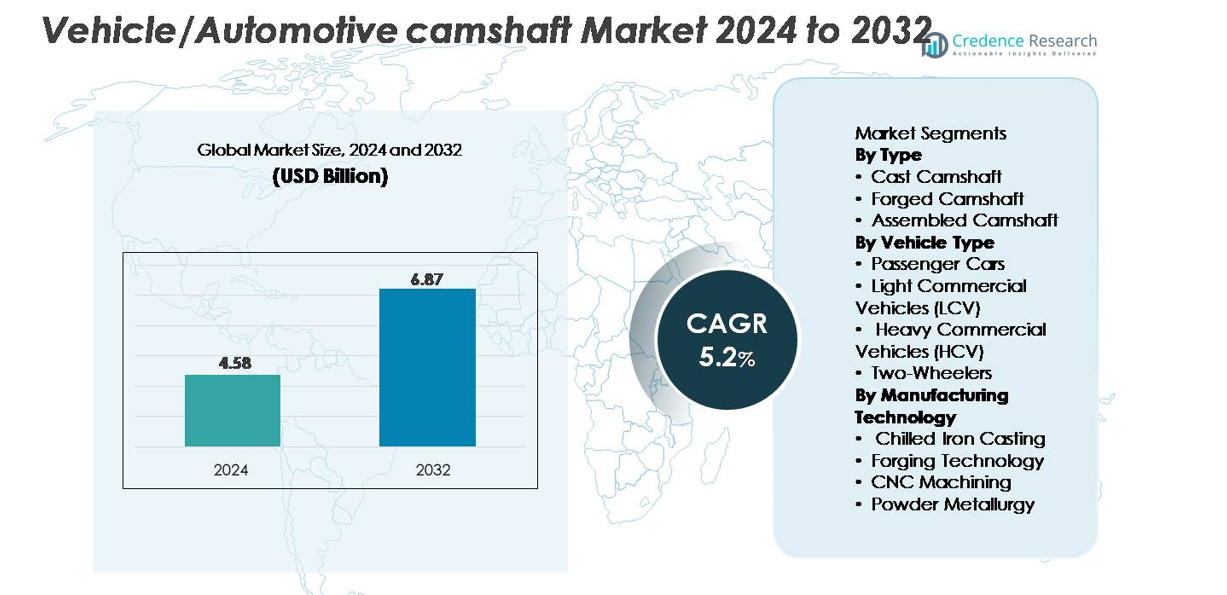

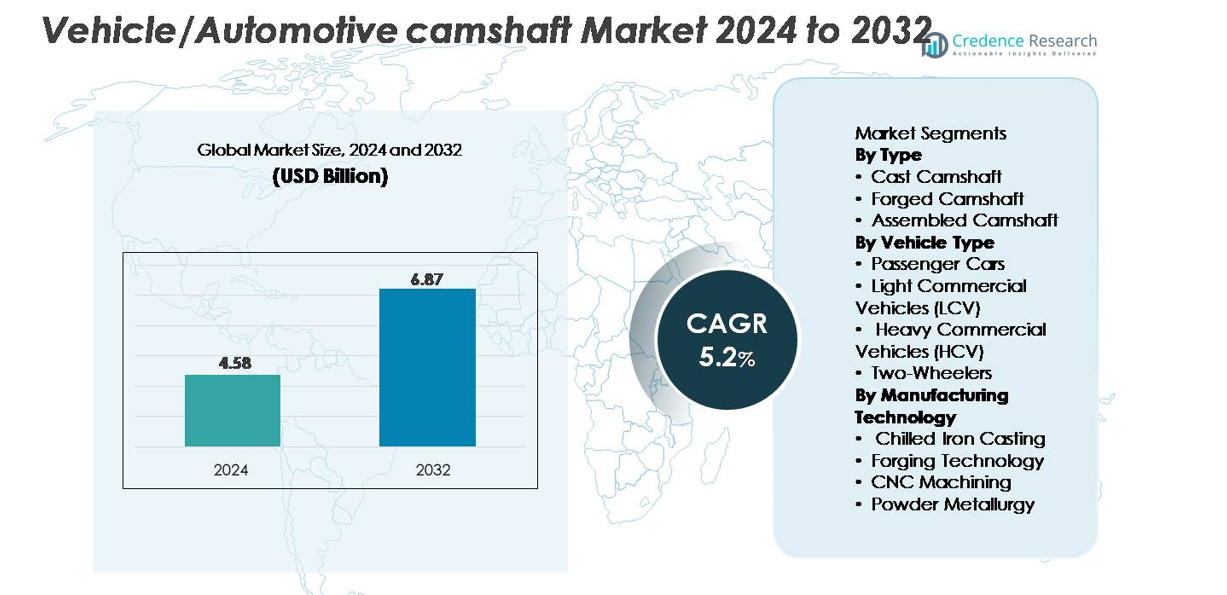

The Vehicle/Automotive Camshaft Market was valued at USD 4.58 billion in 2024 and is projected to reach USD 6.87 billion by 2032, expanding at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vehicle/Automotive Camshaft Market Size 2024 |

USD 4.58 billion |

| Vehicle/Automotive Camshaft Market, CAGR |

5.2% |

| Vehicle/Automotive Camshaft Market Size 2032 |

USD 6.87 billion |

The Vehicle/Automotive Camshaft market is shaped by a strong group of global manufacturers that lead in casting, forging, and precision machining technologies. Key players such as Schaeffler, MAHLE, Thyssenkrupp, Musashi Seimitsu Industry, Aichi Forge, and Linamar maintain competitive strength through advanced forging capabilities, automated CNC machining, and partnerships with major OEMs. Companies like Precision Camshafts, Riken, Estas Camshaft, and Crane Cams further contribute with expertise in chilled casting, surface hardening, and performance-focused camshaft designs. Asia Pacific, holding approximately 38% of the global market share, remains the dominant region due to its extensive automotive production base and strong supply chain for cast and forged components.

Market Insights

- The global Vehicle/Automotive Camshaft Market was valued at USD 4.58 billion in 2024 and is projected to reach USD 6.87 billion by 2032, growing at a CAGR of 5.2%.

- Demand strengthens as cast camshafts hold the largest segment share due to cost efficiency, while forged camshafts gain traction in performance and heavy-duty vehicles; rising ICE engine production and hybrid powertrains continue to fuel industry growth.

- Trends focus on lightweight hollow camshafts, powder-metallurgy designs, and precision CNC machining that improve durability and efficiency, along with increasing integration of VVT and DOHC engine architectures.

- Competition intensifies as major players such as Schaeffler, MAHLE, Thyssenkrupp, Musashi Seimitsu Industry, and Precision Camshafts invest in automated grinding, forging upgrades, and OEM partnerships to expand global supply capabilities.

- Asia Pacific leads the market with 38% share, followed by Europe at 27% and North America at 23%, driven by strong automotive manufacturing bases and high adoption of multi-valve engine platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Cast camshafts hold the dominant share in the market, supported by their widespread use across mass-produced passenger vehicles due to lower manufacturing costs and proven durability. OEMs favor chilled cast iron camshafts for high wear resistance, enabling longer service intervals in high-mileage models. Forged camshafts continue gaining traction in performance-oriented and heavy-duty applications because of their superior tensile strength and fatigue resistance. Assembled camshafts remain a niche segment but attract interest from engine developers seeking lightweight architectures with improved valve-train flexibility in multi-cylinder engines.

- For instance, Linamar, a leading independent producer of camshafts, manufactures assembled camshafts using a lightweight hydroformed process and precision grinding across its manufacturing facilities worldwide, enabling significant weight reductions in high-performance engine platforms.

By Vehicle Type

Passenger cars represent the leading segment, capturing the largest market share due to high global production volumes and the increased adoption of DOHC and VVT-enabled engines requiring more complex camshaft configurations. Light commercial vehicles also contribute significantly as fleet operators demand durable camshafts capable of supporting extended operational cycles. Heavy commercial vehicles rely heavily on forged camshafts to withstand high torque loads, making them an important value-driven segment. Meanwhile, two-wheelers account for steady demand, particularly in emerging markets where single-overhead camshaft engines dominate commuter motorcycle platforms.

- For instance, Bharat Forge operates 18 manufacturing facilities across five countries, producing forged components suitable for heavy-duty powertrains. Meanwhile, two-wheelers maintain steady demand, particularly in emerging markets such as the Asia Pacific region, which is the largest global market for these vehicles.

By Manufacturing Technology

Chilled iron casting is the dominant manufacturing technology, holding the largest share owing to its cost-efficiency and ability to produce camshafts with high surface hardness for mass-market vehicles. Forging technology continues to expand as OEMs prioritize strength and mechanical reliability in commercial vehicles and high-performance engines. CNC machining enhances precision and enables tighter tolerances, driving its adoption for premium vehicle platforms. Powder metallurgy remains a growing niche, offering lightweight and reduced-material camshaft solutions aligned with OEM efforts to optimize fuel efficiency and reduce engine mass.

Key Growth Drivers:

Rising Global Vehicle Production and ICE Engine Demand

Increasing global production of passenger cars and commercial vehicles remains a core catalyst for camshaft demand, as internal combustion engines continue to dominate powertrain architectures despite the growth of electrification. Emerging markets in Asia and Latin America are experiencing strong vehicle replacement cycles and expanding manufacturing footprints, reinforcing steady demand for cast and forged camshafts used in high-volume engine platforms. Automakers are also refreshing engine lineups with improved thermal efficiency and reduced emissions, which requires precision-engineered camshafts with optimized profiles, surface hardening, and better valve-timing integration. Even as hybrids gain traction, ICE engines remain integral to hybrid powertrains, sustaining long-term camshaft utilization for multi-cylinder configurations. The expansion of shared mobility fleets, logistics networks, and last-mile delivery vehicles further stimulates need for durable camshaft components engineered for extended duty cycles and higher operating loads.

- For instance, Precision Camshafts Ltd. (PCL) operates manufacturing facilities with a combined annual casting capacity of approximately 11 million units and a machined camshafts capacity of 4 million units, enabling large-scale supply for global ICE vehicle platforms.

Advancements in Engine Architecture and Valvetrain Technologies

The shift toward multi-valve engines, dual overhead camshaft (DOHC) systems, and variable valve timing (VVT) architectures significantly drives camshaft innovation and volume growth. Modern engines require camshafts capable of delivering precise valve lift and duration control to meet fuel efficiency and emissions targets mandated across global regulatory frameworks. Automakers increasingly integrate hollow camshafts, hybrid material designs, and friction-optimized profiles that enhance combustion efficiency and reduce parasitic losses. VVT-enabled engines, which rely on dynamic phasing of camshaft rotation, further expand opportunities for high-strength, accurately machined camshafts. These design upgrades stimulate demand for CNC-machined and forged variants capable of supporting aggressive valve events, higher RPM performance, and thermal stability under boosted and direct-injection operating conditions. As OEMs continue focusing on higher power density engines, advanced camshaft materials and manufacturing technologies will remain essential.

- For instance, Linamar manufactures advanced hollow and assembled camshafts using hydroformed tubes and precision-welded lobes across its 65 global manufacturing facilities, supporting high-efficiency DOHC platforms.

Growth in Heavy-Duty Mobility, Commercial Fleets, and Aftermarket Services

Rising utilization of heavy commercial vehicles, LCV fleets, and industrial-duty engines boosts demand for high-strength camshafts with superior fatigue resistance. Global expansion of logistics, e-commerce, and infrastructure development stimulates higher production of long-haul trucks, construction vehicles, and agricultural machinery each requiring robust valvetrain components engineered for high torque loads and prolonged service hours. This drives adoption of forged camshafts and chilled-iron variants with enhanced wear properties. In parallel, the aftermarket sector grows steadily as aging vehicle populations require replacement camshafts and remanufactured engine components. Fleet operators prioritize long-life camshafts that can sustain multi-shift operations, reinforcing demand for precision-ground profiles and surface-hardened alloys. The combination of OEM and aftermarket demand anchors strong, recurring revenue streams for camshaft manufacturers, particularly in regions with large commercial vehicle fleets and extended vehicle life cycles.

Key Trends and Opportunities:

Shift Toward Lightweight, High-Strength, and Low-Friction Camshaft Designs

Automakers are accelerating adoption of lightweight and efficiency-optimized camshaft designs as part of broader engine downsizing and emissions-reduction strategies. Hollow camshafts, hybrid steel-aluminum designs, and friction-reduced surface treatments are gaining prominence due to their ability to improve engine responsiveness and fuel economy. Powder metallurgy offers opportunities for producing lightweight profiles with controlled porosity and reduced material waste, aligning with sustainability goals. Engine developers increasingly use simulation-led design, advanced grinding systems, and precision CNC machining to refine camshaft geometry for lower frictional losses. These trends create opportunities for suppliers specializing in metallurgical innovation and digital manufacturing. As engines evolve to support tighter emission regulations, the ability to deliver lighter, stronger, and thermally stable camshafts becomes a differentiating factor for global manufacturers.

- For instance, Linamar manufactures lightweight assembled camshafts using hydroformed tubes and welded lobes across 65 global manufacturing sites, supporting reduced mass in modern DOHC engines.

Increasing Adoption of Variable Valve Timing (VVT) and Performance-Oriented Engines

The rapid integration of VVT systems across mass-market and premium vehicles presents a major growth opportunity for technologically advanced camshafts. VVT-equipped engines require camshafts with ultra-precise machining tolerances, high torsional rigidity, and reliable performance under dynamic load cycles. Performance vehicles and turbocharged engines also push camshaft requirements higher, demanding advanced materials and intricate profiles to support optimized valve lift curves. Automakers are expanding the use of dual VVT and cam-phasing mechanisms, thereby increasing the technical sophistication and value of camshaft components. As high-power and high-efficiency engines continue to proliferate, suppliers offering engineered camshafts compatible with dynamic timing actuators and advanced lubrication systems stand to capture significant market opportunities.

- For instance, Schaeffler enhances VVT system production through its global network of over 100 manufacturing locations, supplying camshaft phasing units and precision-machined valvetrain components for high-load engines.

Expansion of Automation and Smart Manufacturing in Camshaft Production

Camshaft production is undergoing digital transformation as manufacturers adopt CNC machining centers, robotic handling, inline surface inspection, and automated grinding systems that improve consistency and throughput. Smart manufacturing enables precision machining at micron-level tolerances, critical for modern valvetrain systems. Integration of IoT-enabled quality monitoring, real-time tool wear detection, and digital twins enhances process reliability while reducing scrap rates. These advancements open opportunities for suppliers able to supply high-performance camshafts at scale while meeting stringent OEM quality standards. Automation also supports production of complex geometries required for VVT and DOHC engines, strengthening long-term competitiveness.

Key Challenges:

Growing Shift Toward Electric Vehicles and Reduction in ICE-Dependent Components

The global acceleration of battery electric vehicle (BEV) adoption poses a structural challenge for the camshaft market due to the absence of ICE valvetrain components in pure electric drivetrains. As governments tighten emission regulations and incentivize zero-emission vehicles, automakers are allocating more resources to electrification platforms that do not require camshafts. Hybrid vehicles offer temporary insulation, but long-term BEV expansion could gradually reduce OEM demand. Suppliers must navigate fluctuating ICE production volumes, delayed engine refresh cycles, and inventory optimization pressures. Diversification into hybrid components, precision machining services, or non-automotive engine markets becomes increasingly important to mitigate long-term electrification risks.

High Manufacturing Complexity, Cost Pressures, and Raw Material Volatility

Camshaft manufacturers face persistent challenges related to high machining complexity, rising energy costs, and volatility in steel, alloy, and metallurgical input prices. Producing forged and precision-ground camshafts requires sophisticated equipment and skilled labor, raising capital and operational expenditures. OEMs simultaneously demand cost reductions, pushing suppliers to optimize production while maintaining stringent dimensional accuracy and durability requirements. Fluctuations in alloy steel and casting-grade iron prices further strain margins, particularly for suppliers operating on long-term fixed contracts. Ensuring consistent quality while controlling material waste and machining cycle times remains a critical challenge across global production facilities.

Regional Analysis:

North America

North America accounts for roughly 23% of the global camshaft market, supported by strong production of light trucks, SUVs, and high-performance gasoline engines. The U.S. remains the primary contributor, with OEMs emphasizing advanced forged camshafts for durability and high-load applications. Demand is reinforced by a sizable aftermarket, driven by long vehicle lifespans and high replacement rates for older ICE platforms. Despite growing EV adoption, internal combustion engines maintain a significant footprint, particularly in commercial fleets and utility vehicles, sustaining steady demand for precision-machined and wear-resistant camshaft components.

Europe

Europe holds an estimated 27% share, driven by its strong automotive manufacturing base and adoption of advanced multi-valve and DOHC engine architectures. Germany, Italy, and France lead camshaft demand due to high production of premium vehicles requiring precisely machined and lightweight camshaft designs. Stringent emission regulations accelerate integration of VVT-enabled engines, boosting requirements for high-precision forged and CNC-machined camshafts. Although the region is advancing toward electrified platforms, hybrid powertrains maintain robust demand for complex valvetrain systems. Additionally, Europe’s well-established aftermarket supports ongoing replacement needs for aging ICE vehicle fleets.

Asia Pacific

Asia Pacific dominates the global market with approximately 38% share, driven by large-scale automotive manufacturing in China, India, Japan, and South Korea. High-volume production of passenger cars, two-wheelers, and commercial vehicles fuels strong adoption of cast and chilled-iron camshafts. The region’s expanding middle-class consumer base and rapid urbanization push OEMs to boost output, sustaining steady demand across all vehicle categories. Local suppliers increasingly invest in automated forging and CNC machining technologies to meet global quality requirements. APAC’s growing aftermarket, supported by extensive vehicle parc, also contributes significantly to camshaft replacement and remanufacturing activities.

Latin America

Latin America captures nearly 7% of the global market, with Brazil and Mexico serving as the primary manufacturing hubs for passenger cars and commercial vehicles. Steady demand for durable camshafts supports applications in flex-fuel engines and light commercial fleets widely used in logistics and agriculture. Economic recovery and expansion of regional assembly operations improve OEM procurement of cast and forged camshafts. The aftermarket remains a significant contributor due to extended vehicle usage cycles and reliance on cost-effective replacement parts. Despite moderate electrification, ICE dominance ensures consistent camshaft demand across key markets.

Middle East & Africa

The Middle East & Africa region accounts for around 5% of the market, driven primarily by demand from commercial vehicles, off-highway equipment, and diesel-powered fleets used in construction, mining, and logistics. GCC countries and South Africa represent the largest consumption centers, relying heavily on forged and heavy-duty camshafts suited for high-temperature and high-load operations. The aftermarket plays a vital role due to challenging operating environments that accelerate wear rates. Growing investments in infrastructure and industrialization support demand for durable engine components, although EV penetration remains limited, keeping ICE-based vehicles dominant.

Market Segmentations:

By Type

- Cast Camshaft

- Forged Camshaft

- Assembled Camshaft

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- Two-Wheelers

By Manufacturing Technology

- Chilled Iron Casting

- Forging Technology

- CNC Machining

- Powder Metallurgy

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the Vehicle/Automotive Camshaft market is characterized by a mix of global OEM suppliers, specialized forging and casting companies, and precision machining manufacturers competing on technology, quality, and cost efficiency. Leading players focus on expanding production capabilities for forged and CNC-machined camshafts to meet rising demand from high-performance and commercial vehicle segments. Companies increasingly invest in automated grinding, robotic handling, and advanced surface-hardening processes to enhance durability and dimensional accuracy. Strategic collaborations with automakers support co-development of camshafts tailored for DOHC, VVT, and downsized turbocharged engines. Many manufacturers are diversifying into lightweight hollow camshafts and powder-metallurgy variants to align with efficiency and emission targets. The aftermarket remains a key revenue stream, encouraging suppliers to offer remanufactured and replacement camshafts with OEM-grade performance. Overall, competition is intensifying as firms modernize production lines and pursue global supply contracts to strengthen market presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Crane Cams

- Linamar

- Aichi Forge

- Schaeffler

- Musashi Seimitsu Industry

- MAHLE

- Thyssenkrupp

- Riken

- Estas Camshaft

- Precision Camshafts

Recent Developments:

- In July 2025, Musashi marked 23 years of operations in India and announced an R&D expansion via the launch of a new “technology excellence centre” under its Indian arm

- In 2024, Precision Camshafts Ltd. (PCL) has continued to advance its EV business, specifically by partnering with companies like Bluwheelz to retrofit LCVs, and is actively developing its LCV retrofitting capabilities

- In October 2, 2023, Riken Corporation and Nippon Piston Ring Co., Ltd. merged to form a new holding company, NPR-Riken Corporation. The new entity aimed to combine their strengths in engine components like piston rings and valve seats.

Report Coverage:

The research report offers an in-depth analysis based on Type, Vehicle type, Manufacturing technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will retain steady demand as internal combustion engines remain essential in passenger cars, hybrids, and commercial vehicles.

- Advancements in DOHC, VVT, and turbocharged engines will increase the need for precision-forged and CNC-machined camshafts.

- Lightweight hollow and hybrid-material camshafts will gain wider adoption to support efficiency and emission-reduction targets.

- Automation in casting, forging, and grinding operations will enhance production consistency and reduce cycle times.

- Growth in commercial fleets and logistics operations will boost demand for high-strength camshafts built for heavy-duty cycles.

- Aftermarket sales will rise as aging global vehicle fleets require remanufactured and replacement camshaft components.

- Powder metallurgy camshafts will expand gradually due to improved material uniformity and manufacturing cost benefits.

- Partnerships between OEMs and suppliers will accelerate development of camshafts optimized for next-generation engine platforms.

- Asia Pacific will maintain market leadership with ongoing expansion of automotive manufacturing and export capacity.

- Electrification will moderate long-term growth, prompting suppliers to diversify into hybrid, industrial, and non-automotive engine applications.