Market Overview

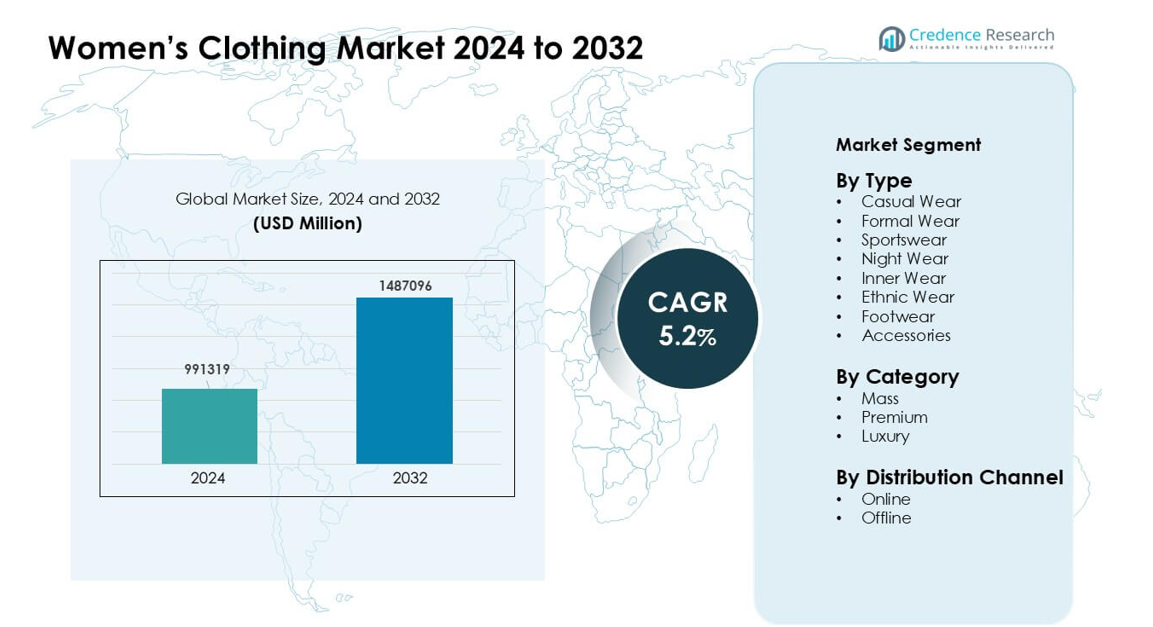

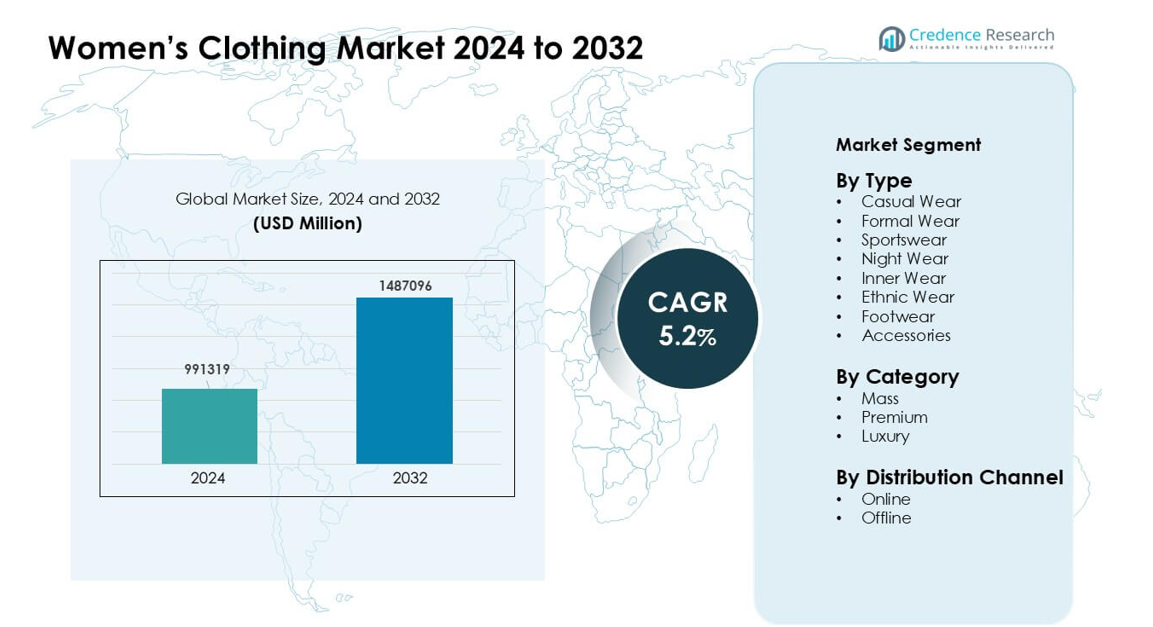

Women’s Clothing Market was valued at USD 991319 million in 2024 and is anticipated to reach USD 1487096 million by 2032, growing at a CAGR of 5.2 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Women’s Clothing Market Size 2024 |

USD 991319 million |

| Women’s Clothing Market, CAGR |

5.2% |

| Women’s Clothing Market Size 2032 |

USD 1487096 million |

The Women’s Clothing Market is shaped by major fashion houses that drive global demand through strong brand equity and diverse product lines. Key players such as Gianni Versace S.r.l., DIOR, Burberry, MANOLO BLAHNIK, PRADA, Chanel, Giorgio Armani S.p.A., LOUIS VUITTON, DOLCE & GABBANA S.R.L, and Guccio Gucci S.p.A. strengthen the industry with premium collections, luxury craftsmanship, and continuous design innovation. These companies expand influence through flagship stores, digital retail, and strategic collaborations. Asia-Pacific emerged as the leading region in 2024 with about 38% share, supported by rising disposable incomes, rapid urbanization, and strong adoption of both premium and fast-fashion categories.

Market Insights

- The Women’s Clothing Market was valued at USD 991319 million in 2024 and is projected to reach USD 1487096 million by 2032, growing at a CAGR of 5.2%.

- Rising demand for casual wear, which held about 36% share in 2024, drives growth as women prefer comfortable and versatile clothing supported by hybrid work habits and lifestyle shifts.

- Sustainability, digital commerce, and personalization remain key trends, with eco-friendly fabrics and AI-based recommendations shaping purchase decisions across premium and mass categories.

- Competition intensifies as luxury brands and fast-fashion players expand global footprints, offering rapid product cycles, multi-channel strategies, and design-focused collections.

- Asia-Pacific led the market with around 38% share in 2024, followed by North America at 32%, driven by high spending power, strong brand presence, and rising demand across casual, athleisure, and premium segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Casual wear dominated the Women’s Clothing Market in 2024 with about 36% share due to strong demand for comfortable, everyday apparel driven by hybrid work patterns and social lifestyle shifts. Women preferred versatile tops, denim, and relaxed fits that suit both home and outdoor use. Brands pushed wider collections using breathable fabrics and trend-driven designs, which increased repeat purchases. Sportswear grew fast as fitness culture expanded, while ethnic wear retained steady demand in culturally diverse regions. Nightwear, innerwear, footwear, and accessories showed stable growth but held smaller shares than casual wear.

- For instance, Uniqlo expanded its minimalist everyday wear lines globally in 2024 to cater to this demand illustrating how international players are leaning into casualsegmentation.

By Category

The mass category led the market in 2024 with nearly 58% share, supported by high demand for affordable, trend-aligned clothing across urban and semi-urban consumers. Fast-fashion retailers expanded product lines and delivery reach, which attracted price-sensitive buyers. Premium clothing advanced as shoppers sought better fabric quality, durability, and brand value. Luxury wear held a niche but profitable segment due to strong engagement from high-income groups and rising interest in designer collections. Growing digital exposure inspired women to follow global fashion trends across all categories.

- For instance, global fast‑fashion labels such as H&M and Primark through their extensive supply chains continued to dominate mass‑market womenswear by offering frequent collections at lower price points, showing how scale and cost-efficiency reinforce mass‑market dominance.

By Distribution Channel

Offline channels dominated the distribution segment in 2024 with around 67% share as consumers continued to prefer physical stores for fit assessment, fabric checks, and instant purchasing. Large retail chains and specialty boutiques expanded store formats to enhance customer experience through better merchandising and in-store styling. Online channels grew quickly due to easy returns, wider assortment, and influencer-driven promotions. E-commerce adoption rose most among younger women and Tier-2 and Tier-3 cities, where expanded logistics networks improved delivery speed. Digital platforms also pushed personalized recommendations and seasonal discounts, boosting conversion rates.

Key Growth Drivers:

Growing Adoption of Affordable Fashion

Rising demand for affordable and trend-focused apparel acts as a major growth driver in the Women’s Clothing Market. Fast-fashion brands release new styles quickly, which attracts shoppers who want frequent wardrobe updates. This model supports higher sales volume as women buy more pieces at lower prices. Expanding retail chains in urban and semi-urban areas also boost accessibility. Digital platforms widen reach by offering budget collections with flexible payment options and tailored recommendations. Social media boosts visibility for low-cost fashion through influencers who promote new looks. These factors push steady demand across casual, ethnic, and fusion wear categories and strengthen market expansion.

- For instance, Grand View Research estimated the global women’s wear market size at $1,054.52 billion (over $1 trillion) in 2023.

Shift Toward Comfort and Athleisure Wear

Women increasingly prefer clothing that blends style and comfort, driving significant demand for athleisure, loungewear, and relaxed everyday outfits. This shift grows as more women adopt fitness routines, hybrid work, and travel lifestyles. Brands introduce breathable fabrics, stretch materials, and ergonomic designs to improve appeal. Athleisure becomes a daily wear choice rather than only sportswear, which expands the category. Online retail supports this growth by offering size customization and easy comparisons. Influencers reinforce comfort-led fashion through real-life styling content. This trend reshapes product strategies and encourages companies to innovate across fabric technology and multifunctional designs.

- For instance, the global women’s activewear market which includes pieces suitable for leisure as well as workouts is estimated to account for a significant portion of activewear demand, illustrating how many women choose these garments not just for fitness but also daily wear.

Premiumization and Quality Consciousness

Many women now prioritize quality, durability, and brand reputation, which drives strong momentum in the premium clothing segment. Higher disposable income and exposure to global fashion trends increase willingness to pay more for well-made garments. Premium brands invest in fine fabrics, ethical sourcing, and long-lasting construction to strengthen differentiation. This shift also aligns with the rise of sustainable choices, where better-quality items reduce frequent replacements. Digital marketing helps luxury and premium labels showcase craftsmanship and limited-edition lines. As more women seek value beyond price, premium wear grows faster in formal, workwear, and festive categories.

Key Trends & Opportunities:

Rise of Sustainability and Ethical Fashion

Sustainability emerges as a key trend and opportunity as women prefer eco-friendly fabrics, responsible sourcing, and transparent production. Brands adopt organic cotton, recycled polyester, and low-impact dyes to appeal to conscious buyers. Many women value clothing that reduces waste, which pushes demand for slow fashion and capsule wardrobes. Certifications and traceability tools increase trust in ethical fashion. Retailers highlight green collections online to attract younger shoppers who prioritize environmental impact. This trend encourages manufacturers to redesign supply chains and reduce carbon footprints while opening new premium niches for responsible fashion labels.

- For instance, In 2023 and 2024 reports, the non-profit organization Fashion Revolution found that only 52% of major fashion brands disclose their Tier 1 (final stage) supplier lists.

Expansion of Digital Commerce and Personalization

E-commerce unlocks major opportunities as women rely on online platforms for convenience, variety, and competitive pricing. Retailers use AI-driven tools to offer size suggestions, virtual try-ons, and personalized product feeds. This improves buying confidence and reduces return rates. Social commerce grows through live shopping sessions and influencer-led styling videos that drive impulse buying. Digital brands expand quickly without physical stores, offering unique designs at lower operational costs. Enhanced logistics networks improve delivery speed and reach smaller cities, fueling wider adoption. Personalization strengthens brand loyalty and helps companies target niche fashion categories more effectively.

- For instance, ASOS introduced its “See My Fit” AR‑powered tool, letting customers view 800 dresses on 16 different model body types (sizes 4–18), helping shoppers pick the best fit before ordering.

Key Challenges:

Intense Competition and Price Pressure

Rising competition among global, regional, and local brands creates strong pricing pressure in the Women’s Clothing Market. Fast-fashion labels launch products at very low prices, making it harder for smaller companies to maintain margins. Frequent discounts across online platforms further compress profitability. Consumers expect constant new styles, which increases production costs and shortens product lifecycles. Brands struggle to balance affordability with quality, marketing investment, and logistics. Smaller manufacturers face difficulty keeping up with rapid design cycles and digital promotions. This challenge pushes companies to focus on operational efficiency and stronger value propositions.

Supply Chain Disruptions and Inventory Management Issues

The market faces challenges from supply chain delays, fluctuating raw material costs, and dynamic demand patterns. Fashion items follow short cycles, making inventory planning complex. Overproduction leads to waste, while underproduction causes stockouts and revenue loss. Global events, fabric shortages, and shipping delays affect delivery timelines and increase costs. Retailers rely heavily on accurate forecasting, yet changing trends make predictions difficult. Online returns add further strain due to reverse logistics. To mitigate these risks, companies invest in agile supply chains, local sourcing, and real-time inventory systems, yet these upgrades demand significant resources and planning.

Regional Analysis

North America

North America held about 32% share of the Women’s Clothing Market in 2024, supported by strong demand for casual wear, athleisure, and premium fashion. Consumers favored high-quality fabrics, sustainable materials, and versatile designs. Major brands expanded omnichannel strategies, combining in-store experience with digital platforms to drive engagement. Growing influence of social media trends encouraged rapid product turnover. The U.S. remained the largest contributor due to high spending power and strong penetration of global fashion labels. Canada showed steady growth with rising interest in eco-friendly and comfort-focused apparel.

Europe

Europe accounted for nearly 28% share in 2024, driven by established fashion houses, rising premiumization, and high awareness of sustainable clothing. Women preferred durable fabrics, ethical manufacturing, and minimalist styling popularized by regional brands. Fast-fashion players strengthened presence in Western Europe, while online channels expanded rapidly in Central and Eastern Europe. The region benefited from strong demand for workwear, occasion wear, and luxury apparel. Fashion-conscious shoppers in Germany, the U.K., France, and Italy pushed continued demand, supported by diverse retail networks and evolving seasonal trends.

Asia-Pacific

Asia-Pacific led the global market with about 38% share in 2024, fueled by a large female population, rising disposable incomes, and expanding fashion adoption in urban centers. Fast-fashion availability, influencer culture, and mobile commerce shaped buying behavior. China and India drove significant sales across casual wear, ethnic wear, and affordable premium fashion. Southeast Asia saw strong growth due to young demographics and rapid e-commerce penetration. Regional manufacturers increased output of low-cost and trend-driven apparel, boosting competitiveness. Expanding mall development and stronger logistics infrastructure supported broader retail reach.

Latin America

Latin America captured nearly 8% share in 2024, with demand centered on affordable everyday wear, festive clothing, and vibrant fashion influenced by cultural styles. Brazil, Mexico, and Argentina led purchases, supported by growing urbanization and wider access to international brands. Economic volatility encouraged price-sensitive buying, pushing strong performance in the mass segment. Local designers gained popularity through unique patterns and regional aesthetics. E-commerce adoption improved as digital payments expanded, helping retailers offer deeper assortments and seasonal collections. Despite fluctuations in consumer spending, steady fashion interest supported moderate growth.

Middle East & Africa

The Middle East & Africa accounted for about 7% share in 2024, driven by rising demand for modest wear, premium fashion, and culturally influenced apparel. Gulf countries showed strong spending on luxury brands supported by high-income groups and expanding mall infrastructure. African markets displayed rising interest in casual and affordable fashion, guided by urban growth and increasing online access. Local designers blended traditional styles with modern cuts, boosting regional identity. Expanding retail chains and improved logistics widened product availability. Although purchasing power varies across countries, fashion adoption continues to strengthen across key metros.

Market Segmentations:

By Type

- Casual Wear

- Formal Wear

- Sportswear

- Night Wear

- Inner Wear

- Ethnic Wear

- Footwear

- Accessories

By Category

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Women’s Clothing Market features strong competition from global luxury houses, fast-fashion leaders, and rising digital-first brands. Companies such as Gianni Versace S.r.l., DIOR, Burberry, MANOLO BLAHNIK, PRADA, Chanel, Giorgio Armani S.p.A., LOUIS VUITTON, DOLCE & GABBANA S.R.L, and Guccio Gucci S.p.A. focus on premium craftsmanship, exclusive designs, and high brand value, strengthening their influence in the luxury and premium segments. Fast-fashion players compete through rapid design cycles, large-scale production, and competitive pricing. Digital-native brands expand quickly by using influencer partnerships, fast delivery, and data-driven product development. Sustainability, ethical sourcing, and fabric innovation also shape competition as companies seek better differentiation. Retailers invest in omnichannel models that combine store experience with online convenience, enhancing customer engagement. Frequent seasonal launches, strategic collaborations, and expansion into emerging markets further intensify rivalry across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Gianni Versace S.r.l.

- DIOR

- Burberry

- MANOLO BLAHNIK

- PRADA

- Chanel

- Giorgio Armani S.p.A.

- LOUIS VUITTON

- DOLCE & GABBANA S.R.L

- Guccio Gucci S.pA.

Recent Developments

- In May 2025, Dior announced that its long-time creative director for women’s collections, Maria Grazia Chiuri, left after nine years.

- In February 2025, Guccio Gucci S.p.A.: Announced creative director Sabato De Sarno would exit. The Fall/Winter 2025 womenswear runway is being designed by Gucci’s internal studio.

- In October 2024, LOUIS VUITTON: Showed its Spring-Summer 2025 womenswear collection at Cour Carrée. Models walked a runway built from 1,000 trunks, highlighting the house’s travel heritage.

Report Coverage

The research report offers an in-depth analysis based on Type, Category, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising demand for comfort-first clothing across daily wear.

- Premium and luxury segments will grow as women choose higher-quality materials.

- Sustainable fabrics and ethical production will become major purchase drivers.

- Digital commerce will expand through virtual try-ons and AI-led styling tools.

- Fast-fashion brands will adopt shorter design cycles to match rapid trend shifts.

- Regional brands will gain traction by blending cultural designs with modern cuts.

- Omnichannel retail will strengthen as stores integrate digital experiences.

- Personalization will increase through data-driven size, fit, and style suggestions.

- Athleisure and activewear will rise as fitness and wellness adoption grows.

- Global competition will intensify as more players enter emerging markets.