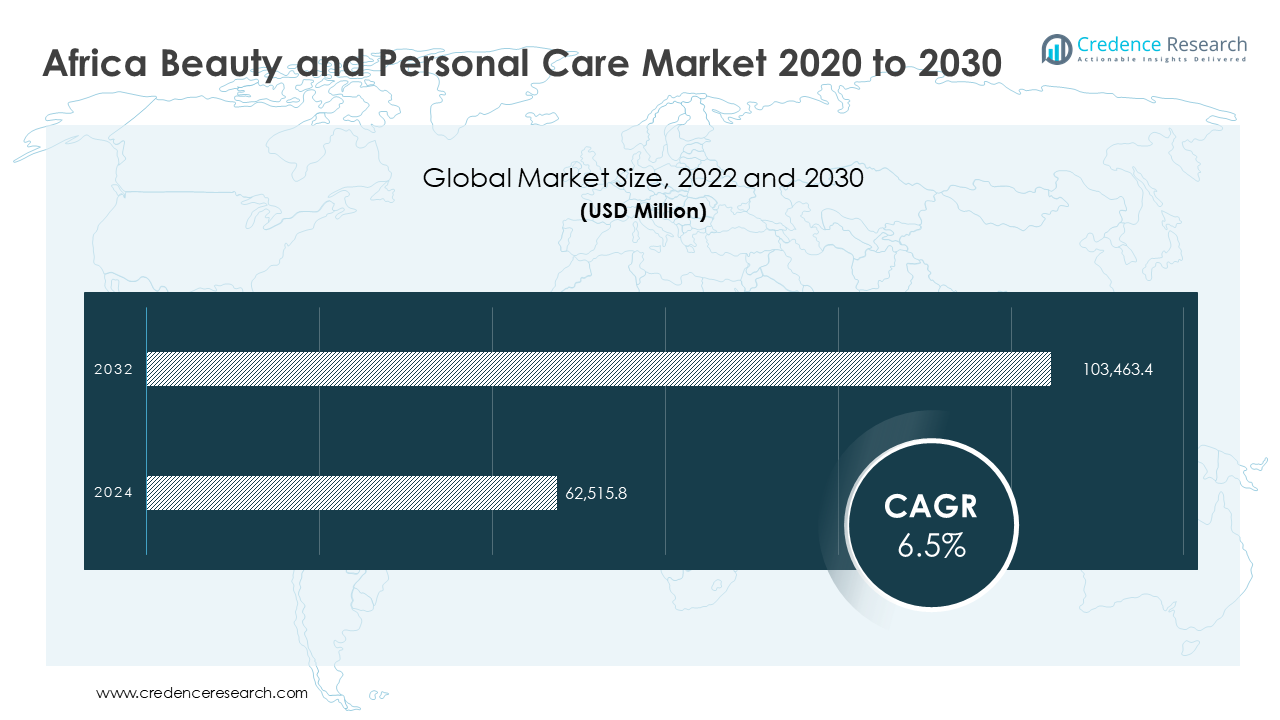

According to a new market research report published by Credence Research the Africa beauty and personal care market was valued at USD 62,515.8 million in 2022. It is projected to reach USD 103,463.4 million by 2030, expanding at a compound annual growth rate (CAGR) of 6.5% between 2023 and 2030. Market growth is influenced by strong demographic drivers, rapid digital adoption, evolving consumer preferences, and regional trade integration.

Market Driver: Young Demographics and Rising Urbanization

Africa’s youthful population is one of the strongest demand-side drivers of the beauty and personal care market. Over half of the continent’s population is under the age of 25, creating a large consumer base that prioritizes grooming and self-care. Young consumers are highly receptive to international beauty trends and actively shape demand across skincare, haircare, and color cosmetics categories.

Urbanization is accelerating this growth. More Africans are living in cities, where they gain access to modern retail outlets and exposure to global beauty trends. Urban centers create concentrated markets that support higher product variety and adoption of premium brands. Alongside these structural shifts, demand for natural and organic ingredients such as shea butter and botanicals has risen. Consumers are seeking culturally relevant solutions designed for textured hair and darker skin, fueling demand for both local and international offerings.

Browse market data figures spread through 220+ pages and an in-depth TOC on “Africa Beauty and Personal Care Market“

Market Trend: Expansion of Digital Platforms and Social Commerce

Digital adoption is reshaping how consumers in Africa purchase beauty and personal care products. Widespread use of smartphones has made global beauty content accessible, including influencer campaigns, tutorials, and social media-driven product launches. These factors significantly influence buying behavior, particularly among younger demographics.

Mobile money solutions and digital wallets are enhancing trust in e-commerce platforms. This financial infrastructure enables cross-border transactions and broadens access to beauty products even in underserved regions. Social commerce is gaining momentum as local and international brands use influencer-led strategies to expand reach.

E-commerce is no longer limited to metropolitan consumers. Digital-first channels enable brands to reach smaller cities and rural areas, where traditional retail infrastructure remains weak. For companies, this trend reduces dependence on physical distribution networks and allows for scalable market penetration across the continent.

Market Challenge: Counterfeit Products and Informal Markets

Counterfeit and low-quality products remain a persistent challenge for the Africa beauty and personal care industry. Informal markets dominate sales in several countries, making it difficult to enforce regulatory standards and quality control. This undermines consumer trust and poses health risks, discouraging long-term brand loyalty.

Weak supply chain infrastructure compounds the issue. Limited cold storage, inefficient logistics, and high transportation costs hinder the distribution of high-quality products across Africa. These challenges make beauty and personal care products more expensive for mass consumers and restrict small and medium-sized businesses from scaling effectively.

Additionally, the diversity of regulatory frameworks across African countries creates complex compliance barriers. Inconsistent product safety standards, import restrictions, and lengthy approval processes increase entry costs for both regional and global companies. These regulatory challenges reduce innovation and slow the launch of new product lines.

Growth Opportunities Across Africa

Several opportunities continue to support expansion. Demand for natural and inclusive beauty products is rising, with consumers showing preference for shea butter, baobab oil, and other indigenous botanicals. Specialized offerings for textured hair and darker skin tones remain underserved segments, representing growth potential.

Halal beauty products are another promising segment, driven by cultural and religious preferences across North and West Africa. Premiumisation is also evident in middle-class markets such as Nigeria and South Africa, where consumers are shifting toward higher-quality branded goods.

Male grooming is emerging as a growth category, particularly in urban areas. Products such as men’s skincare and shaving solutions are seeing wider acceptance. Local manufacturing also provides opportunities. Egypt, for example, is projected to achieve a beauty and personal care market value of USD 7.6 billion by 2030, growing at 8.1% CAGR, benefiting from favorable currency movements and strong regional demand.

Market Segmentation

By Skincare

- Cleansers and Toners

- Moisturizers

- Sunscreen and Sun Protection

By Hair Care

- Shampoos and Conditioners

- Styling Products

- Natural and Organic Haircare

By Color Cosmetics

- Lipsticks, Eyeshadows, and Blushes

- Nail Care

By Fragrances

- Perfumes and Deodorants

- Body Sprays

By Men’s Grooming

- Shaving and Grooming Products

- Skincare for Men

By Anti-Aging Products

- Anti-Wrinkle Creams

- Serums and Treatments

By Ethnic and Cultural-Specific Products

- Afro-Textured Haircare

- Cultural Influences

By E-Commerce and Online Retail

- Online Beauty Retail

- Social Media Influencers

By Health and Wellness Integration

- Natural Beauty and Wellness

- Functional Ingredients

By Customization and Personalization

- Customized Skincare Regimens

- Tailored Fragrances

Key Players Operating in the Africa beauty and personal Care Market

- Adidas AG

- Amway Corp.

- Beiersdorf AG

- Chanel Ltd

- Christian Dior SE

- Church & Dwight Co. Inc

- Colgate Palmolive Co.

- Edgewell Personal Care Co.

- Esse Skincare

- Godrej Consumer Products Ltd

- House of Tara International

- Johnson & Johnson

- Kering S.A.

- L’Oreal S.A.

- Lulu & Marula Proprietary Ltd

- Natura & Co. Holding S.A.

- Oriflame Cosmetics S.A.

- Pauline Cosmetics Ltd

- Reckitt Benckiser Group Plc

- Revlon Inc

- The Estee Lauder Companies, Inc

- The Procter & Gamble Co.

- Unilever Plc

- Zaron Cosmetics & Beauty

- Tiger Brands Ltd

- Others

“Africa Beauty and Personal Care Market By Skincare (Cleansers and Toners, Moisturizers, Sunscreen and Sun Protection); By Hair Care (Shampoos and Conditioners, Styling Products, Natural and Organic Haircare); By Color Cosmetics (Lipsticks, Eyeshadows, and Blushes, Nail Care); By Fragrances (Perfumes and Deodorants, Body Sprays); By Men’s Grooming (Shaving and Grooming Products, Skincare for Men); By Anti-Aging Products (Anti-Wrinkle Creams, Serums and Treatments); By Ethnic and Cultural-Specific Products (Afro-Textured Haircare, Cultural Influences); By E-Commerce and Online Retail (Online Beauty Retail, Social Media Influencers); By Health and Wellness Integration (Natural Beauty and Wellness, Functional Ingredients); By Customization and Personalization (Customized Skincare Regimens, Tailored Fragrances) – Growth, Future Prospects & Competitive Analysis, 2022 – 2030” provides comprehensive insights into market trends, challenges, and opportunities across Africa.

About Us:

Credence Research is a viable intelligence and market research platform that provides quantitative B2B research to more than 2000 clients worldwide and is built on the Give principle. The company is a market research and consulting firm serving governments, non-legislative associations, non-profit organizations, and various organizations worldwide. We help our clients improve their execution in a lasting way and understand their most imperative objectives.

Contact Us

Credence Research Europe LTD

128 City Road, London,

EC1V 2NX, UNITED KINGDOM

Europe – +44 7809 866 263

North America – +1 304 308 1216

Australia – +61 4192 46279

Asia Pacific – +81 5050 50 9250

+64 22 017 0275

India – +91 6232 49 3207

sales@credenceresearch.com

www.credenceresearch.com