CHAPTER NO. 1 : INTRODUCTION 21

1.1. Report Description 21

Purpose of the Report 21

USP & Key Offerings 21

1.2. Key Benefits for Stakeholders 22

1.3. Target Audience 22

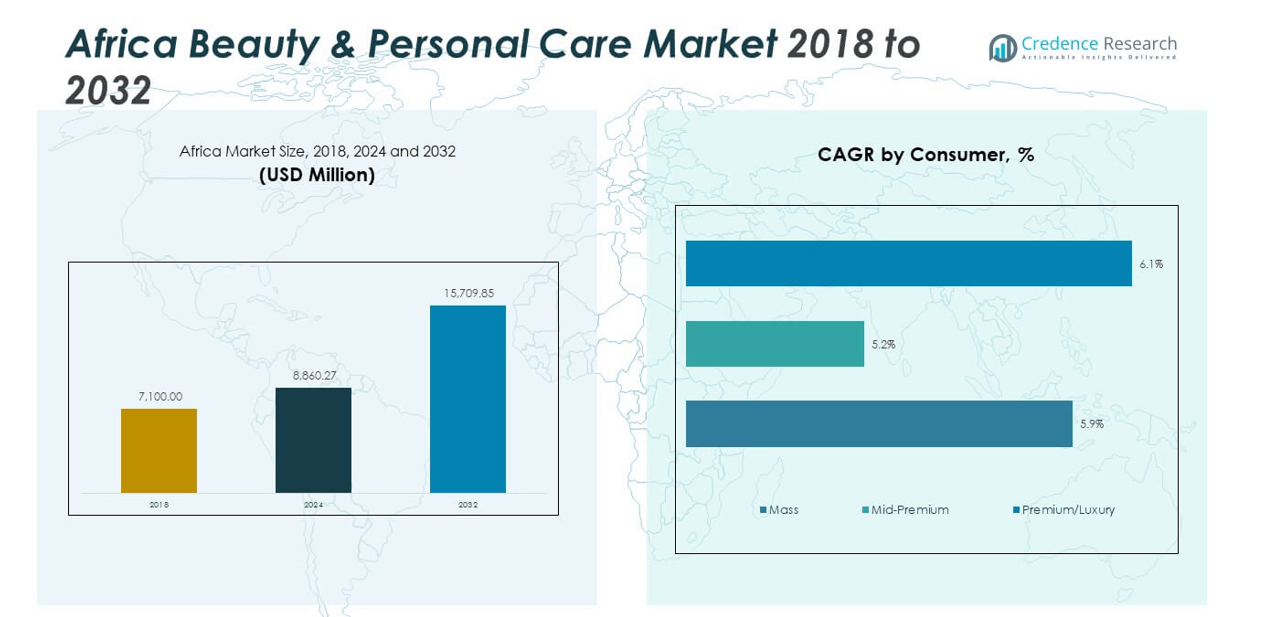

CHAPTER NO. 2 : EXECUTIVE SUMMARY 23

CHAPTER NO. 3 : AFRICA BEAUTY & PERSONAL CARE MARKET FORCES & INDUSTRY PULSE 25

3.1. Foundations of Change – Market Overview 25

3.2. Catalysts of Expansion – Key Market Drivers 27

3.3. Momentum Boosters – Growth Triggers 28

3.4. Innovation Fuel – Disruptive Technologies 28

3.5. Headwinds & Crosswinds – Market Restraints 29

3.6. Regulatory Tides – Compliance Challenges 30

3.7. Economic Frictions – Inflationary Pressures 30

3.8. Untapped Horizons – Growth Potential & Opportunities and Strategic Navigation – Industry Frameworks 31

3.9. Market Equilibrium – Porter’s Five Forces 32

3.10. Ecosystem Dynamics – Value Chain Analysis 34

3.11. Macro Forces – PESTEL Breakdown 36

3.12. Price Trend Analysis 38

3.12.1. Price Trend by Product Type 39

3.13. Buying Criteria 40

CHAPTER NO. 4 : COMPETITION ANALYSIS 41

4.1. Company Market Share Analysis 41

4.1.1. Africa Beauty & Personal Care Market Company Revenue Market Share 41

4.2. Strategic Developments 43

4.2.1. Acquisitions & Mergers 43

4.2.2. New Product Type Launch 44

4.2.3. Agreements & Collaborations 45

4.3. Competitive Dashboard 46

4.4. Company Assessment Metrics, 2024 47

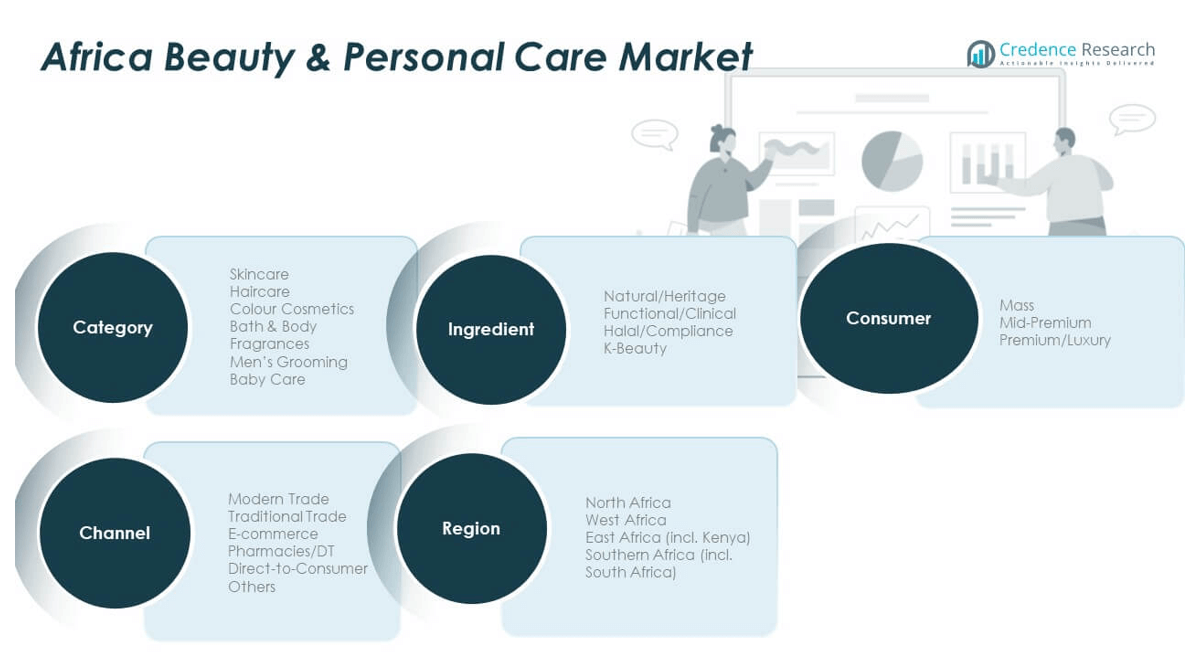

CHAPTER NO. 5 : AFRICA MARKET ANALYSIS, INSIGHTS & FORECAST, BY CATEGORY 48

CHAPTER NO. 6 : AFRICA MARKET ANALYSIS, INSIGHTS & FORECAST, BY CONSUMER 53

CHAPTER NO. 7 : AFRICA MARKET ANALYSIS, INSIGHTS & FORECAST, BY INGREDIENT 57

CHAPTER NO. 8 : AFRICA MARKET ANALYSIS, INSIGHTS & FORECAST, BY CHANNEL 61

CHAPTER NO. 9 : AFRICA MARKET ANALYSIS, INSIGHTS & FORECAST, BY REGION 66

CHAPTER NO. 10 : COMPANY PROFILE 70

10.1. L’Oréal 70

10.2. Unilever 73

10.3. Procter & Gamble (P&G) 73

10.4. Estée Lauder Companies 73

10.5. Beiersdorf 73

10.6. Company 6 73

10.7. Company 7 73

10.8. Company 8 73

10.9. Company 9 73

10.10. Company 10 73

10.11. Company 11 73

10.12. Company 12 73

10.13. Company 13 73

10.14. Company 14 73

List of Figures

FIG NO. 1. Africa Beauty & Personal Care Market Revenue Share, By Category, 2024 & 2032 48

FIG NO. 2. Market Attractiveness Analysis, By Category 49

FIG NO. 3. Incremental Revenue Growth Opportunity by Category, 2024 – 2032 50

FIG NO. 4. Africa Beauty & Personal Care Market Revenue Share, By Consumer, 2024 & 2032 53

FIG NO. 5. Market Attractiveness Analysis, By Consumer 54

FIG NO. 6. Incremental Revenue Growth Opportunity by Consumer, 2024 – 2032 55

FIG NO. 7. Africa Beauty & Personal Care Market Revenue Share, By Ingredient, 2024 & 2032 57

FIG NO. 8. Market Attractiveness Analysis, By Ingredient 58

FIG NO. 9. Incremental Revenue Growth Opportunity by Ingredient, 2024 – 2032 59

FIG NO. 10. Africa Beauty & Personal Care Market Revenue Share, By Channel, 2024 & 2032 61

FIG NO. 11. Market Attractiveness Analysis, By Channel 62

FIG NO. 12. Incremental Revenue Growth Opportunity by Channel, 2024 – 2032 63

FIG NO. 13. Africa Beauty & Personal Care Market Revenue Share, By Region, 2024 & 2032 66

FIG NO. 14. Market Attractiveness Analysis, By Region 67

FIG NO. 15. Incremental Revenue Growth Opportunity by Region, 2024 – 2032 68

List of Tables

TABLE NO. 1. : Africa Beauty & Personal Care Market Revenue, By Category, 2018 – 2024 (USD Million) 51

TABLE NO. 2. : Africa Beauty & Personal Care Market Revenue, By Category, 2025 – 2032 (USD Million) 52

TABLE NO. 3. : Africa Beauty & Personal Care Market Revenue, By Consumer, 2018 – 2024 (USD Million) 56

TABLE NO. 4. : Africa Beauty & Personal Care Market Revenue, By Consumer, 2025 – 2032 (USD Million) 56

TABLE NO. 5. : Africa Beauty & Personal Care Market Revenue, By Ingredient, 2018 – 2024 (USD Million) 60

TABLE NO. 6. : Africa Beauty & Personal Care Market Revenue, By Ingredient, 2025 – 2032 (USD Million) 60

TABLE NO. 7. : Africa Beauty & Personal Care Market Revenue, By Channel, 2018 – 2024 (USD Million) 64

TABLE NO. 8. : Africa Beauty & Personal Care Market Revenue, By Channel, 2025 – 2032 (USD Million) 65

TABLE NO. 9. : Africa Beauty & Personal Care Market Revenue, By Region, 2018 – 2024 (USD Million) 69

TABLE NO. 10. : Africa Beauty & Personal Care Market Revenue, By Region, 2025 – 2032 (USD Million) 69