Market Overview

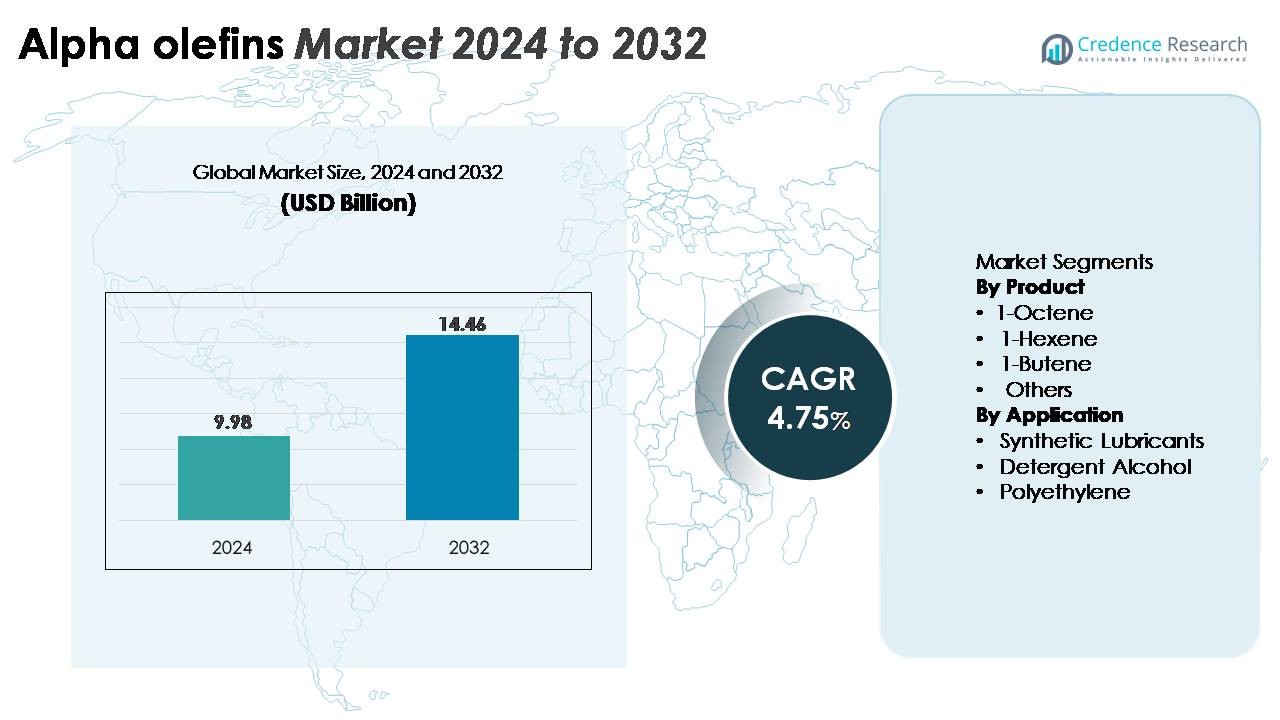

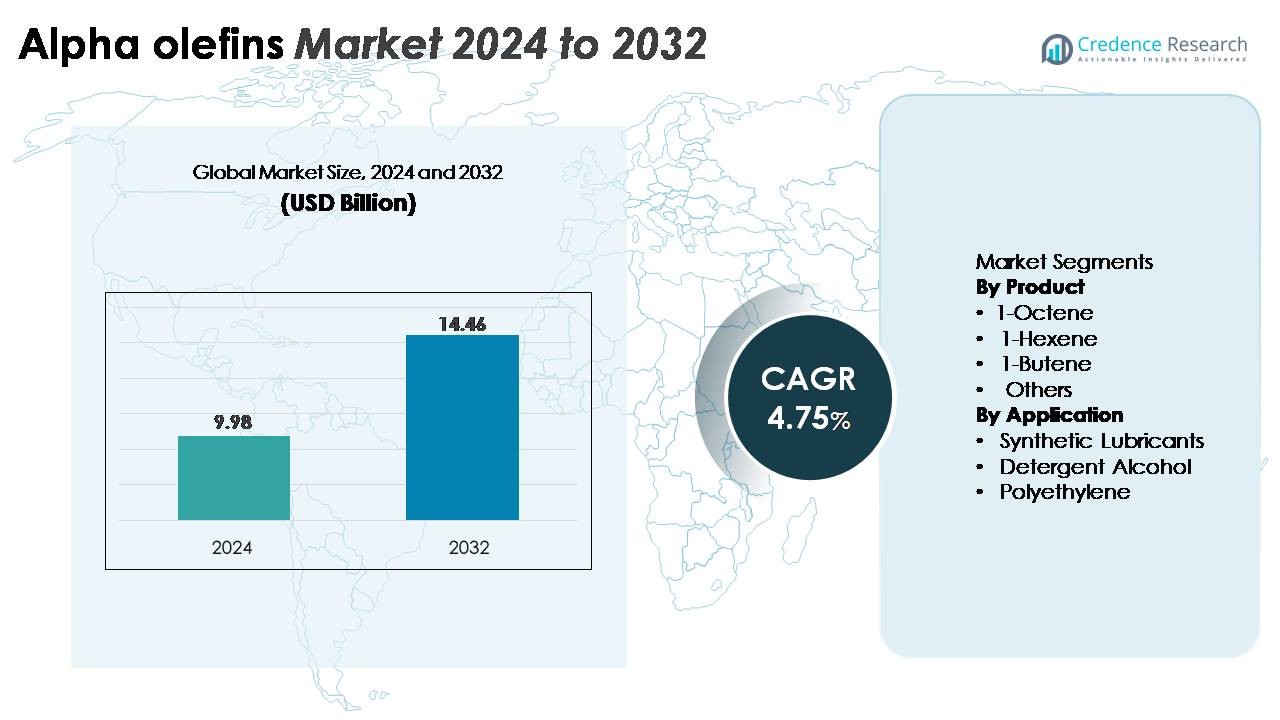

The global alpha olefins market was valued at USD 9.98 billion in 2024 and is projected to reach USD 14.46 billion by 2032, reflecting a compound annual growth rate (CAGR) of 4.75% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Alpha Olefins Market Size 2024 |

USD 9.98 Billion |

| Alpha Olefins Market, CAGR |

4.75% |

| Alpha Olefins Market Size 2032 |

USD 14.46 Billion |

The competitive landscape of the alpha olefins market features a mix of global chemical manufacturers and specialized surfactant producers, including Nouryon, Kao Corporation, Stepan Company, Enaspol, Huntsman Corporation, Pilot Chemical Company, Zanyu Technology Group Co. Ltd., Clariant AG, Rohit Surfactants Private Limited, and P. Chemicals. These companies strengthen their positions through integrated production capabilities, advanced oligomerization technologies, and strong downstream linkages with polyethylene, lubricant, and detergent alcohol manufacturers. North America leads the market with approximately 36% share, driven by large-scale ethylene crackers and competitively priced feedstocks, while Asia-Pacific follows as a rapidly growing hub supported by expanding petrochemical capacities and rising polymer demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global alpha olefins market reached USD 9.98 billion in 2024 and is projected to hit USD 14.46 billion by 2032, registering a CAGR of 4.75% during the forecast period.

- Market growth is driven by rising demand for LLDPE and HDPE, where 1-Butene leads the product segment due to its extensive use as a comonomer for high-strength and flexible polyethylene applications.

- Trends such as increasing adoption of high-purity 1-Hexene and 1-Octene for premium metallocene-grade PE and growing utilization in synthetic lubricants continue to reshape industry dynamics.

- Competitive activity remains strong, with major players expanding oligomerization capacities while navigating restraints linked to ethylene feedstock volatility and tightening sustainability regulations.

- Regionally, North America holds about 36% of the market, followed by Asia-Pacific with nearly 31%, while Europe maintains around 22%, supported by established chemical clusters and demand from polyethylene and surfactant industries.

Market Segmentation Analysis:

By Product (1-Octene, 1-Hexene, 1-Butene, Others)

In the product category, 1-Butene retains the dominant market share, supported by its widespread use as a comonomer in LLDPE and HDPE production, where it enhances flexibility, processability, and impact resistance. Its cost-effectiveness and high availability further reinforce its leadership across film packaging, industrial liners, and molded goods. While 1-Hexene and 1-Octene continue gaining traction in premium polyethylene grades, their higher production complexity limits volume uptake. The “Others” segment, comprising specialty alpha olefins, benefits from rising demand in elastomers, adhesives, and surfactants but remains comparatively smaller.

- For example, ExxonMobil is a leading global producer of linear alpha olefins, with large-scale manufacturing integrated into its Baytown and Baton Rouge complexes. The company is a major supplier of 1-butene, 1-hexene, and higher alpha olefins used in LLDPE, HDPE, and specialty surfactant applications, as documented in its Chemical Product Portfolio disclosures.

By Application (Synthetic Lubricants, Detergent Alcohol, Polyethylene, Others)

Within applications, polyethylene represents the largest and most influential segment, driven by increasing global consumption of LLDPE and HDPE in packaging, construction, automotive components, and consumer goods. Alpha olefins play a crucial role in improving polymer strength, sealing behavior, and durability, positioning polyethylene as the dominant demand center. Synthetic lubricants show strong growth momentum as PAO-based formulations gain preference in high-performance engines and industrial systems. Detergent alcohols also contribute significantly due to steady demand from household cleaning and personal care markets, supported by expanding production of fatty alcohol derivatives.

- For instance, Chevron Phillips Chemical operates a dedicated 1-Hexene unit in Baytown, Texas, with a production capacity of 250,000 metric tons per year, supplying high-performance comonomers for next-generation polyethylene grades. Synthetic lubricants continue to expand with PAO-based formulations, while detergent alcohols grow steadily due to increased production of C12–C14 fatty alcohol derivatives for cleaning and personal-care applications.

Key Growth Drivers

Rising Demand for Polyethylene Across Packaging and Industrial Applications

The global shift toward high-performance polyethylene materials remains a primary driver for alpha olefin consumption. As LLDPE and HDPE manufacturers increase production to serve rising demand for films, flexible packaging, geomembranes, and molded products, the use of alpha olefins as comonomers becomes indispensable. 1-Butene, 1-Hexene, and 1-Octene enhance mechanical strength, sealing behavior, durability, and flexibility properties essential for advanced packaging formats used in food, e-commerce, industrial liners, and agricultural films. Additionally, infrastructure and automotive industries increasingly rely on HDPE for pipes, containers, tanks, and lightweight components, further strengthening alpha olefin uptake. Expanding petrochemical complexes in Asia and the Middle East, along with continuous capacity additions by polymer producers, create a stable supply-demand environment. As manufacturers adopt metallocene catalyst technologies for premium PE grades, alpha olefins gain strategic importance in enabling custom performance characteristics, solidifying their role in global polymer value chains.

- For instance, Shell’s AlphaPlus® unit in Geismar supplies on-purpose 1-Octene that supports advanced PE used in pressure-rated pipe systems.

Expanding Utilization in Synthetic Lubricant and Oleochemical Industries

Synthetic lubricant production particularly polyalphaolefins (PAOs) continues to boost alpha olefin demand due to growing requirements in automotive, aerospace, marine, and industrial machinery applications. Alpha olefins such as 1-Decene are central feedstocks for high-viscosity, thermally stable PAO formulations. These lubricants support extended drain intervals, superior oxidation resistance, and enhanced fuel efficiency for modern engines and high-load equipment. The oleochemical industry also reinforces demand through the production of detergent alcohols and surfactants, where long-chain alpha olefins serve as key intermediates. Rising consumption of personal care products, home cleaning solutions, and industrial surfactants accelerates the need for high-purity alpha olefins. Growth in specialty applications including plasticizers, oil-field chemicals, and adhesives further broadens the consumption base. As industries prioritize energy efficiency and environmentally compliant formulations, the use of performance-optimized synthetic lubricants continues to expand, positioning alpha olefins at the core of next-generation lubrication and chemical solutions.

- For instance, Chevron Phillips Chemical’s PAO facility in Cedar Bayou, Texas operates with a production capacity of approximately 58,000 metric tons per year(mtpa), supplying Group IV PAOs used in high-efficiency automotive and turbine lubricants.

Technological Advancements in On-Purpose Production Processes

Ongoing advancements in production technologies significantly strengthen the alpha olefins market by enabling higher yields, improved selectivity, and cost-efficient manufacturing. Innovations in ethylene oligomerization such as Shell Higher Olefin Process (SHOP), Chevron Phillips’ AlphaPlus, and Sasol’s advanced catalytic systems allow producers to customize product distribution and scale output effectively. Enhanced catalyst performance ensures stability, longer life cycles, and greater precision in generating desired carbon-chain lengths, supporting consistent supply for polyethylene and specialty chemical segments. The industry is also witnessing the integration of digital twins, AI-based process optimization, and advanced heat-integration systems that reduce energy consumption and operational costs. Furthermore, investments in on-purpose 1-Hexene and 1-Octene facilities enable manufacturers to meet rising demand for premium PE grades without relying solely on co-product streams. These technological improvements collectively enhance competitiveness, operational efficiency, and global production reliability for alpha olefins.

Key Trends & Opportunities

Increasing Shift Toward High-Purity and Specialty Alpha Olefins

A notable trend in the market is the accelerating shift toward high-purity and specialty alpha olefins driven by end-user preferences for advanced materials and formulations. High-purity 1-Hexene and 1-Octene support the production of metallocene-based polyethylene, which offers superior clarity, puncture resistance, and mechanical properties for premium film packaging. Specialty alpha olefins such as C12–C20 chains continue gaining momentum in applications including surfactants, drilling fluids, automotive lubricants, and specialty polymers. Manufacturers are responding by expanding dedicated oligomerization units and upgrading purification systems to produce tailored carbon-chain distributions. Growth opportunities also arise from the increasing adoption of bio-based alpha olefins as industries explore renewable ethylene pathways. As sustainability frameworks tighten globally, specialty grades offering enhanced performance and lower environmental footprints become strategically important, creating new revenue channels for integrated petrochemical and specialty chemical producers.

· For example, Shell expanded its Geismar alpha olefins complex with the AO4 unit, adding 425,000 metric tons per year of total LAO capacity and raising the site’s output to 1.3 million metric tons per year, the largest globally. The unit uses Shell’s SHOP technology to supply high-purity cuts such as 1-butene, 1-hexene, and 1-octene for advanced polyethylene applications

Rising Investments in Capacity Expansion and Regional Petrochemical Integration

Integrated petrochemical hubs in Asia-Pacific, the Middle East, and North America are investing heavily in ethylene and downstream alpha olefin production, creating large-scale opportunities over the next decade. The availability of competitively priced feedstocks particularly shale-derived ethane in the U.S. and abundant natural gas liquids in the Middle East continues to support large capacity expansions. These investments strengthen supply-chain resilience, reduce import dependency, and improve regional competitiveness in polyethylene and synthetic lubricant value chains. Emerging economies are also accelerating infrastructure development, stimulating demand for HDPE pipes, geomembranes, and industrial components, which further enhances alpha olefin consumption. Companies are increasingly integrating alpha olefin units with steam cracker complexes for optimized feedstock utilization and cost efficiency. As global consumption patterns shift toward lightweight materials and specialty chemicals, regions with integrated petrochemical ecosystems are positioned to capture substantial long-term opportunities.

· For instance, INEOS started up its new 420,000-ton-per-year Linear Alpha Olefins (LAO) unit at the Chocolate Bayou complex in Texas in 2024, expanding integrated production alongside its nearby ethylene cracker and securing long-term supply for polyethylene and synthetic-lubricant customers.

Key Challenges

Volatility in Ethylene Feedstock Prices and Supply Dynamics

Feedstock volatility, especially in ethylene pricing, remains a structural challenge for the alpha olefins market. Since ethylene is the primary raw material for oligomerization processes, fluctuations driven by crude oil and natural gas market instability directly affect production economics. Geopolitical disruptions, refinery shutdowns, and supply chain constraints can create sudden price spikes and supply shortages, impacting profitability for producers and downstream converters. Ethylene-intensive regions face additional risk from constrained cracker operations and maintenance schedules. This volatility complicates long-term planning for polyethylene manufacturers, lubricant formulators, and surfactant producers who rely on stable alpha olefin supply. While integrated petrochemical complexes offer partial risk mitigation, global supply-demand imbalances continue to pressure margins and limit operational flexibility for market participants.

Environmental Regulations and Sustainability Pressures

Stringent environmental regulations affecting petrochemical operations present a significant challenge for alpha olefin producers, particularly regarding emissions, waste management, and energy consumption. Governments worldwide are enforcing tighter controls on carbon output, flare management, and hazardous by-products, increasing compliance costs across production sites. At the same time, consumer and industrial demand is shifting toward renewable or low-carbon alternatives, potentially impacting long-term reliance on fossil-based olefins. Companies must invest in cleaner technologies, carbon-capture systems, and renewable ethylene pathways to align with sustainability expectations. While these investments support long-term competitiveness, they require substantial capital expenditure and operational restructuring. Balancing regulatory compliance, sustainability commitments, and cost efficiency remains a complex challenge for industry stakeholders, especially as global climate policies continue to evolve.

Regional Analysis

North America

North America holds around 36% of the global alpha olefins market, supported by abundant shale-derived ethylene and strong integration across petrochemical value chains. The U.S. remains the primary production hub, with major players operating large oligomerization units that supply polyethylene, synthetic lubricants, and detergent alcohol manufacturers. Robust demand from LLDPE and HDPE converters reinforces regional consumption, particularly in packaging, construction, and automotive applications. Capacity expansions in the Gulf Coast, along with competitive feedstock pricing, continue to enhance production efficiency. The region also benefits from increasing exports to Latin America, Europe, and Asia-Pacific.

Europe

Europe accounts for nearly 22% of the alpha olefins market, driven by established chemical clusters in Germany, the Netherlands, Belgium, and France. Demand is primarily shaped by the region’s advanced plastics sector, synthetic lubricant manufacturers, and detergent alcohol producers. Regulatory focus on high-efficiency lubricants and environmentally compliant surfactants supports consistent alpha olefin uptake. However, higher feedstock costs and decarbonization pressures influence production economics. Despite these constraints, Europe maintains strong technological leadership in specialty alpha olefins and metallocene-grade comonomers, ensuring competitive advantages in premium polyethylene and oleochemical applications.

Asia-Pacific

Asia-Pacific holds approximately 31% market share and represents the fastest-expanding region due to rapid industrialization, rising polyethylene consumption, and large-scale petrochemical investments. China, South Korea, India, and Singapore drive substantial demand for LLDPE, HDPE, surfactants, and synthetic lubricants. Expanding e-commerce packaging needs, automotive manufacturing growth, and infrastructure development significantly boost alpha olefin usage. Regional producers continue increasing ethylene and oligomerization capacities to reduce import dependency. The shift toward high-purity 1-Hexene and 1-Octene for premium polymer grades further strengthens demand, positioning Asia-Pacific as a critical long-term growth engine.

Latin America

Latin America accounts for roughly 7% of the alpha olefins market, led by Brazil and Mexico, where polyethylene processing and detergent alcohol production remain key demand drivers. Growth is supported by rising consumption of packaging materials, agricultural films, pipes, and industrial components. While the region largely depends on imports from North America and the Middle East, ongoing capacity upgrades in Brazil’s petrochemical sector are improving local supply reliability. Expanding automotive and manufacturing activities also enhance synthetic lubricant usage. Despite economic fluctuations, long-term prospects remain stable due to infrastructure development and rising industrial investments.

Middle East & Africa

The Middle East & Africa region holds nearly 4% market share, driven by strong petrochemical integration in Saudi Arabia, UAE, and Qatar. Access to competitively priced ethane and NGL feedstocks enables cost-efficient alpha olefin production, much of which is exported to Europe and Asia. Domestic demand is gradually increasing due to expanding polyethylene processing capacities and industrial diversification initiatives. Africa contributes modestly, with growth driven by packaging and construction industries. Strategic investments in downstream chemicals, combined with large-scale expansion of ethylene crackers, are expected to strengthen the region’s role as a global supply base.

Market Segmentations:

By Product

- 1-Octene

- 1-Hexene

- 1-Butene

- Others

By Application

- Synthetic Lubricants

- Detergent Alcohol

- Polyethylene

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the alpha olefins market is characterized by a concentrated group of global petrochemical leaders with strong backward integration into ethylene production and advanced oligomerization technologies. Companies such as Shell, Chevron Phillips Chemical, ExxonMobil, INEOS, SABIC, and Sasol dominate supply through large-scale facilities and proprietary catalytic processes that enable high selectivity across product ranges from 1-Butene to specialty long-chain olefins. Their competitiveness is reinforced by extensive global distribution networks, robust feedstock access, and continuous investments in on-purpose 1-Hexene and 1-Octene capacities to meet rising demand for premium polyethylene grades. Strategic expansions in the U.S. Gulf Coast, Middle East, and Asia-Pacific strengthen supply reliability and cost efficiency. Collaboration with polymer manufacturers, lubricant formulators, and surfactant producers further enhances market presence. Additionally, technological innovations, sustainability initiatives, and value chain partnerships remain central to maintaining leadership positions in an increasingly performance-driven and efficiency-focused market environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nouryon

- Kao Corporation

- Stepan Company

- Enaspol

- Huntsman Corporation

- Pilot Chemical Company

- Zanyu Technology Group Co. Ltd.

- Clariant AG

- Rohit Surfactants Private Limited

- P. Chemicals

Recent Developments

- In November 2025, Nouryon opened a new innovation center in Shanghai to strengthen localized innovation, customer collaboration and development of polymer-specialty solutions in China and Asia-Pacific.

- In October 2025, Nouryon the company expanded its polymer specialties business by increasing metal-alkyls production capacity and adding a new MMAO production capability and organic peroxides innovation center in China, supporting catalyst supply for polyolefins.

- In May 2025, Pilot Chemical entered into an exclusive partnership with Novvi LLC to introduce biobased alpha-olefin sulfonate (AOS) surfactants in North America. The agreement makes Pilot the sole sulfonator and distributor of Novvi’s CalCare® AOS surfactants for household, industrial & institutional (I&I), and personal-care markets.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for alpha olefins will continue rising as global LLDPE and HDPE consumption expands across packaging and infrastructure sectors.

- Adoption of high-purity 1-Hexene and 1-Octene will increase as metallocene-grade polyethylene gains preference for premium film and molding applications.

- Synthetic lubricant usage will grow steadily, strengthening demand for long-chain alpha olefins used in PAO formulations.

- Producers will accelerate capacity expansions in North America, the Middle East, and Asia-Pacific to improve supply reliability.

- Technological advancements in oligomerization catalysts will enhance production efficiency and product selectivity.

- Integration with steam crackers and low-cost feedstock sources will remain a priority for cost-competitive manufacturing.

- Sustainability pressures will drive interest in renewable or bio-based alpha olefins developed from alternative ethylene pathways.

- Digital optimization of production systems will support improved operational performance and energy efficiency.

- Specialty alpha olefins will gain traction in applications such as surfactants, adhesives, and drilling fluids.

- Regional trade flows will shift as emerging markets increase polyethylene capacity and strengthen downstream value chains.