| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anti-collision Sensors Market Size 2024 |

USD 20,646.04 million |

| Anti-collision Sensors Market, CAGR |

15.95% |

| Anti-collision Sensors Market Size 2032 |

USD 66,727.11 million |

Market Overview

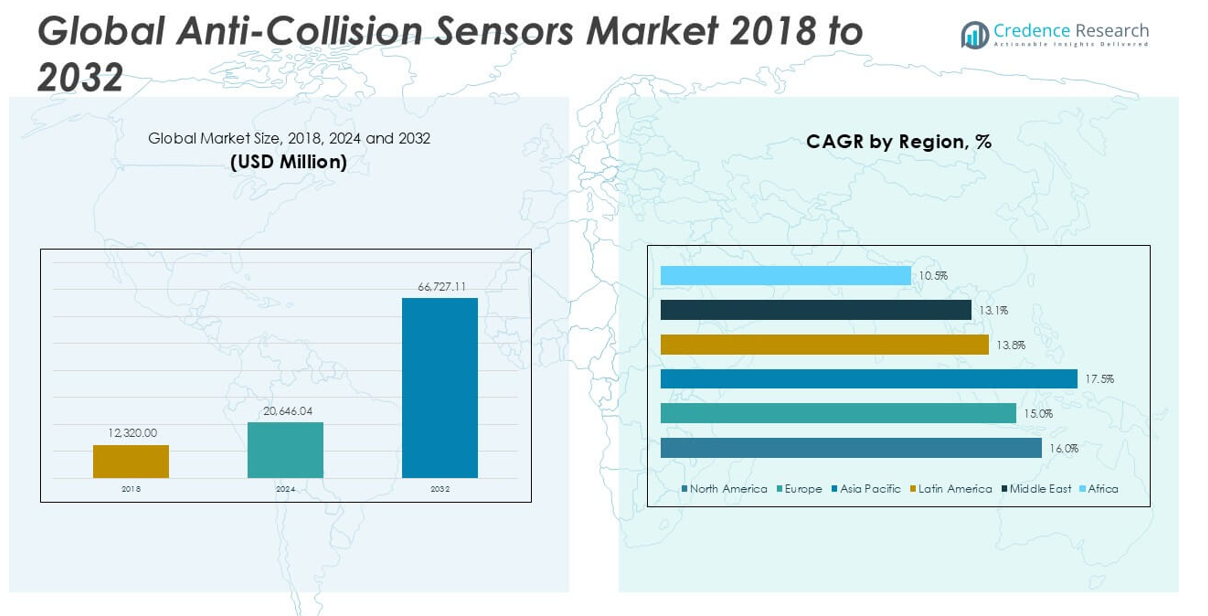

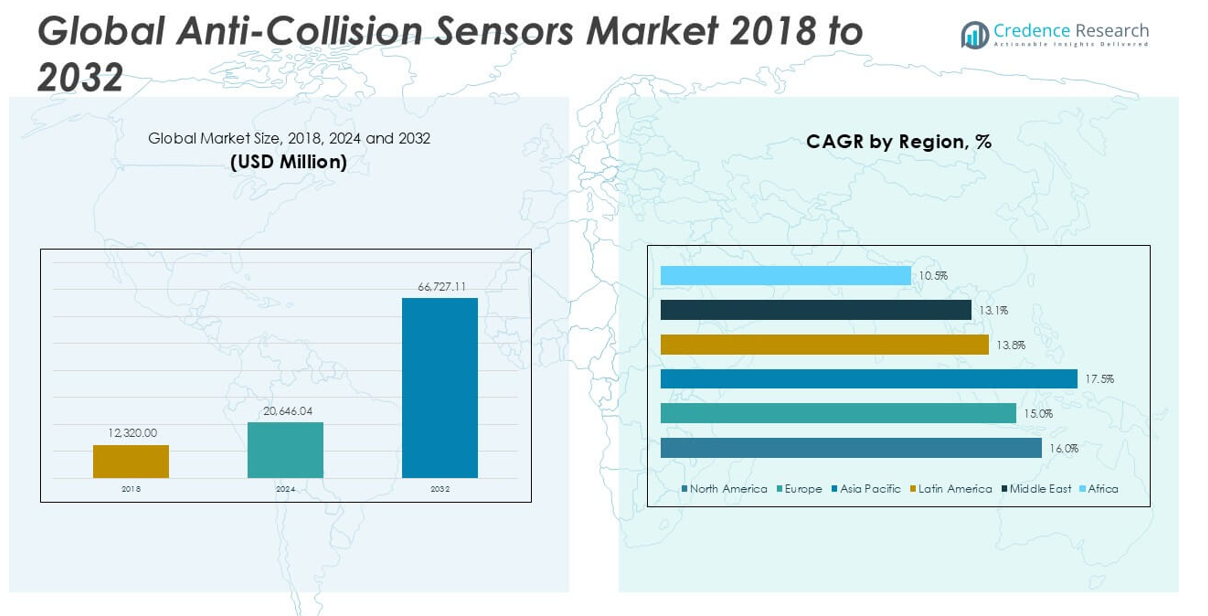

The Anti-collision Sensors Market size was valued at USD 12,320.00 million in 2018, increased to USD 20,646.04 million in 2024, and is anticipated to reach USD 66,727.11 million by 2032, at a CAGR of 15.95% during the forecast period.

The Anti-collision Sensors Market is experiencing robust growth, driven by the increasing adoption of advanced driver-assistance systems (ADAS) in vehicles to enhance safety and comply with stringent government regulations. The rapid expansion of the automotive industry, coupled with rising concerns regarding road accidents and passenger safety, has accelerated the integration of anti-collision technologies across both commercial and passenger vehicles. Additionally, the proliferation of autonomous and semi-autonomous vehicles is fueling demand for high-precision sensors capable of real-time object detection and collision avoidance. Technological advancements in radar, LiDAR, ultrasonic, and camera-based systems are further supporting market expansion by improving detection accuracy and reliability. The trend towards smart mobility solutions and connected vehicles also contributes to market growth, as manufacturers focus on offering enhanced safety features and seamless user experiences. This dynamic market landscape is marked by continuous innovation and strategic partnerships among key industry players.

The geographical analysis of the Anti-collision Sensors Market highlights strong growth across North America, Europe, and Asia Pacific, with these regions leading in the adoption of advanced automotive safety technologies. North America and Europe benefit from strict regulatory standards, high consumer awareness, and the early presence of connected and autonomous vehicles, while Asia Pacific’s growth is fueled by large-scale automotive manufacturing, urbanization, and rising demand for safety features in emerging economies like China, Japan, and India. Key players shaping the competitive landscape include Robert Bosch GmbH, renowned for its innovation in automotive safety systems; DENSO CORPORATION, which offers a broad portfolio of sensor technologies; and Siemens AG, recognized for its integration of advanced solutions into both commercial and passenger vehicles. These companies, along with others like Honeywell International Inc., continue to invest in research and development, forming strategic alliances to strengthen their market positions.

Market Insights

- The Anti-collision Sensors Market is valued at USD 20,646.04 million in 2024 and is projected to reach USD 66,727.11 million by 2032, at a CAGR of 15.95% during the forecast period.

- Growing emphasis on vehicle safety and the adoption of stringent automotive regulations are driving the widespread integration of anti-collision sensors in both passenger and commercial vehicles.

- Technological advancements in radar, LiDAR, ultrasonic, and camera-based systems are shaping product innovation, supporting higher detection accuracy and real-time collision prevention.

- Leading companies such as Robert Bosch GmbH, DENSO CORPORATION, and Siemens AG focus on product development, strategic partnerships, and geographic expansion to strengthen their market presence.

- High costs of advanced sensor technologies and technical limitations under adverse environmental conditions continue to restrain market adoption, particularly in cost-sensitive regions.

- North America, Europe, and Asia Pacific dominate the market, with strong contributions from countries such as the United States, Germany, China, and Japan, supported by regulatory initiatives and robust automotive industries.

- Increasing demand for autonomous and connected vehicles, expansion into emerging markets, and ongoing R&D investments present significant opportunities for future market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Stringent Vehicle Safety Regulations Propel Sensor Adoption

Global regulatory agencies have prioritized automotive safety, prompting automakers to adopt anti-collision sensors across a wide range of vehicle models. Stricter mandates on road safety standards require manufacturers to integrate advanced driver-assistance features that mitigate collision risks. The Anti-collision Sensors Market benefits from laws that mandate collision avoidance systems in both passenger and commercial vehicles. Compliance with these safety norms accelerates sensor implementation, driving market growth. Consumer demand for vehicles equipped with safety technologies supports regulatory momentum. Automakers and component suppliers are compelled to invest in research and development, ensuring products align with evolving legal requirements. The regulatory landscape fosters an environment where adoption of anti-collision sensors is not optional but essential.

- For instance, the National Highway Traffic Safety Administration (NHTSA) in the U.S. reported that more than 20 countries now require new vehicles to be equipped with some form of automatic emergency braking or forward collision warning systems.

Growth in Automotive Production and Electrification Drives Demand

Automotive manufacturing continues to expand in emerging and established economies, creating higher demand for sensor integration. The market captures value from rising vehicle production, especially as electric vehicles and hybrid models increase in popularity. It leverages the need for advanced safety technologies in new vehicle designs, positioning sensors as critical components for modern mobility. Electrification trends intensify focus on smart systems that enhance driver and passenger safety. High-volume automotive output creates economies of scale, lowering production costs for sensor technologies. The proliferation of connected and autonomous vehicle prototypes also contributes to demand. Vehicle manufacturers embrace sensors to differentiate products and address evolving consumer preferences.

- For instance, the International Organization of Motor Vehicle Manufacturers (OICA) recorded global production of over 85 million vehicles in the latest year, with a substantial increase in electric and hybrid models.

Technological Advancements Improve Sensor Performance

Ongoing innovation in sensor technologies enhances accuracy, reliability, and efficiency. Radar, LiDAR, ultrasonic, and camera-based systems now offer superior detection and response capabilities. The Anti-collision Sensors Market capitalizes on these advances to deliver solutions tailored for complex driving environments. It incorporates artificial intelligence and machine learning to process sensor data in real time, supporting predictive safety features. Miniaturization and integration facilitate seamless installation within diverse vehicle platforms. Continuous product enhancements enable manufacturers to address new market requirements and vehicle categories. Technological leadership remains vital for companies seeking a competitive advantage.

Rising Awareness of Road Safety and Consumer Preferences Influence Market Dynamics

Consumers are prioritizing safety in their vehicle purchasing decisions, shaping trends across the automotive sector. The Anti-collision Sensors Market responds by offering user-centric safety solutions that address everyday driving hazards. Heightened awareness about accident risks encourages buyers to seek vehicles with comprehensive safety features. It aligns with insurance industry incentives and fleet operator requirements, reinforcing the case for sensor integration. Marketing campaigns and safety ratings further educate consumers on the benefits of anti-collision technologies. Enhanced trust in sensor-enabled vehicles builds customer loyalty and supports long-term market growth.

Market Trends

Integration of Multi-Sensor Technologies Shapes Product Evolution

Automotive manufacturers are increasingly integrating multiple sensor types—such as radar, LiDAR, ultrasonic, and cameras—to create robust anti-collision systems. This trend enables higher detection accuracy and adaptability in diverse driving conditions. The Anti-collision Sensors Market reflects this move toward sensor fusion, which allows systems to compensate for individual sensor limitations and deliver reliable real-time data. It encourages innovation in signal processing algorithms and facilitates smoother interaction with other vehicle electronics. Product development focuses on seamlessly blending hardware and software for comprehensive coverage. The industry prioritizes multi-modal sensing solutions to address emerging requirements in both conventional and autonomous vehicles. Sensor integration drives new standards for vehicle safety and efficiency.

- For instance, Euro NCAP testing data reveals more than 30 car models now utilize at least three sensor technologies for collision avoidance and parking assistance.

Growth of Autonomous and Semi-Autonomous Vehicles Accelerates Adoption

The shift toward autonomous and semi-autonomous vehicles intensifies demand for sophisticated anti-collision sensors. The Anti-collision Sensors Market is adapting to the needs of vehicles that must interpret complex traffic environments and make split-second decisions. It provides advanced solutions capable of supporting features such as lane-keeping assistance, emergency braking, and adaptive cruise control. Manufacturers rely on high-precision sensors to ensure safety in all driving scenarios, including congested urban areas and highway travel. The development of reliable, scalable sensors underpins the rollout of self-driving technologies. Growing consumer trust in automation fuels the implementation of anti-collision systems across new vehicle launches. This trend shapes long-term innovation roadmaps within the automotive sector.

- For instance, the California Department of Motor Vehicles reported that more than 60 companies have received permits for testing autonomous vehicles equipped with advanced sensor arrays.

Focus on Miniaturization and Cost Optimization Enhances Accessibility

Manufacturers are prioritizing sensor miniaturization and cost-effective designs, making advanced safety technology accessible for a wider range of vehicles. The Anti-collision Sensors Market is witnessing a shift towards compact, modular sensors that reduce installation complexity and improve system integration. It responds to automakers’ demand for lightweight, low-power components that meet efficiency and design requirements. Economies of scale in manufacturing are lowering sensor costs, expanding their availability beyond premium vehicle segments. Technology providers are also streamlining supply chains to meet increased production volumes. Miniaturization supports the integration of anti-collision sensors into new vehicle categories, including smaller cars and two-wheelers.

Emphasis on Connectivity and Data Analytics Drives Advanced Features

Industry players are investing in connectivity and real-time data analytics to enhance the functionality of anti-collision sensors. The Anti-collision Sensors Market is evolving to support vehicle-to-everything (V2X) communication and cloud-based safety platforms. It enables proactive hazard detection, remote diagnostics, and over-the-air software updates for continuous improvement. Advanced data processing enhances situational awareness and enables predictive safety responses. Automakers are leveraging data insights to personalize driver assistance features and refine system performance. Connected sensor ecosystems position manufacturers to address future trends in mobility and intelligent transportation systems

Market Challenges Analysis

High Cost of Advanced Sensor Technologies Limits Widespread Adoption

Premium anti-collision sensor technologies, such as LiDAR and high-resolution radar, carry significant costs that challenge their integration into lower-priced vehicle segments. The Anti-collision Sensors Market faces barriers when automakers seek to balance affordability with advanced safety features. High research and development expenses, coupled with the need for precision manufacturing, often restrict access to these sensors for cost-sensitive markets. Automakers in emerging economies find it difficult to justify the price increase, impacting large-scale adoption. It experiences further pressure from fluctuating raw material prices and complex supply chains, which can elevate production costs. Manufacturers must pursue innovations that lower expenses without sacrificing quality to expand the market’s reach. Persistent cost concerns slow the democratization of cutting-edge safety technologies.

Technical Limitations and Environmental Factors Affect Sensor Reliability

Anti-collision sensor systems must perform accurately in diverse real-world conditions, but technical constraints still exist. The Anti-collision Sensors Market encounters reliability issues due to adverse weather, dust, or obstructions, which can impair sensor function. It struggles with challenges in differentiating between static and moving objects or interpreting complex urban scenarios. False positives or missed detections may undermine consumer trust and hinder regulatory approval. Integration with legacy vehicle platforms can also complicate deployment, requiring customized solutions. The industry needs ongoing research to address environmental influences and technical shortcomings. Achieving robust performance across varied conditions remains a critical challenge for manufacturers and suppliers.

Market Opportunities

Expansion into Emerging Automotive Markets Presents Significant Growth Potential

Rising vehicle production in emerging markets offers considerable opportunity for anti-collision sensor suppliers. The Anti-collision Sensors Market stands to benefit as automakers invest in advanced safety features to comply with evolving regulatory standards in regions such as Asia-Pacific, Latin America, and the Middle East. Consumer awareness of vehicle safety is increasing, driving demand for cars equipped with sophisticated collision avoidance systems. It positions suppliers to establish local manufacturing and distribution partnerships, streamlining access to high-growth regions. Companies that tailor products to meet local pricing and environmental requirements can gain a competitive edge. Collaborating with regional automakers and technology providers further supports expansion efforts. Emerging markets represent a key driver for future industry growth.

Advancements in Autonomous and Connected Vehicle Technologies Unlock New Opportunities

The acceleration of autonomous and connected vehicle development creates a dynamic landscape for anti-collision sensor innovation. The Anti-collision Sensors Market is poised to capitalize on rising demand for intelligent safety solutions in next-generation vehicles. It enables integration with vehicle-to-everything (V2X) communication, advanced data analytics, and predictive safety features. Collaborations between automakers, sensor developers, and software companies open doors to new applications beyond traditional passenger vehicles, including commercial fleets and public transportation. The push for smart cities and intelligent transportation systems drives adoption of advanced anti-collision technologies. Companies that invest in research and strategic partnerships are well positioned to capture these expanding opportunities.

Market Segmentation Analysis:

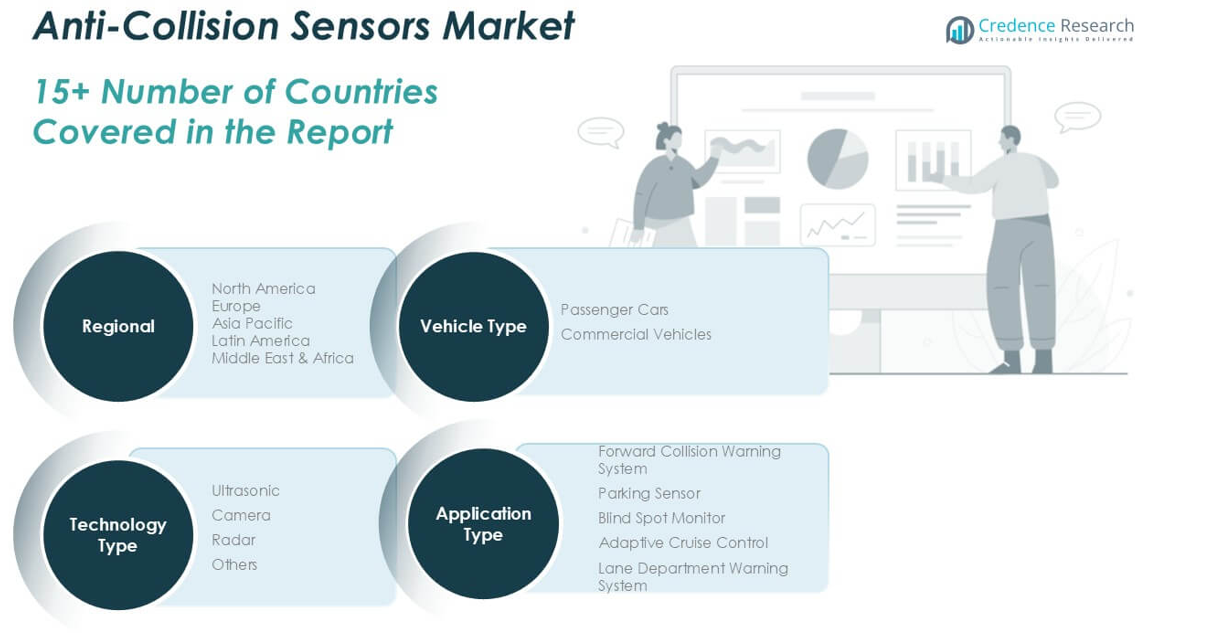

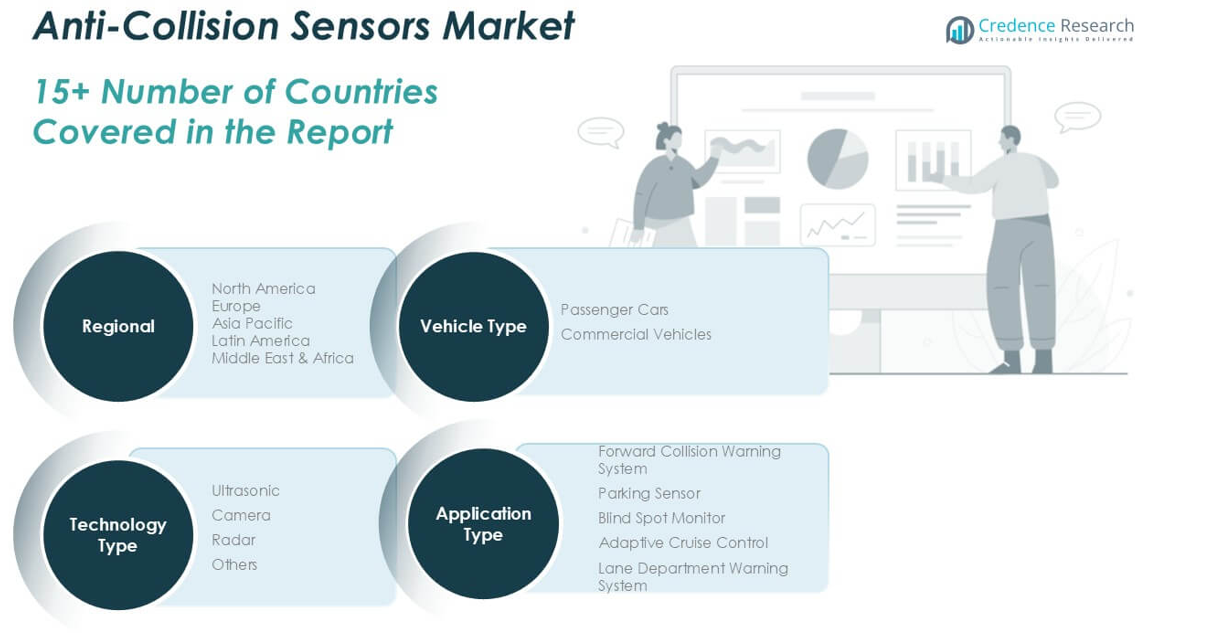

By Vehicle Type:

The market includes passenger cars and commercial vehicles. Passenger cars account for a significant share, driven by consumer demand for enhanced safety and the widespread integration of advanced driver-assistance systems in new models. Commercial vehicles contribute to market expansion, supported by regulatory mandates and the growing focus on fleet safety. These vehicles require reliable sensor solutions to improve operational safety and minimize accident risks during logistics and transportation activities.

- For instance, Transport Research Laboratory in the UK reported over 150 car models with integrated collision warning sensors on the market

By Application:

The Anti-collision Sensors Market encompasses forward collision warning systems, parking sensors, blind spot monitors, adaptive cruise control, and lane departure warning systems. Forward collision warning systems represent a core application, addressing real-time detection of potential obstacles and reducing rear-end collision risks. Parking sensors continue to see high adoption due to urbanization trends and the need for precise maneuvering in tight spaces. Blind spot monitors and lane departure warning systems enhance driver awareness, supporting accident prevention in complex traffic environments. Adaptive cruise control stands out in premium and mid-range vehicles, leveraging sensor capabilities to automatically adjust vehicle speed and maintain safe distances on highways.

- For instance, the Japan Automobile Manufacturers Association (JAMA) reported that more than 400 new vehicle models released in a single year featured some form of forward collision warning or lane-keeping assistance.

By Technology Type:

The market includes ultrasonic, camera, radar, and other sensor solutions. Radar technology maintains a leading position, valued for its accuracy and performance under various environmental conditions. Camera-based sensors are gaining traction, offering high-resolution imaging and supporting advanced features such as object recognition. Ultrasonic sensors remain popular for close-range applications, particularly in parking and low-speed maneuvering scenarios. Other emerging technologies are expanding the capabilities of anti-collision systems, including sensor fusion approaches that combine multiple detection methods. The market’s segmentation highlights the critical role of tailored sensor solutions across vehicle categories, use cases, and technology platforms. This diverse landscape creates ongoing opportunities for innovation and differentiation among industry participants.

Segments:

Based on Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Based on Application:

- Forward Collision Warning System

- Parking Sensor

- Blind Spot Monitor

- Adaptive Cruise Control

- Lane Departure Warning System

Based on Technology Type:

- Ultrasonic

- Camera

- Radar

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Anti-collision Sensors Market

North America Anti-collision Sensors Market grew from USD 4,336.64 million in 2018 to USD 7,208.03 million in 2024 and is projected to reach USD 23,378.07 million by 2032, reflecting a compound annual growth rate (CAGR) of 16.0%. North America is holding a 35% market share. The United States and Canada lead the adoption of advanced vehicle safety technologies, driven by strict regulatory standards and high consumer awareness. The presence of leading automotive manufacturers and a strong focus on autonomous vehicles support steady market expansion. High penetration of connected vehicles further accelerates sensor deployment in both passenger and commercial fleets. Investment in R&D and a strong aftermarket ecosystem sustain the region’s leadership position.

Europe Anti-collision Sensors Market

Europe Anti-collision Sensors Market grew from USD 3,105.87 million in 2018 to USD 4,993.71 million in 2024 and is expected to reach USD 15,071.83 million by 2032, with a CAGR of 15.0%. Europe accounts for approximately 22% market share. Germany, France, and the United Kingdom play pivotal roles, with OEMs adopting advanced sensor solutions to comply with Euro NCAP safety ratings and EU regulations. The region’s focus on sustainable mobility and the growth of electric vehicles contribute to robust market activity. Investments in smart infrastructure and cross-border collaborations promote new sensor applications. The presence of renowned automotive suppliers underpins the market’s technological advancement.

Asia Pacific Anti-collision Sensors Market

Asia Pacific Anti-collision Sensors Market grew from USD 3,747.74 million in 2018 to USD 6,440.31 million in 2024 and is forecast to reach USD 23,074.80 million by 2032, at a CAGR of 17.5%. Asia Pacific holds the largest market share, accounting for 34%. China, Japan, South Korea, and India drive market momentum through large-scale automotive production and government initiatives supporting road safety. Rapid urbanization and rising disposable income fuel demand for vehicles equipped with advanced safety features. Local and global manufacturers focus on cost-effective sensor integration, making safety technologies accessible across vehicle segments. Strategic alliances and expanding manufacturing capacities enhance the region’s growth prospects.

Latin America Anti-collision Sensors Market

Latin America Anti-collision Sensors Market grew from USD 482.94 million in 2018 to USD 796.73 million in 2024 and is projected to reach USD 2,217.34 million by 2032, representing a CAGR of 13.8%. Latin America maintains a 4% market share. Brazil and Mexico are the primary contributors, supported by gradual regulatory improvements and rising consumer interest in vehicle safety. Economic fluctuations and varying vehicle replacement cycles impact market growth. Manufacturers target cost-effective solutions to address budget-sensitive segments. Collaboration with regional distributors and OEMs supports wider sensor adoption. The market’s potential is tied to ongoing policy reforms and modernization of the regional vehicle fleet.

Middle East Anti-collision Sensors Market

Middle East Anti-collision Sensors Market grew from USD 301.84 million in 2018 to USD 456.14 million in 2024 and is forecast to reach USD 1,207.33 million by 2032, registering a CAGR of 13.1%. The Middle East holds a 2% market share. Saudi Arabia and the United Arab Emirates anchor demand, with governments introducing road safety initiatives and smart mobility projects. The luxury vehicle segment and commercial fleets drive premium sensor adoption. Infrastructure development and the influx of international automotive brands support technology penetration. The market benefits from ongoing investments in intelligent transportation systems.

Africa Anti-collision Sensors Market

Africa Anti-collision Sensors Market grew from USD 344.96 million in 2018 to USD 751.11 million in 2024 and is expected to reach USD 1,777.75 million by 2032, achieving a CAGR of 10.5%. Africa contributes around 3% market share. South Africa and Egypt lead the regional market, where rising vehicle imports and government safety campaigns stimulate demand for sensor-based safety systems. Price sensitivity and limited local production constrain wider adoption. Manufacturers prioritize basic sensor integration in entry-level vehicles. Partnerships with regional stakeholders are vital for growth in diverse markets. The potential for expansion remains strong, driven by gradual improvements in infrastructure and vehicle standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Robert Bosch GmbH

- Honeywell International Inc.

- Wabtec Corporation

- Siemens AG

- ALSTOM

- DENSO CORPORATION

- GENERAL ELECTRIC

- Delphi Automotive LLP

Competitive Analysis

The competitive landscape of the Anti-collision Sensors Market is characterized by strong innovation, technological partnerships, and global expansion strategies among the leading players. Robert Bosch GmbH, DENSO CORPORATION, Siemens AG, Honeywell International Inc., Wabtec Corporation, ALSTOM, GENERAL ELECTRIC, and Delphi Automotive LLP dominate the market through broad product portfolios and a strong focus on research and development. These companies invest heavily in developing advanced radar, LiDAR, camera, and ultrasonic sensor technologies to meet evolving safety regulations and customer requirements. They collaborate with automotive manufacturers to integrate anti-collision sensors into new vehicle platforms, ensuring compatibility with both passenger and commercial vehicles. Many players pursue geographic expansion by establishing manufacturing bases and distribution networks in high-growth regions, especially across Asia Pacific and North America. Strategic alliances and acquisitions are common, enabling faster technology transfer and access to new markets. Leading firms also prioritize continual product improvement and reliability, leveraging artificial intelligence and sensor fusion to offer comprehensive safety solutions. The intense competition encourages sustained innovation and supports the market’s long-term growth trajectory.

Recent Developments

- In December 2024, Infineon Technologies introduced the RASIC™ CTRX8191F, a 28nm radar MMIC designed for 4D and HD imaging radars in autonomous vehicles. The radar enhances performance with a superior signal-to-noise ratio, enabling detection up to 380 meters, and supports rapid prototyping through the CARKIT development kit.

- In October 2024, NOVOSENSE and Continental formed a strategic partnership to develop advanced automotive-grade pressure sensor chips for applications like airbags and collision detection.

- In January 2024, Texas Instruments unveiled three new chips at CES 2024 to enhance ADAS and battery management systems. These chips are designed to support the evolution towards Software Defined Vehicles (SDV) and accelerate the transition to electric vehicles.

- In September 2023, Google Cloud and technology company Continental announced a strategic partnership to offer innovative, flexible, and future-oriented digital solutions for the automotive industry.

Market Concentration & Characteristics

The Anti-collision Sensors Market demonstrates moderate to high market concentration, with a few global players commanding significant influence due to their technological expertise, comprehensive product offerings, and established partnerships with major automotive manufacturers. It features leading companies such as Robert Bosch GmbH, DENSO CORPORATION, Siemens AG, and Honeywell International Inc., which set industry benchmarks in innovation and reliability. Barriers to entry remain high because of the substantial investment required in research and development, regulatory compliance, and advanced manufacturing capabilities. The market exhibits rapid technological evolution, with strong emphasis on sensor integration, artificial intelligence, and real-time data analytics to deliver enhanced safety features. It serves a dynamic customer base that spans both passenger and commercial vehicle segments, adapting solutions to diverse regulatory requirements and performance standards across regions. The industry’s competitive nature encourages ongoing product improvements and a swift response to changing market demands, reinforcing its role as a cornerstone in modern vehicle safety technology.

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Application, Technology Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is projected to experience significant growth, driven by increasing demand for advanced driver-assistance systems (ADAS) and autonomous driving technologies.

- Stringent government safety regulations worldwide are compelling automakers to integrate anti-collision sensors into vehicles, enhancing road safety.

- Technological advancements in sensor technologies, including radar, LiDAR, ultrasonic, and camera systems, are enhancing detection accuracy and reliability.

- The adoption of anti-collision sensors is expanding beyond automotive applications into sectors like defense, law enforcement, public transportation, and agriculture.

- The Asia-Pacific region is expected to witness rapid growth due to increasing vehicle production and rising consumer demand for advanced safety features in emerging markets like China and India.

- Declining prices of cameras and radars are making advanced safety systems more accessible, leading to increased sales of vehicles equipped with these technologies.

- Major players in the market, such as Robert Bosch GmbH, DENSO CORPORATION, and Siemens AG, are investing heavily in research and development to innovate and expand their product portfolios.

- The integration of artificial intelligence and machine learning algorithms is expected to enhance the functionality of anti-collision systems, enabling predictive safety measures.

- Collaborations and partnerships among automotive manufacturers and technology providers are facilitating the development of more sophisticated and integrated safety solutions.

- Despite the positive outlook, challenges such as high initial investment costs and technical limitations under adverse environmental conditions may restrain market adoption in certain regions.