Market Overview

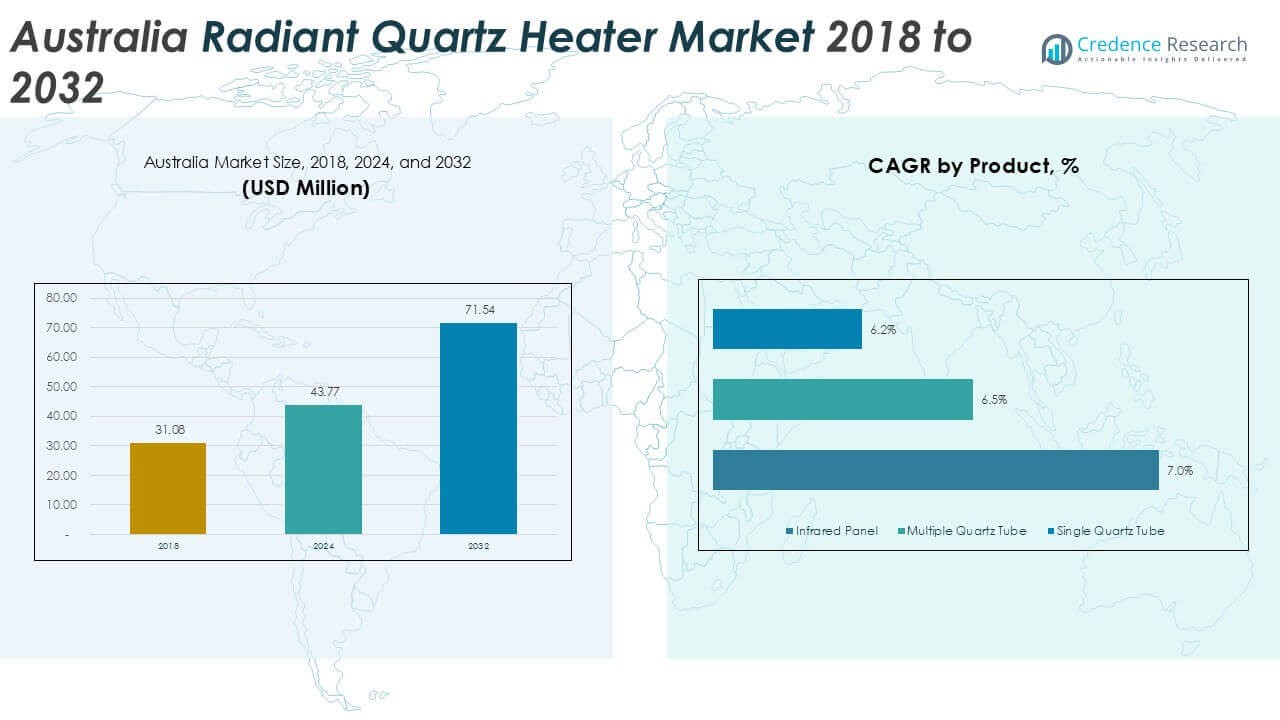

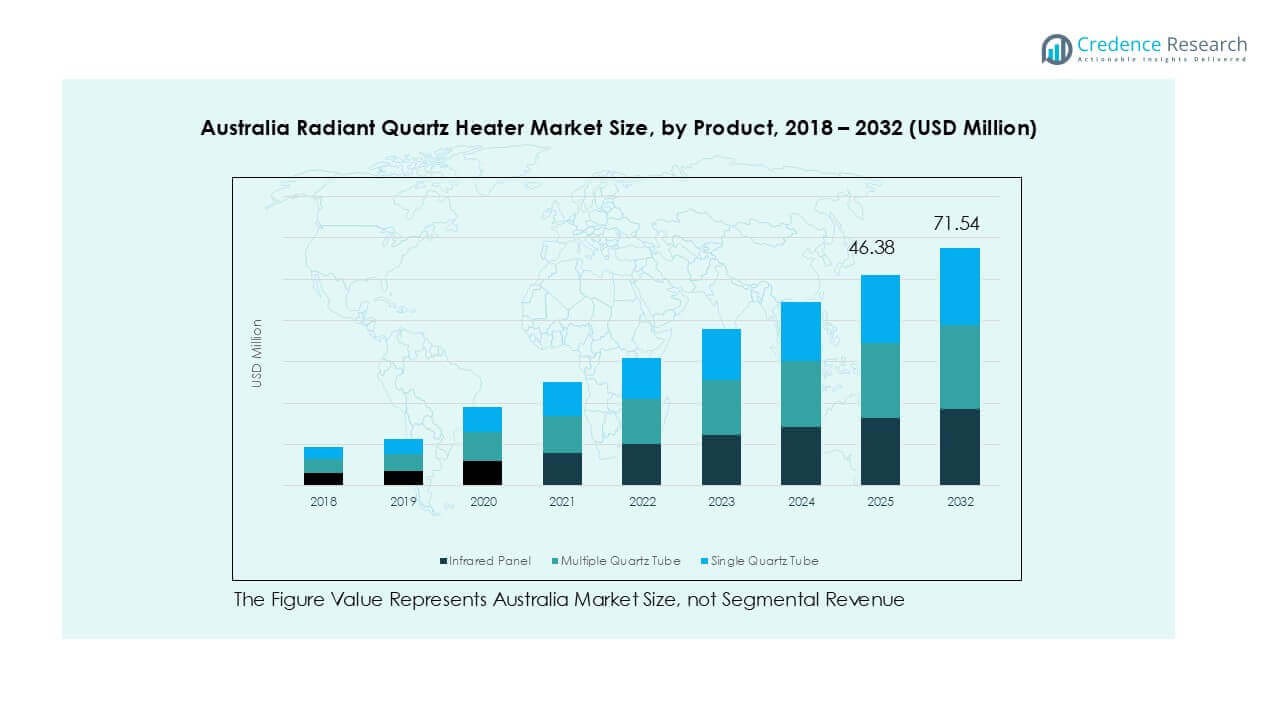

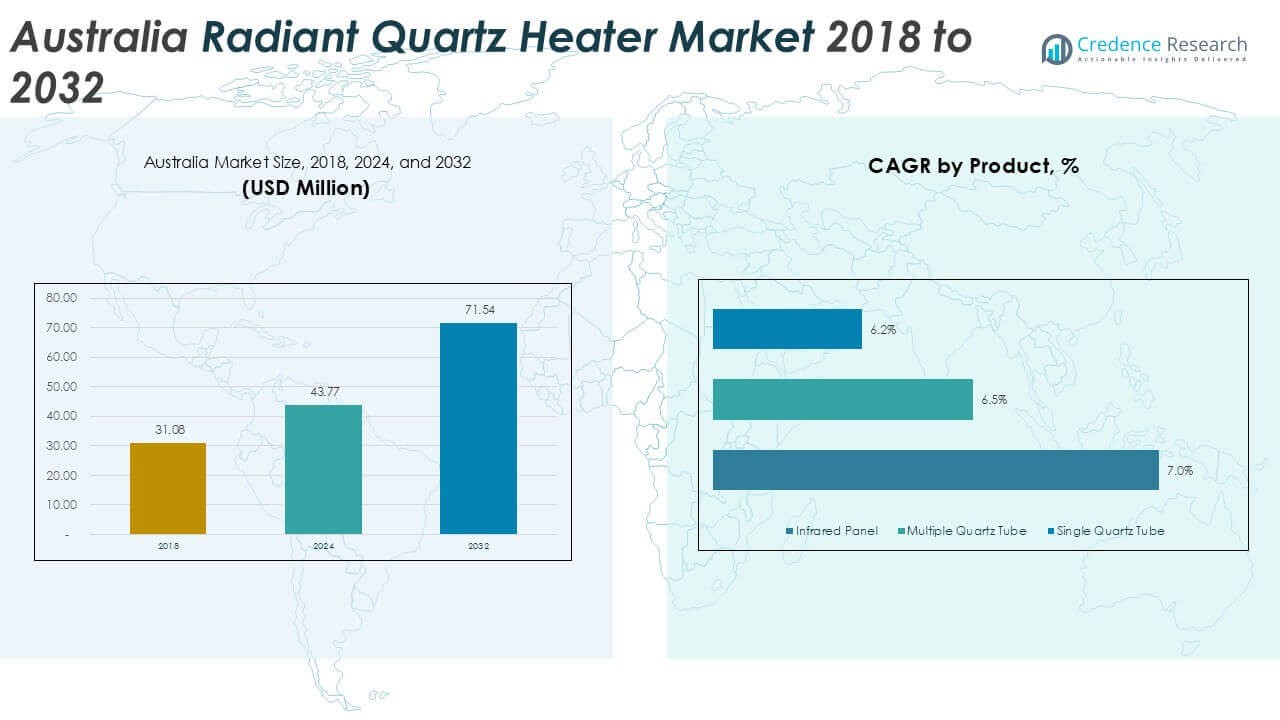

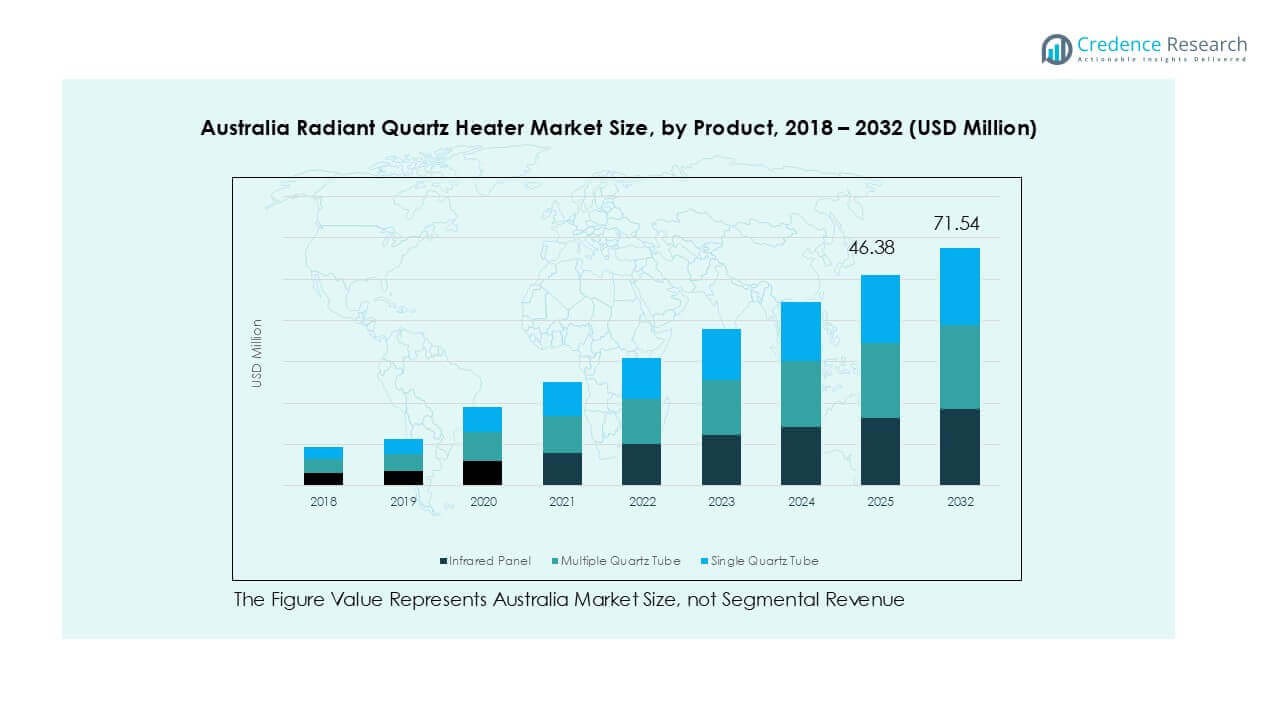

Australia Radiant Quartz Heater market size was valued at USD 31.08 million in 2018 to USD 43.77 million in 2024 and is anticipated to reach USD 71.54 million by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Radiant Quartz Heater Market Size 2024 |

USD 43.77 Million |

| Australia Radiant Quartz Heater Market, CAGR |

6.3% |

| Australia Radiant Quartz Heater Market Size 2032 |

USD 71.54 Million |

The Australia radiant quartz heater market features a mix of domestic and international players, including Heat Australia Pty Ltd, Convectronics, Lasko Products, TPI Corporation, Watlow, Duraflame, SPACE-RAY, Tempco Electric Heater Corporation, Döbeln Elektrowärme GmbH, and Sawhney Industries. These companies compete on safety compliance, product efficiency, and retail reach. Local brands benefit from strong offline distribution, while global players leverage brand scale and product breadth. New South Wales leads the market with a 33% share, driven by dense urban housing and high replacement demand. Victoria follows with 28% share, supported by colder winters and longer heating periods. Queensland, Western Australia, and South Australia collectively account for the remaining share, led by seasonal and regional demand patterns.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia radiant quartz heater market reached USD 43.77 million in 2024 and is projected to grow at a 6.3% CAGR through 2032, driven by steady replacement demand and urban usage.

- Rising electricity costs and preference for zone heating drive adoption, as quartz heaters deliver instant warmth with controlled energy use in small spaces.

- Design-led infrared panel heaters dominate with around 42–45% segment share, while 1000–1500-watt models lead with nearly 50% share due to balanced performance and efficiency.

- Competition remains moderate, with local and global brands focusing on safety features, mid-range pricing, and strong offline retail presence, while online sales intensify price pressure.

- New South Wales leads with about 33% share, followed by Victoria at 28%, while Queensland, Western Australia, and South Australia together account for the remaining demand, shaped by climate variation.

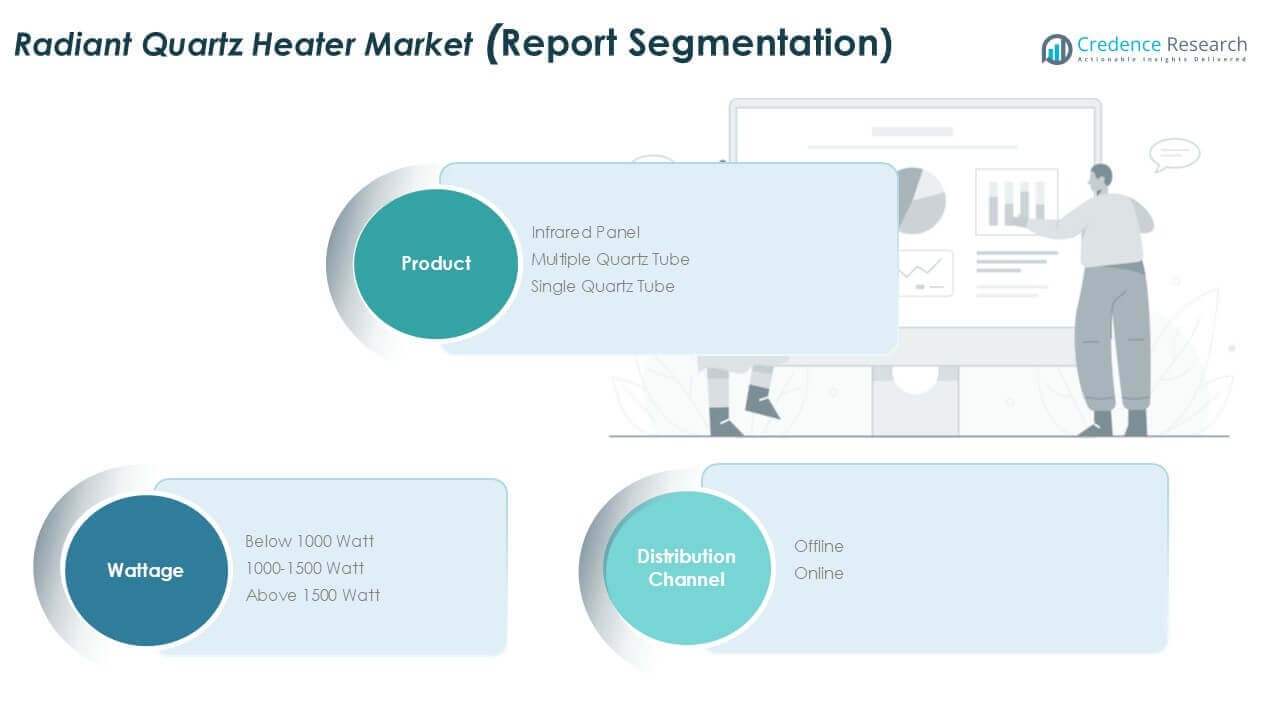

Market Segmentation Analysis:

By Product

Infrared panel heaters dominate the Australia radiant quartz heater market, holding about 42–45% share. Strong demand comes from modern homes and apartments seeking slim, wall-mounted heating. Infrared panels deliver uniform heat, silent operation, and strong visual appeal. Consumers value fast warm-up and reduced surface glare. Hospitality and office users also prefer discreet designs. Multiple quartz tube heaters follow, driven by higher heat output for larger spaces. Single quartz tube models serve budget buyers. Design preference, space efficiency, and indoor comfort trends support infrared panel leadership.

- For instance, Herschel Infrared’s Select XLS panel heater delivers 1,100 watts, measures 1,550 × 600 mm, and reaches operating temperature in under 7 minutes, making it suitable for apartments and commercial interiors.

By Wattage Segment

The 1000–1500-watt segment leads with nearly 48–50% market share. This range balances heating performance with manageable electricity use. Households favor this wattage for bedrooms, living rooms, and small offices. The segment suits Australia’s mild-to-cool winters and short heating cycles. Below 1000-watt models see demand for personal heating and compact rooms. Above 1500-watt units serve garages and open areas. Energy cost awareness and household safety standards strongly drive preference toward mid-range wattage heaters.

- For instance, Stiebel Eltron Australia’s IW 120 quartz infrared heater operates at 1,200 watts, delivers full radiant heat in under 2 seconds, and is rated for rooms up to 12 square meters, aligning with residential safety standards.

By Distribution Channel

By distribution channel, offline retail remains dominant, accounting for around 60–62% share. Consumers prefer in-store evaluation of heater size, heat output, and safety features. Retail chains and appliance stores offer seasonal promotions and installation guidance. Immediate product availability also supports offline sales. Online channels grow steadily, driven by price comparison and wider product choice. E-commerce appeals to urban buyers and repeats customers. However, safety concerns and the need for physical inspection keep offline channels firmly in the lead.

Key Growth Drivers

Rising Demand for Energy-Efficient Heating Solutions

Energy efficiency remains a major growth driver in Australia’s radiant quartz heater market. Households face rising electricity tariffs and stronger cost awareness. Quartz heaters deliver instant heat with minimal warm-up time. This efficiency reduces overall operating hours. Consumers prefer zone heating instead of whole-room systems. Radiant quartz models suit this need well. Compact units heat people and objects directly. These limits wasted energy in unused spaces. Government focus on energy conservation reinforces demand. Retailers promote quartz heaters as cost-effective seasonal solutions. Rental households also favor plug-and-play heaters. These units avoid installation costs. Energy labeling and efficiency messaging influence purchase decisions. This driver supports steady replacement demand and repeats purchases.

- For instance, Stiebel Eltron Australia’s IW 120 quartz infrared heater operates at 1,200 watts, reaches full radiant output in under 2 seconds, and is specified for rooms up to 12 square meters, supporting short-duration heating.

Growth in Urban Living and Compact Housing

Urbanization supports demand for compact heating solutions. Apartments and smaller homes dominate Australian cities. Space constraints favor slim and portable heaters. Radiant quartz heaters fit modern interiors well. Wall-mounted and tower designs save floor space. Consumers seek heating that blends with décor. Quartz heaters meet both functional and design needs. Quick heating suits short winter usage patterns. Urban professionals prefer flexible and movable appliances. Rental mobility increases demand for lightweight heaters. Property developers also specify compact heaters in projects. This trend strengthens volume sales in metropolitan regions. Urban living patterns continue to expand the addressable market.

- For instance, Herschel Infrared’s Select XLS panel heater delivers 1,100 watts, measures 1,550 × 600 mm (or 60 x 155 cm), and mounts flush to the wall, freeing floor space in small apartments.

Increased Focus on Safety and Compliance Standards

Safety awareness drives product upgrades and replacement cycles. Australian consumers prioritize electrical and fire safety. Radiant quartz heaters now include tip-over protection. Overheat shut-off features are standard in premium models. Improved grill designs reduce burn risks. Families with children and elderly users value these features. Retailers highlight safety certifications at point of sale. Compliance with Australian electrical standards builds trust. Insurance and rental property requirements also influence purchases. Manufacturers invest in safer materials and controls. Safety innovation supports premium pricing. This driver encourages consumers to replace older heaters. Regulatory emphasis sustains long-term demand growth.

Key Trends & Opportunities

Expansion of Smart and Feature-Enhanced Heaters

Smart features create strong market opportunities. Consumers seek better control over energy use. Timers and remote controls improve convenience. Smart plugs enable basic automation without high cost. Some models integrate app-based scheduling. These features support energy savings. Tech-aware households value connected functionality. Feature upgrades help brands differentiate products. Premium segments benefit most from this trend. Retailers upsell smart-enabled models during winter peaks. As smart homes expand, heater integration grows. This trend supports higher margins. Feature innovation extends product life cycles. Smart functionality increases perceived value.

- For instance, Mill Australia’s WiFi-enabled panel heater operates at 1,500 watts, supports 2.4 GHz Wi-Fi, and allows temperature settings from 5 °C to 35 °C with weekly scheduling through a mobile app.

Demand for Aesthetic and Design-Focused Products

Design plays a growing role in purchase decisions. Consumers prefer heaters that match interior styles. Neutral colors and minimal designs gain popularity. Slim infrared and quartz panels suit modern homes. Hospitality and office spaces demand discreet heating. Temporary venues use stylish portable heaters. Design appeal supports premium positioning. Visual comfort matters alongside heat performance. Manufacturers invest in form and finish. Retail displays emphasize aesthetics. This trend opens opportunities in premium retail channels. Design differentiation attracts higher-income buyers. Visual appeal increasingly influences brand choice.

- For instance, the Herschel Inspire infrared panel heater is available in various wattages up to 1,250 watts, has a panel thickness of 25 mm, and mounts almost flush on walls or ceilings, supporting discreet residential and hospitality use.

Key Challenges

Seasonality and Demand Volatility

Seasonal demand creates planning challenges for manufacturers. Sales peak during short winter periods. Warm winters reduce heater purchases sharply. Retailers manage high inventory risk. Overstocking impacts margins after winter ends. Demand forecasting remains difficult. Weather variability adds uncertainty. Manufacturers rely on promotions to clear stock. This pressure affects pricing stability. Smaller brands face higher financial risk. Seasonality limits year-round production efficiency. Supply chains must stay flexible. This challenge constrains capacity expansion. Managing seasonal swings remains critical.

Competition from Alternative Heating Technologies

Radiant quartz heaters face competition from other technologies. Reverse-cycle air conditioners dominate whole-room heating. Oil-filled radiators offer longer heat retention. Panel heaters compete in similar price ranges. Consumers compare energy costs across options. Government incentives favor heat pumps in some regions. This shifts long-term preferences. Quartz heaters must justify value through speed and portability. Price sensitivity increases competition intensity. Brands face margin pressure. Differentiation becomes harder in crowded shelves. This challenge requires continuous innovation and clear positioning.

Regional Analysis

New South Wales

New South Wales leads the Australia radiant quartz heater market, accounting for about 32–34% share. High urban density drives strong demand for compact and portable heaters. Apartments and rental homes favor plug-and-play heating solutions. Consumers seek fast heating during short winter periods. Rising electricity costs increase interest in efficient zone heating. Retail chains and online platforms show high seasonal sales volumes. Safety-certified models perform well in family households. Hospitality and commercial offices also support demand. Strong retail presence and higher disposable income sustain NSW’s leading position.

Victoria

Victoria holds roughly 27–29% market share, supported by colder winters and longer heating seasons. Households rely more on supplementary electric heating. Radiant quartz heaters serve bedrooms and living areas efficiently. Consumers value quick heat delivery during temperature drops. The market sees strong replacement demand for older heaters. Urban apartments and suburban homes both contribute. Retail promotions peak during extended winter months. Safety and mid-range wattage models sell well. Higher heating intensity makes Victoria a core revenue region for manufacturers.

Queensland

Queensland represents about 16–18% share of the market. Mild winters limit overall heating demand. However, regional and inland areas still require seasonal heating. Consumers prefer low-to-mid wattage quartz heaters. Portable models dominate due to flexible usage. Cost-conscious buyers favor affordable options. Retail sales concentrate in short winter windows. Online channels grow faster in this region. Compact design and low power consumption drive purchases. Queensland’s market growth remains steady but weather dependent.

Western Australia

Western Australia accounts for nearly 11–13% market share. Cooler southern regions drive most demand. Detached homes increase use of portable room heaters. Radiant quartz heaters support supplementary heating needs. Consumers value durability and safety features. Retail distribution remains dominant across the state. Seasonal buying patterns mirror eastern regions. Mining towns and regional areas support steady volumes. Energy cost awareness shapes wattage selection. The market shows stable demand with moderate growth potential.

South Australia and Others

South Australia and other territories contribute around 9–11% share. Colder nights increase heater usage despite smaller populations. Households rely on portable electric heaters for bedrooms. Quartz heaters appeal due to fast heat output. Price sensitivity remains high in this region. Offline retail channels dominate sales. Replacement demand supports steady volumes. Rural areas favor simple and durable models. Limited population restricts scale. However, consistent winter demand sustains market presence across these regions.

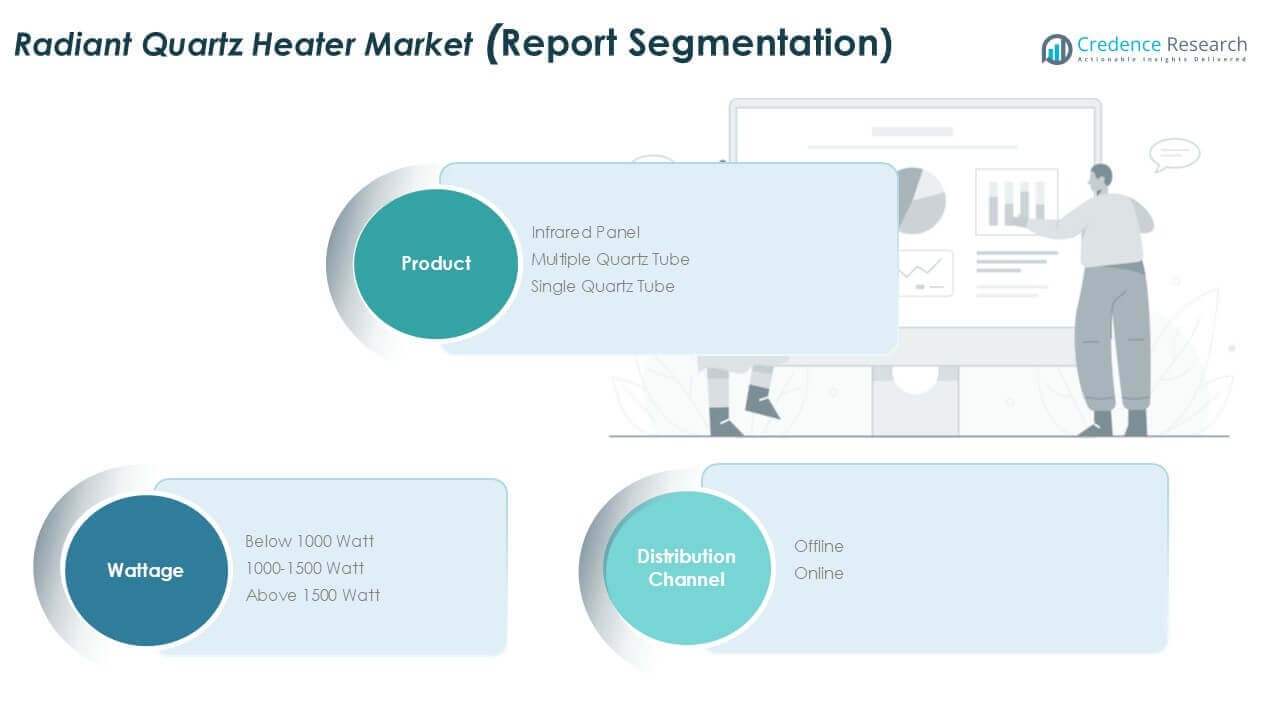

Market Segmentations:

By Product

- Infrared Panel

- Multiple Quartz Tube

- Single Quartz Tube

By Wattage Segment

- Below 1000 Watt

- 1000–1500 Watt

- Above 1500 Watt

By Distribution Channel

By Geography

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia and Others

Competitive Landscape

The Australia radiant quartz heater market shows moderate competition, with a mix of domestic manufacturers and global heating brands. Companies compete on product efficiency, safety features, and price positioning. Established players leverage strong retail networks and brand recognition to secure shelf space. Product differentiation focuses on wattage options, design aesthetics, and compliance with Australian safety standards. Many brands emphasize compact and portable models to target urban households. Seasonal promotions and private-label offerings increase price competition. Online channels intensify rivalry through rapid price comparison. Innovation remains incremental, centered on improved safety controls and energy management features. Strategic focus on mid-range products helps firms balance volume and margins.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Heat Australia Pty Ltd

- Convectronics

- Tempco Electric Heater Corporation

- Döbeln Elektrowärme GmbH

- Lasko Products, LLC

- TPI Corporation

- Watlow

- Duraflame, Inc.

- SPACE-RAY

- Sawhney Industries

Recent Developments

- In June 2023, The European Union revised its overarching Energy Efficiency Directive, and new, stricter Ecodesign standards for local space heaters, including radiant heaters, were adopted in April 2024 and will apply from July 1, 2025.

- In January 2023, Honeywell announced a new line of smart radiant quartz heaters with integrated Wi-Fi capabilities.

Report Coverage

The research report offers an in-depth analysis based on Product, Wattage Segment, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Urban housing growth will sustain demand for compact and portable radiant quartz heaters.

- Energy cost awareness will continue to favor zone heating over whole-room systems.

- Infrared panel heaters will gain share due to slim design and visual appeal.

- Mid-range wattage models will remain the preferred choice for households.

- Safety-certified products will drive replacement of older heater units.

- Offline retail will stay dominant, supported by seasonal in-store promotions.

- Online channels will expand through price transparency and wider product access.

- Product differentiation will focus on design, safety, and ease of use.

- Climate variability will influence year-to-year demand patterns.

- Moderate competition will encourage incremental innovation and stable pricing.