Market Overview

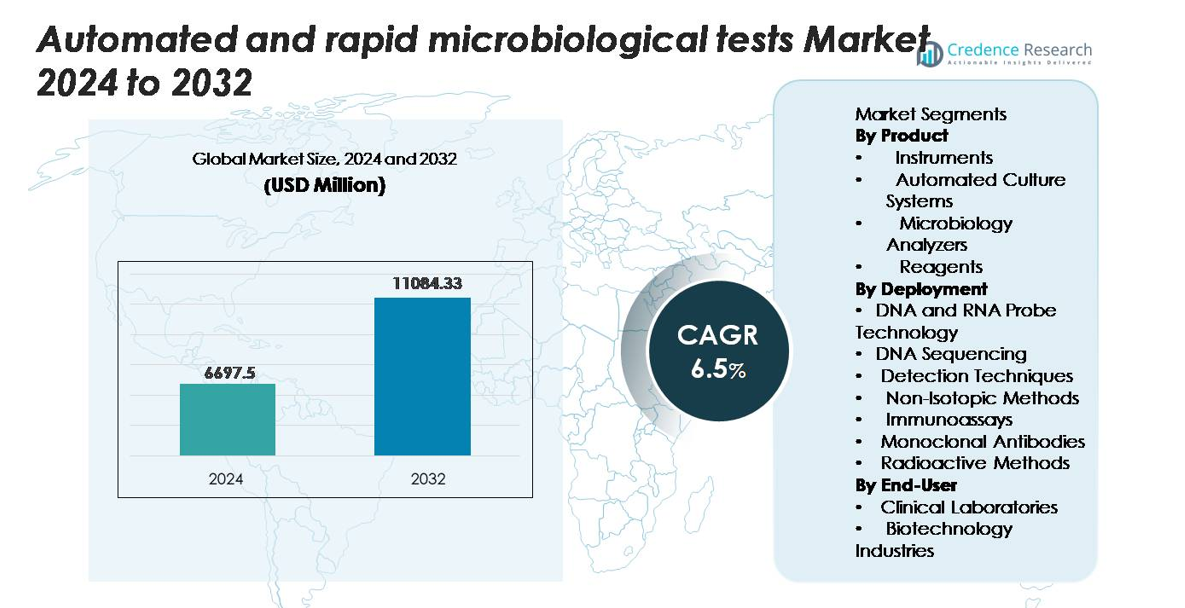

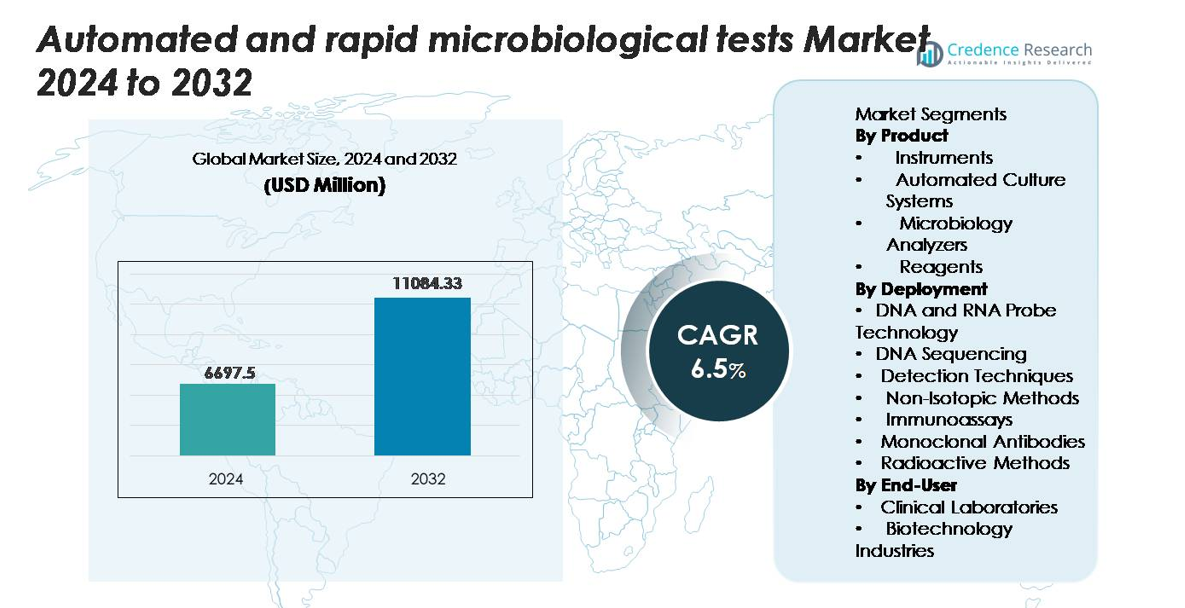

The automated and rapid microbiological tests market was valued at USD 6,697.5 million in 2024 and is projected to reach USD 11,084.33 million by 2032, expanding at a CAGR of 6.5% during the forecast period.”

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automated and rapid microbiological tests market Size 2024 |

USD 6,697.5 million |

| Automated and rapid microbiological tests market, CAGR |

6.5% |

| Automated and rapid microbiological tests market Size 2032 |

USD 11,084.33 million |

The automated and rapid microbiological tests market is shaped by strong competition among leading players such as Thermo Fisher Scientific, bioMérieux, Beckman Coulter, Merck KGaA, Becton Dickinson, Rapid Micro Biosystems, Microbiology International, Clever Culture Systems, Zhuhai Meihua Medical Technology, and Cardinal Health. These companies drive innovation through advanced molecular platforms, automated culture technologies, and digital microbiology solutions aimed at improving speed, accuracy, and workflow efficiency. North America leads the global market with a 37% share, supported by advanced diagnostic infrastructure and high adoption of automation-driven microbiology systems. Europe and Asia-Pacific follow as major contributors, benefiting from strong healthcare modernization and increasing demand for rapid microbial detection.

Market Insights

- The market for automated and rapid microbiological tests reached USD 6,697.5 million in 2024 and is projected to hit USD 11,084.33 million by 2032, expanding at a CAGR of 6.5%.

- Growing demand for fast, accurate pathogen detection, rising infectious disease burden, and expanding biopharmaceutical manufacturing continue to drive adoption of automated analyzers and molecular diagnostic platforms.

- Key trends include increasing digital microbiology integration, AI-driven image analysis, decentralized rapid testing, and wider industrial adoption across food, water, and pharmaceutical applications.

- Competition intensifies as major players such as Thermo Fisher Scientific, bioMérieux, Beckman Coulter, Merck KGaA, and Becton Dickinson advance high-throughput automation despite restraints such as high capital costs and workforce skill gaps.

- Regionally, North America leads with 37%, followed by Europe at 29% and Asia-Pacific at 25%, while segment-wise, microbiology analyzers hold the largest share due to high throughput and standardized automated workflows.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product:

In the product segment, microbiology analyzers hold the dominant market position, accounting for the largest share of the automated and rapid microbiological tests market due to their high throughput, integrated workflows, and ability to deliver rapid, standardized results. Their adoption is driven by rising demand for automated identification and susceptibility testing in high-volume clinical settings. Automated culture systems continue to expand as laboratories shift from manual plate handling to walk-away incubation and imaging platforms. Instruments and reagents also show steady growth as end users invest in modular systems and consumable-based testing models to support continuous, high-efficiency microbiology operations.

- For instance, one major vendor’s automated microbiology analyzer processes panels using industry standard well formats, such as 96-well microtiter plates or proprietary 64-well AST cards, for antimicrobial dilutions.

By Deployment:

Across deployment technologies, DNA and RNA probe technology dominates the market, capturing the highest share owing to its proven accuracy, rapid hybridization-based detection, and suitability for pathogen identification and genetic marker analysis. DNA sequencing is gaining strong traction as next-generation sequencing becomes more affordable for surveillance applications. Detection techniques, including fluorescence and chemiluminescence, support high-sensitivity workflows in clinical and industrial microbiology. Non-isotopic methods and immunoassays remain widely adopted for routine diagnostics, while monoclonal antibody-based assays and radioactive methods serve specialized niches where precision and specificity are essential.

- For instance, Abbott’s ID NOW™ molecular platform uses isothermal nucleic acid amplification and delivers RNA/DNA probe-based results in as little as 5 minutes for certain respiratory pathogens, supported by an integrated fluorescence detection module calibrated for signals above 520 nm.

By End-User:

Within end-user categories, clinical laboratories represent the largest market share, fueled by increasing test volumes, antimicrobial resistance surveillance needs, and a strong push toward automated platforms that reduce turnaround times. Hospitals and diagnostic networks continue upgrading their microbiology units to high-throughput, walk-away systems to meet rising patient demand. Biotechnology industries show steady growth as they require stringent contamination monitoring, sterility assurance, and environmental testing to support bioprocessing and product development. These end users increasingly prefer integrated automated systems that offer reproducibility, regulatory compliance, and reduced manual intervention.

Key Growth Drivers

Rising Global Burden of Infectious Diseases and Antimicrobial Resistance

The increasing prevalence of infectious diseases and escalating antimicrobial resistance (AMR) significantly accelerate the adoption of automated and rapid microbiological testing. Healthcare systems face mounting pressure to diagnose infections faster and initiate targeted therapies, especially in scenarios where delayed results lead to higher morbidity and operational burden. Automated platforms provide accelerated pathogen detection, streamlined sample handling, and standardized workflows that reduce human error while supporting mass testing requirements. Rapid microbiological assays also enable faster identification of resistance genes, helping clinicians optimize antimicrobial stewardship programs. With public health authorities prioritizing early detection and surveillance, hospitals and reference laboratories increasingly invest in high-throughput automated analyzers, molecular diagnostic panels, and advanced culture systems. This heightened need for speed, accuracy, and reliability creates sustained demand for fully automated solutions capable of processing large sample loads while ensuring consistent diagnostic performance.

- For instance, Cepheid’s GeneXpert® Xpress platform delivers fully automated real-time PCR results in as little as 30 minutes and integrates sample preparation, amplification, and detection within a sealed cartridge containing over 50 microfluidic chambers.

Advances in Molecular Diagnostics and High-Throughput Automation

Technological advancements in molecular diagnostics serve as a major growth catalyst for automated and rapid microbiological testing. Innovations in probe-based hybridization, real-time amplification, multiplex PCR, and sequencing-based workflows enable laboratories to detect pathogens with high precision and reduced turnaround times. Automated sample preparation systems, robotics-driven assay processing, and integrated digital reporting enhance throughput and operational efficiency. These technologies replace labor-intensive manual workflows with fully automated platforms capable of performing complex diagnostic steps in a fraction of the time. The industry also benefits from software-driven decision support, AI-enhanced image analysis, and smart connectivity features that facilitate remote monitoring and quality control. With life sciences manufacturers prioritizing system miniaturization, modular design, and cartridge-based testing formats, molecular diagnostics continue to expand into point-of-care and decentralized laboratory environments, supporting broader clinical and industrial adoption.

- For instance, Roche’s cobas® 6800 system performs fully automated nucleic acid extraction and real-time PCR amplification with a capacity of up to 384 tests in an 8-hour shift, using onboard reagent storage that supports up to 8 hours of continuous operation without user intervention.

Expanding Applications in Biopharmaceutical Manufacturing and Sterility Assurance

The rapid growth of biopharmaceutical manufacturing, cell-based therapies, and advanced biologics drives strong demand for automated microbiological testing solutions. Modern bioprocessing environments require stringent microbial monitoring, environmental surveillance, in-process bioburden testing, and rapid sterility validation to ensure product safety and regulatory compliance. Automated culture systems, real-time detection technologies, and molecular contamination assays significantly reduce testing time compared to traditional compendial methods, enabling faster batch release and minimizing production delays. These solutions also support continuous processing and closed-system manufacturing models where manual testing is inefficient and risk prone. With regulatory agencies emphasizing faster and more robust quality control practices, biomanufacturers increasingly adopt high-sensitivity rapid tests that detect microbial contaminants in hours instead of days. This evolving need for accelerated decision-making and contamination control sustains long-term demand for advanced automated microbiology platforms.

Key Trends & Opportunities

Growth of Decentralized and Point-of-Care Microbiology Testing

A major emerging trend is the shift toward decentralized, near-patient microbiological testing enabled by miniaturized and cartridge-based rapid systems. Clinics, emergency departments, ambulatory centers, and remote healthcare sites increasingly use compact molecular platforms to diagnose infections at the point of care. These systems reduce dependency on centralized laboratories and enable faster therapeutic intervention. Manufacturers are developing portable analyzers with integrated sample-to-answer capabilities, allowing non-specialized personnel to perform high-accuracy testing. This trend opens opportunities for companies offering simplified interfaces, telemedicine-compatible reporting tools, and ruggedized devices for field epidemiology. With global health programs emphasizing rapid outbreak response and community-level diagnostics, decentralized testing represents a high-growth segment within the market.

- For instance, Abbott’s ID NOW™ molecular analyzer weighs 2.99 kilograms and delivers isothermal nucleic acid amplification results for several respiratory pathogens in as little as 5 minutes, using single-use cartridges containing over 25 integrated microfluidic elements.

Increasing Integration of AI, Robotics, and Digital Microbiology

Automation in microbiology increasingly incorporates AI-driven image analysis, machine learning–based interpretation, and robotic handling systems. Digital microbiology platforms automate plate imaging, colony counting, pathogen identification, and susceptibility pattern interpretation with high precision. AI algorithms enhance accuracy by standardizing result interpretation and reducing manual variability, particularly in high-volume laboratories. Robotic systems support plate streaking, incubation, and sample transfers, significantly improving workflow efficiency. Cloud-based data management, LIMS integration, and remote quality monitoring further expand digitalization opportunities. As laboratories upgrade to fully automated ecosystems, vendors offering intelligent, interoperable platforms gain competitive advantage, making digital microbiology one of the most promising growth avenues in the coming years.

- For instance, bioMérieux’s DIAMETER™ AI platform is an algorithmic interpretation tool used in antimicrobial susceptibility testing (AST) that processes digital AST plates rapidly by utilizing a large database of phenotypes.

Increasing Adoption of Rapid Methods in Industrial and Environmental Testing

Beyond healthcare and biotechnology, industries such as food processing, pharmaceuticals, water testing, and consumer goods increasingly adopt rapid microbiological methods for contamination control. Companies need faster detection of pathogens, spoilage organisms, and environmental contaminants to comply with stringent quality and safety regulations. Rapid ATP testing, molecular detection, and automated culture technologies allow manufacturers to shorten release cycles and minimize product recalls. Environmental monitoring programs also benefit from high-throughput rapid assays that support real-time facility hygiene management. As regulatory bodies encourage validated rapid microbial methods, industrial adoption is expected to outpace several traditional testing categories, creating strong commercial opportunities for system providers.

Key Challenges

High Capital Costs and Budget Constraints in Small and Mid-Sized Laboratories

Despite strong technological benefits, high upfront investment remains a major challenge for the widespread adoption of automated microbiology systems. Instruments such as automated culture platforms, molecular analyzers, and sequencing systems involve substantial acquisition, installation, and maintenance costs. Smaller laboratories, resource-limited healthcare facilities, and developing regions often struggle to justify these investments, especially when testing volumes are inconsistent. Budget constraints also limit adoption of high-priced proprietary consumables and software licenses. These financial barriers slow market penetration and create cost-related disparities between large reference laboratories and smaller diagnostic centers. Vendors must address affordability challenges through flexible pricing models and scalable system configurations to sustain broader adoption.

Skilled Workforce Shortages and Complexity of System Integration

A significant challenge for the market is the shortage of trained microbiology professionals capable of operating advanced automated platforms. Many laboratories lack personnel with the expertise to manage molecular workflows, robotic systems, and digital microbiology software. System integration with existing LIMS, data security protocols, and quality control requirements further adds complexity. Transitioning from manual to automated workflows often requires extensive training, process restructuring, and validation efforts that slow implementation timelines. Additionally, interoperability issues between different vendor platforms complicate standardization. Without adequate workforce development and user-friendly system design, laboratories may experience operational inefficiencies that hinder successful adoption of automated technologies.

Regional Analysis

North America

North America holds the largest market share at approximately 37%, supported by advanced clinical laboratory infrastructure, strong adoption of automated culture systems, and high utilization of molecular diagnostics. Large hospital networks and reference labs rely on high-throughput analyzers to manage rising infectious disease testing demands. Extensive antimicrobial resistance surveillance and strict regulatory requirements continue driving investment in rapid and automated microbiology platforms. The presence of leading diagnostic and biopharmaceutical companies further strengthens regional market leadership. Continuous upgrades in digital microbiology and sterility testing technologies position North America as the most dominant region in this sector.

Europe

Europe accounts for around 29% of the global market, driven by robust healthcare systems, strong infection-control policies, and early adoption of automated diagnostic technologies. Western European nations lead in digital microbiology integration, while Central and Eastern Europe are rapidly modernizing laboratory workflows. The region’s pharmaceutical and food processing industries require stringent microbial quality control, boosting demand for rapid detection methods. Comprehensive antimicrobial resistance programs and regulatory emphasis on validated rapid tests further reinforce adoption. Europe’s steady investments in laboratory automation and precision diagnostics ensure its position as a major contributor to global market expansion.

Asia-Pacific

Asia-Pacific holds approximately 25% market share and represents the fastest-growing region, supported by expanding healthcare infrastructure, increasing infectious disease prevalence, and rapid investments in laboratory modernization. China, India, Japan, and South Korea are accelerating adoption of automated and molecular microbiology platforms across clinical and industrial sectors. Growing biopharmaceutical manufacturing and stricter regulatory oversight for contamination control fuel strong demand for rapid microbial testing. Government initiatives promoting early diagnosis and technology-driven healthcare further expand market penetration. With rising automation across diagnostics and industry, Asia-Pacific is becoming a key growth engine in the global market.

Latin America

Latin America captures about 5% of the global market, with growth driven by improving laboratory capabilities and rising demand for faster diagnostic solutions. Brazil, Mexico, and Argentina lead adoption due to investments in hospital infrastructure, infectious disease management, and pharmaceutical quality control. Rapid microbiological testing is increasingly used in food safety and environmental monitoring, although budget limitations hinder broader regional adoption. International collaborations and government-led modernization programs are helping accelerate implementation of automated diagnostic systems. As the region continues enhancing diagnostic capacity, it shows steady potential for expanded use of automated microbiological technologies.

Middle East & Africa

The Middle East & Africa region holds approximately 4% market share, showing steady growth as healthcare investments and diagnostic modernization efforts increase. Gulf countries such as the UAE, Saudi Arabia, and Qatar are early adopters of automated culture systems and rapid molecular assays for clinical and industrial applications. Many African nations face infrastructure and funding challenges, limiting widespread adoption, although global health initiatives are improving access to rapid testing technologies. Growing pharmaceutical manufacturing, tighter hygiene regulations, and rising awareness of contamination control support continued market expansion across the region.

Market Segmentations:

By Product

- Instruments

- Automated Culture Systems

- Microbiology Analyzers

- Reagents

By Deployment

- DNA and RNA Probe Technology

- DNA Sequencing

- Detection Techniques

- Non-Isotopic Methods

- Immunoassays

- Monoclonal Antibodies

- Radioactive Methods

By End-User

- Clinical Laboratories

- Biotechnology Industries

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the automated and rapid microbiological tests market is characterized by a mix of global diagnostic leaders, specialized microbiology technology providers, and biopharmaceutical-focused solution developers. Industry leaders continue to expand portfolios through molecular diagnostics, automated culture platforms, rapid contamination detection systems, and integrated digital microbiology solutions. Companies compete by enhancing throughput, reducing turnaround time, and improving assay accuracy through advanced robotics, AI-driven imaging, and multiplex detection technologies. Strategic initiatives—including mergers, acquisitions, and R&D collaborations—strengthen product pipelines and geographic reach. Vendors also prioritize instrument–consumable ecosystems to establish recurring revenue models. As automation and rapid testing gain prominence across clinical, biopharmaceutical, food safety, and environmental applications, competitors increasingly focus on system interoperability, workflow standardization, and regulatory compliance to differentiate their offerings and maintain leadership in a technology-intensive, innovation-driven market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Beckman Coulter launched a fully-automated high-throughput BD-Tau RUO immunoassay test on its DxI 9000/Access 2 platforms.

- In December 2022, the company Zhuhai Meihua Medical Technology Ltd. completed a Series B financing round of over CNY 100 million (approximately $14.3 million USD) to expand its microbiology-diagnostic instrument and reagent manufacturing capabilities

Report Coverage

The research report offers an in-depth analysis based on Product, Deployment, End-Userand Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Automated microbiology systems will become standard in high-volume laboratories as facilities prioritize faster turnaround times and workflow efficiency.

- Molecular-based rapid tests will see broader adoption as sequencing, probe technologies, and multiplex detection become more accessible.

- AI-driven image analysis and digital microbiology platforms will increasingly support automated interpretation and reduce manual variability.

- Point-of-care and decentralized rapid testing solutions will expand, enabling faster infection diagnosis in community and remote settings.

- Biopharmaceutical manufacturing will rely more heavily on rapid sterility and contamination detection to support accelerated product release.

- Integrated instrument–consumable ecosystems will strengthen recurring revenue models and drive long-term vendor–laboratory partnerships.

- Automation will continue to reduce the skill dependency in microbiology workflows, helping laboratories overcome workforce shortages.

- Rapid testing in food processing, water testing, and environmental monitoring will expand as industries pursue real-time quality assurance.

- Regulatory bodies will increasingly encourage validated rapid microbiological methods, accelerating market penetration across applications.

- Digital connectivity, remote monitoring, and LIMS integration will become essential elements of next-generation automated microbiology platforms.