Market Overview:

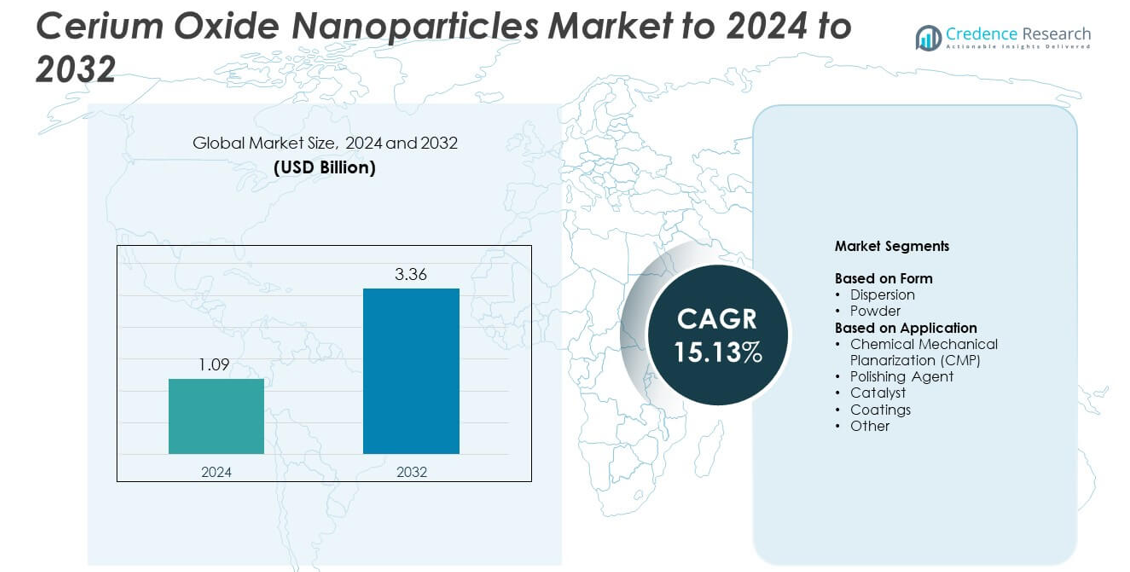

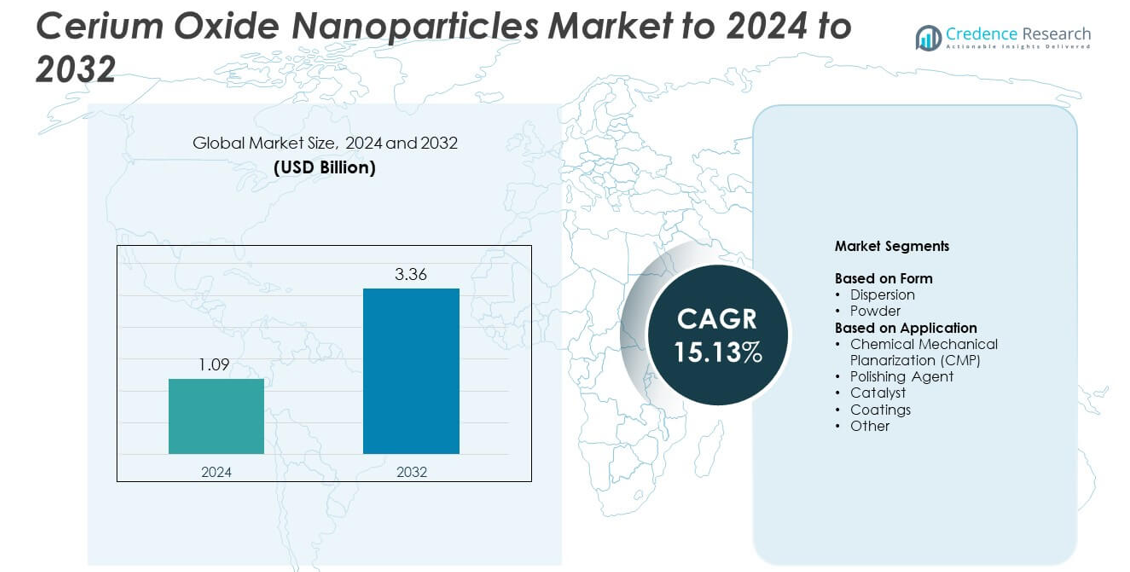

Cerium Oxide Nanoparticles Market size was valued at USD 1.09 billion in 2024 and is anticipated to reach USD 3.36 billion by 2032, at a CAGR of 15.13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cerium Oxide Nanoparticles Market Size 2024 |

USD 1.09 billion |

| Cerium Oxide Nanoparticles Market, CAGR |

15.13% |

| Cerium Oxide Nanoparticles Market Size 2032 |

USD 3.36 billion |

Nanoshel, Platonic Nanotec, Skyspring Nanomaterials, Nanoe, Stem Chemicals, Inframat, Plasmachem, Nanografi Nano Technology, Meliorum Technologies, Nanophase Technologies, American Elements, and Cerion Nanoparticles are key participants in the cerium oxide nanoparticles market. North America holds the leading regional share at approximately 34.6% of the global market. Asia‑Pacific follows closely with roughly 30% share, thanks to rapid electronics and semiconductor growth. Europe occupies about 25% share, driven by stringent emission regulations and advanced industrial applications.

Market Insights

- The global cerium oxide nanoparticles market was valued at USD 1.09 billion in 2024 and is expected to reach USD 3.36 billion by 2032, growing at a CAGR of 15.13% during the forecast period.

- Key drivers include increasing demand from semiconductor, automotive, and healthcare sectors, along with stricter emission regulations and the growing need for high-performance polishing and catalyst applications.

- Market trends show a growing focus on R&D for high-purity nanoceria, tailored nanoparticle sizes, and expanding applications in energy storage and environmental systems.

- Competitive analysis reveals significant investments in scaling up production capabilities and expanding application portfolios, with firms vying for market share in coatings, optics, and biomedicine.

- North America leads the market with approximately 34.6% share, followed by Asia-Pacific at 30% and Europe at 25%, driven by rapid industrial growth and regulatory frameworks across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Form

Dispersion leads this segment with more than 65 % share in 2023. Its dominance comes from strong use in coatings, biomedical fluids and electronic materials where uniform particle distribution is essential. Growth continues as manufacturers adopt dispersion formats for better stability, easy blending and high performance in functional films and surface-engineering tasks. Powder remains important for large-volume industries such as polishing, glass processing and catalysis. Demand for the powder form grows because it is easy to transport, store and use in high-temperature or bulk-processing environments.

- For instance, American Elements’ catalog includes more than 35,000 products, making it a very large, globally recognized manufacturer and supplier of advanced materials, chemicals, and metals.

By Application

Chemical Mechanical Planarization holds the leading position with over 38 % share due to its critical role in semiconductor wafer finishing. Growth rises as chip production expands and device geometries shrink, increasing demand for high-precision nanoceria slurries. Polishing agents also form a major share as nanoceria offers smooth finishing for glass, ceramics and optical parts. Catalyst and coating uses continue to increase with tighter emission norms, stronger surface-protection needs and the rising adoption of high-performance engineered materials.

- For instance, CMC Materials, now part of Entegris, expanded its manufacturing and R&D facilities in Singapore to better serve Asian foundries’ demand for planarization consumables as early as fiscal year 2011, with the expansion involving an additional 30,000 square feet of manufacturing space and a total capital investment of approximately $30 million at that time.

Key Growth Drivers

Rising Demand in Semiconductor Manufacturing

Growth accelerates as cerium oxide nanoparticles play a vital role in Chemical Mechanical Planarization. The semiconductor sector needs high-precision polishing materials for wafers, which increases adoption of nanoceria-based CMP slurries. Expansion of fabrication plants and growth in advanced chip architectures strengthen demand. Rising investment in miniaturized electronics further boosts consumption. This driver remains the most influential because semiconductor output strongly determines long-term volume requirements in this market.

- For instance, Taiwan Semiconductor Manufacturing Company (TSMC) processed 12.0 million 12-inch equivalent wafers in 2023 (a decrease from 15.3 million in 2022), with each wafer requiring multiple planarization steps and high-volume planarization consumables.

Expansion of High-Performance Polishing Applications

Growth increases as industries rely on cerium oxide nanoparticles for precision polishing of glass, ceramics and optical components. Their ability to deliver scratch-free surfaces supports demand from automotive glazing, display panels and optical devices. The shift toward premium finishing standards in consumer electronics drives higher usage. Rapid adoption of advanced optics, electric vehicle displays and high-clarity lenses reinforces this driver across several industrial sectors.

- For instance, Corning’s Specialty Materials segment (which produces Gorilla Glass) delivered approximately flat core sales year over year in 2022, totaling $2.002 billion, despite a dynamic market environment characterized by overall industry declines in the second half of the year. The product has been designed into more than 8 billion devices globally and is used by over 45 major global OEMs (Original Equipment Manufacturers).

Rising Use in Catalysts and Emission Control Systems

Growth strengthens as cerium oxide nanoparticles gain deeper integration in automotive, industrial and environmental catalysts. Their oxygen-storage and redox properties improve reaction efficiency and help meet strict emission norms. Demand rises with expanding vehicle production and tightening global air-quality regulations. Industries also adopt nanoceria for green chemical processes and cleaner industrial operations. This driver gains momentum as sustainability-focused initiatives intensify.

Key Trends and Opportunities

Shift Toward Advanced Coating Applications

A major trend emerges as cerium oxide nanoparticles are adopted in coatings requiring UV resistance, thermal stability and abrasion protection. Automotive and aerospace industries seek coatings that extend component life and reduce maintenance needs. Opportunities grow in high-performance architectural coatings and protective films. Adoption expands as manufacturers move toward durable, eco-aligned coating formulations that improve long-term surface performance.

- For instance, AkzoNobel N.V. reported approximately €10.67 billion in total revenue for 2023, and described its overall volume development for the year as having stabilized despite continuing volatility in some markets.

Growth in Biomedical and Environmental Research

An important trend develops as research institutions explore cerium oxide nanoparticles in drug delivery, antioxidant therapies and environmental remediation. Their redox behaviour supports applications in oxidative stress control and pollutant breakdown. Opportunities expand as healthcare technologies evolve and environmental cleanup projects adopt nanomaterials. This trend gains interest from interdisciplinary research programs and next-generation medical materials developers.

- For instance, the National Institutes of Health (NIH) actively funds a wide variety of nanomedicine research projects, including those focused on cancer, infection, and drug delivery, with 100s of nanomedicines currently in various stages of the clinical process.

Increasing Investment in Nanotechnology Innovation

A strong opportunity rises as global R&D centres push new formulations, improved dispersion stability and high-purity nanoceria. Investments support scalable synthesis methods and more efficient particle engineering. Emerging applications in energy storage, hydrogen production and electronic films open new revenue channels. Market players benefit from a growing shift toward multifunctional nanomaterials with broad industrial usage.

Key Challenges

Stringent Manufacturing and Quality-Control Requirements

A major challenge arises from the need for consistent particle size, purity and dispersion quality. Variations in synthesis processes can affect product performance, limiting adoption in high-precision sectors like semiconductors and optics. Manufacturers face high technical barriers and tight specification demands from end users. Meeting these standards increases production cost and requires advanced process controls.

Environmental and Health Safety Concerns

Another challenge emerges due to uncertainties surrounding long-term environmental impact and workforce exposure. Handling and disposal regulations continue to evolve, pushing companies to adopt safer production and transport practices. Compliance adds operational burdens for producers. Concerns over nanoparticle toxicity in biological and ecological systems create cautious adoption in some sectors and slow regulatory approvals.

Regional Analysis

North America

North America holds a significant share of approximately 34.6% in the global cerium oxide nanoparticles market as of 2024. The region benefits from strong demand across industries such as automotive, semiconductor manufacturing, and healthcare. Key drivers include stringent emission control standards favoring cerium oxide use in catalytic converters and industrial applications. Additionally, high levels of R&D investment in nanotechnology and advanced materials fuel market growth. The U.S. remains a dominant player, with expanding applications in energy storage systems, microelectronics, and nanomedicine, offering a positive long-term outlook for the region.

Europe

Europe represents around 25% of the global cerium oxide nanoparticles market in 2024, driven by a focus on environmental regulations and high-tech industries. Strict emission control policies and the automotive sector’s reliance on cerium oxide for catalytic converters significantly contribute to market share. Expanding applications in semiconductors, optics, and medical fields further boost growth. Germany, France, and the UK are key contributors with their advanced R&D capabilities in nanomaterials. However, regulatory complexities and economic slowdowns may pose challenges to further growth potential in some sectors.

Asia Pacific

Asia Pacific holds the largest share of approximately 30% in the cerium oxide nanoparticles market as of 2024, and is expected to see the fastest growth. The region benefits from rapid industrialization, particularly in China, India, Japan, and South Korea, which are key markets for semiconductor production, electronics manufacturing, and automotive sectors. Government initiatives supporting nanotechnology, sustainable manufacturing, and renewable energy technologies contribute to strong demand. With its vast manufacturing base, Asia Pacific continues to be a crucial market for cerium oxide nanoparticles.

Latin America

Latin America holds a smaller market share of around 5-10% in 2024 but presents emerging growth opportunities. Key countries like Brazil and Mexico are expanding their automotive and electronics sectors, creating demand for cerium oxide nanoparticles, especially in catalytic converters and coatings. Regulatory pressures for cleaner technologies also stimulate demand. While the market potential is increasing, challenges such as limited local manufacturing capabilities and reliance on imports restrain rapid growth. However, regional investments in infrastructure and technology innovation provide a promising outlook for cerium oxide nanoparticles in the medium term.

Middle East & Africa

The Middle East & Africa region holds less than 5% of the global cerium oxide nanoparticles market in 2024. Growth is gradual, driven by a focus on energy-related applications such as energy storage and catalysts in oil refining. GCC countries, particularly Saudi Arabia and the UAE, are increasing investments in advanced materials, spurring demand for cerium oxide. Despite challenges such as economic volatility, limited industrial infrastructure, and lower manufacturing activity compared to other regions, the region presents potential for niche applications, especially in energy and coatings.

Market Segmentations:

By Form

By Application

- Chemical Mechanical Planarization (CMP)

- Polishing Agent

- Catalyst

- Coatings

- Other

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Nanoshel, Platonic Nanotec, Skyspring Nanomaterials, Nanoe, Stem Chemicals, Inframat, Plasmachem, Nanografi Nano Technology, Meliorum Technologies, Nanophase Technologies, American Elements and Cerion Nanoparticles operate in a competitive landscape shaped by product quality, nanoparticle purity and application-specific performance. Companies focus on improving controlled particle size distribution, higher dispersion stability and advanced surface modifications to meet semiconductor, catalyst and polishing requirements. Many producers invest in scaling synthesis methods to strengthen supply reliability for high-volume industrial users. Competition also intensifies as firms expand application portfolios across coatings, optics and environmental systems. Strategic moves include forming partnerships with research institutions, enhancing customer-specific formulations and developing next-generation nanoceria grades that support performance-driven markets. Regional expansion and deeper integration with end-use sectors further influence competitive positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nanoshel

- Platonic Nanotec

- Skyspring Nanomaterials

- Nanoe

- Stem Chemicals

- Inframat

- Plasmachem

- Nanografi Nano Technology

- Meliorum Technologies

- Nanophase Technologies

- American Elements

- Cerion Nanoparticles

Recent Developments

- In 2025, Nanografi Nano Technology (as of July 2025) offers high-purity cerium oxide nanoparticles with sizes ranging from 8 to 28 nm and purity of 99.975%.

- In 2025, Nanophase Technologies rebranded as Solésence, Inc. and continued to leverage its patented technology for surface modification of nanomaterials.

- In 2023, Nanoe, a French company specializing in high-purity ceramic powders, focused on scaling up the production of its Zetamix line to cater to diverse industrial applications.

Report Coverage

The research report offers an in-depth analysis based on Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Market demand will expand as semiconductor wafer dimensions shrink and CMP processes intensify.

- Nanoceria adoption will rise in advanced polishing applications for glass, optics, and ceramic surfaces.

- Environmental regulations will drive increased use of cerium oxide nanoparticles in emission‑control catalysts.

- Coating formulations incorporating nanoceria will grow as industries seek durable, high‑performance surfaces.

- Asia‑Pacific will lead growth due to expanding electronics, automotive and renewable‑energy manufacturing.

- R&D investments will accelerate new nanoceria-based materials for biomedicine and environmental remediation.

- Production costs will decline with improved synthesis and scale‑up, boosting wider commercial use.

- Challenges around safety and regulations will promote standardized handling and certification of nanoparticle products.

- Strategic partnerships and collaborations will become more common between materials producers and end‑use equipment manufacturers.

- Market differentiation will increase as manufacturers focus on tailored nanoparticle sizes, shapes and surface treatments.