Market Overview

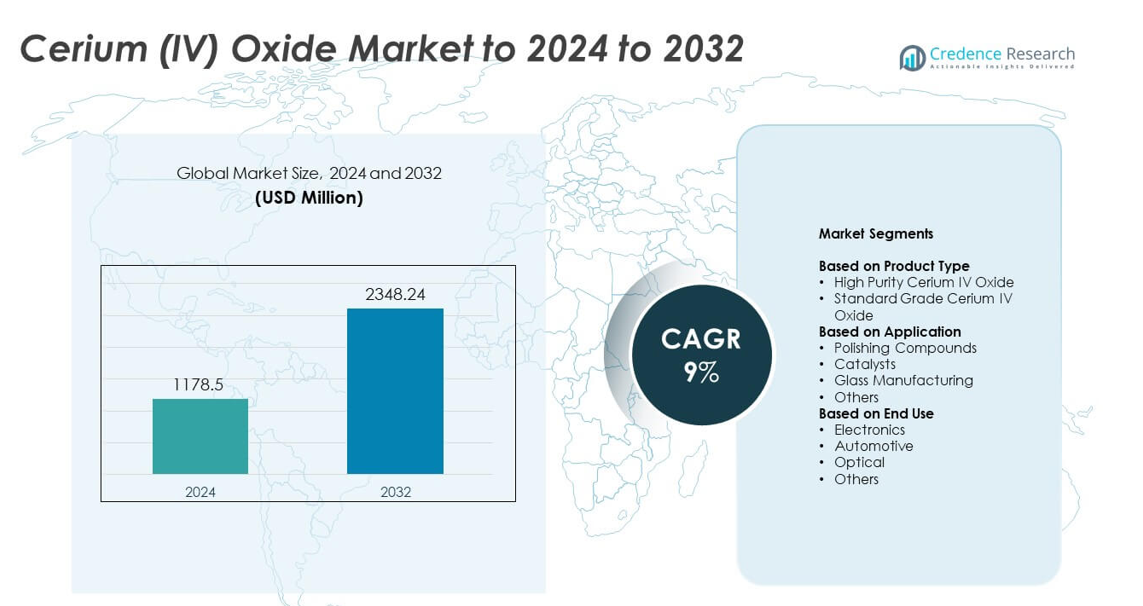

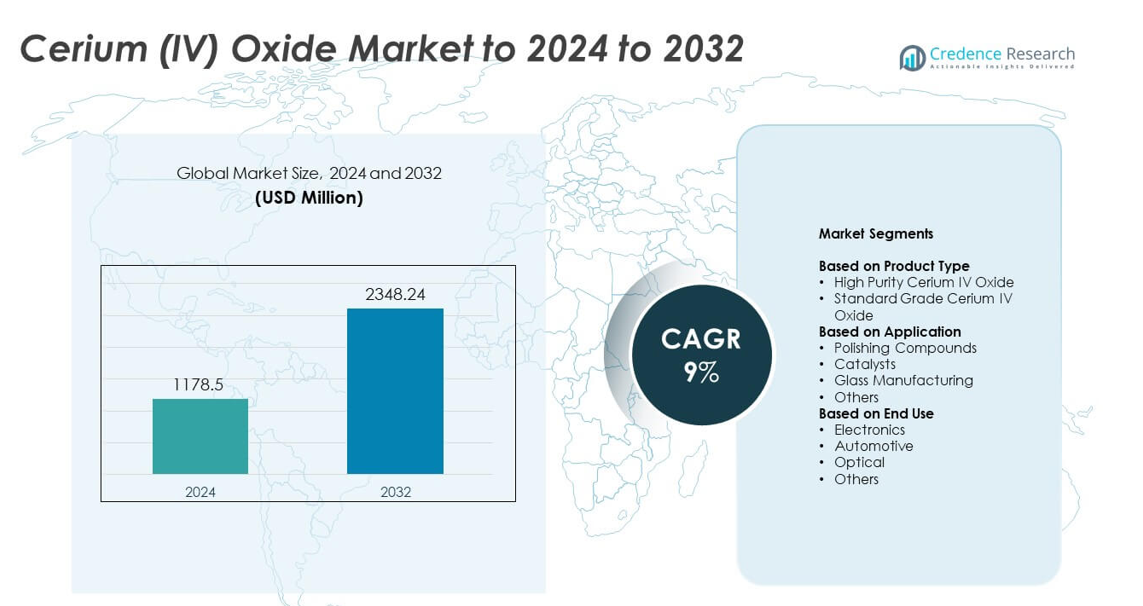

Cerium (IV) Oxide Market size was valued at USD 1,178.5 million in 2024 and is anticipated to reach USD 2,348.24 million by 2032, at a CAGR of 9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cerium (IV) Oxide Market Size 2024 |

USD 1,178.5 million |

| Cerium (IV) Oxide Market, CAGR |

9% |

| Cerium (IV) Oxide Market Size 2032 |

USD 2,348.24 million |

The Cerium (IV) Oxide Market features key players such as Merck KGaA, Neo Performance Materials Inc., Lynas Rare Earths Ltd, Hitachi Chemical Co., Ltd, China Northern Rare Earth Group, Solvay S.A., Showa Denko Materials Co., Ltd, China Minmetals Rare Earth Co., Ltd, Treibacher Industrie AG, and Shin-Etsu Chemical Co., Ltd. These companies compete through high-purity grades, advanced polishing materials, and stronger supply-chain control. Asia Pacific led the global market in 2024 with about 32% share, driven by large semiconductor and electronics clusters. North America followed with nearly 34% share, supported by strong investment in chip fabrication and optical industries, while Europe accounted for around 27% share due to its advanced automotive and precision optics sectors.

Market Insights

- Cerium (IV) Oxide Market size reached USD 1,178.5 million in 2024 and is projected to hit USD 2,348.24 million by 2032 at a CAGR of 9%.

- Strong demand from electronics and semiconductor polishing drives market growth, with high-purity grades holding about 58% share due to wider use in wafer finishing and precision optics.

- Trends show rising adoption of nano-structured cerium oxide and increased use in clean-energy technologies, including fuel cells and emission-control systems across industrial applications.

- Market competition intensifies as leading producers focus on purity improvement, supply-chain stability, and advanced polishing formulations while managing challenges linked to rare-earth sourcing and environmental rules.

- Asia Pacific held about 32% share, North America captured nearly 34%, and Europe accounted for around 27%, with polishing compounds leading applications at roughly 46% share across global demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

High purity cerium IV oxide dominated the product segment in 2024 with a market share of about 58%. Demand stayed strong due to its higher efficiency in precision polishing, catalytic converters, and advanced optical uses. Manufacturers preferred this grade because it offered tighter particle-size control and stronger thermal stability. Standard grade cerium IV oxide held steady adoption in mass polishing, glass formulations, and cost-sensitive industrial tasks. Growth in semiconductor wafer finishing and cleaner automotive exhaust systems continued to support wider use of high purity grades across global markets.

- For instance, US Research Nanomaterials, Inc. offers cerium oxide nanopowder with an average particle size of 10 nanometers and a specific surface area between 35 and 70 square meters per gram for high-precision polishing and electronic applications.

By Application

Polishing compounds led the application segment in 2024 with nearly 46% share. This leadership came from wider use in semiconductor wafers, LCD panels, automotive glass, and precision lens finishing. Cerium IV oxide remained the preferred polishing material due to its chemical-mechanical action, which delivered smoother surfaces with fewer defects. Catalysts saw rising uptake as emission-control rules tightened in major regions. Glass manufacturing and other uses expanded in line with growth in architectural glass, specialty optics, and electronics production.

- For instance, Advanced Abrasives Corporation markets PremaLox C cerium oxide powders in standardized grain sizes of 0.5, 1, 2, and 10 micrometers specifically formulated for glass and optical polishing compounds.

By End Use

Electronics was the dominant end-use segment in 2024, holding around 41% share. Strong demand came from wafer fabrication, display glass finishing, and advanced optical components used in smartphones and high-resolution panels. Cerium IV oxide supported these applications through stable polishing performance and high material purity. The automotive sector showed steady growth as catalytic converter production increased under stricter emission targets. Optical industries also expanded consumption due to rising use of precision lenses, laser components, and coated glass in imaging and scientific devices.

Key Growth Drivers

Rising Demand from Electronics and Semiconductor Processing

Growth accelerated as cerium IV oxide became essential for wafer polishing, display glass finishing, and advanced optical components. The material provided strong chemical-mechanical performance, which improved surface quality in high-precision electronics. Expanding production of smartphones, tablets, and high-resolution displays strengthened its role in global supply chains. Rising investments in semiconductor fabs across Asia and North America also pushed consumption higher. Growing focus on defect-free surfaces in next-generation chips continued to support strong long-term demand.

- For instance, a Ferro Corporation chemical-mechanical polishing slurry disclosed in patent US6491843B1 achieves a silicon dioxide removal rate of 540.1 nanometers per minute while removing silicon nitride at 1.1 nanometers per minute, giving a selectivity of 491 in semiconductor wafer planarization.

Stricter Automotive Emission Regulations Boosting Catalyst Use

Tighter emission norms across Europe, China, and India increased reliance on cerium IV oxide for catalytic converters. Automakers adopted the material due to its oxygen-storage capacity, which enhanced combustion efficiency and reduced harmful exhaust gases. Hybrid and gasoline vehicles maintained strong output, reinforcing steady catalyst demand. As governments pushed toward cleaner mobility, suppliers scaled production of advanced catalytic materials. Rising vehicle fleets in emerging markets further strengthened the need for high-performance catalyst formulations.

- For instance, NGK Europe reports that the NGK Group is a leading global producer of automotive NOx sensor probes, with an annual production capacity of over 25 million (2017 press release) units to support exhaust aftertreatment systems that help vehicles comply with tightening emission standards

Expansion of Precision Optics and Advanced Glass Manufacturing

Demand grew as optical lenses, laser components, and specialty glass products gained wider use in imaging, scientific equipment, and smart devices. Cerium IV oxide remained a preferred polishing and clarifying agent, helping producers achieve high transparency and improved refractive accuracy. Growth in architectural glass coatings and protective glass for electronics also supported higher consumption. Investments in optical fiber and photonics production increased material usage across industrial clusters. The shift toward premium optical and glass components continued to drive global market growth.

Key Trends and Opportunities

Shift Toward High-Purity Grades for Advanced Manufacturing

Manufacturers increased adoption of high-purity cerium IV oxide as semiconductor and optical applications demanded tighter quality control. Higher purity grades delivered improved performance in CMP slurries, precision polishing, and thin-film processes. Demand grew as fabrication plants upgraded to advanced lithography and higher-resolution panels. The trend supported opportunities for suppliers focused on refining, purification, and particle-size optimization. Expanding R&D in nano-structured formulations created additional scope for performance upgrades in modern electronics.

- For instance, Rhodia Operations, now part of Solvay, describes an Actalys HSA20 cerium oxide catalyst that after calcination in air at 400 degrees Celsius for 10 hours reaches a specific surface area of 129.9 square meters per gram, supporting high-performance catalytic processes.

Growth in Clean Energy and Environmental Technologies

Rising investments in hydrogen production, fuel cells, and pollution-control systems opened new opportunities. Cerium IV oxide gained interest for its redox properties, which improved efficiency in catalytic and energy-conversion applications. The material also supported flue-gas cleaning, industrial emission reduction, and air-quality improvement technologies. Its role in emerging energy systems strengthened as governments promoted carbon-reduction goals. Broader adoption of green industrial processes continued to stimulate growth in advanced cerium-based materials.

- For instance, BASF cerium oxide is commonly used by researchers as a catalyst support (such as in Pt/CeO₂ catalyst preparations) to enhance performance in various electrochemical and hydrogen-related energy conversion studies.

Key Challenges

Supply Dependence on Limited Rare-Earth Sources

The market faced challenges due to concentration of rare-earth mining and processing in a few countries. Supply disruptions, export restrictions, and geopolitical tensions created uncertainty for downstream manufacturers. Fluctuating availability increased procurement risks for electronics, optical, and automotive users. Limited diversification in global supply chains added pressure on pricing and long-term security. Efforts to recycle cerium-based materials and expand exploration helped, but dependency remained a major concern for industry stability.

Environmental and Regulatory Constraints in Rare-Earth Mining

Strict environmental rules around rare-earth extraction slowed capacity expansion in several producing regions. Mining activities generated waste and required careful management of radioactive by-products, raising compliance costs. Tougher regulations forced producers to adopt cleaner and more expensive processing technologies. These factors increased operational burdens and limited rapid scaling of production. Heightened scrutiny from regulators and communities continued to challenge the growth of rare-earth mining, indirectly affecting the availability of cerium IV oxide.

Regional Analysis

North America

North America held about 34% share in 2024, supported by strong demand from semiconductor fabrication, advanced optics, and automotive catalytic systems. Growth stayed steady as the United States expanded investments in chip manufacturing and precision glass production. The region benefited from established research facilities and rising adoption of CMP slurries in advanced wafer processes. Automotive catalysts and industrial polishing uses also contributed to stable consumption levels. Ongoing clean-energy projects and emission-control technologies continued to encourage broader use of cerium IV oxide across Canada and the United States.

Europe

Europe accounted for nearly 27% share in 2024, driven by high standards in emission-control technologies and strong production of optical components. Rising demand from Germany, France, and the United Kingdom supported adoption in automotive catalysts, precision lenses, and industrial polishing systems. The region maintained a stable base of glass manufacturers and specialty optics producers, boosting material consumption. Investments in clean-energy research and stricter environmental norms also enhanced the use of cerium-based catalysts. A well-developed automotive sector continued to anchor steady demand across major European economies.

Asia Pacific

Asia Pacific dominated the global market with around 32% share in 2024, led by extensive electronics manufacturing, glass production, and semiconductor expansion in China, Japan, South Korea, and Taiwan. Rapid growth in display panels, smartphones, and chip fabrication drove significant consumption of high-purity cerium IV oxide. Automotive catalyst demand also increased as regional emission norms tightened. Strong investments in optical fiber, precision lenses, and advanced materials research further accelerated adoption. Expanding renewable-energy initiatives and industrial growth continued to strengthen the region’s leadership in global demand.

Latin America

Latin America held about 4% share in 2024, supported by growing adoption of emission-control technologies and rising demand in industrial polishing tasks. Brazil and Mexico contributed most of the regional consumption due to expanding automotive assembly operations and electronics imports. Interest in specialty glass and basic optical components increased at a gradual pace. Limited local rare-earth processing capacity kept the region dependent on imports from Asia and North America. Investments in industrial modernization and clean-technology adoption provided moderate opportunities for broader cerium IV oxide use.

Middle East and Africa

Middle East and Africa captured nearly 3% share in 2024, with demand driven by industrial polishing applications, basic optical uses, and gradual adoption of catalytic materials in emission-control systems. Growth remained modest due to limited local manufacturing of electronics and precision optics. Countries such as the United Arab Emirates and South Africa showed rising interest in advanced materials for infrastructure and industrial modernization. Import dependence remained high, and supply fluctuations influenced procurement cycles. Ongoing diversification efforts across several economies supported steady but moderate expansion in cerium IV oxide demand.

Market Segmentations:

By Product Type

- High Purity Cerium IV Oxide

- Standard Grade Cerium IV Oxide

By Application

- Polishing Compounds

- Catalysts

- Glass Manufacturing

- Others

By End Use

- Electronics

- Automotive

- Optical

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Cerium (IV) Oxide Market includes Merck KGaA, Neo Performance Materials Inc., Lynas Rare Earths Ltd, Hitachi Chemical Co., Ltd, China Northern Rare Earth Group, Solvay S.A., Showa Denko Materials Co., Ltd, China Minmetals Rare Earth Co., Ltd, Treibacher Industrie AG, and Shin-Etsu Chemical Co., Ltd. The market reflects steady competition driven by purity enhancement, particle-size optimization, and improved polishing performance. Producers focus on expanding high-purity grades to support semiconductor fabrication, advanced optics, and catalytic uses. Supply-chain integration remains a priority as companies work to secure rare-earth feedstock and stabilize production. Rising investments in R&D help firms develop nano-structured formulations and advanced surface treatments. Many manufacturers also strengthen their environmental compliance through cleaner extraction and processing technologies. Regional expansion strategies continue as companies target electronics clusters and automotive hubs for long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Merck KGaA

- Neo Performance Materials Inc.

- Lynas Rare Earths Ltd

- Hitachi Chemical Co., Ltd

- China Northern Rare Earth Group

- Solvay S.A.

- Showa Denko Materials Co., Ltd

- China Minmetals Rare Earth Co., Ltd

- Treibacher Industrie AG

- Shin-Etsu Chemical Co., Ltd

Recent Developments

- In 2025, Solvay formed partnerships in the US and Europe to diversify rare earth supply chains and improve processing efficiencies, leveraging proprietary technology to enhance rare earth oxide purity and reduce costs.

- In 2024, China Northern Rare Earth, with Fujian Jinlong Rare Earth Co., Ltd., planned investment to set up a production line for 5,000 metric tons of rare earth oxides, likely inclusive of cerium oxides.

- In 2023, Resonac (formerly Showa Denko Materials Co., Ltd.) expanded its production capacity for nano-ceria slurry used in semiconductor transistor formation processes.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as semiconductor fabs expand advanced polishing and CMP processes.

- Adoption in catalytic systems will grow under stricter global emission norms.

- High-purity grades will gain stronger traction in precision optics and photonics.

- Use in advanced glass coatings and specialty glass products will increase.

- Clean-energy applications will create new opportunities in fuel cells and hydrogen systems.

- Recycling of rare-earth materials will gain importance to stabilize supply.

- Nano-structured cerium oxide formulations will support next-generation electronics.

- Market dependence on concentrated rare-earth sources will drive supply-chain diversification.

- Investments in optical fiber and imaging technologies will strengthen long-term consumption.

- Environmental regulations will push producers toward cleaner extraction and processing methods.