Market Overview

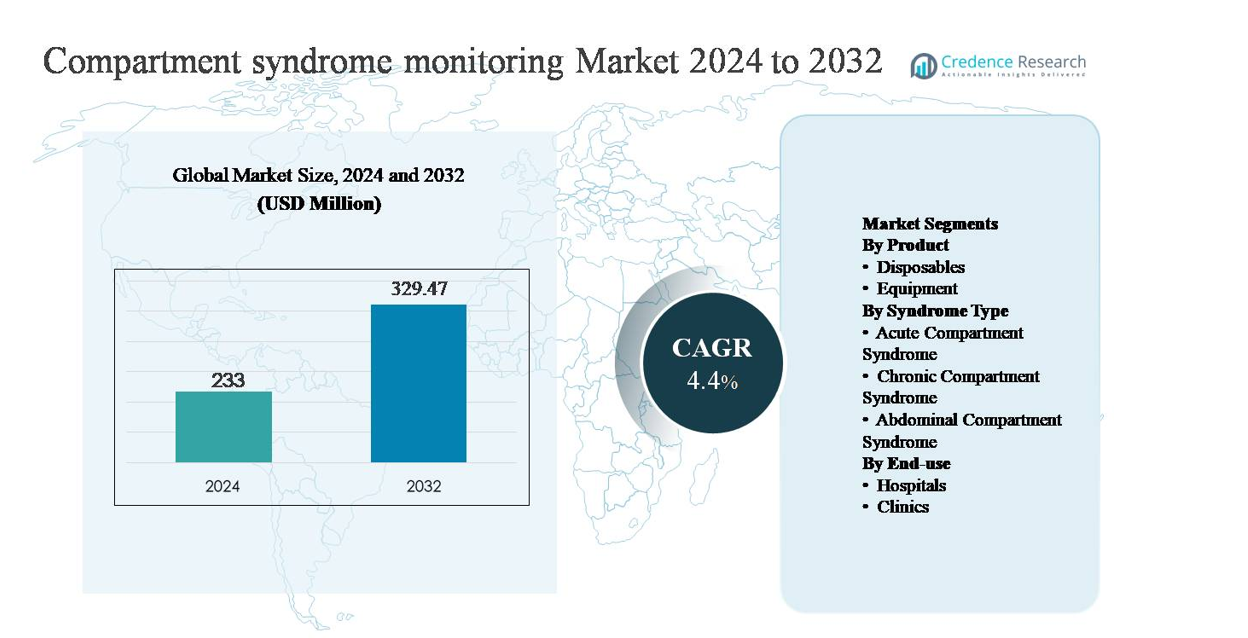

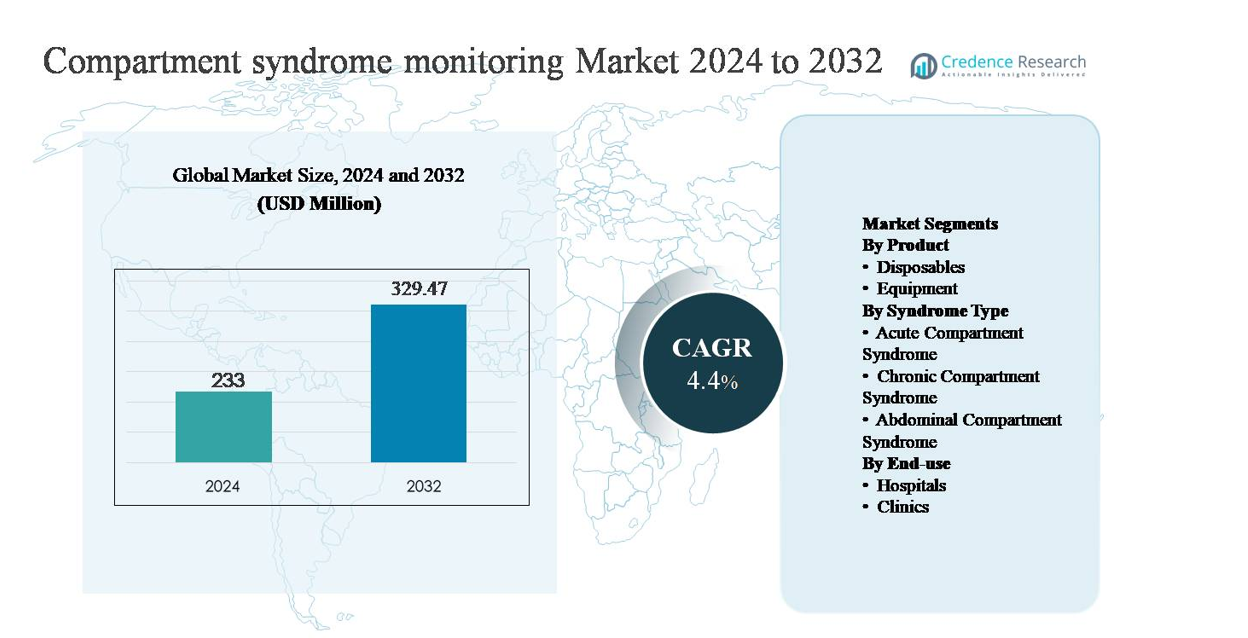

The compartment syndrome monitoring market was valued at USD 233 million in 2024 and is anticipated to reach USD 329.47 million by 2032, expanding at a compound annual growth rate (CAGR) of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compartment Syndrome Monitoring Market Size 2024 |

USD 233 million |

| Compartment Syndrome Monitoring Market, CAGR |

4.4% |

| Compartment Syndrome Monitoring Market Size 2032 |

USD 329.47 million |

The compartment syndrome monitoring market is led by a mix of established medical device manufacturers and specialized diagnostics innovators, including Becton, Dickinson and Company, Medline Industries, Millar, Inc., Spiegelberg GmbH & Co. KG, MY01, Inc., ConvaTec Group, Potrero Medical, Critical Care Diagnostics (C2Dx), Inc., and Biometrix Ltd. (3i Group). These companies compete through clinically validated pressure monitoring technologies, disposable accessories, and workflow-oriented system designs tailored for trauma and orthopedic settings. North America is the leading region, holding an estimated 39% market share, driven by high trauma incidence, advanced hospital infrastructure, and strong adoption of objective diagnostic tools. Europe follows with structured clinical protocols, while Asia Pacific shows accelerating growth supported by expanding trauma care capacity.

Market Insights

- The compartment syndrome monitoring market was valued at USD 233 million in 2024 and is projected to reach USD 329.47 million by 2032, growing at a CAGR of 4.4% during the forecast period.

- Market growth is primarily driven by the rising incidence of trauma, fractures, and complex orthopedic surgeries, which increase the risk of acute compartment syndrome and reinforce the need for objective intracompartmental pressure monitoring, particularly in emergency and postoperative care settings.

- Key market trends include a shift toward device-based diagnosis over subjective clinical assessment, increased adoption of reusable monitoring equipment (holding ~63% segment share), and growing integration of monitoring into standardized trauma and orthopedic protocols.

- Competitive dynamics are shaped by established device manufacturers and specialized innovators focusing on measurement accuracy, workflow efficiency, and disposable-driven recurring revenue, while cost sensitivity and uneven clinical adoption remain notable restraints.

- Regionally, North America leads with ~39% market share, followed by Europe at ~28% and Asia Pacific at ~21%, with hospitals accounting for nearly 70% of end-use demand due to higher trauma case volumes and advanced care infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product:

The product segment in compartment syndrome monitoring is divided into disposables and equipment, with equipment dominating the market, accounting for an estimated 62-65% share. This dominance is driven by the widespread adoption of intracompartmental pressure (ICP) monitoring devices in trauma centers and orthopedic departments, where accurate, repeatable measurements are critical. Capital investments in reusable monitoring systems are justified by their long service life, digital integration, and clinical reliability. Disposables, including single-use catheters and sensors, grow steadily due to infection-control protocols and rising procedural volumes but remain secondary to equipment-led revenue generation.

- For instance, Millar’s Mikro-Cath disposable pressure catheters are manufactured with tip diameters as small as 3.5 Fr (1.2 mm) and are designed for single-patient use while maintaining compatibility with reusable pressure acquisition systems, ensuring clinical safety without replacing core monitoring equipment.

By Syndrome Type:

By syndrome type, acute compartment syndrome represents the dominant sub-segment, contributing approximately 55-58% of overall demand. This leadership is driven by the condition’s emergency nature, high association with fractures, crush injuries, and postoperative complications, and the clinical need for rapid pressure assessment to prevent irreversible tissue damage. Hospitals prioritize monitoring in acute cases to guide timely fasciotomy decisions. Chronic compartment syndrome holds a smaller share, largely linked to sports medicine, while abdominal compartment syndrome remains niche, supported by selective adoption in critical care and intensive monitoring environments.

- For instance, Stryker’s handheld intracompartmental pressure monitoring system is routinely deployed in acute trauma settings and is engineered to deliver digital pressure readings within seconds, with a measurable range extending to 199 mmHg and single-button data capture designed for bedside or intraoperative use.

By End-use:

The end-use segment is led by hospitals, which account for nearly 70% of the market, reflecting their role as primary treatment centers for trauma, orthopedic surgery, and critical care. Hospitals benefit from higher patient inflow, access to trained specialists, and availability of advanced monitoring equipment, making them the main adopters of compartment pressure monitoring systems. Clinics represent a smaller but growing segment, supported by outpatient orthopedic practices and sports injury centers managing chronic cases. However, limited emergency infrastructure constrains clinic-level adoption compared with hospital settings.

Key Growth Drivers

Rising Incidence of Trauma and Orthopedic Injuries

The growing prevalence of trauma cases and complex orthopedic injuries is a primary driver for compartment syndrome monitoring adoption. Road accidents, industrial injuries, sports-related trauma, and high-energy fractures significantly increase the risk of acute compartment syndrome, where delayed diagnosis can lead to permanent neuromuscular damage or limb loss. Clinicians increasingly rely on objective intracompartmental pressure monitoring to support early diagnosis, particularly in unconscious, pediatric, or polytrauma patients where clinical assessment alone is insufficient. The expansion of trauma centers, growth in emergency surgical procedures, and rising awareness of medico-legal risks associated with missed diagnoses further reinforce demand. As orthopedic procedures become more complex and trauma volumes rise globally, monitoring systems are increasingly viewed as essential rather than optional clinical tools.

- “For instance, Spiegelberg GmbH & Co. KG provides continuous pressure monitoring systems designed for intensive care use, incorporating air-pouch sensor technology with automated zeroing and data output for mean pressure values suitable for prolonged monitoring during critical trauma management.

Clinical Emphasis on Early Diagnosis and Outcome Optimization

Healthcare systems are placing stronger emphasis on early intervention and outcome-based care, directly supporting the adoption of compartment syndrome monitoring. Early pressure measurement enables timely surgical decisions, reducing rates of irreversible muscle necrosis, nerve damage, and prolonged rehabilitation. This aligns with hospital goals to shorten length of stay, reduce complication-related costs, and improve functional recovery. Evidence-based protocols increasingly recommend objective pressure monitoring in high-risk cases, driving standardized use across orthopedic and trauma departments. Additionally, the focus on patient safety, quality metrics, and post-surgical outcome tracking encourages clinicians to adopt reliable monitoring technologies that support defensible clinical decision-making and consistent care pathways.

- For instance, MY01, Inc. developed a continuous compartment pressure monitoring system capable of recording pressure data at one-minute intervals for up to 18 hours through a single percutaneous probe, allowing clinicians to track evolving pressure trends rather than relying on isolated spot measurements during the early post-injury window.

Expansion of Surgical and Critical Care Infrastructure

Ongoing investment in hospital infrastructure, particularly in trauma care, orthopedics, and intensive care units, is accelerating market growth. Emerging economies are expanding tertiary hospitals and trauma networks, while developed markets continue upgrading surgical capabilities and monitoring technologies. Compartment syndrome monitoring devices are increasingly integrated into perioperative and critical care workflows, especially in facilities managing high surgical volumes. The availability of trained orthopedic surgeons, anesthesiologists, and critical care specialists supports broader clinical adoption. As healthcare systems scale capacity and prioritize advanced diagnostic tools, monitoring systems benefit from inclusion in standard equipment procurement and trauma readiness programs.

Key Trends & Opportunities

Shift Toward Objective, Device-Based Diagnosis

A key trend shaping the market is the shift from subjective clinical assessment toward objective, device-based compartment pressure measurement. Reliance solely on pain, swelling, or neurological signs is increasingly viewed as insufficient, particularly in sedated or non-communicative patients. This creates opportunities for monitoring devices that offer precise, reproducible readings and clear clinical thresholds. Manufacturers are focusing on improving ease of use, portability, and workflow compatibility to encourage routine adoption. As clinical guidelines increasingly recognize objective measurement as a best practice in high-risk cases, adoption opportunities expand across trauma centers and orthopedic units.

- For instance, ConvaTec Group supports objective, protocol-driven treatment workflows following confirmed compartment syndrome through its advanced wound care portfolio used after fasciotomy.

Technology Advancements and Workflow Integration

Technological innovation presents significant opportunities, particularly in digital pressure sensors and system integration. Modern devices increasingly support faster measurements, improved accuracy, and compatibility with electronic medical records. Opportunities exist for systems that reduce procedure time, minimize operator variability, and support continuous or repeat monitoring. Integration with perioperative and critical care workflows enhances clinical efficiency and strengthens the value proposition for hospitals. As clinicians seek tools that improve decision confidence without adding complexity, manufacturers offering intuitive, reliable systems are well positioned to gain share.

- For instance, Potrero Medical developed the Accuryn® Monitoring System, a digital platform cleared for critical care use that automatically measures urine output with 1 mL resolution and captures data at 15-minute intervals, demonstrating how automated sensor-driven monitoring can replace manual measurements and integrate directly into electronic medical record workflows in intensive care environments.

Key Challenges

Limited Awareness and Inconsistent Clinical Adoption

Despite clinical risks, awareness and routine use of compartment syndrome monitoring remain inconsistent across healthcare settings. Many clinicians continue to rely on clinical judgment alone, particularly in smaller hospitals or clinics, limiting market penetration. Variability in training, lack of standardized protocols, and differing interpretations of pressure thresholds contribute to uneven adoption. In some regions, compartment monitoring is viewed as a secondary diagnostic step rather than a proactive tool. Overcoming this challenge requires education, protocol standardization, and stronger alignment with clinical guidelines to reinforce the value of objective monitoring.

Cost Sensitivity and Procurement Constraints

Cost considerations present another challenge, particularly in resource-limited healthcare systems. While monitoring equipment provides clear clinical value, upfront capital costs and recurring disposable expenses can limit adoption, especially in smaller facilities. Budget constraints often prioritize life-support or imaging equipment over niche monitoring systems. Additionally, reimbursement structures may not explicitly cover compartment pressure measurement, reducing financial incentives for routine use. Manufacturers must address this challenge through cost-effective product designs, clear economic value demonstration, and alignment with hospital procurement priorities to support broader adoption.

Regional Analysis

North America

North America dominates the compartment syndrome monitoring market with an estimated 38-40% market share, driven by a high incidence of trauma cases, advanced orthopedic care infrastructure, and strong adoption of evidence-based diagnostic tools. The U.S. accounts for the majority of regional demand due to well-established trauma centers, high surgical volumes, and widespread availability of intracompartmental pressure monitoring equipment. Clinical awareness of medico-legal risks associated with delayed diagnosis further supports routine monitoring. Favorable reimbursement frameworks, continuous technology upgrades, and the presence of leading medical device manufacturers reinforce North America’s leadership position.

Europe

Europe represents approximately 27-29% of the global market, supported by strong public healthcare systems and standardized orthopedic and trauma care protocols. Countries such as Germany, the UK, and France lead adoption due to high surgical volumes and emphasis on early diagnosis to reduce long-term disability. Regional clinical guidelines increasingly encourage objective compartment pressure measurement in high-risk cases. Investments in hospital modernization and trauma networks support steady demand. While cost containment policies influence procurement decisions, consistent clinician training and protocol-driven care sustain Europe’s significant market contribution.

Asia Pacific

Asia Pacific accounts for an estimated 20-22% market share and is the fastest-growing regional market. Rising road traffic accidents, expanding orthopedic surgery volumes, and rapid development of tertiary hospitals drive demand. Countries such as China, India, and Japan are investing heavily in trauma care infrastructure and surgical capacity. Growing awareness of compartment syndrome complications and gradual adoption of advanced diagnostic technologies support market expansion. Although cost sensitivity remains a constraint in some markets, increasing healthcare expenditure and improving access to specialized care are strengthening regional adoption rates.

Latin America

Latin America holds around 6-7% of the global market, with growth driven by improving trauma care infrastructure and expanding orthopedic services in countries such as Brazil and Mexico. Urbanization and rising accident rates increase demand for timely diagnosis of acute compartment syndrome. Adoption remains concentrated in large public and private hospitals, where access to trained specialists and monitoring equipment is higher. However, budget limitations and uneven healthcare access across the region moderate growth. Ongoing investments in hospital modernization and trauma readiness programs support gradual market expansion.

Middle East & Africa

The Middle East & Africa region accounts for approximately 4-5% market share, reflecting early-stage adoption across much of the region. Demand is strongest in Gulf Cooperation Council countries, supported by advanced hospitals, trauma centers, and government-led healthcare investments. In contrast, adoption in parts of Africa remains limited due to infrastructure gaps and cost constraints. Increasing focus on trauma care, military medicine, and critical care capacity in select markets is improving awareness of compartment syndrome monitoring. Gradual expansion of tertiary care facilities supports long-term growth potential.

Market Segmentations:

By Product

By Syndrome Type

- Acute Compartment Syndrome

- Chronic Compartment Syndrome

- Abdominal Compartment Syndrome

By End-use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the compartment syndrome monitoring market is moderately consolidated, characterized by the presence of established medical device manufacturers and specialized diagnostic solution providers. Leading companies compete primarily on product reliability, measurement accuracy, and ease of clinical use, as these factors directly influence diagnostic confidence in trauma and orthopedic settings. Continuous product refinement, including improved pressure sensors, streamlined catheter designs, and enhanced compatibility with hospital workflows, remains a core competitive strategy. Market participants focus on strengthening relationships with hospitals and trauma centers through clinical education, training programs, and service support. Geographic expansion, particularly in emerging markets with growing trauma care infrastructure, is another key focus area. Additionally, companies emphasize regulatory compliance and clinical validation to reinforce credibility, while cost optimization and disposable portfolio expansion support recurring revenue generation and long-term customer retention.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 7, 2025, MY01, Inc.NTAP status granted by the U.S. Centers for Medicare & Medicaid Services (CMS) for the MY01 Continuous Compartmental Pressure Monitor, expanding reimbursement pathways for use in both inpatient and outpatient settings and enhancing uptake across U.S. healthcare systems.

- In April 21, 2025, Becton,Dickenson and Company Launch of the HemoSphere Alta™ advanced hemodynamic monitoring platform, designed to provide clinicians with predictive, AI-driven clinical decision support and enhanced real-time physiological data to improve monitoring during complex critical care cases. This platform leverages clinical data integration and decision support functionality to increase workflow efficiency in intensive care units.

- In May 31, 2024, MY01, Inc. Appointed Robin Lucia as Director of Medical Education, advancing efforts to standardize clinical use and education on continuous pressure monitoring in compartment syndrome.

Report Coverage

The research report offers an in-depth analysis based on Product, Syndrome type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of compartment syndrome monitoring will increase as trauma and orthopedic care protocols emphasize early, objective diagnosis.

- Hospitals will continue to dominate demand due to higher surgical volumes and expanding trauma care capabilities.

- Reusable monitoring equipment will remain the preferred product type because of durability, accuracy, and long-term cost efficiency.

- Demand for disposable components will grow steadily, supported by infection-control standards and procedural volume growth.

- Acute compartment syndrome will remain the primary clinical application due to its emergency nature and high medico-legal risk.

- Technological improvements will focus on faster measurements, improved sensor accuracy, and simplified clinical workflows.

- Integration of monitoring data into digital patient records will strengthen clinical decision-making and documentation.

- Emerging markets will see higher adoption as tertiary hospitals and trauma centers expand.

- Clinical training and awareness programs will support more consistent use across care settings.

- Manufacturers will increasingly compete on ease of use, clinical validation, and cost-effective system design.