Market overview

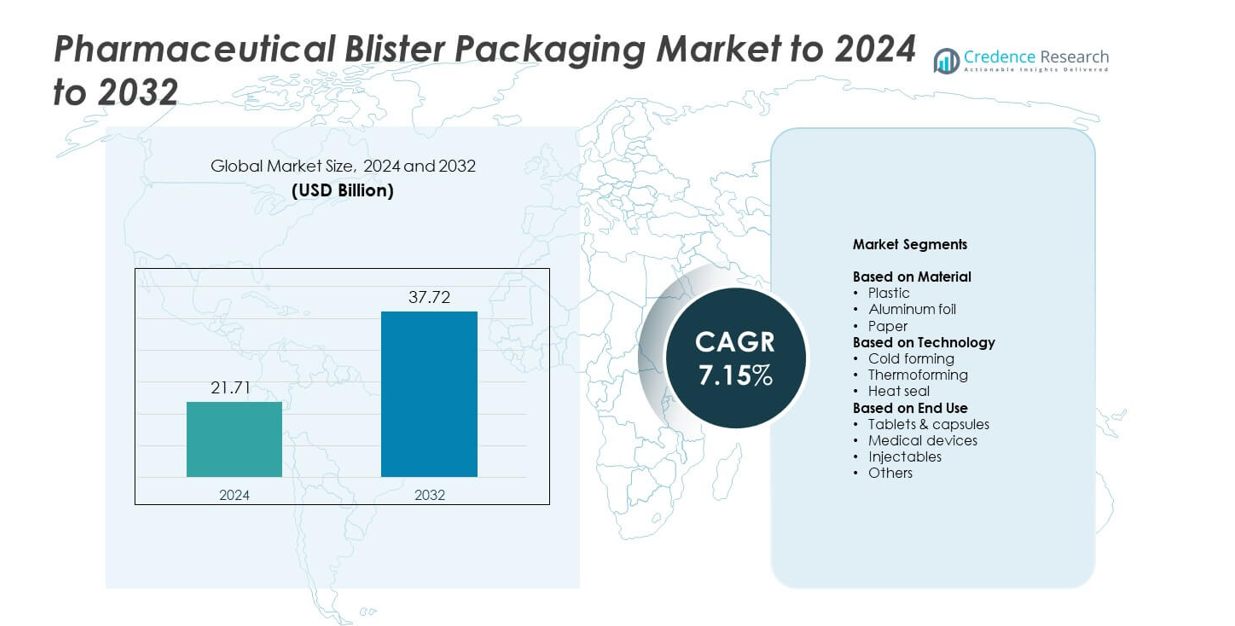

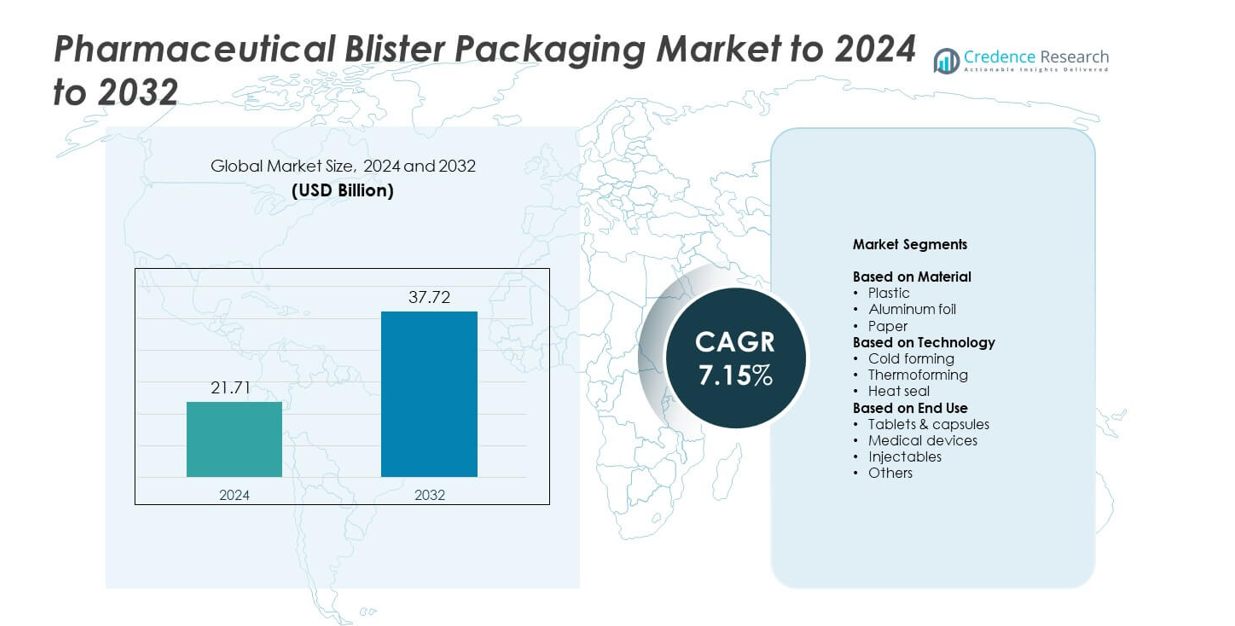

Pharmaceutical Blister Packaging Market size was valued USD 21.71 Billion in 2024 and is anticipated to reach USD 37.72 Billion by 2032, at a CAGR of 7.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pharmaceutical Blister Packaging Market Size 2024 |

USD 21.71 Billion |

| Pharmaceutical Blister Packaging Market, CAGR |

7.15% |

| Pharmaceutical Blister Packaging Market Size 2032 |

USD 37.72 Billion |

The Pharmaceutical Blister Packaging Market is driven by strong competition among leading players such as ACG, Amcor, Aptar, Borealis, Constantia, Carcano and Caprihans. These companies focus on high-barrier materials, sustainable laminates, and advanced thermoforming technologies to meet strict pharmaceutical safety and compliance requirements. North America leads the market with about 34.6 % share in 2024 due to its mature pharma sector and rapid adoption of unit-dose formats. Asia Pacific follows closely with nearly 34.45 % share, supported by large-scale drug production and expanding generic manufacturing. Europe holds around 24 % share, driven by stringent regulatory standards and strong adoption of recyclable blister solutions.

Market Insights

- The Pharmaceutical Blister Packaging Market reached USD 21.71 Billion in 2024 and is projected to hit USD 37.72 Billion by 2032, growing at a CAGR of 7.15 %.

• Strong demand for safe unit-dose formats drives growth as tablets and capsules hold about 60.23 % share, supported by expanding generic drug production and patient-compliance needs.

• High-barrier and sustainable blister materials shape key trends, while thermoforming leads the technology segment with nearly 73.24 % share due to faster production and flexible design.

• Intense competition pushes companies to invest in recyclable laminates, upgraded blister lines and enhanced sealing systems amid rising regulatory pressure.

• Regionally, North America leads with 34.6 % share, followed closely by Asia Pacific at 34.45 % and Europe at 24 %, while Latin America and Middle East & Africa record smaller but steady expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

In the Pharmaceutical Blister Packaging Market, the plastic segment remains dominant, accounting for approximately 51.34 % of the market in 2024. This sub-segment leads due to its cost-efficiency, ease of thermoforming and sealing, and strong adoption for solid oral dose applications. Growth drivers for plastic include rising demand for lightweight packaging, regulatory emphasis on integrity and tamper-evidence, and expansion of generic drugs, which favour plastic blister formats for high-volume production. Aluminum foil and paper segments are also growing, but from smaller bases.

- For instance, ACG Worldwide has completed more than 20,000 machine installations worldwide, according to official company sources and general business information.

By Technology

Within the technology segmentation, the thermoforming sub-segment captured around 73.24 % of the Pharmaceutical Blister Packaging Market in 2024. Thermoforming is preferred because it offers high line speeds, superior visual clarity of packs, and lower tooling costs compared to cold forming. Key growth drivers are increased production of solid oral dosage forms, demand for customised cavity designs and rising volume of over-the-counter and daily-use medications that benefit from this method. Cold forming and heat seal technologies are gaining momentum especially where barrier protection is critical.

- For instance, IMA Group’s C40 blister packaging machine is designed for pharmaceutical and nutraceutical applications and can produce up to 525 blisters per minute.

By End Use

For end-use in the Pharmaceutical Blister Packaging Market, the tablets & capsules sub-segment held approximately 60.23 % share in 2024. This dominance stems from the fact that tablets remain the most common dosage form globally and blister packs offer convenience, compliance benefits and product protection. Growth in this segment is driven by the expansion of generic oral solid medications, increasing pharmaceutical consumption in emerging markets, and the need for tamper-evident, individually dosed packages. Medical devices, injectables and other end-uses are expanding but from smaller bases.

Key Growth Drivers

Rising Demand for Secure Unit-Dose Packaging

Pharmaceutical blister packaging grows due to the rising need for safe and precise unit-dose formats. Drug makers rely on blisters to reduce contamination risks and improve adherence for tablets and capsules. The format supports tamper-evident sealing and stable protection against moisture and oxygen. Expansion of prescription and OTC oral solid dosage drugs strengthens this demand. Growth also accelerates in emerging markets where blister formats replace bulk bottles due to improved safety, portability and dosing accuracy.

- For instance, WestRock’s Shellpak Renew adherence packaging has been dispensed by more than 5 600 pharmacies, with over 500 000 000 Shellpak packages supplied to patients to date.

Growth of Generic and High-Volume Drug Production

The rise of generics boosts demand for blister packaging because manufacturers need fast, economical and high-output packaging systems. Blister lines allow efficient mass production with strong sealing integrity and flexible cavity designs. Regulatory approvals for generic drugs continue to climb worldwide, driving very large packaging volumes. Pharmaceutical companies prefer blister packs due to reduced material use, faster line changeovers and lower operational costs. This supports sustained demand across both mature and developing pharmaceutical hubs.

- For instance, the Romaco Noack Unity 600 high-speed blister packaging line, in its standard double-lane configuration, reaches a maximum output of 600 blisters.

Increasing Focus on Patient Compliance and Safety

Blister packaging adoption expands as companies prioritise compliance-supporting formats for chronic therapies. Blisters help patients track daily doses and improve accuracy in self-administration. The push for senior-friendly and child-resistant formats also boosts development of advanced blister designs. Healthcare professionals promote pack-based dosing to minimise medication errors in clinical and home settings. These compliance-driven needs encourage pharmaceutical brands to transition from bulk containers to calendarised or clearly compartmentalised blister formats.

Key Trends & Opportunities

Shift Toward High-Barrier and Sustainable Materials

A major trend is the shift to advanced barrier structures and eco-designed materials. Rising humidity-sensitive and biologic drug formulations require high-barrier laminates, which increases adoption of cold-form and enhanced foil systems. At the same time, sustainability policies push companies to lower plastic usage and adopt recyclable or bio-based materials. This dual need creates opportunities for new multi-layer films and mono-material designs. Packaging providers investing in barrier-plus-sustainable solutions gain strong long-term advantages.

- For instance, in July 2021 Huhtamaki and Syntegon launched the Push Tab paper tablet blister, a paper-based solution using advanced barrier coatings on renewable paper sourced from FSC-certified European suppliers. The solution, which won the 2021 German Packaging Award for sustainability, is made of more than 75% paper-based material and utilizes Syntegon’s unique paper shaping technology for processing and forming the material.

Automation and Digitalisation of Blister Packaging Lines

Automation is expanding as companies aim for higher accuracy, productivity and traceability. Advanced blister machines now integrate vision inspection, real-time monitoring and automated rejection systems to support compliance with strict global regulations. Digital printing and serialisation create new opportunities for personalised therapies, anti-counterfeiting and small-batch production. Pharmaceutical firms benefit from lower labour costs, fewer errors and faster changeovers. This trend strengthens investment in smart blister packaging systems across global plants.

- For instance, Syntegon’s Versynta microBatch, which won the German Packaging Award Gold in 2022, is a fully automated production cell that fills between 120 and 500 syringes per hour with integrated pharmaceutical processing and inspection.

Key Challenges

Rising Material Costs and Supply Chain Volatility

Material price volatility poses a significant challenge for blister packaging manufacturers. Costs for PVC, PVDC, aluminium and specialty laminates fluctuate due to energy prices, raw-material shortages and geopolitical pressures. These fluctuations raise production expenses and complicate long-term planning for pharmaceutical partners. Supply chain disruptions also delay delivery of films and foils, forcing companies to hold larger inventories or shift to alternative materials. Managing these pressures remains difficult for many packaging suppliers.

Strict Regulatory and Sustainability Compliance Pressure

Regulatory standards for pharmaceutical packaging continue to tighten worldwide, increasing compliance complexity. Requirements for barrier integrity, child-resistance, serialisation and recyclability demand continuous redesign of blister materials and tooling. Sustainability mandates add more pressure as companies must balance barrier performance with reduced environmental impact. Meeting these combined expectations requires high investment in R&D, testing and certification. Smaller manufacturers often struggle with these costs, slowing innovation and global expansion

Regional Analysis

North America

The North America region held a market share of around 34.6 % in the Pharmaceutical Blister Packaging Market in 2024. The region benefits from a well-established pharmaceutical industry, high healthcare spending, and strong regulatory frameworks that encourage unit-dose packaging. Manufacturers in the U.S. and Canada are adopting advanced blister technologies and sustainable materials to meet strict patient-safety and compliance requirements. Growth is driven by generic drug expansion, patient-centric packaging solutions, and rising adoption of outpatient and home-care therapies needing convenient dosing formats.

Europe

Europe captured approximately 24.0 % of the Pharmaceutical Blister Packaging Market in 2024. The region has a dense concentration of pharmaceutical manufacturing and rigorous regulations on packaging waste reduction and product traceability. These factors push packaging providers to invest in high-barrier materials, anti-counterfeiting features and recyclable formats. Market growth is supported by strong demand in Germany, France and the UK for tamper-evident and child-resistant blister packs. Sustainability initiatives and regulatory mandates around 2030 are further accelerating the transition to eco-friendly blister solutions.

Asia Pacific

Asia Pacific accounted for roughly 34.45 % of the Pharmaceutical Blister Packaging Market in 2024 and is the fastest-growing region. Rapid pharmaceutical production expansion in China, India and South‐East Asia fuels high blister demand. Market growth is underpinned by rising chronic disease prevalence, increasing healthcare access and low manufacturing costs. Governments support local production through favourable policies, which attracts major global packaging firms. The region also sees rising demand for sustainable and smart blister formats that meet both domestic and export requirements.

Latin America

Latin America held an estimated share around 7 % to 8 % of the Pharmaceutical Blister Packaging Market in 2024. Growth in the region is driven by expanding pharmaceutical access, rising healthcare expenditures and increasing generic drug penetration. Packaging converters are upgrading to comply with stricter regulation and adopt unit-dose blister systems. The market faces limitations from economic volatility and infrastructure gaps, but opportunities exist in Brazil, Mexico and Chile for packaging upgrades and increasing demand for cost-effective blister formats.

Middle East & Africa

The Middle East & Africa region represented an estimated share of about 6 % to 7 % of the Pharmaceutical Blister Packaging Market in 2024. Growth is driven by rising healthcare spending, expanding pharmaceutical manufacturing hubs in the Gulf region and increasing regulatory focus on patient-safe packaging. Developments in one-dose therapy formats and import-substitution strategies support blister uptake. Challenges include uneven infrastructure, limited local manufacturing capacity and regulatory inconsistencies, but sustainability and regional production investments offer notable opportunity.

Market Segmentations:

By Material

- Plastic

- Aluminum foil

- Paper

By Technology

- Cold forming

- Thermoforming

- Heat seal

By End Use

- Tablets & capsules

- Medical devices

- Injectables

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Pharmaceutical Blister Packaging Market features active competition among Constantia, Borealis, ACG, Carcano, Aptar, Amcor and Caprihans. The competitive environment is shaped by continuous investment in high-barrier materials, improved forming technology and sustainable packaging formats. Companies focus on expanding thermoforming and cold-form capabilities to support the growing volume of oral solid dosage drugs and rising global compliance requirements. Many manufacturers strengthen regional presence through capacity additions, technical collaborations and upgrades in automated blister lines. Innovation in recyclable structures, reduced-plastic laminates and smarter sealing systems drives differentiation as regulatory pressure intensifies across major markets. Competitors also concentrate on enhancing quality control, integrating digital inspection and expanding customisation options for pharmaceutical clients seeking efficiency and reliability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Constantia

- Borealis

- ACG

- Carcano

- Aptar

- Amcor

- Caprihans

Recent Developments

- In 2025, Amcor continued to promote AmSky™, a breakthrough mono-PE, PVC- and aluminum-free thermoform blister system compliant with PFAS regulations, designed for recycling in both rigid and flexible PE streams.

- In 2024, Bayer developed and launched a first-of-its-kind polyethylene terephthalate (PET) blister pack for its Aleve OTC drug brand, resulting in an 18% lighter package with a 38% reduction in carbon footprint by eliminating PVC.

- In 2023, Constantia Flexibles launched REGULA CIRC, a cold-form foil blister system that replaces PVC with a polyethylene sealing layer to cut plastic content and improve recyclability while preserving barrier performance.

Report Coverage

The research report offers an in-depth analysis based on Material, Technology, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as demand rises for safe and compliant unit-dose packaging.

- Adoption of high-barrier films will grow to support moisture-sensitive and complex drugs.

- Sustainability will shape new designs that reduce plastic use and support recyclability.

- Automation and smart packaging lines will increase output and lower operational errors.

- Blister formats will gain traction in emerging markets with rising generic drug production.

- Pharmaceutical companies will invest more in child-resistant and senior-friendly designs.

- Digital printing and serialisation will strengthen anti-counterfeiting measures.

- Demand for cold-form blister solutions will grow for high-protection drug needs.

- Global regulatory pressure will accelerate material innovation and safer packaging formats.

- Partnerships between pharma firms and packaging technology providers will intensify