| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Health Technologies Market Size 2024 |

USD 254.03 Million |

| Digital Health Technologies Market, CAGR |

10.69% |

| Digital Health Technologies Market Size 2032 |

USD 605.80 Million |

Market Overview

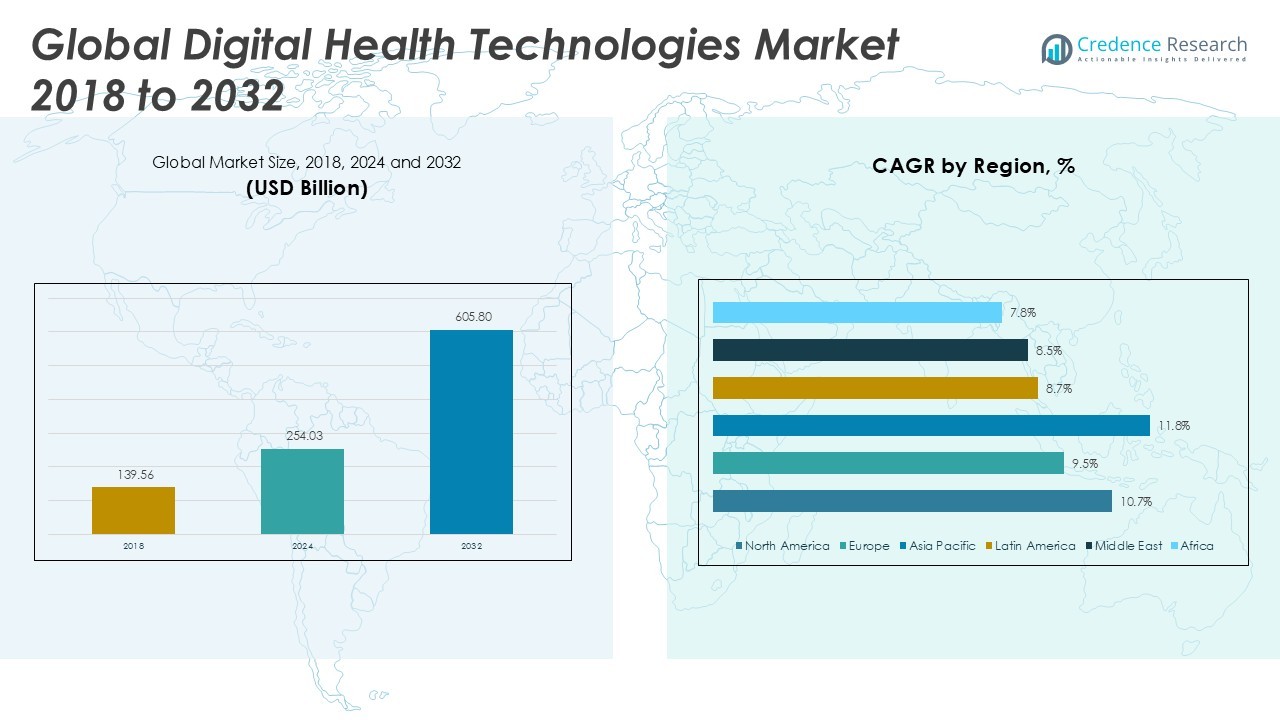

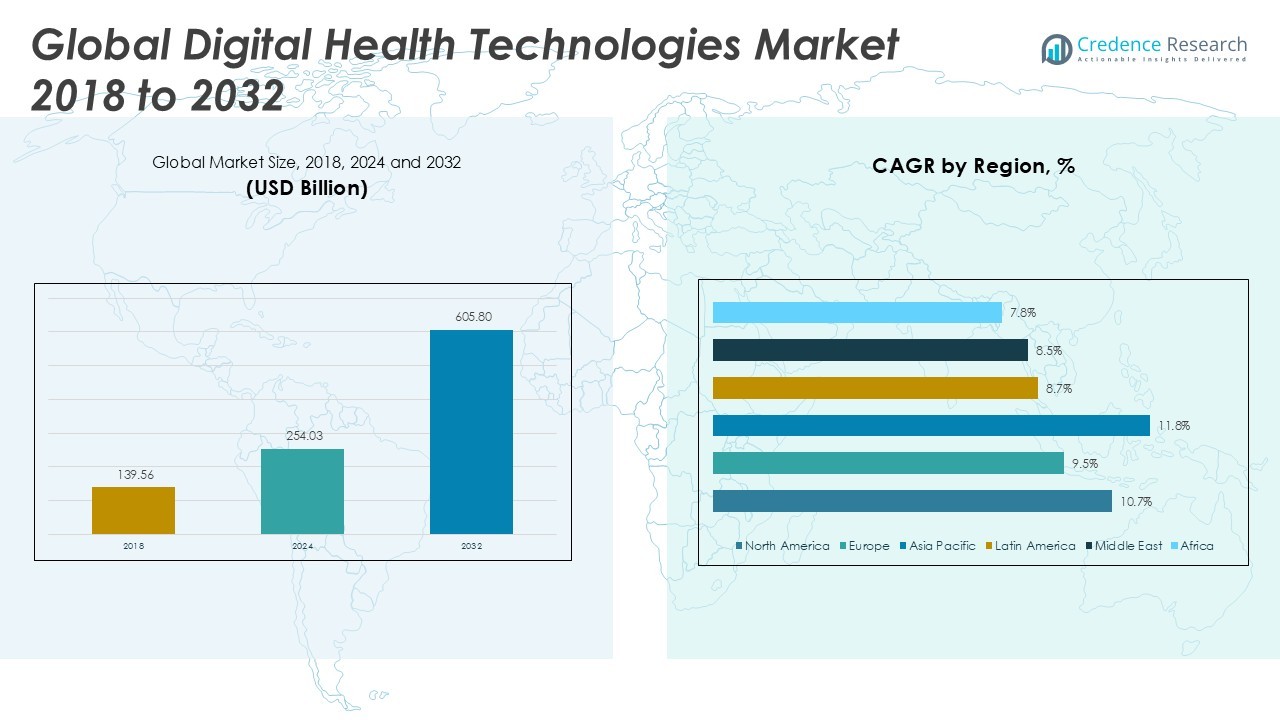

The Digital Health Technologies Market was valued at USD 139.56 billion in 2018 and USD 254.03 billion in 2024. It is anticipated to reach USD 605.80 billion by 2032, reflecting a compound annual growth rate (CAGR) of 10.69% during the forecast period.

The Digital Health Technologies market is driven by the rapid adoption of telemedicine, increasing use of wearable health devices, and the integration of artificial intelligence and data analytics into healthcare systems. Rising healthcare costs and the growing need for remote patient monitoring are pushing healthcare providers and patients to embrace digital solutions that improve efficiency and outcomes. Governments and private organizations are investing in digital infrastructure and promoting regulatory support for digital health innovations, further accelerating market growth. However, data privacy and security concerns present challenges to widespread adoption. Key trends include the expansion of personalized medicine through data-driven insights, the proliferation of mobile health applications, and advancements in interoperability among healthcare platforms. As consumer awareness and acceptance of digital health tools continue to rise, the market is expected to witness sustained growth, transforming traditional healthcare delivery and enabling more proactive, patient-centered care worldwide.

The geographical analysis of the Digital Health Technologies Market highlights strong adoption across North America, Europe, and Asia Pacific, driven by advanced healthcare infrastructure, supportive government initiatives, and a high degree of digital literacy. The United States, Germany, China, and India are key countries spearheading innovation and integration of digital health solutions into mainstream healthcare delivery. Rapid urbanization and the widespread use of smartphones further accelerate market growth in these regions. Among the leading players in the Digital Health Technologies Market, Apple Inc., Google LLC (including Fitbit & Google Health), and Philips Healthcare stand out for their extensive product portfolios, significant investment in research and development, and strategic partnerships. These companies continue to drive technological advancements, offering innovative solutions that enhance patient care, remote monitoring, and overall healthcare efficiency on a global scale.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Digital Health Technologies Market was valued at USD 254.03 billion in 2024 and is projected to reach USD 605.80 billion by 2032, registering a CAGR of 10.69% during the forecast period.

- Rapid adoption of telehealth, mobile health, and wearable devices is driving digital transformation in healthcare, improving patient engagement and access to care.

- Key trends include the growing use of artificial intelligence, predictive analytics, and interoperability solutions to enable personalized medicine and real-time patient monitoring.

- Leading players such as Apple Inc., Google LLC (Fitbit & Google Health), and Philips Healthcare invest in R&D, strategic partnerships, and product development to maintain competitive advantage.

- Data privacy concerns, complex regulatory environments, and interoperability gaps between systems act as significant restraints, challenging seamless integration and adoption.

- North America, Europe, and Asia Pacific represent the most lucrative regions, supported by advanced infrastructure, digital literacy, and proactive policy support; the United States, China, and Germany are key country markets.

- Regional growth is further supported by government initiatives, public-private partnerships, and increasing demand for remote healthcare solutions in emerging economies, while disparities in digital access and infrastructure remain a challenge in Latin America, the Middle East, and Africa.

Market Drivers

Rapid Growth in Telemedicine and Remote Patient Monitoring Fuels Market Expansion

The Digital Health Technologies Market is experiencing robust growth due to the widespread adoption of telemedicine and remote patient monitoring solutions. Healthcare providers use these technologies to offer timely and efficient care, especially for chronic disease management and post-acute care. Patients benefit from convenience and improved access, driving demand for virtual consultations and continuous monitoring devices. Health systems report reduced hospital readmissions and operational costs by implementing remote monitoring programs. Insurers also support telehealth adoption through expanded reimbursement policies, making digital platforms more accessible. This shift is redefining patient engagement and clinical workflows across global healthcare systems.

- For instance, Teladoc Health conducted over 18.5 million virtual visits in 2023, demonstrating its technological capacity to handle large-scale remote consultations.

Integration of Artificial Intelligence and Data Analytics Enhances Clinical Decision-Making

The integration of artificial intelligence (AI) and advanced data analytics is a significant driver for the Digital Health Technologies Market. AI-powered tools streamline administrative tasks, support diagnostic accuracy, and enable predictive modeling for better health outcomes. Data analytics platforms extract actionable insights from large volumes of patient data, helping clinicians personalize treatment plans and identify at-risk populations. It facilitates faster, evidence-based decisions and supports value-based care initiatives. Pharmaceutical companies use these technologies for efficient drug development and clinical trials. The demand for interoperable and scalable AI solutions continues to rise, attracting substantial investment from healthcare stakeholders.

- For instance, IBM Watson Health’s AI has analyzed more than 300 million patient records to assist clinicians in oncology decision-making worldwide.

Government Initiatives and Favorable Regulatory Environment Support Market Growth

Government initiatives play a pivotal role in driving the adoption of digital health solutions, especially in developed and emerging economies. National healthcare strategies increasingly prioritize digitalization, encouraging investments in telehealth infrastructure and electronic health records (EHR) systems. Regulatory bodies have introduced guidelines and standards for digital health applications, providing greater clarity for market participants. It ensures patient safety and data security, helping to build trust in digital health platforms. Financial incentives and public-private partnerships further stimulate innovation and deployment of new solutions. Governments actively address barriers such as interoperability and access to digital tools in underserved areas.

Rising Consumer Awareness and Demand for Personalized Healthcare Propel Innovation

Rising consumer awareness about health and wellness, combined with a growing preference for personalized care, accelerates the adoption of digital health technologies. Consumers now expect real-time access to health information and personalized insights through mobile health apps and wearable devices. It leads to the development of solutions focused on prevention, early intervention, and lifestyle management. Companies invest heavily in user-friendly interfaces and secure data management to enhance the patient experience. The focus on patient empowerment drives competition among technology vendors, spurring rapid innovation. This trend positions the market for ongoing growth, with digital health becoming integral to modern healthcare delivery.

Market Trends

Expansion of Mobile Health Applications and Wearable Devices is Reshaping Patient Engagement

The Digital Health Technologies Market is witnessing strong growth in mobile health applications and wearable devices, transforming how patients interact with healthcare providers. Consumers are adopting smartwatches, fitness trackers, and health monitoring apps to manage their well-being proactively. These tools enable real-time health data collection, supporting preventive care and early intervention. Healthcare professionals leverage this data to personalize treatment and monitor patient progress outside clinical settings. Companies are enhancing device interoperability and integrating features such as remote diagnostics, medication reminders, and wellness coaching. The growing acceptance of digital health tools increases patient engagement and supports healthier lifestyles.

- For instance, Apple reported that the Apple Watch had over 100 million active users globally in 2023, providing health tracking and notification features at scale.

Telemedicine Platforms and Virtual Care Models Continue to Evolve Rapidly

Telemedicine platforms and virtual care models represent a prominent trend in the Digital Health Technologies Market. Hospitals and clinics are scaling telehealth offerings to provide convenient, on-demand access to care. It addresses challenges in rural and underserved regions, reducing the need for travel and minimizing delays in treatment. Providers are investing in secure, user-friendly platforms that support video consultations, electronic prescriptions, and digital health records. The shift to hybrid care models—combining in-person and virtual services—reflects changing patient preferences and operational efficiencies. The evolution of telemedicine is shaping long-term healthcare delivery strategies worldwide.

- For instance, Philips’ tele-ICU solutions remotely monitor over 130,000 intensive care unit beds globally, optimizing care delivery in hospitals and remote settings.

Artificial Intelligence and Data Analytics Drive Innovation Across Healthcare Ecosystems

Artificial intelligence and data analytics are at the forefront of innovation in the Digital Health Technologies Market. AI-driven tools enable faster diagnostics, risk prediction, and population health management, helping clinicians deliver more accurate and personalized care. Organizations are deploying predictive analytics to optimize resource allocation and improve outcomes for complex conditions. Pharmaceutical firms use AI to streamline drug discovery and clinical trial processes, reducing costs and development times. The demand for advanced data integration platforms is accelerating, facilitating secure sharing and analysis across networks. The continuous advancement of AI technologies underpins future market competitiveness.

Focus on Data Security, Privacy, and Regulatory Compliance Gains Momentum

A heightened focus on data security, privacy, and regulatory compliance is reshaping the Digital Health Technologies Market. Companies are prioritizing robust cybersecurity measures to protect sensitive patient data from breaches and cyber threats. Regulatory authorities introduce updated frameworks and certification requirements for digital health products, creating a more structured environment for innovation. It increases confidence among healthcare providers and patients in adopting digital solutions. The push for compliance also encourages investment in transparent data management and secure cloud infrastructure. Evolving global regulations and rising cyber risk awareness drive industry-wide improvements in digital health practices.

Market Challenges Analysis

Data Privacy, Cybersecurity, and Regulatory Complexities Impede Market Progress

The Digital Health Technologies Market faces significant challenges related to data privacy, cybersecurity threats, and a complex regulatory environment. Healthcare providers must ensure robust protection of sensitive patient information to prevent unauthorized access and data breaches. It creates a persistent need for investment in advanced cybersecurity solutions and regular compliance updates with evolving regulations. Diverse and often fragmented regulatory standards across regions make global expansion difficult for technology providers. Companies must navigate requirements for data storage, patient consent, and cross-border data transfers, increasing operational complexity and compliance costs. Uncertainty around legal frameworks can hinder innovation and delay new product launches.

Interoperability Gaps and Unequal Access Restrict Digital Health Adoption

Interoperability remains a persistent challenge in the Digital Health Technologies Market, limiting seamless integration between different healthcare platforms and systems. Inadequate data exchange capabilities hinder effective communication among providers and reduce the value of digital health investments. It creates barriers to comprehensive patient care and complicates coordination across the healthcare continuum. Unequal access to digital health tools, particularly in rural or low-resource settings, further restricts widespread adoption. Socioeconomic disparities and lack of digital literacy also slow the uptake of advanced solutions. Addressing these challenges is critical to unlocking the full potential of digital health on a global scale.

Market Opportunities

Emerging Markets and Expanding Digital Infrastructure Present Growth Prospects

The Digital Health Technologies Market holds significant opportunities in emerging economies where healthcare digitalization remains in early stages. Rising investments in broadband connectivity and mobile penetration lay a strong foundation for digital health adoption in these regions. Governments support large-scale digital transformation projects, including telehealth networks and electronic health record systems. It creates new business avenues for technology providers to introduce tailored solutions for local needs. Companies can leverage public-private partnerships to expand their presence and bridge care gaps in underserved communities. The market’s expansion in these regions supports broader healthcare access and efficiency.

Personalized Medicine and Advanced Analytics Unlock Value for Stakeholders

Personalized medicine and the integration of advanced analytics drive new opportunities in the Digital Health Technologies Market. Increasing demand for customized healthcare interventions prompts companies to develop solutions that analyze patient data for targeted treatment and prevention strategies. It enables providers to offer more precise care, improving outcomes and patient satisfaction. Pharmaceutical firms can utilize digital platforms to enhance clinical trial design and drug development processes. The application of real-time analytics and artificial intelligence also supports population health management, creating measurable value for payers, providers, and patients alike.

Market Segmentation Analysis:

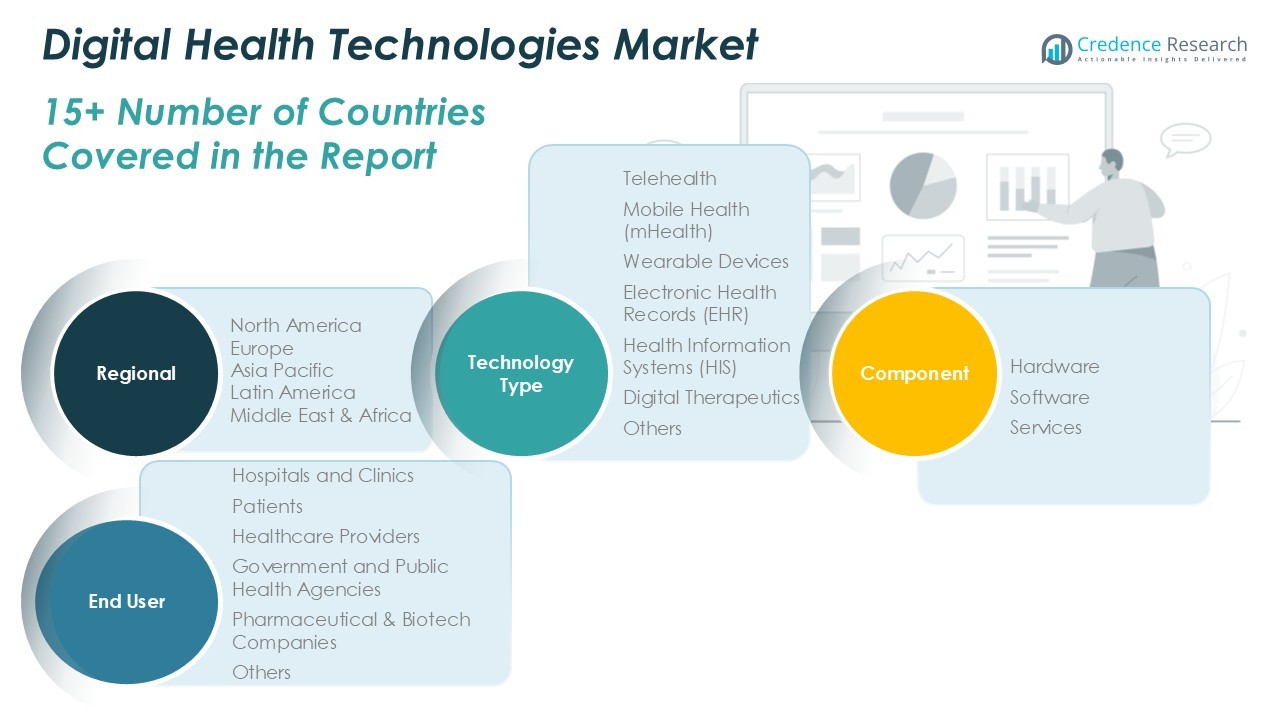

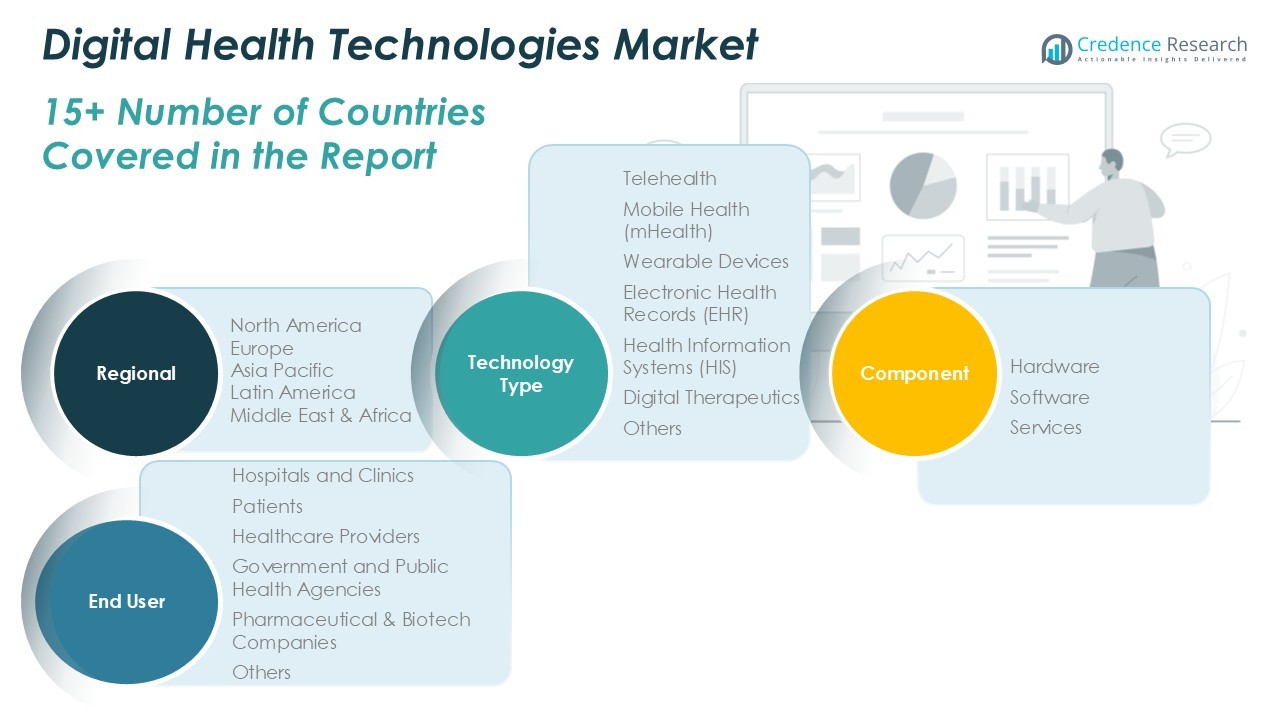

By Technology Type:

Telehealth represents a significant portion of market revenue, supported by the widespread adoption of remote consultation and virtual care platforms. Mobile health (mHealth) has gained traction due to increasing smartphone penetration and demand for accessible health information and self-care tools. Wearable devices, including fitness trackers and medical-grade monitoring solutions, drive continuous patient engagement and real-time data collection. Electronic Health Records (EHR) facilitate seamless data exchange between stakeholders and support clinical decision-making. Health Information Systems (HIS) play a pivotal role in hospital management and resource optimization, while digital therapeutics address chronic disease management and behavioral health through evidence-based interventions. The “others” category includes emerging solutions that complement mainstream technologies and enhance digital care ecosystems.

- For instance, Epic Systems manages EHR data for over 305 million patients worldwide, demonstrating the scale and impact of electronic records integration.

By Component:

The market consists of hardware, software, and services. Hardware includes medical devices, sensors, and wearable equipment that enable real-time monitoring and data acquisition. Software forms the backbone of digital health, encompassing platforms for telehealth, analytics, EHR, and digital therapeutics, which enable interoperability, data analysis, and workflow automation. Services provide critical support, including system integration, maintenance, and consulting, ensuring technology adoption and effective utilization. The increasing complexity of healthcare systems fuels demand for end-to-end service solutions.

- For instance, Medtronic’s connected devices transmit health data from more than 2 million cardiac patients globally, supporting continuous monitoring and digital healthcare services.

By End-User:

Hospitals and clinics constitute a primary market segment, relying on digital health solutions to streamline operations, improve patient outcomes, and optimize resource management. Patients increasingly use mobile health applications, wearables, and virtual care platforms for preventive care, disease management, and health monitoring. Healthcare providers leverage digital tools to enhance diagnostics, care coordination, and patient engagement. Government and public health agencies focus on population health management, public health surveillance, and telemedicine deployment to expand care access. Pharmaceutical and biotech companies integrate digital technologies for clinical research, drug development, and real-world evidence collection. The “others” segment encompasses research institutes, insurers, and ancillary healthcare players who benefit from tailored digital health innovations. The market’s comprehensive segmentation supports diverse use cases and drives innovation across global healthcare landscapes.

Segments:

Based on Technology Type:

- Telehealth

- Mobile Health (mHealth)

- Wearable Devices

- Electronic Health Records (EHR)

- Health Information Systems (HIS)

- Digital Therapeutics

- Others

Based on Component:

- Hardware

- Software

- Services

Based on End User:

- Hospitals and Clinics

- Patients

- Healthcare Providers

- Government and Public Health Agencies

- Pharmaceutical & Biotech Companies

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Digital Health Technologies Market

North America Digital Health Technologies Market grew from USD 54.23 billion in 2018 to USD 97.55 billion in 2024 and is projected to reach USD 233.37 billion by 2032, reflecting a compound annual growth rate (CAGR) of 10.7%. North America is holding a 36% market share. The Digital Health Technologies Market in this region is driven by robust healthcare infrastructure, widespread digital adoption, and supportive government initiatives. The United States and Canada remain at the forefront, accounting for the largest revenue contributions. Increasing investments in telemedicine, mobile health apps, and remote patient monitoring are supporting market growth. It is benefiting from significant R&D activities, strong presence of leading technology providers, and advanced regulatory frameworks. High patient awareness and acceptance of innovative healthcare solutions are further fueling demand.

Europe Digital Health Technologies Market

Europe Digital Health Technologies Market grew from USD 27.56 billion in 2018 to USD 47.56 billion in 2024 and is projected to reach USD 103.73 billion by 2032, reflecting a CAGR of 9.5%. Europe is holding a 16% market share. The Digital Health Technologies Market in Europe is marked by strong government backing for eHealth initiatives and digital transformation in public health systems. Key countries such as Germany, the United Kingdom, and France are investing in telehealth, electronic health records, and AI-driven diagnostics. It is also shaped by strict data protection regulations that ensure patient privacy. Growth is supported by increasing geriatric population and the need for efficient chronic disease management. Cross-border healthcare programs and interoperability standards are expanding digital health adoption.

Asia Pacific Digital Health Technologies Market

Asia Pacific Digital Health Technologies Market grew from USD 45.54 billion in 2018 to USD 87.00 billion in 2024 and is projected to reach USD 224.22 billion by 2032, reflecting a CAGR of 11.8%. Asia Pacific is holding a 34% market share. The Digital Health Technologies Market is expanding rapidly due to rising smartphone penetration, government-led digitalization campaigns, and a growing middle class. China, Japan, and India lead the market with large investments in telemedicine platforms and mobile health solutions. It is benefitting from an increasing demand for accessible healthcare in rural and urban areas alike. The region’s healthcare sector is leveraging AI, IoT, and big data analytics to enhance patient outcomes. Local start-ups and global players are actively entering this fast-evolving space.

Latin America Digital Health Technologies Market

Latin America Digital Health Technologies Market grew from USD 5.77 billion in 2018 to USD 10.35 billion in 2024 and is projected to reach USD 21.44 billion by 2032, reflecting a CAGR of 8.7%. Latin America is holding a 3% market share. The Digital Health Technologies Market in Latin America is advancing with gradual improvements in digital infrastructure and policy support. Brazil and Mexico are leading growth, driven by the adoption of teleconsultation and remote diagnostics. It is witnessing greater demand for digital tools to address healthcare access gaps and improve service delivery in underserved regions. Investment in health IT is increasing as governments and private entities collaborate on modernization initiatives. Regulatory harmonization efforts are supporting market expansion.

Middle East Digital Health Technologies Market

Middle East Digital Health Technologies Market grew from USD 4.13 billion in 2018 to USD 6.90 billion in 2024 and is projected to reach USD 14.03 billion by 2032, reflecting a CAGR of 8.5%. The Middle East is holding a 2% market share. The Digital Health Technologies Market is growing as countries like Saudi Arabia and the UAE prioritize smart healthcare projects and digital transformation strategies. Government investments in telemedicine platforms, e-prescriptions, and connected care systems are strengthening healthcare delivery. It is experiencing an uptick in public-private partnerships and tech-driven healthcare innovation. The market is gaining momentum through enhanced digital literacy and strategic health sector reforms. Focus on health tourism and international collaboration is further contributing to growth.

Africa Digital Health Technologies Market

Africa Digital Health Technologies Market grew from USD 2.34 billion in 2018 to USD 4.67 billion in 2024 and is projected to reach USD 9.02 billion by 2032, reflecting a CAGR of 7.8%. Africa is holding a 1% market share. The Digital Health Technologies Market in Africa is evolving with gradual advancements in mobile health, telemedicine, and digital health infrastructure. Key markets such as South Africa, Nigeria, and Kenya are leveraging mobile connectivity to expand access to healthcare services. It is driven by rising government and NGO involvement in digital health projects, aiming to bridge gaps in rural and underserved communities. Affordable mobile solutions and local partnerships are spurring adoption across the continent. The market is poised for further growth as investments in health IT increase and digital ecosystems mature.

Key Player Analysis

- Apple Inc.

- Google LLC (Fitbit & Google Health)

- Philips Healthcare

- Cerner Corporation

- Teladoc Health, Inc.

- Medtronic plc

- Siemens Healthineers

- GE HealthCare Technologies Inc.

- Allscripts Healthcare Solutions, Inc.

- IBM Watson Health

Competitive Analysis

The competitive landscape of the Digital Health Technologies Market features several prominent players, including Apple Inc., Google LLC (Fitbit & Google Health), Philips Healthcare, Cerner Corporation, Teladoc Health, Inc., Medtronic plc, Siemens Healthineers, GE HealthCare Technologies Inc., Allscripts Healthcare Solutions, Inc., and IBM Watson Health. These companies lead the market by leveraging advanced technologies, broad product portfolios, and global reach. Apple Inc. and Google LLC are at the forefront with their ecosystem-driven platforms, integrating wearable devices, health monitoring apps, and personalized digital services. These organizations leverage advanced technologies such as artificial intelligence, machine learning, and interoperability solutions to create integrated platforms that enhance patient engagement and streamline clinical workflows. Strong emphasis on user-friendly interfaces and secure data management helps them build trust with healthcare providers and consumers alike. Strategic partnerships and collaborations with hospitals, payers, and technology firms are common approaches for expanding market presence and accelerating product adoption. Companies continually adapt to evolving regulatory environments and respond to regional healthcare demands to strengthen their positions in this dynamic and rapidly growing sector. The focus remains on delivering scalable, reliable, and outcome-driven digital health solutions to meet the needs of global healthcare systems.

Recent Developments

- In January 2024, JD Health introduced a new elderly care channel on its app to provide a comprehensive platform for the various healthcare needs of China’s aging population.

- In January 2024, 98point6 Technologies announced the acquisition of Bright.md. to accelerate the launch of 98point6’s asynchronous care module. This development enables healthcare organizations to license an integrated, purpose-built clinician solution supporting multiple care delivery models.

- In May 2023 Medtronic (Ireland) acquired EOFlow Co. Ltd. (South Korea) to expand its ability to treat patients with diabetes. In March 2023, GE HealthCare (US) partnered with Advantus Health Partners (US) to sign a multi-year contract to expand access to Healthcare Technology Management Services.

- In April 2023, Abbott (US) acquired Cardiovascular Systems, Inc. (CSI) (US) to gain a complementary treatment option for vascular illness. The highly advanced atherectomy technology from CSI prepares vessels for angioplasty or stenting to restore blood flow.

- In April 2023, Microsoft collaborated with Epic Systems Corporation to integrate AI into EHR, enabling healthcare practitioners to improve their productivity and patient communication with AI-enabled solutions.

- In March 2023, BlueRock Therapeutics LP entered a collaboration with Emerald Innovations and Rune Labs with a major focus on innovations using contactless & invisible, wearable digital health technology to improve monitoring of Parkinson’s disease.

- In March 2023, Google launched Open Health Stack, an open-source program for developers to build health-related apps by including strategies, such as AI partnerships focusing on cancer screening.

- In March 2023, Nabla Technologies launched Copilot, a digital assistant tool, as a Chrome extension using GPT-3 for doctors to make patients’ conversations turn into action.

Market Concentration & Characteristics

The Digital Health Technologies Market demonstrates moderate to high market concentration, with a mix of global technology leaders, established medical device manufacturers, and specialized health IT firms dominating the landscape. It features a blend of large-scale companies with robust R&D capabilities and smaller innovators focused on niche solutions such as digital therapeutics, mobile health apps, and AI-driven analytics. The market’s characteristics include rapid technological advancement, a strong emphasis on interoperability, and frequent collaborations between healthcare providers and technology firms. Regulatory compliance and data security are central concerns, shaping product development and market entry strategies. End users—ranging from hospitals and clinics to individual patients and government agencies—seek integrated, scalable, and user-friendly solutions that deliver measurable clinical and operational value. Intense competition drives continuous product innovation and customization, while regional differences in digital health infrastructure and policy create diverse growth opportunities. The market evolves quickly, influenced by changing patient expectations and ongoing healthcare digitalization initiatives worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Technology Type, Component, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Telehealth solutions will reach wider populations, enhancing access to remote care.

- AI-powered diagnostics will improve early disease detection and treatment precision.

- Integration of wearable technologies will support real-time patient monitoring and personalized care.

- Digital therapeutics will expand into chronic disease and mental health management.

- Blockchain and advanced security measures will strengthen data integrity and patient privacy.

- Interoperable platforms will enable seamless health data exchange across multiple care settings.

- Cloud-based infrastructure will support scalable digital health deployments globally.

- Voice-assistant and natural language processing tools will enhance patient engagement and clinician workflow efficiency.

- Virtual reality and augmented reality will gain traction in medical training and rehabilitation programs.

- Public-private partnerships will accelerate innovation and infrastructure development in underserved regions.