Market Overview

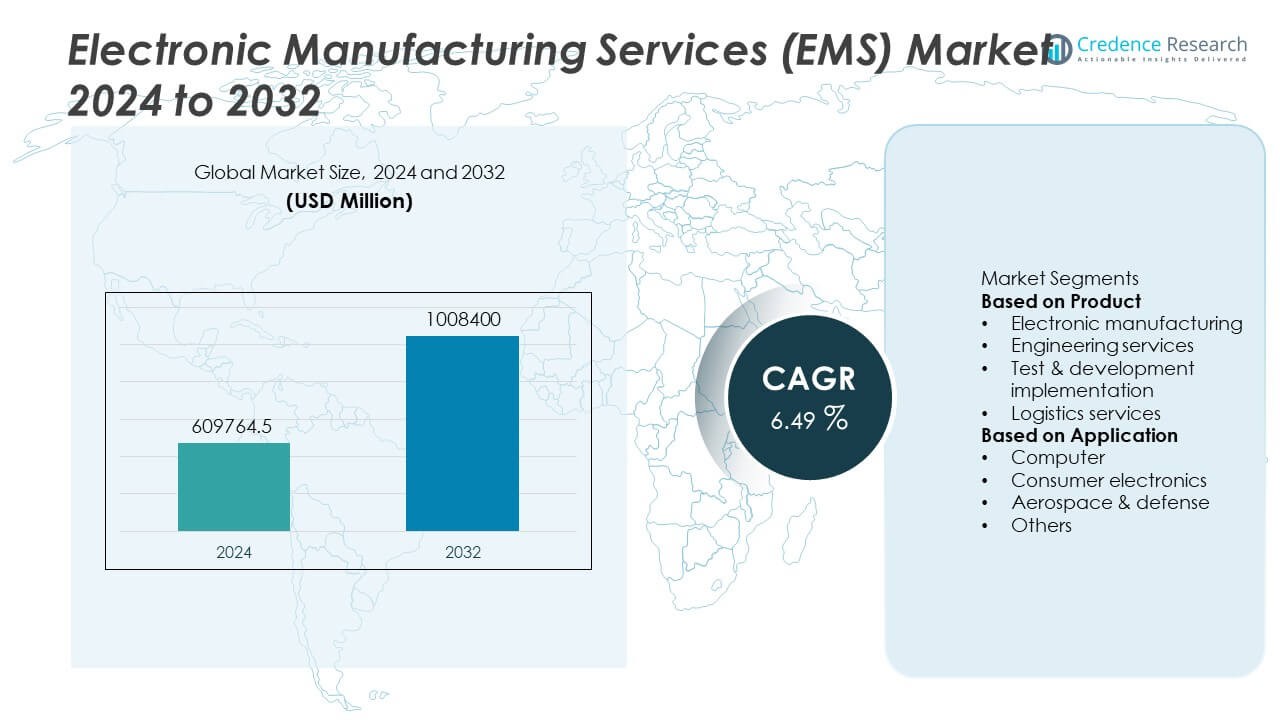

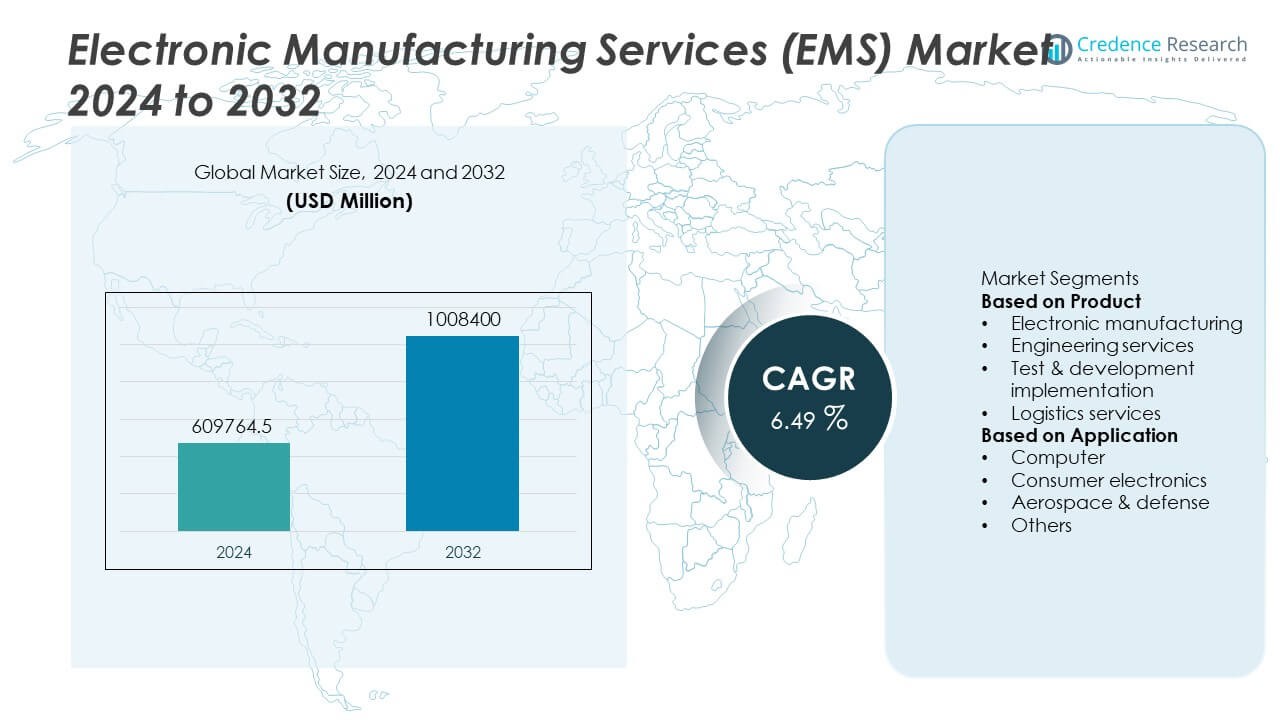

The Electronic Manufacturing Services (EMS) market size was valued at USD 697,645 million in 2024 and is projected to reach USD 1,008,400 million by 2032, growing at a CAGR of 6.49% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electronic Manufacturing Services (EMS)Market Size 2024 |

USD 697,645 Million |

| Electronic Manufacturing Services (EMS) Market, CAGR |

6.49% |

| Electronic Manufacturing Services (EMS)Market Size 2032 |

USD 1,008,400 Million |

The electronic manufacturing services (EMS) market is led by top players such as Foxconn (Hon Hai Precision Industry Co., Ltd.), Wistron Corporation, Compal Electronics, Inc., Flex Ltd., Quanta Computer Inc., Jabil Inc., Pegatron Corporation, Celestica Inc., Sanmina Corporation, and Benchmark Electronics, Inc. These companies dominate with large-scale production, advanced engineering, and global supply chain capabilities, serving industries from consumer electronics to automotive and aerospace. Regionally, Asia Pacific led the EMS market in 2024 with 46% share, driven by strong manufacturing bases in China, Taiwan, and India. North America followed with 27% share, supported by advanced design services and high-value electronics demand, while Europe accounted for 20%, Latin America 4%, and the Middle East & Africa together held 3%, reflecting growing but smaller contributions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The electronic manufacturing services (EMS) market was valued at USD 69764.5 million in 2024 and is projected to reach USD 1008400 million by 2032, expanding at a CAGR of 6.49%.

- Rising demand for consumer electronics and computing devices drives EMS adoption, with consumer electronics holding 40% share in 2024 due to mass production needs.

- Trends such as miniaturization, IoT-enabled devices, and automation in testing and development strengthen growth opportunities across diverse industries including automotive and aerospace.

- Key players including Foxconn, Flex, Quanta, Wistron, and Jabil dominate competition through large-scale manufacturing, design services, and global supply chains, ensuring wide market reach.

- Regionally, Asia Pacific led with 46% share in 2024 due to strong manufacturing hubs in China and Taiwan, followed by North America at 27%, Europe at 20%, Latin America at 4%, and the Middle East & Africa holding 3%, reflecting widespread but uneven global adoption.

Market Segmentation Analysis:

By Product

The electronic manufacturing segment dominated the EMS market in 2024, holding 52% of the total share. Its leadership is driven by rising demand for outsourced manufacturing across consumer electronics, automotive, and telecom industries. Companies increasingly rely on EMS providers for cost efficiency, scalability, and advanced production capabilities, reducing in-house complexities. Engineering services accounted for 18% share, supporting product design and prototyping, while test and development implementation captured 16% share, ensuring quality and compliance. Logistics services held 14% share, playing a critical role in supply chain optimization and timely product delivery.

- For instance, Jabil Inc. operates over 100 manufacturing sites worldwide, acquired Intel’s silicon photonics optical modules business in late 2023, and announced a multi-year $500 million investment in 2025 to expand its U.S. manufacturing footprint for cloud and AI infrastructure.

By Application

Consumer electronics led the EMS market in 2024, contributing 38% of the application share, supported by mass production of smartphones, wearables, and smart home devices. The segment benefits from shorter product life cycles and high global demand for connected devices. Computers followed with 25% share, fueled by the need for laptops, servers, and data storage systems. Aerospace and defense accounted for 20% share, emphasizing precision manufacturing and compliance standards, while the “others” segment, including automotive and healthcare electronics, represented 17% share, reflecting growing adoption of EMS in diverse industries.

- For instance, Sanmina Corporation delivered mission-critical defense electronics across 20+ certified U.S. facilities, enabling aerospace customers to meet MIL-STD compliance with high precision systems integration.

Key Growth Drivers

Rising Demand for Consumer Electronics

The EMS market is driven by the growing demand for smartphones, tablets, wearables, and smart home devices. With shorter product lifecycles and frequent technology upgrades, OEMs increasingly outsource manufacturing to EMS providers for speed and efficiency. Consumer electronics accounted for 38% share in 2024, highlighting its dominance. EMS companies provide cost optimization, scalability, and advanced assembly capabilities that meet high-volume requirements. The global appetite for connected and IoT-enabled devices ensures sustained demand, making consumer electronics a critical driver for EMS market growth.

- For instance, Foxconn’s Zhengzhou iPhone City employs up to 200,000 workers during peak production season and assembles a large portion of the world’s iPhones annually, significantly supporting Apple’s global smartphone demand.

Expansion of Automotive Electronics

Automotive electrification and the rise of advanced driver-assistance systems (ADAS) are fueling EMS adoption. Automakers depend on EMS providers for electronic control units, battery management systems, and infotainment solutions. EMS providers offer quality assurance, miniaturization, and global supply chain expertise, reducing costs for OEMs. The integration of EV-specific components and autonomous driving technologies further drives this trend. As automotive electronics become more complex, EMS companies play a pivotal role in scaling production while ensuring compliance, reliability, and innovation across the industry.

- For instance, Flex Ltd. is an established automotive supplier that offers advanced product design and manufacturing solutions for global carmakers, with its products featured on hundreds of vehicle platforms worldwide. The company provides manufacturing-ready platforms that support ADAS and other advanced mobility solutions.

Focus on Cost Efficiency and Outsourcing

OEMs across industries outsource to EMS providers to optimize costs, reduce capital investment, and streamline operations. EMS partners deliver economies of scale, access to global supply chains, and advanced facilities that minimize time-to-market. With labor costs rising in developed countries, outsourcing to EMS providers in Asia-Pacific has become a standard practice. This model allows OEMs to focus on R&D and branding while delegating high-volume, precision manufacturing to EMS specialists. The emphasis on lean operations and efficiency makes outsourcing a central driver of market expansion.

Key Trends and Opportunities

Adoption of Industry 4.0 in EMS

Industry 4.0 technologies such as IoT, robotics, and automation are reshaping EMS operations. Smart factories with predictive analytics and AI-driven monitoring improve efficiency, reduce downtime, and enhance quality. EMS providers integrating advanced technologies offer faster, more reliable, and scalable solutions for OEMs. The demand for intelligent manufacturing also aligns with sustainability goals, as automation reduces waste and energy use. As more enterprises adopt digital transformation, Industry 4.0 integration creates significant growth opportunities for EMS providers to deliver value-added, technology-driven services.

- For instance, Wistron integrated Industrial Internet of Things (IIoT) under Industry 4.0 in plants such as its Kunshan facility, enabling AI-powered insights, flexible automation, and real-time monitoring of operations. In doing so, it enhanced productivity and reduced costs.

Growing Role in Aerospace and Defense

The aerospace and defense sector accounted for 20% share in 2024, providing EMS providers with long-term growth potential. These industries demand precision manufacturing, regulatory compliance, and advanced testing capabilities. EMS companies play a vital role in delivering high-reliability components, avionics, and defense electronics. With rising global defense budgets and increasing demand for aircraft, EMS providers offering design support, secure supply chains, and strict quality assurance will gain competitive advantage. The trend highlights opportunities for EMS providers to expand beyond consumer markets into mission-critical applications.

- For instance, Celestica provides high-reliability defense electronics to more than 25 global aerospace customers, including production of secure communication modules and satellite payload components with precise testing capabilities.

Key Challenges

Supply Chain Disruptions

Global EMS operations are highly vulnerable to supply chain disruptions caused by geopolitical tensions, component shortages, and logistical bottlenecks. Events such as semiconductor shortages have already delayed production timelines and increased costs for OEMs. As EMS providers rely heavily on just-in-time inventory models, disruptions can severely affect margins and delivery schedules. Ensuring resilience through diversification, nearshoring, and digital supply chain visibility remains a pressing challenge for the industry. Without robust strategies, disruptions may hinder the ability of EMS providers to meet growing demand.

Intense Market Competition

The EMS market faces strong competition with multiple global and regional players offering similar services at competitive prices. Price pressures often reduce profit margins, forcing providers to differentiate through innovation, scale, or vertical specialization. Smaller EMS providers struggle to compete with larger players that benefit from economies of scale and global reach. Additionally, OEMs often switch between EMS partners based on pricing and capacity, making long-term contracts harder to secure. Sustaining competitiveness in such an environment requires continuous investment in technology, efficiency, and customer-centric solutions.

Regional Analysis

North America

North America held 32% share of the EMS market in 2024, driven by strong demand from aerospace, defense, and healthcare industries. The region benefits from advanced manufacturing infrastructure, high R&D investments, and strong presence of global OEMs. The U.S. leads with increasing adoption of EMS for consumer electronics and automotive applications, supported by the rise of electric vehicles. Regulatory compliance and quality standards also boost outsourcing to EMS providers. The emphasis on reshoring and supply chain resilience creates further opportunities, making North America a mature but steadily growing EMS market.

Europe

Europe accounted for 28% share of the EMS market in 2024, supported by its advanced automotive and industrial electronics sectors. Countries like Germany, France, and the United Kingdom drive demand with strong manufacturing bases and growing investment in electric mobility. EMS adoption is also fueled by strict quality standards and regulatory compliance across industries such as healthcare and aerospace. The region’s emphasis on sustainability and green manufacturing is shaping EMS operations with energy-efficient practices. Continued demand for high-value, precision electronics ensures that Europe remains a key hub for EMS growth.

Asia Pacific

Asia Pacific dominated the EMS market with 34% share in 2024, making it the largest regional contributor. China, India, Japan, and South Korea drive this dominance through large-scale consumer electronics production, cost-effective labor, and advanced supply chain networks. The region is also the global hub for semiconductor and PCB manufacturing, which supports EMS providers across industries. Rising adoption of electric vehicles and 5G technology further accelerates demand. With growing investments in smart manufacturing and digital technologies, Asia Pacific continues to lead the EMS market, offering scale, innovation, and affordability for global OEMs.

Latin America

Latin America represented 4% share of the EMS market in 2024, with Brazil and Mexico as the primary contributors. The region is gaining importance due to increasing electronics production and proximity to North American markets. Growth is supported by rising demand for consumer electronics, automotive components, and industrial electronics. EMS providers are expanding operations in Mexico due to favorable trade agreements and cost advantages. However, challenges such as economic instability and limited infrastructure affect large-scale adoption. Despite these hurdles, Latin America shows steady growth potential in EMS with increasing foreign investments.

Middle East and Africa

The Middle East and Africa together accounted for 2% share of the EMS market in 2024, reflecting early-stage adoption but growing opportunities. The United Arab Emirates and Saudi Arabia lead demand, driven by diversification efforts in aerospace, defense, and industrial electronics. In Africa, South Africa contributes to growth with increasing adoption in telecommunications and automotive sectors. Limited manufacturing infrastructure remains a challenge, but government-led digitalization programs and investments in industrial development are supporting EMS expansion. As enterprises modernize operations, the region is expected to register steady growth in the EMS market over the forecast period.

Market Segmentations:

By Product

- Electronic manufacturing

- Engineering services

- Test & development implementation

- Logistics services

By Application

- Computer

- Consumer electronics

- Aerospace & defense

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the electronic manufacturing services (EMS) market is shaped by leading players including Wistron Corporation, Compal Electronics, Inc., Foxconn (Hon Hai Precision Industry Co., Ltd.), Flex Ltd., Quanta Computer Inc., Jabil Inc., Celestica Inc., Sanmina Corporation, Pegatron Corporation, and Benchmark Electronics, Inc. These companies dominate the market by offering large-scale production capabilities, advanced engineering expertise, and global supply chain management. Foxconn and Quanta lead in consumer electronics and computer assembly, while Flex and Jabil focus on diversified sectors including healthcare, automotive, and industrial electronics. Celestica, Pegatron, and Sanmina emphasize precision manufacturing, logistics, and system integration to support high-demand industries. Increasing demand for outsourcing, rapid innovation cycles, and cost efficiency continue to drive competition. Key players invest in automation, robotics, and digital manufacturing platforms to enhance productivity and reduce turnaround times. Their strategies revolve around expanding global footprints, maintaining scalability, and delivering end-to-end solutions to meet evolving OEM requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Wistron Corporation

- Compal Electronics, Inc.

- Foxconn (Hon Hai Precision Industry Co., Ltd.)

- Flex Ltd.

- Quanta Computer Inc.

- Jabil Inc.

- Celestica Inc.

- Sanmina Corporation

- Pegatron Corporation

- Benchmark Electronics, Inc.

Recent Developments

- In August 2025, Foxconn (Hon Hai) adopted NVIDIA RTX PRO servers to accelerate GenAI and smart manufacturing systems.

- In July 2025, Foxconn and TECO formed a strategic alliance targeting AI data center capabilities and modular architectures.

- In February 2025, Flex Ltd. expanded its U.S. manufacturing footprint via a new 400,000 sq ft facility in Dallas to support power-product demand.

- In January 2024, Tata Electronics Private Limited acquired Wistron Infocomm Manufacturing (India) by acquiring 100% stake of the company marking a momentous milestone in the Indian electronics manufacturing.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The EMS market will expand with rising demand for consumer electronics and connected devices.

- Asia Pacific will maintain dominance as global manufacturing hubs continue scaling production capacity.

- Adoption of automation and robotics will enhance efficiency and reduce production errors.

- Demand from automotive electronics and EV components will significantly boost EMS growth.

- Cloud integration and IoT-enabled devices will increase the need for advanced EMS solutions.

- Large players will expand through vertical integration and global supply chain optimization.

- Miniaturization of electronic components will create new opportunities in high-tech assembly.

- Aerospace and defense demand will grow with rising investments in advanced electronics.

- Sustainability practices and green manufacturing will gain importance across EMS providers.

- Strategic partnerships and acquisitions will reshape competition and expand global presence.