Market Overview

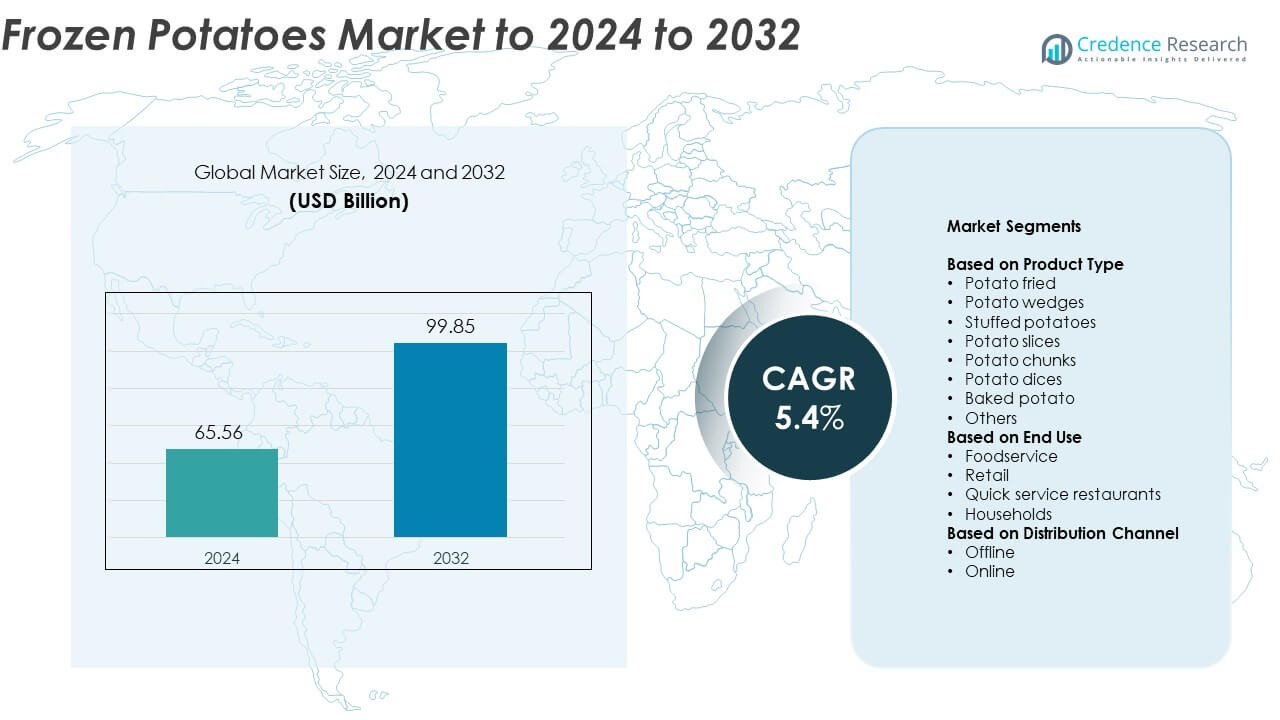

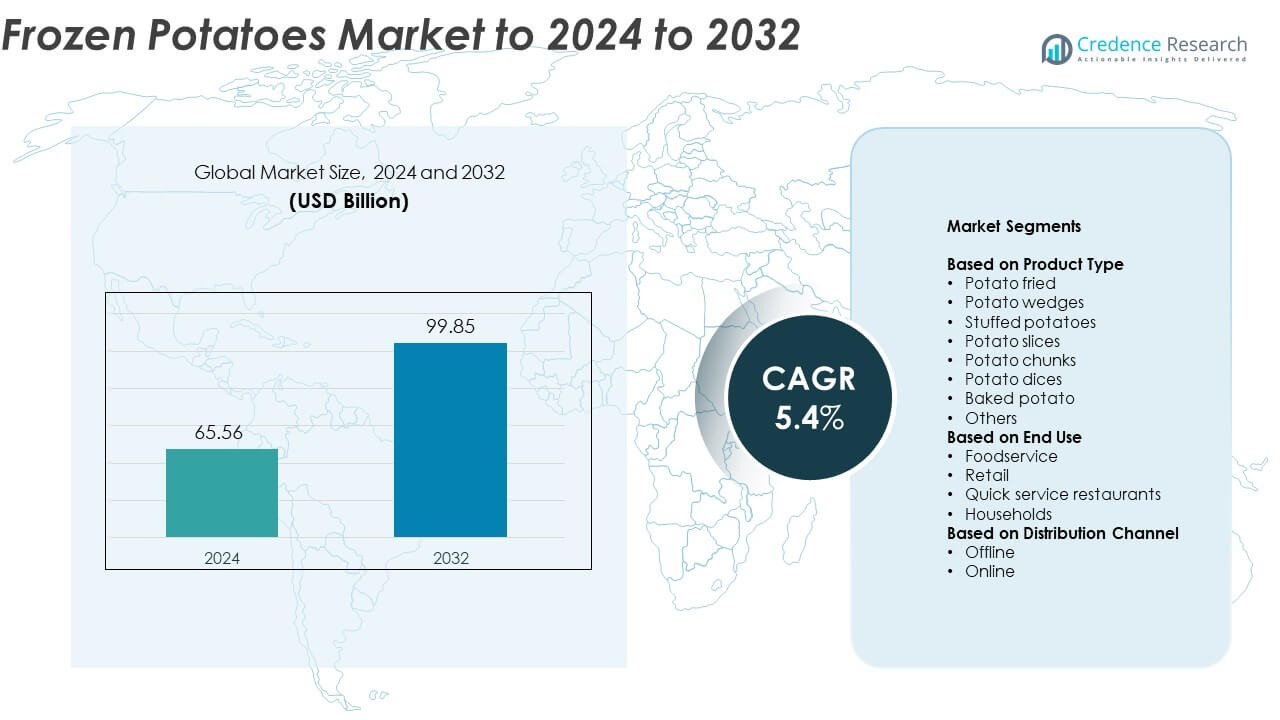

Frozen Potatoes market size was valued at USD 65.56 Billion in 2024 and is anticipated to reach USD 99.85 Billion by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Frozen Potatoes market Size 2024 |

USD 65.56 Billion |

| Frozen Potatoes market , CAGR |

5.4% |

| Frozen Potatoes market Size 2032 |

USD 99.85 Billion |

The frozen potatoes market is led by key players such as Aviko, Lamb Weston, McCain Foods, Farm Frites, and J. R. Simplot Company. These companies dominate through extensive global distribution networks, product innovation, and strategic collaborations with foodservice chains. Their focus on advanced freezing technology and sustainable production practices strengthens their market presence. North America leads the global market with around 37.2% share in 2024, supported by strong fast-food culture and robust cold-chain infrastructure. Europe follows with 29.6% share, driven by established processing facilities and export capacity, while Asia Pacific emerges as the fastest-growing region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The frozen potatoes market was valued at USD 65.56 Billion in 2024 and is projected to reach USD 99.85 Billion by 2032, expanding at a CAGR of 5.4%.

- Rising demand for convenience and ready-to-cook foods continues to drive market growth, supported by urbanization and the rapid expansion of quick service restaurants worldwide.

- Emerging trends include increasing consumer preference for healthier frozen potato variants such as low-fat, air-fried, and organic options, along with innovation in sustainable packaging.

- The competitive landscape is dominated by major players focusing on product diversification, technological advancements, and strategic partnerships to strengthen global reach.

- North America leads the market with 37.2% share, followed by Europe with 29.6%, while Asia Pacific remains the fastest-growing region; among product types, potato fries hold a dominant 42.7% share due to high demand from fast-food and foodservice segments.

Market Segmentation Analysis:

By Product Type

Potato fries dominate the frozen potatoes market with around 42.7% share in 2024. Their popularity stems from their extensive use across quick service restaurants and fast-food chains globally. Fries are preferred for their long shelf life, consistent taste, and ease of preparation. Rising demand for ready-to-cook snacks and increased consumption of Western-style foods in emerging economies further strengthen their market presence. Meanwhile, segments like potato wedges and baked potatoes are gaining attention due to growing consumer preference for varied textures and healthier oven-baked alternatives.

- For instance, McCain purchases approximately 6.6 million tonnes of potatoes annually according to some sources, while others, including a recent 2024 report, mention nearly 6.8 million tonnes of potatoes harvested every year.

By End Use

The foodservice segment leads the frozen potatoes market, accounting for nearly 51.8% share in 2024. Growth is fueled by the expansion of quick service restaurants and fast-casual dining formats worldwide. The sector benefits from the convenience, storage stability, and quick preparation time of frozen potato products, which help maintain operational efficiency. Rising urbanization and increasing consumption of fried and baked snacks in cafes and hotels further support segment dominance. Meanwhile, the retail sector continues to grow with rising adoption of frozen ready-to-eat foods among households.

- For instance, McDonald’s operated 43,477 restaurants at year-end 2024, underscoring huge fry throughput in foodservice.

By Distribution Channel

Offline channels hold the largest share of about 68.4% in 2024, driven by widespread availability across supermarkets, hypermarkets, and specialty food stores. Consumers continue to prefer in-store purchases due to immediate product access and variety in pack sizes. Retail chains frequently run promotional offers that boost sales of frozen food items, including potato-based snacks. However, the online distribution channel is expanding rapidly as e-commerce platforms enhance cold-chain logistics and offer doorstep delivery of frozen foods, attracting tech-savvy consumers seeking convenience and time efficiency.

Key Growth Drivers

Rising Demand for Convenience Foods

Increasing urbanization and changing lifestyles are driving higher consumption of ready-to-eat meals. Frozen potatoes offer easy preparation, longer shelf life, and consistent taste, making them ideal for busy consumers. Quick service restaurants and fast-food chains rely heavily on frozen potato products to meet high-volume demand, ensuring operational efficiency. The convenience factor continues to fuel adoption in both developed and emerging economies, where dual-income households prefer time-saving meal solutions.

- For instance, Nomad Foods reports over 8 million European households enjoy its frozen foods daily.

Expansion of Quick Service Restaurants

Global growth in quick service restaurants is a major driver of frozen potato demand. Major chains increasingly depend on standardized frozen products to maintain taste and quality across locations. This trend has expanded beyond Western regions into Asia Pacific and Latin America. Franchises and local outlets continue investing in advanced cold storage and logistics infrastructure, supporting consistent product availability. Rising preference for Western-style fried snacks further accelerates sales growth within this segment.

- For instance, Yum! Brands operated over 61,000 restaurants in more than 155 countries and territories at year-end 2024, underscoring huge fry throughput in foodservice.

Technological Advancements in Processing and Preservation

Innovation in freezing and packaging technologies is improving product texture and flavor retention. Advanced techniques like individual quick freezing (IQF) and vacuum packaging help maintain freshness and reduce waste. Manufacturers are adopting automation and energy-efficient refrigeration systems to enhance quality and sustainability. These improvements also enable expansion of export opportunities by extending shelf life and ensuring product consistency across international markets.

Key Trends & Opportunities

Shift Toward Healthier Product Variants

Growing health awareness among consumers is prompting manufacturers to develop low-fat, air-fried, and organic frozen potato options. Brands are experimenting with plant-based coatings and reduced sodium formulations. Demand for oven-baked and non-fried products is also rising, aligning with the global push toward healthier eating. This trend opens opportunities for new product launches targeting fitness-conscious and young urban demographics.

- For instance, Aunt Bessie’s Crispy & Fluffy Homestyle Chips list 3.6 g of fat per 100 g as sold or 4.5 g of fat per portion when oven-baked on the websites of major UK retailers like Tesco and Sainsbury’s.

Expansion in Emerging Economies

Rapid retail expansion and changing dietary habits in Asia Pacific, the Middle East, and Africa present strong growth potential. Modern cold chain facilities and rising disposable incomes are increasing the accessibility of frozen potato products. Multinational brands are partnering with local distributors to strengthen regional supply networks. The growing influence of Western dining culture further accelerates market penetration across these developing regions.

- For instance, Farm Frites’ Egypt site installed capacity above 150,000 tons per year to serve MENA demand.

Key Challenges

Fluctuating Raw Material Prices

Volatility in potato prices due to unpredictable weather patterns and crop yields affects production costs. Farmers and manufacturers face challenges maintaining consistent supply, leading to price instability in the value chain. High energy costs for freezing and storage further strain profitability. Companies are focusing on long-term supplier contracts and improved sourcing strategies to reduce the impact of price fluctuations.

Supply Chain and Storage Constraints

Efficient cold chain logistics remain a key challenge, especially in developing markets. Inadequate storage infrastructure and temperature control issues can lead to quality degradation and wastage. Transportation delays also disrupt supply to foodservice and retail outlets. Investments in modern refrigeration, distribution systems, and advanced monitoring solutions are essential to overcome these operational barriers and sustain consistent product quality.

Regional Analysis

North America

North America dominates the frozen potatoes market with around 37.2% share in 2024. The region’s leadership is driven by the widespread presence of fast-food chains and high consumption of processed snacks. The United States remains the key market, supported by strong cold-chain infrastructure and high per capita consumption of frozen fries. Rising preference for convenient meal options among working populations further supports growth. Canada also contributes significantly through increasing retail penetration and demand for healthier frozen potato variants with reduced oil and sodium content.

Europe

Europe holds about 29.6% share of the global frozen potatoes market in 2024. Countries like Germany, the U.K., Belgium, and the Netherlands serve as major production hubs due to advanced processing facilities and large-scale potato farming. The growing popularity of frozen fries and wedges across restaurants and retail stores boosts demand. Sustainable sourcing and organic frozen potato products are gaining attention as consumers prioritize health and eco-friendly food choices. The expansion of export networks from European producers also strengthens the region’s global supply position.

Asia Pacific

Asia Pacific accounts for nearly 22.4% share of the frozen potatoes market in 2024 and is the fastest-growing region. Rapid urbanization, rising disposable incomes, and increasing Western food influence are key growth enablers. The expansion of fast-food chains in China, India, Japan, and South Korea drives large-scale product adoption. Improving cold storage infrastructure and e-commerce distribution channels are making frozen potato products more accessible to households. Regional players are also investing in capacity expansion to meet domestic and export demand efficiently.

Latin America

Latin America captures about 6.4% share of the global frozen potatoes market in 2024. Brazil, Mexico, and Argentina lead regional consumption, supported by growing demand for convenient snack foods and restaurant expansion. Rising import of frozen potato products from Europe and North America caters to local fast-food industries. Improved logistics and storage systems enhance market efficiency, while growing supermarket penetration strengthens retail sales. Manufacturers are introducing locally adapted product variations to align with regional taste preferences and consumption patterns.

Middle East & Africa

The Middle East & Africa represent approximately 4.4% share of the frozen potatoes market in 2024. Rising urban populations and the spread of quick service restaurants across the UAE, Saudi Arabia, and South Africa drive regional demand. Dependence on imports remains high due to limited domestic potato processing. However, increasing investments in cold-chain networks and food retail infrastructure are improving accessibility. Changing lifestyles and expanding tourism sectors are also boosting consumption of frozen fries and other ready-to-cook potato products across the region.

Market Segmentations:

By Product Type

- Potato fried

- Potato wedges

- Stuffed potatoes

- Potato slices

- Potato chunks

- Potato dices

- Baked potato

- Others

By End Use

- Foodservice

- Retail

- Quick service restaurants

- Households

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Aviko, Lamb Weston, McCain Foods, Farm Frites, and J. R. Simplot Company are the prominent players shaping the competitive landscape of the frozen potatoes market. The market is characterized by strong competition, with companies focusing on product innovation, capacity expansion, and improved supply chain efficiency to strengthen global presence. Many producers are investing in advanced freezing technologies to retain nutritional value and enhance texture. Strategic mergers and acquisitions are common as brands seek to expand distribution networks and enter emerging markets. Growing emphasis on sustainability, including eco-friendly packaging and responsible sourcing, is influencing brand positioning. Additionally, partnerships with quick service restaurants and food retailers continue to drive consistent demand, ensuring stable long-term growth across both developed and developing regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, McCain Foods UK introduced an innovative potato snack combining the crispiness of a chip and fluffiness of a fry, launched exclusively in Iceland, with plans for wider release in UK retailers like Tesco and Sainsbury’s by March 2025.

- In 2025, J.R. Simplot announced plans to acquire Belgian potato processor Clarebout Potatoes. This strategic move expands Simplot’s global frozen potato supply footprint and consolidates processing operations with complementary assets across 23 locations worldwide.

- In September 2023, Lamb Weston acquired the Australian food manufacturer Crackerjack Foods.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-Use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for frozen potatoes will continue to rise with growing quick service restaurant expansion.

- Health-oriented product innovations such as low-fat and organic variants will gain strong traction.

- Technological advancements in freezing and packaging will improve product quality and shelf life.

- Expansion of retail and e-commerce platforms will enhance product accessibility across all regions.

- Asia Pacific will emerge as the fastest-growing regional market during the forecast period.

- Manufacturers will invest in automation and energy-efficient processing to optimize production costs.

- Strategic partnerships with local distributors will strengthen market penetration in emerging economies.

- Sustainable sourcing and eco-friendly packaging solutions will become a key industry focus.

- Rising global snack culture will drive steady demand for frozen fries and wedges.

- Enhanced cold-chain infrastructure will support consistent product delivery and quality preservation.