| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Invisible Orthodontics Market Size 2024 |

USD 6,554.51 million |

| Invisible Orthodontics Market, CAGR |

27.46% |

| Invisible Orthodontics Market Size 2032 |

USD 45,480.41 million |

Market Overview

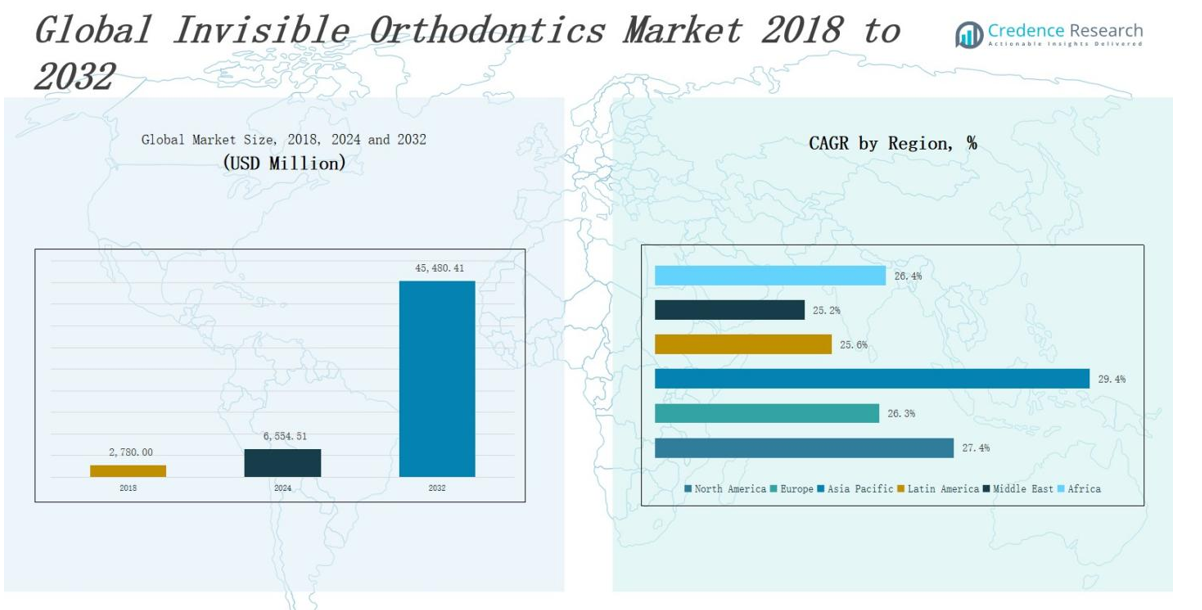

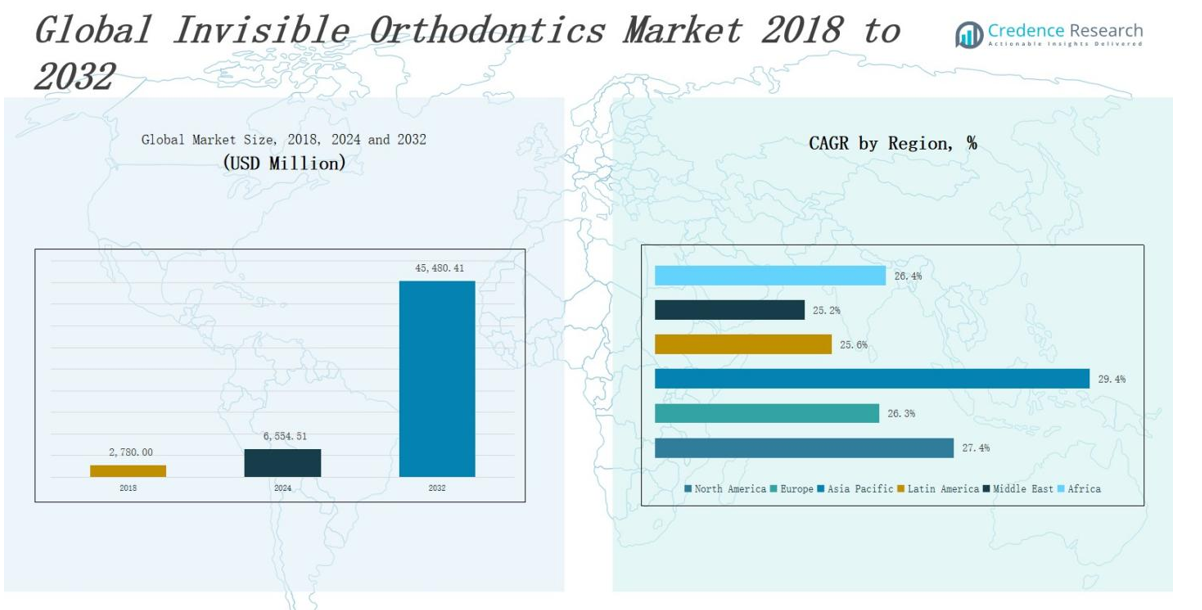

The Invisible Orthodontics Market size was valued at USD 2,780.00million in 2018 to USD 6,554.51 million in 2024 and is anticipated to reach USD 45,480.41 million by 2032, at a CAGR of 27.46 % during the forecast period.

The Invisible Orthodontics Market is experiencing strong growth driven by rising demand for aesthetically appealing and non-invasive dental correction solutions. Increasing awareness about oral health, especially among younger and adult populations, has accelerated the adoption of clear aligners and transparent braces. The growing preference for removable, comfortable, and virtually invisible orthodontic devices is reshaping the treatment landscape. Technological advancements such as AI-based treatment planning, 3D printing, and digital scanning are enhancing precision and personalization in orthodontic care, further fueling market expansion. The surge in tele-dentistry and direct-to-consumer models is also making invisible orthodontic solutions more accessible and affordable. Additionally, the increase in disposable incomes, coupled with a higher focus on appearance across social and professional spheres, is influencing treatment choices. Dental service providers and manufacturers are investing in marketing campaigns and product innovations to capture a broader consumer base. These trends collectively support the rapid and sustained growth of the invisible orthodontics market across global regions.

The Invisible Orthodontics Market demonstrates robust growth across all major regions, including North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. North America leads with the highest market share due to strong infrastructure and early technology adoption. Europe follows, driven by demand for adult orthodontics and aesthetic solutions. Asia Pacific exhibits the fastest growth, fueled by a rising middle class and expanding dental access. Latin America and the Middle East show steady uptake supported by urbanization and cosmetic dentistry trends, while Africa presents emerging opportunities amid improving healthcare access. Key players shaping the market include Align Technology, SmileDirectClub, Dentsply Sirona, Institut Straumann AG, 3M, Henry Schein, Angel Aligner, SmarTee, ClearPath Healthcare, SCHEU DENTAL, and Ormco (Envista). These companies focus on innovation, global expansion, and digital orthodontics to maintain competitive advantage across diverse geographies.

Market Insights

- The Invisible Orthodontics Market was valued at USD 2,780.00 million in 2018, reached USD 6,554.51 million in 2024, and is projected to hit USD 45,480.41 million by 2032, growing at a CAGR of 27.46%.

- Rising preference for aesthetically appealing, removable, and comfortable dental correction solutions is driving demand across both teens and adults.

- Advancements in AI-driven treatment planning, 3D printing, and digital scanning are enhancing customization and clinical precision.

- Tele-dentistry and direct-to-consumer aligner services are expanding access and affordability, especially in underserved markets.

- North America holds the largest market share, while Asia Pacific shows the fastest growth due to rising dental awareness and middle-class expansion.

- High treatment costs and limited insurance coverage pose affordability challenges, particularly in emerging economies.

- Key players like Align Technology, SmileDirectClub, Dentsply Sirona, Institut Straumann AG, 3M, and ClearPath Healthcare are driving innovation and global expansion strategies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Aesthetic and Comfortable Orthodontic Solutions

The Invisible Orthodontics Market is driven by the growing consumer demand for discreet and comfortable alternatives to traditional metal braces. Patients increasingly prefer clear aligners and invisible braces due to their minimal visual impact and improved comfort. This trend is especially prominent among image-conscious adults and working professionals who seek subtle correction without lifestyle disruption. It appeals to patients desiring removable devices that simplify eating, brushing, and flossing. The aesthetic benefits have become a major factor influencing treatment choices, fueling product adoption across urban and suburban populations. With improved awareness and marketing, invisible orthodontics continues to gain momentum globally.

- For instance, 3M Oral Care launched the Clarity Aligners Flex + Force system in July 2021, offering advanced digital treatment design through its 3M oral care portal to enhance patient comfort and treatment precision.

Technological Advancements in Digital Dentistry and 3D Printing

Rapid advancements in digital orthodontics and 3D printing technologies are transforming the Invisible Orthodontics Market. These innovations allow for the customization of aligners using intraoral scans and computer-aided design, improving treatment precision and patient outcomes. Companies now offer faster turnaround times, more accurate fittings, and better user experiences due to automated workflows and cloud-based planning platforms. AI-driven tools assist orthodontists in designing predictable and personalized treatment plans. Digital tools also enable real-time progress monitoring, allowing adjustments without frequent in-person visits. These capabilities reduce chair time for clinicians and make treatments more scalable and patient-friendly.

- For instance, Shining 3D launched the Aoralscan Elite wireless scanner and AccuFab F1 printer in 2025, enabling faster, more precise digital impressions and same-day dental appliances.

Growing Prevalence of Malocclusion and Orthodontic Disorders

An increasing number of individuals are seeking treatment for malocclusion, crowding, overbite, and spacing issues, which is expanding the patient pool in the Invisible Orthodontics Market. Poor oral habits, genetic factors, and changing dietary patterns have contributed to a higher incidence of orthodontic problems. Pediatric and adult populations alike are being diagnosed earlier, thanks to enhanced dental screening programs and greater clinical awareness. With more people requiring correction, demand for efficient and less invasive treatments has risen. Clear aligners provide a non-surgical, pain-minimizing solution with proven efficacy. The rising prevalence of orthodontic conditions strengthens market potential globally.

Expansion of Direct-to-Consumer and Teleorthodontic Platforms

The emergence of direct-to-consumer brands and teleorthodontic services is reshaping the distribution landscape of the Invisible Orthodontics Market. These models offer home impression kits, remote consultations, and virtual monitoring, enabling cost-effective access to orthodontic care. Consumers benefit from greater convenience and affordability, while companies scale operations without heavy reliance on in-office visits. Strategic investments in e-commerce platforms and mobile applications have improved customer engagement and retention. These developments are particularly relevant in underpenetrated markets and regions with limited specialist availability. By reducing geographic and cost barriers, teleorthodontics is broadening the reach of invisible orthodontic solutions.

Market Trends

Growing Adoption Among Adults and Working Professionals

The Invisible Orthodontics Market is witnessing a significant rise in adoption among adults and working professionals who prioritize aesthetics and comfort. Patients in their 30s to 50s are increasingly opting for clear aligners to improve dental alignment without the visibility of metal braces. This demographic values discreet solutions that do not interfere with social or professional interactions. Greater financial independence, higher awareness, and flexible financing options are encouraging adults to pursue delayed orthodontic treatment. Dental professionals also report a rise in consultations from this age group. The market continues to evolve with more adult-centric designs and marketing strategies.

- For instance, Candid Co. introduced a line of aligners specifically marketed to working professionals, which saw a 30% rise in sales within its first year of launch, reflecting the market’s shift toward adult-centric solutions.

Integration of Artificial Intelligence and Digital Workflow

AI and digital workflow integration is transforming the design, customization, and monitoring processes in the Invisible Orthodontics Market. Orthodontists use AI algorithms to simulate tooth movement, predict outcomes, and improve accuracy in treatment planning. Digital workflows streamline data capture, aligner manufacturing, and patient progress tracking through cloud-based platforms. This enhances both clinical efficiency and user experience. Remote monitoring tools and smart wearables are being integrated to track compliance and treatment response. Clinics leveraging digital technologies gain competitive advantages through speed, precision, and patient satisfaction. These innovations are setting new standards in modern orthodontics.

- For instance, AI-powered platforms like Diagnocat use advanced algorithms to analyze extensive historical orthodontic data, allowing orthodontists to predict tooth movement with remarkable accuracy and continuously adapt aligner designs based on real-time patient progress.

Expansion of Direct-to-Consumer and E-commerce Channels

The Invisible Orthodontics Market is seeing rapid growth in direct-to-consumer models and online sales platforms. Brands are offering home impression kits, remote consultations, and subscription-based aligner delivery, eliminating the need for multiple clinic visits. E-commerce and digital marketing strategies target tech-savvy consumers who value convenience, affordability, and privacy. Startups and established players are investing in user-friendly mobile apps and digital interfaces for treatment tracking and communication. This shift is expanding access across urban and rural regions alike. Online channels are reshaping consumer behavior and redefining the orthodontic patient journey.

Sustainable Materials and Eco-conscious Manufacturing Practices

There is a growing emphasis on sustainability in the Invisible Orthodontics Market, with manufacturers adopting eco-friendly materials and practices. Consumers are more aware of the environmental impact of medical products and prefer aligners made from recyclable or biodegradable materials. Companies are responding by developing BPA-free, non-toxic, and sustainably sourced plastics. Some are also adopting energy-efficient production methods and minimal packaging designs. These initiatives align with broader global sustainability goals and appeal to environmentally conscious customers. Sustainability is becoming a differentiator in branding and customer retention. It plays a growing role in product innovation and procurement strategies.

Market Challenges Analysis

High Cost of Treatment and Limited Insurance Coverage

The Invisible Orthodontics Market faces a significant barrier in the form of high treatment costs and limited reimbursement through dental insurance. Clear aligners and invisible braces often require substantial out-of-pocket expenses, making them inaccessible to a large portion of the population. Many insurance plans either exclude orthodontic treatment or offer only partial coverage, restricting patient affordability. This pricing challenge disproportionately affects middle- and low-income demographics, slowing market penetration. Despite rising demand, cost sensitivity continues to limit uptake, particularly in emerging markets. Manufacturers and service providers must address this issue through flexible payment options and affordable product lines.

Clinical Limitations and Need for Professional Supervision

The Invisible Orthodontics Market also encounters challenges related to clinical limitations in complex cases. Clear aligners are highly effective for mild to moderate misalignments but may not offer optimal results for severe malocclusion or jaw-related issues. In such cases, traditional braces or surgical intervention may still be necessary. The expansion of direct-to-consumer models without professional oversight raises concerns about improper diagnosis, treatment planning, and outcomes. Regulatory bodies are increasing scrutiny to ensure clinical safety and efficacy. These concerns could affect consumer confidence and restrict market growth if not addressed responsibly.

Market Opportunities

Rising Demand in Emerging Economies and Untapped Markets

The Invisible Orthodontics Market has strong growth potential in emerging economies where urbanization, disposable income, and healthcare access are improving. Countries in Asia-Pacific, Latin America, and the Middle East show rising awareness of dental aesthetics and preventive care. A growing middle class in these regions is willing to invest in advanced orthodontic treatments. Market players have an opportunity to expand distribution, build local partnerships, and customize pricing strategies. Government initiatives to improve oral health infrastructure further support adoption. Expanding into these underpenetrated regions could significantly boost global revenue share.

Innovation in Personalized and Hybrid Orthodontic Solutions

Product innovation presents another key opportunity for the Invisible Orthodontics Market, particularly in the area of personalized and hybrid solutions. Combining clear aligners with AI-driven treatment plans, sensors for wear tracking, and teleorthodontic services can elevate patient experience. Advances in material science also allow for more comfortable, durable, and sustainable aligners. Companies that invest in R&D and user-centric technologies can differentiate themselves in a competitive landscape. Hybrid treatment models involving in-office visits and remote management can appeal to both providers and consumers. These innovations open new avenues for scaling and long-term market leadership.

Market Segmentation Analysis:

By Product

The Invisible Orthodontics Market is segmented into clear aligners, ceramic braces, and lingual braces. Clear aligners dominate the segment due to their aesthetic appeal, removability, and growing adoption among tech-savvy and image-conscious consumers. Ceramic braces offer a less noticeable alternative to metal braces and are often preferred by patients requiring more complex corrections. Lingual braces, positioned behind the teeth, appeal to users seeking complete invisibility, although higher costs and longer adjustment periods limit broader use. The market continues to evolve with innovations focused on material comfort and treatment precision.

- For instance, Invisalign by Align Technology has treated over 17 million patients worldwide as of 2024, highlighting its widespread adoption among image-conscious consumers.

By Age

The market sees strong participation from both teens and adults, though adults represent the faster-growing demographic. Rising awareness of dental aesthetics and increasing affordability have led to greater adult uptake of invisible orthodontic solutions. Teens continue to form a key market segment due to early intervention programs and increasing parental willingness to invest in discreet treatment options. The Invisible Orthodontics Market benefits from expanding product designs tailored to age-specific dental needs.

- For instance, SureSmile aligners are designed to accommodate the unique needs of each age group: teenagers benefit from treatment plans that account for ongoing jaw growth, while adults often require more precise planning due to denser bone structure, sometimes resulting in longer treatment durations for similar alignment issues.

By End-Use

Hospitals, stand-alone practices, group practices, and others represent key end-use segments. Stand-alone practices lead the segment due to personalized treatment models and specialist availability. Group practices are gaining traction by offering integrated dental services under one roof. Hospitals play a vital role in serving patients with complex or multidisciplinary treatment requirements. The market also includes emerging retail-based and teleorthodontic models under the “others” category, which are expanding access in underserved regions. Each end-use setting contributes to diversified demand across the orthodontic care landscape.

Segments:

Based on Product:

- Clear Aligners

- Ceramic Braces

- Lingual Braces

Based on Age:

Based on End-Use:

- Hospitals

- Stand Alone Practices

- Group Practices

- Others

Based on Dentist Type:

- General Dentists

- Orthodontists

Based on Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The North America Invisible Orthodontics Market size was valued at USD 1,515.66 million in 2018 to USD 3,544.64 million in 2024 and is anticipated to reach USD 24,540.78 million by 2032, at a CAGR of 27.4% during the forecast period. North America holds the largest market share, driven by strong consumer awareness, advanced dental infrastructure, and early adoption of digital orthodontics. The United States leads the region due to the presence of key market players, high per capita spending on dental care, and favorable reimbursement models. Increasing demand for aesthetic dental solutions and expansion of direct-to-consumer aligner brands support growth. Canada and Mexico also contribute steadily, with rising investments in orthodontic care and awareness initiatives. The Invisible Orthodontics Market in North America continues to benefit from innovation and patient-centric models.

Europe

The Europe Invisible Orthodontics Market size was valued at USD 571.57 million in 2018 to USD 1,280.57 million in 2024 and is anticipated to reach USD 8,247.99 million by 2032, at a CAGR of 26.3% during the forecast period. Europe maintains the second-largest share, led by countries such as Germany, France, the UK, and Italy. The region benefits from growing adoption of aesthetic dentistry, expanding dental tourism, and favorable regulatory standards. Orthodontists across Europe are integrating AI and digital imaging for treatment planning, improving clinical outcomes. Increasing awareness of oral health and higher disposable income fuel market expansion. The Invisible Orthodontics Market in Europe is strengthening through regional collaborations and rising demand for adult orthodontic care.

Asia Pacific

The Asia Pacific Invisible Orthodontics Market size was valued at USD 466.48 million in 2018 to USD 1,170.93 million in 2024 and is anticipated to reach USD 9,219.37 million by 2032, at a CAGR of 29.4% during the forecast period. Asia Pacific is the fastest-growing region, driven by a large population base, rising middle-class income, and increasing urbanization. Countries such as China, India, Japan, and South Korea are witnessing rapid uptake of clear aligners due to rising dental awareness and expanding private dental clinics. Local and global players are investing in digital dentistry infrastructure and offering cost-effective solutions. The Invisible Orthodontics Market in Asia Pacific benefits from strong demand among younger demographics and improving access to orthodontic services.

Latin America

The Latin America Invisible Orthodontics Market size was valued at USD 114.54 million in 2018 to USD 266.05 million in 2024 and is anticipated to reach USD 1,640.48 million by 2032, at a CAGR of 25.6% during the forecast period. Brazil, Mexico, and Argentina drive market activity due to growing interest in aesthetic enhancements and rising access to private dental care. Regional orthodontists are increasingly adopting clear aligners and hybrid treatment models to meet evolving patient preferences. Social media influence and celebrity endorsements are encouraging younger populations to seek invisible orthodontics. Economic improvements and better insurance penetration support market growth. The Invisible Orthodontics Market in Latin America presents opportunities for brand expansion and pricing innovation.

Middle East

The Middle East Invisible Orthodontics Market size was valued at USD 77.28 million in 2018 to USD 166.44 million in 2024 and is anticipated to reach USD 996.27 million by 2032, at a CAGR of 25.2% during the forecast period. Countries like the UAE, Saudi Arabia, and Israel are seeing a rise in demand for modern orthodontic treatments. A growing affluent population, dental tourism, and high awareness of cosmetic procedures contribute to market development. Clinics are investing in digital tools and offering premium aligner services. The Invisible Orthodontics Market in the Middle East benefits from increasing private healthcare investments and a focus on advanced dental aesthetics.

Africa

The Africa Invisible Orthodontics Market size was valued at USD 34.47 million in 2018 to USD 125.87 million in 2024 and is anticipated to reach USD 835.52 million by 2032, at a CAGR of 26.4% during the forecast period. Africa remains an emerging market with untapped potential, supported by urban growth, expanding dental care awareness, and improving healthcare infrastructure. South Africa and Egypt lead regional activity, offering orthodontic services in urban centers. Access to invisible orthodontics is improving through mobile dental units and public-private partnerships. The Invisible Orthodontics Market in Africa is gradually expanding as affordability and distribution improve across key nations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Angel Aligner

- SmarTee

- Dentsply Sirona

- Institut Straumann AG

- SCHEU DENTAL GmbH

- Ormco Corporation (Envista)

- Henry Schein, Inc.

- SmileDirectClub

- Align Technology, Inc.

- TP Orthodontics, Inc.

- K Line Europe GmbH

- 3M

- ClearPath Healthcare Services Pvt Ltd

- DB Orthodontics, Inc.

- G&H Orthodontics

- Orthodontics SDC

Competitive Analysis

The Invisible Orthodontics Market is highly competitive, with key players focusing on innovation, strategic partnerships, and geographic expansion to strengthen their market position. Companies like Align Technology, SmileDirectClub, Institut Straumann, and 3M lead the market through robust product portfolios and advanced digital platforms. It is witnessing increased competition from emerging regional players offering cost-effective and localized solutions. Manufacturers are investing in AI-driven treatment planning, sustainable materials, and direct-to-consumer delivery models to capture evolving patient preferences. Competitive pricing, brand differentiation, and clinical effectiveness remain core areas of focus. The market also sees consolidation through mergers and acquisitions aimed at enhancing technological capabilities and expanding customer reach. Players emphasizing clinician training, patient engagement, and integrated service delivery maintain a competitive edge in both developed and emerging regions.

Recent Developments

- In May 2025, Align Technology received regulatory approval in China for its Invisalign Palatal Expander System, with commercial availability expected in the second half of 2025.

- In March 2025, SmarTee introduced its Live Update feature on SmarteeCheck, enabling clinicians to adjust treatment plans in just 20 seconds using AI, dramatically accelerating workflow.

- In April 2025, Align Technology launched a new Invisalign clear aligner with integrated mandibular advancement, offering combined Class II correction and tooth alignment in a single solution.

- In June 2024, 3M (via Solventum) launched 3M Clarity™ Aligners in the UK, featuring multilayer proprietary polymers and 3D‑printed precision‑grip attachments.

Market Concentration & Characteristics

The Invisible Orthodontics Market is moderately concentrated, with a mix of global leaders and emerging regional players competing on innovation, pricing, and digital integration. It is characterized by rapid technological advancement, high patient engagement, and strong brand influence. Leading companies such as Align Technology, SmileDirectClub, and Dentsply Sirona hold significant market share due to their early adoption of 3D printing, AI-driven diagnostics, and direct-to-consumer models. The market demonstrates high entry barriers, including regulatory compliance, clinical validation, and technology infrastructure. Clear aligners dominate the product mix, supported by patient demand for comfort and aesthetics. Market dynamics favor companies that offer scalable digital workflows, orthodontist networks, and personalized treatment solutions. Growth in emerging regions is accelerating due to rising awareness and expanding dental care access. The market reflects a shift toward convenience, speed, and patient-centric experiences, with competition intensifying around innovation, affordability, and global reach.

Report Coverage

The research report offers an in-depth analysis based on Product, Age, Dentist Type, End-User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see increased adoption of clear aligners driven by rising demand for aesthetic dental solutions.

- AI and machine learning will continue to enhance treatment planning and outcome predictability.

- Direct-to-consumer aligner models will expand, improving access in remote and underserved areas.

- Global players will invest in emerging markets to tap into growing dental awareness and urban populations.

- Hybrid orthodontic models combining in-office and remote care will become more common.

- Manufacturers will focus on sustainable materials and eco-friendly packaging to meet consumer preferences.

- Digital dentistry tools like intraoral scanners and 3D printers will become standard in clinical workflows.

- Pediatric and adult demand will grow simultaneously as awareness rises across age groups.

- Dental insurers may expand coverage for invisible orthodontics, improving affordability and market reach.

- Strategic collaborations between dental tech companies and orthodontists will shape future product innovations.