Market Overview

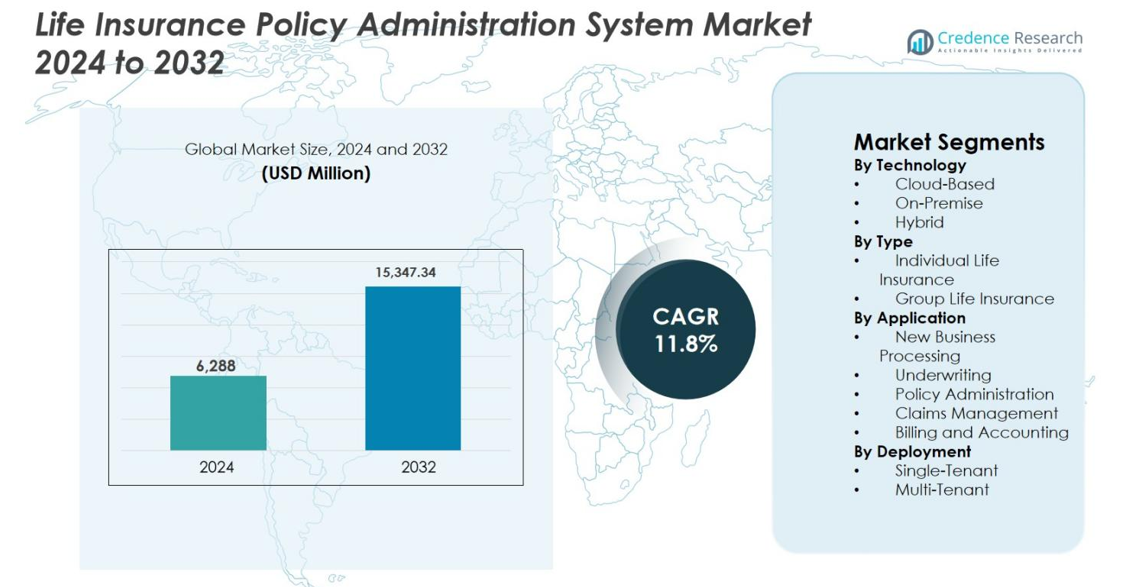

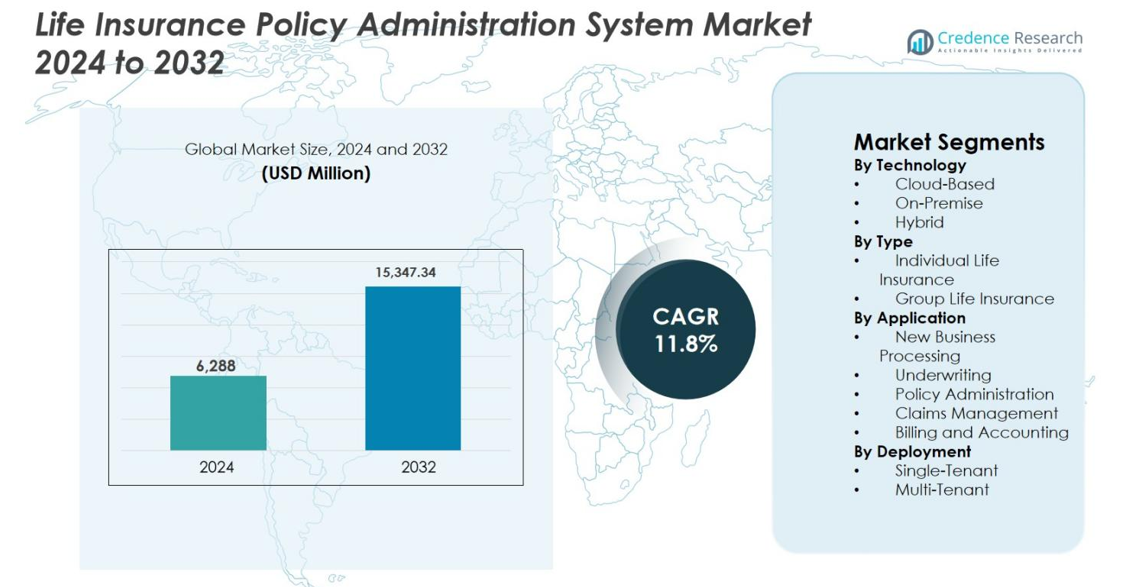

The Life Insurance Policy Administration System market size was valued at USD 6,288 million in 2024 and is anticipated to reach USD 15,347.34 million by 2032, expanding at a CAGR of 11.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Life Insurance Policy Administration System Market Size 2024 |

USD 6,288 million |

| Life Insurance Policy Administration System Market, CAGR |

11.8% |

| Life Insurance Policy Administration System Market Size 2032 |

USD 15,347.34 million |

Life Insurance Policy Administration System market is characterized by the strong presence of established insurance software providers and global IT service firms focused on core system modernization and digital enablement. Leading players such as Majesco, Oracle, Accenture, Infosys, EIS Group, Insurity, EXL, FAST Technology, and Edlund compete through configurable platforms, cloud-native deployments, and deep insurance domain expertise. These companies invest in automation, analytics, and API-driven integration to support complex policy lifecycles and regulatory compliance. Regionally, North America leads the market with a 38.4% share, supported by early technology adoption and large-scale modernization initiatives, followed by Europe at 26.1% and Asia-Pacific at 22.7%, where rapid digital insurance expansion continues to strengthen market momentum.

Market Insights

- Life Insurance Policy Administration System market was valued at USD 6,288 million in 2024 and is projected to reach USD 15,347.34 million by 2032, growing at a CAGR of 11.8% through the forecast period, driven by increasing digitalization and core insurance system modernization initiatives.

- Growing demand for automated policy lifecycle management, faster product launches, and enhanced customer experience drives adoption, with cloud-based deployment leading the technology segment at a 58.6% share.

- Market trends highlight increased adoption of SaaS models, API-driven ecosystems, and analytics-enabled platforms, while policy administration applications dominate with a 41.8% segment share.

- The competitive environment includes specialized insurance software providers and global IT firms focusing on configurable platforms, cloud migration, and system integration to strengthen insurer agility.

- Regionally, North America leads with a 38.4% market share, followed by Europe at 26.1% and Asia-Pacific at 22.7%, while emerging regions show steady growth driven by digital insurance expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

The Life Insurance Policy Administration System market is segmented into cloud-based, on-premise, and hybrid deployment models. Cloud-based systems dominate the segment, accounting for 58.6% market share, driven by scalability, faster implementation, and lower total cost of ownership. Insurers increasingly adopt cloud platforms to support digital policy servicing, remote operations, and rapid product configuration. Built-in analytics, API integration, and regulatory updates further strengthen adoption. Hybrid solutions are gaining traction among mid-to-large insurers seeking gradual modernization, while on-premise systems retain relevance in regions with strict data-sovereignty and legacy infrastructure constraints.

- For instance, Infosys McCamish’s NGIN platform is positioned as a cloud-native life insurance and annuity policy administration system used by global insurers to manage complete policy lifecycles with multi-geo support and scalable infrastructure

By Type

Based on type, the Life Insurance Policy Administration System market includes individual life insurance and group life insurance. Individual life insurance leads with a 64.2% share, supported by rising demand for personalized policies, flexible premium structures, and long-term protection products. Insurers require advanced systems to manage complex policy lifecycles, endorsements, renewals, and customer servicing. Growth in middle-class populations, digital direct-to-consumer channels, and product customization drives system adoption. Group life insurance systems grow steadily, fueled by employer-sponsored coverage expansion and automation needs for high-volume policy administration.

- For instance, MetLife modernized its individual life operations by deploying advanced policy administration platforms that support configurable products, automated underwriting workflows, and continuous policy servicing across digital channels.

By Application

By application, the market covers new business processing, underwriting, policy administration, claims management, and billing and accounting. Policy administration is the dominant sub-segment with a 41.8% market share, as it forms the operational core of life insurers. Demand is driven by the need for real-time policy updates, automated endorsements, compliance management, and seamless customer servicing. Integration with CRM, analytics, and digital channels enhances efficiency and retention. Increasing policy volumes, regulatory complexity, and the shift toward straight-through processing further accelerate adoption of advanced policy administration modules.

Key Growth Drivers

Digital Transformation and Core System Modernization

Accelerated digital transformation across the insurance sector is a primary growth driver for the Life Insurance Policy Administration System market. Insurers are replacing legacy, monolithic platforms with modern, configurable policy administration systems to improve agility, reduce operational costs, and support faster product launches. Modern systems enable straight-through processing, automated workflows, and real-time policy servicing, significantly enhancing operational efficiency. Increasing customer expectations for digital onboarding, self-service portals, and omnichannel engagement further push insurers to modernize core systems. Additionally, regulatory complexity and frequent product changes require flexible platforms that support rapid configuration and compliance updates. As insurers prioritize modernization to remain competitive and digitally resilient, demand for advanced policy administration solutions continues to rise steadily.

- For instance, AXA advanced its digital transformation by modernizing life insurance core systems to enable straight-through processing, automated underwriting, and real-time policy servicing, improving speed and operational efficiency across customer touchpoints.

Rising Demand for Product Personalization and Faster Time-to-Market

Growing demand for personalized life insurance products strongly drives adoption of advanced policy administration systems. Customers increasingly seek flexible coverage options, customized riders, dynamic premium structures, and usage-based features. To meet these expectations, insurers require systems capable of rapid product configuration, rule-based pricing, and automated policy lifecycle management. Modern platforms allow insurers to quickly design, test, and launch new products without extensive coding, significantly reducing time-to-market. This capability supports competitive differentiation in crowded markets. Additionally, personalized offerings generate higher customer engagement and retention, making robust policy administration systems a strategic investment for insurers focused on long-term growth and profitability.

- For instance, HDFC Life has strengthened its digital product architecture through advanced policy administration capabilities that enable rapid customization of individual life products and seamless servicing through digital channels

Expansion of Digital Distribution and Direct-to-Consumer Channels

The rapid expansion of digital distribution channels is another major growth driver for the Life Insurance Policy Administration System market. Insurers increasingly rely on online portals, mobile applications, bancassurance platforms, and digital agents to acquire and service customers. These channels require seamless integration with core policy administration systems to enable real-time underwriting decisions, instant policy issuance, and automated billing. Advanced platforms support API-based connectivity, enabling insurers to partner with fintechs, aggregators, and embedded insurance providers. As digital sales volumes increase, insurers must scale policy processing and servicing efficiently, reinforcing demand for robust, cloud-enabled policy administration systems.

Key Trends & Opportunities

Shift Toward Cloud-Based and SaaS Deployment Models

The transition toward cloud-based and software-as-a-service deployment models represents a key trend and opportunity in the Life Insurance Policy Administration System market. Insurers increasingly adopt cloud platforms to achieve scalability, faster implementation, and reduced infrastructure costs. Cloud-based systems enable continuous updates, rapid regulatory compliance, and improved disaster recovery capabilities. They also support advanced analytics, AI-driven automation, and remote operations. For vendors, cloud adoption opens opportunities to offer modular, subscription-based solutions that appeal to small and mid-sized insurers. As regulatory acceptance of cloud environments improves globally, cloud deployment continues to unlock long-term growth opportunities.

- For instance, Zurich Insurance Group has migrated core insurance workloads to cloud platforms to enable continuous system updates, stronger disaster recovery, and faster regulatory compliance across multiple regions.

Integration of Advanced Analytics and Intelligent Automation

Integration of advanced analytics, artificial intelligence, and intelligent automation is emerging as a major opportunity for policy administration system providers. Insurers leverage analytics to gain real-time insights into policy performance, customer behavior, and operational efficiency. AI-enabled automation enhances underwriting accuracy, detects anomalies in policy servicing, and streamlines claims and billing processes. Intelligent workflows reduce manual intervention, lower error rates, and improve customer experience. Vendors that embed analytics and automation capabilities within core policy administration platforms can deliver higher value, supporting data-driven decision-making and operational optimization across the insurance value chain.

- For instance, Sun Life Financial leverages intelligent automation and analytics embedded in its policy administration platforms to streamline billing, policy changes, and customer inquiries, enabling faster turnaround times and consistent omnichannel experiences.

Key Challenges

Complexity of Legacy System Migration and Data Integration

Migrating from legacy policy administration systems presents a significant challenge for insurers. Legacy platforms often contain decades of policy data, customized workflows, and regulatory configurations, making migration complex and time-consuming. Data cleansing, mapping, and validation require substantial effort and expertise. Integration with surrounding systems such as claims, billing, CRM, and third-party platforms further increases implementation risk. Any disruption during migration can impact policy servicing and customer trust. These complexities may delay modernization initiatives and increase project costs, posing a barrier to faster adoption of new policy administration systems.

Regulatory Compliance and Data Security Concerns

Regulatory compliance and data security remain critical challenges in the Life Insurance Policy Administration System market. Insurers must comply with evolving data protection laws, reporting requirements, and solvency regulations across multiple jurisdictions. Policy administration systems handle sensitive customer data, making them prime targets for cyber threats. Ensuring data privacy, secure access controls, and regulatory audit readiness adds to system complexity. Cloud adoption, while beneficial, raises additional concerns around data residency and third-party risk management. Vendors and insurers must continuously invest in security frameworks and compliance capabilities, increasing operational and implementation costs.

Regional Analysis

North America

North America leads the Life Insurance Policy Administration System market with a 38.4% market share, driven by early adoption of digital insurance platforms and large-scale core system modernization initiatives. Insurers across the US and Canada actively replace legacy policy systems to improve operational efficiency, regulatory compliance, and customer experience. Strong demand for cloud-based solutions, API-driven ecosystems, and analytics-enabled policy servicing supports market growth. High insurance penetration, complex product portfolios, and stringent regulatory requirements further accelerate investment in advanced policy administration systems, making North America the most mature and technology-driven regional market.

Europe

Europe accounts for 26.1% of the Life Insurance Policy Administration System market, supported by regulatory-driven modernization and rising digital adoption among insurers. Compliance with frameworks such as GDPR and Solvency II increases demand for flexible, audit-ready policy administration platforms. European insurers focus on system upgrades to support product standardization, cross-border operations, and digital servicing. Cloud adoption is growing steadily, particularly in Western Europe, while hybrid deployments remain common. The region’s emphasis on data security, operational transparency, and customer-centric insurance models continues to drive sustained system investments.

Asia-Pacific

Asia-Pacific represents the fastest-growing region, holding a 22.7% market share in the Life Insurance Policy Administration System market. Growth is driven by rapid expansion of life insurance penetration, rising middle-class populations, and digital-first insurance models in countries such as China, India, Japan, and Southeast Asia. Insurers increasingly adopt cloud-based platforms to support high policy volumes, digital onboarding, and scalable operations. Regulatory reforms and government-led financial inclusion initiatives further boost demand. The region’s strong focus on automation and cost-efficient system deployment accelerates adoption among both large and emerging insurers.

Latin America

Latin America holds 7.4% market share in the Life Insurance Policy Administration System market, supported by gradual digital transformation across the insurance sector. Insurers in Brazil, Mexico, and Chile increasingly invest in modern policy systems to improve operational efficiency and expand digital distribution. Cloud-based deployments gain traction due to lower upfront costs and faster implementation. Growing awareness of life insurance products, coupled with regulatory modernization, drives system upgrades. However, budget constraints and legacy infrastructure challenges moderate adoption speed, resulting in steady but comparatively slower market growth.

Middle East & Africa

The Middle East & Africa region accounts for 5.4% of the Life Insurance Policy Administration System market, driven by expanding insurance penetration and digitalization initiatives. Gulf countries lead adoption due to strong financial infrastructure, regulatory reforms, and investments in digital insurance platforms. Insurers focus on modern systems to support product diversification, regulatory reporting, and improved customer engagement. In Africa, adoption remains nascent but growing, supported by mobile-based insurance models and financial inclusion programs. Increasing demand for scalable, cloud-enabled solutions supports long-term regional growth potential.

Market Segmentations:

By Technology

- Cloud-Based

- On-Premise

- Hybrid

By Type

- Individual Life Insurance

- Group Life Insurance

By Application

- New Business Processing

- Underwriting

- Policy Administration

- Claims Management

- Billing and Accounting

By Deployment

- Single-Tenant

- Multi-Tenant

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Life Insurance Policy Administration System market features a competitive landscape characterized by the presence of global technology providers, specialized insurance software vendors, and system integrators competing on functionality, scalability, and deployment flexibility. Key players such as Majesco, Oracle, Accenture, Infosys, EIS Group, Insurity, EXL, FAST Technology, and Edlund focus on delivering configurable, cloud-enabled platforms that support end-to-end policy lifecycle management. Vendors increasingly differentiate through modular architectures, low-code configuration, and API-driven integration to support rapid product launches and digital channels. Strategic partnerships with insurers, cloud service providers, and fintech firms are common to expand solution capabilities and geographic reach. Continuous investment in analytics, automation, and regulatory compliance features strengthens vendor positioning, while system integration expertise and post-implementation support play a critical role in winning large transformation projects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- EIS Group Inc.

- Infosys

- Majesco

- EXL

- Oracle

- Edlund

- Accenture Plc

- FAST Technology

- Insurity

- Accenture Life Insurance Solutions Group

Recent Developments

- In January 2025, Majesco announced that Celina Insurance Group selected Majesco Intelligent Claims for P&C to modernize its claims operations, boost workforce productivity, optimize business processes, and improve overall customer experience.

- In September 2024, the Life Insurance Corporation (LIC) revealed a strategic collaboration with Infosys to build a next-generation digital platform that will underpin critical business applications, including customer and sales super apps, digital branches, and integrated portals.

Report Coverage

The research report offers an in-depth analysis based on Technology, Type, Application, Deployment and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Insurers will continue accelerating replacement of legacy policy systems to improve agility and reduce operational complexity.

- Cloud-based and SaaS policy administration platforms will see sustained adoption across large and mid-sized insurers.

- Demand for configurable and low-code systems will increase to support rapid product innovation and customization.

- Integration of artificial intelligence and automation will enhance underwriting, policy servicing, and operational efficiency.

- API-driven ecosystems will strengthen connectivity with digital channels, fintech partners, and third-party platforms.

- Insurers will prioritize real-time data processing to improve customer experience and policy lifecycle visibility.

- Regulatory compliance capabilities will become a core differentiator for policy administration system providers.

- Cybersecurity and data privacy features will gain increased focus as digital policy volumes grow.

- Emerging markets will drive incremental demand through rising insurance penetration and digital-first models.

- Vendors will expand modular offerings and managed services to support long-term insurer transformation strategies.