| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Early Life Nutrition Market Size 2024 |

USD 55,067.35 Million |

| Early Life Nutrition Market, CAGR |

8.15% |

| Early Life Nutrition Market Size 2032 |

USD 1,07,743.87 Million |

Market Overview

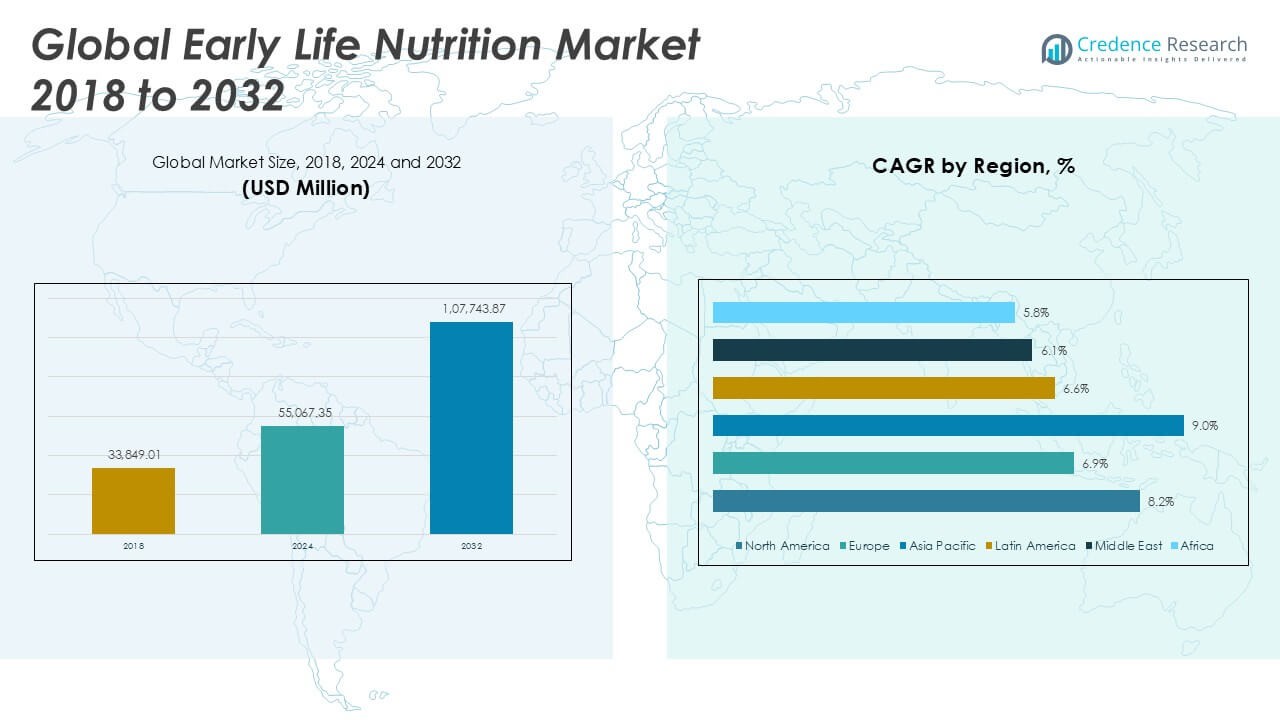

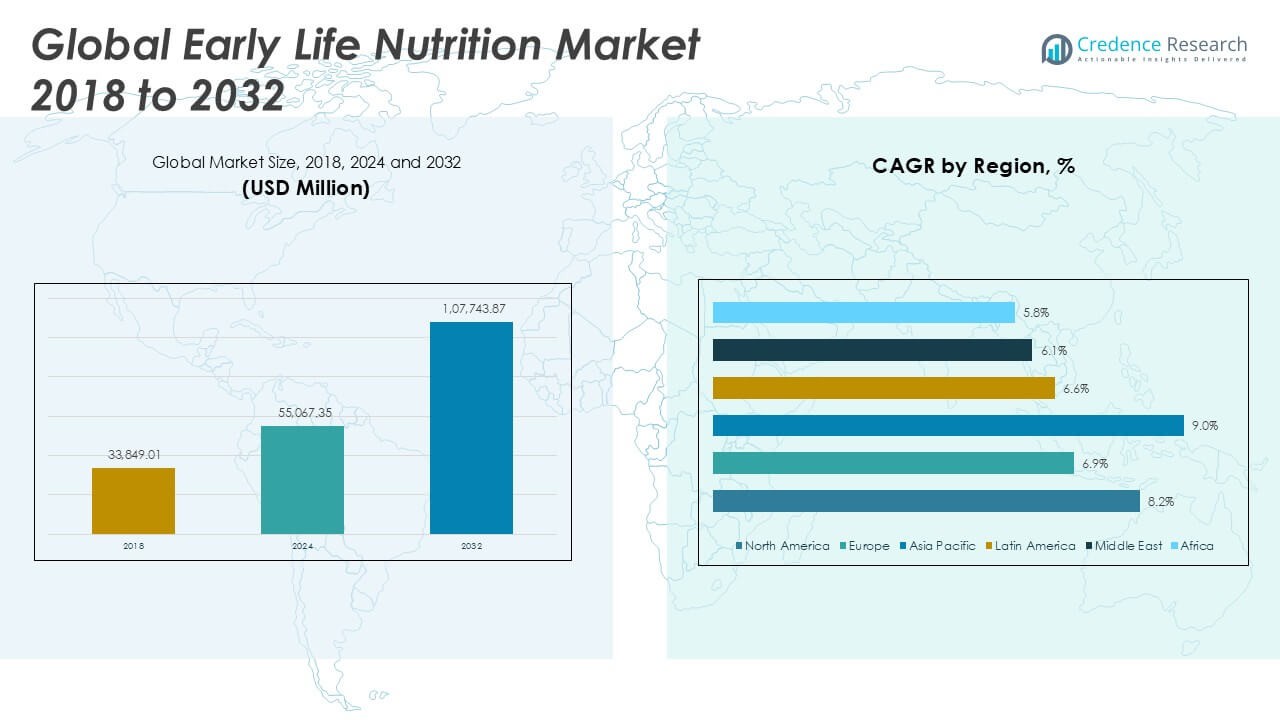

The Early Life Nutrition Market size was valued at USD 33,849.01 million in 2018, reached USD 55,067.35 million in 2024, and is anticipated to reach USD 1,07,743.87 million by 2032, at a CAGR of 8.15% during the forecast period.

The Early Life Nutrition Market is experiencing robust growth, driven by increasing awareness of the long-term health benefits of proper nutrition during infancy and early childhood. Rising birth rates in emerging economies, coupled with greater focus on reducing childhood malnutrition, are boosting demand for high-quality infant formula, follow-on milk, and complementary foods. Urbanization, higher disposable incomes, and greater participation of women in the workforce are further fueling the shift toward convenient, science-backed nutritional products. Key trends include the growing preference for organic and clean-label offerings, rising adoption of fortified and functional foods, and a surge in digital health platforms providing personalized nutrition advice. Regulatory initiatives promoting safe and fortified products are shaping market dynamics, while ongoing research and innovation are resulting in advanced formulations tailored to diverse nutritional needs. These factors collectively support the expanding scope and value of the early life nutrition market globally.

The Early Life Nutrition Market demonstrates dynamic growth across diverse geographical regions, shaped by varying levels of economic development, regulatory environments, and consumer awareness. North America and Europe exhibit strong demand for premium and organic nutrition products, driven by advanced healthcare infrastructure and a focus on clean-label formulations. Asia Pacific emerges as a key growth engine, supported by rising birth rates, expanding middle-class populations, and growing investments in child health and nutrition. Latin America, the Middle East, and Africa are experiencing increasing adoption of fortified products and improved accessibility through modern retail channels. Leading players shaping the competitive landscape include Nestlé S.A., Danone S.A., and Abbott Laboratories, which leverage robust R&D capabilities, wide product portfolios, and strong distribution networks to maintain their leadership. Cargill, Incorporated, is also recognized for its role in advancing ingredients innovation and supporting the market’s ongoing evolution.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Early Life Nutrition Market grew from USD 33,849.01 million in 2018 to USD 55,067.35 million in 2024 and is expected to reach USD 1,07,743.87 million by 2032, with a CAGR of 8.15%.

- Rising awareness of the importance of infant and early childhood nutrition, coupled with increasing birth rates in emerging economies, is driving market growth.

- Clean-label, organic, and natural nutrition products are in high demand, while innovation in fortified and science-backed formulations shapes product development.

- Leading companies such as Nestlé S.A., Danone S.A., Abbott Laboratories, and Cargill, Incorporated, maintain strong market positions through extensive portfolios, global reach, and robust R&D investment.

- Stringent regulatory requirements and complex approval processes create challenges for manufacturers, impacting speed to market and increasing compliance costs.

- Asia Pacific dominates the market, holding a 43.1% share, followed by North America and Europe, while Latin America, the Middle East, and Africa see growing adoption of premium and fortified products.

- Online retail and digital health platforms are reshaping distribution and consumer engagement, while sustainability and ethical sourcing influence purchasing decisions and product innovation.

Market Drivers

Rising Global Awareness of Infant and Childhood Nutrition Drives Market Demand

Increasing awareness regarding the critical role of nutrition during early childhood is propelling demand in the market. Parents and healthcare professionals emphasize proper nutrition during the first 1,000 days, recognizing its impact on lifelong health and cognitive development. This shift in mindset has led to a surge in demand for specialized infant formulas and early childhood nutritional products. The Early Life Nutrition Market benefits from education campaigns and public health initiatives that highlight the importance of balanced diets and adequate nutrient intake for infants and toddlers. It aligns with broader public health goals to reduce rates of stunting, wasting, and other forms of childhood malnutrition. This heightened awareness is translating into higher sales of fortified and science-backed nutritional solutions.

- For instance, Danone’s “One Planet. One Health” initiative has reached more than 5 million families through its early childhood nutrition education programs, directly influencing infant feeding practices worldwide.

Economic Development and Urbanization Encourage Premium Product Adoption

Rapid economic growth and urbanization, particularly in emerging markets, are fueling the adoption of premium and value-added nutrition products for young children. Rising disposable incomes allow parents to prioritize quality and safety when selecting infant formula, follow-on milk, and weaning foods. Urban lifestyles often involve dual-income households and time constraints, encouraging the use of convenient, packaged nutrition options. It supports the proliferation of branded, fortified, and organic products that meet evolving consumer preferences. Modern retail infrastructure and e-commerce platforms provide wider access to advanced nutritional offerings. These trends contribute to the robust expansion of the market in both developed and developing economies.

- For instance, Nestlé’s Gerber brand introduced over 50 new premium products in its infant nutrition range in the last three years, capitalizing on urban consumers’ demand for convenience and quality.

Changing Family Structures and Increased Workforce Participation Among Women Support Market Growth

Changing family dynamics, including smaller family sizes and increased female workforce participation, are reshaping purchasing decisions for early life nutrition products. Working mothers seek reliable, convenient, and nutritionally balanced alternatives to breast milk, driving demand for infant formula and complementary foods. The Early Life Nutrition Market responds by innovating products that mimic the benefits of breastfeeding and support healthy development. It underscores the importance of flexibility, safety, and ease of use in product design. Brands invest in R&D to deliver solutions tailored to modern parenting needs. These social and demographic shifts are fostering a steady rise in market demand.

Regulatory Initiatives and Advances in Nutritional Science Enhance Product Quality

Strict regulatory frameworks and continuous advances in nutritional science underpin improvements in product quality and safety. Governments and global organizations enforce standards for nutrient fortification, labeling, and safety testing. The market adapts by incorporating the latest research in pediatric nutrition, resulting in advanced formulations that support growth and immunity. It also encourages transparency and traceability in sourcing ingredients. Regulatory compliance enhances consumer trust, prompting parents to invest in scientifically validated products. Ongoing collaboration between regulators, healthcare professionals, and industry stakeholders sustains a dynamic environment focused on child health and well-being.

Market Trends

Growing Demand for Clean-Label, Organic, and Natural Nutrition Products

A prominent trend in early life nutrition is the shift toward clean-label, organic, and natural offerings. Parents increasingly prefer products with transparent ingredient lists and minimal additives, reflecting a rising health consciousness. Brands introduce organic-certified infant formulas and baby foods that avoid artificial preservatives, colors, and genetically modified organisms. Consumer preference for non-GMO and allergen-free products continues to gain traction. This move aligns with broader consumer trends seen across food and beverage sectors. The Early Life Nutrition Market supports this by expanding its range of organic and plant-based alternatives, responding to a global push for safer, more natural nutrition options for infants and toddlers.

- For instance, HiPP produces over 260 organic baby food products, each certified under EU organic regulations, and sources ingredients from more than 8,000 certified organic farmers.

Innovation in Product Formulations and Fortification Drives Competitive Differentiation

Continuous innovation defines the competitive landscape, with manufacturers investing in research to develop advanced formulations tailored to infants’ specific nutritional needs. Companies introduce products fortified with probiotics, omega-3 fatty acids, and micronutrients that support immune function, brain development, and gut health. Functional ingredients such as prebiotics and lactoferrin feature prominently in new launches, reflecting a science-driven approach. Brands seek to mimic the benefits of breast milk as closely as possible, utilizing evolving nutritional science and improved ingredient sourcing. It encourages collaborations with pediatric experts and nutritionists to validate claims. Innovation remains central to capturing market share and maintaining consumer trust.

- For instance, Abbott’s Similac Pro-Advance is formulated with 2’-FL HMO, a prebiotic structurally identical to one found in breast milk, and has undergone clinical evaluation in more than 1,200 infants globally.

Expansion of Digital Health Platforms and Personalized Nutrition Solutions

Digital health and personalized nutrition solutions are transforming the way parents approach early life nutrition. Technology-enabled platforms offer customized dietary recommendations, monitor infant growth, and deliver targeted nutritional advice. E-commerce channels facilitate direct-to-consumer access, allowing parents to research and purchase products more conveniently. Subscription-based delivery models are gaining popularity, ensuring consistent supply and ease of access to specialty nutrition products. It supports the trend toward greater consumer engagement and education around infant nutrition. The adoption of digital health tools and data-driven guidance is set to further shape purchasing decisions in this evolving market.

Emphasis on Sustainability and Ethical Sourcing in Production and Packaging

Sustainability initiatives are increasingly influencing product development and packaging strategies in early life nutrition. Brands focus on responsibly sourced raw materials, eco-friendly packaging, and reduced environmental footprints. Investments in recyclable materials and biodegradable packaging solutions underscore a growing commitment to environmental stewardship. It enhances brand reputation and appeals to environmentally conscious consumers, particularly among younger parents. Ethical sourcing of ingredients ensures traceability and supports fair labor practices across supply chains. This sustainability focus continues to drive innovation and differentiation across the global early life nutrition market.

Market Challenges Analysis

Stringent Regulatory Requirements and Complex Approval Processes Hinder Market Expansion

Stringent regulatory frameworks and complex approval processes present significant challenges for manufacturers in early life nutrition. Regulatory bodies impose strict standards for ingredient safety, labeling, and product claims to ensure infant health and consumer trust. Companies must invest heavily in research, testing, and compliance to meet evolving international regulations. These requirements increase the time and cost involved in launching new products, particularly in multiple geographies with varying legal standards. The Early Life Nutrition Market faces frequent updates to guidelines, demanding continuous adaptation and vigilance. Failure to comply with regulatory expectations can lead to product recalls, reputational damage, and restricted market access.

Supply Chain Disruptions and Rising Raw Material Costs Impact Profitability

The market contends with supply chain disruptions and rising raw material costs that threaten operational efficiency and profitability. Volatile prices for dairy, grains, and specialty ingredients can increase production expenses and limit the ability to maintain competitive pricing. Logistical issues, including transportation delays and geopolitical uncertainties, further complicate reliable product delivery. The Early Life Nutrition Market must manage risks related to ingredient quality, shelf life, and traceability. It requires strategic partnerships and resilient supply networks to address these challenges. Companies focusing on local sourcing and advanced inventory management systems strengthen their ability to navigate market volatility and ensure consistent supply.

Market Opportunities

Expansion into Emerging Markets and Rural Regions Offers Significant Growth Potential

Expanding into emerging markets and underserved rural regions presents strong growth potential for the early life nutrition industry. Rising birth rates, increasing health awareness, and economic development in Asia, Africa, and Latin America create robust demand for high-quality infant and toddler nutrition products. Companies entering these regions can leverage localized marketing, culturally adapted formulations, and partnerships with healthcare providers to build brand loyalty. Government initiatives to combat malnutrition and improve child health further support market entry. The Early Life Nutrition Market benefits from expanding distribution networks and digital platforms, increasing accessibility in remote locations. It enables companies to capture new consumer segments and drive sustained revenue growth.

Innovation in Functional Ingredients and Personalized Nutrition Drives Product Differentiation

Innovation in functional ingredients and personalized nutrition offers significant opportunities to differentiate products and address evolving consumer needs. Advances in nutritional science enable the development of formulations with probiotics, prebiotics, and bioactive compounds tailored for specific growth stages and health concerns. Digital health platforms facilitate personalized dietary recommendations, allowing parents to make informed choices. The Early Life Nutrition Market can harness technology to deliver customized solutions and build trust through transparency and science-backed claims. Investment in R&D and collaborations with pediatric experts support the creation of next-generation products. It allows brands to strengthen their competitive position and respond to the growing demand for targeted, effective early childhood nutrition.

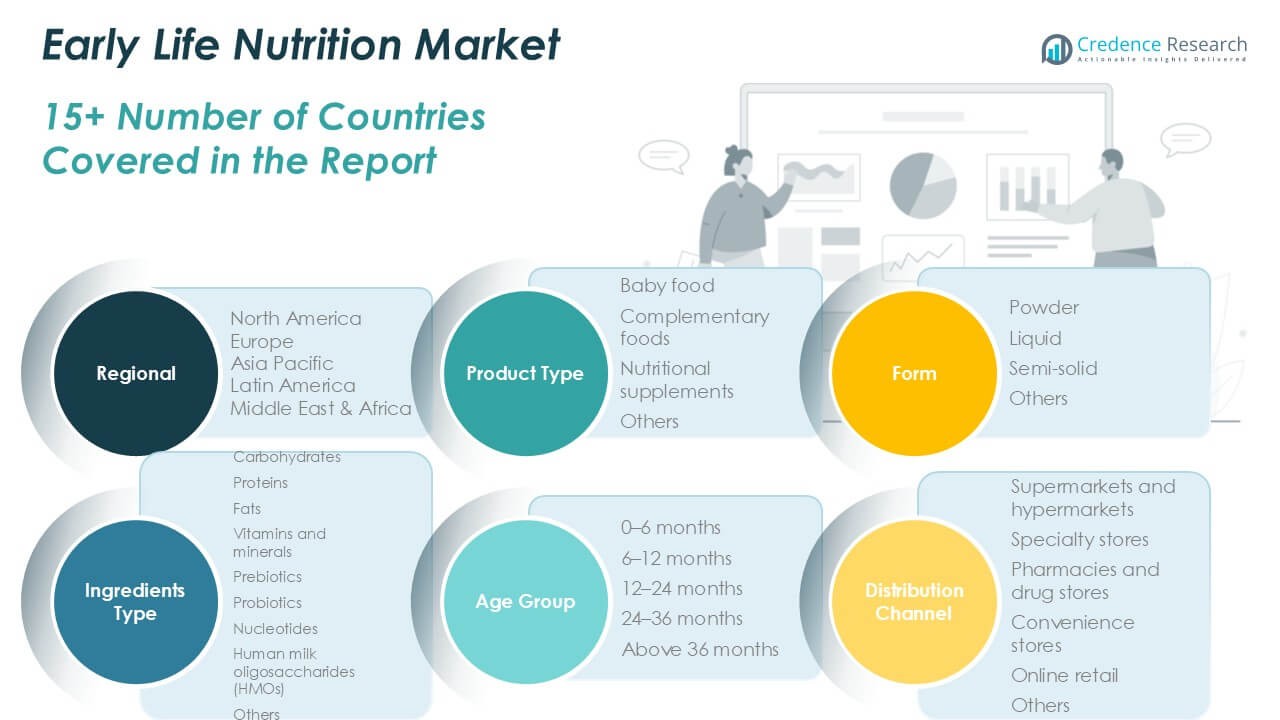

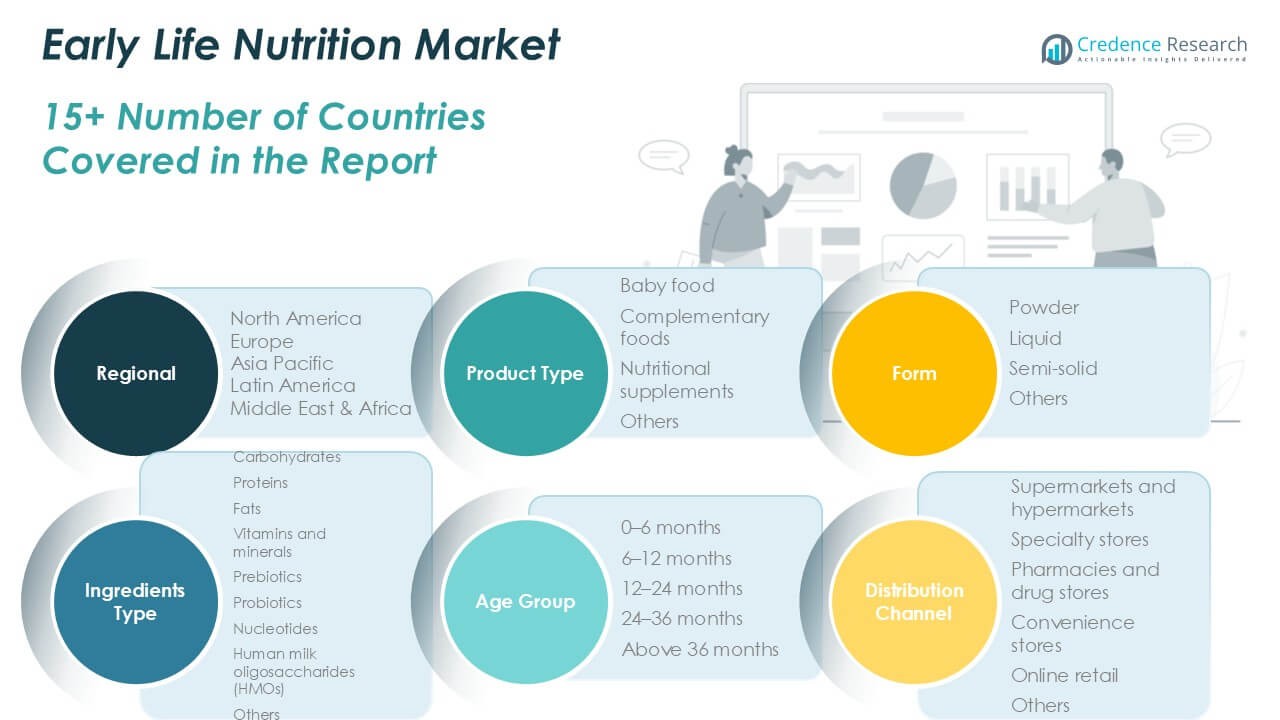

Market Segmentation Analysis:

By Product Type:

Baby food holds a substantial share, driven by its role in supporting balanced growth and convenient feeding solutions for busy families. Complementary foods gain traction among parents seeking to bridge nutritional gaps as infants transition from milk-based diets. Nutritional supplements provide targeted solutions for specific deficiencies and health concerns, strengthening their presence in both developed and emerging markets. The ‘others’ category, including specialty and functional products, expands market breadth and caters to niche consumer demands.

- For instance, Else Nutrition reported a shipment of more than 700,000 units of its plant-based baby food in North America in the last twelve months, highlighting strong acceptance among families seeking non-dairy alternatives.

By Form:

Formulation trends reveal a strong preference for powdered products due to their extended shelf life, easy storage, and cost-effectiveness, making them popular across global markets. Liquid forms address the need for ready-to-consume convenience and appeal to urban, on-the-go consumers. Semi-solid formats find favor during weaning stages, supporting texture transition and ease of consumption. The market continues to introduce innovative options in the ‘others’ category, including gummies and dissolvable tablets, responding to shifting parental preferences and child acceptability.

- For instance, Perrigo manufactures over 60 million cans of powdered infant formula annually from its U.S. and European facilities, ensuring reliable supply across major retail and pharmacy chains.

By Ingredients Type:

Ingredient segmentation underscores the importance of a holistic nutritional profile. Carbohydrates and proteins form the foundation of early childhood diets, supporting energy requirements and healthy growth. Fats contribute to brain development and provide essential fatty acids critical in the first years of life. Vitamins and minerals address micronutrient deficiencies prevalent in various regions, ensuring comprehensive nutritional coverage. Prebiotics and probiotics are prominent for their role in promoting digestive health and immunity, attracting parents who prioritize gut health from an early age. Nucleotides and human milk oligosaccharides (HMOs) highlight advancements in formulation science, mimicking the beneficial properties of breast milk to enhance immune support and cognitive function. The ‘others’ segment incorporates specialty nutrients and functional additives that further differentiate products in a competitive landscape.

Segments:

Based on Product Type:

- Baby food

- Complementary foods

- Nutritional supplements

- Others

Based on Form:

- Powder

- Liquid

- Semi-solid

- Others

Based on Ingredients Type:

- Carbohydrates

- Proteins

- Fats

- Vitamins and minerals

- Prebiotics

- Probiotics

- Nucleotides

- Human milk oligosaccharides (HMOs)

- Others

Based on Age Group:

- 0–6 months

- 6–12 months

- 12–24 months

- 24–36 months

- Above 36 months

Based on Distribution Channel:

- Supermarkets and hypermarkets

- Specialty stores

- Pharmacies and drug stores

- Convenience stores

- Online retail

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Early Life Nutrition Market

North America Early Life Nutrition Market grew from USD 10,640.10 million in 2018 to USD 17,060.14 million in 2024 and is projected to reach USD 33,508.88 million by 2032, reflecting a compound annual growth rate (CAGR) of 8.2%. North America is holding a 31% market share. The United States and Canada drive market expansion through high awareness of infant nutrition, strong healthcare infrastructure, and high disposable income. Regulatory bodies ensure rigorous product standards, supporting trust and widespread adoption. Ongoing innovation in organic and fortified products caters to evolving parental preferences, while the rise of working mothers accelerates demand for convenient solutions. Digital health platforms and e-commerce further boost accessibility and market penetration in this region.

Europe Early Life Nutrition Market

Europe Early Life Nutrition Market grew from USD 6,683.49 million in 2018 to USD 10,309.86 million in 2024 and is forecasted to reach USD 18,448.19 million by 2032, at a CAGR of 6.9%. Europe commands a 17% market share, with Germany, France, and the UK as major contributors. Strict regulatory standards and strong emphasis on clean-label and organic products shape consumer preferences. European manufacturers innovate with products focusing on allergen-free and sustainable ingredients. Parental focus on early childhood health, supported by national nutrition programs, stimulates demand. Online retail and specialty stores play a growing role in product distribution. Environmental concerns are driving sustainable packaging trends.

Asia Pacific Early Life Nutrition Market

Asia Pacific Early Life Nutrition Market grew from USD 13,114.80 million in 2018 to USD 22,224.36 million in 2024 and is expected to reach USD 46,461.85 million by 2032, registering a CAGR of 9.0%. Asia Pacific holds the largest market share at 43%. China, India, and Japan are key growth engines, supported by rising birth rates, rapid urbanization, and growing awareness of childhood nutrition. Government initiatives targeting malnutrition and infant health amplify demand for fortified products. Expansion of middle-class populations drives premium product uptake. Domestic and global brands compete intensely, introducing regionally tailored formulations. E-commerce adoption continues to reshape the purchasing landscape.

Latin America Early Life Nutrition Market

Latin America Early Life Nutrition Market grew from USD 1,666.52 million in 2018 to USD 2,678.85 million in 2024 and is projected to reach USD 4,663.89 million by 2032, with a CAGR of 6.6%. The region accounts for a 4% market share. Brazil and Mexico represent the largest markets due to improving economic conditions and rising urbanization. Public health campaigns promote the benefits of early life nutrition, while partnerships with healthcare professionals help boost product credibility. Demand for both affordable and premium products is growing, reflecting a widening consumer base. Distribution expansion through supermarkets and pharmacies supports greater accessibility.

Middle East Early Life Nutrition Market

Middle East Early Life Nutrition Market grew from USD 1,060.83 million in 2018 to USD 1,593.29 million in 2024 and is set to reach USD 2,686.43 million by 2032, at a CAGR of 6.1%. The region holds a 3% market share, with the United Arab Emirates and Saudi Arabia leading growth. Increasing awareness about infant nutrition and healthcare investments supports market development. Product demand rises alongside a growing expatriate population seeking high-quality imported brands. Retail modernization and government-backed health programs contribute to better product reach. Manufacturers invest in local partnerships to strengthen distribution networks and market presence.

Africa Early Life Nutrition Market

Africa Early Life Nutrition Market grew from USD 683.28 million in 2018 to USD 1,200.86 million in 2024 and is forecast to reach USD 1,974.63 million by 2032, showing a CAGR of 5.8%. Africa represents a 2% market share. South Africa, Nigeria, and Egypt are primary markets, influenced by gradual improvements in income levels and urban migration. Nutritional awareness campaigns, often supported by international organizations, drive market education and product adoption. Access to affordable, fortified nutrition solutions remains a priority for governments and NGOs. Challenges persist in rural distribution and regulatory harmonization, yet increasing urban demand signals future growth opportunities.

Key Player Analysis

- Cargill, Incorporated

- Nestlé S.A.

- Danone S.A.

- Abbott Laboratories

- Reckitt Benckiser Group

- Arla Foods

- Perrigo Company plc

- HiPP GmbH & Co. Vertrieb KG

- Else Nutrition USA Inc.

- Kabrita

Competitive Analysis

The Early Life Nutrition Market is highly competitive, with several established players holding significant market share due to their strong product portfolios, global presence, and commitment to research and development. Leading companies such as Nestlé S.A., Danone S.A., Abbott Laboratories, Cargill, Incorporated, Reckitt Benckiser Group, Arla Foods, Perrigo Company plc, HiPP GmbH & Co. Vertrieb KG, Else Nutrition USA Inc., and Kabrita consistently invest in product innovation to address evolving consumer preferences and regulatory standards. These players focus on developing clean-label, organic, and fortified nutrition products, responding to growing demand for natural and science-backed offerings. Extensive distribution networks, robust marketing strategies, and strong partnerships with healthcare professionals and retailers support their dominance in both developed and emerging markets. Strategic acquisitions and collaborations further expand their reach, allowing rapid adaptation to local market requirements and consumer trends. Companies differentiate themselves through advanced formulations, such as products fortified with probiotics, prebiotics, and human milk oligosaccharides, and by offering tailored solutions for different age groups and dietary needs. Ongoing investment in digital platforms and e-commerce enhances accessibility and brand visibility. Intense competition drives continuous improvement, benefiting end-users with higher product quality, safety, and variety.

Recent Developments

- In November 2024, DSM-Firmenich launched Dry Vit A Palmitate for Early Life Nutrition, a clean-label solution that enhances infant formula nutrition without the stability issues of traditional vitamin A ingredients.

- In October 2023, Nestlé developed Sinergity, a blend of probiotics and six HMOs to support infant development. The combination of B. infantis LMG11588 and HMOs enhances gut health and immunity by promoting beneficial bacteria, creating a synergistic effect for stronger immunity and a healthier gut.

- In August 2023, Hyderabad: Sresta Natural Bioproducts, a pioneer in India’s organic food sector, is set to launch a new range of organic baby and children’s food products. The rollout, planned in the coming weeks, will include snacks and frozen items like bread, rotis, chapatis, and samosas. The baby food line targets children aged six months to four years, while kiddie foods cater to up to 10 years. Founder and MD Raj Seelam confirmed the expansion as part of the company’s product diversification strategy.

Market Concentration & Characteristics

The Early Life Nutrition Market exhibits a moderate to high level of market concentration, with a few multinational corporations dominating global sales and product innovation. It features a mix of established industry leaders and specialized regional brands, each leveraging strong distribution channels and deep research capabilities. The market’s characteristics include a strong emphasis on product safety, scientific validation, and compliance with evolving regulatory standards, supporting sustained consumer trust. Product differentiation centers on advanced formulations, clean-label claims, and tailored solutions for varying age groups and nutritional needs. High entry barriers, driven by rigorous regulations and significant investment requirements for research and manufacturing, limit the influx of new competitors. The Early Life Nutrition Market also shows rapid adoption of digital platforms for marketing and distribution, supporting broader consumer access and education. Sustainability initiatives, ethical sourcing, and transparency play an increasingly important role in brand positioning and long-term growth strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, Ingredients Type, Age Group, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow as parents increasingly prioritize optimal nutrition during the first 1,000 days of life.

- Rising awareness of the link between early nutrition and long-term cognitive and physical health will boost product demand.

- Innovation in infant formulas and functional baby foods will expand to meet diverse dietary and developmental needs.

- Companies will focus on organic, clean-label, and non-GMO ingredients to align with consumer preferences.

- The expansion of e-commerce platforms will improve accessibility and availability of premium nutrition products.

- Pediatric healthcare providers will play a larger role in recommending personalized nutritional solutions.

- Government and NGO-led nutrition awareness campaigns will increase market penetration in developing regions.

- The demand for plant-based and allergen-free infant food options will rise among health-conscious families.

- Strategic partnerships and acquisitions will drive innovation and market consolidation.

- Technological advancements in formulation and packaging will enhance product quality and shelf life.