Market Overview

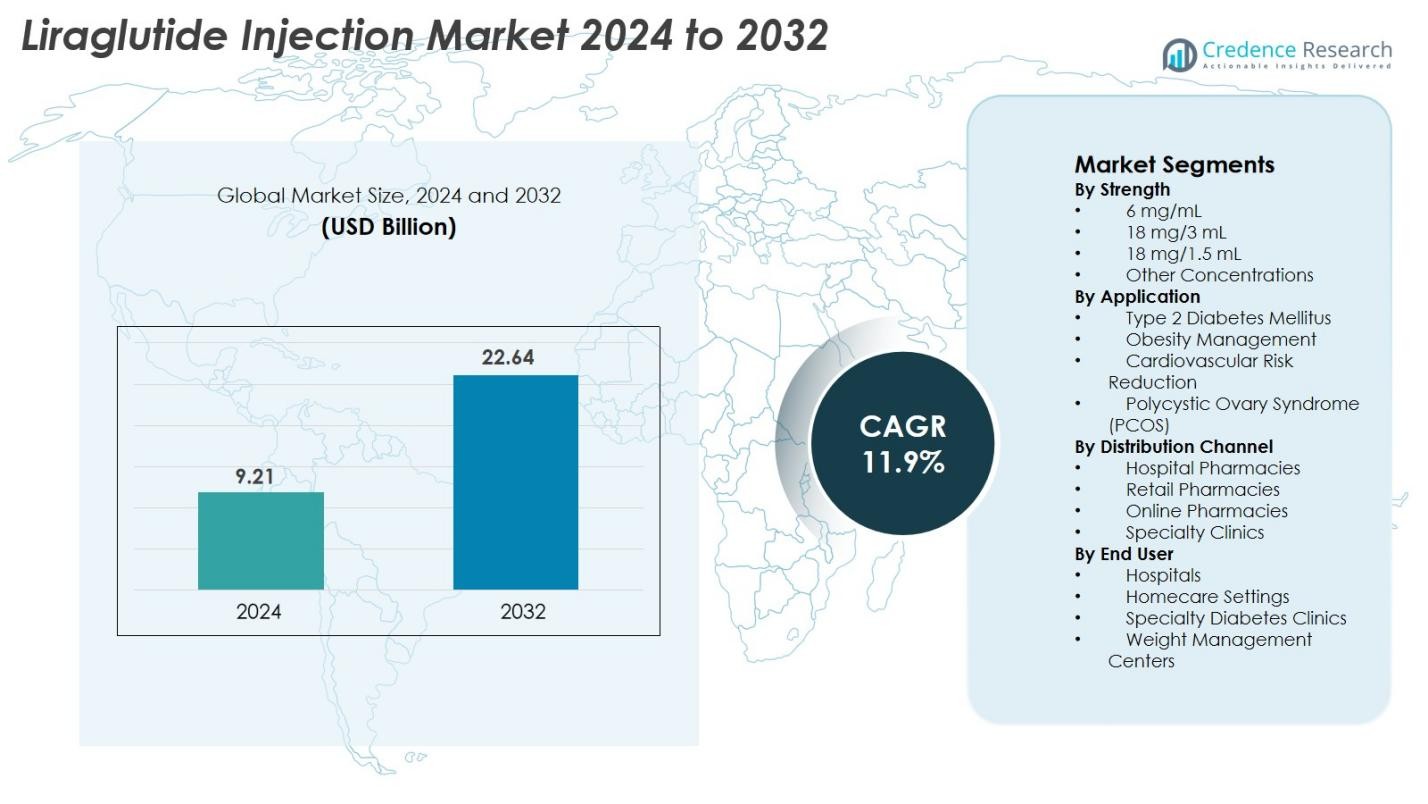

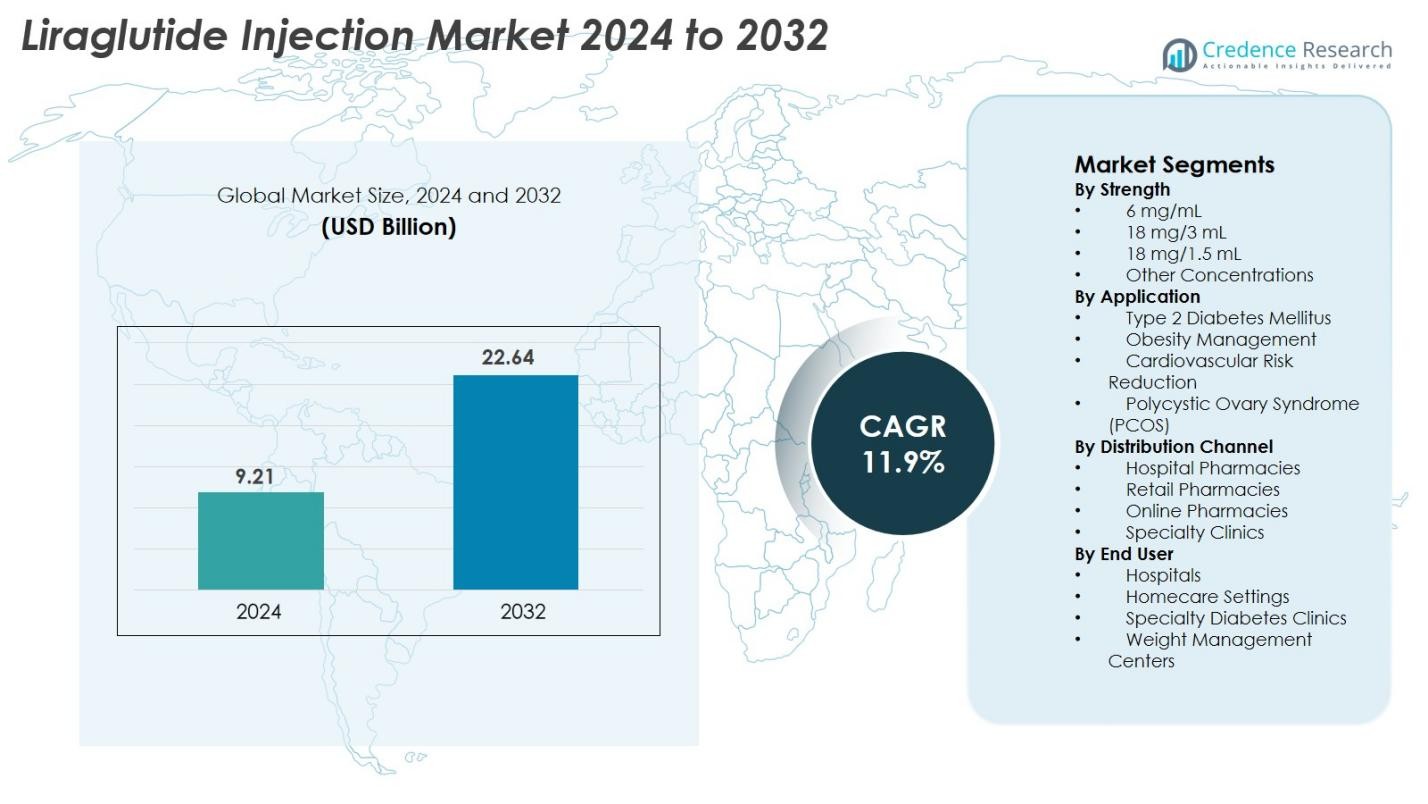

Liraglutide Injection Market size was valued at USD 9.21 Billion in 2024 and is anticipated to reach USD 22.64 Billion by 2032, at a CAGR of 11.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Liraglutide Injection Market Size 2024 |

USD 9.21 Billion |

| Liraglutide Injection Market, CAGR |

11.9% |

| Liraglutide Injection Market Size 2032 |

USD 22.64 Billion |

The Liraglutide Injection market is driven by strong participation from leading players such as Novo Nordisk A/S, Bachem Holding AG, HEC Pharma Co. Ltd., Hybio Pharmaceutical Co. Ltd., ALP Pharm Beijing Co. Ltd., Viruj Pharmaceutical, Shenzhen JYMed Technology Co. Ltd., Kingpep Biotechnology, Wuxi Asiapeptide, and Amphastar Pharmaceuticals, Inc. Novo Nordisk remains the market leader due to its extensive GLP-1 therapeutics portfolio and global distribution strength. Regionally, North America leads the market with a 38.6% share, supported by high diabetes and obesity prevalence and strong reimbursement systems, followed by Europe with 29.4% and Asia-Pacific with 22.7%, reflecting expanding adoption and rising metabolic disorder burdens.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Liraglutide Injection market was valued at USD 9.21 Billion in 2024 and is projected to reach USD 22.64 Billion by 2032, growing at a CAGR of 11.9% during the forecast period.

- Strong market growth is driven by rising global diabetes and obesity rates, increasing adoption of GLP-1 therapies, and expanding use of liraglutide in weight management and metabolic disorders.

- Market trends include higher preference for prefilled injection pens, growing acceptance of long-acting GLP-1 treatments, and expanding clinical applications beyond diabetes toward cardiovascular and metabolic risk reduction.

- Key players such as Novo Nordisk, Bachem, HEC Pharma, Hybio Pharma, and Shenzhen JYMed strengthen competition through manufacturing advancements, peptide innovation, and expanded supply capabilities.

- Regionally, North America leads with 38.6% share, followed by Europe at 29.4% and Asia-Pacific at 22.7%, while the 18 mg/3 mL strength dominates the segment with nearly 46.8% share, supported by high global prescription volume.

Market Segmentation Analysis

By Strength

The Liraglutide Injection market is segmented into 6 mg/mL, 18 mg/3 mL, 18 mg/1.5 mL, and other concentrations, with 18 mg/3 mL dominating the segment with 46.8% share. Its strong adoption is driven by its widespread use in both diabetes and obesity therapy, user-friendly prefilled pen designs, and high prescription volume in developed markets. The format’s proven dosing convenience and strong clinical acceptance further support demand. Meanwhile, 6 mg/mL and 18 mg/1.5 mL continue to grow steadily due to increased accessibility and expanding use in emerging economies.

- For instance, Novo Nordisk demonstrated the performance of its liraglutide formulation through the SCALE Obesity and Prediabetes trial, where patients receiving liraglutide achieved a mean reduction of 8.0 kg in body weight compared with placebo.

By Application

The application segment includes Type 2 Diabetes Mellitus, Obesity Management, Cardiovascular Risk Reduction, and Polycystic Ovary Syndrome (PCOS), with Type 2 Diabetes Mellitus leading at 52.4% share. This dominance is fueled by rising global diabetes prevalence, improved treatment adherence driven by liraglutide’s glycemic control benefits, and favorable clinical outcomes. Obesity Management is the fastest-growing sub-segment owing to increasing obesity rates and rising preference for GLP-1-based pharmacotherapy. Additional growth stems from guidelines recommending liraglutide in patients requiring improved metabolic outcomes.

- For instance, in a randomized trial of patients receiving 3.0 mg liraglutide (adjunct to diet and exercise), mean weight loss was 8.8 kg and 35.9 % of participants lost more than 10 % of body weight.

By Distribution Channel

The distribution channels include Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Specialty Clinics, with Retail Pharmacies holding the largest share at 41.7% due to high prescription dispensing rates and strong patient accessibility. Their extensive penetration across urban and semi-urban areas supports consistent adoption. Online Pharmacies are expanding rapidly as digital health and doorstep delivery options gain popularity, particularly among chronic disease patients. Hospital Pharmacies maintain steady demand due to specialist-driven prescriptions for newly diagnosed patients, while Specialty Clinics contribute through obesity and metabolic disorder programs.

Key Growth Drivers

Rising Global Burden of Diabetes and Obesity

The Liraglutide Injection market is experiencing significant growth primarily driven by the accelerating global prevalence of type 2 diabetes and obesity. With over 537 million adults living with diabetes and more than 1 billion individuals classified as obese globally, the demand for long-acting GLP-1 receptor agonists such as liraglutide has increased substantially. Liraglutide’s proven efficacy in glycemic control, weight reduction, and lowering cardiometabolic risks makes it a preferred therapeutic option for long-term management. Healthcare providers are increasingly prescribing liraglutide for patients who do not respond adequately to oral antidiabetic agents, strengthening its adoption. Public health initiatives promoting early diagnosis of metabolic disorders, combined with rising awareness about injectable therapies, further expand market penetration. Additionally, growth in urban populations, sedentary lifestyles, and an aging demographic contribute to a sustained rise in potential patient pools. These factors collectively position liraglutide as a critical treatment option, driving strong global market expansion.

- For instance, Novo Nordisk’s SCALE Obesity trial recorded a mean weight reduction of 8.0 kg among participants receiving liraglutide.

Expanding Use in Obesity Management and Metabolic Disorders

Another major driver is the rapidly growing adoption of liraglutide injections in obesity management and related metabolic disorders. Regulatory approval of liraglutide for chronic weight management has accelerated its demand, particularly as obesity-related complications such as cardiovascular disease, PCOS, and insulin resistance rise sharply. Patients seeking non-surgical weight-loss solutions increasingly rely on liraglutide due to its dual benefits of appetite suppression and improved metabolic function. Wellness centers, endocrinology clinics, and weight-management programs are incorporating GLP-1 therapies into routine care, further widening the market base. Increased clinical evidence demonstrating liraglutide’s ability to reduce cardiovascular events and improve overall quality of life enhances its therapeutic acceptance. In many countries, obesity is now recognized as a chronic disease, prompting insurers and healthcare systems to expand coverage for medically supervised pharmacotherapy. These developments collectively contribute to strong, sustained growth in the obesity and metabolic treatment segment of the market.

- For instance, Novo Nordisk’s SCALE Maintenance trial reported that individuals treated with liraglutide maintained a weight reduction of 6.2 kg from baseline across the study period.

Growing Preference for Advanced Injectable Delivery Systems

The development of innovative drug delivery systems is significantly influencing market expansion for liraglutide injections. Prefilled, ready-to-use injection pens have become a major enabler of adoption, offering convenience, precision dosing, and ease of handling for patients requiring daily administration. The shift from vial-and-syringe formats to modern pen injectors has improved patient compliance, reduced dosing errors, and enhanced user experience—key factors that drive long-term therapy adherence. Manufacturers are further investing in device optimization, focusing on ergonomic designs, dose-adjustment mechanisms, and minimal injection discomfort. These technological improvements enhance acceptance among newly diagnosed patients and those transitioning from oral medications. Moreover, the growing trend of self-administration and home-based chronic disease management aligns well with liraglutide pen formats. Digital health integration, including connected injection devices and mobile reminders, is emerging as an additional catalyst that supports continued growth within the global liraglutide delivery ecosystem.

Key Trends & Opportunities

Accelerating R&D for Multi-Indication Expansion

The expanding research focus on GLP-1 receptor agonists offers significant opportunities for the Liraglutide Injection market. Researchers are actively exploring liraglutide’s potential across new therapeutic areas, including non-alcoholic fatty liver disease (NAFLD), cardiovascular protection, sleep apnea linked to obesity, and reproductive metabolic disorders. These clinical investigations are supported by mounting evidence of liraglutide’s ability to reduce inflammation, improve lipid metabolism, and support long-term weight reduction. As metabolic diseases continue to overlap, multi-indication approvals can substantially increase the eligible patient pool and broaden healthcare provider endorsement. Pharmaceutical companies are also leveraging combination therapy strategies, integrating liraglutide with insulin or other weight-loss drugs to enhance treatment outcomes. This ongoing innovation pipeline positions liraglutide as a versatile molecule with the potential to expand far beyond diabetes and obesity treatment, opening profitable avenues for market participants across various therapeutic segments.

- For instance, in a randomized NAFLD trial published in The Lancet, liraglutide achieved histological resolution of steatohepatitis in 9 of 23 treated patients compared with 2 of 22 in the control group.

Increasing Adoption of Digital Health and Remote Patient Management

The growing shift toward digital health presents a major opportunity for expanding liraglutide use worldwide. Remote patient monitoring, telemedicine consultations, and mobile health applications have made chronic disease management more efficient and accessible. Patients using liraglutide injections increasingly rely on digital tools for dose reminders, adherence tracking, and real-time feedback. These platforms improve treatment compliance, especially in long-term regimens such as obesity or diabetes therapy. Healthcare providers benefit from integrated dashboards that allow them to monitor patient progress and adjust doses remotely, reducing the need for frequent in-person visits. In addition, digital pharmacies and online prescription services are making access to liraglutide easier for patients in rural or underserved regions. As digital ecosystems mature globally, they create a supportive environment for wider liraglutide adoption and position GLP-1 therapies as key components in modern, technology-assisted metabolic care.

- For instance, Novo Nordisk and Noom established a partnership in late 2019 to provide digital health solutions for individuals with obesity.

Key Challenges

High Treatment Cost and Limited Reimbursement Coverage

A major challenge facing the Liraglutide Injection market is the high cost of therapy, which restricts accessibility for many patients, particularly in developing regions. Liraglutide is priced significantly higher than conventional antidiabetic medications, making long-term treatment financially burdensome for middle-income groups. In numerous countries, reimbursement coverage for obesity management drugs remains limited, as insurers often classify weight-loss treatment as non-essential or cosmetic. This lack of financial support reduces adoption despite proven clinical benefits. Even in diabetes care, reimbursement frameworks vary widely across health systems, creating inequities in access. Cost concerns also impact medication adherence, with some patients discontinuing therapy due to economic strain. These pricing and coverage barriers pose a substantial obstacle to market expansion, prompting a need for policy reforms, pricing adjustments, and broader insurer participation to improve patient access.

Stringent Regulatory Requirements and Safety Considerations

Regulatory scrutiny poses another significant challenge for the Liraglutide Injection market. As a biologically active GLP-1 analog, liraglutide undergoes rigorous evaluation related to safety, efficacy, and long-term health outcomes. Regulatory authorities closely monitor potential adverse effects such as gastrointestinal discomfort, pancreatitis risk, thyroid-related concerns, and cardiovascular implications. These safety considerations require extensive clinical trials, post-marketing surveillance, and continuous data reporting, increasing development and compliance costs for manufacturers. In some regions, regulatory delays or varying approval pathways hinder timely market entry. Additionally, growing competition from newer GLP-1 and dual-agonist therapies raises performance expectations, making it essential for manufacturers to demonstrate superior safety profiles. These stringent regulatory and clinical demands create operational complexity and may limit the speed at which liraglutide products expand into new indications or markets.

Regional Analysis

North America

North America holds the largest share of the Liraglutide Injection market at 38.6%, driven by a high prevalence of obesity, diabetes, and metabolic syndrome across the U.S. and Canada. Strong adoption of GLP-1 therapies, well-established reimbursement systems, and the presence of leading manufacturers support sustained growth. Increasing use of liraglutide for both diabetes and weight management, supported by advanced clinical practices, drives higher prescription rates. Expansion of telehealth, digital pharmacies, and awareness campaigns for obesity treatment further strengthens the region’s dominance, ensuring continued demand across commercial and hospital pharmacy channels.

Europe

Europe accounts for 29.4% of the Liraglutide Injection market, supported by rising diabetes incidence, structured clinical guidelines, and broad acceptance of GLP-1 receptor agonists. Countries such as Germany, the U.K., France, and the Nordics show strong uptake due to active adoption of evidence-based obesity management protocols. Favorable reimbursement environments for diabetes therapies also contribute to higher accessibility. Increasing focus on weight-loss pharmacotherapy and cardiovascular risk reduction enhances usage. Expanding healthcare expenditure, aging populations, and strong presence of specialty diabetes clinics drive further penetration across both Western and Eastern European markets.

Asia-Pacific

Asia-Pacific represents one of the fastest-growing regions, holding 22.7% market share, driven by surging diabetes rates, lifestyle changes, and growing obesity prevalence in China, India, Japan, and Southeast Asia. Urbanization, sedentary behavior, and rising disposable incomes accelerate the demand for GLP-1 therapies. Liraglutide adoption is strengthening as governments promote chronic disease management and expand healthcare modernization. Increasing approvals, supply-chain expansion, and wider physician awareness support growth, while obesity-focused treatment programs further push uptake. The rapid expansion of online pharmacies and hospital networks enhances medicine accessibility across densely populated urban centers.

Latin America

Latin America captures 5.8% of the Liraglutide Injection market, driven by increasing obesity and diabetes burdens in Brazil, Mexico, Chile, and Argentina. Growing acceptance of modern injectable therapies and expanding private healthcare systems contribute to rising demand. Although reimbursement constraints limit large-scale adoption, rising middle-class income and improved physician awareness support market penetration. Urban healthcare centers increasingly utilize liraglutide for weight management programs, while obesity-focused public health initiatives stimulate regional demand. Expansion of multinational pharmaceutical distribution and digital pharmacy platforms is gradually improving accessibility across major metropolitan regions.

Middle East & Africa

The Middle East & Africa region holds 3.5% market share, supported by a rising prevalence of lifestyle-related metabolic disorders, especially in Gulf countries such as Saudi Arabia, the UAE, and Qatar. Increasing obesity rates due to dietary patterns and sedentary behavior drive higher demand for GLP-1 therapies. Improved healthcare infrastructure, growing specialist clinics, and rising adoption of premium injectable treatments support market expansion. However, limited reimbursement coverage and cost sensitivity in parts of Africa restrain widespread use. Nevertheless, expanding urban healthcare systems and growing awareness of weight-management solutions continue to enhance regional uptake.

Market Segmentations

By Strength

- 6 mg/mL

- 18 mg/3 mL

- 18 mg/1.5 mL

- Other Concentrations

By Application

- Type 2 Diabetes Mellitus

- Obesity Management

- Cardiovascular Risk Reduction

- Polycystic Ovary Syndrome (PCOS)

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Specialty Clinics

By End User

- Hospitals

- Homecare Settings

- Specialty Diabetes Clinics

- Weight Management Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Liraglutide Injection market features an increasingly dynamic competitive landscape driven by strong participation from global and regional pharmaceutical manufacturers. Novo Nordisk A/S remains the dominant player, leveraging its established brand portfolio, extensive clinical data, and wide distribution networks. Companies such as HEC Pharma Co. Ltd., Bachem Holding AG, Hybio Pharmaceutical Co. Ltd., ALP Pharm Beijing Co. Ltd., Viruj Pharmaceutical, Shenzhen JYMed Technology Co. Ltd., Kingpep Biotechnology, Wuxi Asiapeptide, and Amphastar Pharmaceuticals, Inc. are strengthening their positions through strategic manufacturing expansions, peptide production capabilities, and partnerships targeting large-volume GLP-1 demand. These firms focus on improving production efficiency, securing regulatory approvals, and expanding presence across high-growth markets in Asia-Pacific and Latin America. The competitive environment is further shaped by increasing investments in formulation enhancements, pen-injector device innovations, and affordability initiatives aimed at improving patient access. As demand for diabetes and obesity therapies accelerates, competition is expected to intensify, driving innovation and broader global penetration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hybio Pharmaceutical Co. Ltd.

- Viruj Pharmaceutical

- Wuxi Asiapeptide

- Bachem Holding AG

- Shenzhen JYMed Technology Co. Ltd.

- Novo Nordisk A/S

- HEC Pharma Co. Ltd.

- ALP Pharm Beijing Co. Ltd.

- Kingpep Biotechnology

- Amphastar Pharmaceuticals, Inc.

Recent Developments

- In October 2025, Lupin launched its liraglutide-injection (18 mg/3 mL single-patient use prefilled pen) in the United States.

- In August 2025, Teva Pharmaceuticals, Inc. announced FDA approval and launch in the U.S. of a generic version of Liraglutide injection (brand : Saxenda), positioning it as the first generic GLP-1 therapy for weight loss.

- In July 2025, Lupin Limited obtained FDA approval for its generic injectable version of liraglutide (bioequivalent to Victoza) in the U.S. market, as part of its complex generics segment.

Report Coverage

The research report offers an in-depth analysis based on Strength, Application, Distribution Channel, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness strong growth as obesity and diabetes prevalence continues to rise globally.

- Adoption of GLP-1 therapies will accelerate due to enhanced clinical outcomes and broader physician acceptance.

- Liraglutide use will expand into new metabolic indications supported by ongoing clinical research.

- Prefilled pen injectors will drive higher patient compliance and strengthen long-term therapy adoption.

- Digital health integration will enhance treatment monitoring and support remote patient management.

- Pharmaceutical companies will increase investments in peptide manufacturing and delivery system innovation.

- Emerging markets will experience rapid uptake as healthcare infrastructure and awareness improve.

- Competitive pressure will intensify with more players entering the GLP-1 and weight-management drug space.

- Pricing strategies and reimbursement improvements will become essential to expanding patient access.

- Regulatory approvals for wider therapeutic uses will create new growth opportunities across global markets.