Market Overview

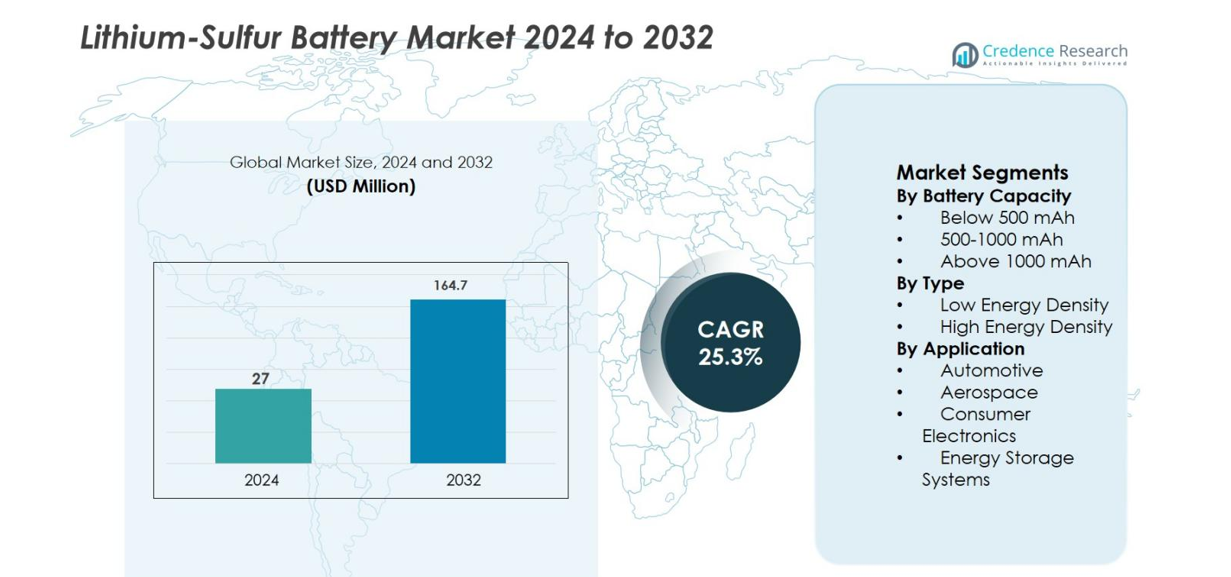

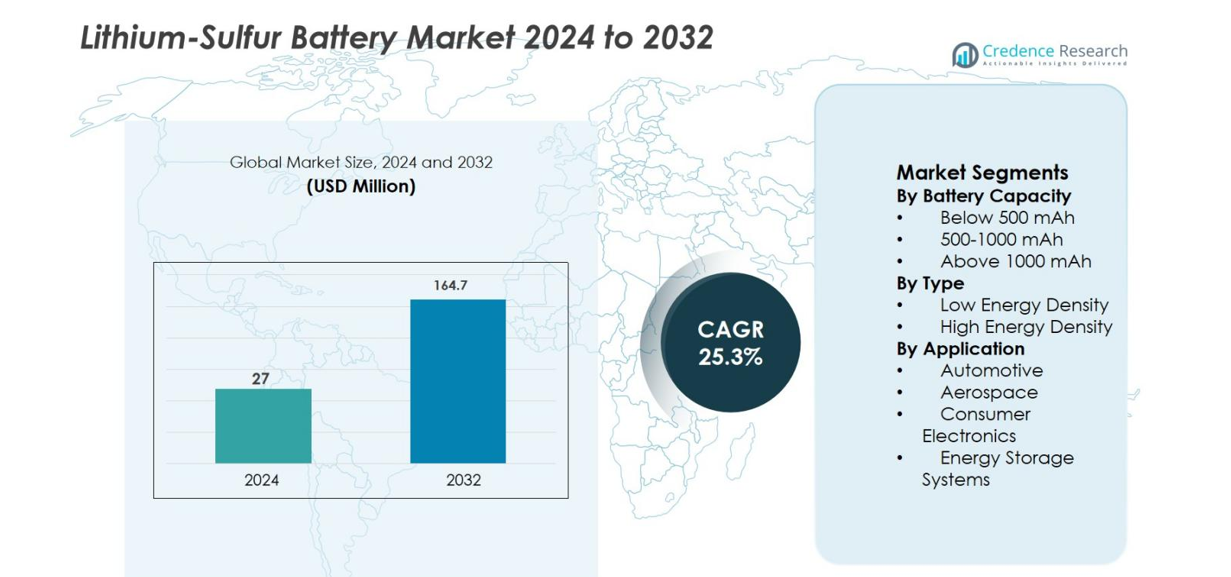

Lithium-Sulfur Battery market size was valued at USD 27 million in 2024 and is anticipated to reach USD 164.7 million by 2032, at a CAGR of 25.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lithium-Sulfur Battery Market Size 2024 |

USD 27 million |

| Lithium-Sulfur Battery Market, CAGR |

25.3% |

| Lithium-Sulfur Battery Market Size 2032 |

USD 164.7 million |

Lithium-Sulfur Battery market is shaped by a mix of established battery manufacturers and innovation-focused developers advancing next-generation chemistries. Key players include Sion Power Corporation, Li-S Energy Limited, PolyPlus Battery Company, Zeta Energy LLC, Gelion PLC, NexTech Batteries Inc., GS Yuasa Corporation, Saft Groupe SA, LG Energy Solution Ltd., and Johnson Matthey, all investing in improved cycle life, energy density, and scalable production. Regionally, North America leads the Lithium-Sulfur Battery market with a 34.6% share, supported by strong R&D funding, aerospace programs, and defense applications. Europe follows with 28.9% share, driven by sustainability mandates and alternative battery initiatives, while Asia-Pacific accounts for 26.1%, supported by battery manufacturing expertise and electric mobility expansion.

Market Insights

- Lithium-Sulfur Battery market was valued at USD 27 million in 2024 and is projected to grow at a CAGR of 25.3% to reach USD 164.7 million by 2032.

- Market growth is driven by rising demand for high-energy-density and lightweight batteries from automotive, aerospace, and defense sectors, with the Above 1000 mAh capacity segment leading at 46.8% share due to suitability for long-duration and high-performance applications.

- Technological trends focus on advanced sulfur cathodes, electrolyte stabilization, and mitigation of polysulfide shuttle effects, while high energy density batteries dominate the type segment with a 62.4% share, supporting next-generation mobility and aerospace systems.

- The market landscape includes innovation-driven players such as Sion Power Corporation, Li-S Energy Limited, PolyPlus Battery Company, Zeta Energy LLC, Gelion PLC, and GS Yuasa Corporation, emphasizing pilot projects, partnerships, and proprietary cell designs.

- Regionally, North America leads with 34.6% share, followed by Europe at 28.9% driven by sustainability initiatives, and Asia-Pacific at 26.1% supported by battery manufacturing expertise and electric mobility expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Battery Capacity

The Lithium-Sulfur Battery market, by battery capacity, is led by the Above 1000 mAh segment, which accounted for 46.8% market share in 2024. This dominance is driven by strong demand from applications requiring long-duration power and higher energy output, particularly electric vehicles, aerospace systems, and stationary energy storage. Above 1000 mAh batteries offer extended discharge cycles, improved gravimetric energy density, and better suitability for next-generation mobility platforms. Ongoing advancements in sulfur cathodes and electrolyte stabilization further enhance capacity retention, supporting large-format battery adoption and reinforcing the segment’s leadership.

- For instance, Lyten lithium-sulfur cells can enable up to ~40% lower weight than lithium-ion and ~60% lower weight than LFP in targeted applications, reinforcing why higher-capacity packs are prioritized for weight-sensitive platforms.

By Type

Based on type, the High Energy Density segment dominated the Lithium-Sulfur Battery market with a 62.4% share in 2024. High energy density batteries are preferred due to their ability to deliver lightweight designs with significantly higher theoretical energy storage compared to conventional lithium-ion batteries. This advantage is critical for aerospace, advanced automotive, and defense applications where weight reduction directly improves performance and efficiency. Continuous R&D focused on mitigating polysulfide shuttle effects and improving cycle life strengthens commercial viability, positioning high energy density lithium-sulfur batteries as the primary growth driver.

- For instance, NASA-supported testing disclosed in 2024 showed lithium-sulfur pouch cells delivering ~255 Wh/kg at C/10 and ~210 Wh/kg at 1C, validating high energy density performance under practical operating conditions for aerospace use.

By Application

By application, the Automotive segment held the largest share of 38.9% in 2024 in the Lithium-Sulfur Battery market. The segment’s dominance is supported by rising investments in electric vehicles, demand for extended driving range, and the need for lighter battery systems to improve vehicle efficiency. Lithium-sulfur batteries offer higher specific energy, enabling reduced battery pack weight compared to lithium-ion alternatives. Automotive OEMs and battery developers are actively piloting lithium-sulfur technologies for next-generation EV platforms, accelerating commercialization and sustaining strong demand growth.

Key Growth Drivers

Rising Demand for High-Energy-Density and Lightweight Batteries

The Lithium-Sulfur Battery market is strongly driven by the growing demand for high-energy-density and lightweight energy storage solutions across automotive, aerospace, and defense sectors. Lithium-sulfur batteries offer significantly higher theoretical specific energy compared to conventional lithium-ion batteries, enabling substantial weight reduction and improved system efficiency. In electric vehicles, lighter batteries directly enhance driving range and vehicle performance, while in aerospace and unmanned aerial systems, reduced weight translates into longer flight times and higher payload capacity. Continuous advancements in sulfur cathode materials, electrolyte formulations, and cell architecture are improving cycle life and stability, making lithium-sulfur technology increasingly viable for commercial deployment. These performance advantages position lithium-sulfur batteries as a next-generation solution, driving sustained market growth.

- For instance, Stellantis and Zeta Energy (December 2024) announced joint development of lithium-sulfur EV battery cells, highlighting industry efforts to translate lightweight, high-energy designs into automotive-grade applications.

Accelerating Electrification in Automotive and Aerospace Applications

The rapid acceleration of electrification in transportation is a major driver for the Lithium-Sulfur Battery market. Automotive manufacturers are actively exploring alternatives to lithium-ion batteries to meet range extension, efficiency, and sustainability targets. Lithium-sulfur batteries support higher energy storage at lower material weight, aligning with next-generation electric vehicle and hybrid aircraft design requirements. In aerospace, the push toward electric and hybrid-electric propulsion systems increases demand for batteries that deliver high specific energy without compromising safety. Government initiatives supporting clean mobility, coupled with rising investments from OEMs and battery developers, are accelerating pilot projects and validation programs, strengthening demand for lithium-sulfur battery technologies.

- For instance, Sion Power (2024) confirmed continued development of its Licerion® lithium-sulfur cells targeting >400 Wh/kg specific energy, positioning the chemistry for electric aviation and long-range electric vehicle applications where mass reduction is critical.

Material Sustainability and Reduced Reliance on Critical Metals

Sustainability considerations are increasingly influencing battery technology adoption, supporting growth in the Lithium-Sulfur Battery market. Unlike lithium-ion batteries that rely on cobalt and nickel, lithium-sulfur batteries use sulfur, which is abundant, low-cost, and environmentally favorable. This reduces supply chain risks and exposure to price volatility associated with critical metals. Regulatory pressure to improve battery sustainability and recyclability further encourages the shift toward alternative chemistries. Manufacturers are investing in scalable production processes and recycling pathways for lithium-sulfur batteries, enhancing their environmental profile. These sustainability advantages strengthen long-term adoption potential and reinforce lithium-sulfur batteries as a strategic solution for future energy storage systems.

Key Trends & Opportunities

Advancements in Electrolyte and Cathode Technologies

A key trend shaping the Lithium-Sulfur Battery market is continuous innovation in electrolyte and cathode technologies aimed at overcoming performance limitations. Research efforts focus on suppressing the polysulfide shuttle effect, improving ionic conductivity, and enhancing cycle stability. Solid-state and gel polymer electrolytes, along with advanced carbon-sulfur composite cathodes, are gaining attention for their ability to improve durability and safety. These technological advancements open opportunities for commercial-scale deployment across high-performance applications. As laboratory breakthroughs transition into pilot production, battery manufacturers can differentiate through improved lifespan and reliability, accelerating market penetration.

- For instance, Gelion (2023–2024) advanced gel-based lithium-sulfur pouch cells, leveraging polymer electrolyte formulations to improve electrochemical stability and manufacturability, supporting transition from laboratory prototypes to pilot-scale production.

Emerging Opportunities in Energy Storage and Defense Applications

Beyond transportation, lithium-sulfur batteries are gaining traction in energy storage systems and defense applications, creating new growth opportunities. Their high specific energy and lightweight design make them suitable for portable power systems, remote energy storage, and military equipment. Defense agencies prioritize technologies that enhance mobility and operational endurance, supporting adoption of lithium-sulfur batteries. In stationary energy storage, improved cycle performance enables use in backup power and grid-support applications. Expansion into these non-automotive segments diversifies revenue streams and reduces dependency on a single end-use market, supporting long-term growth.

- For instance, US Department of Defense–funded research programs (2023–2024) continued evaluating lithium-sulfur batteries for soldier-worn and unmanned systems, focusing on increased energy-to-weight ratios to enhance mobility and operational endurance.

Key Challenges

Limited Cycle Life and Performance Degradation

One of the primary challenges facing the Lithium-Sulfur Battery market is limited cycle life compared to mature lithium-ion technologies. Capacity fading caused by polysulfide dissolution and electrode degradation restricts long-term performance. Although significant progress has been made through material engineering and cell design, achieving stable performance over extended charge-discharge cycles remains complex. This limitation affects suitability for applications requiring long operational lifespans, such as passenger electric vehicles and stationary energy storage. Addressing this challenge requires continued investment in advanced materials and manufacturing processes, which may increase development costs.

Commercial Scalability and Manufacturing Complexity

Scaling lithium-sulfur battery production for mass commercialization presents another major challenge. Manufacturing processes differ significantly from conventional lithium-ion battery lines, requiring new equipment, quality controls, and supply chain adaptations. Achieving consistent cell performance at scale remains difficult due to sensitivity to material composition and processing conditions. Additionally, higher initial production costs and limited large-scale suppliers slow adoption. Overcoming these barriers depends on successful pilot-to-commercial transitions, process standardization, and increased collaboration between technology developers and manufacturing partners.

Regional Analysis

North America

North America accounted for 34.6% of the Lithium-Sulfur Battery market share in 2024, driven by strong investments in advanced battery R&D, aerospace innovation, and defense modernization programs. The United States leads regional demand due to active involvement of technology developers, startups, and government-backed research institutions focusing on next-generation energy storage solutions. Growing interest from electric vehicle manufacturers and aerospace companies seeking lightweight, high-energy-density batteries further supports adoption. Federal funding initiatives and collaborations between universities and private players accelerate pilot-scale commercialization, positioning North America as a key innovation hub for lithium-sulfur battery development.

Europe

Europe held a 28.9% market share in 2024 in the Lithium-Sulfur Battery market, supported by strong sustainability policies and strategic investments in alternative battery chemistries. The region emphasizes reducing dependence on critical raw materials such as cobalt and nickel, favoring sulfur-based solutions. Countries including Germany, the UK, and France actively support battery innovation through public-private partnerships and clean mobility programs. Growing adoption in aerospace, defense, and energy storage applications further strengthens demand. Europe’s focus on battery recycling, lifecycle sustainability, and regulatory compliance enhances long-term growth potential.

Asia-Pacific

Asia-Pacific captured 26.1% of the Lithium-Sulfur Battery market share in 2024, driven by rapid technological advancement and expanding electric mobility ecosystems. Japan, China, and South Korea play key roles through strong battery manufacturing expertise and increasing R&D investments in next-generation chemistries. Automotive OEMs and electronics manufacturers in the region are exploring lithium-sulfur batteries to achieve higher energy density and weight reduction. Government incentives supporting electric vehicles and advanced energy storage further stimulate adoption. Asia-Pacific’s manufacturing scale and innovation capacity position it as a critical region for future commercialization.

Rest of the World

The Rest of the World region accounted for 10.4% of the Lithium-Sulfur Battery market share in 2024, with growth driven by emerging adoption across the Middle East, Latin America, and select defense-focused economies. Demand is supported by increasing interest in lightweight energy storage for military, remote power, and off-grid applications. While commercialization remains at an early stage, rising investments in renewable energy integration and energy storage infrastructure create future opportunities. Strategic partnerships with global battery developers and gradual technology transfer are expected to support steady market expansion.

Market Segmentations:

By Battery Capacity

- Below 500 mAh

- 500-1000 mAh

- Above 1000 mAh

By Type

- Low Energy Density

- High Energy Density

By Application

- Automotive

- Aerospace

- Consumer Electronics

- Energy Storage Systems

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Lithium-Sulfur Battery market features a developing competitive landscape characterized by strong research intensity, strategic partnerships, and pilot-scale commercialization initiatives. Key players such as Sion Power Corporation, Li-S Energy Limited, PolyPlus Battery Company, Zeta Energy LLC, Gelion PLC, NexTech Batteries Inc., GS Yuasa Corporation, Saft Groupe SA, LG Energy Solution Ltd., and Johnson Matthey focus on overcoming technical barriers related to cycle life, safety, and scalability. Companies actively invest in advanced cathode materials, electrolyte stabilization, and proprietary cell architectures to improve performance and manufacturability. Collaborations with automotive OEMs, aerospace manufacturers, and defense agencies support technology validation and early adoption. Larger battery manufacturers leverage established production expertise and global supply chains, while startups emphasize innovation-driven differentiation. This combination of technological advancement, strategic alliances, and gradual scale-up defines competition and shapes the long-term commercialization trajectory of lithium-sulfur batteries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sion Power Corporation

- Gelion PLC

- LG Energy Solutions Ltd.

- Zeta Energy LLC

- GS Yuasa Corporation

- PolyPlus Battery Company

- Johnson Matthey

- Li-S Energy Limited

- Saft Groupe SA

- NexTech Batteries Inc.

Recent Developments

- In November 2025, Li-S Energy, an Australian lithium-sulfur battery developer, secured nearly $8 million in federal government funding to advance planning for a large-scale lithium-sulfur battery cell manufacturing facility targeting 1 GWh annual output.

- In August 2025, Lyten acquired most of the remaining assets and intellectual property of Northvolt, including manufacturing facilities in Sweden and Germany, to expand its lithium-sulfur battery production and technology capabilities.

- In March 2025, Solidion Technology reached a major milestone with its lithium-sulfur batteries achieving a cell energy density of 380 Wh/kg, marking a significant advancement toward high-density energy storage solutions

Report Coverage

The research report offers an in-depth analysis based on Battery Capacity, Type. Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Lithium-Sulfur Battery market will witness accelerated commercialization as improvements in cycle life and stability progress toward industry benchmarks.

- Automotive and aerospace sectors will increasingly adopt lithium-sulfur batteries to achieve weight reduction and extended operational range.

- Continued advancements in sulfur cathode and electrolyte technologies will enhance energy efficiency and safety performance.

- Pilot-scale production facilities will transition into early commercial manufacturing over the forecast period.

- Strategic collaborations between battery developers, OEMs, and research institutions will intensify to accelerate validation and adoption.

- Sustainability advantages will strengthen adoption as manufacturers seek alternatives to cobalt- and nickel-intensive chemistries.

- Defense and unmanned systems will remain early adopters due to strong demand for high specific energy solutions.

- Manufacturing process optimization will reduce cost barriers and improve scalability.

- Expansion into stationary and portable energy storage applications will diversify end-use demand.

- Regulatory support for clean mobility and advanced energy storage will reinforce long-term market growth.