Market Overview

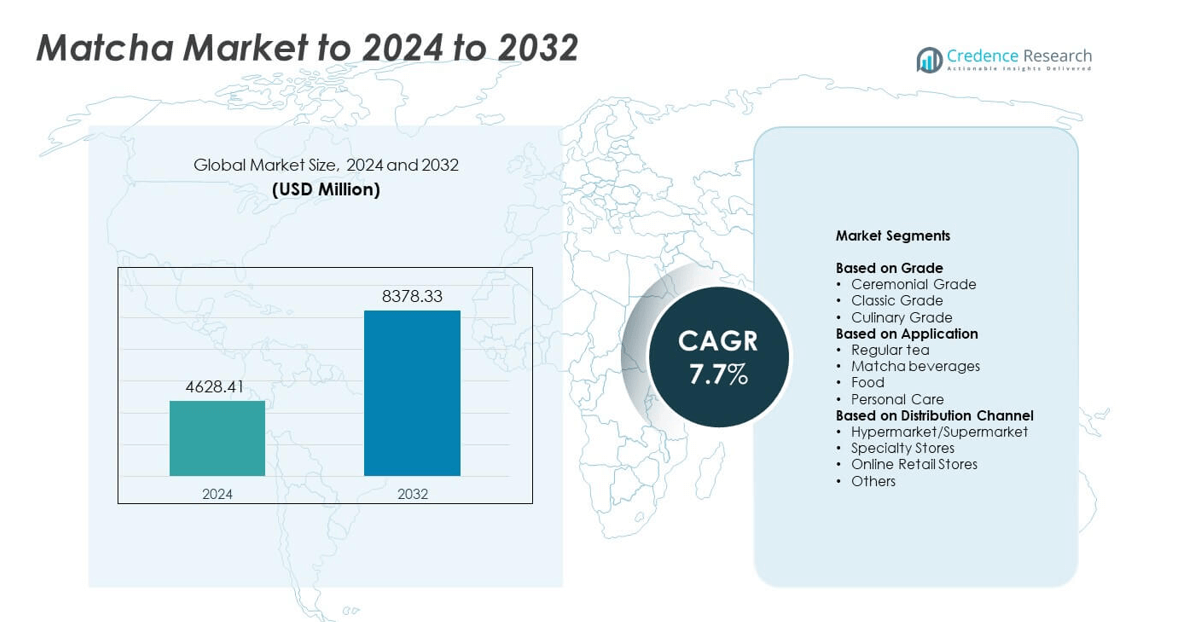

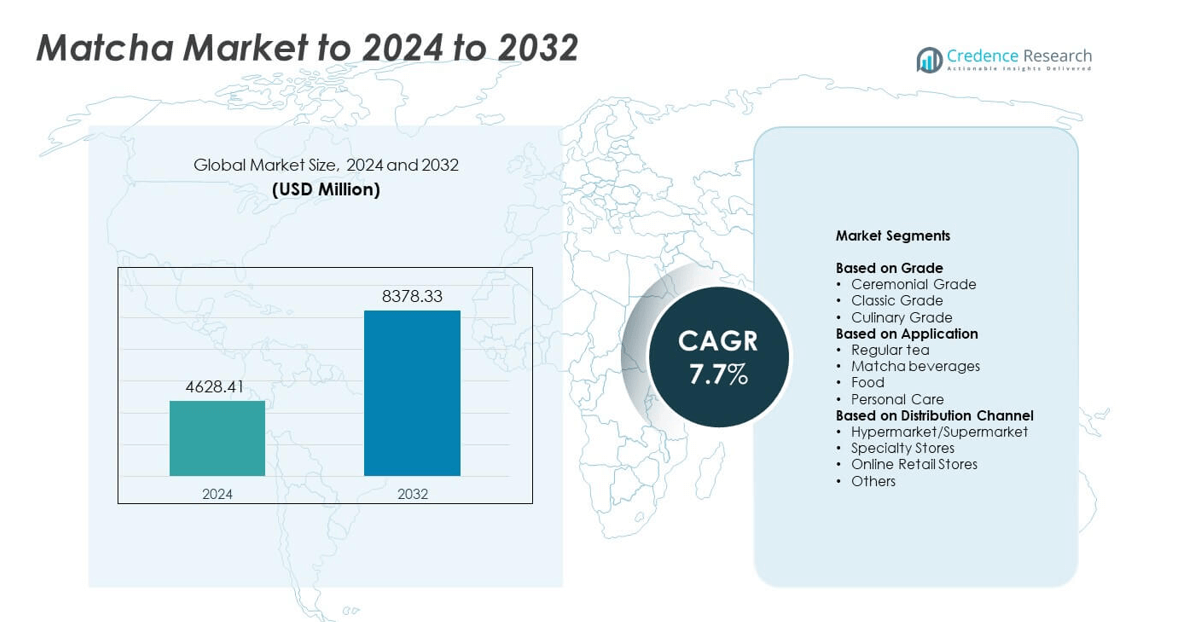

Matcha Market size was valued USD 4628.41 Million in 2024 and is anticipated to reach USD 8378.33 Million by 2032, at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Matcha Market Size 2024 |

USD 4628.41 Million |

| Matcha Market, CAGR |

7.7% |

| Matcha Market Size 2032 |

USD 8378.33 Million |

The Matcha Market includes major players such as Midori Spring, DoMatcha, Aiya America Inc., Jade Monk, Garden To Cup Organics, The AOI Tea Company, Encha, TEAJA Organic, Ippodo Tea USA, and Goli Nutrition Inc. These companies expand their presence through premium grades, organic certification, and wider retail distribution. Asia Pacific leads the global market with about 34% share in 2024 due to strong production roots and rising café culture. North America follows with nearly 32% share, driven by high demand for wellness beverages and ready-to-drink matcha products. Europe accounts for around 27% share, supported by growing interest in natural energy alternatives.

Market Insights

- Matcha Market reached USD 4628.41 Million in 2024 and will reach USD 8378.33 Million by 2032 at a CAGR of 7.7%.

- Growth rises due to strong demand for antioxidant-rich drinks and rising use of ceremonial-grade products, which hold about 46% share in 2024.

- Trends focus on premium blends, organic sourcing, and wider use in ready-to-drink beverages, while regular tea applications lead with nearly 43% share.

- Competition increases as brands invest in quality control, clean-label claims, and online retail expansion, while restraints include supply pressure and high production costs.

- Asia Pacific leads with about 34% share in 2024, followed by North America at 32% and Europe at 27%, while hypermarkets and supermarkets remain dominant with nearly 38% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Grade

Ceremonial grade leads this segment with about 46% share in 2024. Buyers choose this grade for its strong flavor profile and bright green color. Demand grows as premium tea brands promote whisk-grade matcha for daily use. Classic grade follows due to steady interest from cafes and wellness users. Culinary grade expands with rising use in bakery, confectionery, and ready mixes across global markets.

- For instance, Marukyu Koyamaen sells ceremonial matcha in a domestic market where Japan produced 5,336 tons of tencha in 2024, according to the Japanese Tea Production Association.

By Application

Regular tea dominates this segment with nearly 43% share in 2024. Consumers prefer matcha tea because it offers clean energy and strong antioxidant content. Growth accelerates as wellness trends push users toward low-calorie beverage options. Matcha beverages grow fast through launches of lattes, canned drinks, and energy blends. Food applications rise as brands add matcha to snacks, desserts, and dairy products.

- For instance, Ippodo operates in a market where Japan’s annual matcha production increased from 1,471 tons in 2010 to 4,176 tons in 2023, based on data reported by Japan’s agriculture ministry.

By Distribution Channel

Hypermarket and supermarket stores hold the largest share at about 38% in 2024. Shoppers trust these channels due to wide availability and clear product labeling. Growth strengthens as retailers expand premium tea shelves and health food sections. Specialty stores attract repeat buyers seeking high-grade products. Online retail grows quickly due to subscription boxes, global shipping, and discounted bundles.

Key Growth Drivers

Rising Health and Wellness Awareness

Demand increases as people seek natural energy sources and antioxidant-rich drinks. Matcha appeals to health-focused consumers who want clean labels and simple ingredients. Brands promote matcha as a daily wellness booster that supports metabolism and calm focus. The rising shift toward mindful eating strengthens interest across young buyers. Growing awareness of catechin content also supports adoption. This health-driven preference now shapes product launches across beverages and packaged foods, making wellness promotion a major growth driver for the global Matcha Market.

- For instance, PepsiCo’s Lipton brand recalled 2,854 cases, more than 34,000 bottles, of Lipton Green Tea Citrus in 2025 after a labelling error hid 25 grams of sugar in each bottle, highlighting how closely health-focused shoppers examine tea beverages.

Expansion of Ready-to-Drink Products

Ready-to-drink matcha beverages gain strong traction across retail formats. These products offer fast consumption and consistent taste for busy consumers. Brands release chilled cans, bottled lattes and functional blends with added nutrients. Convenience stores and supermarkets widen their assortments to meet rising demand. Young buyers prefer grab-and-go options that deliver energy without sugar spikes. This growing acceptance of ready-made formats encourages investment from large beverage companies, making ready-to-drink innovation a major driver for the Matcha Market.

- For instance, Ito En’s Oi Ocha unsweetened green tea brand sold more than 90 million cases in 2018, a performance recognised by Guinness World Records as the world’s best-selling ready-to-drink green tea.

Growth in Global Café Culture

Cafés worldwide increase matcha-based menu offerings to attract health-focused customers. Matcha lattes, cold brews and flavored blends appear on premium café menus. The rise of international coffee chains strengthens matcha visibility across urban markets. Social media trends highlight vibrant green drinks, boosting café footfall. Retailers also use matcha to diversify seasonal offerings. This café-linked expansion pushes matcha into mainstream beverage culture, making global café adoption a major growth driver for the Matcha Market.

Key Trends and Opportunities

Premiumization of Matcha Products

Consumers show strong interest in high-grade and organic matcha. Premium blends gain value as buyers look for authentic taste and stronger color. Brands highlight origin, shading techniques and grinding methods to justify higher prices. Luxury cafés promote ceremonial-grade drinks, boosting awareness among new customers. The rising focus on quality allows companies to introduce exclusive blends and limited batches. This shift toward premium choices creates strong opportunities for value growth across the Matcha Market.

- For instance, premium chains such as Tsujiri compete for high-grade leaves in Japan, where national matcha output climbed from 1,471 tons in 2010 to 4,176 tons in 2023, tightening supply for top ceremonial grades.

Rising Use in Food, Beauty and Functional Products

Matcha applications expand into bakery, confectionery, supplements and skincare. Food brands add matcha to snacks, desserts and dairy products. Beauty companies use matcha for its antioxidant profile in creams and cleansers. Supplement makers blend matcha with probiotics and vitamins to target energy and immunity. This shift from pure tea use to multi-category adoption opens new revenue paths. The widening cross-industry appeal drives strong opportunities within the Matcha Market.

- For instance, Nestlé’s Japanese KitKat team has developed more than 350 flavour variants since 2000, including Uji matcha chocolate created after a 2004 process innovation that allowed matcha powder to be mixed directly into the coating, proving how matcha now extends deep into confectionery and other value-added products.

Key Challenges

Price Volatility and Supply Constraints

Matcha production depends heavily on stable climate and careful shading processes. Weather shifts reduce leaf quality and raise production costs. Limited regional cultivation also restricts global supply during peak demand. Producers face rising labor costs due to intensive harvest methods. These pressure points cause price swings that affect retail margins. Smaller brands struggle to secure consistent stock. This supply instability remains a major challenge for the Matcha Market.

Quality Variations and Market Fragmentation

Strong market expansion leads to inconsistent quality across global suppliers. Many low-grade products enter online channels with unclear labeling. This variation confuses new buyers and weakens consumer trust. Brands must invest in certification, testing and traceability to protect market position. Fragmented standards also hinder price clarity across grades. Companies face challenges in educating customers about quality differences. This inconsistency remains a key challenge for the Matcha Market.

Regional Analysis

North America

North America holds about 32% share in 2024, driven by strong demand for premium beverages and rising interest in clean-label wellness drinks. Cafés and specialty tea shops promote matcha lattes, boosting adoption among younger consumers. Retailers expand organic and ceremonial-grade options across supermarkets. Growing awareness of antioxidant benefits supports household consumption. The region also benefits from strong online sales, with subscription models gaining traction. Product innovation in ready-to-drink formats further increases visibility and market penetration.

Europe

Europe accounts for nearly 27% share in 2024, supported by growing interest in natural energy drinks and plant-based diets. Consumers across Germany, the UK, and France show rising preference for ceremonial and classic grades. Café chains introduce matcha-infused beverages, helping drive mainstream adoption. Food manufacturers add matcha to bakery and dairy categories, expanding usage beyond tea. Rising demand for organic and certified products strengthens premium sales. Online platforms also play a key role in widening access to imported blends.

Asia Pacific

Asia Pacific leads the global market with about 34% share in 2024, supported by Japan’s deep-rooted tea culture and strong export ecosystem. China, South Korea, and Taiwan show rising demand for premium grades due to expanding café culture and wellness trends. Matcha use grows across confectionery, desserts, and ready-to-drink products. Increasing tourism in Japan also boosts awareness of authentic ceremonial matcha. Regional manufacturers invest in shading and grinding technologies to maintain quality leadership, strengthening Asia Pacific’s dominance.

Latin America

Latin America represents around 4% share in 2024, driven by emerging interest in functional beverages and plant-based ingredients. Urban consumers in Brazil, Mexico, and Chile adopt matcha for energy and weight-management benefits. Specialty stores and online platforms expand availability of imported products. Café chains introduce matcha-based drinks to diversify menu offerings. Awareness remains moderate but continues to rise through social media trends. Food manufacturers experiment with matcha in snacks and bakery items, supporting gradual market expansion.

Middle East and Africa

Middle East and Africa hold nearly 3% share in 2024, supported by rising demand for premium tea products and increasing adoption in upscale cafés. Consumers in the UAE and Saudi Arabia show growing interest in wellness-oriented beverages. Retailers introduce both classic and ceremonial grades, mainly through specialty stores and e-commerce channels. Tourism and expatriate populations also play a role in promoting matcha consumption. Though overall penetration remains low, rising health awareness and café expansion strengthen long-term growth potential.

Market Segmentations:

By Grade

- Ceremonial Grade

- Classic Grade

- Culinary Grade

By Application

- Regular tea

- Matcha beverages

- Food

- Personal Care

By Distribution Channel

- Hypermarket/Supermarket

- Specialty Stores

- Online Retail Stores

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Matcha Market features key players such as Midori Spring, DoMatcha, Aiya America Inc., Jade Monk, Garden To Cup Organics, The AOI Tea Company, Encha, TEAJA Organic, Ippodo Tea USA, and Goli Nutrition Inc. Competition grows as companies focus on premium sourcing, shade-grown cultivation, and refined grinding techniques to improve color and flavor consistency. Brands emphasize organic certification, quality transparency, and origin-based positioning to attract health-focused buyers. Many firms expand product lines with ready-to-drink beverages, flavored blends, and culinary-grade powders to capture diverse consumer groups. Retail presence strengthens through supermarkets, specialty tea stores, and online channels offering subscription models. Marketing strategies highlight wellness benefits and clean-label formulation, helping brands build trust in crowded digital marketplaces. As demand rises globally, companies invest in supply stability and sustainable farming to secure long-term growth potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Ippodo Tea released the “New Harvest Matcha 2025,” a limited seasonal edition made from freshly harvested tencha leaves. The product was released around May to July of that year.

- In 2024, Aiya America, Inc. recently revealed its distribution expansion to Whole Foods Market stores

- In 2024, Goli Nutrition Inc. announced the launch of its new Matcha Mind Cognitive Gummies. It combines clinically studied Cognizin and matcha to help support focus, attention and cognitive health

Report Coverage

The research report offers an in-depth analysis based on Grade, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising demand for premium and organic matcha grades.

- Ready-to-drink matcha beverages will gain stronger traction across global retail chains.

- Café expansion will continue to boost matcha visibility in urban markets.

- Matcha use in bakery, snacks, and dairy products will grow steadily.

- Online retail channels will expand as consumers seek variety and subscription options.

- Brands will invest more in sustainable farming and transparent sourcing.

- Beauty and personal care products with matcha extracts will see higher adoption.

- Innovation in flavored matcha blends will attract younger consumers.

- Companies will focus on improving grinding and shading techniques to enhance quality.

- Global supply chains will strengthen to support consistent grade availability.