Market Overview

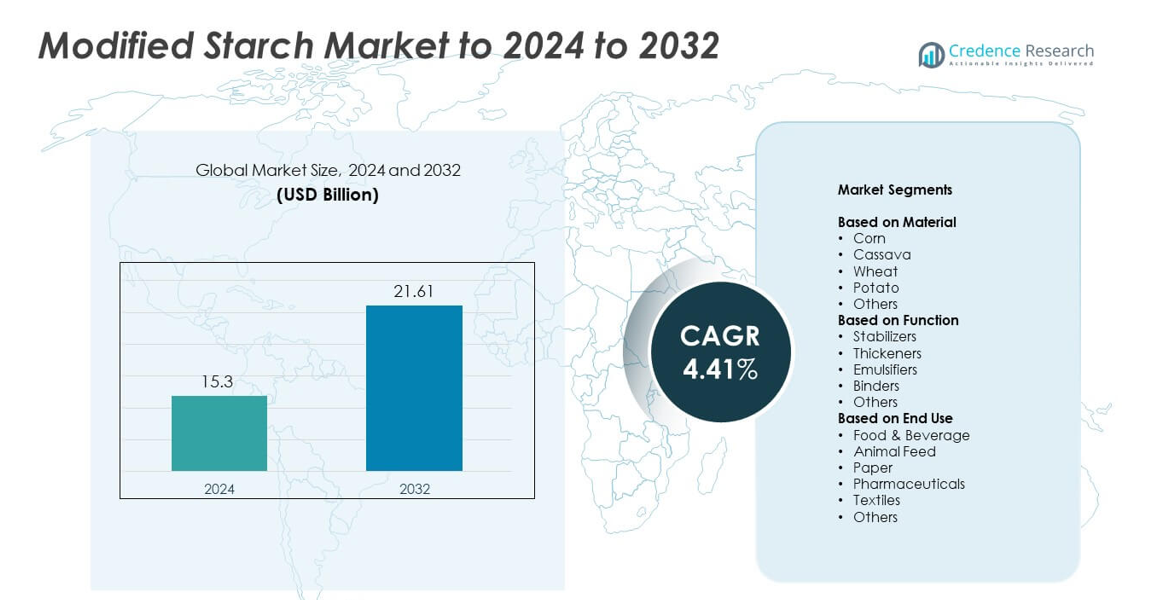

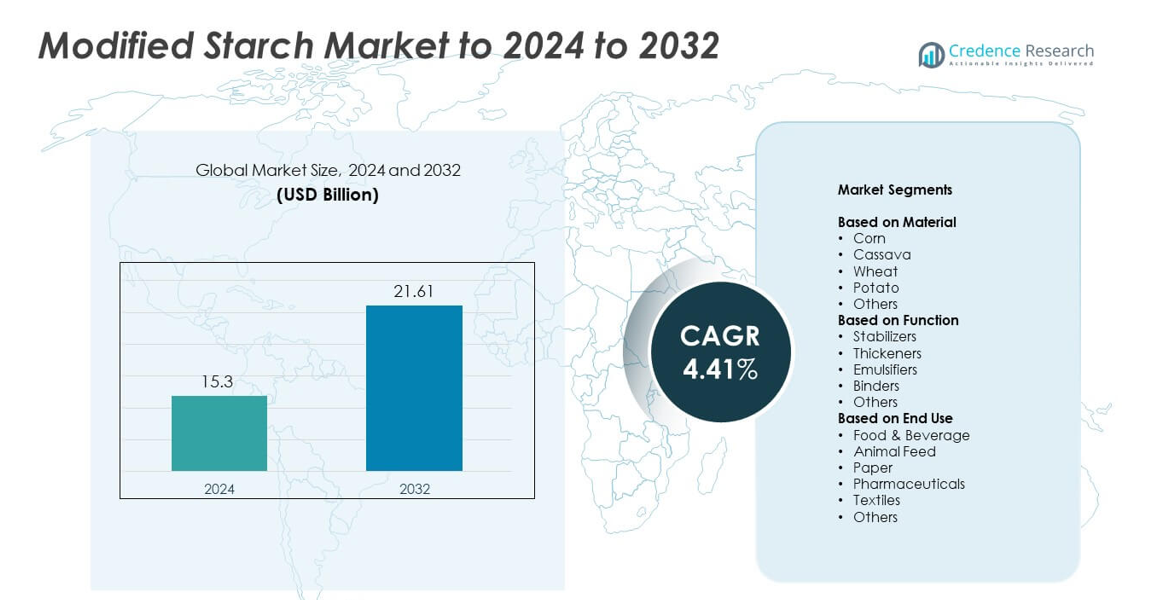

Modified Starch Market size was valued USD 15.3 Billion in 2024 and is anticipated to reach USD 21.61 Billion by 2032, at a CAGR of 4.41% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Modified Starch Market Size 2024 |

USD 15.3 Billion |

| Modified Starch Market, CAGR |

4.41% |

| Modified Starch Market Size 2032 |

USD 21.61 Billion |

The Modified Starch Market is shaped by leading companies such as ADM, Avebe U.A., Roquette Frères, Ingredion Incorporated, Agrana Beteiligungs AG, Grain Processing Corporation, Global Bio-Chem Technology Group Company Limited, and Emsland-Stärke GmbH. These producers strengthen the market through wide product ranges, advanced modification technologies, and strong supply networks. Asia Pacific stands as the leading region with about 34% share due to high raw material availability and rapid food processing expansion. North America follows with nearly 32% share, supported by strong adoption in processed foods and industrial applications. Europe holds close to 27% share, driven by clean-label demand and established manufacturing capabilities.

Market Insights

- The Modified Starch Market reached USD 15.3 Billion in 2024 and is projected to reach USD 21.61 Billion by 2032, growing at a CAGR of 4.41%.

- The market grows due to strong demand from food and beverage producers who rely on modified starch for thickening, stability, and texture enhancement.

- Clean-label shifts and rising use in gluten-free and plant-based products support new trends, while specialty starches gain traction in premium formulations.

- Competition remains strong as major players expand capacity, improve processing technologies, and strengthen supply chains to manage raw material volatility.

- Asia Pacific leads with about 34% share, followed by North America at 32% and Europe at 27%, while food and beverage dominates end use with nearly 62% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Corn led the material category in 2024 with about 57% share. Food and beverage makers prefer corn-based modified starch because of its steady supply, clean taste, and strong performance in thickening and stabilizing functions. Corn also dominates due to its lower cost and well-established global processing network. Cassava and potato starch gain steady traction in gluten-free and clean-label products, while wheat remains relevant in bakery and processed foods. Rising demand for processed snacks and convenience meals continues to strengthen the dominance of corn within this segment.

- For instance, Cargill’s new corn milling plant in Gwalior has an initial capacity of 500 tons of corn per day, with scope to expand to 1,000 tons per day, supplying starch derivatives to confectionery, infant formula, and dairy manufacturers in India.

By Function

Thickeners dominated the function segment in 2024 with nearly 41% share. Thickeners maintain strong use across sauces, dairy items, soups, and ready meals because they improve viscosity, texture, and product stability. Manufacturers choose modified thickeners for heat resistance and improved processing tolerance. Stabilizers and emulsifiers grow through expanding demand from beverages, dressings, and processed foods that need better shelf life. Binders remain important in pharmaceuticals and paper applications. Growth in packaged foods and instant mixes continues to support the leadership of thickeners in this segment.

- For instance, Ingredion employs approximately 11,200 people and serves customers in more than 120 countries

By End Use

Food and beverage accounted for the largest share in 2024 at around 62%. This category dominated because modified starch improves texture, stability, and appearance in bakery items, snacks, dairy products, and processed meals. The segment also grows due to rising consumption of packaged and convenience foods worldwide. Animal feed and paper industries increase adoption for performance enhancement and cost efficiency. Pharmaceuticals and textiles rely on modified starch for coating, binding, and controlled-release functions. The expanding ready-to-eat and processed food market continues to reinforce the lead of food and beverage applications.

Key Growth Drivers

Rising Demand from Processed Food and Beverage Industry

The food and beverage sector drives strong demand for modified starch as manufacturers use it to enhance texture, stability, and shelf life in bakery items, dairy products, snacks, and ready meals. Growth in packaged and convenience foods increases the need for reliable thickening and stabilizing ingredients. Modified starch also supports clean taste profiles and heat stability, which strengthens its adoption in rapidly expanding global food production. Rising urbanization and busy lifestyles continue to boost processed food consumption, reinforcing this driver.

- For instance, Roquette’s Lestrem site handles more than 2 million tons of wheat and corn per year and operates 57 manufacturing workshops with around 2,800 employees, supplying plant-based ingredients used widely in processed foods.

Expansion of Industrial Applications Beyond Food

Industrial users, including paper, pharmaceuticals, textiles, and adhesives, increasingly adopt modified starch due to its binding, coating, and film-forming properties. The paper industry values it for improving strength and print quality, while pharmaceuticals rely on it for tablet binding and controlled-release functions. Textile manufacturers benefit from better weaving efficiency and finishing performance. Growing demand for bio-based additives across these industries continues to expand the market footprint of modified starch, strengthening its role as a versatile industrial material.

- For instance, Royal Avebe processes approximately 3 million tonnes of potatoes annually.

Shift Toward Clean-Label and Plant-Based Ingredients

Consumers show strong preference for natural, plant-derived ingredients, leading companies to adopt modified starch as a clean-label thickener and stabilizer. The shift toward transparency in ingredient lists supports this trend, as modified starch offers a familiar and safe profile with broad regulatory acceptance. Plant-based and vegan food categories rely heavily on starch to create desirable textures. This rise in health-conscious spending and preference for minimally processed ingredients drives sustained market growth and supports wider use across global food sectors.

Key Trends and Opportunities

Growth of Specialty and High-Performance Starch Products

Manufacturers invest in specialty starches designed for specific functions such as freeze–thaw stability, instant solubility, and enhanced heat resistance. These products support innovation in ready-to-eat meals, frozen foods, and dairy alternatives. As food companies launch new product lines with improved texture and stability requirements, demand for premium functional starches increases. Expansion of convenience food formats and growth in global retail channels create strong opportunities for specialized starch formulations.

- For instance, the Emsland Group processes more than 2.2 million tonnes of potatoes and over 160,000 tonnes of peas annually to produce its range of ingredients, including the Emfibre® range.

Increasing Adoption in Plant-Based and Gluten-Free Products

The rise of plant-based diets and gluten-free products creates new opportunities for modified starch. Producers use starch to recreate desirable textures in dairy substitutes, meat analogues, and gluten-free bakery items. Strong consumer interest in healthier and allergen-free alternatives supports this trend. Growth in vegan product launches and reformulated clean-label recipes continues to enhance the role of modified starch as a core ingredient, driving greater adoption across global markets.

- For instance, AKV processes around 1 million hectokilograms(equivalent to 210,000 tonnes) of potatoes per harvest. Based on typical starch yields of 18-22%, this volume yields roughly 37,800 to 46,200 tonnes of potato starch (not 80,000 to 90,000 tonnes), along with potato protein and other by-products such as pulp, with potato starch widely used in gluten-free food products.

Advancements in Bio-Based and Sustainable Starch Solutions

Sustainability-focused innovation creates opportunities for developing greener, bio-based starch derivatives. Manufacturers explore enzymatic and physical modification processes to reduce chemical use, improve biodegradability, and lower environmental impact. These advancements support rising corporate sustainability goals and regulatory pressure to shift toward eco-friendly additives. Expanding demand for renewable materials across food, packaging, and industrial sectors strengthens future opportunities for sustainable modified starch solutions.

Key Challenges

Volatility in Raw Material Supply and Pricing

Corn, cassava, potato, and wheat serve as primary raw materials, and their prices fluctuate due to weather conditions, crop yield swings, and global trade disruptions. This volatility affects production costs and reduces predictability for manufacturers. Competition between food and industrial uses can further strain supply, especially during drought periods or export restrictions. These uncertainties impact profit margins and force producers to adjust sourcing strategies, making raw material instability a persistent challenge.

Availability of Substitutes in Food and Industrial Sectors

Various alternatives such as gums, pectins, proteins, and hydrocolloids compete with modified starch across many applications. These substitutes often offer stronger gelling, thickening, or stabilization properties in specific product categories. Industrial users may also shift to synthetic or advanced bio-based additives with higher performance consistency. As end users compare functionality, pricing, and processing advantages, substitutes can reduce the growth potential of modified starch in certain markets, presenting an ongoing competitive challenge.

Regional Analysis

North America

North America held around 32% share in 2024, driven by strong demand from food, beverage, paper, and pharmaceutical industries. The region benefits from advanced processing technologies and steady consumption of packaged foods. Rising use of modified starch in dairy products, snacks, and ready meals supports growth, while industrial users adopt it for coating and binding applications. The United States leads due to large-scale production and high innovation activity. Clean-label product launches and plant-based food growth further increase adoption across key sectors in the region.

Europe

Europe accounted for nearly 27% share in 2024, supported by strong demand for clean-label and plant-based food products. The region maintains high usage in bakery, dairy, and processed foods, driven by strict quality standards and strong consumer preference for natural ingredients. Modified starch also sees significant use in paper, textiles, and pharmaceuticals. Countries like Germany, France, and the Netherlands lead production and export activity. Ongoing innovation in specialty starches and sustainable modification methods continues to enhance market growth across the region.

Asia Pacific

Asia Pacific dominated the market with about 34% share in 2024, fueled by rapid expansion in food processing, paper manufacturing, and textile production. Rising urbanization and higher consumption of packaged foods support strong demand across China, India, Indonesia, and Thailand. The region also benefits from abundant raw materials such as cassava and corn, enabling competitive production. Growing adoption of modified starch in pharmaceuticals and industrial applications further boosts market growth. Expanding retail channels and growing middle-class spending reinforce Asia Pacific’s leadership position.

Latin America

Latin America held roughly 5% share in 2024, driven by steady growth in processed foods, snacks, and bakery products. Countries such as Brazil and Mexico experience rising consumption of convenience foods, which increases demand for modified starch. The region also produces large volumes of cassava, supporting cost-effective starch manufacturing. Expanding use in paper, textiles, and animal feed strengthens market presence. While adoption continues to grow, limited industrial capacity and slower technology upgrades remain challenges, though ongoing investments improve regional competitiveness.

Middle East and Africa

Middle East and Africa accounted for about 2% share in 2024, supported by growing food processing activities and rising urban population. Demand increases for modified starch in bakery products, dairy items, and packaged foods across Gulf countries and parts of Africa. Industrial use in paper and textiles expands gradually as manufacturing capacity develops. Dependence on imports influences pricing and availability, but rising investments in local food industries and improving distribution networks help drive market growth across the region.

Market Segmentations:

By Material

- Corn

- Cassava

- Wheat

- Potato

- Others

By Function

- Stabilizers

- Thickeners

- Emulsifiers

- Binders

- Others

By End Use

- Food & Beverage

- Animal Feed

- Paper

- Pharmaceuticals

- Textiles

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Modified Starch Market features leading companies such as ADM, Avebe U.A., Roquette Frères, Ingredion Incorporated, Agrana Beteiligungs AG, Grain Processing Corporation, Global Bio-Chem Technology Group Company Limited, and Emsland-Stärke GmbH. The competitive landscape is shaped by strong global production capabilities, broad product portfolios, and advanced modification technologies. Companies focus on expanding specialty starch offerings with improved functionality, higher stability, and clean-label compatibility. Many producers invest in innovation to support growing needs in processed foods, pharmaceuticals, textiles, and industrial applications. Strategic partnerships with food manufacturers help strengthen market reach and ensure consistent quality standards. Firms also expand capacity in regions rich in raw materials to secure cost advantages and supply stability. Sustainability initiatives, including bio-based processing and reduced chemical use, continue to influence competitive strategies. Growing demand for customized formulations encourages ongoing development of tailored solutions for diverse end-use industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ADM

- Avebe U.A.

- Roquette Frères

- Ingredion Incorporated

- Agrana Beteiligungs AG

- Grain Processing Corporation

- Global Bio-Chem Technology Group Company Limited

- Emsland-Stärke GmbH

Recent Developments

- In 2025, Agrana Beteiligungs AG is expanding its starch production capabilities with a new plant expansion scheduled to start construction at its Țăndărei site in Romania.

- In 2024, Ingredion Launched the clean-label NOVATION INDULGE 2940 starch, a non-GMO native corn starch texturizer.

- In 2024, Emsland-Stärke GmbH announced plans for an expansion and began site preparation for a new potato starch silo at its Kyritz, Germany plant.

Report Coverage

The research report offers an in-depth analysis based on Material, Function, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as processed food consumption increases worldwide.

- Demand will rise for clean-label and plant-based starch ingredients across major food sectors.

- Specialty starches with higher functionality will gain stronger adoption in premium product lines.

- Industrial applications will expand in paper, textiles, pharmaceuticals, and adhesives.

- Innovation in sustainable and bio-based modification methods will become a key focus.

- Asia Pacific will strengthen its lead due to raw material abundance and rapid industrial growth.

- Manufacturers will invest more in enzymatic and physical modification technologies.

- Gluten-free and vegan product expansion will boost starch use for texture and stability needs.

- Supply chain optimization will grow in importance due to raw material price fluctuations.

- Collaboration between food producers and starch processors will increase to meet evolving product requirements.