Market Overview:

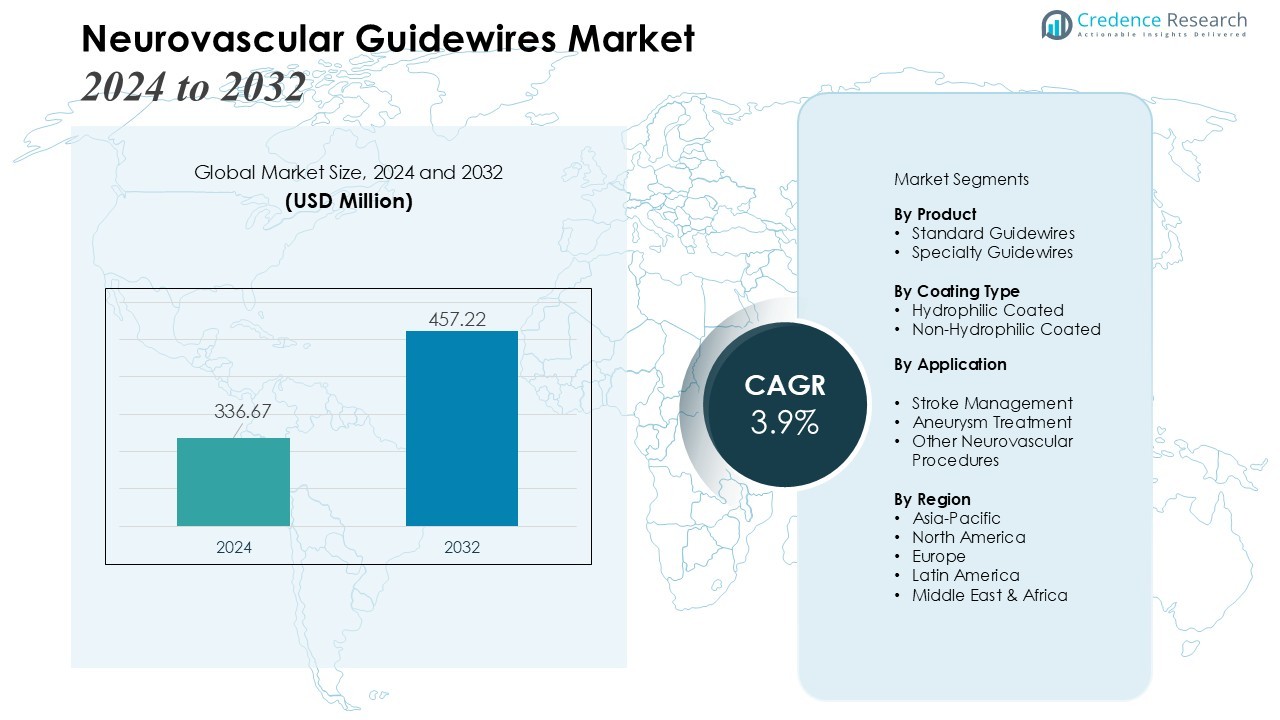

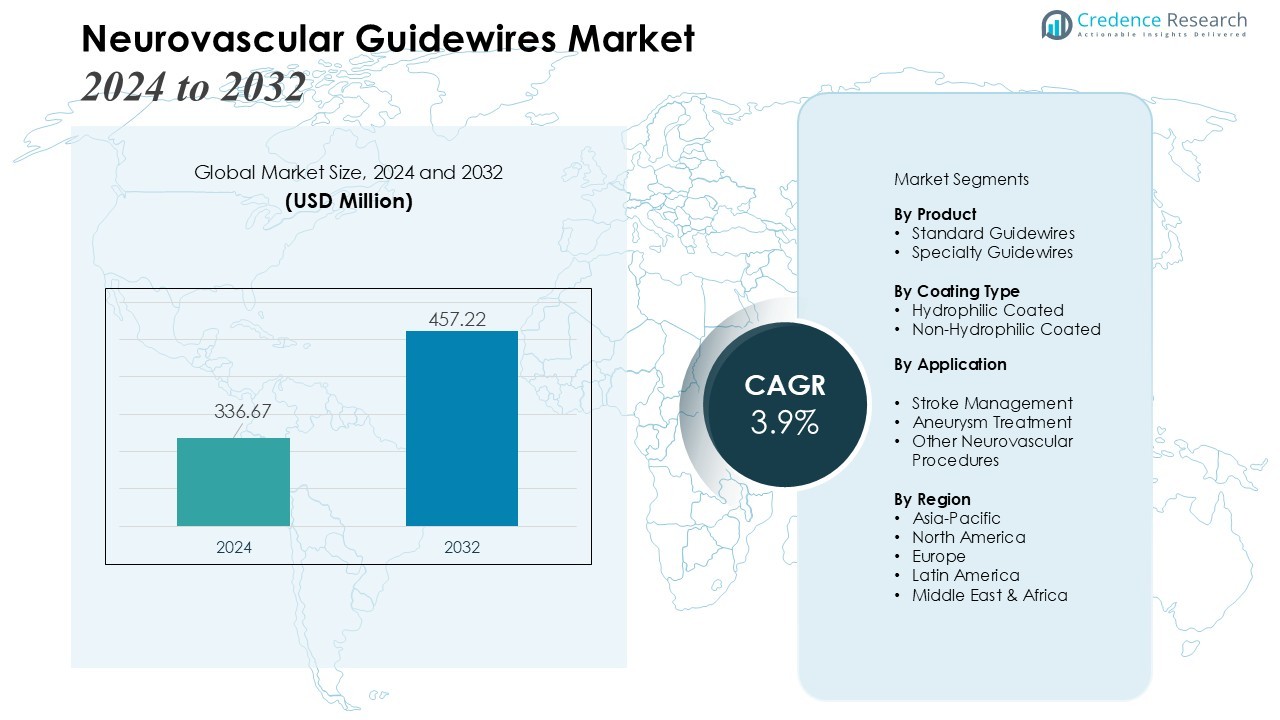

The Neurovascular Guidewires Market size was valued at USD 336.67 million in 2024 and is anticipated to reach USD 457.22 million by 2032, at a CAGR of 3.9% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Neurovascular Guidewires Market Size 2024 |

USD 336.67 Million |

| Neurovascular Guidewires Market, CAGR |

3.9% |

| Neurovascular Guidewires Market Size 2032 |

USD 457.22 Million |

The market is driven by the growing adoption of minimally invasive procedures, technological advancements in guidewire design, and enhanced imaging techniques that improve procedural safety and outcomes. Rising awareness of neurovascular diseases, increasing healthcare spending, and favorable regulatory frameworks further support market expansion. Additionally, the demand for patient-specific and high-performance guidewires in complex neuro-interventions is fueling innovation and adoption in hospitals and specialized clinics globally.

Regionally, North America dominates the market, owing to mature neuro-interventional infrastructure, high incidence of neurovascular disorders, and supportive reimbursement policies. Europe holds the second-largest share, driven by advanced healthcare facilities and growing adoption of endovascular procedures. Asia-Pacific is emerging as the fastest-growing market, supported by rising healthcare investments, increasing prevalence of neurovascular diseases, and growing awareness in countries such as China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Neurovascular Guidewires Market was valued at USD 336.67 million in 2024 and is projected to reach USD 457.22 million by 2032, growing at a CAGR of 3.9%.

- Rising incidence of stroke, cerebral aneurysms, and other neurovascular disorders drives demand for precise and reliable guidewires in hospitals and specialized clinics.

- Technological advancements enhance flexibility, torque control, and trackability, enabling safer navigation through complex vascular structures and reducing procedural complications.

- Adoption of minimally invasive neuro-interventional procedures allows physicians to perform interventions with lower patient trauma, shorter recovery periods, and higher efficiency.

- Expansion of healthcare infrastructure, government initiatives, and reimbursement policies support broader access to advanced guidewires, particularly in emerging markets.

- High cost of advanced guidewires and stringent regulatory requirements pose challenges, limiting adoption in budget-sensitive hospitals and extending product approval timelines.

- North America holds 38% of the market due to mature healthcare infrastructure, Europe contributes 28% driven by endovascular adoption, and Asia-Pacific accounts for 22%, emerging as the fastest-growing region with rising investments and awareness.

Market Drivers:

Market Drivers:

Rising Prevalence of Neurovascular Disorders and Increasing Patient Demand

The Neurovascular Guidewires Market experiences strong growth due to the increasing incidence of stroke, cerebral aneurysms, and other neurovascular conditions worldwide. Hospitals and specialized clinics require precise and reliable guidewires to improve procedural success rates and patient outcomes. It enables physicians to navigate complex vascular structures safely and efficiently, meeting the rising demand for advanced neuro-interventional procedures. The growing patient population seeking minimally invasive treatments further supports market expansion.

- For Instance, the National Institutes of Health (NIH) website, reported that the Artiria Medical SmartGUIDE 0.014-inch guidewire was successfully used to reach the target vessel independently in 24 out of 25 cases, achieving a 96% technical success rate across various complex neurointerventional procedures, including aneurysm and AVM embolization.

Advancements in Guidewire Technology and Enhanced Device Performance

Technological innovation drives the market by improving flexibility, torque control, and trackability of guidewires. Manufacturers continuously develop high-performance devices that allow safe navigation through tortuous vascular pathways. It helps reduce procedural complications and shortens operation times, increasing physician preference for premium products. Enhanced durability and biocompatibility make guidewires more suitable for complex interventions, strengthening market adoption.

- For example, many general-purpose hydrophilic guidewires (such as those with coatings made from polyvinylpyrrolidone (PVP) or the Medtronic Dura-Trac system) incorporate a biocompatible polymer coating that, when wet, dramatically reduces the coefficient of friction to as low as 0.01 (compared to 0.3-0.4 for uncoated wires), facilitating smoother device delivery in delicate vascular procedures.

Increasing Adoption of Minimally Invasive Neuro-Interventional Procedures

The market benefits from the global shift toward minimally invasive neurovascular treatments. It allows physicians to perform interventions with reduced patient trauma, shorter recovery periods, and lower risk of complications. Hospitals increasingly adopt these procedures to improve efficiency and patient satisfaction. Rising awareness among clinicians regarding the benefits of endovascular treatments supports consistent demand for advanced guidewires.

Expansion of Healthcare Infrastructure and Government Support

The growth of healthcare facilities, particularly in emerging economies, fuels demand for specialized medical devices. It ensures wider availability of neuro-interventional services and access to advanced guidewires. Government initiatives promoting stroke care, funding for neurovascular research, and reimbursement policies encourage hospitals to invest in high-quality devices. This framework strengthens market penetration and long-term growth potential.

Market Trends:

Increasing Focus on High-Precision and Patient-Specific Neurovascular Guidewires

The Neurovascular Guidewires Market demonstrates a clear shift toward high-precision devices designed for patient-specific applications. It allows physicians to navigate complex vascular structures with greater accuracy, reducing procedural complications and improving clinical outcomes. Manufacturers invest in research and development to produce guidewires with enhanced flexibility, torque control, and biocompatibility. Hospitals and specialized clinics prefer these advanced products to meet the growing demand for safer and more effective neuro-interventional procedures. Adoption of devices tailored for specific conditions, including aneurysms and ischemic strokes, continues to expand.

- For instance, Abbott’s Hi-Torque guidewire features excellent torque control and tip durability, which can facilitate navigation through challenging coronary lesions and potentially streamline procedures.

Integration of Advanced Imaging Techniques and Digital Solutions in Neurovascular Procedures

The market trend emphasizes the integration of advanced imaging technologies with guidewire systems to enhance procedural precision. It supports real-time visualization during interventions, allowing physicians to make informed decisions and improve treatment efficiency. Growing adoption of robotics-assisted neuro-interventions and digital navigation platforms increases demand for compatible guidewires. Healthcare providers invest in solutions that reduce operation times and minimize patient risk. Continuous technological collaborations between device manufacturers and medical institutions drive innovation and broaden product offerings. The focus on digital-assisted procedures reflects the industry’s commitment to improving patient care quality and clinical outcomes.

- For instance, Stryker’s Synchro 2 guidewire features a platinum/tungsten alloy coil tip for fluoroscopic visualization, enabling real-time vessel navigation, and has a 0.014-inch diameter for microcatheter compatibility.

Market Challenges Analysis:

High Cost of Advanced Neurovascular Guidewires Limiting Adoption

The Neurovascular Guidewires Market faces challenges due to the high cost of advanced and specialized devices. It limits adoption, particularly in smaller hospitals and clinics with budget constraints. The expense of integrating high-precision guidewires with imaging systems can restrict widespread use. Healthcare providers must balance device costs with procedural efficiency and patient outcomes. Price-sensitive markets in developing regions may experience slower growth due to limited access to premium products.

Stringent Regulatory Requirements and Complex Approval Processes

The market contends with strict regulatory frameworks governing medical devices in multiple regions. It requires manufacturers to meet rigorous safety, efficacy, and quality standards before product approval. Prolonged testing and certification processes can delay product launches and affect market entry timelines. Navigating differing regulations across regions increases operational complexity and costs. Companies must invest in compliance and clinical validation to maintain market credibility and sustain growth.

Market Opportunities:

Expansion into Emerging Markets with Growing Healthcare Infrastructure

The Neurovascular Guidewires Market presents significant opportunities in emerging regions with expanding healthcare infrastructure. It allows hospitals and clinics to adopt advanced neuro-interventional procedures and improve patient outcomes. Rising awareness of stroke and cerebral aneurysms creates demand for high-quality guidewires. Governments in developing countries support investment in neurovascular care, providing incentives for healthcare modernization. Companies can leverage these markets to increase penetration and establish strategic partnerships with local providers. Expanding insurance coverage and reimbursement schemes further facilitate adoption of premium devices.

Innovation in Device Design and Integration with Digital Health Solutions

The market benefits from opportunities in developing next-generation guidewires with enhanced performance and compatibility with digital health technologies. It supports real-time imaging, robotics-assisted interventions, and patient-specific procedural planning. Research and development focused on biocompatible materials and high-precision navigation expands product portfolios. Collaborations between manufacturers and medical institutions drive innovation and clinical validation. Companies can differentiate through specialized offerings for complex neurovascular procedures. Demand for safer, faster, and more efficient interventions strengthens long-term growth potential.

Market Segmentation Analysis:

By Product

The Neurovascular Guidewires Market includes standard guidewires and specialty guidewires designed for complex interventions. It sees strong adoption of specialty guidewires due to their enhanced flexibility and torque control, which allow physicians to navigate tortuous vascular pathways safely. Standard guidewires maintain steady demand in routine procedures, offering cost-effective solutions for hospitals and clinics. High-performance products designed for patient-specific treatments continue to drive innovation and differentiation in the market.

- For Instance, Asahi Intecc’s CHIKAI X10 neurovascular guidewire improves access and control through enhanced torque response in complex procedures.

By Coating Type

Guidewires are segmented into hydrophilic and non-hydrophilic coatings. It favors hydrophilic-coated guidewires for complex neuro-interventional procedures because they provide smoother navigation through vessels, reduce friction, and improve procedural success rates. Non-hydrophilic guidewires remain relevant for standard interventions, offering reliable performance at lower costs. The choice of coating influences adoption, procedure efficiency, and overall clinical outcomes, highlighting the need for tailored solutions for different intervention types.

- For instance, Medtronic’s Avigo Hydrophilic Guidewire, designed for neurovascular use, enhances tracking and crossing support with its stable hydrophilic coating over a 200 cm length.

By Application

The market segments applications into aneurysm treatment, stroke management, and other neurovascular procedures. It witnesses increasing demand in stroke management due to rising incidence rates and the preference for minimally invasive interventions. Aneurysm treatment also contributes significantly, driven by technological advancements and higher procedural precision requirements. Other applications, including arteriovenous malformations and vessel recanalization, offer growth potential through specialized guidewire designs. Hospitals and specialized clinics invest in application-specific guidewires to optimize treatment outcomes and enhance procedural safety.

Segmentations:

By Product

- Standard Guidewires

- Specialty Guidewires

By Coating Type

- Hydrophilic Coated

- Non-Hydrophilic Coated

By Application

- Stroke Management

- Aneurysm Treatment

- Other Neurovascular Procedures

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leads with Largest Market Contribution

North America accounts for 38% of the global Neurovascular Guidewires Market, maintaining the largest regional contribution. The region benefits from a mature healthcare system and high prevalence of neurovascular disorders. It leverages well-established neuro-interventional facilities and extensive adoption of minimally invasive procedures. Strong reimbursement frameworks encourage hospitals and clinics to invest in advanced guidewires. Research institutions and collaborations with medical device manufacturers drive continuous innovation. Rising awareness among clinicians about precision devices further strengthens demand.

Europe Demonstrates Strong Presence in Neurovascular Device Adoption

Europe holds 28% of the global Neurovascular Guidewires Market and shows steady growth due to widespread use of endovascular techniques. It provides healthcare providers with access to innovative guidewire technologies that improve procedural outcomes. Government initiatives promoting stroke care and neurovascular research enhance device adoption. Clinical training programs for physicians facilitate broader utilization of minimally invasive interventions. The focus on patient safety and improved procedural efficiency sustains demand. Germany, France, and the UK contribute significantly to regional revenue.

Asia-Pacific Becomes Fastest-Growing Region with Expanding Opportunities

Asia-Pacific contributes 22% to the global Neurovascular Guidewires Market and emerges as the fastest-growing region. It experiences rising prevalence of neurovascular diseases and expanding healthcare infrastructure. Government programs and increased healthcare investments support the adoption of advanced neuro-interventional procedures. Training initiatives for medical professionals improve device utilization and procedural success. Rising patient awareness and growing urban healthcare centers strengthen market potential. China, India, and Japan drive regional expansion and long-term growth.

Key Player Analysis:

- Bristol-Myers Squibb

- F. Hoffmann-La Roche Ltd

- Novartis AG

- Pfizer

- Teva Pharmaceuticals

- Viatris

- Baxter

- Hikma Pharmaceuticals

- Sun Pharmaceutical Industries

- Cipla

Competitive Analysis:

The Neurovascular Guidewires Market features a competitive landscape with key players focusing on innovation, product differentiation, and strategic collaborations. It includes leading companies such as Medtronic, Stryker Corporation, Boston Scientific Corporation, Terumo Corporation, and MicroVention, which drive market growth through research and development of high-performance guidewires. Companies emphasize advanced designs, enhanced flexibility, and compatibility with imaging and robotic-assisted interventions to meet clinical demands. Strategic partnerships with hospitals and healthcare institutions allow manufacturers to expand market reach and strengthen brand presence. Competitive pricing, strong distribution networks, and continuous product launches further enhance market positioning. Regional players also focus on localized production and training programs to increase adoption in emerging markets. Overall, competition in the Neurovascular Guidewires Market fosters innovation, improves procedural outcomes, and ensures the availability of specialized solutions for complex neurovascular interventions globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments:

- In July 2025, Bristol-Myers Squibb partnered with Bain Capital to create a new company focused on innovative immunology therapies.

- In June 2025, Bristol-Myers Squibb entered a global strategic partnership with BioNTech to co-develop and co-commercialize the bispecific antibody BNT327 for solid tumors.

Report Coverage:

The research report offers an in-depth analysis based on Product, Coating Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and ITALY economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will witness continued adoption of minimally invasive neurovascular procedures across hospitals and specialized clinics.

- High-performance guidewires with enhanced flexibility and torque control will drive preference among physicians.

- Integration of guidewires with advanced imaging systems and digital navigation platforms will improve procedural precision.

- Development of patient-specific guidewires for complex interventions will expand treatment options.

- Emerging markets will experience rapid growth due to expanding healthcare infrastructure and increased awareness of neurovascular diseases.

- Strategic collaborations between manufacturers and medical institutions will accelerate innovation and clinical validation.

- Training programs for clinicians on advanced neuro-interventional techniques will support wider adoption of specialized guidewires.

- Biocompatible materials and durable coatings will enhance safety and procedural success rates.

- Hospitals will increasingly invest in premium guidewires to improve efficiency, reduce complications, and optimize patient outcomes.

- Technological advancements, coupled with rising demand for safer and faster interventions, will strengthen long-term market potential.

Market Drivers:

Market Drivers: