Market Overview

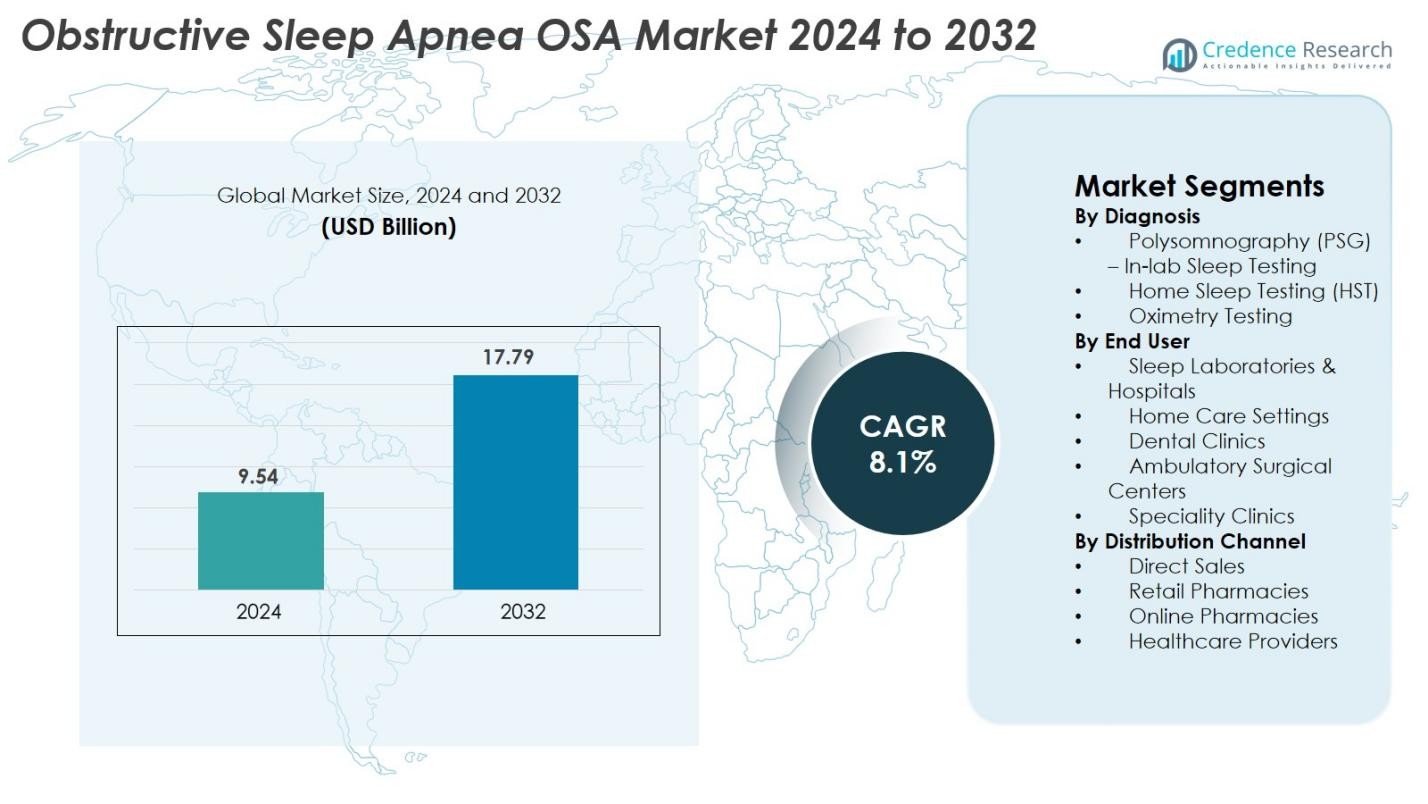

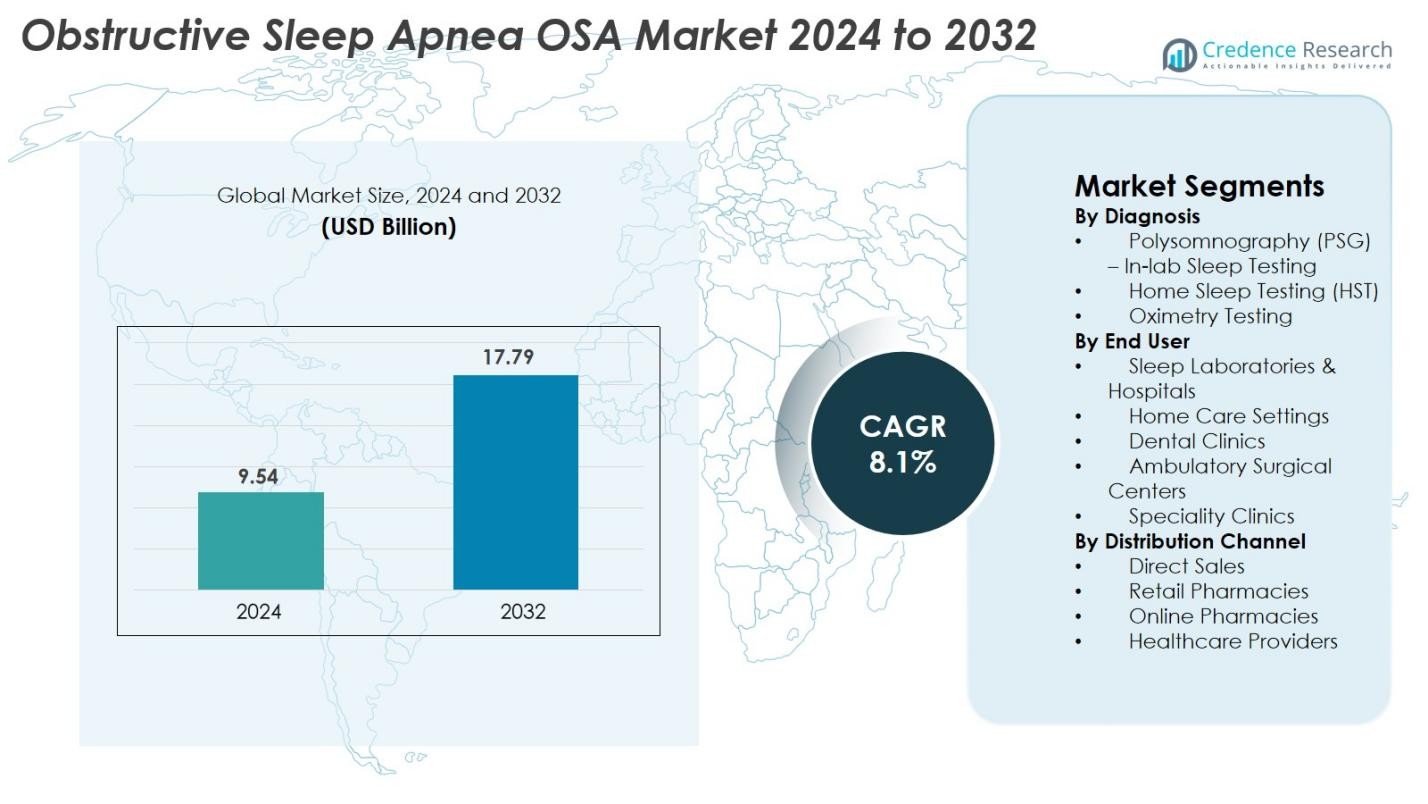

Obstructive Sleep Apnea (OSA) market size was valued at USD 9.54 Billion in 2024 and is anticipated to reach USD 17.79 Billion by 2032, at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Obstructive Sleep Apnea (OSA) market Size 2024 |

USD 9.54 Billion |

| Obstructive Sleep Apnea (OSA) market, CAGR |

8.1% |

| Obstructive Sleep Apnea (OSA) market Size 2032 |

USD 17.79 Billion |

The Obstructive Sleep Apnea (OSA) market is driven by a strong ecosystem of established medical device and pharmaceutical companies, including ResMed Inc., Philips Respironics, Fisher & Paykel Healthcare, Cephalon (Teva Pharmaceuticals), Bioprojet PHARMA, Jazz Pharmaceuticals, Axsome Therapeutics, Apnimed, Incannex Healthcare, Desitin Arzneimittel GmbH, Eli Lilly and Company, and Takeda. These players lead advancements in CPAP/APAP systems, home sleep testing, neurostimulation therapies, and emerging pharmacological solutions. Regionally, North America dominates the global market with a 41.6% share in 2024, supported by high diagnostic rates, strong reimbursement frameworks, and widespread adoption of connected sleep therapy devices, positioning it as the most influential hub for innovation and commercial growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Obstructive Sleep Apnea (OSA) market was valued at USD 9.54 Billion in 2024 and is expected to reach USD 17.79 Billion by 2032, expanding at a CAGR of 8.1% during the forecast period.

- Market growth is driven by rising obesity prevalence, increasing adoption of home sleep testing, and strong demand for CPAP/APAP devices, with Polysomnography (PSG) holding the largest diagnostic share at 46.8%.

- Key trends include rapid expansion of telemedicine-based sleep care, adoption of AI-enabled monitoring platforms, and rising preference for non-CPAP therapies such as oral appliances and neurostimulation systems.

- The competitive landscape is led by major players including ResMed, Philips Respironics, Fisher & Paykel Healthcare, Jazz Pharmaceuticals, Axsome Therapeutics, Apnimed, and Takeda, all focusing on connected devices and advanced treatment innovations.

- Regionally, North America dominates with 41.6%, followed by Europe at 28.4% and Asia-Pacific at 21.7%, driven by strong diagnostic infrastructure, growing awareness, and expanding access to sleep therapy solutions.

Market Segmentation Analysis

By Diagnosis

Polysomnography (PSG) – In-lab Sleep Testing held the dominant share of 46.8% in the Obstructive Sleep Apnea (OSA) market in 2024, driven by its high diagnostic accuracy, multi-parameter monitoring capabilities, and strong adoption across hospital-based sleep centers. PSG remains the gold standard for confirming OSA severity, supporting early and precise diagnosis among high-risk patients. Home Sleep Testing (HST) is expanding rapidly due to growing preference for convenient at-home evaluations and lower costs, while oximetry and actigraphy gain traction for initial screening and monitoring, particularly in resource-limited settings.

- For instance, ResMed’s ApneaLink Air system measures up to five clinically validated parameters and, in validation studies, has shown variable sensitivity and specificity depending on the diagnostic threshold used.

By End User

Sleep Laboratories & Hospitals accounted for the largest share of 52.3% in 2024, supported by the availability of advanced diagnostic infrastructure, qualified sleep specialists, and integrated treatment pathways for moderate to severe OSA cases. Hospitals also manage high patient volumes and complex comorbidities, strengthening demand. Home Care Settings are witnessing accelerated growth as portable CPAP/APAP devices, telemonitoring solutions, and at-home sleep testing improve patient convenience and therapy adherence. Dental clinics, ambulatory surgical centers, and specialty clinics continue to expand their role, particularly in managing mild and moderate OSA using oral appliance therapies.

- For instance, ResMed’s AirSense 11 platform supports remote monitoring through cloud connectivity and has documented over 2.5 billion nights of patient data uploads, enhancing home-based therapy management.

By Distribution Channel

Direct Sales dominated the distribution segment with a 41.5% market share in 2024, driven by strong procurement from hospitals, sleep labs, and large healthcare networks that prefer direct manufacturer partnerships for device reliability, bulk pricing, and after-sales service. Retail pharmacies remain a key channel for consumables and accessories, while online pharmacies are gaining momentum due to rising e-commerce adoption, subscription-based CPAP supplies, and lower delivery costs. Healthcare providers further reinforce distribution by integrating device dispensing into clinical workflows, ensuring faster access to diagnostic and therapeutic OSA solutions.

Key Growth Drivers

Rising Prevalence of Obesity and Aging Population

The increasing global prevalence of obesity and the rapid expansion of the geriatric population serve as major growth accelerators for the Obstructive Sleep Apnea (OSA) market. Obesity remains the strongest modifiable risk factor for OSA, with excess fat deposition causing airway narrowing and soft tissue collapse during sleep. Countries across North America, Europe, and emerging Asia are experiencing a steady rise in obesity rates, directly boosting OSA incidence and driving demand for diagnostic solutions. At the same time, the global elderly population is projected to expand significantly, bringing higher vulnerability to sleep-disordered breathing due to physiological changes, comorbidities, and reduced neuromuscular control. As these patient groups increasingly seek treatment for complications like cardiovascular disease and hypertension, the need for CPAP, APAP, BiPAP, and oral appliance therapies continues to escalate, resulting in sustained market growth.

- For instance, ResMed reported more than 20 million cloud-connected CPAP and APAP devices in active use globally, enabling large-scale remote monitoring for patients with obesity-linked sleep apnea.

Technological Advancements in Sleep Diagnostics and Therapeutic Devices

Technological innovation across sleep diagnostics and therapy devices plays a pivotal role in accelerating market growth, particularly through enhanced accuracy, ease of use, and improved patient adherence. Cloud-connected CPAP and APAP devices, wearable sleep trackers, and advanced home sleep testing kits enable earlier detection and continuous monitoring of OSA. AI-driven algorithms now support automated scoring, patient profiling, and personalized therapy adjustments, enabling clinicians to provide optimized, data-driven care. Enhanced comfort features, auto-adjusting pressure modes, and quieter device designs further elevate treatment acceptance in home care settings. Innovations such as adaptive servo-ventilation and next-generation bi-level systems broaden therapeutic options for complex sleep apnea, while smartphone-connected oximetry and contactless monitoring tools expand accessibility. As digital health ecosystems mature, technology-driven solutions are transforming clinical workflows and strengthening the long-term outlook of the OSA market.

- For instance, Itamar Medical’s WatchPAT 300 demonstrated an apnea–hypopnea index correlation of 0.87 against in-lab polysomnography in clinical validation, underscoring the ability of AI-supported automated scoring to match full PSG reliability.

Growing Awareness and Policy Support for Sleep Health

Strengthening public awareness of sleep health and expanding policy support are critical forces driving OSA market expansion. Global health agencies, medical societies, and private organizations are prioritizing sleep disorder education due to rising evidence linking untreated OSA with cardiovascular disease, diabetes, cognitive impairment, and workplace accidents. Reimbursement improvements for sleep studies, CPAP equipment, and telemonitoring programs are reducing patient cost burdens and encouraging earlier diagnosis. Occupational health policies in transportation, aviation, and industrial sectors now mandate sleep disorder screening among high-risk workers, further driving diagnostic volumes. The growing visibility of sleep health through social media, wellness campaigns, and endorsements by public figures is normalizing device usage and reducing stigma. As primary care networks incorporate routine sleep assessments, patient screening funnels expand, supporting increased adoption of OSA therapies across global markets.

Key Trends & Opportunities

Expansion of Home Sleep Testing and Remote Patient Monitoring

The shift toward home-based diagnostics and remote patient monitoring presents a substantial opportunity for the OSA market. Home Sleep Testing (HST) continues to gain adoption due to its convenience, lower cost, and ability to reach broader patient populations compared to traditional sleep labs. The integration of telemedicine and cloud-linked monitoring tools allows clinicians to remotely analyze apnea events, pressure settings, and adherence metrics, enabling personalized therapy adjustments. This model enhances patient comfort, reduces hospital visits, and supports continuous care for chronic sleep apnea management. AI-supported HST devices, smartphone-linked sensors, and subscription-based remote monitoring programs are becoming integral components of modern sleep medicine. As clinical guidelines increasingly endorse HST for suitable cases, manufacturers have strong opportunities to innovate in portable diagnostic systems and cloud-enabled therapy platforms.

- For instance, Itamar Medical’s WatchPAT ONE a single-use HST device transmits raw sleep data directly to the cloud and provides automated AI-scored reports within 1–2 minutes post-upload, accelerating diagnostic turnaround times.

Growing Adoption of Non-CPAP Therapies and Personalized Treatment Pathways

The expanding interest in non-CPAP therapies and personalized treatment strategies marks a transformative trend in the OSA market. Although CPAP remains the leading therapy, compliance challenges have led to higher demand for alternatives such as mandibular advancement devices, hypoglossal nerve stimulation implants, positional therapy solutions, and lifestyle-driven interventions. Oral appliance therapy is gaining traction in dental clinics due to its comfort, portability, and effectiveness in managing mild to moderate cases. Advances in neurostimulation technology offer a promising option for CPAP-intolerant patients, opening a rapidly expanding therapeutic segment. AI-driven patient profiling now enables clinicians to customize treatment pathways based on anatomical structure, symptom severity, comorbidities, and phenotypic characteristics. This shift toward personalized sleep medicine is reshaping product innovation and creating new market opportunities for diversified therapeutic devices.

- For instance, Inspire Medical Systems’ hypoglossal nerve stimulation implant operates with a sensing lead that detects breathing patterns at a sampling rate of 40 Hz and delivers targeted stimulation pulses up to 4 volts, enabling airway patency in appropriately selected patients.

Key Challenges

Low Patient Compliance and Therapy Dropout Rates

Low long-term compliance with OSA therapy, especially CPAP treatment, remains a significant challenge affecting market penetration and clinical outcomes. Many patients discontinue therapy due to discomfort from masks, pressure intolerance, noise, nasal dryness, or feelings of claustrophobia. Without adequate education, follow-up support, and device customization, dropout rates can be substantial, undermining treatment effectiveness. Limited behavioral coaching and insufficient monitoring further worsen adherence challenges. In certain regions, lack of reimbursement for follow-up services prevents consistent patient engagement, reducing the likelihood of successful long-term therapy. Since untreated OSA increases risks of cardiovascular disease and cognitive decline, improving adherence through ergonomic device design, telemonitoring platforms, and personalized patient support programs is critical for overcoming this challenge.

High Cost of Advanced Diagnostic and Therapeutic Systems

The high cost of diagnostic and therapeutic systems continues to restrict widespread adoption, particularly in developing and underserved markets. In-lab polysomnography remains expensive due to specialized equipment, trained personnel, and overnight monitoring requirements. Advanced therapeutic systems such as APAP, BiPAP, and neurostimulation implants—carry premium prices, limiting accessibility for uninsured or underinsured populations. Many regions lack comprehensive reimbursement frameworks, forcing patients to bear full out-of-pocket expenses for diagnostics, masks, tubing, and replacement accessories. This financial burden delays diagnosis and reduces treatment uptake, contributing to a large pool of undiagnosed cases. To expand market reach, manufacturers must focus on cost-efficient home-based diagnostics, affordable CPAP models, subscription plans, and scalable telehealth-driven sleep management programs.

Regional Analysis

North America

North America held the largest share of 41.6% in the Obstructive Sleep Apnea (OSA) market in 2024, driven by strong adoption of advanced sleep diagnostics, high prevalence of obesity, and a well-established network of sleep laboratories. The U.S. leads regional growth due to widespread insurance coverage for polysomnography, CPAP therapies, and telemonitoring solutions. Strong awareness programs, favorable reimbursement policies, and increasing adoption of home sleep testing support sustained growth. Expanding digital health infrastructure and the presence of leading device manufacturers further reinforce North America’s dominant position in the global OSA landscape.

Europe

Europe accounted for 28.4% of the global OSA market in 2024, supported by rising clinical awareness, aging demographics, and widespread adoption of non-CPAP therapies such as oral appliances. Germany, the UK, and France lead regional demand, backed by strong healthcare expenditure and structured diagnostic pathways. Government-supported screening programs and advancements in sleep medicine contribute to early detection. Increasing use of portable monitoring systems and digital compliance tools enhances treatment adherence across Europe. Growing collaboration between sleep clinics, dental practices, and ENT specialists continues to strengthen market penetration across key European countries.

Asia-Pacific

Asia-Pacific captured 21.7% of the OSA market in 2024 and represents the fastest-growing region, fueled by rising obesity rates, rapid urbanization, and increasing awareness of sleep disorders. Countries such as China, Japan, South Korea, and India are witnessing strong demand for cost-effective home sleep testing and CPAP devices. Expanding healthcare infrastructure, improving reimbursement frameworks, and the emergence of sleep clinics support market expansion. Growing adoption of telehealth and digital monitoring solutions enhances accessibility in remote areas. As regional governments prioritize chronic disease management, APAC remains a high-potential market for diagnostic and therapeutic OSA devices.

Latin America

Latin America held a 5.3% share of the OSA market in 2024, with growth driven by rising obesity prevalence, increasing recognition of sleep-related disorders, and expanding access to sleep diagnostics. Brazil and Mexico dominate market demand due to improving healthcare systems and growing private-sector investment in sleep medicine. Adoption of CPAP and portable sleep testing devices continues to rise as awareness campaigns expand. However, limited reimbursement and cost constraints slow large-scale adoption. Despite these barriers, increasing telemedicine penetration and partnerships with international manufacturers present strong opportunities for regional market expansion.

Middle East & Africa

The Middle East & Africa region accounted for 3.0% of the OSA market in 2024, supported by increasing screening initiatives, rising lifestyle-related risk factors, and expanding hospital infrastructure in Gulf countries. Saudi Arabia and the UAE lead adoption due to high awareness and investment in advanced diagnostic technologies. In contrast, Africa faces challenges related to affordability, limited sleep laboratories, and low awareness. However, growing availability of low-cost CPAP systems, mobile health platforms, and government-led chronic disease programs are gradually improving diagnosis and treatment rates, positioning MEA for steady long-term growth.

Market Segmentations

By Diagnosis

- Polysomnography (PSG) – In-lab Sleep Testing

- Home Sleep Testing (HST)

- Oximetry Testing

By End User

- Sleep Laboratories & Hospitals

- Home Care Settings

- Dental Clinics

- Ambulatory Surgical Centers

- Speciality Clinics

By Distribution Channel

- Direct Sales

- Retail Pharmacies

- Online Pharmacies

- Healthcare Providers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Obstructive Sleep Apnea (OSA) market is characterized by strong participation from global medical device manufacturers, pharmaceutical companies, and emerging digital health innovators. Leading players such as ResMed Inc., Philips Respironics, Fisher & Paykel Healthcare, Cephalon (Teva Pharmaceuticals), Bioprojet PHARMA, Jazz Pharmaceuticals, Axsome Therapeutics, Apnimed, Incannex Healthcare, Desitin Arzneimittel GmbH, Eli Lilly and Company, and Takeda focus on expanding their portfolios through advanced diagnostic systems, cloud-connected CPAP/APAP devices, and next-generation pharmaceutical therapies. Companies are increasingly investing in AI-enabled sleep monitoring, remote patient management platforms, and ergonomic interface designs to improve adherence and patient comfort. Strategic collaborations with sleep clinics, hospitals, and digital therapeutics providers are accelerating product adoption across home care and clinical settings. Additionally, new entrants are exploring non-CPAP alternatives such as neurostimulation implants and oral appliance therapies, intensifying competition and driving continuous innovation in the global OSA market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, ResMed Inc. presented new research and expanded its home-based testing solutions portfolio for OSA diagnosis and treatment at SLEEP 2025.

- In June 2025, Vivos Therapeutics, Inc. completed the acquisition of The Sleep Center of Nevada, bringing OSA diagnostic revenue and treatment capacity to its portfolio.

- In April 2025, Samsung Electronics Co., Ltd. announced a collaboration with Stanford Medicine to advance its sleep-apnea detection feature (on Galaxy Watch) into proactive care and AI-enabled monitoring.

Report Coverage

The research report offers an in-depth analysis based on Diagnosis, End User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong growth as awareness of sleep disorders increases across both developed and emerging regions.

- Adoption of home sleep testing will rise significantly, supported by telehealth integration and improved diagnostic accuracy.

- CPAP and APAP devices will continue to dominate therapy use, driven by advancements in comfort, connectivity, and auto-adjusting technology.

- Non-CPAP alternatives such as oral appliances and neurostimulation implants will gain wider acceptance among CPAP-intolerant patients.

- AI-driven sleep monitoring and predictive analytics will enhance personalized treatment and long-term patient adherence.

- Digital health platforms will expand remote monitoring capabilities, improving therapy outcomes and clinical follow-up.

- Manufacturers will invest in lightweight, ergonomic mask designs to reduce dropout rates and improve compliance.

- Growth in obesity and aging populations will sustain long-term market demand for diagnostic and therapeutic solutions.

- Emerging markets will show accelerated adoption as healthcare infrastructure and reimbursement frameworks improve.

- Strategic collaborations between sleep clinics, hospitals, and device companies will strengthen global access to advanced OSA treatments.